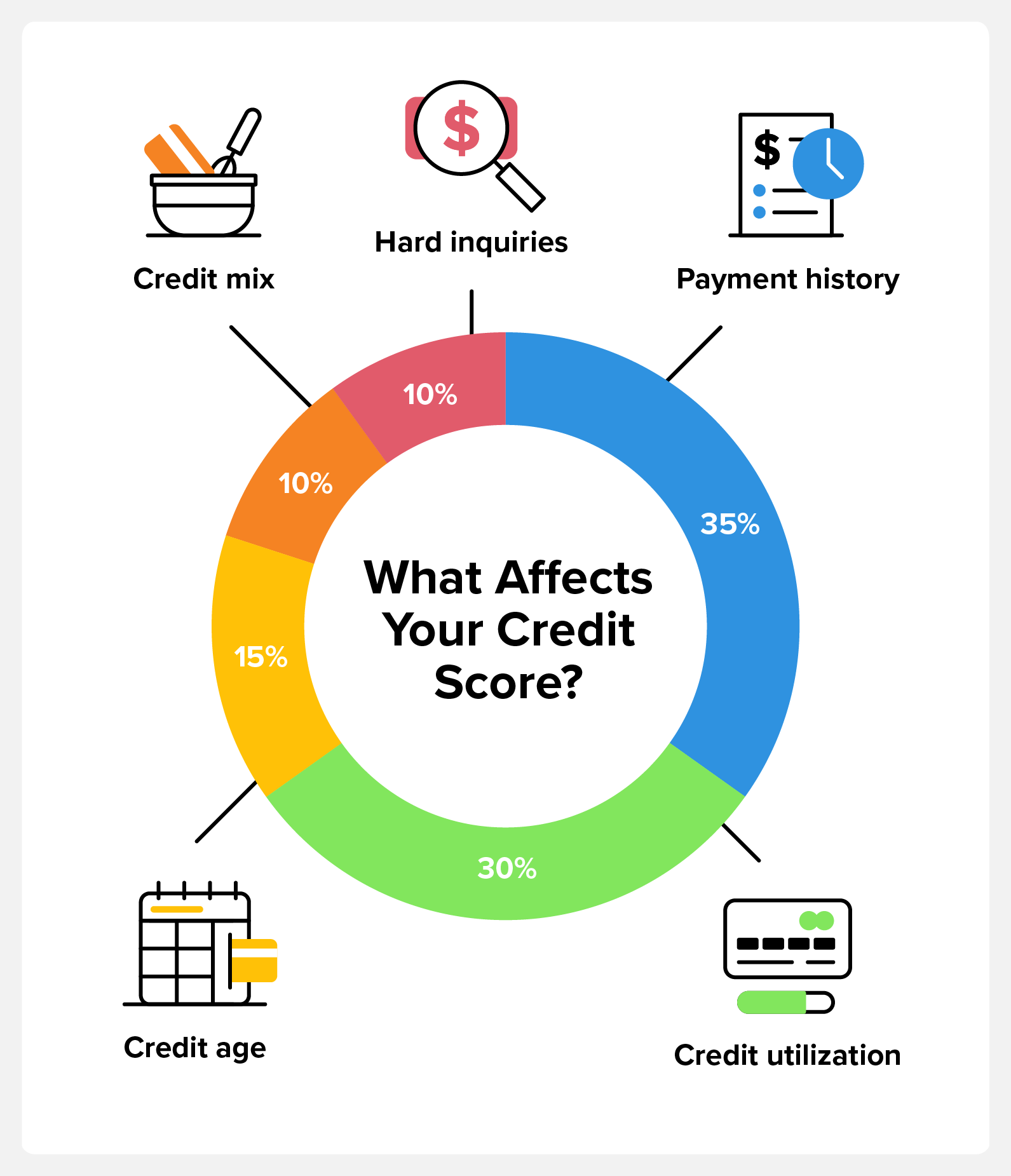

Did you know a single hard inquiry can lower your credit score by 5-10 points? Understand how these credit checks work, their 2025 impact, and proven removal strategies to safeguard your financial profile.

【Understanding Hard Inquiries】

What Is a Hard Inquiry?

Definition and common causes

A hard inquiry (also known as a hard pull) occurs when a lender or financial institution checks your credit report as part of their decision-making process for a loan or credit application you’ve initiated. This type of credit check requires your explicit permission and is directly tied to your pursuit of new credit or financing. Lenders perform hard pulls to assess your creditworthiness and the risk involved in lending to you.

Common causes of hard inquiries include:

- Applying for a mortgage or home loan

- Seeking approval for a new credit card

- Financing an automobile purchase (auto loan)

- Applying for a personal loan or student loan

- Requesting a credit limit increase (some, but not all, lenders do a hard pull for this)

- Applying for certain utility services or apartment rentals (less common, but possible)

Each of these applications typically triggers a hard inquiry recorded on the credit report pulled by that specific lender.

