Did you know 90% of top lenders use FICO® Scores? Unlock your free credit score today! Learn where to get genuine FICO® Scores without cost and how they impact loans, cards, and mortgages.

Understanding FICO® Scores

Why Your FICO® Score Matters

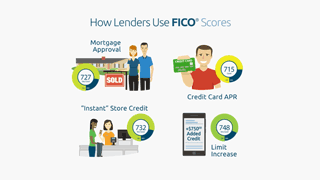

Lenders’ Preferred Credit Metric

- 90% of top U.S. lenders use FICO® Scores for loan decisions

- Impacts approval for credit cards, auto loans, and mortgages

Different Versions of FICO® Scores

Industry-Specific Scoring Models

- Mortgage lenders use FICO® Scores 2, 4, and 5

- Credit card issuers use FICO® Bankcard Scores

- Auto lenders use specialized auto-enhanced scores

Accessing Your FICO® Score for Free

Official Free Sources

Contrary to popular belief, you can legally obtain genuine FICO® Scores without paying. Here are verified free methods for 2025:

-

AnnualCreditReport.com:

- Federally mandated source for free weekly credit reports from all three bureaus (Equifax, Experian, TransUnion) through at least the end of 2025.

- While reports don’t always include a FICO® Score, Equifax often provides a free FICO® Score 8 with its report directly through this site.

-

Credit Card & Loan Statements:

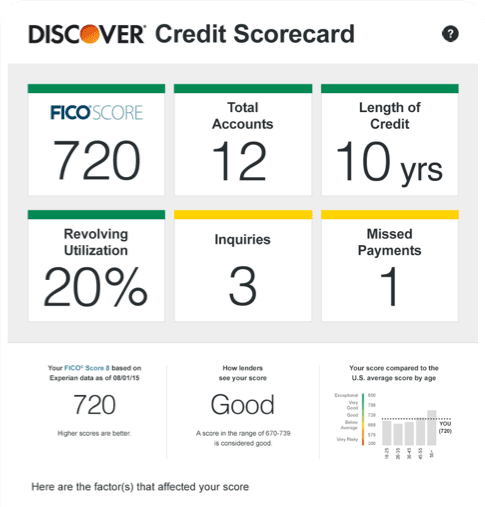

- Many major credit card issuers (e.g., Discover, Bank of America, Citi, American Express, Chase) provide a free monthly FICO® Score to cardholders. Check your online account or monthly statement.

- Often indicates the specific FICO® Score version used (e.g., FICO® Score 8 based on Experian data).

- Some auto lenders and mortgage servicers also provide free FICO® Scores relevant to your loan type.

-

Banks & Credit Unions:

- Numerous banks and credit unions offer free FICO® Score access as a perk to checking account or other customers (e.g., Wells Fargo, U.S. Bank, PenFed Credit Union). Log into your online banking portal to check availability.

| Free FICO® Score Source (2025) | Typical Score Version | Frequency | Key Limitation |

|---|---|---|---|

| AnnualCreditReport.com (Equifax) | FICO® Score 8 | Weekly (Report) | Only Equifax; Score not always present |

| Major Credit Card Issuers | Varies (Often FICO® 8 or Bankcard) | Monthly | Specific to that issuer’s card product |

| Participating Banks/Credit Unions | Varies (Often FICO® 8 or 9) | Monthly | Requires specific account relationship |

Understanding the Limitations of Free Scores

While invaluable for monitoring, free FICO® Scores often have caveats:

- Version Differences: The score you get free (often FICO® 8 or 9) might not be the exact version a specific lender uses (like FICO® 2,4,5 for mortgages). Your free score is a great indicator, but not the final word for every loan type.

- Single Bureau: Most free sources provide a score from only one credit bureau. Your score can differ slightly between bureaus.

- Timing: Free scores are typically updated monthly, not in real-time.

The Value of Knowing Your Score

Regularly checking your free FICO® Score empowers you to:

- Understand your current credit standing.

- Detect potential errors or signs of identity theft early.

- Track progress if you’re actively working to improve your credit.

- Gauge your likelihood of approval before applying for new credit.

Monitoring your free FICO® Score is a crucial first step in credit health awareness. If you discover significant errors or complex issues impacting your scores, professional help can be beneficial. For comprehensive credit report analysis and tailored dispute strategies, consider exploring reputable services like those offered at https://fixcreditscenter.com.

myFICO Free Plan Explained

Building on accessing genuine FICO® Scores without cost, the myFICO Free Plan stands as a specific, readily available option in 2025. Understanding exactly what it delivers – and its constraints – helps you determine if it meets your credit monitoring needs.

