Did you know 79% of credit report disputes result in corrections? Unlock free, official credit repair solutions from bureaus and government programs. Start fixing errors today!

【Official Credit Bureau Solutions】

The journey to credit repair often begins not with costly services, but by leveraging the powerful, legally mandated tools provided directly by the entities holding your data: the three nationwide credit bureaus (Equifax, Experian, and TransUnion). Understanding these official channels is your first line of defense and repair.

Free Credit Report Access

Contrary to popular belief, you possess significant, free access to the very information lenders use to judge you. This isn’t a privilege; it’s a right.

AnnualCreditReport.com entitlement

- The Law: The Fair Credit Reporting Act (FCRA) guarantees you access to your credit reports.

- The Source: AnnualCreditReport.com is the only Federally-authorized source for free reports.

- The Frequency (2025): As established during recent economic disruptions, consumers are entitled to request free weekly reports from each of the three bureaus through this portal. This is crucial for monitoring changes and spotting errors promptly.

- The Action: Regularly download your reports from all three bureaus. Discrepancies between them are common red flags for errors.

TransUnion Service Center features

While AnnualCreditReport.com provides comprehensive tri-merge access, TransUnion offers an additional, valuable free tool directly:

- TransUnion Credit Monitoring Service: Signing up for a free account via their Service Center often grants access to daily refreshes of your TransUnion credit report and VantageScore credit score.

- The Benefit: This allows for near real-time tracking of your TransUnion file, helping you catch new information or potential inaccuracies much faster than waiting for your next weekly pull from AnnualCreditReport.com. It’s a powerful supplement for active monitoring.

