Did you know 35% of your FICO® Score depends on payment history? Cashback credit cards aren’t just rewarding—they’re powerful tools for rebuilding credit when used strategically. Here’s how to turn everyday spending into credit score gains in 2025.

【Why Cashback Cards Help Rebuild Credit】

Responsible Spending Builds Positive History

Using a cashback credit card responsibly is one of the most effective tools for rebuilding your credit profile in 2025. The core mechanics of credit scoring reward consistent, on-time payments and controlled borrowing – exactly what these cards facilitate when managed well. Here’s how responsible use directly impacts the largest factors in your FICO® Score:

Key credit factors improved by card use

- Payment History (35% of FICO score): This is the single most crucial factor. Every single on-time payment you make with your cashback card gets reported to the major credit bureaus (Experian, Equifax, TransUnion). Setting up autopay for at least the minimum payment is a powerful safeguard against missed payments, steadily building a positive history over time. Consistency here is key.

- Credit Utilization Ratio (30% of score): This measures how much of your available credit you’re using. Low utilization (generally under 30%, ideally under 10%) signals responsible credit management. Cashback cards provide a revolving credit line. By making small, planned purchases you know you can pay off immediately, and then paying the statement balance in full by the due date, you keep this ratio low. This demonstrates you can access credit without overextending yourself.

Impact of Responsible Cashback Card Use on Credit Factors:

| Credit Factor | Weight in FICO® Score | How Cashback Card Use Helps | Key Action for Rebuilders |

|---|---|---|---|

| Payment History | 35% | Reports positive history with each on-time payment. | Always pay on time (set autopay minimum). |

| Credit Utilization | 30% | Provides revolving credit; low balances reported when paid off keep utilization ratio low. | Keep balances very low & pay in full. |

| Credit Age | 15% | Adds a new active account; contributes to average age over time. | Keep the account open long-term. |

| Credit Mix | 10% | Adds a type of credit (revolving) to your profile. | Diversifies your credit types. |

| New Credit | 10% | The initial application causes a hard inquiry (small, temporary dip). | Apply strategically, not frequently. |

Rewards Motivate Consistent Usage

Beyond the core credit-building mechanics, cashback rewards offer a unique psychological advantage for those focused on rebuilding: they provide tangible, immediate positive reinforcement for using the card responsibly. This motivation is crucial for establishing the consistent usage patterns needed for long-term credit improvement.

Cashback encourages regular small purchases

- The prospect of earning cash back on everyday spending (like groceries, gas, or streaming services) incentivizes you to use the card for planned, budgeted expenses you would make anyway with cash or debit. This regular activity is vital.

- Example: Swiping your cashback card for a predictable $25-$50 monthly grocery charge, then paying that full balance off by the due date, accomplishes multiple goals simultaneously:

- It reports a positive payment to the bureaus.

- It reports a low balance, keeping your utilization ratio healthy.

- It earns you a small reward (e.g., $0.50 – $1.00 back).

- It keeps the account active and reporting positive data monthly.

- Avoids inactivity account closure: Credit card issuers may close accounts that sit unused for extended periods. A closed account, especially a newer one, can negatively impact your average account age and overall available credit, hurting your utilization ratio. Regular, small, responsible purchases funded by cashback rewards prevent this inactivity, ensuring the account remains open and contributing positively to your credit history over the long term. Consistent, manageable usage is far more beneficial for rebuilding than sporadic large purchases or letting the card gather dust.

The combination of building positive payment history, maintaining low utilization, and keeping the account actively contributing to your credit age creates a powerful foundation for score improvement. The cashback rewards act as a helpful nudge, making this necessary credit-rebuilding activity feel more rewarding in the short term while you work towards the larger goal of a healthier credit profile. For personalized strategies on optimizing your credit repair journey in 2025, consider consulting resources available at https://fixcreditscenter.com.