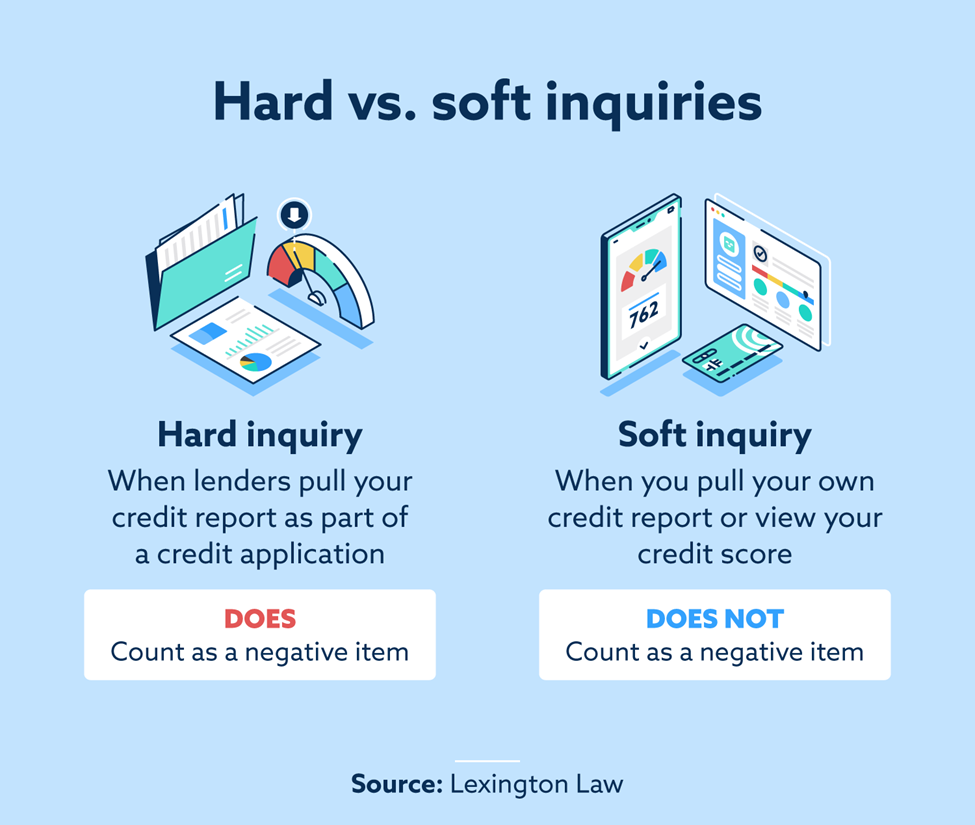

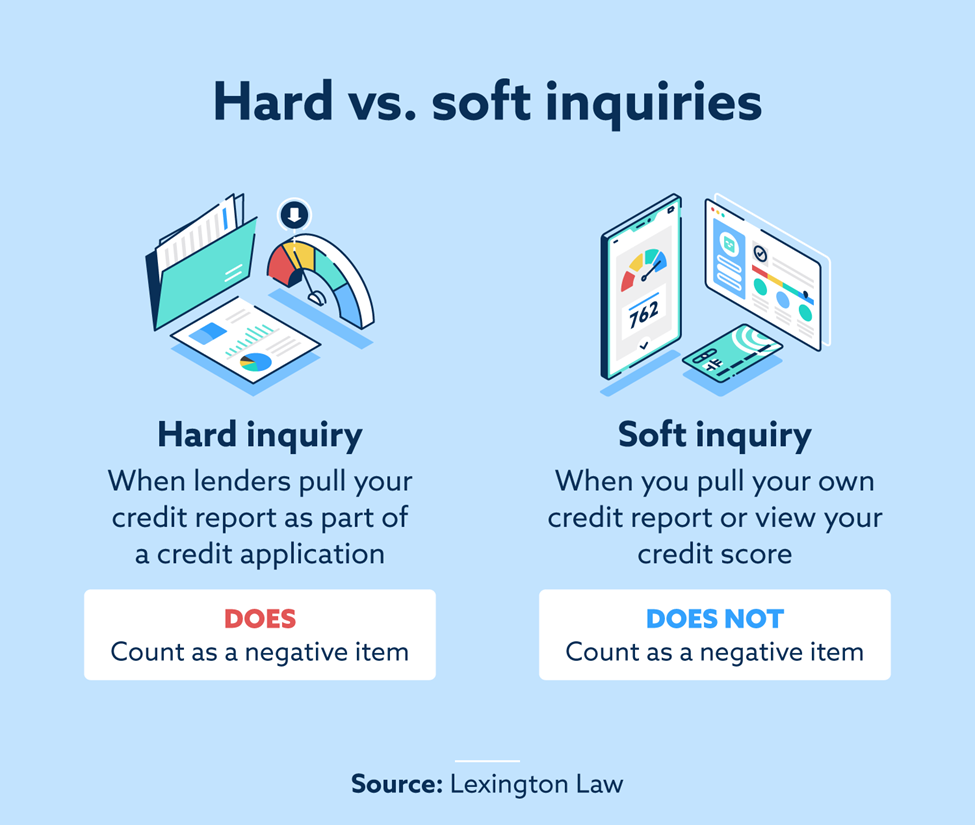

Hard vs. Soft Inquiries

Key differences that affect your credit

Understanding the distinction between hard and soft inquiries is crucial because they impact your credit report and score differently:

| Feature | Hard Inquiry | Soft Inquiry |

|---|---|---|

| Initiation | Triggered by your application for credit/financing. Requires your permission. | Can occur without your application (pre-approved offers, background checks). |

| Impact on Score | Typically causes a small, temporary decrease (usually 5-10 points per inquiry). | No impact on your credit score whatsoever. |

| Visibility | Visible to any lender or creditor who checks your report. | Only visible to you on personal credit report copies. Lenders cannot see soft inquiries. |

| Common Examples | Mortgage application, credit card application, auto loan application. | Checking your own credit report, pre-approved credit offers, employer background checks (usually), insurance quotes (usually). |

Why the Difference Matters: Hard inquiries signal active credit-seeking behavior to lenders. Multiple hard inquiries within a short timeframe (e.g., for rate-shopping on a mortgage) can be a red flag, suggesting potential financial strain or overextension, hence the temporary score dip. Soft inquiries, being informational or background checks, do not indicate new credit risk and are treated neutrally.

While the impact of a single hard inquiry is usually minor and fades within months, numerous inquiries can compound the effect. Managing unnecessary hard pulls is part of responsible credit health. For persistent errors or complex challenges with inquiries or other credit report items, reputable services like fixcreditscenter can offer guidance on navigating disputes and credit repair strategies as of 2025.

【Identifying Unauthorized Inquiries】

Monitoring your credit report for unauthorized hard inquiries is essential to protect your financial health. While legitimate inquiries occur when you apply for credit, unauthorized ones can stem from fraud or errors, potentially harming your score. By learning to spot and address these, you can prevent unnecessary damage and take steps toward removal.

Spotting Fraudulent Activity

Fraudulent hard inquiries often leave clear warning signs on your credit report. Detecting these early helps you act swiftly to dispute and remove them.

Red flags on your credit report

Key indicators of unauthorized activity include:

- Creditor names you don’t recognize: If a lender’s name appears unfamiliar—such as one you never applied to—it could signal identity theft or a scam. For example, seeing “XYZ Lending” when you only deal with major banks warrants immediate investigation.

- Inquiries during periods you didn’t apply for credit: Hard pulls should align with your credit applications. If inquiries show up in months you weren’t seeking loans—like during a job loss or vacation—it suggests potential fraud. For instance, an inquiry dated January 2025 when you were on a sabbatical is a red flag.