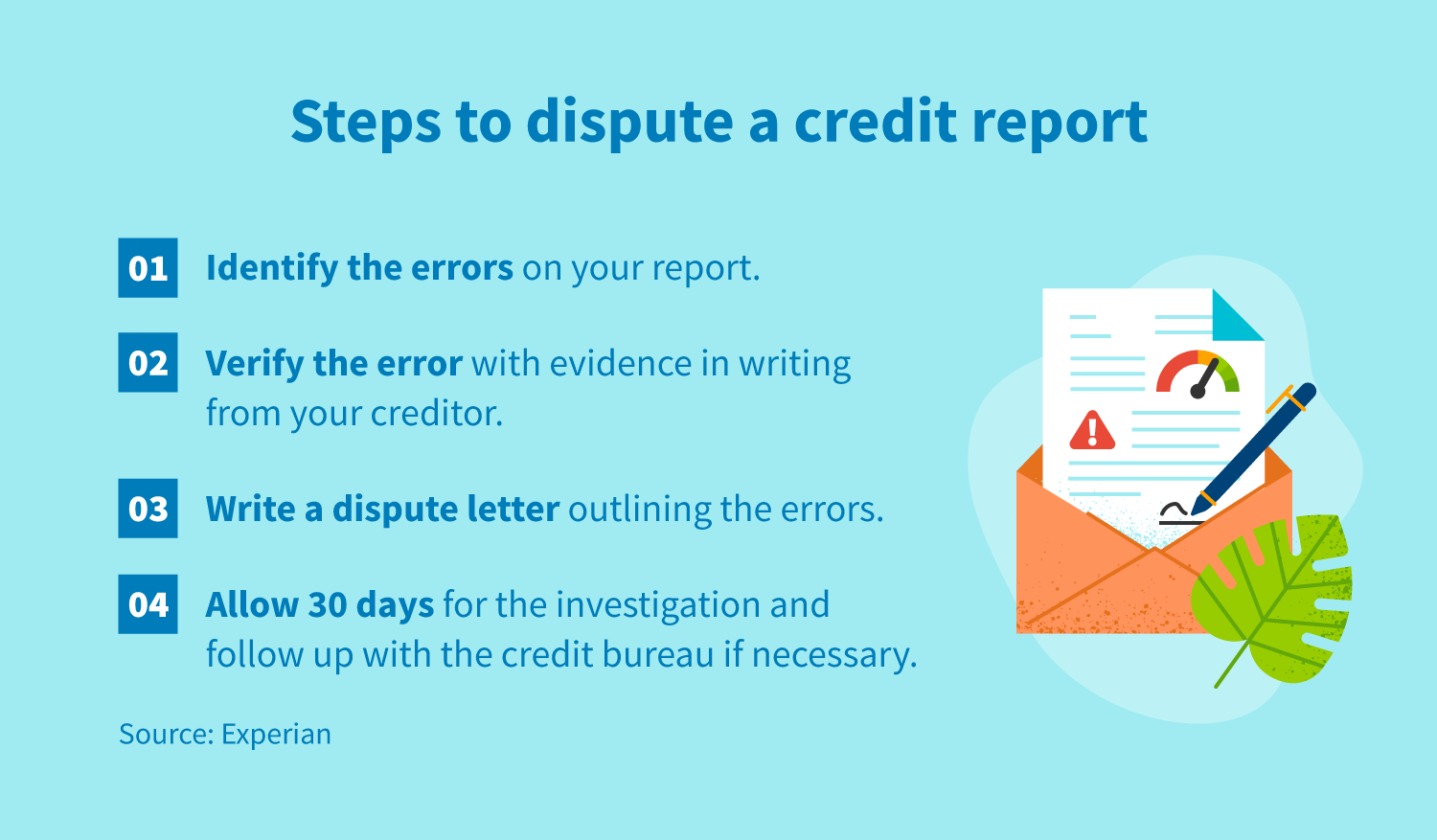

Dispute Process Demystified

Finding an error is only step one. The true power lies in effectively wielding the dispute process – a right enshrined in law and highly effective when used correctly.

How to challenge errors effectively

The FCRA provides a clear framework for disputing inaccuracies:

- Identify & Document: Pinpoint the exact error (wrong account, incorrect balance, fraudulent entry) on your report. Gather any supporting documentation (statements, payment confirmations, police reports for fraud).

- File Formally: Submit your dispute directly to the credit bureau(s) reporting the error. Use their online portals (often the fastest method), certified mail, or their designated dispute forms. Clearly state what is inaccurate and why, and include copies (not originals) of your evidence.

- Bureau’s Duty: Upon receiving your dispute, the bureau must investigate your claim, typically by forwarding it to the data furnisher (the lender or creditor who provided the information).

- Furnisher’s Duty: The furnisher must conduct its own investigation and report back to the bureau.

- The Timeline: The entire process, from the bureau receiving your dispute to providing you with the results, must be completed within 30 days (with limited exceptions, like receiving additional information from you during the investigation). This is a strict FCRA requirement.

- The Result: You will receive the investigation results in writing. If the information is found inaccurate, incomplete, or unverifiable, the bureau must delete or correct it.

Common dispute outcomes

The system, while sometimes frustrating, demonstrably works for consumers who use it diligently:

- High Success Rate: According to a significant study by the Consumer Financial Protection Bureau (CFPB), approximately 79% of consumers who filed disputes saw at least one modification on their credit report. This overwhelmingly means inaccuracies were corrected or removed.

- Correction vs. Deletion: Outcomes vary. An account might be updated with the correct balance or status, or a completely erroneous or unverifiable account might be deleted entirely. Both outcomes improve your credit profile.

- No Change: If the furnisher verifies the information as accurate, the item remains. However, you have the right to add a brief statement of dispute to your file explaining your side.

- The Power is Yours: This data underscores a critical point: The most effective agent for fixing your credit for free is often you, armed with your rights and the official dispute process. While persistence is sometimes needed, the legal framework and high success rate provide a powerful, cost-free path to accuracy.

Mastering these official solutions – vigilant monitoring using your free reports and strategically employing the dispute process – forms the bedrock of legitimate credit repair. For those seeking structured guidance navigating these steps or exploring additional strategies, resources exist to help streamline the process. Platforms like fixcreditscenter offer tools and insights to support your journey, accessible at https://fixcreditscenter.com.

【Government-Backed Assistance】

Building upon the foundation of credit bureau tools, significant free help exists within government-mandated frameworks. These resources empower consumers facing complex debt situations or grappling with credit report inaccuracies, ensuring expert guidance and legal protections are accessible without cost.

FTC-Certified Credit Counseling

The Federal Trade Commission (FTC) endorses nonprofit credit counseling agencies as a primary resource for overwhelmed consumers. Crucially, accessing their core services won’t drain your wallet.

Nonprofit agency requirements

To gain FTC certification and maintain legitimacy, these agencies must adhere to strict standards:

- Nonprofit Status: They must operate as 501(c)(3) nonprofit organizations, prioritizing client well-being over shareholder profits.

- Free Initial Consultation: A fundamental requirement is offering a comprehensive financial assessment and consultation at absolutely no charge. This session allows counselors to understand your unique situation and outline potential solutions.