【Best Secured Cashback Cards】

Secured credit cards require a refundable security deposit, which becomes your credit limit. This makes them accessible for credit rebuilding while offering cashback rewards. Choosing the right secured card combines credit-building fundamentals with tangible rewards, reinforcing the responsible habits discussed earlier. Here are top contenders for 2025:

Discover it® Secured Credit Card

This card stands out for its robust rewards and clear path to transitioning to an unsecured card.

Rewards structure & credit benefits

- Earn 2% cash back at Gas Stations and Restaurants (on up to $1,000 in combined purchases each quarter), plus 1% cash back on all other purchases. This structure rewards common, budgeted spending categories.

- Automatic reviews for graduation: Starting at 7 months, Discover automatically reviews your account monthly for responsible usage (like consistent on-time payments and low utilization). Upon graduation, you receive your deposit back and the card converts to an unsecured cashback card, continuing to report positive history. This systematic review process is a major advantage for rebuilders aiming to transition away from secured cards.

No annual fee advantage

- $0 yearly cost: Unlike many secured cards that charge annual fees (often around $35), the Discover it® Secured card has no annual fee. This maximizes the value of your cashback earnings and reduces the cost of rebuilding credit.

- First-year cashback match: Discover matches all the cash back you earn at the end of your first year as a new cardmember. This effectively doubles your first-year rewards, providing significant extra value as you establish positive credit habits.

Capital One Quicksilver Secured Cash Rewards

This card offers simplicity with flat-rate rewards and flexible deposit options.

Lower deposit flexibility

- Accessible deposit amounts: Depending on your creditworthiness, you may be approved with a security deposit of $49, $99, or $200 to establish an initial credit line of $200. This lower potential deposit requirement makes it easier to get started compared to cards requiring a deposit equal to the full credit line.

- Possible credit limit increase at 6 months: Capital One may automatically review your account after 6 months of responsible use (on-time payments, low balances). If approved, you can receive a higher credit limit without needing to add to your initial deposit. A higher limit further aids in maintaining a low credit utilization ratio.

Flat-rate rewards simplicity

- 1.5% cash back on all purchases: Earn unlimited 1.5% cash back on every purchase, every day. There are no rotating categories or spending caps to track. This simplicity makes it easy to earn rewards on all your planned spending without complication.

- 5% cash back on Capital One Travel bookings: Earn an elevated 5% cash back on hotels and rental cars booked through Capital One Travel. This provides extra value for occasional travel expenses.

| Card Feature Comparison (2025) | Discover it® Secured | Capital One Quicksilver Secured |

|---|---|---|

| Min. Security Deposit | $200 (Determines credit line) | $49, $99, or $200 (for $200 line) |

| Rewards Rate | 2% Gas/Restaurants ($1k/qtr), 1% else | 1.5% on all purchases |

| Annual Fee | $0 | $0 |

| Path to Graduation/Unsecured | Automatic review starting at 7 months | Potential CLI review at 6 months |

| Key Psychological Benefit for Rebuilders | High rewards potential + clear graduation path | Lower deposit entry + simple flat rewards |

Both cards effectively leverage cashback rewards to incentivize the consistent, responsible card usage essential for rebuilding credit – reporting on-time payments, enabling low utilization, and keeping accounts active. The Discover card excels with higher potential rewards in key categories and a defined graduation timeline, while the Capital One card offers greater initial deposit flexibility and straightforward flat-rate earnings. Selecting the card that best aligns with your spending patterns and deposit capability helps turn necessary credit-building actions into a more rewarding process. For tailored advice on integrating these tools into your broader 2025 credit recovery plan, explore strategies at https://fixcreditscenter.com.

【Managing Your Rebuilding Card】

Successfully using your secured cashback card to rebuild credit hinges on consistent, responsible habits. While the rewards are a nice perk, the core focus remains demonstrating reliability to credit bureaus. Here’s how to optimize usage and sidestep common traps.

Optimizing Credit Utilization

Your credit utilization ratio – the percentage of your credit limit you’re using – is a major factor in your credit score. Keeping it low signals control.

