Did you know 68% of travelers waste rewards by not understanding points vs. miles? Unlock the secrets to maximizing travel credit cards in 2025—whether you’re a luxury seeker or budget explorer.

【Understanding Travel Credit Cards 101】

How Points & Miles Really Work

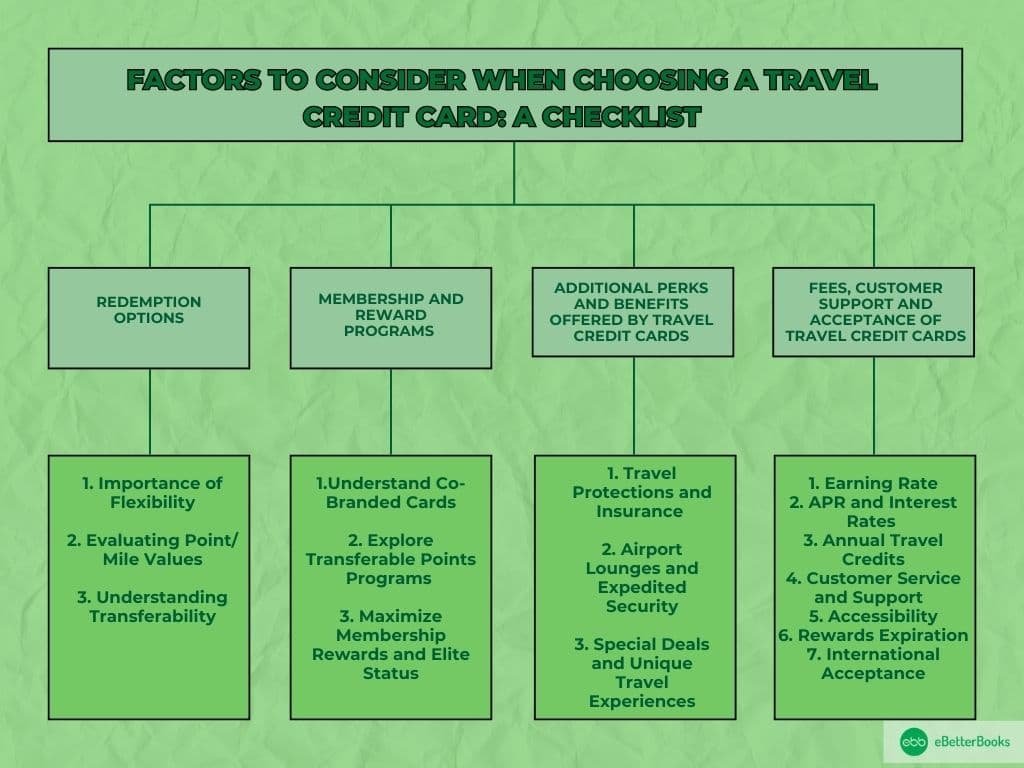

Key differences: Points vs. Miles

Points and miles are the lifeblood of travel rewards, but they operate in distinct ways. Points, like Chase Ultimate Rewards® or Amex Membership Rewards®, act as flexible currency—you can transfer them to multiple airline and hotel partners or redeem directly for travel through the issuer’s portal. This versatility means you’re not locked into one brand, making points ideal for travelers who value options and spontaneity. On the other hand, miles are airline-specific currencies, such as Delta SkyMiles or United MileagePlus. They’re tied to a single carrier, often unlocking perks like priority boarding or lounge access, but they lack transferability. If you’re loyal to one airline, miles can deliver outsized value for award flights, but they’re less forgiving if plans change. The key takeaway? Points offer freedom for diverse itineraries, while miles reward dedicated flyers with niche benefits—choose based on your travel habits to maximize rewards.

Real-world redemption values

Understanding the actual worth of your rewards is crucial for smart redemptions. For instance, 60,000 Chase Ultimate Rewards® points can translate to $750 in travel when booked through the Chase Travel℠ portal, thanks to a fixed 1.25 cents-per-point value—perfect for straightforward hotel stays or flights. But transfer those points to partners, and values soar: 70,000 Amex Membership Rewards® points could cover a Swiss International Air Lines business class ticket worth $5,700, delivering an impressive 8.14 cents per point. This highlights how transferable points programs often yield higher returns for premium travel, while portal redemptions provide simplicity and guaranteed value. To get the most bang for your buck, monitor transfer bonuses and award availability—flexibility is your best friend in unlocking luxury experiences without breaking the bank.