- Transparency: They are obligated to clearly disclose all fees (if any, typically for ongoing management plans) upfront, before you commit to any service. Pressure tactics or obscuring costs violate their certification standards.

Services covered at no cost

Beyond the mandatory free consultation, certified agencies provide several key services without charge:

- Budget Creation & Analysis: Expert help in building a realistic budget based on your income and expenses.

- Credit Report Review: Assistance in understanding your credit reports and identifying potential issues or errors.

- Debt Management Plan (DMP) Creation: If appropriate, they will develop a structured Debt Management Plan tailored to your circumstances. This plan consolidates payments and often negotiates lower interest rates or waived fees with creditors.

- Financial Education: Workshops, materials, and coaching on topics like money management and credit building principles.

(Note: While creating a DMP is free, agencies may charge a small monthly fee to administer the plan, which involves distributing payments to creditors. This fee must be clearly disclosed during your free consultation).

FACT Act Protections

The Fair and Accurate Credit Transactions Act (FACT Act) significantly bolsters your rights regarding credit information accuracy and identity theft recovery, providing essential free remedies.

Your legal right to accuracy

The FACT Act reinforces your FCRA rights and adds critical free access points:

- Beyond AnnualCreditReport.com: While the central hub provides weekly online reports, the FACT Act guarantees you the right to request your free credit report by mail or phone if needed. This is vital for those without reliable internet access.

- Free Disputes via All Channels: Whether you file a dispute online, by mail, or over the phone directly with a credit bureau, the investigation process itself must always be free. Bureaus cannot charge you for correcting errors they or their data furnishers made.

- Free Report After Adverse Action: If you are denied credit, insurance, or employment based on your credit report, you are entitled to a free copy of the report used in that decision within 60 days, allowing you to review it for accuracy.

Identity theft recovery resources

The FACT Act established crucial, free federal resources to combat the devastating impact of identity theft:

- FTC IdentityTheft.gov: This is the official, Federally-mandated resource for identity theft victims. It provides a centralized recovery plan.

- Free Affidavit Assistance: The site offers step-by-step guidance and generates the free, standardized FTC Identity Theft Affidavit. This powerful document is universally recognized by creditors and credit bureaus to report the crime and begin the fraud validation process.

- Recovery Plan & Pre-Filled Letters: IdentityTheft.gov creates a personalized recovery plan and generates pre-filled dispute letters and forms you can send to credit bureaus, creditors, debt collectors, and law enforcement – all critical tools provided at no cost.

- Fraud Alerts & Credit Freezes: Guidance on placing free initial 90-day fraud alerts or longer-term extended alerts (with police report) and implementing free credit freezes on your reports to prevent new fraudulent accounts.

Leveraging these government-backed resources – certified counseling for debt strategy and the FACT Act’s robust accuracy and identity theft protections – provides powerful, legitimate avenues for credit improvement at zero cost. For individuals seeking to integrate these strategies with bureau tools into a cohesive plan, platforms like fixcreditscenter offer structured support and insights at https://fixcreditscenter.com.

