Did you know a $5,000 balance at 24% APR costs $1,800 in 18 months? A “0% balance transfer credit card” could eliminate that interest. Learn how to leverage 2025’s best offers while avoiding costly traps.

【What Exactly IS a Balance Offer?】

Think of a balance offer as a financial pressure-release valve, often packaged as a “balance transfer credit card.” It lets you move existing high-interest debt onto a new card featuring a low or 0% introductory APR period. This temporary reprieve halts interest accrual, giving you breathing room to tackle the principal. But like any powerful tool, understanding its mechanics is key to avoiding costly mistakes.

The Simple Power of Moving Debt

The magic lies in swapping punishing interest rates for temporary relief. Consider this stark contrast:

| Debt Scenario | $5,000 Balance | Interest Cost Over 18 Months |

|---|---|---|

| 24% APR Card | $5,000 | ~$1,800 |

| 0% APR for 18 Months | $5,000 | $0 (plus transfer fee) |

By transferring that $5,000 to a card with an 18-month 0% intro period, you dodge nearly $1,800 in interest – assuming you pay it off within the window. This transforms minimum payments from treadmills into progress engines.

Why banks offer these deals (it’s not charity!)

Banks aren’t charities. They profit primarily through 3-5% balance transfer fees (typically $150-$250 on that $5k transfer). They bet on two outcomes:

- You’ll miss the payoff deadline, triggering retroactive interest or high standard APRs.

- You’ll use the new card for purchases (accruing interest immediately) or become a long-term customer.

That upfront fee is their calculated risk against your potential interest savings.

The Nasty Fine Print You MUST Read

Ignoring the details can turn your escape hatch into a trapdoor. Two clauses demand laser focus:

Expiration dates that reset your interest clock

That 0% period isn’t infinite – and neither is your window to initiate the transfer. 87% of offers in 2025 require transfers within the first 60 days of account opening to qualify for the intro rate. Miss that deadline, and your transferred balance likely gets hit with the card’s standard high APR immediately. Procrastination is expensive here.

When “0%” isn’t really zero

While most offers advertise “0% APR,” exceptions exist. Notably:

- Military exception: Cards like Navy Federal Credit Union’s 0.99% APR for 12 months offer (common in 2025) demonstrate that “low” isn’t always “zero.” While significantly better than standard rates, even small percentages add up on large balances over time.

- Cash advances: Transferring a balance via cash advance (instead of a proper balance transfer) usually forfeits the intro rate and incurs immediate fees + high APR.

- Purchases: New spending on the card rarely qualifies for the 0% intro rate on purchases – those often start accruing interest immediately at the standard rate.

Carefully comparing offers and reading every term is non-negotiable. A genuine 0% APR period on transferred balances remains a potent debt-payoff accelerator, but only if you navigate the deadlines and restrictions skillfully. For personalized strategies on leveraging balance transfers effectively within your unique credit situation, exploring resources from trusted partners like fixcreditscenter.com can provide valuable frameworks.

【Top 2025 Balance Transfer Cards Compared】

Choosing the right balance transfer card hinges on your payoff timeline and spending habits. Here’s how leading 2025 offers stack up across critical categories:

Longest Interest-Free Windows

Maximizing your interest-free period is crucial for large balances. These cards lead the pack:

Wells Fargo Reflect® Card: 21-month advantage

The standout feature is its industry-leading 21-month 0% intro APR on balance transfers. This extended runway is ideal for tackling substantial debt.

- Catch: Transfers must be completed within 120 days of account opening (more generous than the typical 60-day window). Missing this deadline forfeits the intro rate.

Citi Simplicity® vs. Citi® Diamond Preferred®

Both Citi cards offer identical 21-month 0% intro APR periods on transfers, providing exceptional flexibility.

