Did you know a single late payment can slash 100 points off your credit score? Learn how late payments hurt your finances and discover 2025’s best repair strategies to recover fast.

【Why Late Payments Crush Your Credit Score】

The Real Damage to Your Finances

A single late payment can significantly derail your credit progress. Understanding the immediate and long-term fallout is crucial for managing your financial health.

Credit Score Drop Range

- One 30-Day Late Payment: Typically causes an immediate drop of 50–100 points from your current score. The higher your score before the late payment, the steeper the initial decline tends to be.

- Multiple or Severe Delinquencies: The damage compounds rapidly. A 60-day or 90-day late payment, or having multiple accounts reporting lates (even if only 30 days), will result in a much larger score decrease, easily exceeding 100 points or more. Recent late payments hurt more than older ones.

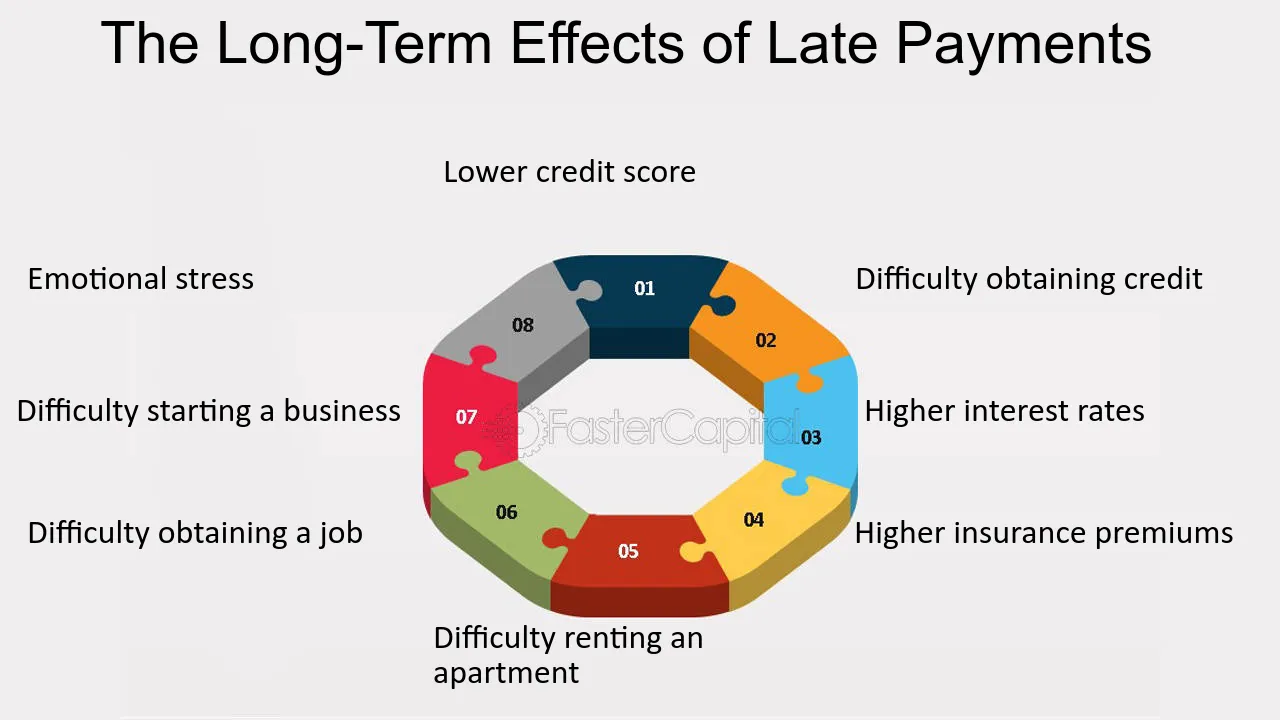

Long-Term Consequences

The sting of a late payment lasts far beyond the initial score drop:

- Higher Interest Rates: Lenders view borrowers with late payments as higher risk. This translates to significantly higher interest rates on loans (like auto loans, mortgages, and personal loans) and credit cards you may apply for over the next 7 years. This can cost you thousands in extra finance charges.

