Did you know 42% of credit reports contain errors? Fixing them is your fastest path to a higher score. Learn 2025’s top strategies for a “credit fix fast”—from dispute shortcuts to utilization hacks.

【Understanding Credit Repair Speed】

Credit repair isn’t an overnight process, but with focused actions, you can achieve noticeable improvements quickly—especially if you target high-impact factors. In 2025, understanding how credit scoring timelines work is key to accelerating your “credit fix fast” journey. Let’s break down the mechanics and what you can realistically accomplish in a short timeframe.

How Credit Scoring Timelines Work

Credit scores evolve based on regular reporting cycles, not instant updates. Knowing these rhythms helps you time your actions for maximum speed.

Key Reporting Cycles

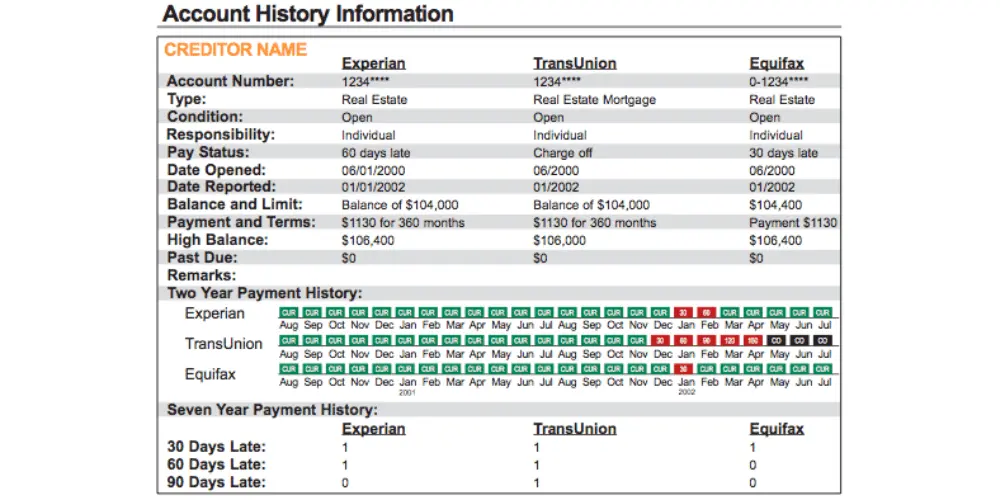

- Creditor reporting frequency: Most lenders report account updates to credit bureaus (like Equifax, Experian, and TransUnion) every 30–45 days. This means changes to your credit behavior—such as paying off debt—won’t reflect immediately but typically appear on your report within this window.

- Dispute resolution under FCRA: The Fair Credit Reporting Act mandates that credit bureaus investigate disputes within 30 days of receipt. If you spot errors (e.g., incorrect late payments), filing a dispute can lead to corrections in under a month, potentially boosting your score fast.

For context: These cycles ensure data accuracy but introduce a slight delay; acting promptly during reporting periods speeds up visible results.

Realistic Expectations for Quick Improvements

While a full credit overhaul takes time, certain elements respond swiftly to targeted efforts—ideal for a “credit fix fast” approach. Aim for these high-leverage areas to see gains in as little as 30 days.

