Struggling with bad credit? Did you know 1 in 3 Americans have errors on their reports? Our 2025 guide reveals legal ways to fix your credit score fast and rebuild financial health.

【Why Dispute Letters Are Your Credit Secret Weapon】

How Errors Destroy Your Credit Score

Credit report errors are far from rare – a major FTC study found a staggering 79% of reports contain mistakes. These inaccuracies aren’t minor oversights; they actively sabotage your financial health. The most common culprits include:

- Incorrect Account Balances: Reporting outdated or inflated debt amounts.

- Outdated Collections: Accounts lingering past the 7-year reporting limit.

- Mixed Files: Information from someone with a similar name appearing on your report.

- Fraudulent Accounts: Opened by identity thieves.

The impact is severe and quantifiable. Even a single significant error can trigger a credit score drop of 50 to 150 points. This plunge directly translates to real-world consequences:

| Credit Score Impact | Financial Consequence (2025) |

|---|---|

| 50-100 Point Drop | Higher auto loan APRs (+1.5-3%), increased insurance premiums |

| 100-150+ Point Drop | Mortgage denials or significantly higher interest rates, credit card application rejections, security deposit requirements for utilities |

| Any Significant Drop | Reduced negotiating power for loans, potential job offer impacts (where permitted) |

Your Legal Right to Accurate Reports

The Fair Credit Reporting Act (FCRA) is your powerful legal shield against credit report errors. Enacted to ensure fairness and accuracy, it mandates strict procedures credit bureaus and data furnishers (creditors, lenders, collectors) must follow:

- Your Right to Dispute: You have the explicit right to challenge any information you believe is inaccurate or incomplete on your report.

- Bureau Obligation: Upon receiving your valid dispute letter, the credit reporting agencies (Equifax, Experian, TransUnion) are legally required to initiate an investigation within 30 days (2025 update: electronic disputes often trigger faster automated checks, but mailed letters remain crucial for complex issues).

- Furnisher Verification: The bureau must forward your dispute to the entity that provided the data (the furnisher). That furnisher is then obligated to investigate your claim, review relevant evidence, and report back to the bureau.

- Correct or Delete: If the furnisher cannot verify the information’s accuracy during their investigation, or if the bureau finds the dispute valid, the item must be corrected or permanently deleted from your report.

- Results Notification: The bureau must provide you with the written results of their investigation and a free copy of your report if the dispute resulted in a change. If an item is changed or deleted, they must also notify you of your right to request that notices of the correction be sent to anyone who received your report in the past six months (two years for employment purposes).

Understanding and exercising these FCRA rights is fundamental. A well-crafted dispute letter triggers this powerful legal process, forcing the system to verify the questionable items harming your score. While navigating disputes yourself is possible, leveraging specialized tools like those offered by fixcreditscenter.com can streamline the process, ensuring your letters meet all FCRA requirements and maximizing your chances of success in 2025’s credit landscape.

【Crafting Dispute Letters That Get RESULTS】

The Agero Formula Blueprint

Ask these key verification questions

Forcing creditors and bureaus to verify disputed items is the core of effective credit repair. Under the Fair Credit Reporting Act (FCRA), they must respond to specific, targeted questions within 30 days (2025 update: electronic disputes may accelerate timelines, but mailed letters ensure thorough handling). Focus your dispute letters on these high-impact verification demands:

- Date account opened/Payment history accuracy: Challenge inconsistencies in account age or payment records, as errors here directly skew credit utilization and history length calculations. Demand proof like original statements to confirm timelines.

- Original creditor name/Current ownership proof: Verify if debt ownership has changed legally, preventing outdated or fraudulent claims. Require documented evidence of chain of title to avoid mixed-file errors common in 2025 credit reports.

Demand complete data validation

Elevate your dispute by insisting on full documentation per FCRA mandates. This shifts the burden to furnishers to prove item validity, increasing deletion rates for unverifiable data:

- “Provide signed contract copy per FCRA § 623”: Cite this section to compel proof of a legally binding agreement, as unverifiable contracts invalidate debt claims. In 2025, this tactic combats prevalent errors like inflated balances.

- “Show complete payment history chain”: Require an unbroken record from origination to present, exposing gaps or inaccuracies. This forces correction or removal of items like outdated collections lingering past the 7-year limit.