Keeping balances below 30% limit

- The Golden Rule: Aim to keep your reported statement balance below 30% of your credit limit. For example, with a $300 limit, your balance should ideally be $90 or less when the statement closes. Lower utilization (under 10%) is even better for scoring.

- Multiple monthly payments strategy: Don’t wait for the due date. Make multiple small payments throughout the month, especially after larger purchases. This actively keeps your reported balance low and minimizes utilization, even if you spend close to your limit within a billing cycle. Set calendar reminders or use app alerts to stay on track.

Avoiding Common Pitfalls

Rebuilding credit requires vigilance against costly mistakes that can undo your progress.

High-interest danger zones

- Carrying a balance is costly: Secured cards often carry high APRs, typically ranging from 27% to 30% in 2025. Carrying even a small balance month-to-month quickly erases any cashback earned and adds significant debt. Always pay your statement balance in full by the due date.

- Late payment double-whammy: Missing a payment triggers a late fee (averaging around $40) and significantly damages your credit score. Payment history is the most crucial scoring factor. Set up autopay for at least the minimum due as a safety net.

Fee minimization tactics

- Prioritize $0 annual fee cards: As highlighted with cards like the Discover it® Secured and Capital One Quicksilver Secured, choosing a card with no annual fee is paramount. This ensures your cashback earnings aren’t negated and reduces the overall cost of rebuilding. Avoid cards charging annual fees unless the benefits demonstrably outweigh the cost (rare for secured cards).

- Steer clear of cash advances: Cash advances typically start accruing high interest immediately (often even higher than purchase APR) and usually come with fees (e.g., 3-5% of the advance amount). They offer no rewards and harm utilization. Use your card solely for planned purchases you can pay off.

Managing your secured card wisely transforms it from a simple tool into a powerful engine for credit recovery. By diligently controlling utilization, paying in full, avoiding fees, and sidestepping high-cost traps, you maximize the positive reporting impact. For personalized strategies on integrating these cards into your broader 2025 credit improvement journey, discover actionable plans at https://fixcreditscenter.com.

【Rebuilding Credit Timeline】

Understanding the realistic timeframe for credit score improvement helps manage expectations and identify strategic milestones, like seeking credit limit increases. Consistent, responsible use of secured cashback cards builds positive payment history and lowers utilization – the key drivers for score gains.

Realistic Score Improvement Expectations

While individual results vary significantly based on your starting point and overall credit profile, data from major secured card issuers provides benchmarks:

Average point gains with responsible use

Responsible use means paying your statement balance in full every month and maintaining low utilization (ideally under 30%, preferably under 10%). Based on reported user data:

| Card Provider | Timeframe | Avg. FICO® Score Increase | Key Responsible Use Factors |

|---|---|---|---|

| Discover | 6 months | +30 points | On-time payments, <30% utilization |

| OpenSky | 6 months | +47 points | On-time payments, low utilization |

- Important Context: These are averages. Your increase depends on your unique credit history (e.g., severity/duration of past issues). Gains are often faster initially as new positive habits offset recent negatives. Continued responsible use beyond 6 months yields further, though potentially slower, improvements. Patience and consistency are non-negotiable.

When to Seek Credit Line Increases (CLIs)

A higher credit limit is a powerful tool. It directly improves your credit utilization ratio when you maintain similar spending levels. Timing your request strategically increases approval odds.

Qualification indicators

Lenders look for clear proof of reliability before granting a CLI on a secured card or considering an unsecured product change:

- Sustained On-Time History: 6+ months of consecutive on-time payments is the absolute minimum baseline. A full year of perfect payments significantly strengthens your case. This demonstrates consistent reliability – the core factor lenders assess.

- Demonstrated Need & Ability: Increased, verifiable income (e.g., recent pay stubs, tax returns) shows you can handle more credit responsibly. Also, consistently using a significant portion of your current limit while still paying it off monthly indicates the need for more headroom to maintain low utilization.

