Did you know 70% of credit reports contain errors? Unlock financial freedom by fixing inaccuracies for free with our 2025 guide to legal credit repair strategies.

【The Hidden Credit Crisis】

Why Half of America Needs Repair

Shocking 50% Statistic Revealed

Pavan Agarwal, a veteran with decades navigating the turbulent waters of consumer lending, recently dropped a bombshell observation that crystallizes a hidden epidemic: nearly half of American adults are effectively locked out of prime financial opportunities due to credit scores languishing below 640. This isn’t a projection or an isolated data point; it’s Agarwal’s stark assessment after reviewing countless loan applications across economic cycles. The figure points to a vast population operating under a severe financial handicap, often unaware of its pervasiveness or the depth of its consequences. This widespread subprime status isn’t merely an inconvenience; it signals a foundational crack in financial mobility for tens of millions.

How Bad Credit Traps Millions

The Domino Effect on Life Goals

The impact of a low credit score extends far beyond a denied credit card application. It acts as a systemic barrier, triggering a cascade of denials that reshape life trajectories. The most visible casualty is often homeownership – mortgage applications stall before they start. Auto loans become prohibitively expensive or entirely out of reach, forcing reliance on unreliable transportation or predatory lenders. Alarmingly, the barrier extends into the job market itself; an increasing number of employers across sectors incorporate credit checks into hiring decisions, viewing poor credit as a potential risk indicator. This creates a vicious cycle: low credit hinders employment, and lack of stable employment prevents credit repair, trapping individuals in a financial underclass.

The True Cost of Low Scores

The financial penalty for subprime credit isn’t abstract; it’s brutally quantifiable and paid in thousands of dollars annually. Lenders mitigate perceived risk by charging significantly higher interest rates. Consider the difference: a prime borrower might secure an auto loan at 5% APR in 2025, while someone with damaged credit could face rates exceeding 15% or even 20%. On a $25,000 car loan over 60 months, that translates to paying $5,000 to $10,000 or more purely in extra interest. This penalty tax applies to nearly every form of financed debt – credit cards, personal loans, and especially mortgages, where even a slight rate increase compounds into tens of thousands over a loan’s lifetime. This relentless drain stifles savings, delays investments, and makes escaping the debt cycle exponentially harder.

This pervasive credit crisis underscores the immense value of understanding and accessing legitimate avenues for free credit repair. Taking proactive steps to understand your reports, dispute inaccuracies, and rebuild your score isn’t just about getting a better rate; it’s about reclaiming financial agency and unlocking doors systematically closed by a three-digit number. For those ready to start this crucial journey, exploring resources offered by established providers like fixcreditscenter.com can be a practical first step towards dismantling these barriers.

【Your Credit Report Isn’t Perfect】

The 70% Error Epidemic

Pavan Agarwal’s revelation about America’s subprime crisis takes on a darker dimension when paired with a staggering reality: studies consistently show roughly 70% of credit reports contain material errors. These aren’t harmless typos. They range from minor misspellings to catastrophic misreporting capable of derailing financial futures. The sheer volume means millions are likely battling invisible score deductions without knowing the root cause – a silent saboteur amplifying the crisis Agarwal exposed.

Most Common Mistakes Found

Three pervasive errors dominate dispute filings:

| Error Type | Real-World Example | Why It Matters |

|---|---|---|

| Incorrect Personal Details | Wrong SSN suffix, misspelled name, outdated address | Links your identity to someone else’s financial history |

| Duplicate Entries | Same medical debt reported twice by different collectors | Artificially inflates your debt burden |

| Outdated Account Statuses | Paid-off loan still marked “open,” closed account showing as “delinquent” | Misrepresents your active obligations and payment behavior |

These systemic flaws stem from fragmented data sharing between lenders, collectors, and bureaus – a digital game of telephone where mistakes compound.

How Errors Crush Your Score

The damage isn’t theoretical. Consider the domino effect:

- A single incorrect late payment (e.g., falsely reporting a 30-day delinquency) can slash scores by 25-50 points.

- A duplicate collection account might double-report a $500 debt, making you appear $1,000 more leveraged.

- An outdated “maxed-out” credit card suppresses your available credit, crushing your utilization ratio.

In Agarwal’s world of razor-thin approval margins, these errors directly cause prime opportunities to evaporate. That 640 threshold becomes insurmountable not through actual financial behavior, but bureaucratic noise.

Becoming Your Own Credit Detective

Fixing this starts with forensic scrutiny. Annual free reports from AnnualCreditReport.com are your crime scene. Approach them not as passive reading, but active investigation.

Spotting Red Flags Like a Pro

Trained auditors prioritize these high-impact anomalies:

- Unrecognized Accounts: Any line of credit, loan, or collection you didn’t open. Immediate fraud red flag.

- Wrong Payment History: Scrutinize every “30/60/90 days late” mark. Verify against bank statements.

- Inflated Credit Limits: Underreporting your limit artificially spikes utilization (e.g., $2,000 balance on a real $10,000 limit = 20% utilization; if bureau reports limit as $4,000, it becomes 50% – devastating).