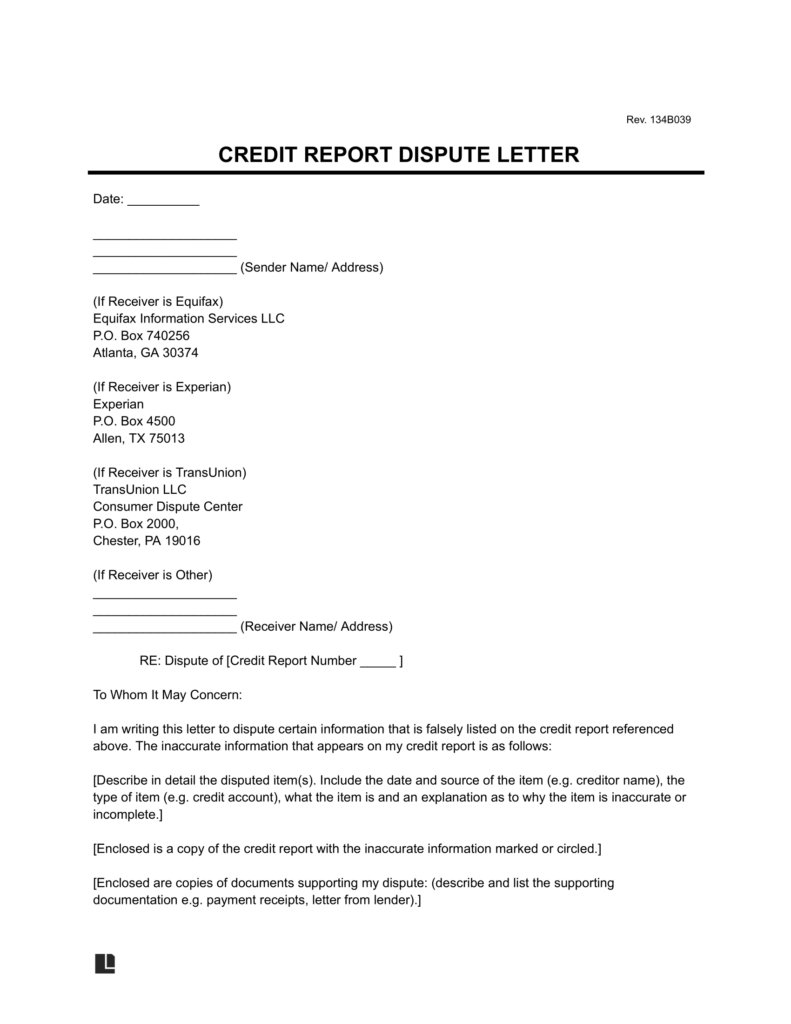

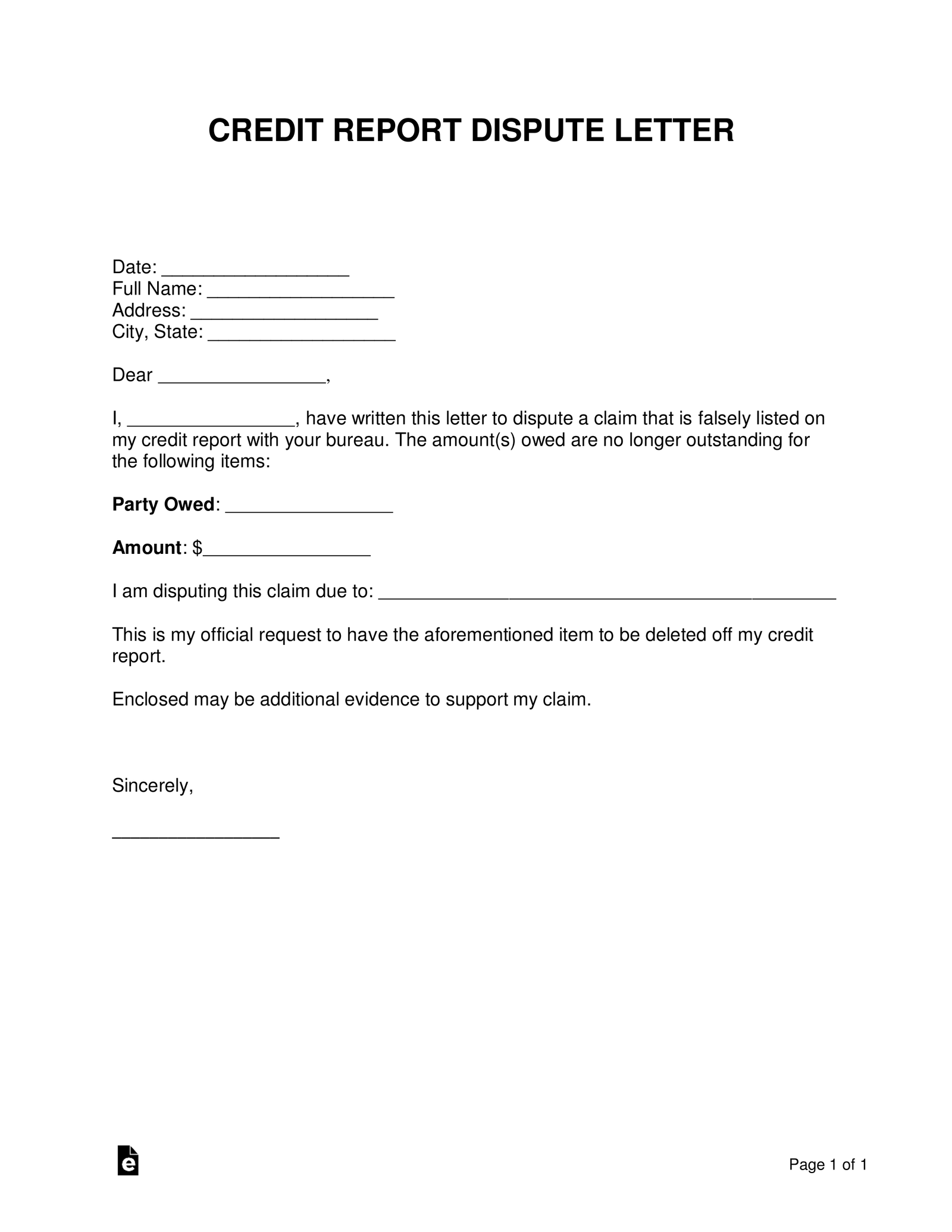

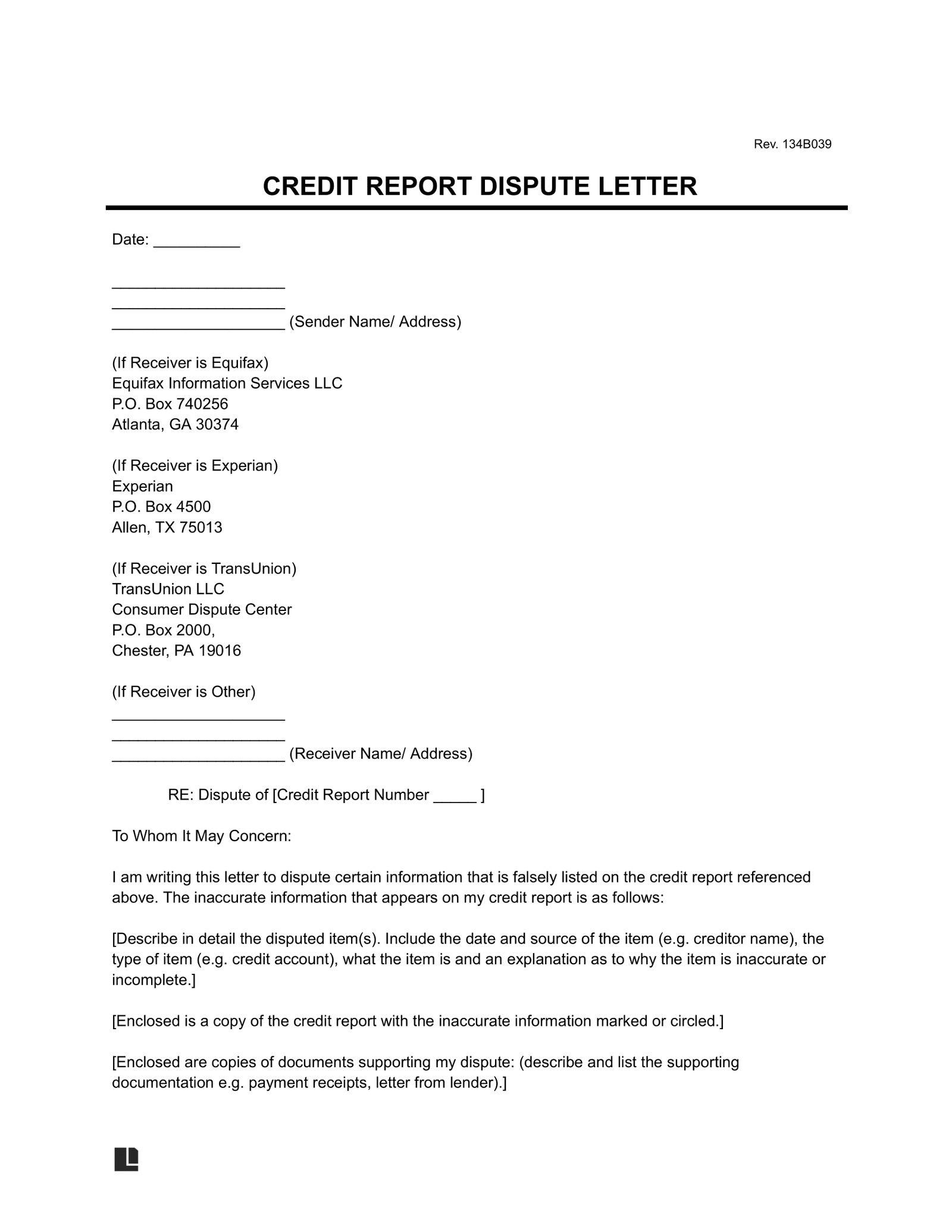

Factual Dispute Template Essentials

Step-by-step letter structure

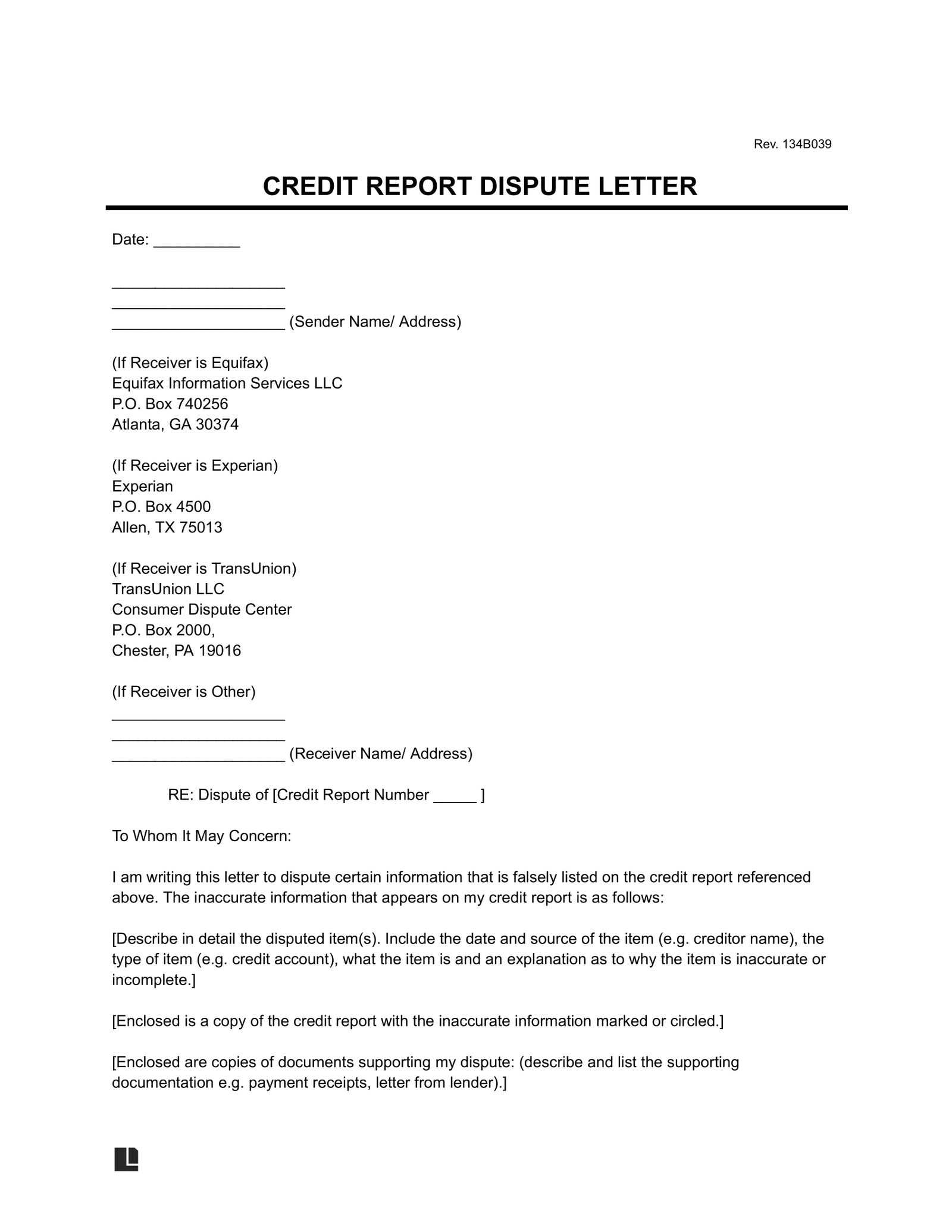

A well-structured dispute letter triggers FCRA investigations efficiently. Follow this exact format to ensure bureaus act:

- Header: Include your full name, address, date of birth, and Social Security number, plus the credit bureau’s address (e.g., Equifax, Experian, or TransUnion). Add a subject line: “Formal Dispute of Inaccurate Information per FCRA.”

- Body: List each disputed item by report line number, describing the error factually (e.g., “Account #12345 shows an incorrect balance of $500 vs. actual $300”). Attach copies of evidence like credit reports or receipts—never originals. Reference FCRA rights to underscore legitimacy.

- Demand: End with a clear, bolded statement: “Delete if unverified within 30 days per FCRA § 611(a).” This sets a firm deadline for correction or removal, leveraging your legal protections.

Critical components for success

Maximize dispute effectiveness with these non-negotiable elements, essential in 2025’s digital-heavy credit environment:

- Certified mail tracking (proof of delivery): Always send letters via USPS certified mail with return receipt. This creates a verifiable paper trail, proving timely delivery if disputes escalate legally.

- Reference FCRA violation codes like § 611: Explicitly cite codes such as § 611 (investigation requirements) to highlight potential violations. This pressures bureaus to comply, avoiding generic rejections common with online disputes. For persistent issues, tools from fixcreditscenter.com automate tracking and code integration, streamlining your credit repair journey.

【Remove Collections & Charge-Offs WITHOUT Paying】

Beating Collections with Validation Letters

Debt validation vs. credit disputes

Understand the critical distinction:

- Debt Validation (DV) Letters: Sent directly to debt collectors under the Fair Debt Collection Practices Act (FDCPA). You have 30 days from their initial contact to demand proof they legally own the debt and can collect it. This is not sent to credit bureaus.

- Credit Dispute Letters: Sent to credit bureaus (Equifax, Experian, TransUnion) under the FCRA to challenge inaccurate reporting on your credit report itself.

Key Action: Upon receiving a collection notice, immediately send a formal Debt Validation Letter via USPS Certified Mail. Demand:

- Proof of the original signed contract or agreement.