Pre-approved upgrade opportunities

Many secured card issuers actively review accounts for graduation, often around the 7-12 month mark. Look for these signals:

- Product Change to Unsecured Cards: If you receive an offer to convert your secured card (e.g., Discover it® Secured, Capital One Quicksilver Secured) to its unsecured version without needing a new application, this is a major milestone. It typically includes:

- Security Deposit Refund: Your initial deposit is returned.

- Potential CLI: Often comes with a higher credit limit.

- Retained Benefits: You usually keep your account history and any earned rewards.

- Security Deposit Refund Processes: Some issuers may proactively refund your deposit while keeping the card open as unsecured, or invite you to apply for the refund after a period of good standing (e.g., 8-12 months). Check your cardholder agreement or online account for specific policies.

Successfully navigating the rebuilding timeline hinges on the disciplined habits outlined earlier – low utilization, full payments, and avoiding fees. Monitoring your progress and recognizing when you qualify for the next step, like a CLI or graduation, accelerates your recovery. For tailored strategies to optimize your secured card usage and transition to stronger credit products in 2025, explore comprehensive guidance at https://fixcreditscenter.com.

【Alternative Options Comparison】

While the secured cards discussed earlier are foundational for rebuilding, two additional options deserve consideration in 2025 based on specific needs: one secured card requiring no credit check, and one unsecured card offering cashback with a low annual fee. Carefully weigh these against your starting point and rebuilding goals.

No Credit Check Cards

For individuals whose credit history is extremely limited or damaged to the point where even standard secured card approvals are uncertain, a no credit check secured card can be a critical entry point. These cards typically still require a security deposit but bypass traditional credit pulls.

OpenSky® Plus Secured Visa®

This card provides a viable path when other doors might be closed, focusing on building positive payment history without an initial credit inquiry.

- $0 Annual Fee with $300+ Deposit: A significant advantage over some alternatives, it avoids recurring costs. The minimum deposit starts at $300, determining your credit limit. Higher deposits directly increase your available credit, aiding utilization management from day one.

- Credit Bureau Reporting to All Three Agencies: Crucially, OpenSky reports your payment activity monthly to Experian, Equifax, and TransUnion. This consistent, positive reporting is the primary mechanism for rebuilding your scores over time, provided you make all payments on time and keep utilization low.

Key Consideration: While accessible, the lack of an initial credit check means the issuer relies heavily on your deposit. Responsible use (on-time payments, low utilization) remains paramount for score improvement. Monitor for potential graduation offers after sustained good standing (typically 12+ months).

Low-Fee Unsecured Options

As your credit begins to recover (often after 6-12 months of responsible secured card use), exploring unsecured cards with modest fees and rewards becomes feasible. These cards represent a step forward but require caution regarding costs.

Credit One Bank® Platinum Visa®

This card targets those transitioning from secured cards or with fair credit seeking rewards, but requires careful fee evaluation.

- Cashback on Groceries/Gas/Utilities: Earns 1% cash back on eligible purchases in these essential spending categories. While rewards rates are modest, they offer a tangible benefit on everyday expenses compared to non-reward secured cards.

- Free Credit Score Tracking Included: Provides regular access to your credit score (typically VantageScore 3.0 based on TransUnion data), helping you monitor your rebuilding progress conveniently within your account.

Key Considerations: This card often has an annual fee (ranging from $0 to $99 in the first year, varying by creditworthiness, potentially increasing in subsequent years – always confirm the specific offer terms). It may also have higher variable APRs. Weigh the potential cashback earned against the annual fee to ensure it’s truly beneficial. Approval generally requires demonstrating improved creditworthiness beyond the starting point for secured cards.

Choosing the right tool depends heavily on your current credit standing and financial discipline. For those needing the most accessible entry point with no credit check, secured options like OpenSky provide the essential reporting framework. As scores improve through consistent positive habits (on-time payments, low utilization), low-fee unsecured cards like the Credit One Platinum might offer rewards, but require diligent cost-benefit analysis. Continue focusing on the core rebuilding principles outlined previously, and when ready to strategically navigate these options or seek product upgrades, detailed 2025 guidance is available at https://fixcreditscenter.com.