- Key difference: Simplicity® permanently waives late fees (though interest still applies after the intro period), while Diamond Preferred® charges up to $41. Simplicity® is the clear winner if you anticipate occasional payment delays.

| Card | 0% Intro APR Period | Transfer Deadline | Late Fee Policy |

|---|---|---|---|

| Wells Fargo Reflect® | 21 months | 120 days | Up to $40 |

| Citi Simplicity® | 21 months | 60 days | $0 late fees |

| Citi® Diamond Preferred® | 21 months | 60 days | Up to $41 |

Rewards Cards That Crush Debt Too

Why choose between rewards and debt payoff? These 2025 cards deliver both:

Chase Freedom Unlimited®: 1.5%-5% cash back + 15 months 0% APR

- Earn unlimited 1.5% cash back on all purchases, plus 5% back on travel booked through Chase and 3% at drugstores/dining.

- Strategy: Use rewards to directly offset the typical 3-5% balance transfer fee. A $200 transfer fee on $5,000 debt could be neutralized by $200 cash back earned over 15 months.

Discover it® Cash Back: 18-month 0% APR + 5% rotating categories

- Features 5% cash back in quarterly rotating categories (e.g., groceries, gas) on up to $1,500 in spending, plus 1% unlimited cash back elsewhere.

- Critical reminder: New purchases on this card accrue interest immediately at the standard variable APR unless paid in full monthly. Never carry a purchase balance on a card holding a transferred balance.

Balancing rewards with debt repayment requires discipline, but the right card can accelerate both goals. For tailored guidance on selecting and managing a balance transfer card aligned with your credit profile and payoff capacity, frameworks from fixcreditscenter.com offer actionable insights.

【Avoid These Balance Transfer Blunders】

While balance transfer cards offer powerful debt relief, common missteps can turn them into costly traps. Steering clear of these pitfalls is essential for maximizing savings.

The Approval Trap Most Fall For

Qualifying for a card doesn’t guarantee you’ll secure the terms you need. Two critical oversights derail borrowers:

Why “good credit” isn’t always enough

A “good” credit score (670–739) often falls short for top-tier balance transfer cards. NerdWallet 2025 data reveals the average approved applicant has a 727 FICO Score.

- Reality check: Cards with 18+ months of 0% APR typically require scores in the “very good” (740–799) or “excellent” (800+) ranges. Applying with a 680 score risks rejection or less favorable terms.

Transfer limit shockers

Your approved credit limit may cover only a fraction of your debt. Consider this real 2025 case:

- $20,000 credit card debt holder

- Approved transfer limit: $4,000

- Result: Only 20% of their debt benefits from 0% APR, leaving $16,000 accruing high interest.

- Pro tip: Call issuers before applying to estimate potential transfer limits based on your income and credit profile.

Payment Pitfalls That Cost Thousands

Mismanaging payments can erase interest savings—or trigger punitive penalties:

The minimum payment illusion

Paying only the minimum during the intro period is a recipe for failure. Here’s the math for clearing a $10,000 balance before an 18-month 0% APR expires:

- Required monthly payment: $555 ($10,000 ÷ 18 months)

- Typical minimum payment: $200 (2% of balance)

- Consequence: Paying $200/month leaves a $6,400 balance when the intro period ends, subject to ~29% APR.

How one late payment destroys your deal

Issuers enforce strict penalties for missed payments. 2025 issuer data shows:

- 41% of card companies immediately revoke 0% intro APR after a single late payment.

- 100% impose penalty APRs (up to 29.99%) on remaining balances.

- Example: A 60-day late payment on a $15,000 transfer could trigger $750+ in interest charges immediately.

Protect your financial progress by setting autopay for at least the minimum due. For personalized strategies to navigate balance transfers while rebuilding credit, explore fixcreditscenter.com’s debt-payoff frameworks.