- Documentation establishing the collector’s legal right to collect this specific debt (chain of title).

- A detailed accounting showing how the current balance was calculated.

When collectors can’t validate

The 2025 reality is stark: most collection agencies operate on thin documentation. When you force validation:

- High Failure Rate: Industry data suggests approximately 7 out of 10 collectors cannot produce the legally required documentation upon request.

- Mandatory Result: Under FDCPA § 809(b), if a collector fails to validate the debt within 30 days of your request, they must cease all collection efforts. Crucially, they cannot report or continue reporting the debt to credit bureaus. This leads to permanent deletion of the collection account from your credit reports.

Wiping Out Charge-Offs Legally

Why paying doesn’t fix credit

Paying a charged-off account seems logical, but it often backfires for credit scoring:

- “Paid Charge-Off” Status: The negative mark (“Charged Off”) remains on your report for the full 7-year period from the date of first delinquency. While “paid” is marginally better than “unpaid,” it’s still a severe derogatory item dragging down your scores.

- No Score Reset: Payment does not restart the 7-year reporting clock, but it also doesn’t remove the negative history. Your scores suffer for years regardless.

Smarter Strategy: Dispute the charge-off directly with the credit bureaus and the original creditor (furnisher) using FCRA-based dispute letters. Focus your demand on compelling them to validate the debt’s legitimacy per FCRA § 623(a)(8), specifically requesting a copy of the original signed contract proving your liability.

Free removal methods that work

Leverage these dispute tactics to target charge-offs for deletion without payment:

- Challenge Balance Accuracy: Dispute the reported balance with the bureaus. Furnishers often fail to update balances accurately after charge-off, especially if fees were added. Demand they provide a complete payment history chain proving the current amount. Inaccuracies force correction or deletion.

- Verify Statute of Limitations (SOL) Compliance: While the SOL (varying by state, typically 3-6 years in 2025) governs how long you can be sued for the debt, disputing whether the charge-off is reported with the correct Date of First Delinquency (DoFD) is crucial. The DoFD determines when the 7-year reporting period expires. If the DoFD is incorrect, disputing it can lead to early removal. Demand documentation proving the DoFD.