【Rebuilding Credit FAQs】

Navigating credit rebuilding involves answering key questions about card choices. Based on 2025 options, this section clarifies common debates to help you make informed decisions aligned with your financial recovery goals.

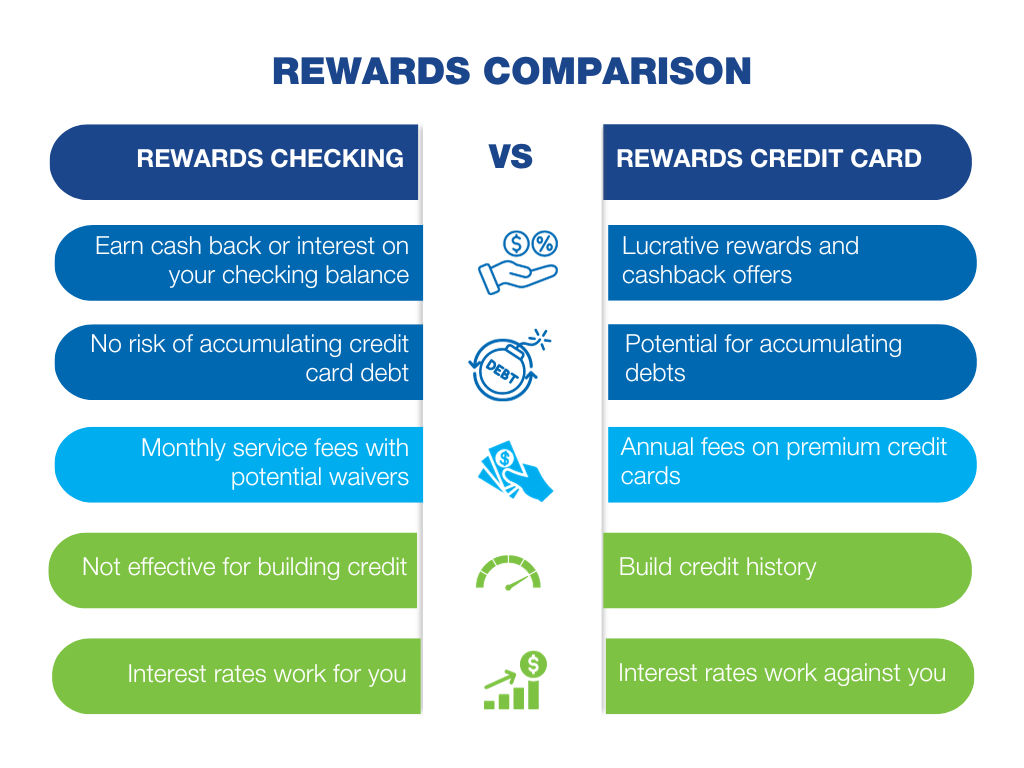

Secured vs. Unsecured Cards Debate

Understanding the core differences between secured and unsecured cards is vital for rebuilding credit effectively. Each has distinct trade-offs tied to deposit requirements and accessibility.

Deposit requirement trade-offs

The choice often boils down to whether you prioritize upfront security or immediate flexibility:

- Secured cards demand a cash deposit as collateral, which locks your funds but offers significant advantages. As seen with options like the OpenSky® Plus Secured Visa®, they typically feature lower fees (e.g., $0 annual fee) and higher approval odds—especially for those with damaged credit. Your deposit (starting at $300) directly sets your credit limit, aiding utilization control from day one. This makes them ideal for establishing a positive payment history through consistent reporting to all three bureaus.

- Unsecured cards, such as the Credit One Bank® Platinum Visa®, require no deposit, granting immediate spending power. However, this comes with higher costs, including variable annual fees (up to $99) and APRs. They’re better suited for those with improving credit after 6-12 months of secured use, but the lack of a deposit buffer increases risk if utilization isn’t managed tightly.

Rewards vs. No-Fee Priorities

Balancing rewards like cashback against cost savings is crucial in 2025. Focus on your spending habits and rebuilding stage to determine what aligns best with your needs.