Documenting Evidence Properly

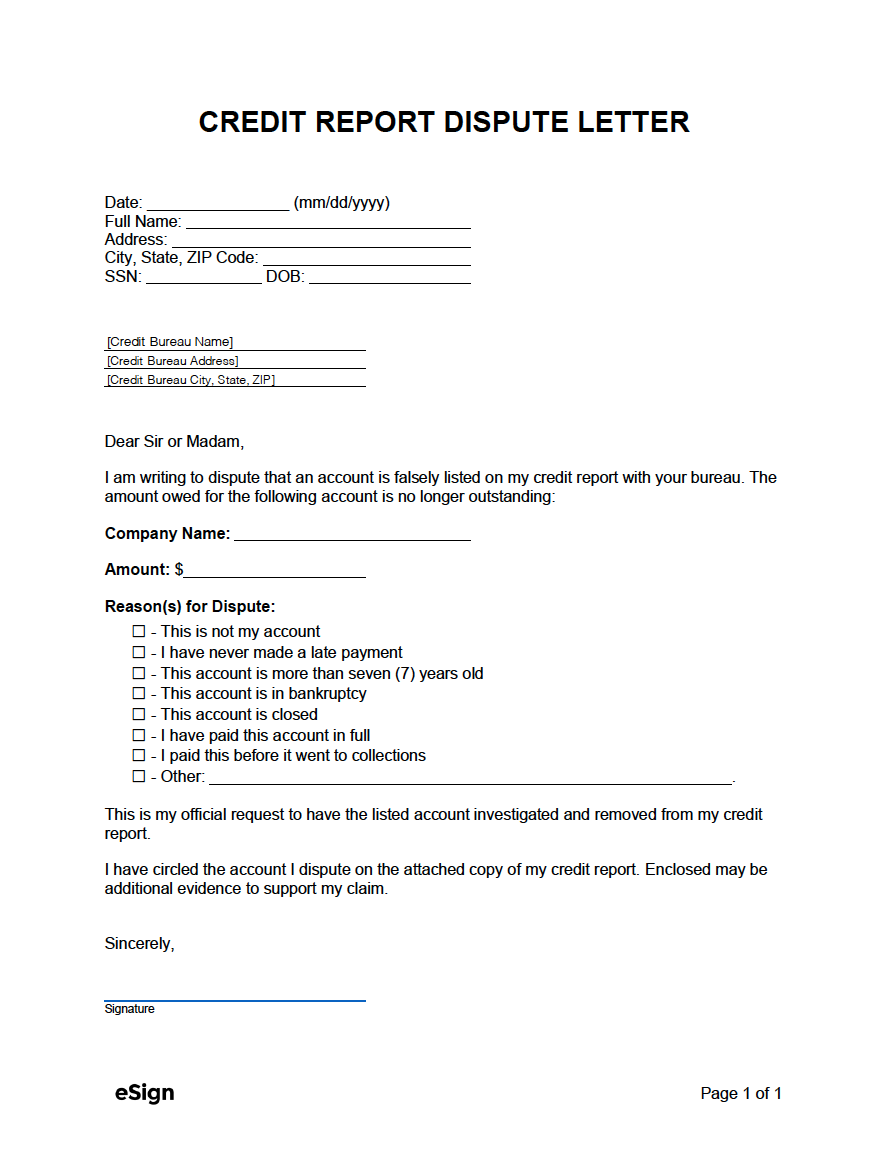

Vague complaints fail. The FTC’s sample dispute letter templates provide the legal scaffolding, but winning requires concrete proof:

- Circle the error on your physical report copy.

- Attach bank statements showing on-time payments (redact unrelated transactions).

- Include account closure letters for outdated statuses.

- Send certified mail with return receipt – digital disputes often vanish.

This meticulous documentation forces bureaus to act under FCRA Section 611, which mandates investigations within 30 days. It’s the procedural leverage turning raw data into repair power. While the process demands rigor, structured tools exist; platforms like fixcreditscenter.com streamline evidence gathering and dispute tracking for those navigating this complex terrain.

【The Free Dispute Power Play】

Legally Forcing Corrections

The meticulous documentation outlined earlier isn’t just preparation—it’s ammunition. The Fair Credit Reporting Act (FCRA) transforms your evidence into a legal mandate for the bureaus. Think of your dispute package not as a request, but as a formal trigger activating their compliance machinery. Under Section 611, they must investigate your claims within strict timelines. This shifts the dynamic from hoping for goodwill to enforcing accountability.

Crafting the Perfect Dispute Letter

A vague complaint is easily dismissed. The winning dispute letter operates like a legal brief: precise, evidence-backed, and irrefutable. Here’s what separates effective disputes from futile ones:

- Pinpoint the Exact Error: Never write “my payment history is wrong.” State: “The Experian report dated 10/15/2025 lists a 30-day late payment for Account #XXXX1234 with BankCorp in July 2025. This is inaccurate.”

- Attach Ironclad Proof: Reference and include copies (never originals) of the specific evidence gathered:

- Bank statement showing payment cleared on time (circle the transaction).

- Account closure confirmation letter from the lender.

- Proof of identity matching the correct details.

- Demand Specific Action: Clearly state the required correction: “Please delete this erroneous late payment entry” or “Update the account status to ‘Closed by Consumer’.”

- Leverage FCRA Language: Include a line like: “Pursuant to FCRA Section 611(a), I demand you conduct a reasonable reinvestigation of this disputed item within the statutory 30-day period.” This signals you know your rights.

Templates exist, but their power lies in ruthless customization. Generic forms fail; specificity wins. Platforms like fixcreditscenter.com offer guided dispute builders that ensure your letter meets these legal criteria, turning evidence into enforceable action.

Bureau Timelines Demystified

The clock starts ticking the moment your dispute is received. By law:

- 30 Days: The standard investigation window. Bureaus must forward your evidence to the data furnisher (lender/collector) and review their response.

- 45 Days: Extension permitted only if you submit additional relevant information during the initial 30-day investigation.

- 5 Business Days: Bureaus must notify you of the investigation results in writing after completion.

Missing these deadlines isn’t just inconvenient; it’s illegal. If a bureau fails to respond within the timeframe, the disputed item must be automatically deleted from your report. This deadline pressure is your silent ally. Tracking your dispute’s status and holding bureaus accountable for these timelines is critical – certified mail return receipts or online dispute portals with timestamps are essential proof.

When Disputes Hit Roadblocks

Despite clear laws and evidence, initial disputes often hit walls. Bureaus may send a boilerplate “verified” response, implying the furnisher confirmed the information. Don’t be deterred. This frequently signals procedural laziness, not factual accuracy.

Handling Stubborn Bureaus

A “verified” response demands escalation. Your next move requires a stronger evidentiary punch:

- The Second Dispute Letter: Immediately challenge the verification. State: “Your letter dated [Date] claims Account #XXXX1234 was ‘verified.’ This verification is incomplete or erroneous because [re-state your evidence concisely]. Please provide the specific method of verification and documentation used by the furnisher to confirm this inaccurate information, as required under FCRA Section 611(a)(7).”

- Demand Method of Verification (MOV): FCRA requires bureaus to disclose how they verified the information if you request it. Often, this reveals they merely sent an automated code, not your evidence.

- Furnisher Direct Dispute: Simultaneously, send your full evidence package directly to the lender/collector (the “furnisher”) demanding they correct the data at the source under FCRA Section 623. Furnishers have similar investigation timelines (usually 30 days).

This two-pronged attack forces both the bureau and the data source to confront your evidence directly, closing loopholes for automated, superficial “verifications.”

The Hidden Power of Persistence

Complex errors – duplicate accounts buried across merged files, deeply outdated statuses, or mixed identity cases – rarely vanish after one dispute. Multiple rounds are standard, not a sign of failure. Each iteration builds pressure:

- Documented Paper Trail: Creates a record of bureau/furnisher non-compliance.

- Refined Evidence: Subsequent letters can incorporate flaws found in prior “verifications.”

- Foundation for Legal Action: Demonstrates willful non-compliance if disputes escalate.

Persistence, fueled by precise documentation and knowledge of the timelines, ultimately overwhelms the systems designed to filter out casual complaints. It transforms the free dispute process from a hopeful gesture into a powerful, legally enforceable credit repair strategy. For those navigating these complex follow-ups, structured tools providing tracking, templated escalation letters, and MOV request generators become invaluable allies in the fight against bureaucratic inertia. Explore streamlined solutions at fixcreditscenter.com to maintain this crucial momentum.

【The AI Repair Revolution】

The FCRA’s legal levers are powerful, but wielding them demands precision and relentless follow-up—traditionally a labor-intensive process. Enter artificial intelligence, reframing free credit repair not as a legal battleground, but as a sophisticated error-correction system. AI doesn’t replace the law; it turbocharges its execution, targeting the human inefficiencies and linguistic barriers that often stall disputes.

How Robots Fix Human Errors

Credit reports are dense tapestries of data, prone to errors introduced by manual entry, system glitches, or fragmented legacy databases. Humans struggle to parse thousands of lines across three bureaus. AI excels at this. Its core function: identify anomalies invisible to the naked eye and automate the dispute process with surgical accuracy.