- Demand Contract Validation (Furnisher Level): Send a direct dispute to the original creditor demanding validation per FCRA § 623. State clearly: “Per FCRA § 623(a)(8)(B), I demand you provide me with documentation verifying that I entered into a legally binding contract for this account, including a copy bearing my signature.” Failure to provide this often results in deletion.

Persistence Pays: Track your disputes meticulously. If initial disputes fail, escalate by citing specific FCRA violations (§ 611 investigation failures, § 623 furnisher inaccuracies). Tools from fixcreditscenter.com streamline this process, providing templates, certified mail tracking, and violation code integration to maximize your success rate. Take control of your report – validate first, pay never. Start crafting your dispute letters today at https://fixcreditscenter.com.

【Fast-Track Credit Repair in 14-60 Days】

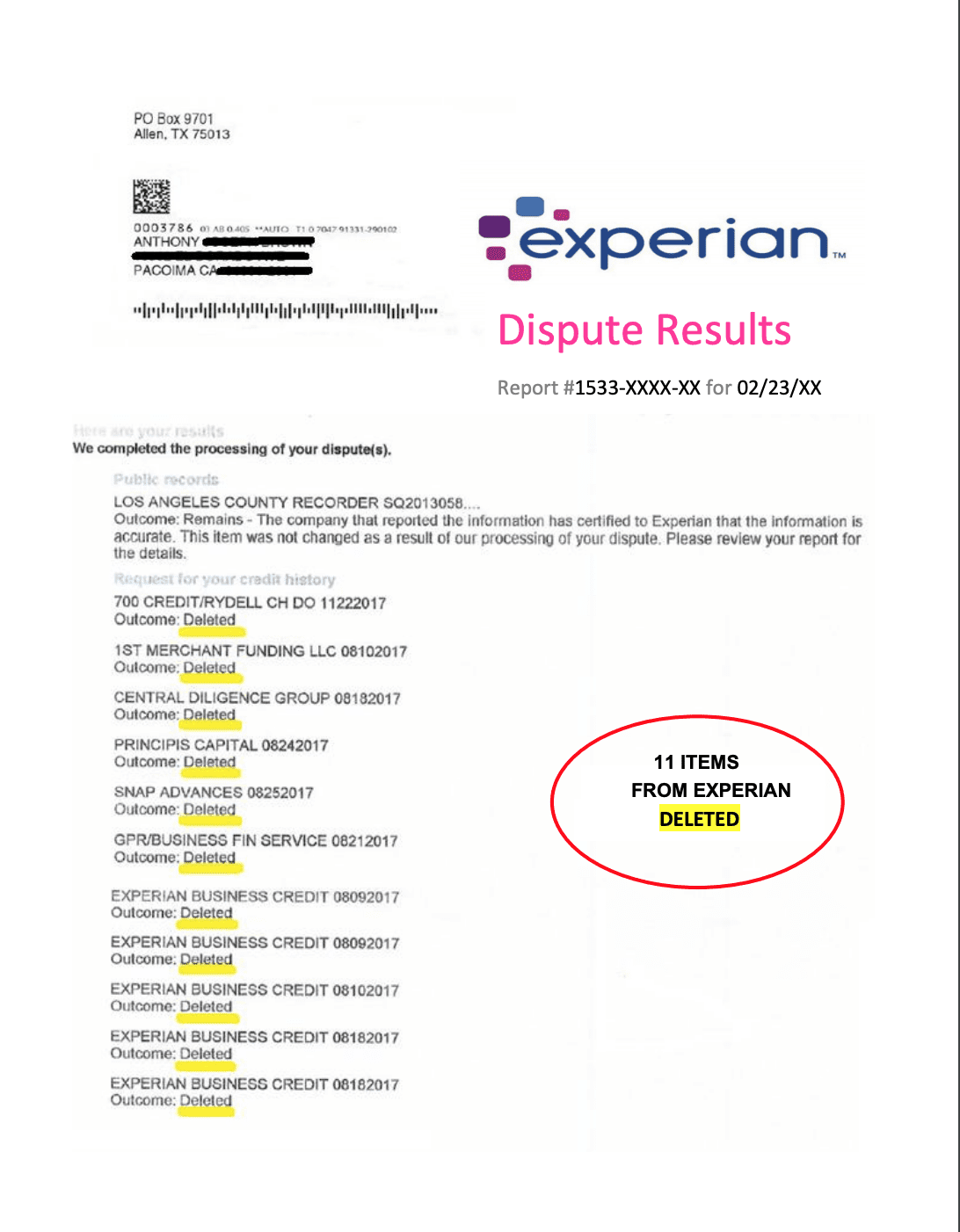

Building on the foundation of strategically removing collections and charge-offs without payment, the next step is implementing a structured, time-bound system to maximize dispute efficiency and accelerate results. The 60-Day Dispute Funnel System leverages legal timeframes to force bureau and creditor action.

The 60-Day Dispute Funnel System

This system capitalizes on the strict investigation deadlines mandated by the FCRA (Fair Credit Reporting Act). Credit bureaus have only 30 days (typically 30-45 days including mail time) to complete their investigation upon receiving your dispute.

Phase 1: Initial disputes (Days 1-15)

- Strategic Targeting: Select 3-5 specific, disputable items per bureau. Prioritize items where you have clear evidence of inaccuracy (e.g., wrong dates, incorrect balances, accounts not yours, outdated collections/charge-offs lacking validation proof as discussed previously). Avoid disputing too many items simultaneously per bureau to reduce the risk of your dispute being flagged as “frivolous”.

- Dual-Channel Filing: Maximize pressure and create a verifiable paper trail:

- Online Disputes: File disputes directly through each bureau’s online portal (Equifax, Experian, TransUnion). This initiates the official 30-day investigation clock immediately.

- Certified Mail Disputes: Simultaneously send a detailed dispute letter for the same items via USPS Certified Mail with Return Receipt Requested. Your letter must clearly identify each item (creditor name, account number), state the specific reason for the dispute (e.g., “Incorrect Date of First Delinquency,” “Balance inaccurately reported,” “Not my account,” “Lacks validation per FCRA § 623”), and demand deletion or correction. Include copies (NOT originals) of supporting documents. This mailed copy serves as your legal proof of the dispute date and content if the online system fails or the bureau claims non-receipt.

Phase 2: Escalation tactics (Days 16-45)

- Reinvestigation Demands: Monitor bureau responses closely. If you receive an incomplete response (e.g., “verified” without providing how it was verified or what evidence was used), a generic response, or no response by Day 30-35:

- Immediately send a Reinvestigation Demand Letter via Certified Mail. Cite FCRA § 611(a)(7) which requires bureaus to provide you with a description of the investigation procedure, the name/address of the furnisher contacted, and the results of the investigation. State that their initial response failed to comply and demand a proper reinvestigation.

- CFPB Complaint (Day 40+): If the reinvestigation demand fails to yield a proper resolution or deletion by Day 40-45, file a formal complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB complaint portal forces the bureau and/or furnisher to respond directly to the government regulator within 15-60 days. This step resolves a significant portion of stalled disputes. Clearly reference your previous dispute attempts (include Certified Mail tracking numbers) and the specific FCRA violations (§ 611 non-compliance).

Rapid Score Boost Strategies

While removing major negatives is crucial, quick wins provide momentum and can yield noticeable score increases in as little as 14 days, creating immediate benefits for loan applications or credit card approvals.