- Denied Applications: Beyond credit, late payments on your report can lead to denied apartment rental applications or impact employment opportunities, especially in finance or roles requiring security clearance, as CBS News and others have reported employers often check credit reports as part of background checks.

How Late Payments Stay on Reports

Once reported, late payments become a persistent mark on your credit history, governed by federal law.

Standard Reporting Timeline

- The 7-Year Rule: Under the Fair Credit Reporting Act (FCRA), a late payment (delinquency) can legally remain on your credit reports for seven years from the original date of the first delinquency that led to the late status.

- Automatic Removal: After the seven-year period passes, the credit bureaus are required to automatically remove the late payment entry from your reports. You generally don’t need to request its removal once the timeframe elapses.

Severity Matters

Not all late payments hurt equally. The impact escalates sharply based on how late the payment was and how frequent the lapses are:

| Delinquency Severity | Typical Score Impact | Reporting Timeline |

|---|---|---|

| 30 Days Late | Significant Drop (50-100+) | 7 years from first occurrence |

| 60 Days Late | Severe Drop (>100 points) | 7 years from first occurrence |

| 90+ Days Late | Major Damage (Charge-off) | 7 years from first occurrence |

| Multiple Lates | Compounding Severe Damage | Each late has its own 7-year clock |

- 30 vs. 60 vs. 90+ Days: A payment reported 30 days late is damaging, but one reported 60 or 90+ days late signals much more serious financial distress to lenders and causes exponentially greater harm to your credit score. A 90-day late often precedes an account being charged off.

- Multiple Lates Compound Damage: Having late payments reported on multiple accounts, or multiple lates on the same account, dramatically compounds the negative impact on your credit score. Each additional late payment reinforces the perception of unreliability to potential creditors.

While these marks are long-lasting, taking proactive steps to address inaccuracies or explore legitimate options for improving your report is always worthwhile. For personalized strategies on managing your credit history, consider the resources available at fixcreditscenter.com.

【Legitimate Ways to Remove Late Payments】

While late payments remain on reports for seven years, inaccurate reporting isn’t inevitable. You have legal rights to challenge errors directly with credit bureaus or original creditors. Acting promptly is crucial.

Disputing Errors with Credit Bureaus

The Fair Credit Reporting Act (FCRA) empowers you to dispute inaccurate late payments. The process demands documentation and persistence.