Regularly reviewing your credit reports (e.g., via AnnualCreditReport.com) helps catch these signs. If you spot them, report them to the credit bureaus right away to start the dispute process.

Common Causes of Errors

Errors leading to unauthorized inquiries aren’t always malicious; they often arise from systemic issues. Understanding how they happen makes it easier to identify and correct them.

How mistakes happen

Three primary causes contribute to erroneous hard inquiries:

- Creditor processing errors: Lenders sometimes pull reports for the wrong applicant due to typos or system glitches. For example, if a bank employee enters an incorrect Social Security number during your loan application, it might trigger an inquiry on someone else’s report.

- Identity theft incidents: Criminals use stolen personal data to apply for credit in your name. As of 2025, identity theft remains a top cause of fraudulent inquiries, often linked to data breaches. Victims might see multiple inquiries from unfamiliar lenders within days.

- Credit bureau reporting mix-ups: Bureaus like Equifax or Experian can misreport data, such as merging your file with a similar-named individual’s. This might result in inquiries from loans you never applied for, especially if addresses or birthdates overlap.

Addressing these causes involves disputing errors with the bureaus and creditors. For complex cases, services like fixcreditscenter offer expert guidance on fast removal strategies and credit repair as of 2025.

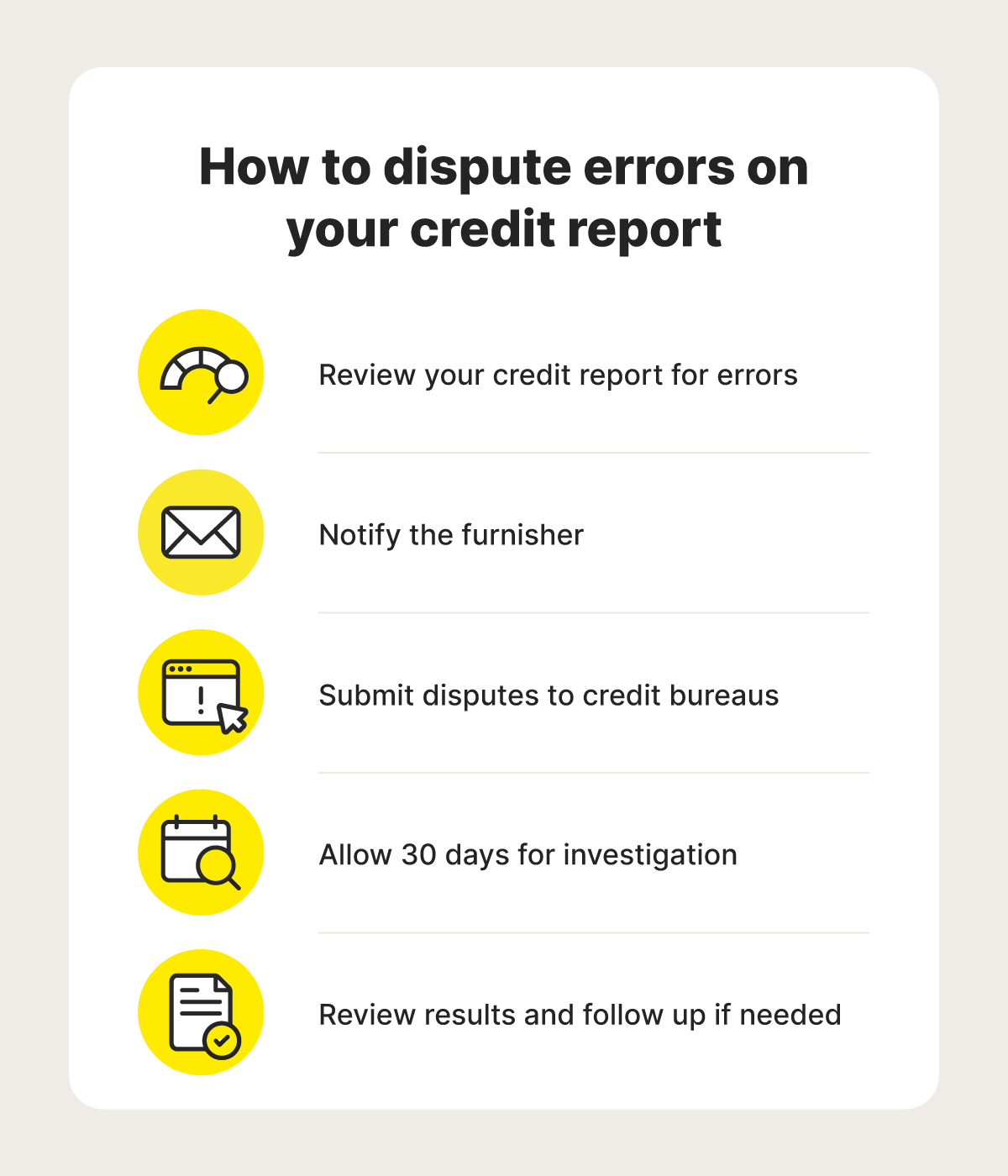

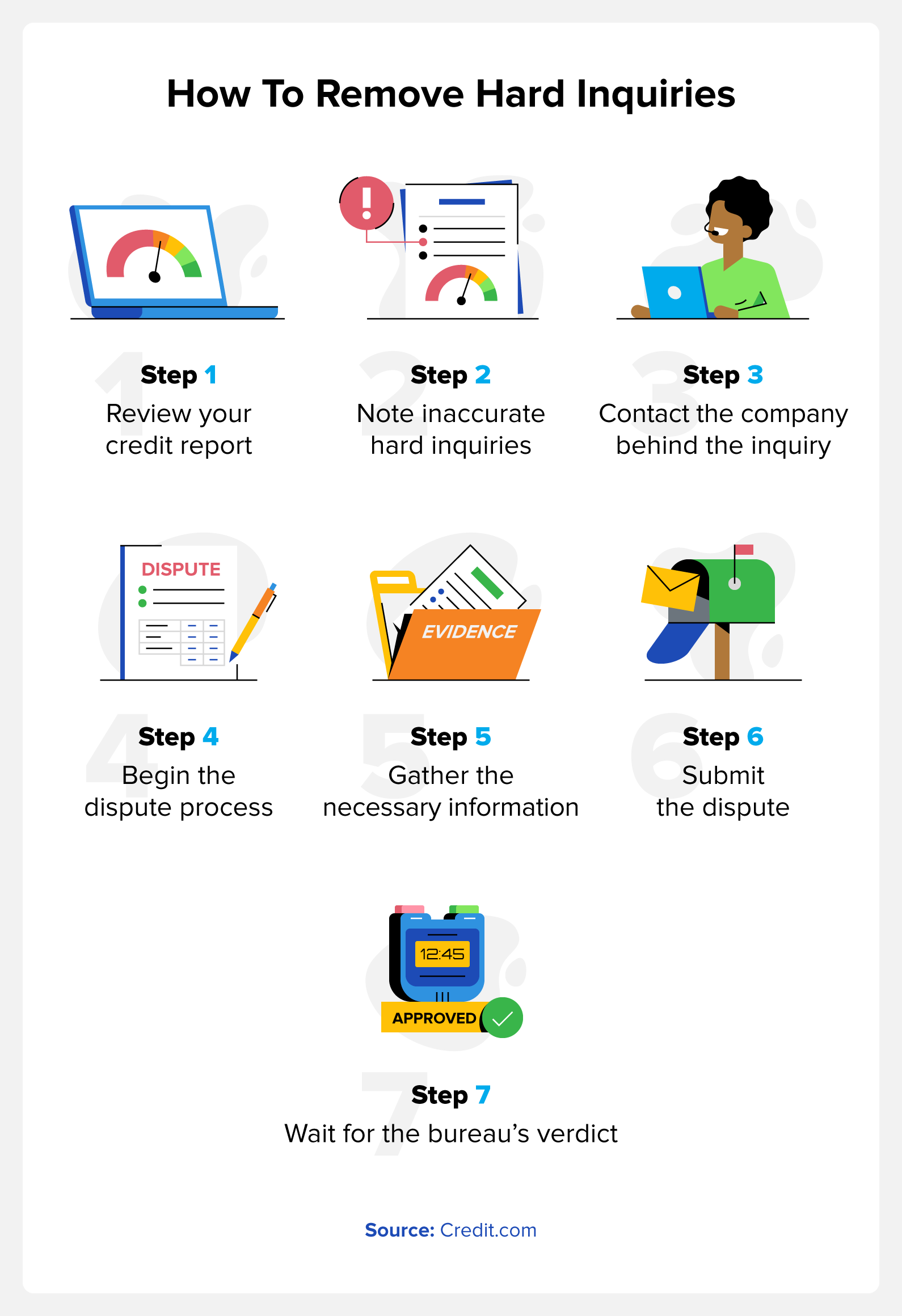

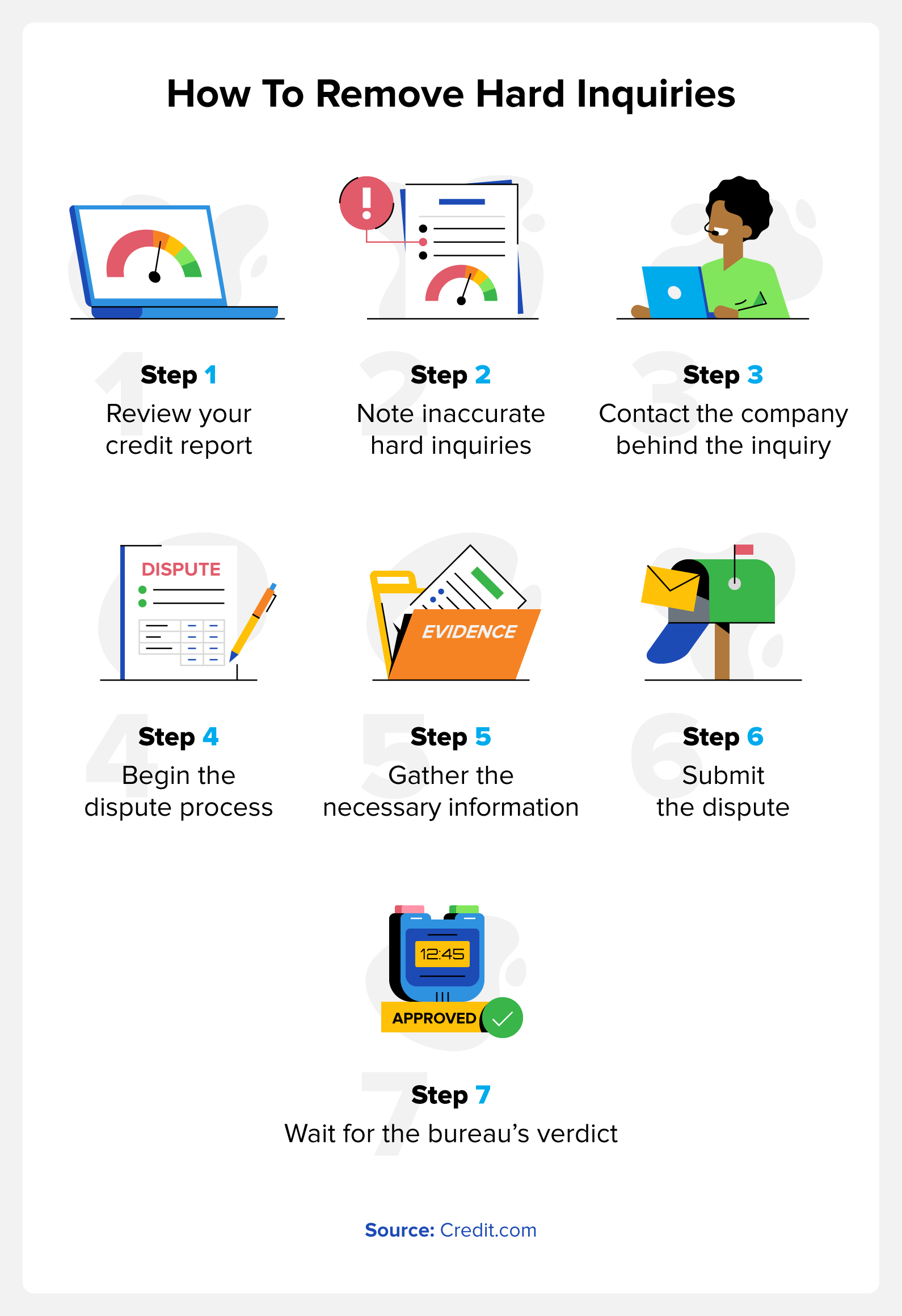

【Step-by-Step Removal Process】

Once you’ve identified unauthorized or erroneous hard inquiries on your credit report, acting quickly is key to minimizing their impact. Here’s how to remove them efficiently as of 2025:

Step 1: Review Credit Reports Thoroughly

Start by gathering your full credit reports. Hard inquiries may appear on one, two, or all three major reports.