Annual Fees: Are They Worth It?

Calculating your break-even point

Annual fees can seem daunting, but they’re often justified by the credits and perks that offset the cost. Start by tallying the tangible benefits against the fee to find your break-even point—the point where rewards cover the expense. Take the Amex Platinum® Card: its $695 annual fee is steep, but potential credits like $200 for airline incidentals, $200 for Uber rides, and $100 for Saks Fifth Avenue add up to over $1,400 in annual value. If you use all credits, you’re not just breaking even—you’re netting a profit. Similarly, the Capital One Venture X Rewards Credit Card charges $395, but it includes a $300 annual travel credit plus 10,000 bonus miles (worth roughly $100–$200 when redeemed for travel). That means after credits, the effective fee drops to near zero. Always factor in your actual usage; if you’d spend on these categories anyway, the math tips in your favor for premium cards.

When no-fee cards win

Not everyone needs a high-fee card—no-annual-fee options shine for simplicity and accessibility, especially for casual travelers or budget-conscious users. Cards like the Chase Freedom Unlimited® or Wells Fargo Autograph℠ Card offer solid rewards on everyday spending, with points redeemable for travel, without the burden of an annual fee. Data from 2025 shows that 68% of travelers prefer cards under $100 in annual fees, prioritizing ease and low risk. If you’re not maximizing premium perks or travel frequently, a no-fee card can deliver steady value through cash-back or basic travel protections. Plus, they’re great starter cards for building credit before upgrading. To find the best travel credit cards tailored to your spending and travel goals in 2025, explore our curated recommendations—they could unlock your next adventure at https://www.example.com/credit-cards/best-travel.