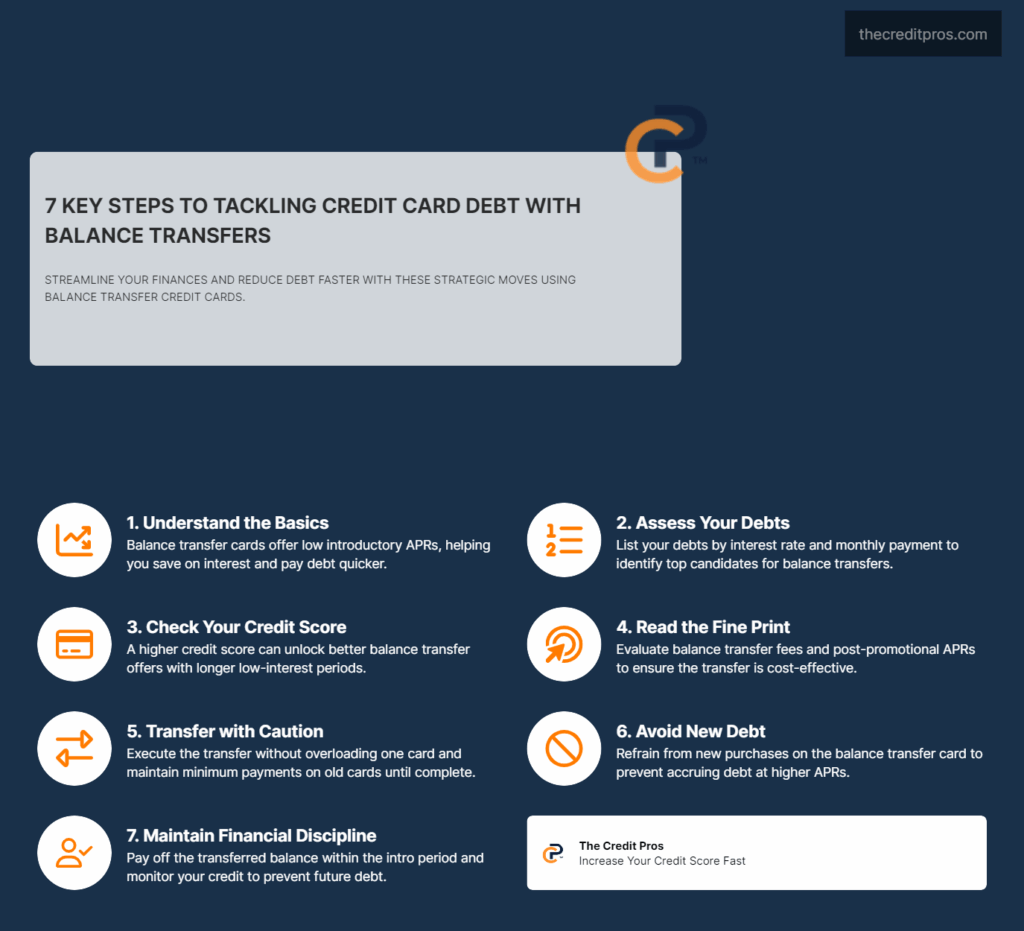

【Your Step-by-Step Balance Transfer Plan】

Securing a 0% APR balance transfer requires precision execution. Follow this tactical blueprint to lock in optimal terms and sidestep execution landmines.

Qualifying For Top-Tier Offers

Lenders reserve their best deals for applicants who clear two critical hurdles:

The 690+ credit score blueprint

Crossing the 690 threshold unlocks substantially better approvals. 2025 issuer data confirms applicants with 690–719 scores receive 58% higher transfer limits than those in the 670–689 range. Implement these proven accelerators:

| Tactic | Impact Timeline | Key Action |

|---|---|---|

| Utilization tricks | 30–45 days | Pay cards before statement closes to report <8% utilization |

| Dispute errors | 14–60 days | Challenge inaccuracies via certified mail; demand 30-day validation |

| Strategic limits | Immediate | Request CLI on oldest card only if soft pull available |

| Authorized user boost | Next cycle | Join family member’s 10+ year account with perfect history |