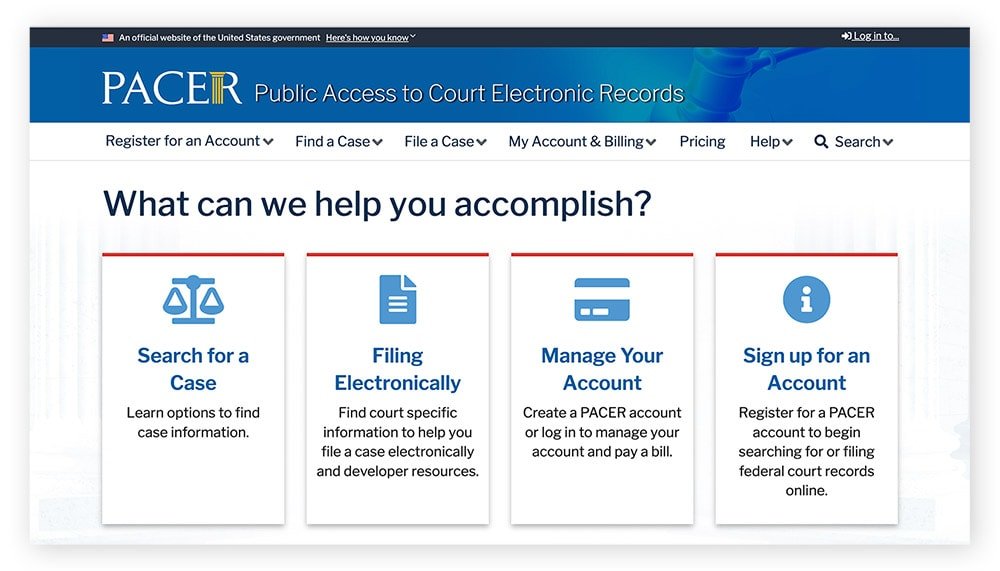

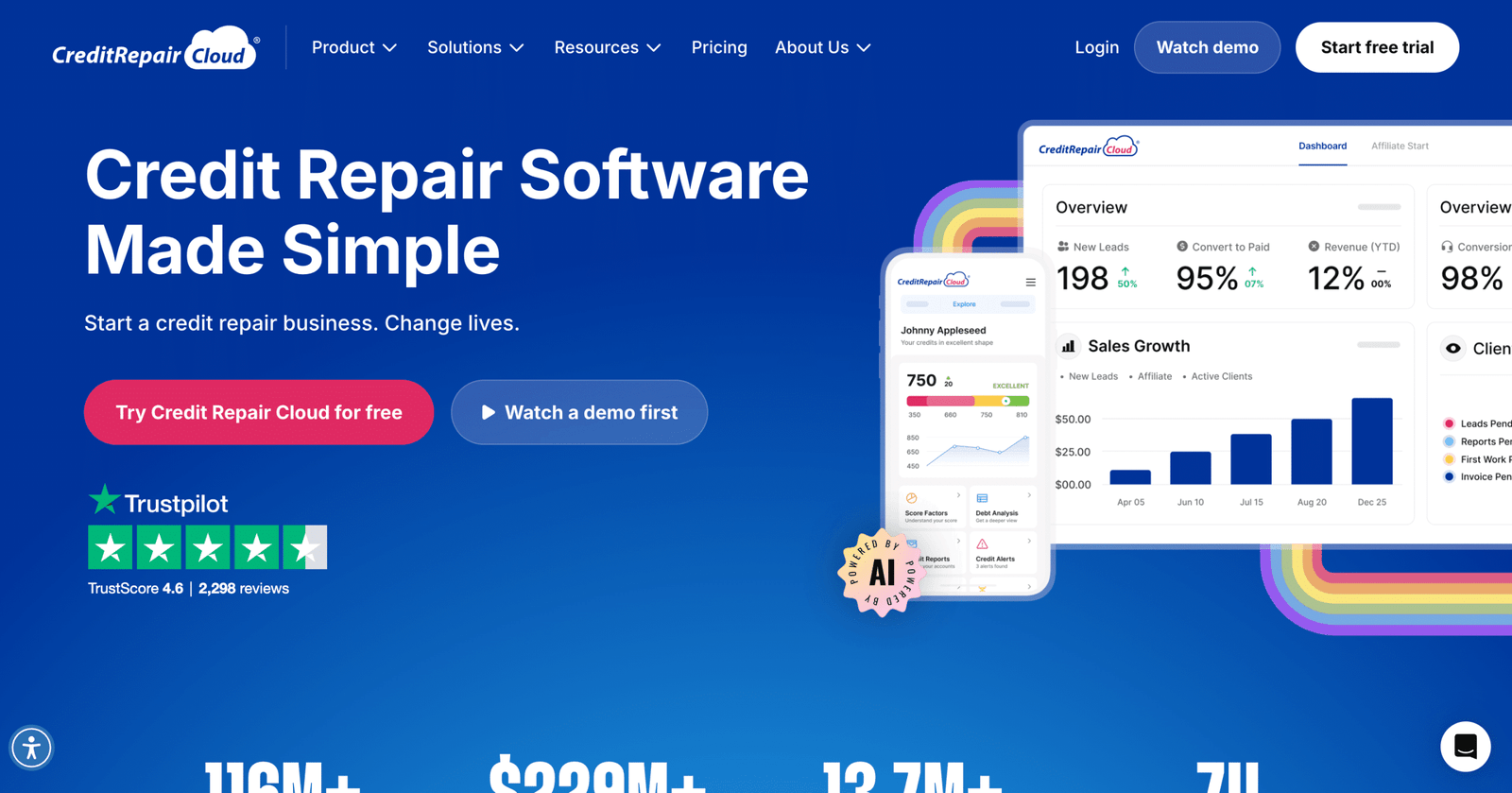

【Automated Credit Tools】

Building on government-backed safeguards, technology offers another layer of free assistance through automated platforms. These digital tools empower proactive credit management by identifying potential issues swiftly and bolstering security, often at minimal or no initial cost.