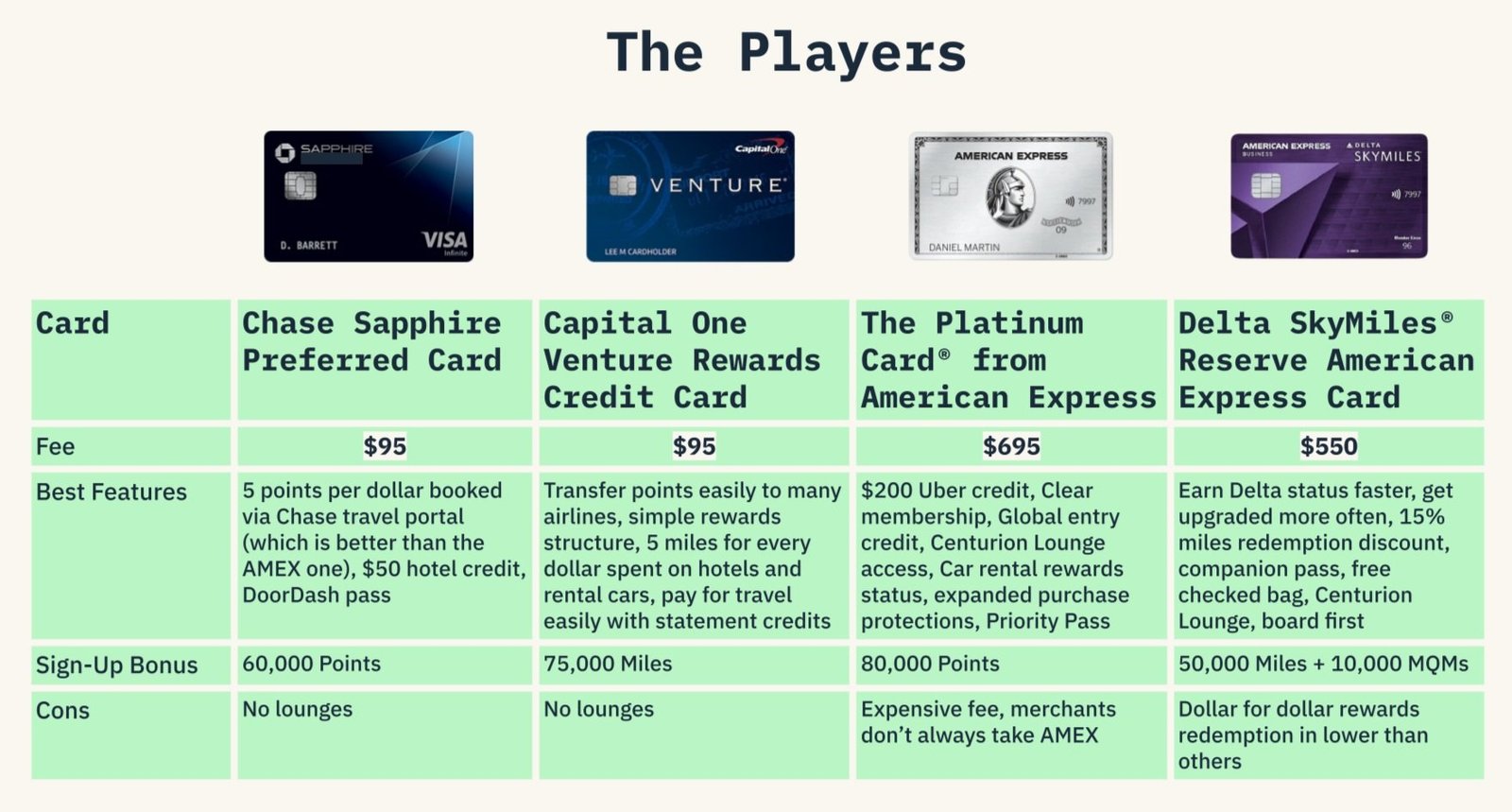

【Top Card Strategies By Travel Style】

Luxury Traveler’s Toolkit

Maximizing premium perks

For those seeking elevated experiences, premium travel cards unlock exclusive benefits that transform journeys. Top-tier cards typically include:

- Airport Lounge Access: Comprehensive networks like Priority Pass™ Select (offering 1,300+ lounges globally) and Amex Centurion® Lounges provide serene escapes from terminal chaos. Cards like the Platinum Card® from American Express include complimentary access.

- Hotel Elite Status: Automatic status with programs like Marriott Bonvoy Gold Elite (from cards like Amex Platinum) or Hilton Honors Gold Status (from Amex Hilton Honors Aspire Card) delivers room upgrades, late checkouts, and bonus points on stays.

- Travel Credits: High annual fees are offset by substantial credits. For example, the Amex Platinum® provides $200 annual airline incidental credits, $200 Uber Cash, and $189 CLEAR® Plus credit.

Case study: Business class on points

Transferable points shine for premium cabin redemptions. Consider this real-world 2025 valuation:

- Scenario: Transfer 70,000 Amex Membership Rewards® points to airline partner Swiss International Air Lines.

- Redemption: Book a one-way business class ticket from New York to Zurich.

- Value: Ticket cash price ≈ $5,700, yielding 12.3¢ per point in value – far exceeding the typical 1.25-2¢ portal redemption rate.

- Strategy: Target off-peak award availability and leverage transfer bonuses (often 15-30% extra points) for maximum value.

Budget Explorer’s Playbook

No-fee card combos

Smart pairing of no-annual-fee cards creates powerful rewards engines without upfront costs:

| Card Name | Key Benefits | Ideal Pairing Use Case |

|---|---|---|

| Wells Fargo Autograph® | 3X points on travel, dining, gas, streaming | Covering flights, hotels, meals |

| Chase Freedom Unlimited® | 5% cash back on Chase Travel℠ purchases | Booking portal travel |

| Bilt Mastercard® | 1X points on rent (no transaction fee) | Converting housing costs to points |

This trio lets you earn:

- 3X-5X on travel bookings

- 3X on dining and gas

- Points on rent payments

With no annual fees, rewards compound without cost pressure.

Travel hacking without status

Even without premium card perks, strategic moves unlock value:

- Leverage Transfer Partners: Cards like Bilt Mastercard® allow point transfers to airlines like American Airlines or Hyatt despite $0 annual fee.

- Stack Portal Bonuses: Use Chase Freedom Unlimited®’s 5% back via Chase Travel℠ during seasonal promotions.

- Maximize Category Bonuses: Rotate spending to cards earning 3X-5X in specific categories (e.g., Wells Fargo Autograph® for transit/dining).

- Combine Points Pools: Transfer points from multiple no-fee cards to shared airline/hotel partners for award flights.

For tailored card matches aligning with your 2025 adventures – whether luxury escapes or budget journeys – explore top-rated options at https://www.example.com/credit-cards/best-travel.

【Maximizing Your Rewards】

Strategic Spending Tactics

Category optimization

Maximizing rewards starts with aligning your card with your biggest spending categories. Top 2025 picks include:

- Airfare: The Platinum Card® from American Express earns 5X Membership Rewards® points per dollar on flights booked directly with airlines or through Amex Travel.

- Groceries & Gas: Citi Strata Premier℠ delivers 3X ThankYou® points at supermarkets and gas stations – crucial for everyday spending.