What You Can Fix in 30 Days

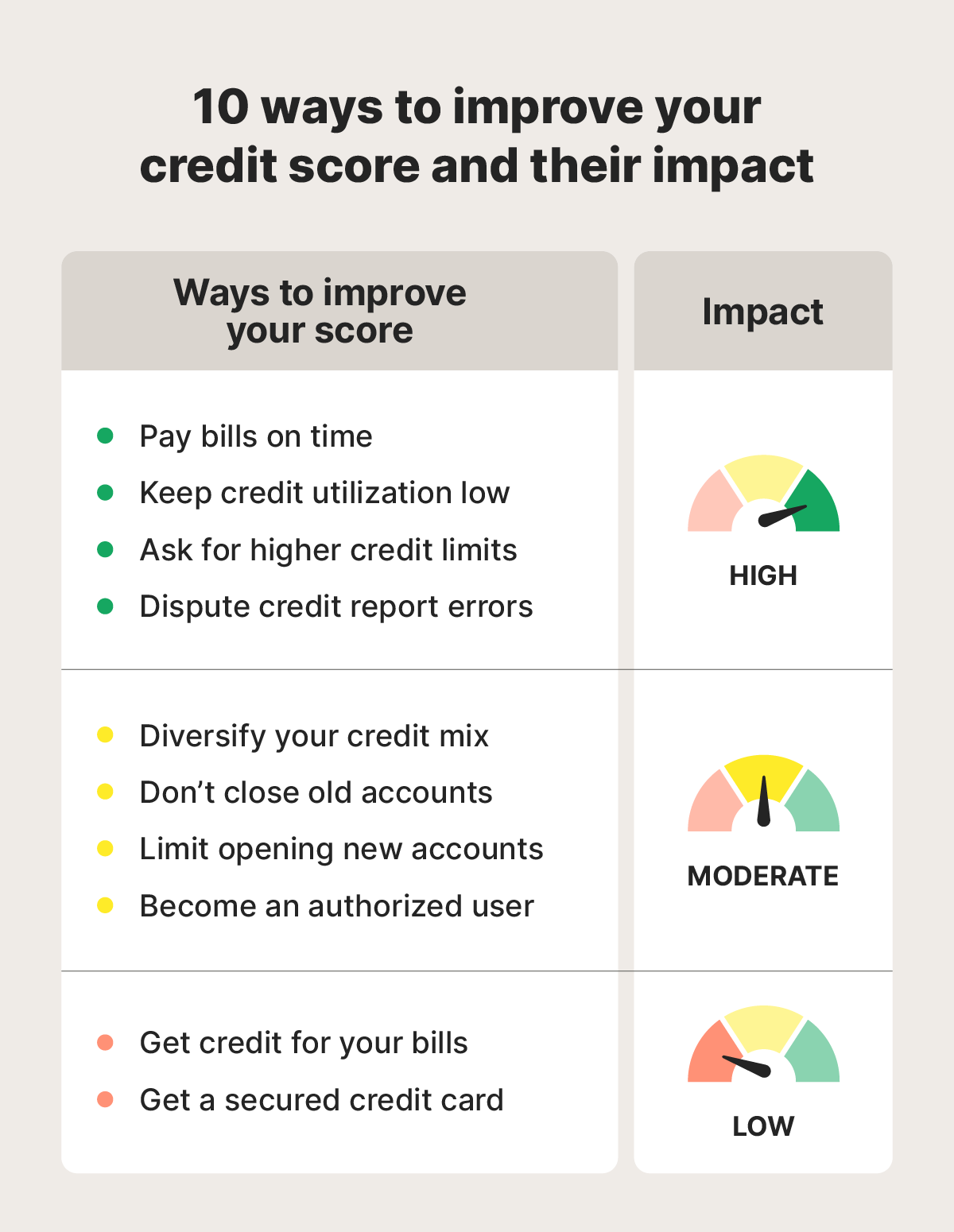

- Payment history updates (35% of FICO score): Correcting errors like misreported late payments or ensuring on-time payments are reported can yield quick wins. Since this category heavily influences your score, resolving inaccuracies through disputes or creditor updates often shows improvements within one billing cycle.

- Credit utilization reductions (30% of FICO score): Lowering your credit card balances to below 30% of your limits has a rapid impact. Paying down debt before the next reporting date (usually within 30–45 days) can reduce utilization, directly lifting your score.

For personalized strategies to accelerate your credit repair, consider tools from fixcreditscenter.com—they specialize in fast, effective solutions tailored to 2025 credit dynamics.

【Credit Report Error Correction】

Fixing credit report inaccuracies is one of the fastest paths to a “credit fix fast” strategy. The FTC revealed 42% of reports contain material errors, making proactive review essential. Targeting specific mistakes ensures efficient corrections.

Identifying Report Mistakes

Systematically scan all three bureau reports (Equifax, Experian, TransUnion) for discrepancies. Prioritize these high-impact, quick-resolvable categories:

Common Fast-Fix Errors

- Incorrect late payments: Verify payment dates against your records. Misdated or phantom late payments (impacting 35% of your FICO score) are frequent errors.

- Outdated collections: Under FCRA § 605(c), collections must drop off after 7 years. Accounts exceeding this limit are illegal to report.

- Duplicate accounts: Same debt listed multiple times artificially inflates your debt burden.

- Incorrect account status: Closed accounts marked “open” or paid debts labeled “unpaid” distort credit utilization.

| Error Type | Impact Severity | Typical Resolution Time |

|---|---|---|

| Outdated Collections | High | Under 30 days (FCRA mandate) |

| Incorrect Late Payments | Critical | 1 billing cycle |

| Duplicate Accounts | Moderate | 14-45 days |

Dispute Process Demystified

Filing a dispute triggers a 30-day investigation per FCRA § 611(a). Success depends on precision and documentation:

Step-by-Step Dispute Letters

- Target specific items: Isolate each error with account numbers and dates.