AI-Powered Dispute Platforms

Artificial intelligence is reshaping credit repair efficiency. Specialized platforms now leverage algorithms to scan your reports for potential inaccuracies faster and more systematically than manual reviews.

How automated disputes work

The core functionality relies on sophisticated pattern recognition:

- Algorithmic Scanning: AI scans your credit report data against known patterns of common errors, outdated information, and potential inaccuracies (e.g., duplicate accounts, incorrect late payment dates, accounts exceeding statute of limitations).

- Disputable Item Identification: The algorithm flags items most likely to be successfully disputed based on credit reporting rules and historical dispute success rates.

- Automated Dispute Generation: For flagged items, the platform can often generate and submit dispute letters directly to the relevant credit bureau(s) on your behalf, streamlining the traditionally cumbersome process.

Free tier limitations

While promising, free access tiers typically come with significant constraints:

- Single-Bureau Focus: Free plans often allow disputes for items appearing on reports from only one of the three major credit bureaus (Equifax, Experian, or TransUnion). Addressing an error across all bureaus where it appears usually requires a paid upgrade.

- Limited Dispute Volume: There may be caps on the number of items you can dispute per month or year under the free tier.

- Basic Error Types: Free algorithms might focus only on the most common, easily identifiable errors, missing more complex inaccuracies requiring nuanced analysis.

- Reduced Customization: Automated dispute letters generated under free plans may be generic templates, lacking the tailored arguments sometimes needed for tougher disputes.

Credit Monitoring Alerts

Constant vigilance is key to credit health and security. Free credit monitoring services act as your early warning system.

Real-time change notifications

The primary value lies in immediate awareness:

- Hard Inquiry Alerts: Receive notifications (often via email or app) typically within 24 hours whenever a lender performs a “hard pull” of your credit report, signaling a new credit application. This allows you to quickly spot unauthorized applications.

- New Account Alerts: Get notified when new credit accounts (credit cards, loans) are opened in your name.

- Balance & Utilization Changes: Track significant increases in reported balances or credit utilization ratios that could negatively impact your score.

- Derogatory Marks: Alerts for new negative items like late payments, collections, charge-offs, or bankruptcies hitting your report.

Security freeze advantages

Beyond alerts, proactive security measures are crucial and free:

- Preventing Unauthorized Access: A security freeze (also known as a credit freeze) is the most effective tool. When frozen, your credit report cannot be accessed by potential new creditors, effectively preventing unauthorized account openings in your name.

- Freeze is Free: Federal law mandates that placing, temporarily lifting, or permanently removing a security freeze must be free of charge at all three major credit bureaus.

- Control: You retain full control; you can temporarily lift the freeze (using a unique PIN) when you legitimately apply for credit yourself, then re-freeze it.

- Distinct from Lock: A freeze offers stronger legal protections than a simple credit “lock” often marketed by bureaus or third parties.

These automated tools – AI dispute assistants and vigilant monitoring/freeze capabilities – provide accessible, tech-driven leverage for maintaining and improving credit standing. For individuals navigating the convergence of government resources, bureau tools, and these automated platforms in 2025, integrating strategies through fixcreditscenter can offer a structured pathway forward at https://fixcreditscenter.com.

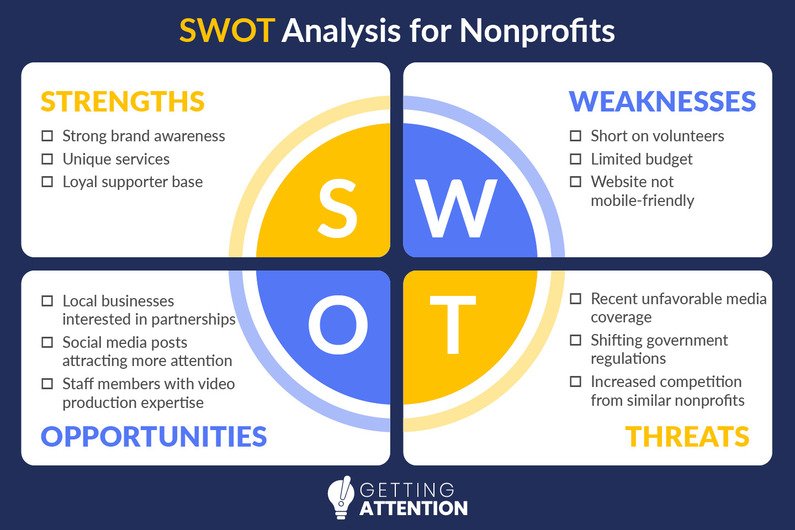

【Strategic DIY Methods】

Moving beyond automated tools, the most impactful credit repair often involves hands-on financial strategy. Mastering payment behavior and credit utilization constitutes the bedrock of sustainable score improvement – requiring discipline rather than direct financial cost.