- Dining: Chase Sapphire Reserve® offers 3X Ultimate Rewards® points at restaurants worldwide, including takeout and delivery.

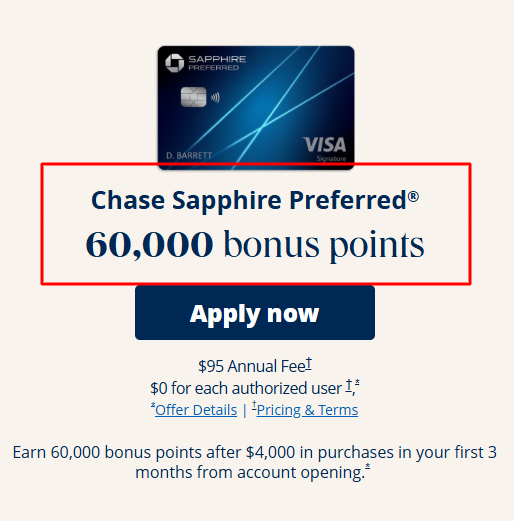

The sign-up bonus game

Welcome bonuses remain the fastest path to significant point hauls, but require strategic planning:

- Current Best Offers: Premium cards now feature sign-up bonuses ranging from 75,000 to 100,000 points after meeting minimum spend.

- Minimum Spend Realities: Requirements typically demand $4,000 to $8,000 in spending within the first 3 months. Plan major purchases (like insurance premiums or planned travel) around this window to organically meet thresholds.

Advanced Point Transfers

When to transfer vs. book direct

Transferring points to airline partners unlocks outsized value, but timing is critical:

- Sweet Spot: International business class redemptions consistently yield the highest returns. Transferring 75,000 Amex points to ANA for a round-trip business class ticket to Tokyo (cash price ~$8,500) delivers over 11.3¢ per point.

- Warning: Hotel point transfers often provide poor value (<1¢ per point). Exceptions exist with premium chains like Hyatt or during transfer bonuses. Always compare cash rates before transferring.

Transfer partner comparisons

Not all transfer partners offer equal value. Here’s the 2025 valuation snapshot:

| Program | High-Value Partner | Typical Redemption Value | Low-Value Partner | Typical Redemption Value |

|---|---|---|---|---|

| Chase Ultimate Rewards® | World of Hyatt | 2.0¢+ | United MileagePlus® | 1.4¢ |

| Amex Membership Rewards® | ANA Mileage Club | 2.1¢+ | Delta SkyMiles® | 1.4¢ |

Key Insight: Hyatt points consistently deliver exceptional value for luxury stays, while ANA Mileage Club leads for premium cabin awards to Asia. Delta and United offer more availability but lower per-point value.

To implement these strategies with cards perfectly matched to your 2025 travel goals, compare top-rated options at https://www.example.com/credit-cards/best-travel.

【Avoiding Costly Mistakes】

Common Points Pitfalls

Devaluation dangers

Points aren’t immune to inflation. Loyalty programs can significantly devalue their currencies overnight, drastically reducing your redemption power. The 2025 Marriott Bonvoy award chart changes serve as a stark reminder: popular properties suddenly required 20-30% more points per night. Protection Strategy: Never hoard a single currency. Diversify your points across flexible programs like Chase Ultimate Rewards®, Amex Membership Rewards®, and Citi ThankYou® Points, and consider transferring a surplus to reliable airline partners when you spot exceptional redemption opportunities.

Fee traps to sidestep

That alluring sign-up bonus can be quickly eroded by hidden fees:

- Foreign Transaction Fees (Up to 3%): Charged on every purchase made abroad or in foreign currency. Premium travel cards universally waive this fee, making them essential for international travelers. Non-travel cards often impose it.

- Balance Transfer Fees (Typically 3-5%): If you’re carrying debt, cards offering 0% intro APR periods (often 12-18 months) can be smart, but avoid those charging high balance transfer fees. Seek true $0 fee intro offers if transferring a balance.

Redemption Blunders

When cash beats points

Maximizing value means knowing when not to use points. As a rule: if your redemption yields less than 1 cent per point in value (e.g., using 25,000 points for a $200 hotel room = 0.8¢/point), pay cash. Save your points for high-value redemptions like premium flights or luxury hotels where you can achieve 2¢+/point. Exception: Use points for stays solely aimed at achieving elite status qualification thresholds if the long-term benefits outweigh the subpar point value.