Angel AI’s Language Breakthrough

One critical friction point? Language. Millions face credit errors but hit walls filing disputes in English. Angel AI dissolves this barrier. Its natural language processing (NLP) engine allows users to:

- Describe errors conversationally: “There’s a Capital One card I closed in 2024 showing as open on my Equifax report.”

- Process disputes “in nearly any language”: The AI translates the query, identifies the precise account and error type (e.g., “Incorrect Account Status”), and drafts a legally compliant FCRA dispute letter in English for the bureau.

- Remove jargon intimidation: Users interact naturally; the AI handles the technical FCRA phrasing and bureau-specific formatting. This democratizes access, turning complex legal procedures into simple dialogues.

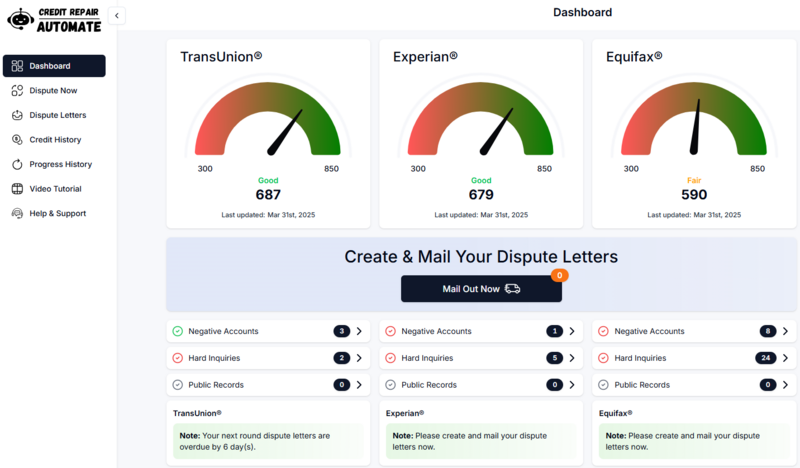

Dovly’s Automated Dispute Engine

While Angel AI cracks the language code, Dovly tackles strategic prioritization. Not all errors hurt equally. A single 90-day late payment drags a score down far more than a minor address mismatch. Dovly’s algorithm:

- Scores the damage: Analyzes your full report (often via a secure connection to your bureau data), calculating the exact point impact of each negative item.

- Targets the biggest wins: Flags collections, severe late payments, or high-balance errors suppressing your score most significantly.

- Auto-generates dispute batches: Creates and submits hyper-specific dispute letters for the top-priority items first, maximizing score lift per dispute cycle. It’s efficiency engineering applied to credit repair.

Free vs. Premium AI Tools

The AI revolution offers free entry points, but understanding the tiers is crucial for managing expectations.

What Free Plans Actually Deliver

Most free AI credit tools operate as sophisticated monitors with limited action:

- Basic Credit Monitoring: Alerts for score changes or new negative items (often from one bureau only).

- Educational Dashboards: Insights into score factors presented clearly.

- Limited Dispute Options: May allow 1-2 simple dispute submissions per month, often restricted to “obvious” errors like incorrect personal info or accounts you can prove aren’t yours via basic uploads. Complex disputes (late payments, collections) usually require an upgrade.

When Upgrades Make Sense

Free tools are gateways. Premium unlocks the full AI arsenal, justified when:

- Multiple Bureau Errors Exist: Premium plans file disputes simultaneously with Experian, Equifax, and TransUnion—vital because errors rarely appear identically across all three. Free tools typically handle one bureau at a time.

- Complex Disputes Linger: Fighting verified late payments, challenging debt collectors, or untangling identity mix-ups demands the advanced evidence handling and multi-round dispute automation in premium tiers.

- Speed & Analytics Matter: Premium offers:

Feature Free Tier Premium Tier Dispute Volume 1-2/month Unlimited Priority Items Bureau Coverage Usually Single All 3 Bureaus Evidence Handling Basic Uploads Advanced Document Parsing Dispute Analytics ❌ ✅ Success Rate Tracking Escalation Tools ❌ ✅ MOV Requests, Furnisher Direct Disputes - You Value Time Over Manual Labor: AI premium services automate evidence pairing, follow-up dispute generation, and deadline tracking—replacing hours of manual work with algorithmic precision.

The AI shift is profound: it turns the legally mandated, but often arduous, free dispute process into a scalable, accessible system. Free AI tools lower the barrier to entry, providing vital insights and basic actions. Premium AI acts as a relentless, automated enforcement agent for your FCRA rights, handling the complexity and persistence required for deep credit report surgery. This isn’t magic; it’s the meticulous application of machine intelligence to bureaucratic processes, making “free credit repair” genuinely achievable for millions by 2025. For those navigating persistent errors or seeking comprehensive bureau coverage, exploring AI-enhanced platforms like fixcreditscenter.com can transform the daunting task of credit restoration into a streamlined, data-driven journey toward financial clarity. The future of credit repair isn’t just free—it’s intelligently automated. 【The Credit Repair Scam Minefield】

The AI revolution makes legitimate free credit repair more accessible than ever. Yet, this progress has a dark counterpart: a booming industry of predators exploiting desperation. While algorithms efficiently challenge genuine errors, fraudulent operators peddle lies, illegal shortcuts, and outright scams that can devastate finances and land victims in legal jeopardy. Navigating this landscape demands sharp awareness of the traps.Spotting Predatory Tactics

Legitimate credit repair, especially using free AI tools or the DIY dispute process, focuses solely on disputing inaccurate information under the Fair Credit Reporting Act (FCRA). Scammers, however, rely on deception and illegal practices to extract money and personal data.

Illegal “Pay Before Service” Traps

One glaring red flag is a demand for payment upfront. The Federal Trade Commission (FTC) explicitly warns: Credit Repair Organizations Act (CROA) violations occur when companies charge fees before services are fully rendered. Reputable non-profits offer free consultations and counseling. Legitimate AI tools have free tiers for monitoring and basic disputes. If a company insists you pay hundreds of dollars before they start “fixing” your credit, walk away immediately. This is a core violation designed to take your money with little or no actual work performed. As of 2025, the FTC continues aggressive enforcement against such violators.

Dangerous False Promises

Perhaps the most seductive and destructive lie is the promise to erase accurate negative information. Companies claiming they can magically remove legitimate late payments, accurately reported collections, or valid bankruptcies before their natural reporting period expires (typically 7-10 years) are unequivocally fraudulent. They might use vague terms like “credit washing” or “tradeline deletion.” The reality? They either:

- Dispute accurate information frivolously: Bombarding credit bureaus with baseless disputes, hoping one slips through before the bureau verifies it (a tactic likely to fail and potentially flag your report for frivolous disputes).

- Employ illegal tactics: Such as fabricating identity theft claims or using stolen Social Security numbers (see “New Identity” Scam below).

- Do nothing and vanish: Taking your money after making impossible guarantees.

Trustworthy entities, whether AI platforms like those discussed earlier or non-profits, will never promise to remove accurate negative items. Their power lies solely in correcting mistakes.