How to access your reports

- Free weekly reports: Use AnnualCreditReport.com to pull reports from Equifax, Experian, and TransUnion weekly at no cost (extended indefinitely as of 2025).

- Tri-bureau check: Verify inquiries across all bureaus. One bureau might list a fraudulent inquiry others missed.

Document every discrepancy:

- Note the creditor name, inquiry date, and associated account (if any)

- Highlight unrecognized inquiries from the past 24 months (most impact scores within this period)

Step 2: Dispute with Creditors First

Contact the creditor directly before escalating to bureaus. Legitimate creditors often withdraw inquiries upon verification.

Contacting the source directly

- Find contact details: Use the creditor’s address/phone listed next to the inquiry on your report.

- Formal written request: Demand written verification of the inquiry per FCRA Section 611. Include:

- Your full name and address

- Inquiry details (date, creditor reference number)

- Statement: “I did not authorize this hard inquiry. Please provide proof of permissible purpose.”

- Creditor obligations: If they can’t validate your application within 30 days, they must notify bureaus to remove the inquiry.

Tip: Send letters via certified mail with return receipt. Keep copies for evidence.

Step 3: File Bureau Disputes

If the creditor doesn’t respond or validate, escalate to credit bureaus.

Official dispute procedures

| Method | Best For | Steps | Timeline |

|---|---|---|---|

| Online Portal | Simple errors or single inquiries | Submit dispute via Experian/Equifax/TransUnion online portals. Upload supporting documents. | 10-14 days (fastest) |

| Mail Dispute | Complex cases or identity theft | Mail dispute letter + copies of ID/theft report to bureau addresses. Use FTC Identity Theft Report if applicable. | Up to 30 days |

Key requirements for mailed disputes:

- Include a copy of your report with inquiries circled

- Attach proof of identity (SSN copy, driver’s license)

- For identity theft: Include FTC Report (get at IdentityTheft.gov)

Bureaus must investigate within 30 days per FCRA. If the creditor fails to verify, the inquiry is removed.

For persistent inquiries or complex identity theft cases, services like fixcreditscenter provide specialized dispute strategies and creditor negotiations to expedite removal as of 2025.

【Preventing Future Issues】

After addressing unauthorized or erroneous hard inquiries, implementing preventive measures is crucial to safeguard your credit health long-term. As of 2025, these strategies reduce the risk of future disputes and minimize score impacts.

Fraud Alerts and Credit Freezes

Place alerts or freezes to deter identity theft and unauthorized credit checks.

Proactive identity theft protection

- Initial fraud alert: Add a free 1-year alert to your reports via any major bureau (Equifax, Experian, or TransUnion). Creditors must verify your identity before approving new credit.

- Credit freeze: Lock all credit reports completely—no lender can access them without your PIN. Free to set up and lift anytime through bureau portals. Blocks fraudulent applications instantly.

Action step: Initiate freezes online at bureau websites or by phone. For alerts, submit a request via AnnualCreditReport.com.

Smart Credit Application Habits

Limit legitimate inquiries by optimizing timing and frequency.

Reducing legitimate inquiries

- Rate shopping: Cluster loan applications (e.g., mortgage, auto) within a 14-45 day window—credit scoring models count these as a single inquiry as of 2025.

- Space applications: Wait 6+ months between credit card or personal loan requests to avoid multiple hard pulls.

Real-life impact: This habit can preserve 5-10 points per inquiry on your FICO score.

For personalized monitoring or complex prevention plans, explore tools like fixcreditscenter, which offers real-time alerts and dispute support tailored to 2025 regulations.