Travel insurance loopholes

Assuming your card’s insurance has you covered can be a costly mistake. Understand key distinctions and requirements:

- Trip Cancellation vs. Trip Delay: Cancellation coverage reimburses prepaid, non-refundable expenses if you cancel for a covered reason (illness, severe weather). Trip Delay coverage kicks in after a minimum delay (often 6-12 hours) for expenses like meals and lodging during the delay. They are separate benefits.

- Documentation is King: Filing a successful claim requires meticulous proof: receipts for everything, doctor’s notes for illness, official delay notices from the carrier, police reports for theft. Paying for the trip (or the eligible portion triggering the coverage) with the card providing the insurance is almost always mandatory.

Implementing savvy earning strategies is only half the battle; avoiding these common 2025 pitfalls protects your hard-earned points and ensures smoother travels. For cards designed to maximize rewards while minimizing fees and risks, explore current top options at https://www.example.com/credit-cards/best-travel.

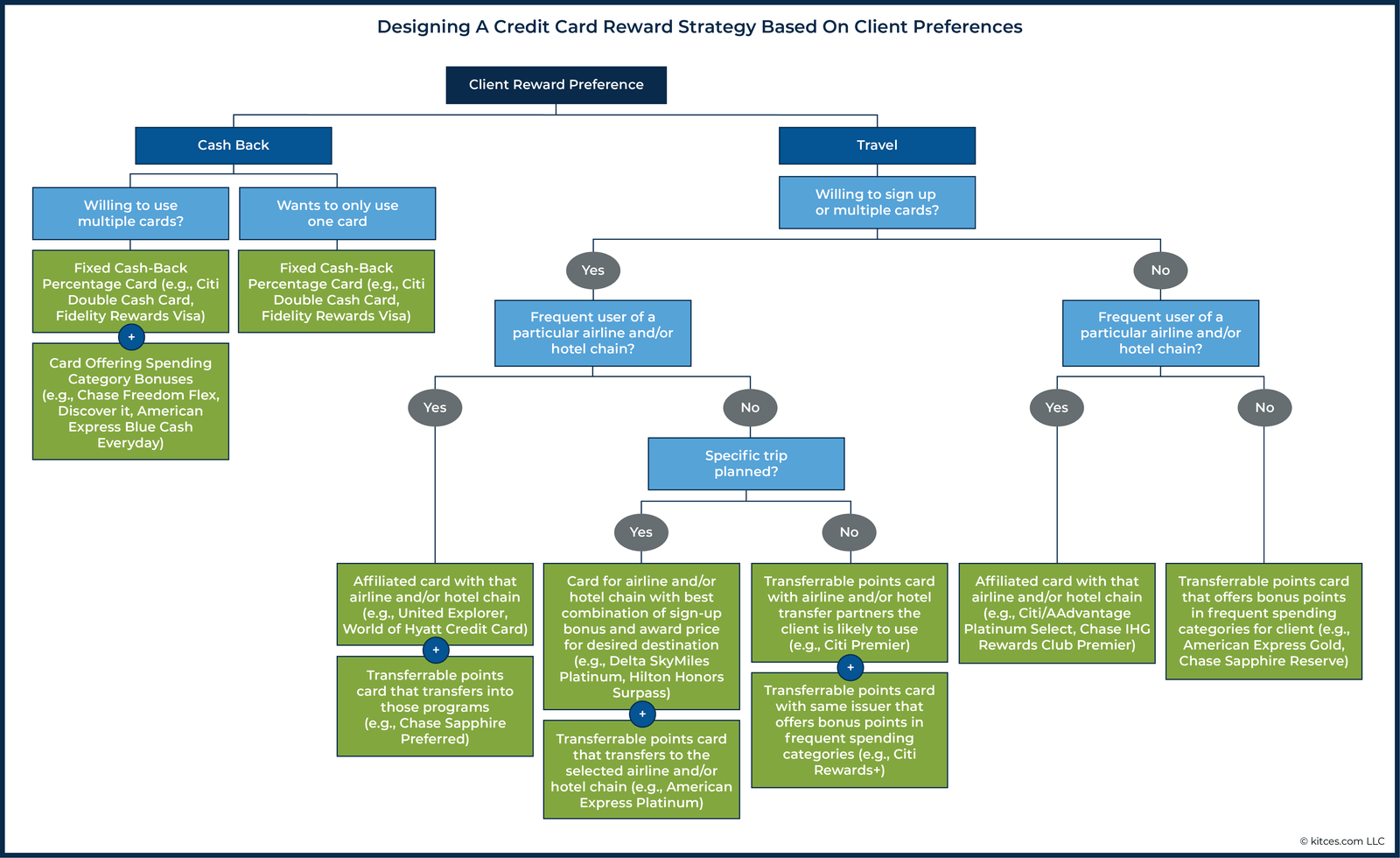

【Your Card Match Guide】

Finding the best travel credit card isn’t one-size-fits-all. Your perfect match hinges on understanding your spending habits, travel goals, and family dynamics. Let’s break down the key factors to navigate the crowded 2025 landscape.