Quick-win targets for 14-day results

- Remove Outdated Personal Information: Dispute obsolete or incorrect personal details:

- Past Addresses: Bureaus often link negative accounts to old addresses. Dispute removal of any address where you never lived or haven’t resided at for several years. This can sometimes weaken the bureau’s ability to “verify” negative accounts associated with that address. Use the online dispute system for addresses/names – these are often processed faster than account disputes.

- Incorrect Name Variations/Misspellings: Dispute removal of maiden names, nicknames, or typos. Reduces confusion and potential mixed-file errors.

- Dispute Minor Late Payments: Target isolated, older (12+ months) 30-day late payments on otherwise positive accounts, especially if:

- You believe it was reported in error.

- The creditor offers a goodwill adjustment (call first, but follow up with a dispute if refused).

- The reporting seems inconsistent (e.g., late one month but not adjacent months). Removal of even one recent late payment can provide a quick score lift.

Rebuilding with $0 cost options

Simultaneously build positive history without upfront fees:

- Secured Cards: Opt for cards with $0 annual fees. Prioritize issuers known to graduate to unsecured cards (e.g., Discover it® Secured, SDFCU Savings Secured Visa). Deposit amounts as low as $200-$500. Use responsibly (<10% utilization) and pay in full monthly. This reports positive payment history to all bureaus.

- Credit Builder Loans: Utilize alternatives to Self Lender:

- Credit Union Options: Many federal credit unions (e.g., Digital Federal Credit Union – DCU, Alliant CU) offer low/no-fee credit builder loans or secured share loans.

- No-Fee Services: Platforms like SeedFi Credit Builder (or similar services prevalent in 2025) often provide credit builder loans without upfront fees, reporting payments to all three bureaus. Funds are typically accessible after successful repayment.

Leveraging this structured 60-Day Funnel, targeting quick wins, and adding positive $0-cost tradelines creates a powerful acceleration strategy. For precision dispute letters tailored to each tactic (initial dispute, reinvestigation demand, CFPB escalation draft), certified mail tracking, and FCRA violation templates, fixcreditscenter.com provides the essential tools to execute this system efficiently. Streamline your path to a higher score at https://fixcreditscenter.com.

【Why Bother Fixing Credit Report Errors?】

Building on the structured 60-Day Dispute Funnel and rapid score boost tactics, addressing inaccuracies isn’t just about optimization—it’s essential financial hygiene. Errors lurking in your reports actively undermine your financial foundation and legal rights demand proactive correction.

Errors Wreck Your Financial Health

Credit report inaccuracies aren’t mere paperwork glitches; they inflict tangible, costly damage:

Impact on Credit Scores

- The Prevalence Problem: A landmark FTC study reveals 1 in 5 consumers (20%) have identifiable errors on their credit reports (Source: HighRadius). These range from minor personal detail mistakes to major reporting inaccuracies like accounts you never opened or paid collections erroneously marked as unpaid.

- Score Suppression: Even a single error can be catastrophic. An incorrectly reported late payment, inflated balance, or fraudulent account can slash scores by 100+ points. This drop isn’t abstract—it directly translates to worse financial opportunities.

Real-Life Consequences

- Higher Borrowing Costs: Errors lead to higher interest rates or outright denials. As noted by the Florida Bar, a lower credit score can cost tens of thousands of dollars in extra interest over the life of a mortgage or auto loan (Source: Florida Bar). A seemingly small rate difference compounds massively.

- Beyond Loans: Errors affect insurance premiums, rental applications, utility deposits, and even job prospects. Landlords and employers often check creditworthiness, and inaccurate negatives unfairly penalize you.

Your Legal Rights Under FCRA

The Fair Credit Reporting Act (FCRA) isn’t just legalese—it’s your enforceable toolkit for demanding accuracy.

Fair Credit Reporting Act Protections

- The 30-Day Mandate: The cornerstone of credit repair. Credit bureaus must investigate your disputes within 30 days of receipt and correct or delete unverifiable information (Source: CFPB). This legal deadline is the engine driving the 60-Day Dispute Funnel System.

- Bureau & Furnisher Liability: The FCRA holds both credit reporting agencies (Equifax, Experian, TransUnion) and the entities furnishing them data (banks, lenders, collectors) accountable for reporting accurate information. If they fail, you have legal recourse.

Section 609 Explained

- Your Verification Right: FCRA Section 609(c)(2)(E) empowers you to demand proof. It grants you the explicit right to request verification of any item listed on your credit report (Source: HighRadius). This is crucial when disputing accounts. If a creditor cannot provide documented proof of the debt’s validity and accuracy upon your request (often triggered via a dispute), the item must be removed.

- Foundation for Disputes: Section 609 requests are powerful tools within dispute letters. Demanding verification forces the bureau and furnisher to prove their claim, shifting the burden off you. Many deletions occur because furnishers fail to meet this legal requirement within the tight timeframe.

Ignoring errors means surrendering financial control. Proactively wielding your FCRA rights—especially through targeted credit dispute letters that work—is the most effective way to reclaim accuracy and financial opportunity. For dispute letter templates leveraging Section 609, certified mail tracking, and FCRA violation guides to enforce your rights, fixcreditscenter.com provides the precise tools needed. Start enforcing your rights today at https://fixcreditscenter.com.

【Preparing to Dispute Like a Pro】

Building on the critical need to enforce your FCRA rights against damaging credit report errors, effective preparation is non-negotiable. Skipping this step undermines even the strongest dispute letters. Here’s how to methodically gather and organize your ammunition.

Get Your Credit Reports

You can’t dispute what you haven’t seen. Obtaining your full reports is the essential first step.

Where to Access Free Reports

- The Official Source: AnnualCreditReport.com remains the federally authorized website for obtaining your free credit reports weekly from Equifax, Experian, and TransUnion (Source: CFPB). Accessing all three is crucial, as errors often appear on only one or two reports.

- Post-Dispute Tip: After submitting disputes, request your reports again (still free via AnnualCreditReport.com) to verify corrections were made accurately.

Spotting Common Errors

Scrutinize every line item. Focus especially on:

- Incorrect Account Balances/Limits: Balances reported higher than actual, or credit limits lower than reality, hurt utilization ratios.

- Duplicate Accounts: The same debt listed multiple times.

- Fraudulent Accounts/Inquiries: Accounts or hard inquiries you didn’t authorize (Source: NerdWallet).

- Outdated Negative Information: Late payments, collections, or bankruptcies reported beyond the 7-10 year limit.

- Inaccurate Personal Information: Misspelled names, wrong addresses, or incorrect SSN digits – these can signal mixed files.

Gather Your Evidence

A dispute without proof is just a complaint. Documentation forces bureaus and furnishers to act.

Essential Documentation

Assemble proof relevant to each specific error:

- Proof of Payment: Canceled checks, bank statements showing payments cleared, payment confirmation numbers/receipts.

- Account Statements: Official statements showing the correct balance, payment history, or account status.

- Identity & Address Proofs: Copy of driver’s license, passport, or recent utility bill to confirm your identity and resolve personal info errors (Source: FTC).

- Communication Records: Copies of emails or letters with creditors regarding account resolution.

- Police Reports/Identity Theft Affidavits: Essential for disputing fraudulent accounts.

Organizing Your Case

Clarity wins disputes. Organize systematically:

-

Obtain Physical Copies: Print your credit reports from each bureau.