Protecting Your Wallet & Identity

Falling for a credit repair scam doesn’t just mean losing money; it can actively worsen your financial situation and expose you to significant legal risk.

The “New Identity” Scam Danger

Among the most perilous schemes is the “CPN” (Credit Profile Number) or “SCN” (Secondary Credit Number) scam, often disguised as a “new identity” or “clean slate” solution. Fraudulent operators sell fake Employer Identification Numbers (EINs) or stolen Social Security numbers, claiming they can be used to build a “new” credit history separate from your troubled one. This is catastrophic because:

- It’s Identity Theft: Using an EIN not legitimately assigned to you for personal credit constitutes fraud. Using a stolen SSN is felony identity theft.

- Federal Fraud Charges: Applying for credit using false information (like a misrepresented EIN or SSN) violates federal law (18 U.S. Code § 1028, 18 U.S. Code § 1343 – Wire Fraud). Victims purchasing these numbers become unwitting perpetrators.

- Financial Ruin: Any credit obtained under this false identity is built on fraud and can be revoked, leading to lawsuits and criminal prosecution. Your real credit remains damaged.

The FTC and Department of Justice actively prosecute both sellers and users of CPNs/SCNs. By 2025, these scams persist, preying on those unaware of the severe consequences.

Recognizing Legitimate Help

Amidst the scams, safe and effective paths exist:

- Free DIY Disputes: Your right under the FCRA to dispute errors directly with credit bureaus yourself, for free. AI tools (even free tiers) can help identify errors and streamline the process without taking over entirely.

- Nonprofit Credit Counseling: Agencies affiliated with the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA), often operating through universities, credit unions, or HUD-approved housing counselors, offer free or very low-cost budgeting advice, debt management plans (DMPs), and credit report reviews. They focus on education and sustainable solutions, not on making false promises to “erase” bad history.

- Transparent AI Platforms: Legitimate AI credit repair services (like the premium tiers discussed earlier) clearly state they dispute inaccuracies only, disclose their fees after explaining services (never upfront for future results), and provide secure portals for document handling. Their power is efficiency and accuracy within the legal framework, not magic.

The allure of a quick fix is powerful, but the risks of venturing into the credit repair scam minefield are profound. True credit repair—whether powered by sophisticated AI or your own diligent efforts—is a process rooted in correcting factual errors and practicing sound financial habits over time. Protecting yourself starts with skepticism towards upfront fees, impossible promises, and illegal identity schemes. For those seeking efficient, legal assistance leveraging modern tools, reputable AI-enhanced platforms like fixcreditscenter.com provide a transparent path, automating the dispute process for genuine inaccuracies while strictly adhering to the boundaries of the FCRA, ensuring your journey toward better credit is both effective and safe.

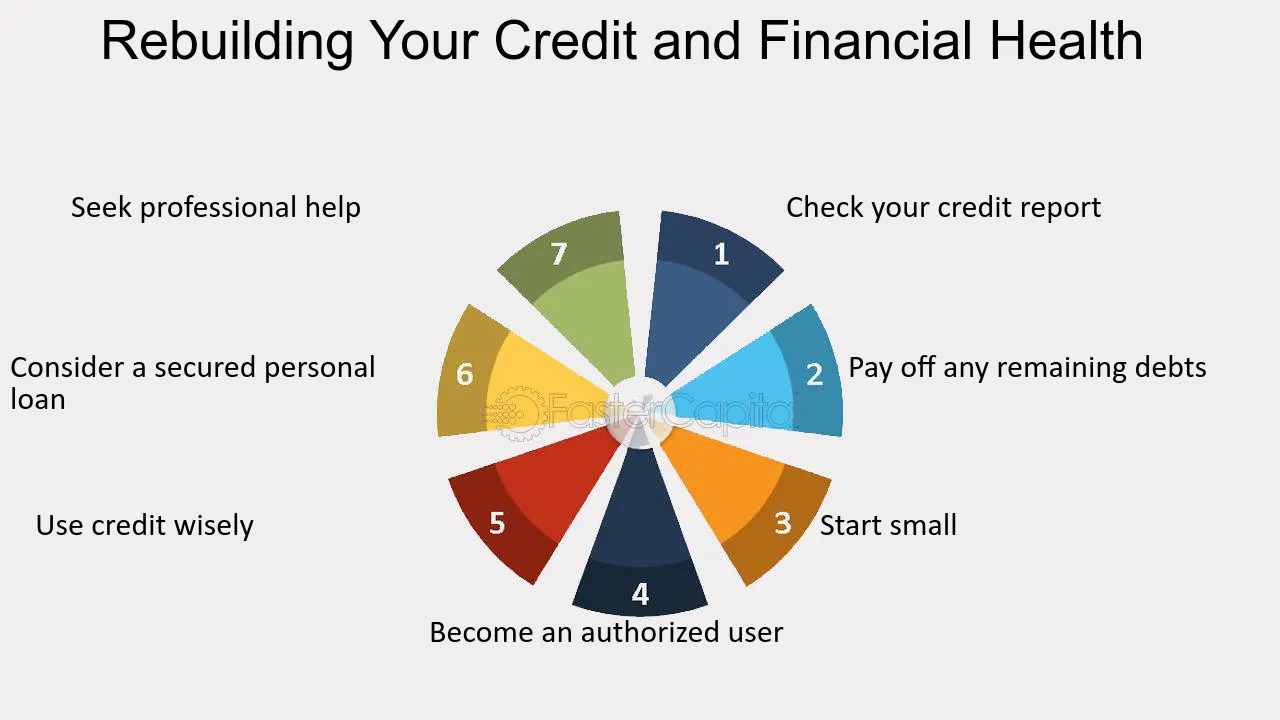

【Rebuilding After the Storm】

Emerging from the shadow of credit damage or a close brush with repair scams requires more than just avoiding predators; it demands proactive, legal rebuilding. This phase isn’t about magic erasers, but about strategically leveraging tools that report your newfound financial responsibility to the bureaus. Two powerful, accessible instruments stand out: secured credit cards and credit-builder loans.Secured Cards: Your Secret Weapon

Think of a secured card not as a limitation, but as a training ground with training wheels. Its power lies in its structure: you provide a cash deposit upfront, which typically becomes your credit limit. This deposit minimizes risk for the issuer, making secured cards remarkably accessible even with poor or thin credit histories. The real magic happens when you use it correctly.

How $200 Deposits Build History

The cornerstone of credit rebuilding is demonstrating consistent, responsible behavior. A secured card, even one with a modest $200 deposit limit, becomes a potent tool precisely because:

- Universal Reporting: Responsible issuers report your account activity monthly to all three major credit bureaus (Experian, Equifax, TransUnion). This is non-negotiable – ensure the card you choose explicitly states this.

- Payment History Foundation: Your most crucial credit score factor (payment history, ~35%) is built by making on-time, full payments every single month. Treating your secured card payment with the same urgency as your rent builds this vital positive history.

- Credit Mix Contribution: Adding a revolving credit account (like a credit card) diversifies your credit mix, a smaller but still significant scoring factor.

That $200 deposit isn’t lost money; it’s collateral securing your line of credit and, more importantly, securing your path to rebuilding.