- Use clear language: “This [item] is inaccurate because [reason with evidence, e.g., ‘payment was made on 05/01/2025 per bank statement’].”

- Attach proof: Include bank statements, payment confirmations, or identity documents.

- Send via certified mail: Tracking provides legal proof of receipt date.

Key Tip: Bureaus must forward disputes to data furnishers within 5 business days. Follow up if no response within 35 days.

For streamlined dispute handling with bureau-compliant templates and tracking tools, fixcreditscenter.com offers tailored 2025 solutions to expedite corrections.

【Rapid Score Boost Tactics】

Building on the foundation of accurate credit reports, strategically managing your credit utilization offers the most immediate path to a “credit fix fast”. Accounting for 30% of your FICO score, utilization (your revolving balances divided by limits) responds quickly to targeted actions.

Credit Utilization Strategies

Lowering your reported credit card balances is paramount. The key insight: issuers report balances to bureaus around your statement closing date. Paying down balances before this date ensures lower utilization gets reported.

Balance Paydown Techniques

- Pre-Statement Payments: Make significant payments before your statement generates, not just the due date. This directly lowers the balance reported to bureaus.

- Utilization Thresholds: Aim to keep individual card and overall utilization below 30%. For maximum score impact, target <10%.

- Multiple Payments: If carrying a high balance, make multiple payments within a billing cycle to keep the reported balance low.

- Avoid Zero Reporting: While low utilization is good, having all cards report $0 can slightly lower scores versus one card reporting a small (<10%) balance.

| Payment Timing Impact | Reported Utilization | Estimated Score Effect |

|---|---|---|

| Full payment after statement date | High (e.g., 75%) | Significant Negative |

| Partial payment before statement date | Moderate (e.g., 25%) | Neutral/Positive |

| Paydown to <10% before statement date | Low (e.g., 8%) | Strong Positive |

Strategic Credit Limit Increases

Increasing your total available credit automatically lowers your overall utilization ratio without requiring additional debt payoff – a powerful “credit fix fast” lever.

How to Request Successfully

- Timing is Crucial: Contact issuers after demonstrating 6+ months of flawless on-time payments and responsible credit management with their card.

- Request “Soft Pull” Increases: Explicitly ask: “Is this credit limit increase available based on a soft inquiry that won’t impact my credit report?” Many issuers (e.g., Discover, Amex, Capital One) offer soft-pull CLIs.

- Highlight Positive Factors: Briefly state your reason, focusing on:

- Consistent on-time payment history with them.

- Increased income (be prepared to verify if requested).

- Desire to improve utilization ratio.

- Avoid Hard Inquiries: If the issuer requires a hard credit check (“hard pull”), decline unless the potential limit increase justifies the temporary score dip (rarely the case for rapid fixes).

- Space Out Requests: Request CLIs from different issuers at least 3-6 months apart.

Successfully lowering utilization via paydowns or limit increases can yield noticeable score improvements in 30-60 days as new balances are reported. For ongoing management and tracking of utilization thresholds across all your accounts, tools like those at fixcreditscenter.com provide tailored 2025 strategies and monitoring.

【Credit Building Shortcuts】

While lowering utilization provides a rapid path to a “credit fix fast,” strategically leveraging relationships and diversifying your credit profile offers additional, sometimes accelerated, avenues for score improvement in 2025. These methods, when executed correctly, can bolster your credit foundation alongside utilization management.

Becoming an Authorized User

One effective shortcut involves being added as an authorized user (AU) on someone else’s established credit card account. The primary account holder’s positive history – their on-time payments and low utilization – can be reflected on your credit reports, giving your score a potential boost. However, not all accounts are created equal for this purpose.

Choosing Optimal Accounts

Selecting the right primary account is critical for maximizing the benefit and minimizing risk:

- 12+ Month Perfect Payment History Required: Only consider accounts where the primary user has maintained flawless on-time payments for at least the past year. Any late payments reported during this period will also negatively impact your credit.

- Low Utilization (<20%) Primary Accounts Best: Prioritize accounts where the primary user consistently keeps the balance well below the credit limit, ideally under 20%. High utilization on the primary account will hurt your score just as it would on your own cards.

- High Credit Limit & Long History: Older accounts with high credit limits tend to contribute more positively to the authorized user’s credit profile due to the increased average age of accounts and lower overall utilization potential.