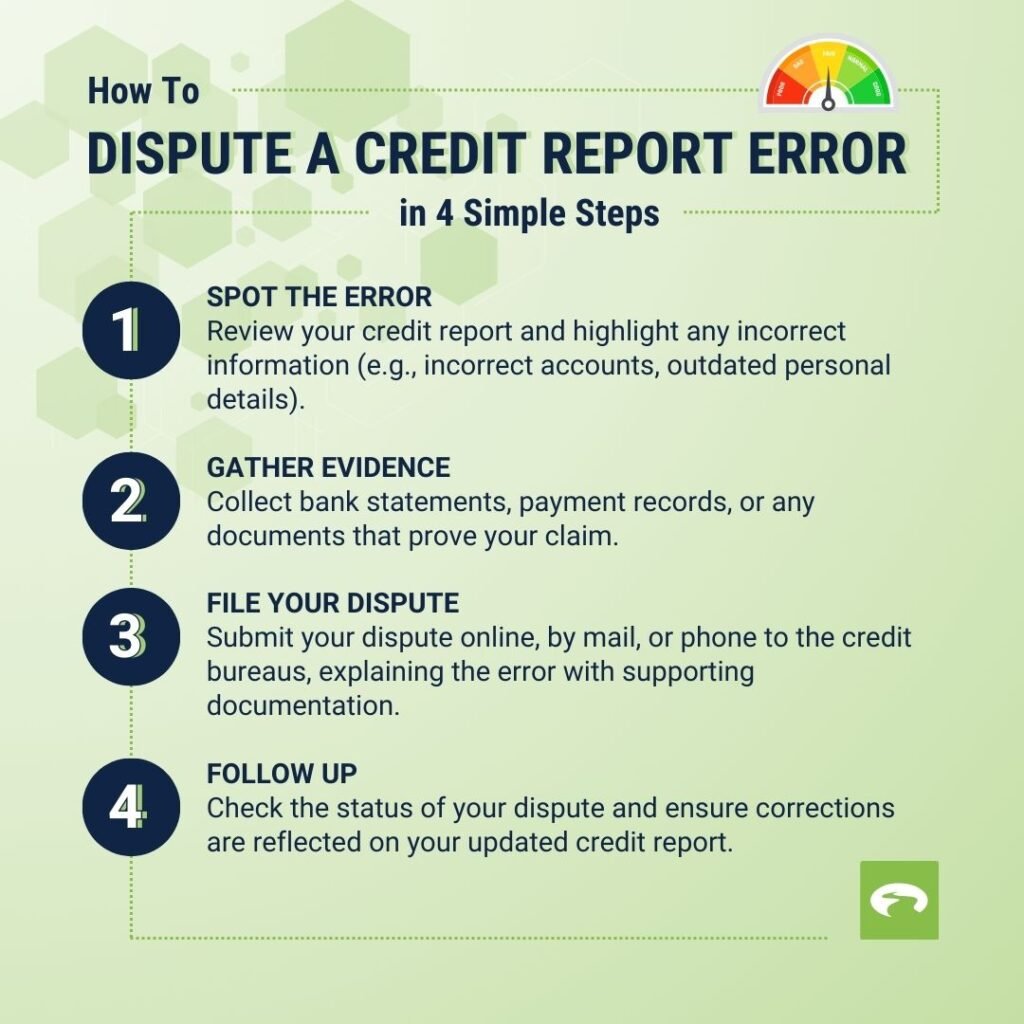

Step-by-Step Dispute Process

- Gather Proof: Collect concrete evidence proving the payment was on time. This includes:

- Bank statements showing the cleared payment (highlight the transaction).

- Payment confirmation emails or screenshots from the creditor’s portal.

- Cancelled checks or money order receipts.

- Certified mail receipts proving payment was sent before the due date.

- File Formal Disputes: Submit disputes online through each credit bureau’s portal (Experian, Equifax, TransUnion). Clearly identify the account and late payment date in question. Attach copies (not originals) of your supporting evidence. State concisely why the reporting is inaccurate. Always keep copies of your dispute submission and evidence.

FCRA Protection Timeline

The law mandates strict timelines for resolution:

- 30-Day Investigation: Credit bureaus must initiate an investigation within 30 days of receiving your dispute.

- Verification Requirement: The bureau forwards your dispute and evidence to the creditor reporting the late payment. The creditor must verify the accuracy of the information.

- Automatic Removal: If the creditor cannot verify the late payment within the investigation period, the credit bureau must remove or correct the inaccurate entry from your report. You will receive the results of the investigation in writing.

Correcting Creditor Mistakes

Sometimes the error originates with the lender. The FCRA provides a direct path to demand correction.

Contacting Original Lender

- Send a Written Dispute: Draft a formal letter (sent via certified mail, return receipt requested) to the creditor’s designated dispute address. Include:

- Your account number.

- The specific late payment date(s) in dispute.

- Copies of your proof demonstrating on-time payment.

- A clear demand to correct the inaccurate reporting under FCRA Section 623(a).

- Reference FCRA Section 623: This section specifically requires creditors to investigate consumer disputes about information they furnish to credit bureaus and correct inaccuracies.

Creditor Investigation Rules

Creditors have legal obligations mirroring the bureaus’:

- 30-Day Response Window: Data from Experian and other sources confirms that creditors, like bureaus, generally have 30 days to investigate your dispute after receiving it.

- Mandatory Correction: If the creditor’s investigation confirms the late payment was reported in error, they are legally required to notify all three major credit bureaus (Experian, Equifax, TransUnion) to update or delete the inaccurate information.

- Notification Requirement: The creditor must also inform you of the results of their investigation in writing.

Successfully removing an inaccurate late payment can significantly improve your credit standing. For detailed guidance on navigating disputes or understanding your full range of credit repair options, explore the tools and information available at fixcreditscenter.com.

【Can You Remove Accurate Late Payments?】

Accurate late payments—those correctly reported based on your actual payment history—are far more challenging to remove than errors. While they legally remain on your report for seven years, two unofficial strategies are sometimes attempted: goodwill letters and pay-for-delete. Neither is guaranteed, and significant caveats apply.