【Impact and Recovery】

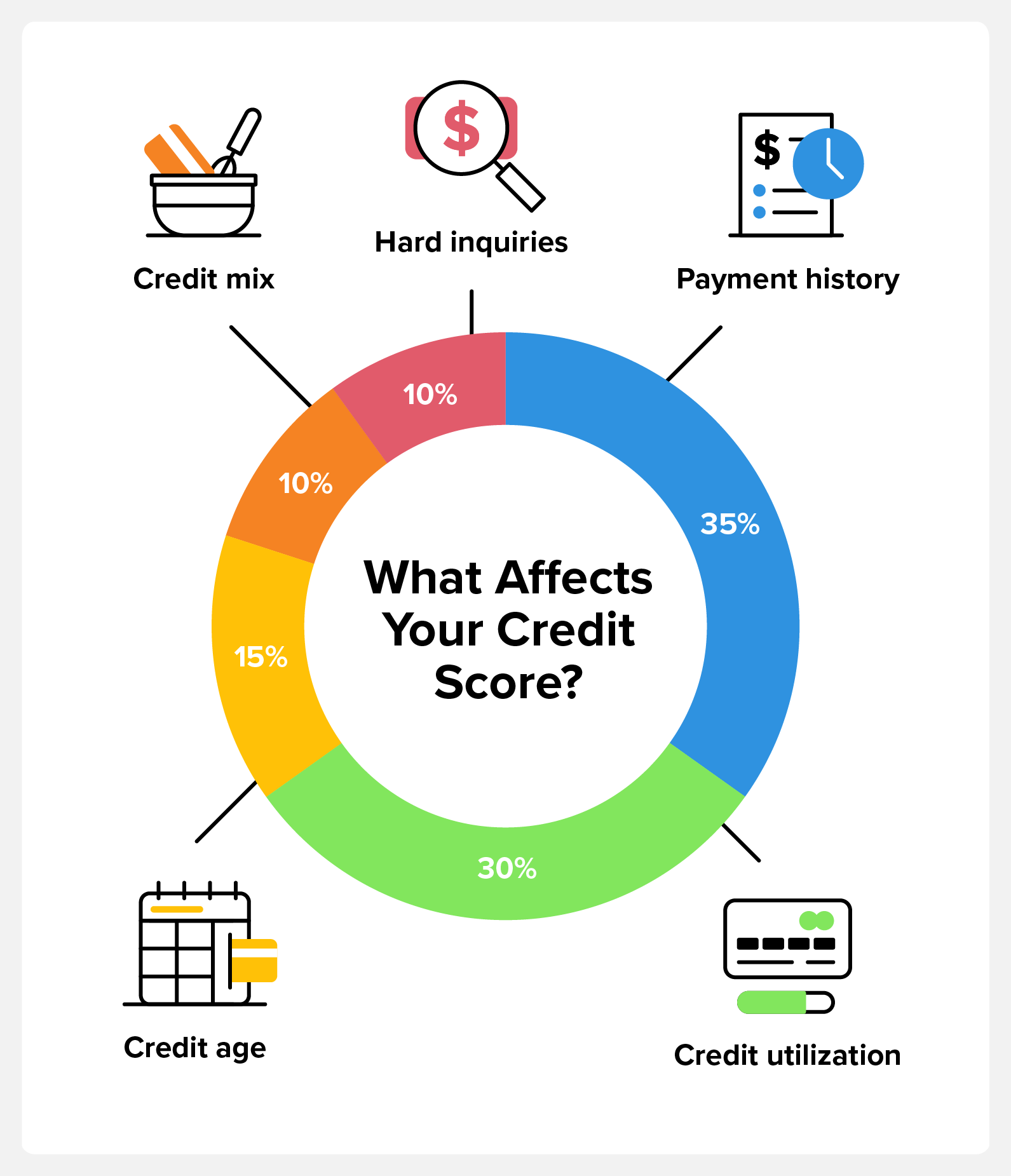

How Inquiries Affect Your Score

Hard inquiries occur when lenders check your credit report during an application process. While necessary for legitimate credit requests, they can temporarily lower your credit score. Understanding their specific impact is key to managing your credit health as of 2025.

FICO score impact facts

- Typical decrease: Each hard inquiry generally causes a 5-10 point drop in your FICO score.

- Duration of impact: The negative effect starts diminishing noticeably after about 6 months. By the 12-month mark, the inquiry typically no longer affects your score calculation, though it remains visible on your report.

- Rate shopping buffers: FICO scoring models recognize when you’re shopping for the best rates on loans like mortgages or autos. Multiple inquiries for the same type of loan made within a 14-45 day window (depending on the scoring model version) are counted as just one inquiry.

| Time Since Inquiry | Approximate Impact on FICO® Score |

|---|---|

| Immediate (0-1 month) | 5-10 point decrease per inquiry |

| 6 months | Significant reduction in impact |

| 12 months | Negligible to zero score impact |

| 24 months | Automatically removed from report |

Rebuilding After Inquiries

The good news is that the damage from hard inquiries is not permanent, and recovery is predictable. Focus shifts to allowing time to pass and maintaining positive credit habits.

Credit score recovery timeline

- Monthly reduction: The negative impact on your score decreases incrementally each month after the inquiry posts.

- 12-month mark: By this point, the inquiry typically stops affecting your FICO score calculation entirely.

- Automatic removal: Hard inquiries automatically fall off your credit report after exactly 24 months, as mandated by the Fair Credit Reporting Act (FCRA). You don’t need to take action for this removal to happen.

Action step: Regularly monitor your credit reports (free weekly at AnnualCreditReport.com) to confirm inquiries drop off at the 24-month mark. If an unauthorized or inaccurate inquiry persists beyond this, file a dispute immediately. For persistent issues or complex cases involving multiple errors, services like fixcreditscenter provide specialized dispute support aligned with 2025 credit regulations.

【FAQs Answered】

Can Legitimate Inquiries Be Removed?

Truth about credit repair myths

Legitimate hard inquiries—those resulting from authorized credit applications—cannot be legally removed from your credit report under the Fair Credit Reporting Act (FCRA). This is because they accurately reflect your credit-seeking behavior and are essential for lenders to assess risk. As of 2025, any company promising to erase valid inquiries is likely operating a scam, as such claims violate federal regulations. Focus instead on disputing only unauthorized or inaccurate inquiries, which can be corrected through proper channels.

How Long Do Disputes Take?

Realistic timeframes

When you dispute an inquiry, credit bureaus (Experian, Equifax, or TransUnion) must investigate and respond within 30 days under the FCRA. For complex cases—such as those involving multiple errors or incomplete documentation—this may extend to a maximum of 45 days. Timelines remain consistent as of 2025, so monitor your report weekly via AnnualCreditReport.com to track resolution. For efficient handling of intricate disputes or persistent errors, specialized services like fixcreditscenter offer expert support aligned with current credit laws.

【Understanding Hard Inquiries】

What Exactly is a Hard Inquiry?

Definition and How It Happens

A hard inquiry (also called a hard pull) occurs when you formally apply for credit. This happens when you:

- Apply for a credit card

- Seek a loan (personal, auto, student)

- Apply for a mortgage or apartment lease

- Request a utility service requiring a credit check (in some cases)

When you submit such an application, the lender or service provider requests your full credit report from one or more credit bureaus (Experian, Equifax, TransUnion) to assess your creditworthiness and lending risk. This request is recorded as a hard inquiry on your report. Each hard inquiry typically remains visible on your credit report for 24 months but impacts your credit score most significantly for the first 12 months, as of 2025.

Hard Inquiry vs. Soft Inquiry

Key Differences That Matter

Not all credit report checks are created equal. Understanding the distinction between hard and soft inquiries is crucial:

| Feature | Hard Inquiry | Soft Inquiry |

|---|---|---|

| Initiation | Requires your explicit authorization as part of a credit application. | Can occur without your explicit permission, often for background checks. |

| Impact on Score | Usually causes a temporary dip (typically 5-10 points) in your credit score. | No impact whatsoever on your credit score. |

| Visibility | Visible to anyone who accesses your full credit report, including lenders. | Only visible to you on personal credit report copies; lenders cannot see them. |

| Common Examples | Mortgage applications, auto loan requests, credit card applications, certain utility setups. | Pre-approved credit offers, employer background checks, checking your own credit score, account reviews by existing creditors. |

The core takeaway: Hard inquiries reflect active credit-seeking behavior and signal potential risk to lenders, hence their impact on your score. Soft inquiries are informational and private, posing no risk to your credit health. Regularly monitoring your report through trusted sources like AnnualCreditReport.com helps you identify inquiries accurately. For complex credit report questions or persistent errors, consulting expert services like fixcreditscenter ensures guidance aligned with 2025 regulations.