-

Highlight & Label: Clearly highlight each disputed item on the relevant report copy. Assign a unique identifier (e.g., “Error 1A: TransUnion, Page 2, Account #XXXX”).

-

Match Evidence: For each highlighted error, attach the specific piece of evidence that proves it’s wrong. Staple or paperclip documents directly to the marked report page.

-

Create a Master List: A simple table keeps track:

Dispute ID Credit Bureau Item Description (e.g., “Chase Visa Incorrect Balance”) Type of Error Supporting Document (e.g., “Chase Statement 03/2025”) 1A TransUnion Account #1234 – Balance $5,000 Incorrect Bal Chase Statement showing $2,500 balance (03/01/2025) 2B Experian “ABC Collections” Account Fraudulent FTC Identity Theft Report (Case #XYZ) (Source: NerdWallet principles for organized dispute filing)

Thorough preparation transforms generic complaints into legally compelling disputes. This meticulous organization directly supports the power of credit dispute letters that work, leveraging the FCRA’s 30-day investigation mandate and Section 609 verification rights discussed previously. When your evidence is irrefutable and presented clearly, deletions follow. For streamlined dispute packages including pre-formatted Section 609 request letters, evidence organization guides, and certified mail tracking, fixcreditscenter.com provides the exact tools to execute this process confidently. Begin your organized dispute journey at https://fixcreditscenter.com.

【Crafting Your Knockout Dispute Letter】

Building directly on your meticulous evidence gathering and organization, the dispute letter itself is your legal lever. A poorly structured letter wastes that preparation. Crafting a precise, legally compliant demand forces action under the FCRA. Here’s what separates effective credit dispute letters that work from ignored complaints.

The Core Components

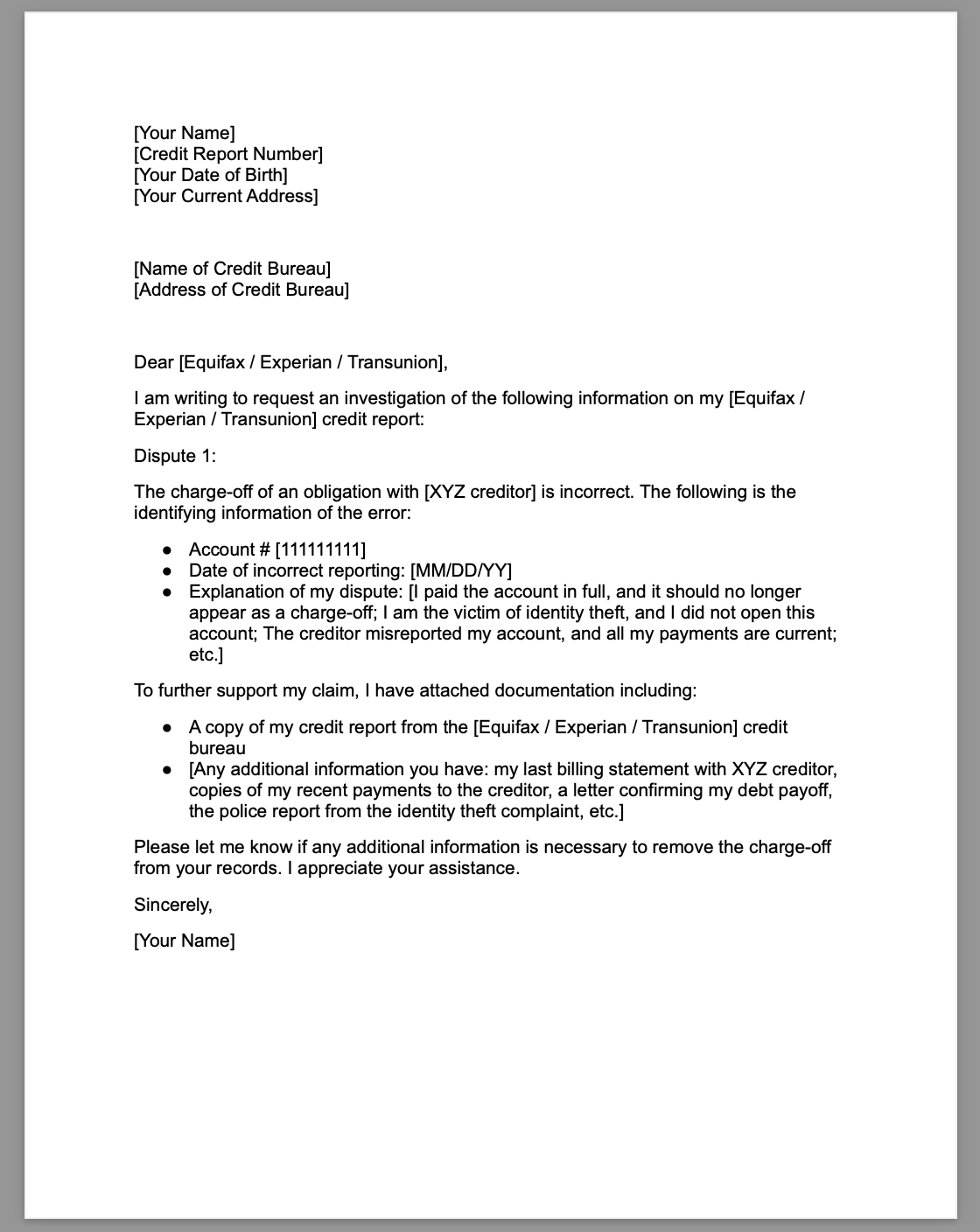

Every dispute letter must contain specific elements to trigger the bureaus’ legal obligations and ensure accurate processing.

Must-Have Elements

Omission of key details can delay resolution or lead to dismissal. Ensure every letter includes:

- Full Personal Information: Your complete legal name, current address, previous addresses (if relevant within the past 2 years), Date of Birth, and full Social Security Number. This prevents confusion with similar names or mixed files.

- Explicit Identification of Each Disputed Item: For every error, state:

- The credit bureau name (Equifax, Experian, TransUnion)

- The creditor name and account number as it appears on the report

- The specific reason for the dispute (e.g., “incorrect balance,” “fraudulent account,” “obsolete late payment”).

- Clear Demand for Action: State unequivocally whether you demand deletion, correction, or investigation. Cite your FCRA rights (e.g., “Pursuant to FCRA Section 611(a)(1), I request you investigate and remove this inaccurate information”).

- Reference to Attached Evidence: Directly link your proof to each disputed item (e.g., “See attached bank statement dated 03/15/2025 showing payment clearing for Account #XXXX, contradicting the reported late payment”).

- Your Signature: A physical or digital signature is legally required (Source: Florida Bar recommendations for enforceable dispute communication).

The Magic of Certified Mail

Sending your dispute via Certified Mail with Return Receipt Requested is non-negotiable. This provides:

- Proof of Delivery: Establishes the exact date the bureau received your dispute, starting their 30-day investigation clock under FCRA Section 611.

- Legal Documentation: Creates a verifiable paper trail essential if litigation becomes necessary. An email or online portal submission lacks this concrete proof of receipt and timeliness (Source: Florida Bar emphasis on preserving legal recourse).

- Priority Handling: Physical mail often receives more rigorous attention than online disputes.

Avoid These Costly Mistakes

Common errors can derail even well-documented disputes. Steer clear of these pitfalls.