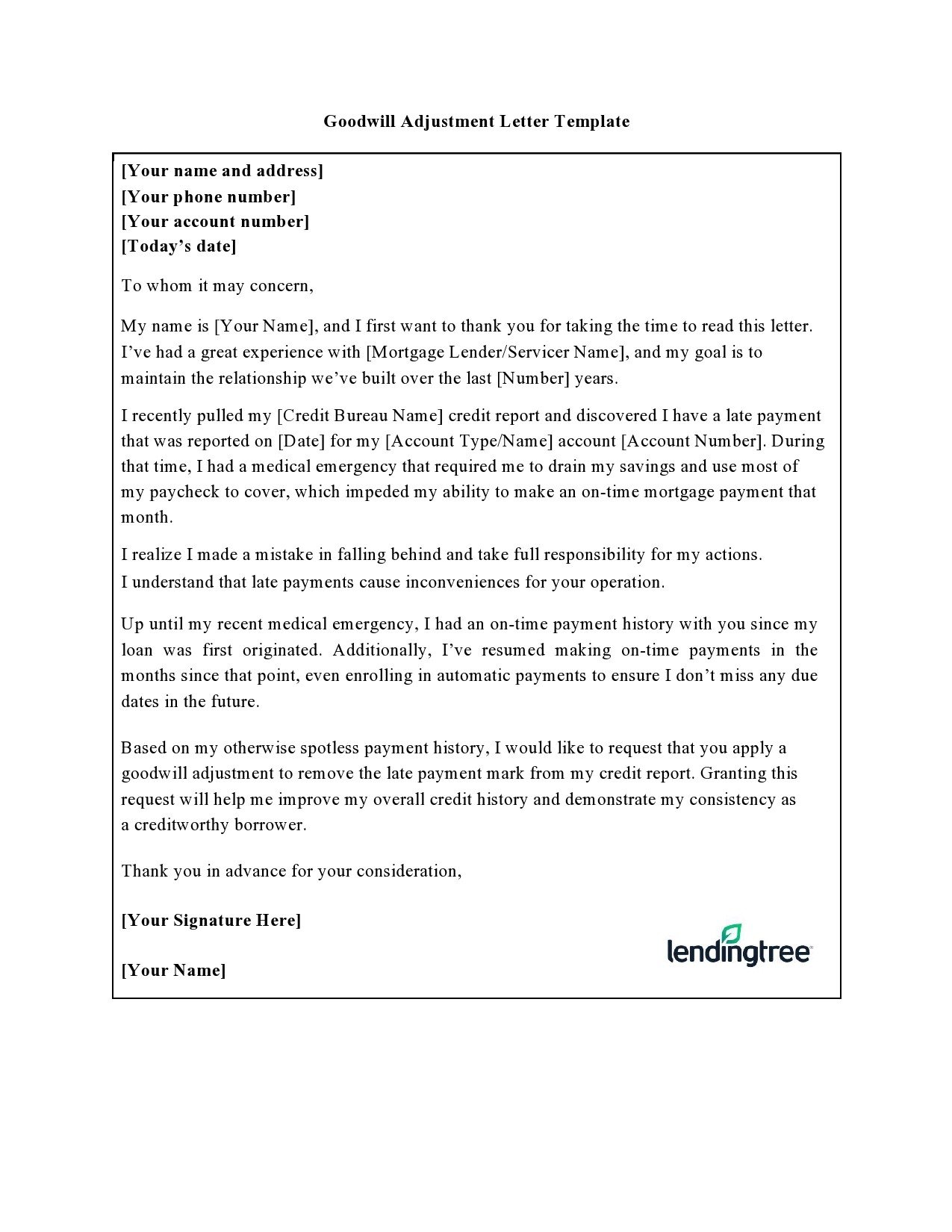

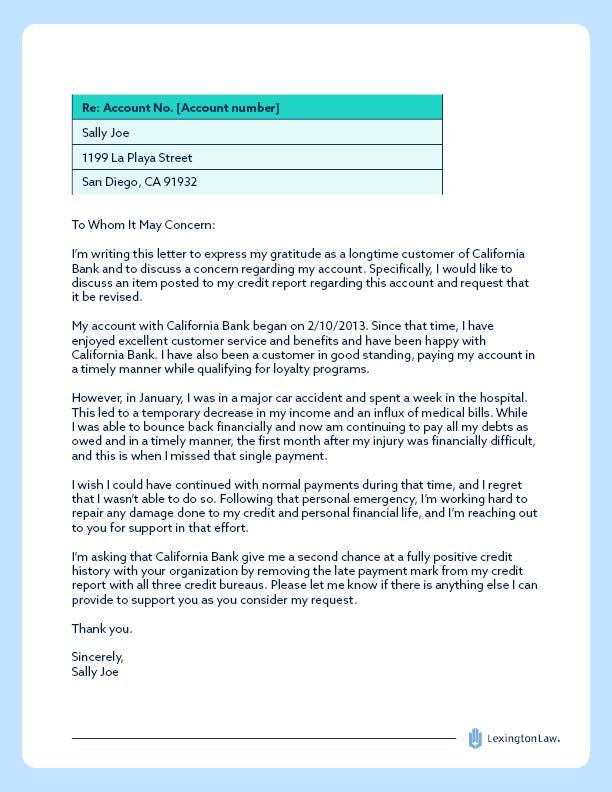

Goodwill Letter Strategy

A goodwill letter is a formal request asking a creditor or lender to remove an accurately reported late payment as an act of courtesy. This approach hinges entirely on the recipient’s discretion.

When It Might Work

Success is rare and highly situational. Creditors may consider it only under specific, verifiable circumstances:

- First-time offense with long payment history: You have a spotless, multi-year payment history with the creditor before the single late payment occurred.

- Valid, documented hardship: A severe, temporary hardship directly caused the lapse (e.g., hospitalization records for a medical emergency, insurance/FEMA documentation for a natural disaster). The hardship must be unrelated to financial mismanagement.

Success Rate Reality

Manage expectations severely:

- No Legal Obligation: Creditors have zero legal requirement under the FCRA to remove accurate negative information based on a goodwill request.

- CreditKarma Confirms Low Odds: Analyses consistently report extremely low approval rates for goodwill adjustments. Most major lenders have formal policies against altering accurate history solely based on a letter.

- Best Shot: Written, personalized requests (not form letters) sent directly to a high-level executive or the lender’s dedicated goodwill department (if one exists) have marginally better odds than standard customer service channels. Persistence (multiple polite requests) is sometimes needed, but respect their final decision.

Pay-for-Delete Risks

Pay-for-delete involves negotiating with a debt collector (or occasionally an original creditor) to remove the negative entry in exchange for payment. It’s primarily discussed for collections accounts, not typically for late payments still held by the original lender. This tactic is highly problematic.