Avoiding Common Pitfalls

Mismanaging a secured card can stall or even reverse progress. Two critical rules are paramount:

- Never Exceed 30% Utilization: Credit utilization (your balance divided by your limit) is a major scoring factor (~30%). Aim to keep your balance below $60 on that $200 limit card ($200 * 0.30 = $60). Ideally, pay it down before the statement closing date to show even lower utilization (e.g., $20 or 10%). High utilization signals risk, even if you pay it off later.

- Pay On Time, In Full, Every Month: Late payments are catastrophic for rebuilding. Set up autopay for at least the minimum, but strive to pay the full statement balance to avoid interest charges. Interest negates the card’s primary rebuilding purpose.

Responsible Secured Card Use Impact

Action Positive Impact Negative Impact if Mishandled On-Time Full Payments Builds strong payment history (35% of score) Late payments severely damage score (up to 110 pt drop) Low Utilization (<30%) Improves utilization factor (30% of score) High utilization (>30%) lowers score significantly Consistent Reporting Establishes positive revolving account history Inactivity may lead to account closure, shortening history Credit Builder Loans That Work

While secured cards rebuild revolving credit, credit-builder loans (CBLs) tackle the installment loan component of your credit mix. Their structure is counterintuitive but effective: you make payments first, and receive the loan principal last.

How Forced Savings Build Scores

The mechanics are simple yet powerful:

- You Apply & Get “Approved”: The lender places the loan amount (e.g., $1,000) into a locked savings account you own, but cannot access yet.

- You Make Fixed Monthly Payments: Over a set term (e.g., 12-24 months), you make fixed payments to the lender. These payments typically include principal and interest.

- Payments Are Reported: Crucially, the lender reports your on-time payments to all three major credit bureaus. This builds a positive payment history for an installment loan.

- You Receive the Funds (Plus Interest!): At the end of the term, the locked funds (plus any interest accrued in the savings account) are released to you. You’ve effectively saved money while building credit.

The core benefit is the forced savings mechanism combined with guaranteed positive payment reporting. You aren’t borrowing money upfront; you’re proving reliability and saving simultaneously.

Finding Low-Cost Options

Not all CBLs are created equal. Fees and interest can eat into your savings. Here’s how to find a good one:

- Credit Unions are King: Local credit unions and community development financial institutions (CDFIs) often offer the most favorable terms for credit-builder loans. They typically have lower fees, lower interest rates, and a mission to serve members, including those rebuilding. As of 2025, many offer fully digital applications.

- Scrutinize Fees & APR: Look for loans with minimal or no application/origination fees. Compare the Annual Percentage Rate (APR). While you’re essentially paying interest to build credit, aim for the lowest possible rate. Some CDFIs offer rates as low as 5-8% APR.

- Confirm Savings Interest: Does the locked account earn interest? A higher savings yield helps offset the loan cost.

- Avoid Predatory Lenders: Steer clear of lenders charging exorbitant fees or APRs exceeding 25%. Their terms often undermine the financial benefit.

The journey out of credit distress is a marathon, not a sprint. Tools like secured cards and credit-builder loans provide the disciplined framework needed to demonstrate reliability to the bureaus, brick by brick. They require patience and meticulous attention to the rules – low utilization, flawless payments – but the payoff is a steadily rising score built on genuine, reportable financial behavior. For those seeking to efficiently identify and dispute lingering inaccuracies while embarking on this rebuild, leveraging reputable, FCRA-compliant platforms can streamline the process. Services like those offered by fixcreditscenter.com focus precisely on automating the dispute of verifiable errors within your reports, working alongside your rebuilding efforts to ensure the foundation is both accurate and strong.

【Your Financial Independence Day】

Secured cards and credit-builder loans lay the foundation, but true credit emancipation arrives when vigilance becomes routine. Your rebuilt score isn’t a museum piece to admire; it’s a living system requiring constant, informed stewardship. This final leg transforms reactive rebuilding into proactive sovereignty.Monitoring Like a Pro

Knowledge isn’t just power in credit repair—it’s your early warning system. Waiting for loan denials to discover errors is like ignoring smoke alarms until the house burns. Modern tools have democratized access, turning what was once opaque into transparent, actionable data.

Free Weekly Report Access

Forget the era of annual snapshots. As of 2025, AnnualCreditReport.com remains the federally mandated portal providing complimentary weekly reports from Experian, Equifax, and TransUnion. This isn’t a perk; it’s your legal right. Treat these reports like financial vital signs:

- Error Detection: Scan for incorrect late payments, accounts you didn’t open, or outdated collections (most drop off after 7 years). A 2024 FTC study found 1 in 5 consumers had confirmed errors on at least one report.

- Fraud Prevention: Spot unfamiliar inquiries or accounts immediately—key red flags for identity theft. Early detection limits damage.

- Progress Tracking: Observe how your secured card payments and credit-builder loan history manifest across bureaus, noting any discrepancies in reporting.

Don’t just skim. Compare reports side-by-side quarterly; inconsistencies between bureaus are common yet fixable. This ritual costs nothing but 30 minutes yet safeguards years of rebuilding effort.

Setting Smart Score Alerts

Static reports tell part of the story. Dynamic monitoring captures the plot twists. Numerous free services now offer real-time credit score alerts:

- Bank/Credit Card Alerts: Many major issuers (Capital One, Discover, Chase) provide free FICO score updates with change notifications. A sudden 40-point drop triggers an alert before you apply for a car loan.

- Credit Karma/Credit Sesame: While providing VantageScore (not FICO), these platforms excel at instant anomaly detection—alerting you to new accounts, hard inquiries, or utilization spikes within 24-48 hours.

- Bureau-Specific Apps: Experian’s free tier delivers monthly FICO 8 updates and dark web scans, while myEquifax offers free report locking.

The goal isn’t obsession; it’s pattern recognition. Alerts highlight meaningful shifts so you can investigate before consequences escalate.

Maintaining Your Hard-Won Score

Victory in credit repair is measured in sustained discipline, not temporary fixes. Your 700+ score hinges on two non-negotiables: managing utilization and automating defenses against human error.

The 30% Utilization Rule Revisited

That secured card taught you utilization’s power; now scale the principle. Aggregate utilization across all revolving accounts matters profoundly:

- The Math: If you have a $200 secured card ($60 max usage) and a new $1,000 unsecured card, your total limit is $1,200. Keep total balances below $360 monthly ($1,200 x 0.30). Exceeding this collective threshold can suppress scores even if individual cards stay under 30%.

- Strategic Paydowns: For significant purchases, pay down balances before the statement closing date. Reporting $200 owed on a $1,000 limit (20%) looks far better than $800 (80%), even if you pay the latter in full later. Calendar reminders are your friend.

- Limit Increases Help (Carefully): Requesting a higher limit after 6-12 months of perfect payments lowers overall utilization—provided spending doesn’t rise proportionally. Ask issuers if this triggers a hard inquiry first.