Payment History Optimization

Your payment history is the single largest factor in your FICO® Score (35%). While avoiding late payments is paramount, understanding reporting nuances creates critical breathing room.

30-day grace period advantage

Crucially, creditors generally only report a payment as “late” to the bureaus once it’s 30 days past the due date. This built-in buffer offers a vital recovery window:

- A payment missed by 5, 10, or even 25 days might incur fees and penalty APRs from your lender, but it won’t automatically crater your credit score if rectified within 29 days.

- Immediate action upon any miss is non-negotiable: Contact the lender instantly, pay the minimum due plus any fees, and confirm it will not be reported late. Document the representative’s name and confirmation number.

- Set payment reminders for at least 5 days before the actual due date, safeguarding against processing delays or forgotten dates.

Negotiation techniques

For existing derogatory marks like collections or charge-offs, strategic negotiation is your strongest free tool:

- “Pay for Delete” (PFD): Before paying a collection account, negotiate in writing. Offer to pay the debt (often settling for less than owed) in exchange for the collector completely removing the negative entry from your credit reports. Key steps:

- Get the agreement IN WRITING before sending any payment. Verbal promises are unenforceable.

- Specify the exact accounts to be deleted and the payment terms.

- Send correspondence via certified mail with return receipt.

- Goodwill Adjustments: For isolated late payments on otherwise perfect accounts, a well-crafted goodwill letter to the original creditor can sometimes succeed. Explain the circumstances (job loss, medical emergency) briefly, emphasize your long-standing positive history, and humbly request they remove the late mark as a courtesy. Success is less guaranteed than PFD but costs only time and a stamp.

Credit Utilization Mastery

Credit utilization (your total revolving balances divided by total credit limits) is the second most influential scoring factor (30%). Widespread advice suggests keeping utilization below 30%, but optimization demands far more precision.

The 30% threshold myth

While staying below 30% avoids severe penalties, FICO’s own data reveals optimal scoring occurs at utilization levels below 10%, and ideally under 7%:

- Individuals with FICO Scores above 785 consistently maintain single-digit aggregate utilization.

- High utilization signals reliance on credit, increasing perceived risk. Ultra-low utilization demonstrates mastery over available credit.

- Strategy: Calculate your total revolving credit limit across all cards. Aim for your total combined balances to be ≤7-10% of that number. This is more impactful than focusing solely on individual card limits.

Balance timing tactics

Since most creditors report balances to bureaus once per month, when they report relative to your statement closing date is critical:

- Statement Closing Date ≠ Due Date: Your reported balance is typically the balance on your statement closing date (the end of your billing cycle), not your payment due date.

- Pre-Closing Payment Strategy: To control what gets reported:

- Identify each card’s statement closing date (found on statements or online accounts).

- Pay down balances before the statement closing date, not just before the due date.

- Aim to have only a small, non-zero balance (e.g., 1-5% of the limit) report on the closing date. Reporting $0 on all cards can sometimes slightly lower scores compared to reporting a tiny, paid-off balance.

- Multiple Payments: If carrying significant monthly spending, make payments during the billing cycle, not just one large payment before the due date, to keep the closing-date balance low.

Integrating these disciplined DIY approaches – meticulous payment timing, strategic negotiation, and surgical control over utilization reporting – with the automated tools and government resources discussed earlier forms a comprehensive, cost-free credit rehabilitation framework. For individuals navigating these combined strategies in 2025, platforms like fixcreditscenter provide structured guidance and tracking at https://fixcreditscenter.com.

【Community Support Systems】

While disciplined personal strategy forms credit repair’s foundation, leveraging community resources provides vital scaffolding. Two proven pathways exist: harnessing established credit relationships through authorized user status, and accessing structured nonprofit guidance – both operating at minimal or zero cost.

Authorized User Strategy

When direct credit-building proves difficult, becoming an authorized user (AU) on someone else’s seasoned credit card allows you to “piggyback” on their positive history. This tactic leverages trust, not cash.