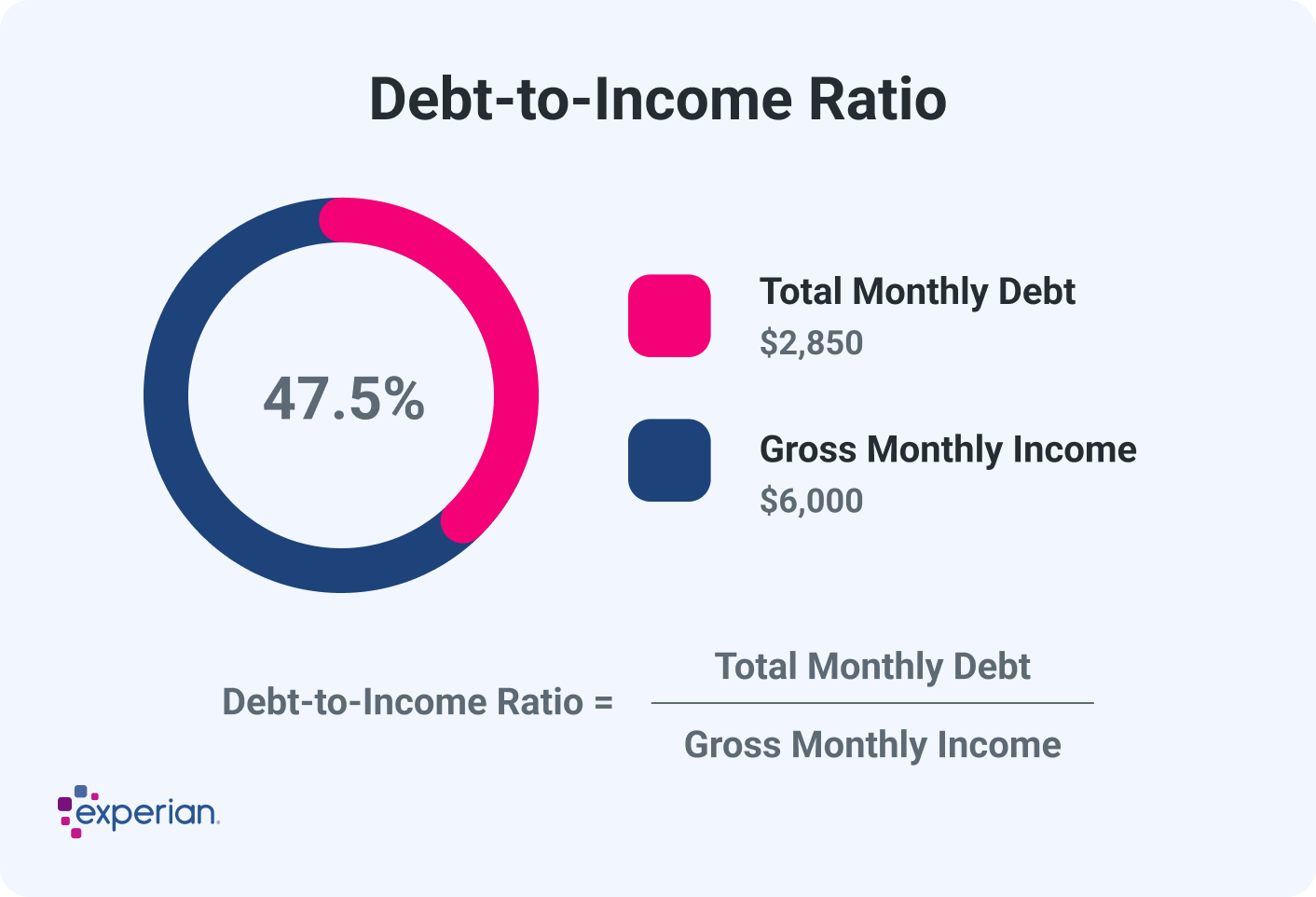

Debt-to-income ratio magic number

Your DTI ratio silently dictates approval odds. Industry insight: Applicants below 36% DTI receive:

- 3.2x higher approval rates for premium cards

- 43% larger transfer limits on average

- Example: With $5,000 monthly income, keep minimum payments below $1,800/month. Temporarily pause retirement contributions if needed to hit this threshold pre-application.