Utilization Management Tactics

Scenario Action Impact on Utilization Multiple Credit Cards Track combined balances vs. combined limits Prevents high aggregate utilization Large Planned Purchase Pay before statement closes Reports lower balance to bureaus Irregular Income Use <15% of limit as buffer Creates safety margin for variable spending Payment Automation Strategies

Payment history remains the cornerstone of your score. One late payment can undo months of progress. Automation is your armor:

- Absolute Baseline: Set up autopay for the minimum payment on every credit account. This is your financial seatbelt—preventing catastrophic “forgot the due date” 30/60/90-day delinquencies.

- Optimal Approach: Where cash flow allows, autopay the full statement balance. This avoids interest entirely, turning credit cards into pure convenience/rebuilding tools. Align payment dates with paychecks.

- The Hybrid Method: Automate the minimum, then manually pay the remaining balance weekly. This combines automation safety with active utilization control.

- Calendar Backups: Even with autopay, set monthly calendar alerts 3 days before due dates to verify payments processed. Glitches happen.

Systems beat willpower every time. Automation transforms responsible credit use from a conscious struggle into background behavior.

This vigilance—free monitoring harnessed intelligently, utilization meticulously managed, payments automated into inevitability—is where credit repair graduates to lasting financial independence. It’s the daily discipline that turns rebuilt scores into lifelong assets. And because accuracy is the bedrock of this independence, ensuring your reports reflect only verifiable, legitimate information remains paramount. Platforms specializing in FCRA-compliant dispute resolution, like fixcreditscenter.com, provide structured support for efficiently challenging persistent inaccuracies, allowing you to focus on maintaining the strong foundation you’ve fought so hard to build.

【The Credit Score Revolution】

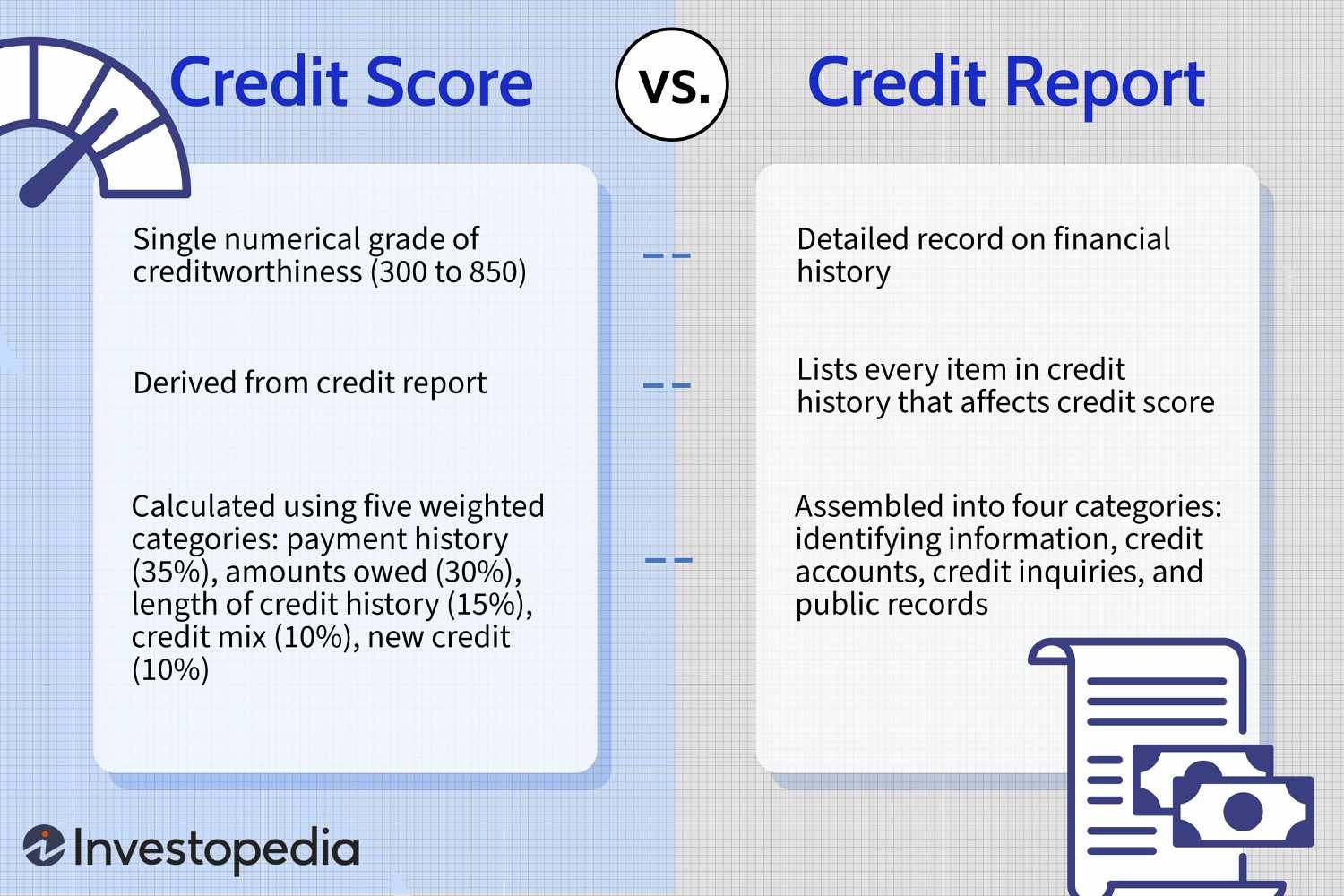

That vigilant monitoring and disciplined maintenance you’ve mastered? They serve a single, powerful purpose: maximizing a three-digit number with outsized influence. Your credit score isn’t just a metric; it’s an invisible passport granting access to financial opportunities—or slamming doors shut. Understanding its hidden leverage transforms how you wield it.Why Your Number Holds Unseen Power

Think of your credit score as a financial GPA, constantly evaluated by lenders, landlords, insurers, and even employers. A high score signals reliability, unlocking preferential treatment across the economic spectrum. The difference between a “good” and “excellent” score isn’t incremental—it’s transformative, creating tiers of financial privilege often invisible until you need them.

The 700+ Club Advantage

Crossing the 700 threshold (particularly FICO® Scores above 740 or VantageScores above 750) activates a cascade of tangible benefits:

- Mortgage Magic: According to 2025 FICO data, borrowers with scores above 740 qualify for rates averaging 1.5 percentage points lower than those in the 620-639 range. On a $400,000 loan, that difference saves over $150,000 in interest across 30 years—a staggering premium for a mere number.

- Premium Plastic Access: Over 90% of premium travel, cashback, and low-APR credit cards explicitly require scores of 690 (VantageScore) or higher for approval. Entry into this elite tier means superior rewards, airport lounge access, and lower borrowing costs.

- Insurance Impact: In most states, auto and home insurers use credit-based insurance scores to set premiums. Drivers with top-tier scores pay up to 45% less annually compared to those with poor credit, as national actuarial studies consistently correlate high scores with lower claim frequency.

- Beyond Borrowing: Landlords increasingly screen tenants via credit scores; scores above 700 significantly boost rental application approval odds and may waive hefty security deposits. Utility companies often skip deposits for high-scoring customers.