- Confirm Reporting Policy: Verify with the card issuer that they do report authorized user activity to all three major credit bureaus (Experian, Equifax, TransUnion). Not all issuers do this consistently for AUs.

| Authorized User Account Selection Criteria | Why It Matters |

|---|---|

| Minimum 12 months of perfect payments | Prevents negative history (late payments) from damaging your score. |

| Consistent utilization below 20% | Ensures the account contributes positively to your utilization ratio. |

| Older account age & higher credit limit | Boosts Average Age of Accounts and lowers overall utilization impact. |

| Issuer reports AU activity to all bureaus | Guarantees the positive history actually appears on your reports. |

Being added as an AU can lead to score improvements as quickly as the next billing cycle after the account is reported. This makes it a viable “credit fix fast” tactic when traditional credit building takes longer.

Credit Mix Optimization

Your credit mix – the variety of credit types (revolving like credit cards, and installment like loans) – contributes to 10% of your FICO score. While not the largest factor, strategically adding a different type of credit can provide a modest score lift, especially if you only have one type currently.

Fast Track to Diverse Credit

Adding a new credit type doesn’t have to mean taking on significant debt or waiting years:

- Credit-Builder Loans Report in 30-45 Days: Offered by many credit unions and community banks (and increasingly some online lenders in 2025), these unique loans are designed specifically to build credit. The borrowed amount is held by the lender in a secured account while you make fixed monthly payments. These payments are reported to the credit bureaus, establishing a positive installment loan history. Crucially, this positive payment history typically starts appearing on your credit reports within 30-45 days of the first payment, making it one of the fastest ways to add an installment loan to your profile.

- Secured Cards Convert to Unsecured in ~12 Months: A secured credit card requires a cash deposit that acts as your credit line. It functions like a regular credit card, and your payments are reported monthly to the bureaus. The key advantage for “credit fix fast” is that many secured card issuers, after observing approximately 12 months of responsible use (on-time payments, low utilization), will automatically convert the account to an unsecured card. They return your deposit, and the account continues reporting positively as a standard revolving line. This transition effectively adds a positive revolving tradeline to your history relatively quickly.

Adding a credit-builder loan provides near-immediate diversification, while a secured card offers a clear path to establishing a positive revolving account within about a year. Combining these “credit fix fast” shortcuts – responsible AU status, strategic utilization management, and targeted credit mix diversification – creates a powerful approach to building a stronger credit profile efficiently. For personalized strategies on implementing these tactics effectively in 2025, exploring resources like fixcreditscenter.com can provide tailored guidance and tracking tools.

【Avoiding Repair Scams】

While legitimate “credit fix fast” strategies like authorized user status and credit-builder loans offer proven paths, navigating the credit repair landscape in 2025 requires vigilance against illegal operations. These scams prey on individuals seeking quick score improvements, often causing financial harm and legal trouble.

Red Flags of Illegal Operations

Spotting deceptive credit repair services is crucial for protecting your finances and credit standing. Be acutely aware of these major warning signs:

FTC Warning Signs

The Federal Trade Commission (FTC) explicitly warns consumers about these illegal practices common among fraudulent credit repair outfits:

- Upfront Payment Demands: Any company demanding payment before performing the promised credit repair services is violating the federal Credit Repair Organizations Act (CROA). Legitimate services earn fees after delivering results.

- “New Identity” or “Credit Privacy Number” (CPN) Promises: Scammers may offer to create a “new” credit identity using a CPN (often a stolen Social Security Number or Employer Identification Number). This is fraud and a felony offense, leading to severe legal consequences including fines and imprisonment. Legitimate credit repair works with your existing credit history and identity.

- Guarantees of Specific Results: No reputable company can guarantee the removal of accurate negative information or a specific point increase. Accurate, timely negative items generally remain on your reports for legally defined periods (e.g., 7 years for most late payments, 10 years for bankruptcies).

- Advising Dispute of All Negative Items: While disputing inaccurate information is your right, advising you to dispute all negative items on your reports, regardless of accuracy, is a hallmark of fraudulent operations. Disputing accurate information is ineffective and wastes time.

- Lack of Written Contract & 3-Day Cancellation Notice: CROA mandates that credit repair companies provide a detailed written contract outlining your rights, services offered, timeframe, and costs, including your right to cancel within three business days without penalty. Failure to provide this is illegal.