When cashback justifies fees

Cashback can offset fees, but only under specific conditions:

- If your monthly spending exceeds $300 in bonus categories (e.g., groceries, gas, or utilities), as with the Credit One Bank® Platinum Visa®’s 1% rewards. For instance, spending $400/month could earn $48 annually, potentially covering a lower-tier fee.

- First-year fee waivers provide a grace period to test rewards without initial costs. Always confirm offer terms, as fees may rise in later years—weigh cashback gains against long-term expenses to avoid net losses.

Pure credit-building focus

For those prioritizing score improvement above all, no-fee cards simplify the process:

- $0 fee secured cards, like the OpenSky® Plus Secured Visa® with its $0 annual fee, eliminate recurring costs while ensuring bureau reporting. This allows you to channel funds toward deposits for better utilization management.

- Emphasize utilization management over rewards: Keep balances below 30% of your limit to maximize score gains. Rewards can distract from core habits like on-time payments; stick with simple tools until your credit stabilizes.

Rebuilding credit demands patience and strategy—monitor your progress using free score trackers and graduate to better products as your scores rise. For personalized 2025 strategies or card comparisons, explore tailored advice at https://fixcreditscenter.com.

【Responsible Card Management】

Rebuilding credit requires more than just choosing the right card—consistent management habits determine your success. These 2025 strategies ensure every payment and balance check actively boosts your score.

Payment Strategies That Build Credit

Timely payments (35% of your FICO® Score) and low utilization (30%) form the foundation of credit recovery. Optimize both with these tactics:

Auto-pay setup for minimum payments

- Critical safeguard: Automating minimum payments prevents accidental 30+ day late reports that tank scores

- Implementation: Link cards to checking accounts via mobile banking apps; set alerts 3 days before due dates

- Pro tip: Pair with calendar reminders for manual full-balance payments when possible to avoid interest

Statement closing date awareness

- Reporting mechanics: Issuers report balances to bureaus after statement closing dates (not payment due dates)

- Strategic payment timing: Pay down balances to <10% of limit 5 days before closing date to showcase ideal utilization

- Example: If your OpenSky® Plus Secured Visa® has a $300 limit and a July 15 closing date, ensure balance is ≤$30 by July 10

Monitoring Your Progress

Track your rebuilding journey with free tools—knowledge prevents setbacks and accelerates progress.

Free credit score resources

| Resource | Frequency | Key Features |

|---|---|---|

| AnnualCreditReport.com | Weekly reports | Official FTC-mandated reports (all 3 bureaus) |

| Credit Karma | Weekly updates | VantageScore® tracking + alert system |

| Experian Free Credit Monitoring | Daily updates | FICO® Score 8 access + dark web scans |

Disputing credit report errors

With 1 in 5 reports containing errors (per 2025 FTC data), corrective action is non-negotiable:

- Identify errors: Review all three reports monthly for inaccuracies like paid debts marked “unresolved”

- File disputes: Submit evidence (bank statements, payment confirmations) via bureau online portals

- Track timelines: By law, bureaus have 30 days to investigate and 5 days to resolve valid disputes

Rebuilding requires vigilance—combine these management tactics with the secured/unsecured cards discussed earlier for maximum impact. For dispute templates or personalized 2025 credit-building plans, leverage expert tools at https://fixcreditscenter.com.

Key Takeaways for Credit Rebuilding Success

Rebuilding your credit with cashback cards hinges on three core principles: consistent on-time payments (set autopay minimums!), keeping utilization below 30%, and long-term account maintenance. The Discover it® Secured and Capital One Quicksilver Secured cards offer the perfect blend of rewards and credit-building features for 2025, with no annual fees and clear graduation paths.

Remember: small, regular purchases you can pay off immediately yield better results than sporadic large charges. Track your progress using free credit monitoring tools, and dispute any errors promptly.

Ready to start your credit recovery journey? Visit https://fixcreditscenter.com for personalized strategies—share your rebuilding story in the comments below!