【Impact on Your Credit】

How Much Damage Do They Cause?

Typical Credit Score Impact

It’s natural to worry about the effect of hard inquiries, but the impact is generally less severe than many assume. As of 2025, here’s what you need to know about their influence on your FICO® Score:

- Minor, Temporary Dips: A single hard inquiry typically lowers your FICO® Score by 5 points or less.

- Maximum Impact: Even in scenarios with a larger impact, a single inquiry is unlikely to drop your score by more than around 10 points.

- Aggregate Effect: While one inquiry has minimal effect, applying for multiple lines of credit within a short timeframe (e.g., several credit cards or loans within a few months) can compound the impact. Multiple inquiries signal heightened credit risk to lenders. However, FICO® Scores have built-in logic to account for rate shopping. For example, multiple auto loan or mortgage inquiries within a focused 14-45 day period (depending on the scoring model) are often treated as a single inquiry for scoring purposes, minimizing the overall hit.

The key takeaway is that while hard inquiries do cause a score decrease, it’s usually modest and short-lived compared to factors like payment history or credit utilization.

How Long Do They Last?

Timeline for Impact and Removal

Understanding the lifespan of a hard inquiry on your credit report is crucial for managing expectations:

| Phase | Duration | Description |

|---|---|---|

| Active Impact | Up to 12 months | This is the period when a hard inquiry has the most significant potential to affect your credit score. The minor dip it causes diminishes over these months. |

| Report Visibility | Up to 24 months | The hard inquiry remains listed on your credit report, visible to you and lenders who pull your full report. |

| Removal | Automatically at 24 months | After precisely 24 months (2 years) from the date it occurred, the hard inquiry is automatically removed from your credit report by the credit bureaus. It disappears entirely and no longer factors into any credit score calculations. |

Important Distinction: While the inquiry stays on your report for two years, its direct scoring impact effectively fades after about a year. You generally cannot force their removal before the 24-month mark unless they are proven to be unauthorized or errors. Regularly monitoring your reports through AnnualCreditReport.com allows you to track inquiry dates and ensure accuracy. If you encounter unauthorized inquiries or need assistance navigating complex credit report issues under 2025 regulations, professional services like fixcreditscenter can provide valuable expertise.

【Removing Unauthorized Inquiries】

Step 1: Identify Suspicious Activity

How to Spot Fraudulent Credit Inquiries

Finding unauthorized hard inquiries starts with vigilant monitoring. Under 2025 regulations, your primary tools are your credit reports from all three major bureaus (Equifax, Experian, TransUnion). Here’s your action plan:

- Review Reports Monthly: Access your free reports weekly via AnnualCreditReport.com as permitted by law. Scrutinize the “Hard Inquiries” section on each.

- Identify Unknown Lenders: Carefully note every lender name associated with a hard pull. Legitimate inquiries stem from applications you submitted (e.g., a mortgage application, a new credit card). Red flags include:

- Financial institutions you’ve never applied to.

- Lenders whose names are unfamiliar or misspelled.

- Inquiries for types of credit you didn’t seek (e.g., an auto loan inquiry when you haven’t shopped for a car).

- Verify Application Dates: Cross-reference inquiry dates with your own records. An inquiry appearing on a date you know you didn’t apply for credit is highly suspicious.

Step 2: Contact the Creditor

Disputing Directly With the Source

Once you identify an unauthorized inquiry, your next step is contacting the creditor listed on your report. This direct approach can yield the fastest resolution:

- Locate Creditor Contact Info: Use the lender’s name and address exactly as it appears on your credit report. Contact information is usually listed alongside the inquiry.

- Initiate the Dispute: Call the creditor’s fraud/security department or send a certified letter with return receipt requested. Clearly state:

- You did NOT apply for credit with their company on the date shown.

- The hard inquiry on your report is unauthorized and potentially fraudulent.

- You demand they verify the application associated with that inquiry. Under the Fair Credit Reporting Act (FCRA), they must investigate.

- Request Removal: Explicitly ask the creditor to notify all three credit bureaus to remove the unauthorized hard inquiry immediately. If they confirm they cannot verify the application (which they won’t be able to, since you didn’t apply), they are obligated to direct the bureaus to delete it.

- Document Everything: Keep detailed records: dates of contact, names of representatives spoken to, copies of letters sent, and any responses received.

Taking swift action against unauthorized inquiries is crucial under 2025 credit reporting standards. If a creditor is unresponsive or the dispute process becomes complex, services like fixcreditscenter specialize in efficiently resolving these errors and protecting your credit standing.

【Formal Dispute Process】

If direct contact with the creditor doesn’t resolve the unauthorized hard inquiry, your next step is initiating a formal dispute directly with the credit reporting agencies (CRAs). This leverages your rights under the Fair Credit Reporting Act (FCRA) and is essential for 2025 compliance.

Filing With Credit Bureaus

To ensure your dispute is processed efficiently and meets regulatory requirements, include specific documentation:

- FTC Identity Theft Report: If you suspect identity theft (common with fraudulent inquiries), include a copy of your official FTC Identity Theft Report (filed at IdentityTheft.gov). This significantly strengthens your claim.

- Clearly List Unauthorized Inquiries: Provide a separate, unambiguous list for each bureau. Include:

- The exact name of the creditor as it appears on your report.

- The date(s) of the unauthorized inquiry.

- The report number associated with your credit file from that bureau.

- Proof of Identity: Enclose a clear copy of your government-issued ID (like a driver’s license) and proof of your current address (like a recent utility bill).