Legitimate vs. Fraudulent Services

Understanding the stark difference between legal help and scams is key to pursuing a safe “credit fix fast” approach in 2025.

Safe Alternatives

If you need assistance beyond DIY efforts, focus on these credible and legal resources:

- Nonprofit Credit Counseling: Agencies affiliated with the National Foundation for Credit Counseling (NFCC.org) offer free or low-cost consultations. They provide budgeting advice, debt management plans (DMPs), and guidance on improving credit legally. NFCC agencies are vetted for legitimacy and adhere to strict ethical standards.

- DIY Dispute Templates: For inaccurate information on your reports, the Consumer Financial Protection Bureau (ConsumerFinance.gov) provides free, official dispute letter templates and clear instructions on how to file disputes directly with the credit bureaus yourself. This is the most direct and cost-effective (free) way to challenge errors.

- Self-Education: Resources from the FTC (FTC.gov), CFPB (ConsumerFinance.gov), and major credit bureaus offer extensive free guides on understanding credit reports, building credit, and disputing errors legally.

| Service Type | Key Characteristics | Risk/Benefit | How to Access |

|---|---|---|---|

| Illegitimate Scams | Demands upfront fees, promises “new identity” (CPN), guarantees specific deletions | HIGH RISK: Financial loss, wasted time, potential legal liability, identity theft | Avoid entirely. Report to FTC. |

| Nonprofit Counseling | Free/low-cost advice, NFCC.org affiliation, focuses on budgeting & legal solutions | BENEFIT: Legitimate guidance, debt management options, ethical practices | Find verified agencies at NFCC.org |

| DIY Disputes | Free self-service using official templates (CFPB/FTC), dispute accurate info only | BENEFIT: Cost-free, direct control, legally sound | Use templates from ConsumerFinance.gov |

Choosing the right path ensures your efforts towards a “credit fix fast” in 2025 are effective and safe. Combining smart utilization management, authorized user strategies, and credit-builder tools with strict avoidance of illegal schemes provides the fastest, most sustainable route to better credit. For personalized strategies and secure tracking tools aligned with current regulations, fixcreditscenter.com offers tailored guidance.

【30-Day Action Plan】

Implementing a strategic “credit fix fast” approach requires disciplined execution. This 30-day framework leverages proven tactics while avoiding illegal shortcuts, building directly on legitimate dispute processes and utilization management covered earlier.

Week 1: Assessment Phase

Critical First Steps

Immediate action in the first seven days establishes your baseline and targets:

- Pull All Three Reports: Access your complete 2025 credit profiles at no cost via AnnualCreditReport.com. Federal law still entitles you to weekly free reports from Equifax, Experian, and TransUnion.

- Triangulate Errors: Systematically compare all three reports line-by-line. Note discrepancies (e.g., accounts listed on one bureau but not others, differing balances, or payment histories).

- Prioritize High-Impact Disputes: Identify 3-5 items per bureau that are both inaccurate and significantly dragging down your score. Focus on:

- Accounts not belonging to you

- Incorrect late payments or charge-offs

- Outdated negative items (e.g., debts older than 7 years still reporting)

- Balance inaccuracies exceeding $100

- Gather Documentation: Collect proof (statements, payment confirmations, identity verification) supporting your disputes before initiating them.

Week 2-4: Execution Phase

Rapid Result Techniques

With groundwork complete, focus shifts to high-velocity interventions known to yield relatively quick score improvements:

- Attack High Utilization Immediately:

- Identify credit cards reporting balances above 30% of their limit.

- Allocate available funds to pay down these specific cards first, ideally below 10% utilization. This can yield score bumps in as little as 30 days once bureaus update.

- Example: A card with a $1,000 limit reporting a $600 balance (60% utilization). Paying it down to $300 (30%) or $100 (10%) provides an instant utilization boost.

- Launch Simultaneous Disputes:

- File your 3-5 prioritized disputes with all three bureaus concurrently within this window. Use certified mail or the bureaus’ official online portals.

- Clearly reference the item, state why it’s inaccurate, and attach copies (not originals) of your supporting documents.

- Legitimate disputes trigger bureau investigations, typically requiring a response within 30 days under the Fair Credit Reporting Act (FCRA).

- Monitor Updates & Re-Report Utilization:

- Check report updates weekly (utilizing your free access). Confirm payments lowering utilization are reflected.