Frivolous Dispute Pitfalls

The FCRA (Section 611) allows bureaus to deem disputes “frivolous or irrelevant” and dismiss them without investigation. Avoid triggers like:

- Vague Claims: Disputing an item as “inaccurate” without specifying why or how it’s wrong. Example: “This account is wrong.” vs. “The reported balance of $5,000 for Account #1234 is incorrect; my statement dated 03/01/2025 shows the correct balance is $2,500.”

- Disputing Verifiable Information: Challenging factual, recent late payments you actually made without new evidence proving otherwise.

- Blanket Disputes: Sending a generic letter demanding removal of all negative items without specific reasons and evidence for each one. Bureaus can reject these en masse (Source: CFPB guidance on frivolous disputes).

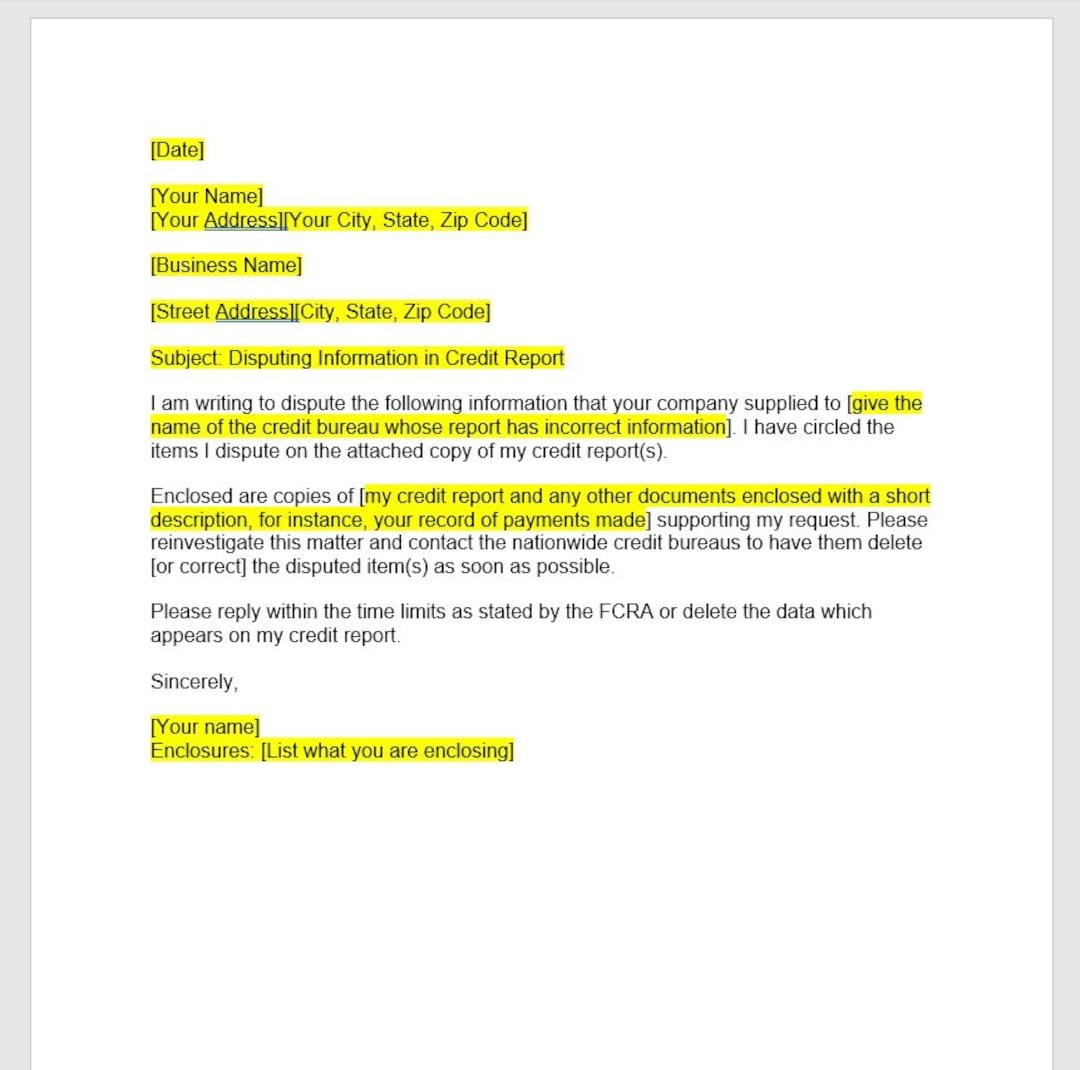

Sample Letter Breakdown

Utilize proven templates to ensure clarity and compliance. Here’s a core structure incorporating FTC and NerdWallet best practices:

[Your Full Name]

[Your Current Address]

[Your Date of Birth]

[Your Full SSN]

[Date]

[Credit Bureau Name] (Send separate letters to each bureau)

Dispute Department

[Bureau Address - Find the *specific* dispute address on their website or your report]

**Subject: Formal Dispute of Inaccurate Information - [Your Name], Report Confirmation # [Your Report Number, if available]**

Dear [Credit Bureau Name],

I am writing to dispute inaccurate information found on my credit report obtained on [Date You Pulled Report]. I request a thorough investigation pursuant to my rights under the Fair Credit Reporting Act (FCRA), Section 611.

**Disputed Item 1:**

* **Creditor Name:** [Name exactly as shown on report]

* **Account Number:** [Number exactly as shown on report]

* **Description of Item:** [e.g., "Late Payment reported for July 2025", "Account Balance of $X"]

* **Reason for Dispute:** [Be SPECIFIC: e.g., "I made the payment on time on MM/DD/2025. The attached bank statement (Page 2) shows the cleared payment on MM/DD/2025.", OR "This account is fraudulent/I am a victim of identity theft. Attached is the FTC Identity Theft Report (Case #XYZ) and police report (Report #123)."]

* **Requested Action:** [e.g., "Please delete this inaccurate late payment entry.", "Please remove this fraudulent account entirely."]

**[Repeat the "Disputed Item" structure above for each separate error]**

Attached are copies of the following documents supporting my dispute for your review:

* [List each supporting document clearly, matching your Dispute ID/evidence from your master list, e.g., "Bank Statement - Chase Visa #XXXX - 03/01/2025", "FTC Identity Theft Report - Case #XYZ"]

Please investigate these disputed items, provide me with written results of your investigation, and furnish corrected reports to all entities that received my report within the past six months (or two years for employment purposes), as required by FCRA Section 611.

Sincerely,

[Your Signature]

[Your Typed Name]

Enclosures: [List number of pages enclosed, e.g., "5 pages: Credit Report Excerpts (3), Bank Statement (1), FTC Report (1)"]

Precisely structured dispute letters, backed by organized evidence and sent via certified mail, maximize your leverage. For expertly drafted, FCRA-compliant dispute letter templates pre-formatted with Section 609 and 611 language, alongside certified mail tracking tools and bureau-specific address guides, fixcreditscenter.com streamlines this critical step. Ensure your dispute demands attention: https://fixcreditscenter.com.

【Sending & Tracking Your Dispute】

![]()

Having crafted your precise dispute letter, sending it correctly and tracking the process is crucial. Bureau-specific protocols and strict timelines govern this phase.

Contacting the Big Three

Always send separate dispute letters to each credit bureau. Using the correct, bureau-specific dispute address ensures your dispute enters their system promptly. Online portals or general mailing addresses can cause delays or misrouting.