What You Get for Free

The myFICO Free Plan provides core features focused on one credit bureau:

Single-Bureau Coverage

- Monthly Equifax Credit Report: You receive access to your full credit report from Equifax once every 30 days.

- One FICO® Score: This plan includes your FICO® Score 8 specifically based on your Equifax credit data. This is a widely used base score version.

Basic Monitoring Features

- Alerts for New Account Openings: You’ll receive notifications if a new credit account (like a credit card or loan) is opened using your Equifax report.

- Credit Report Change Notifications: Significant changes detected on your Equifax report, such as new inquiries or shifts in account balances, will trigger alerts.

Key Limitations to Know

While offering valuable insight, the free tier has significant restrictions compared to paid myFICO subscriptions or multi-bureau monitoring:

Single Bureau Reporting Risk

- Lenders Check Different Bureaus: Creditors may pull your report from Experian, TransUnion, or a combination of bureaus, not necessarily Equifax. An error or negative item present only on your Experian or TransUnion report would be invisible through this free plan.

- Potential Blind Spots: Your monitoring is solely on Equifax data. Issues like fraudulent accounts opened using your information but only reported to Experian or TransUnion would not generate an alert, creating a critical gap in protection.

Limited Score Versions

- Mortgage & Auto Scores Excluded: The free plan provides only your FICO® Score 8. It does not include the specialized FICO® Score versions most critical for major loans, such as FICO® Scores 2, 4, and 5 (used by mortgage lenders) or the auto-enhanced scores favored by auto lenders.

- One of Many Variants: With over 28 different FICO® Score models in active use, the free plan gives you visibility into just one (FICO® Score 8). Your score could differ meaningfully in other versions used by different types of lenders.

The myFICO Free Plan offers a legitimate snapshot of your Equifax-based FICO® Score 8 and basic monitoring for that bureau. However, its single-bureau focus and exclusion of key industry-specific scores mean it might not provide the complete picture needed, especially if you’re planning a major loan application. If discrepancies or complex issues impacting multiple reports are discovered through basic monitoring, seeking expert analysis can be crucial. Services like https://fixcreditscenter.com specialize in comprehensive credit report reviews and targeted dispute resolution strategies.

Free Alternatives Comparison

While the myFICO Free Plan offers a starting point, understanding broader free resources helps maximize your credit insight without cost. Here’s how official reports and bank-provided scores stack up:

Official Free Credit Reports

AnnualCreditReport.com Access

Mandated by federal law, this portal remains your primary source for unrestricted credit reports from Equifax, Experian, and TransUnion. Key details for 2025:

- Weekly Full Reports: Access each bureau’s full report weekly—critical for spotting discrepancies or fraud across all three agencies.

- Raw Data Only: Reports contain your credit history (accounts, inquiries, balances) but exclude all FICO® Scores. You must interpret trends manually.

- No Alerts: Unlike myFICO Free, this service lacks change notifications or score monitoring.

Bank-Provided Free Scores

FICO® Score Open Access Program

Over 200 financial institutions participate in this program, providing complimentary scores to customers. Key nuances:

- FICO® Score 8 Access: Most banks offer this same base score version as myFICO Free—but bureau sources vary.

- Single-Bureau Limitation: Your bank typically shows a score from one bureau only (e.g., Bank A uses Experian, Bank B uses Equifax).

- Inconsistent Updates: Score refresh frequency ranges from monthly to quarterly, depending on the institution.

- No Full Reports: You see your score and limited reason codes, but not your complete credit report.

Quick-Reference Comparison

| Feature | myFICO Free Plan | AnnualCreditReport.com | Bank FICO® Scores (Open Access) |

|---|---|---|---|

| FICO® Score 8 Included | ✓ (Equifax only) | ✘ | ✓ (1 bureau, varies by bank) |

| 3-Bureau Credit Reports | ✘ | ✓ (weekly) | ✘ |

| Report Change Alerts | ✓ (Equifax only) | ✘ | ✘ |

| Specialized Scores (Auto/Mortgage) | ✘ | ✘ | ✘ |

Leveraging all three free options gives broader visibility: Use AnnualCreditReport.com for full tri-bureau reports, your bank for a second FICO® Score snapshot, and myFICO Free for Equifax-specific alerts. If inconsistencies arise—like a score discrepancy between bureaus or unexplained report entries—professional review tools like https://fixcreditscenter.com can pinpoint resolution strategies.