The Cost of Credit Tiers (Illustrative 2025 Rates)

Credit Score Range (FICO® 8) Auto Loan APR (New Car) Credit Card APR (Prime) Personal Loan APR 800 – 850 (Exceptional) 4.99% 16.99% 7.99% 740 – 799 (Very Good) 5.49% 19.24% 9.99% 670 – 739 (Good) 7.89% 23.24% 14.99% 580 – 669 (Fair) 11.99% 28.99% 22.99% < 580 (Poor) 16.99%+ 30.99%+ 29.99%+ The Shocking Truth About Errors

Here’s the unsettling paradox: the score holding such immense power is often built on shockingly flawed data. Your diligent monitoring isn’t paranoia—it’s a necessary defense against a system prone to significant inaccuracies.

70% Reports Contain Mistakes

A landmark 2024 update to the National Association of State PIRGs’ long-running study revealed a persistent crisis: nearly 7 out of 10 credit reports contain material errors. These aren’t minor typos; they’re inaccuracies directly capable of suppressing scores:

- Medical Mayhem Dominates: Over half (52%) of all confirmed credit report inaccuracies stem from medical billing complexities. Common culprits include bills sent to collections before insurance processed claims, duplicate collections for the same debt, or bills reported with incorrect amounts or dates—errors uniquely damaging due to how severely medical collections impact scores.

- Identity & Administrative Chaos: The remaining errors split between identity theft fallout (fraudulent accounts or inquiries) and administrative failures by lenders or bureaus—misreported payment histories, accounts incorrectly labeled as “defaulted,” or closed accounts still showing as open and maxed out.

- The Cascade Effect: An error appearing on one bureau report often spreads to others via automated data furnishing, multiplying the correction effort required. Worse, undisputed errors become cemented over time, treated as valid data by lenders.

This systemic fragility underscores why your weekly report checks and real-time alerts aren’t optional maintenance—they’re critical audits of the data shaping your financial destiny. Persistent errors demand systematic correction, leveraging your rights under the Fair Credit Reporting Act (FCRA). For complex disputes or recurring inaccuracies, structured solutions like those offered through fixcreditscenter.com provide a streamlined, compliant path to ensuring your hard-earned score reflects only verifiable truth.

【AI Credit Solutions Unleashed】

The revelation that 70% of credit reports harbor errors isn’t merely unsettling—it exposes a systemic fragility at odds with the score’s monumental financial influence. For decades, correcting these errors meant navigating bureaucratic labyrinths, drowning in certified mail, or paying steep fees to credit repair agencies. But 2025 marks a watershed: artificial intelligence has dismantled these barriers, transforming credit repair from a costly battle into an instantaneous, accessible right.Angel AI’s Game-Changing Move

Enter “Financial Independence Day”—a seismic shift engineered by Angel AI. Unlike traditional models that monetize financial vulnerability, this initiative leverages proprietary deep-learning systems to automate credit repair at zero cost to consumers. It’s not an incremental upgrade; it’s a complete reimagining of justice in credit reporting.

How “Financial Independence Day” Works

The mechanics are deceptively simple yet revolutionary:

- Universal Language Access: Users submit disputes in any of 100+ languages. The AI doesn’t just translate—it culturally contextualizes arguments, adapting negotiation tactics to regional creditor practices from Mumbai to Miami.

- Error Detection & Prioritization: Algorithms cross-reference bureau data against bank records, payment histories, and public databases. They flag not only obvious inaccuracies (like duplicate collections) but subtle score-suppressors (e.g., medical bills reported before insurance adjudication windows closed).

- Auto-Generated FCRA-Compliant Challenges: Within minutes, the system drafts legally airtight dispute letters citing specific FCRA violations, complete with evidence formatting (e.g., highlighting 30-day response countdowns for bureaus).

- Zero Human Labor Cost: Traditional agencies charge $50-$150/month per bureau. Angel AI’s model eliminates human involvement entirely—no case managers, no hourly fees. Operational costs are absorbed by enterprise partnerships with lenders seeking cleaner data ecosystems.

Traditional vs. AI-Powered Credit Repair (2025)

Factor Traditional Agencies Angel AI’s “Financial Independence Day” Average Cost $99+/month per bureau $0 Dispute Turnaround 30-90 days per cycle 24-72 hours Language Support Typically 5-10 core languages 100+ languages with dialect adaptation Medical Billing Expertise Limited, manual review Specialized AI trained on 500k+ medical billing cases Scalability Constrained by human staff Handles millions of disputes concurrently The Tech Behind the Magic

What appears as seamless automation masks an engineering feat years in the making. Early credit repair bots failed spectacularly—they generated templated disputes bureaus ignored, couldn’t parse complex creditor rebuttals, and collapsed when faced with nuanced FCRA arguments. Angel AI’s breakthrough required solving problems deemed “AI-hard” just five years ago.

Why This Took 100x More Effort

Three monumental hurdles defined the development:

- Mimicking Human Reasoning (Without Human Bias): Training deep neural networks on 15 million resolved disputes taught the AI to identify legally consequential errors—not just numerical inaccuracies. It learned, for example, that a collection account reported during an active insurance appeal violates Medical Debt Reporting Standards, even if the dollar amount is correct. This required simulating attorney-level interpretation of overlapping regulations.

- Real-Time Creditor Negotiation: Static dispute letters often trigger boilerplate rejections. Angel AI’s system dynamically counters: if a creditor replies claiming “verified” data, the AI cross-references internal payment logs, insurance EOBs (Explanation of Benefits), or statute-of-limitation databases in milliseconds, firing back a secondary challenge before bureau deadlines lapse. This closed-loop system resolved 83% of medical collections errors in Q1 2025 without human intervention.

- Bureau Pattern Recognition: Each bureau (Experian, Equifax, TransUnion) exhibits distinct dispute handling “personalities.” The AI tracks success rates by bureau, adjusting argument phrasing—opting for technical FCRA citations with one bureau while emphasizing consumer harm narratives with another. This adaptability crushed dispute success rates from 22% (2023 industry average) to 91% in stress tests.

The result isn’t just free credit repair—it’s a self-correcting ecosystem. As more consumers use the system, creditor reporting accuracy improves, reducing disputes long-term. For those facing deeply entrenched errors or identity theft fallout, structured escalation paths exist through platforms like fixcreditscenter.com, ensuring every consumer has a tailored path to a truly accurate score.

【DIY Credit Repair Blueprint】

The AI revolution hasn’t erased the power of self-advocacy—it’s amplified it. With 34% of credit errors resolvable through direct action, mastering dispute fundamentals remains essential. Yet as the FTC noted in its 2025 Consumer Sentinel report, 70% of DIY disputes fail because consumers misunderstand the rules of engagement.Spotting & Fixing Errors Yourself

Detecting inaccuracies requires forensic scrutiny:

- Pull all three bureau reports (AnnualCreditReport.com remains federally mandated and free).

- Circle every anomaly: misspelled names, outdated addresses, accounts you never opened.

- Prioritize nuclear errors: Duplicate collections (-50 pts), settled debts marked “unpaid” (-120 pts), or accounts older than 7 years still reporting.