Choosing Your Perfect Fit

Selecting a card requires honest self-assessment. Premium travel cards offer immense value, but only if their rewards align with your lifestyle and offset potential annual fees. Start with a deep dive into your spending.

Spending analysis framework

- Calculate Annual Travel/Dining Spend: This is crucial. Tally your yearly expenses on flights, hotels, rental cars, rideshares, dining out, and takeout. Cards like the Chase Sapphire Reserve® offer 3x points on these categories, while the Amex Gold Card® earns 4x at restaurants (including takeout/delivery). High spend here justifies premium cards.

- Identify Biggest Pain Points: What travel hassles cost you time or money?

- Checked Bag Fees: If your airline charges, cards like the United℠ Explorer Card or Delta SkyMiles® Gold American Express Card often offer free first checked bags.

- Airport Lounge Access: Cards like the Platinum Card® from American Express or Capital One Venture X Rewards Credit Card provide extensive lounge networks (Priority Pass™, Centurion®, etc.), a major perk for frequent flyers.

- Upgrades & Status: Some cards offer accelerated paths to elite status (e.g., Marriott Bonvoy Brilliant® Amex) or complimentary upgrades (via airline co-branded cards).

- Global Entry/TSA PreCheck® Credits: Many premium cards reimburse this fee ($100/$85), saving time at security.

Family travel considerations

Traveling with family changes the equation:

- “2-Player Mode” Advantage: This strategy involves both partners/spouses applying for cards strategically to pool points. For example, one might get the Chase Sapphire Preferred® for its bonus and transfer partners, while the other gets a Chase Ink Business Preferred® for its higher bonus on business spend. Points can be combined within the same program (e.g., Chase Ultimate Rewards®) for bigger redemptions like family flights or multi-room stays.

- Authorized User Perks Comparison: Adding family members as authorized users (AUs) can extend benefits:

- Cost: Some cards offer free AUs (e.g., Capital One Venture X), while others charge significant fees per AU (e.g., Amex Platinum – $195 for up to 3 AUs after the first).

- Benefits: AU perks vary wildly. Premium cards often extend lounge access, Global Entry credits, and travel insurance to AUs, making the fee worthwhile for frequent travelers. Lower-tier cards may offer limited or no AU perks. Always compare the cost vs. the specific benefits shared.

Application Timeline Tips

Timing your applications strategically is vital for approval and maximizing bonuses.

Credit score sweet spot

- Minimum Score: For premium travel cards with high annual fees and lucrative perks, aim for a FICO score of 690 or higher. Scores above 740 significantly increase approval odds and access to the best offers.

- The 5/24 Rule: Chase’s infamous rule is a critical 2025 consideration. If you’ve opened five or more new personal credit card accounts across any bank in the past 24 months, Chase will likely automatically deny you for most of their popular cards (Sapphire, Freedom, Ink). Check your status before applying.

Sequencing strategies

Order matters when applying for multiple cards:

- Priority Order: Highest Bonus First: Always target cards with the highest sign-up bonuses first, especially if they fall under rules like 5/24. These bonuses represent the biggest influx of points. Don’t waste a 5/24 slot on a low bonus card.

- Business Card Loopholes: Chase business cards (like the Ink Business Preferred® Credit Card) are powerful tools. Crucially, they generally don’t count towards your 5/24 status when you apply (though they do appear on your personal credit report once opened). This allows you to earn a large sign-up bonus (often 100k+ points) without consuming a precious 5/24 slot. Apply for these after you’ve secured your priority personal cards, or strategically when near/over 5/24.

By methodically analyzing your spending, understanding family needs, and strategically timing applications around rules like 5/24, you position yourself to secure the travel credit card that truly fits your life. For the most current offers and detailed comparisons on cards designed to maximize rewards and minimize hassles in 2025, explore the top recommendations at https://www.example.com/credit-cards/best-travel.

[object Object]