Piggybacking best practices

- Primary user qualifications are critical: The account holder should possess a FICO® Score of 700+, a long credit history (ideally 7+ years), and demonstrate flawless on-time payments. Low utilization (<10%) on the shared card is essential.

- Card issuer policies vary: Confirm the issuer reports AU activity to all three bureaus (Experian, Equifax, TransUnion). Major issuers like American Express, Chase, and Citi typically do.

- Impact potential: Adding an AU to a $10,000-limit card with a perfect 5-year history can potentially boost a thin or damaged credit file by 50+ points, depending on overall profile. Negative account activity (late payments, high balances) harms both parties.

Relationship safeguards

- Written agreement necessity: Formalize expectations before becoming an AU. Key clauses should cover:

Clause Purpose Spending Authorization Explicitly state if the AU receives a card and spending privileges Payment Responsibility Define who pays charges incurred by the AU Removal Trigger Specify conditions for removing AU status (e.g., misuse, score drop) - Zero-liability protection: Legally, the primary cardholder bears full payment responsibility. AUs incur no legal debt obligation, protecting them from collections if the primary user defaults.

- Exit strategy: Establish how AU removal is requested and processed with the issuer to ensure a clean separation if needed.

Nonprofit Financial Coaching

For personalized guidance without commercial pressures, nonprofit credit counseling agencies offer evidence-based support, often completely free.

NFCC member services

The National Foundation for Credit Counseling (NFCC), the largest nonprofit network, provides:

- Free initial consultations: Certified counselors review your credit reports, budget, and debts at no cost (typically 60-90 minutes).

- Customized action plans: Receive tailored strategies addressing your specific credit obstacles (e.g., disputing errors, negotiating debts, budgeting).

- Ongoing support: Many agencies offer free follow-up sessions or educational workshops on credit building and financial literacy.

- Locator tool: Find vetted local agencies via NFCC.org.

Debt management program fees

While counseling is free, enrolling in a formal Debt Management Program (DMP) through an NFCC agency involves regulated, minimal costs:

- Setup fees: Typically $0-$50, often waived for hardship cases. State regulations cap these fees.

- Monthly fees: Average $0-$40/month, calculated based on ability to pay. These cover program administration and creditor communication.

- Key benefit: NFCC agencies negotiate reduced interest rates and waived late fees with creditors, accelerating debt payoff. Payments are consolidated into one monthly sum sent to the agency for distribution.

Combining the relational leverage of authorized user status with the expert, low-cost framework of nonprofit counseling creates a robust support structure for credit rehabilitation. These community-centric approaches, integrated with disciplined personal finance habits and automated monitoring tools, empower sustained recovery. Individuals navigating these combined strategies in 2025 frequently utilize platforms like fixcreditscenter for consolidated tracking and strategy optimization at https://fixcreditscenter.com.

【Credit-Building Products】

While community support leverages relationships and nonprofit guidance, purpose-built financial products offer structured pathways to rebuild credit independently. Secured credit cards and credit builder loans function as foundational tools, designed specifically for those with thin or damaged files, operating on the principle of demonstrated responsibility.Secured Credit Cards

Secured cards require a cash deposit that typically sets your credit limit, transforming collateral into a revolving credit line reported to all three bureaus. This structure minimizes lender risk while creating opportunities for borrowers to prove creditworthiness.

How collateral converts to credit

- Deposit-to-limit ratio: Most issuers match your security deposit dollar-for-dollar. A $200 deposit generally yields a $200 credit limit. Higher deposits (e.g., $500-$2,000) increase available credit proportionally.

- Bureau reporting: Responsible usage—keeping balances low (under 30% of the limit) and paying on time—is reported monthly to Experian, Equifax, and TransUnion, directly influencing your score.

- Minimal qualifications: Approval focuses primarily on your ability to fund the deposit, making these accessible even with recent bankruptcies or low scores.

Graduation to unsecured cards

The end goal is transitioning to an unsecured card with your deposit refunded. Success hinges on consistent performance:

- Typical timeline: Most issuers review accounts after 12-18 months of on-time payments and low utilization.

- Graduation triggers: Some cards auto-convert after meeting criteria, while others require manual requests. Confirm the issuer’s policy before applying.

- Deposit return: Upon graduation, your full security deposit is refunded. Accounts in good standing often receive credit limit increases during this process.