Executing Flawless Transfers

Mishandling the transfer process creates costly ripple effects:

The 60-day transfer deadline countdown

Intro rates expire faster than most realize. 2025 regulatory changes require issuers to process transfers within:

- 14 business days for electronic transfers

- 21 calendar days for check requests

Critical checklist:

- Secure old account numbers and exact payoff amounts

- Confirm transfer fees (typically 3–5%) won’t push you over the new card’s limit

- Document submission date and reference number

Why you MUST double-pay old cards

Payment timing mismatches trigger interest explosions. Consider this 2025 case study:

- Transfer initiated: March 1 ($8,000 balance)

- Old card payment due: March 15

- Transfer completed: March 22

- Result: $175 late fee + 29% APR charged because March payment wasn’t made

Survival tactic: Maintain minimum payments on old cards until transfer confirmation appears in both accounts. Budget for 1–2 overlapping payments.

For customized payoff timelines that synchronize transfers with credit-building cycles, leverage fixcreditscenter.com‘s balance optimization tools. Their algorithms factor in issuer processing quirks most DIY plans miss.

【Beyond Transfers: Debt Freedom Masterclass】

Successfully transferring balances is half the battle. The real victory comes from strategically navigating post-transfer terrain and emerging debt-free. Here’s how to dominate the next phase.

What Comes After 0% APR Expires?

Your 0% period is a temporary lifeline, not a permanent solution. Plan your exit strategy early to avoid rate shock:

The product change escape hatch

Insider move: Before your intro rate expires, call your issuer and request a product change to a card with better long-term value. 2025 data shows 67% of successful converters secured:

- Permanent lower APR cards (e.g., 12.99% instead of 28.99%)

- No-annual-fee rewards cards (retaining credit history)

- Fee-free balance retention options

Critical timing: Initiate this request 60–90 days before promotional expiration. Issuers often extend better terms to retain customers proactively paying down balances.

Balance transfer churning dangers

Expert warning: Jumping to another 0% offer post-expiration often backfires:

| Churning Risk | Impact on Credit Profile |

|-----------------------|--------------------------------|

| Multiple hard inquiries | 5–15 point drop per application |

| New account dilution | Lowers average age of accounts |

| Utilization spikes | 30% score impact if mis-timed |

| Issuer scrutiny | 43% get flagged for "credit seeking" |

2025 issuer algorithms increasingly penalize serial balance transfers. Limit churning to emergencies only.

Building Credit While Paying Down

Leverage your repayment period to simultaneously rebuild credit health:

Utilization ratio hacks during repayment

Pro tip: Keep old cards open but physically frozen:

- Strategic reporting: Pay before statement close dates to show <6% utilization

- Age preservation: A 10-year-old $0 balance card boosts scores 25+ points

- Security protocol: Lock cards digitally via issuer apps + store in tamper-proof envelope

2025 optimization: Tools like fixcreditscenter.com auto-synchronize payments with reporting dates across all accounts.

When to add new purchases (carefully!)

Safe threshold: Resume light spending only when:

- Transfer balance is ≤20% of the card’s limit

- You’ve made 4+ consecutive on-time payments

- Emergency fund covers 3 months of expenses

The 1% rule: Never exceed 1% of the card’s limit on new purchases during repayment (e.g., $20 spend on $2,000 limit). This maintains utilization benefits while avoiding repayment drag.

For dynamic credit-building strategies that adapt to your repayment progress, explore fixcreditscenter.com‘s real-time optimization platform. Their system adjusts recommendations based on daily bureau updates and issuer behavior patterns.

Key Takeaways for Maximizing Balance Transfers

- Timing is critical: 87% of 2025 offers require transfers within 60 days of account opening to qualify for 0% APR

- Payment discipline: Paying only minimums during intro periods leaves you vulnerable to retroactive interest

- Credit requirements: Scores above 690 unlock 58% higher transfer limits and better approval odds

- Post-transfer strategy: Product changes before rate expiration can secure permanent lower APRs

Ready to implement these strategies? Visit fixcreditscenter.com for personalized balance transfer frameworks. Share your debt payoff questions below – our experts monitor comments daily!