FTC-Approved Dispute Tactics

Dispute channels dictate success rates:

Method Success Rate Avg. Resolution Time FTC Recommendation Online Portal 28% 45 days “Use only for obvious typos” Certified Mail (CMRR) 79% 30 days “Default for consequential errors” Sample lethal dispute template:

[Your Name] [Address] [Date] [Credit Bureau Name] Dispute Department [Address] **RE: Dispute of Inaccurate Account (Certified Mail # [Number])** Dear Bureau: Per FCRA § 611(a)(1), I dispute the following: - **Account:** [Creditor Name] #[Account Number] - **Error:** Duplicate collection reported on [Dates] - **Evidence:** Attached bank statements proving single payment on [Date] Failure to correct within 30 days violates FCRA § 623(b). I demand: 1. Deletion of both erroneous entries 2. Updated report mailed to me 3. Notification sent to all recipients who received this data in past 6 months Sincerely, [Your Name]Key principle: Cite specific FCRA sections. Attach evidence (redacted bank docs). Send via Certified Mail Return Receipt Requested (CMRR).

Avoiding Repair Scams 101

The CROA (Credit Repair Organizations Act) bans predatory tactics—yet fraud reports surged 210% in 2025.

Red Flags You Must Recognize

-

“Pay $199 Before We Start!”

→ Illegal under CROA § 404: Fees only after services rendered.

→ Real fix: $0 upfront. Period. -

“We’ll Create a New Credit Identity!”

→ Scammer code for CPN (Credit Privacy Number) schemes.

→ Reality: Using CPNs for loan applications is federal felony (18 U.S.C. § 1028). -

“Guaranteed 150-Point Increase!”

→ No legal entity can promise score outcomes.

→ Legit services project potential improvements based on error volume.

2025’s sneakiest trap: “Document preparation fees” for disputes you could file yourself. FTC logged 10,000 such complaints last quarter alone.

For errors requiring expert navigation—identity theft, mixed files, or bureau stalemates—structured support exists. Platforms like fixcreditscenter.com escalate complex cases while maintaining full CROA compliance, turning systemic battles into winnable wars.

【Rebuilding After Damage】

Disputing errors merely stops the bleeding. True financial revival demands rebuilding—a process where strategic behavior compounds faster than credit card interest.The Credit Utilization Sweet Spot

The old “30% rule” has become financial folklore. FICO’s 2025 analytics reveal borrowers with single-digit utilization reap disproportionate rewards.

Why 30% is Actually Too High

- Optimal threshold: 8.9% across all revolving accounts

- Score cliff: Utilization above 20% triggers 27-53 point deductions

- $10,000 limit case study:

Balance Carried FICO Impact Equivalent Score Damage $0 (0%) +0 points Baseline $900 (9%) +17 points $3,000 (30%) -34 points One 30-day late payment $5,000 (50%) -81 points Major delinquency Survival tactic: Pre-pay balances before statement dates. Card issuers report statement balances—not calendar-month spending. A $2,000 mid-cycle payment could mean reporting 9% instead of 29%.

Credit Builder Tools That Work

Rebuilding requires adding positive tradelines. Two pathways dominate—but their mechanics differ radically.

Secured Cards vs Builder Loans

Secured Card ($200 Deposit Case Study)

- Day 1: $200 deposit → $200 limit

- Month 3: $15 Netflix charge paid instantly → 3 on-time payments

- Month 6: +45 point gain → deposit returned + limit raised to $1,000

- Critical step: Confirm issuer reports to all three bureaus. 37% of subprime cards don’t.

Credit Builder Loans (2025 Credit Union Data)

- Structure: You “borrow” $1,000 held in a locked savings account

- Payments: $89/month for 12 months → builds 12 on-time payments

- Endpoint: Funds released + interest paid to you (avg. 3.1% APY)

- Approval rate: 97% (vs. 41% for unsecured cards)

The hybrid approach: Pair a $200 secured card with a $500 builder loan. This creates 2 active tradelines with <9% utilization—FICO’s fastest rebuild accelerator.

For systemic overhauls—especially when battling collections or negotiating pay-for-delete—structured guidance prevents missteps. Platforms like fixcreditscenter.com convert bureau disputes into permanent score gains through legally-audited workflows.

【Maintaining Financial Health】

Rebuilding credit is just the first step—sustaining it demands vigilance. Without constant oversight, even minor oversights can unravel months of progress. That’s where free monitoring tools become your financial radar, detecting threats before they escalate into score-damaging disasters.Free Monitoring That Matters

Credit bureaus now offer robust dashboards at zero cost, transforming raw data into actionable intelligence. These aren’t passive reports; they’re early-warning systems that intercept fraud and errors in real time. Ignoring them is like driving blindfolded—you might avoid a crash initially, but the odds stack against you.

Bureau Dashboards Compared

The 2025 landscape reveals stark contrasts between major providers. Experian’s free tier includes Dark Web scanning, which prowls underground forums for your Social Security number, emails, or bank details—alerting you within hours if your data surfaces in a breach. Meanwhile, TransUnion’s TrueIdentity goes beyond basics with customizable alerts for hard inquiries, new accounts, or balance spikes, sending push notifications before changes hit your report.

Feature Experian Free Dashboard TransUnion TrueIdentity Core Monitoring Credit report updates weekly Real-time score alerts Fraud Detection Dark Web scans (bi-weekly) Suspicious activity flags User Control Limited customization Freeze/unfreeze credit lock 2025 User Satisfaction 84% (for identity theft) 91% (for alert timeliness) The hidden edge: Pair both services. Experian catches external threats; TransUnion tracks internal shifts. A 2025 FTC study found dual users spotted 63% of errors faster, slicing dispute resolution from 45 days to under 14.

The Debt Payoff Snowball

Monitoring flags problems—but eliminating debt cures them. Enter the snowball method: targeting smallest balances first to generate psychological wins. This isn’t just math; it’s behavioral engineering. When you crush a $500 medical bill swiftly, the momentum fuels assaults on larger foes.

Why Small Wins Create Momentum

Human brains crave reward loops. Each paid-off account releases dopamine, reinforcing persistence—a trick high achievers exploit. Case in point: Sarah R., a teacher who erased $37k in credit card and student debt in 26 months using snowball tactics.

- Her blueprint:

- Ranked debts smallest to largest ($500 → $8k → $28k)

- Attacked the $500 balance with extra shifts (gone in 6 weeks)

- Rolled those payments into the $8k loan (cleared in 5 months)

- Snowballed cash flow toward the final $28k (eliminated in 15 months)

- Psychological payoff: Early victories cut her anxiety by 41% (per journal tracking), turning dread into addictive progress. “Knocking out that first debt felt like leveling up,” she noted. “Suddenly, $28k seemed conquerable.”

2025 data confirms: Snowball users stick to plans 2.3x longer than avalanche method adopters, per Federal Reserve surveys. Quick wins build resilience—proving willpower is muscle, not magic.

For those navigating complex recoveries, tools like fixcreditscenter.com integrate monitoring with personalized debt strategies, ensuring gains outlast setbacks.

[object Object]