Identity Protection Options

Beyond monitoring your credit, proactive security measures are essential—and crucially, all core identity protection tools remain free in 2025. Here’s how to lock down your profile without cost:

Free Security Measures

Credit Freezes Explained

A credit freeze (or “security freeze”) is your strongest free defense against new account fraud:

- $0 Cost at All Bureaus: Federally mandated to be free for placement, temporary lift, and permanent removal at Equifax, Experian, and TransUnion.

- Complete Application Block: Lenders cannot access your frozen credit report, stopping unauthorized credit cards, loans, or services in their tracks.

- On-Demand Control: Unfreeze temporarily via PIN for legitimate applications (e.g., mortgage pre-approval), then re-freeze instantly.

Fraud Alerts Features

For faster, less restrictive protection, use a fraud alert:

- Free 1-Year Coverage: A single request to any bureau activates alerts at all three bureaus for 365 days.

- Mandatory Verification: Lenders must contact you directly to confirm identity before opening new accounts.

- Renewable Protection: Extended 7-year alerts require a police report (identity theft victims only).

What Freezes Don’t Block

Credit freezes won’t disrupt your existing financial life:

Permitted Credit Checks

- Current Account Reviews: Existing creditors can still monitor and soft-pull your frozen reports (e.g., credit limit increases).

- Non-Lending Purposes: Landlords, insurers, and employers may access your file for background checks—freezes only block new credit approvals.

Freezes and alerts work alongside tools like the myFICO Free Plan. If a security breach exposes your data—or frozen reports reveal suspicious pre-freeze activity—services like fixcreditscenter.com provide tailored dispute strategies and bureau escalation support.

Improving Your Score Free

Building a stronger credit profile doesn’t require expensive services. By strategically leveraging free tools and disciplined habits, you can significantly enhance your FICO® Score without opening your wallet.

Building Credit Without Fees

Payment History Optimization

Your payment history is the single largest factor in your FICO® Score—weighted at 35%. One late payment can cause a steep drop, but consistent timeliness steadily lifts scores. Implement these free tactics:

- Automate Minimum Payments: Set up automatic payments through your bank’s free bill-pay system to avoid accidental misses.

- Calendar Alerts: Use free digital calendars (Google Calendar, Apple Reminders) to schedule payment notifications 3 days before due dates.

- Creditor Text Alerts: Enroll in free SMS reminders offered by most credit card issuers and loan servicers.

Credit Utilization Strategies

Credit utilization (balances vs. limits) impacts ~30% of your score. Keeping this ratio low signals responsible borrowing:

- The 30% Threshold: Aim to keep individual card balances below 30% of their limits—and your total revolving debt under 30% of combined limits.

- Pre-Payment Tactics: If carrying balances, make free mid-cycle payments via banking apps before the statement closing date to lower reported utilization.

- Limit Tracking: Monitor credit limits and balances using free dashboards in apps like Capital One’s CreditWise or Amex’s MyCredit Guide.

| Free Utilization Tools | Key Features |

|---|---|

| Credit Card Provider Apps | Real-time balance tracking, limit visibility |

| MyFICO Free Plan Dashboard | Overall utilization % calculation |

| Bank Aggregation Tools | Combined debt/limit views across accounts |

Free Educational Resources

FICO® Score A Better Future™

This nonprofit initiative partners with community centers nationwide to offer free credit-building workshops in 2025. Key benefits include:

- Local In-Person Events: 90-minute sessions covering score fundamentals, dispute processes, and debt management—all at $0 cost.

- 1:1 Virtual Coaching: Book free 30-minute consultations with certified counselors to review your credit report barriers.

- Bilingual Materials: Resources available in English and Spanish at all locations.

myFICO Credit Education Center

Beyond scores, myFICO’s free portal delivers actionable planning tools:

- Loan Savings Calculator: Model how a 50-point score increase slashes mortgage interest costs over 30 years.

- Life-Stage Guides: Custom checklists for milestones like “First Credit Card at 18” or “Rebuilding After Bankruptcy.”

- Pre-Approval Simulator: See which credit cards you’d likely qualify for without a hard inquiry.

Pair these free resources with security freezes (as covered previously) for holistic financial health. If your myFICO free plan reveals deep-rooted inaccuracies—like unauthorized accounts surviving a freeze—fixcreditscenter.com offers specialized dispute workflows and bureau mediation.

[object Object]