Bureau-Specific Addresses

Verify addresses directly on each bureau’s website or your credit report, as they may change. As of 2025, the primary dispute mailing addresses are:

| Credit Bureau | Certified Dispute Mailing Address | Source |

|---|---|---|

| Equifax | PO Box 740256, Atlanta, GA 30374 | Florida Bar |

| Experian | PO Box 4500, Allen, TX 75013 | Florida Bar |

| TransUnion | PO Box 2000, Chester, PA 19016 | Florida Bar |

Always send via Certified Mail with Return Receipt Requested. Retain your mailing receipt and the signed return receipt (green card) as legal proof of delivery and the start date of the investigation period.

The 30-Day Investigation Timeline

Once received, the credit bureau has 30 days under FCRA Section 611 to investigate your dispute and respond in writing.

What Happens Behind the Scenes

- Bureau Notification: The bureau must notify the data furnisher (creditor, lender, etc.) of your dispute within 5 business days of receipt.

- Furnisher Verification: The furnisher is legally obligated to investigate your claim, review all provided evidence, and report back to the bureau. They must verify the accuracy and completeness of the disputed information (Source: CFPB). If they cannot verify it or fail to respond, the bureau must delete or correct the item.

- Bureau Review: The bureau evaluates the furnisher’s response and your evidence. If the information is found inaccurate, unverifiable, or incomplete, it must be corrected or deleted.

Tracking Your Dispute

- Start the Clock: Your 30-day timeline begins the day the bureau receives your dispute (proven by your Certified Mail return receipt).

- Monitor Mail & Online: The bureau will mail investigation results. Some bureaus may also provide online status updates if you have an existing report access account.

- The 45-Day Rule: If you haven’t received results within 45 days of the bureau’s receipt (accounting for mail time), follow up immediately in writing. Cite FCRA Section 611 and include copies of your initial dispute proof. Failure to respond within 30 days generally requires the bureau to remove the disputed item (Source: CFPB guidance on dispute timelines).

- Review Results Carefully: The bureau’s response must include the investigation outcome and a free updated credit report if changes occurred. Verify corrections were made accurately.

Persistent tracking ensures bureaus and furnishers meet their obligations. For streamlined dispute management—including automated tracking of your 30-day window, bureau-specific mailing kits with pre-addressed Certified Mail envelopes, and follow-up templates—fixcreditscenter.com provides essential tools to enforce your rights: https://fixcreditscenter.com.

【When Disputes Don’t Go Your Way】

Even after a meticulous dispute process, credit bureaus may reject your claim. Don’t give up—specific steps exist to escalate your case or seek further recourse under the Fair Credit Reporting Act (FCRA). Act promptly to protect your credit health.

Next Steps After Rejection

If a credit bureau upholds an inaccurate item, reinforce your position immediately. Delaying weakens your leverage under FCRA timelines.

Reinforcing Your Case

Submit additional documentation to strengthen your dispute. Include evidence like payment receipts, account statements, or correspondence that directly contradicts the disputed information. As NerdWallet advises, this new proof must be clear and relevant, forcing bureaus to reopen investigations within 30 days. Always send via Certified Mail and reference your original dispute ID for tracking.

Adding a Statement of Dispute

If evidence alone doesn’t resolve the issue, add a 100-word statement of dispute to your credit report. As the CFPB outlines, this brief explanation remains on file for up to seven years, alerting future lenders to your perspective. Keep it factual and concise—focus on why the item is inaccurate, without emotional language. This step costs nothing and can mitigate damage while you pursue corrections.

When to Seek Legal Help

Certain scenarios signal FCRA violations or severe issues like identity theft, warranting professional intervention. Recognize red flags early to avoid prolonged credit damage.

FCRA Violation Red Flags

Suspect legal breaches if bureaus ignore submitted evidence, fail to conduct timely investigations, or dismiss disputes without valid reasons. According to the Florida Bar, these actions violate FCRA Section 611, potentially entitling you to damages. Document all interactions and consult a consumer rights attorney if patterns persist—many offer free initial consultations to evaluate your case.

Identity Theft Recovery

For disputes linked to identity theft, report the incident immediately at IdentityTheft.gov. As the CFPB emphasizes, this federal portal generates an official recovery plan and report, which you can use to demand permanent item removal from credit reports. Follow up with bureaus within 30 days, attaching your IdentityTheft.gov report as proof to expedite resolutions.

For ongoing dispute support—including identity theft documentation templates and attorney referrals—fixcreditscenter.com offers specialized tools to navigate complex cases: https://fixcreditscenter.com.

【Maintaining Spotless Credit Long-Term】

Securing accurate credit reports is just the start. Long-term credit health demands consistent vigilance and smart financial habits. By adopting proactive monitoring and strategic credit management, you shield yourself from future inaccuracies and build lasting financial resilience.

Regular Monitoring Habits

Catching errors early is crucial. Regular checks transform your credit report from a reactive document into a proactive financial tool.

Free Credit Tracking Tools

- Access Weekly Reports: Leverage your legal right to free weekly credit reports from all three bureaus via

AnnualCreditReport.com(Source: CFPB 2025). This surpasses the pre-2025 annual allowance. - Strategic Review: Rotate checks between Equifax, Experian, and TransUnion every 4 weeks for continuous, year-round coverage without gaps. Scan for unfamiliar accounts, incorrect balances, or reappearing disputed items.

Setting Credit Alerts

- Fraud Alerts: Place a free one-year fraud alert with any bureau (it propagates to all three). This mandates lenders to verify your identity before opening new credit, freezing suspicious activity instantly (Source: FTC 2025).

- Credit Freezes: For maximum security (especially post-identity theft), institute free credit freezes. This locks access to your report entirely, preventing new account openings unless you temporarily lift the freeze using your unique PIN.

Building Financial Resilience

Beyond monitoring, actively strengthening your credit profile minimizes future dispute risks and enhances your financial standing.

Impact of Error Correction

Resolving inaccuracies delivers tangible score benefits, creating a stronger foundation:

| Action | Typical Score Impact (2025 Data) | Timeline for Effect |

|---|---|---|

| Removal of Major Error (e.g., Collections) | +40 to +100 points | Immediate upon update |

| Correction of Balance/Limit Error | +10 to +50 points | 1-2 billing cycles |

| Removal of Late Payment | +20 to +80 points | Varies by recency |

(Source: Aggregate 2025 industry reporting from major credit scoring model analysts)

Healthy Credit Utilization

- The 30% Rule: Keep revolving account balances (like credit cards) below 30% of their credit limit at any reporting date (typically statement closing). Significantly lower utilization (under 10%) is optimal for scoring.

- Strategic Payments: Make payments before your statement closes if you anticipate high spending. This controls the balance reported to bureaus, directly managing your utilization ratio (Source: Credit Bureau Best Practices Guidance 2025).

Maintaining vigilance through free tools and building resilience via low utilization and corrected reports forms your credit health backbone. For personalized dispute tracking templates, advanced monitoring setup guides, and tools to automate credit limit increase requests (optimizing utilization), explore resources at fixcreditscenter.com: https://fixcreditscenter.com.

Key Takeaways for Credit Repair Success

By following these proven strategies – checking reports regularly, disputing errors, and managing payments – you can significantly improve your credit score. Remember, rebuilding credit takes time but starts with smart actions today.

Ready to take control of your financial future? Visit https://fixcreditscenter.com now to explore personalized solutions. Share your credit repair journey in the comments below!