Feature Secured Card Advantage Approval Odds High (requires refundable deposit) Credit Impact Reports like unsecured cards Path to Unsecured Explicit graduation programs after 12-18 months Cost Control Deposit amount sets limit; avoid annual fee options Credit Builder Loans

Unlike traditional loans, credit builder loans (CBLs) hold the borrowed amount in a secured account while you make fixed monthly payments. Only after completing payments do you receive the funds, making repayment history—not the loan proceeds—the primary benefit.

How reverse loans function

- Payment-first structure: You pay installments (e.g., $48/month for 12 months) toward a loan typically $500-$1,500. The lender reports these payments to all three credit bureaus.

- Funds release: After fulfilling the term, you receive the total loan amount minus minimal interest or fees. Missed payments incur penalties and damage credit.

- Score impact: Payment history constitutes 35% of your FICO® Score. Twelve on-time CBL payments can significantly boost thin-file scores.

Local credit union options

Credit unions frequently offer superior CBL terms compared to fintech apps or online lenders:

- Lower fees: Average APRs of 5%-16% versus fintech alternatives charging up to 25%. Many waive application fees.

- Flexible terms: Loan amounts from $200-$3,000 with 6-24 month terms, adjustable to your budget.

- Member support: In-person counseling and payment adjustments during hardships, reducing default risk.

- Accessibility: Most require membership (often based on location or employer), but opening a $5 savings account typically satisfies this.

Integrating these products into your credit rehabilitation strategy provides tangible, reportable activity. Consistent management of a secured card or credit builder loan demonstrates financial reliability to creditors. For those navigating this process in 2025, platforms like fixcreditscenter streamline tracking your progress across multiple rebuilding methods at https://fixcreditscenter.com.

【Long-Term Habit Formation】

While secured cards and credit builder loans initiate credit rehabilitation, sustained improvement demands ingrained financial behaviors. Establishing automated systems and committing to ongoing education transforms short-term tactics into permanent score elevation.Financial Behavior Tracking

Consistency separates temporary fixes from lasting credit health. Modern tools minimize human error while revealing critical spending patterns:

Automatic payment systems

- Late payment prevention: Enrolling in autopay for minimum balances slashes delinquency risk. Experian data shows a 92% reduction in late payments when using scheduled payments.

- Utilization management: Pair autopay with balance alerts to keep credit usage below 30%—a key FICO® factor. Calendar reminders for statement closing dates optimize reporting.

- Creditor preferences: Prioritize autopay for accounts reporting to all three bureaus. Some lenders offer APR reductions (e.g., 0.25%) for enrollment.

Spending pattern analysis

- App integration: Free services like Mint categorize transactions across accounts, flagging high-spend areas. Linking credit cards provides real-time utilization snapshots.

- Cash flow alignment: Budgeting apps project upcoming bills against income cycles, preventing overdrafts that may trigger fee-related credit line reductions.

- Annual review: Export monthly reports to identify recurring subscriptions or memberships. Canceling underused services frees funds for debt repayment.

Tracking Method Primary Credit Benefit Implementation Tip Autopay (minimums) Prevents late payments (35% of FICO®) Set payments 3 days before due date Balance alerts Controls utilization (30% of FICO®) Threshold: 25% of limit Spending categorization Identifies debt repayment opportunities Review “dining” & “entertainment” tabs Continuous Education

Credit scoring evolves—2025 FICO® 10T models incorporate trended data, making historical behavior increasingly vital. Free resources demystify these shifts:

Free FICO score simulators

- Impact forecasting: Tools like Experian’s CreditMatch™ illustrate how paying down a $500 balance could lift scores 20-40 points.

- Application planning: Test how a new credit card inquiry might temporarily lower your score before major loan requests.

- Debt strategy testing: Simulate effects of snowball vs. avalanche repayment methods on both debt levels and credit age metrics.

Official financial literacy resources

- MyMoney.gov frameworks: The U.S. Treasury’s “Building Blocks” courses clarify debt-to-income ratios and safe credit utilization thresholds.

- FDIC Money Smart: Self-paced modules explain credit report dispute processes and rebuilding timelines post-bankruptcy.

- Nonprofit partnerships: NFCC.org offers certified counselors who dissect your credit report line-by-line at no cost.

Embedding these systems transforms credit repair from project to practice. As you refine habits in 2025, platforms like fixcreditscenter consolidate monitoring—tracking secured card graduations, loan payments, and score trends in one dashboard at https://fixcreditscenter.com.

[object Object]