Required Information for Disputes

Precision is critical. Your dispute letter must contain:

| Information Required | Details Needed | Why It’s Important |

|---|---|---|

| Your Full Name | Current legal name, any previous names used on credit | Ensures accurate identification of your file |

| Complete Address | Current mailing address, previous addresses (last 2 years) | Verifies residency history linked to your report |

| Date of Birth | Month, Day, Year | Core identifier for your credit profile |

| SSN (Last 4 Digits) | Only the last four digits for security | Confirms identity while minimizing fraud risk |

| Disputed Items | Creditor name(s), inquiry date(s), account number (if any) | Provides specific targets for the bureau’s investigation |

| Reason for Dispute | “Unauthorized application,” “Identity theft,” “No permission granted” | Clearly states the nature of the FCRA violation |

| Supporting Docs | FTC Report copy (if applicable), ID/address proof | Validates your claim and identity |

Bureau Contact Methods

Formal disputes require written communication sent via certified mail with return receipt requested. This provides proof of delivery and the date the bureau received your dispute, triggering their 30-day investigation timeline under the FCRA. Use these dedicated addresses for disputes:

Where to Send Dispute Letters

- Equifax:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374 - Experian:

Experian

P.O. Box 4500

Allen, TX 75013 - TransUnion:

TransUnion LLC

Consumer Dispute Center

P.O. Box 2000

Chester, PA 19016

Remember to send separate dispute letters to each bureau where the unauthorized inquiry appears. While online disputes are an option for simpler errors, the complexity of unauthorized inquiries—especially under 2025 identity theft protocols—often necessitates the paper trail and legal weight of certified mail. For situations requiring persistent follow-up or navigating intricate cases, leveraging a specialized service like fixcreditscenter can expedite resolution and ensure compliance.

【Preventing Future Problems】

After resolving unauthorized hard inquiries through formal disputes, proactively safeguarding your credit report against future incidents is crucial. These preventative measures not only shield your score but also reduce the risk of identity theft under 2025 regulations.

Credit Freeze Option

A credit freeze is a powerful tool that locks down your credit report, preventing new creditors from accessing your information without your explicit permission. This barrier is essential for halting unauthorized hard inquiries before they occur.

How It Blocks Unauthorized Access

Implementing a credit freeze offers robust protection:

- Stops new creditors from viewing your report: By freezing your file at all three major credit bureaus (Equifax, Experian, and TransUnion), you block lenders, insurers, and other entities from pulling your credit report for new applications. This means no hard inquiries can be added unless you temporarily lift the freeze using a unique PIN or password.

- Free to place and lift at all three bureaus: Thanks to federal laws updated for 2025, placing, temporarily lifting, or permanently removing a freeze costs nothing. You can manage this online, by phone, or via mail at each bureau, ensuring flexibility without financial burden.

Fraud Alerts Explained

Fraud alerts add an extra layer of security by requiring creditors to verify your identity before processing credit applications. This acts as a deterrent against fraudulent activities, complementing a credit freeze.

Extra Security Layer Benefits

Setting up a fraud alert involves straightforward steps with significant advantages:

- Requires creditors to verify identity: When an alert is active, any creditor attempting to access your report must contact you directly (e.g., via phone or email) to confirm your identity before approving new credit. This prevents imposters from slipping through and initiating hard inquiries without your knowledge.

- Lasts 1 year (extendable with police report): An initial fraud alert remains in effect for 12 months and can be renewed for free. If you file a police report for identity theft, you qualify for an extended alert lasting up to seven years, providing long-term protection aligned with 2025 security standards. For ongoing management of these tools or complex credit issues, services like fixcreditscenter streamline the process to keep your report secure.

【Critical FAQs Answered】

Can Legitimate Inquiries Be Removed?

Why You Shouldn’t Try

Attempting to remove accurate hard inquiries that you authorized is ineffective and unethical:

- Disputing accurate information is fraudulent: Credit bureaus verify inquiries with lenders. If you legitimately applied for credit, the inquiry remains as a valid record of creditor activity per 2025 reporting standards. Knowingly disputing truthful data violates federal law.

- Credit repair companies promising removal are scams: Firms guaranteeing illegitimate inquiry deletions often charge upfront fees for services you can do yourself (like filing valid disputes), or engage in illegal tactics like creating fake identity theft reports. Legitimate services focus only on disputing inaccurate items.

Rate Shopping Protection

Special Rules for Loan Comparisons

Credit scoring models provide leeway for consumers comparing mortgage, auto, or student loan rates:

- Multiple mortgage/auto inquiries within 14-45 days count as one: FICO® and VantageScore® group similar inquiries made within a specific “rate shopping” window. This minimizes score impact when seeking the best terms. The exact timeframe varies by model:

| Scoring Model | Rate Shopping Window |

|---|---|

| FICO® | 14-45 days* |

| VantageScore® | 14 days |

*FICO window depends on version (e.g., 30 days for older FICO 8, 45 days for FICO 9/10)

- FICO® Scores recognize legitimate comparison shopping: The algorithm identifies clustered inquiries for specific loan types (mortgages, auto loans) and treats them as a single credit event. This ensures your score isn’t penalized multiple times for responsible rate comparisons. For complex credit report optimization within these rules, tools from fixcreditscenter can help track and manage inquiries efficiently.

【Ongoing Credit Protection】

Why Monitoring Matters

Catching Problems Early

Regularly checking your credit reports is the most effective defense against the negative impact of hard inquiries and potential fraud. Proactive monitoring allows you to:

- Detect unauthorized inquiries immediately: Spot hard pulls you didn’t authorize before they can lower your credit scores or signal risk to lenders. Early detection is key for swift dispute.

- Spot identity theft within crucial first days: Unfamiliar inquiries are often the first red flag of identity theft. Catching them quickly in 2025 significantly improves your chances of minimizing damage and streamlining recovery through resources like IdentityTheft.gov.

Free Monitoring Options

Government-Protected Resources

You don’t need to pay for basic credit surveillance. Utilize these free, secure tools:

- AnnualCreditReport.com: Weekly free reports (as of 2025): This is the only federally authorized source for free credit reports. Access reports weekly from all three major bureaus (Experian, Equifax, TransUnion) to review every inquiry and account detail.

- FTC IdentityTheft.gov: Recovery plans & tools for victims: If you discover fraudulent inquiries indicating identity theft, this official FTC site provides step-by-step recovery plans, pre-filled dispute letters, and tracking tools – essential for navigating the resolution process efficiently.

For ongoing vigilance and tools to help manage legitimate inquiries within rate-shopping windows, consider services like those offered by fixcreditscenter.

[object Object]