- Track dispute statuses via bureau portals or mail responses. Be prepared to supply additional documentation if requested.

| Week | Core Focus | Key Actions | Expected Outcome |

|---|---|---|---|

| 1 | Assessment | Pull 3-bureau reports; Identify 3-5 high-impact inaccuracies per bureau; Gather proof | Clear baseline understanding; Targeted dispute list ready |

| 2-4 | Execution | Pay down cards >30% utilization; File 3-5 disputes per bureau simultaneously; Monitor report updates weekly | Lower utilization penalty; Initiated removal of inaccurate negatives; Real-time tracking |

This focused 30-day strategy combines the legally sound leverage of disputes with the immediate scoring impact of utilization optimization – core pillars of any legitimate “credit fix fast” effort in 2025. For personalized dispute templates, utilization calculators, and secure progress tracking aligned with the latest FCRA and CROA regulations, explore the resources at fixcreditscenter.com.

【Maintaining Improved Credit】

Essential Monitoring Habits

Consistent oversight is non-negotiable for preserving your rapid “credit fix fast” gains in 2025. Treat your credit like vital infrastructure – regular checks prevent minor issues from escalating into major setbacks. Catching errors or unexpected changes early allows for swift correction before they impact your score. Utilize a combination of these key tracking tools to stay informed:

Tracking Tools Comparison

| Tool/Service | Data Source(s) | Score Model Provided | Update Frequency | Cost | Best For |

|---|---|---|---|---|---|

| Credit Karma | TransUnion, Equifax | VantageScore 3.0 | Weekly | Free | Frequent overviews, account monitoring |

| Experian (Direct) | Experian | FICO® Score 8 | Monthly | $24.99/month* | Lender-used FICO tracking |

| AnnualCreditReport.com | All 3 Bureaus | Reports only (no score) | Weekly (2025) | Free | Comprehensive line-item verification |

Key Considerations:

- VantageScore vs. FICO: While Credit Karma provides helpful weekly snapshots via VantageScore, most major lenders in 2025 still primarily use FICO® Score 8 (available through Experian’s paid service). Monitor both periodically to understand lender perspectives.

- Free Weekly Reports: Your foundational tool remains AnnualCreditReport.com. Schedule quarterly deep dives using your free weekly 2025 reports to scrutinize details across all bureaus, verifying that resolved disputes stay off and utilization is accurately reported.

- Alerts Matter: Enable real-time alerts (free on Credit Karma, via subscription elsewhere) for new inquiries, accounts opened in your name, or significant balance changes – critical for fraud detection and utilization management.

Long-Term Financial Behaviors

Sustaining high credit requires embedding smart habits into your routine. “Habit stacking” – attaching new financial behaviors to existing ones – proves highly effective for long-term adherence without burnout. These small, consistent actions prevent backsliding and compound benefits over time.

Habit Stacking Techniques

-

Auto-Pay Setup for Minimum Payments:

- The Stack: Link this action to receiving your paycheck notification or a recurring calendar alert (e.g., “Payday = Set Autopay”).

- The Action: Immediately log into every credit account and ensure the minimum payment is scheduled for automatic withdrawal at least 3 days before the due date.

- The Benefit: Eliminates accidental late payments (a major score killer) and builds foundational payment history reliability. Treat this as your non-negotiable baseline.

-

Biweekly Balance Checks:

- The Stack: Pair this with another biweekly routine, like reviewing your primary bank account balance every other Friday afternoon.

- The Action: During this check, log into your credit card portals or monitoring apps. Review current balances vs. limits.

- The Benefit: Provides an early warning if utilization creeps above your target threshold (ideally below 30%, optimally below 10%). Allows immediate adjustments before the next statement closing date – the point when balances are typically reported to bureaus. This proactive check is crucial for maintaining the “credit fix fast” utilization wins achieved in your initial 30-day sprint.

Integrating these monitoring systems and behavioral shifts transforms your hard-won 2025 credit improvements into a permanent financial foundation. For streamlined tools that automate report tracking, provide custom utilization alerts, and integrate habit-tracking features compliant with 2025 credit protection laws, visit fixcreditscenter.com.

Key Takeaways for Fast Credit Repair

- Dispute inaccuracies first: Target high-impact errors like incorrect late payments (resolved in 30 days under FCRA)

- Lower utilization strategically: Pay down balances before statement dates to quickly boost scores

- Leverage authorized user status: Gain from others’ good credit history in as little as one billing cycle

- Avoid scams: Never pay upfront or use CPNs—stick to FTC-approved methods

Ready to accelerate your credit improvement? Start your journey today with trusted tools at fixcreditscenter.com. Share your success story in the comments!