How It Supposedly Works

The theoretical process involves:

- Contacting the collector holding the debt (or sometimes the creditor reporting the late payment).

- Offering to pay the debt in full (or sometimes a settled amount).

- Requesting the entity delete the entire account or specific late payment entry from your credit reports as a condition of payment.

- Getting the agreement in writing before sending any money.

Major Warning Flags

Exercise extreme caution due to significant risks:

- Violates Credit Bureau Agreements: Major credit bureaus (Experian, Equifax, TransUnion) have explicit agreements with data furnishers (creditors/collectors). These agreements generally prohibit the removal of accurate, verifiable information solely in exchange for payment. Agreeing to “pay-for-delete” puts the creditor/collector in breach of contract.

- Experian Warns Against Scams: Experian directly addresses this tactic, advising consumers that legitimate creditors won’t engage in pay-for-delete and labeling offers to do so as potential “scam” tactics. Collectors making such promises often fail to follow through after payment is received.

- Harmful Alternatives: Paying a collection account typically changes its status to “Paid Collection,” which is still significantly negative for your credit scores. Removal is the only substantial benefit, and achieving it this way is unreliable and often against the rules. Successfully disputing an inaccurate collection remains the legitimate path.

- Statute of Limitations Risk: Negotiating can sometimes restart the clock on your state’s statute of limitations for debt collection lawsuits. Consult legal advice before engaging.

While accurate late payments are difficult to challenge, ensuring all other information on your report is correct is vital. For a comprehensive review of your credit report accuracy and personalized strategies based on your unique situation, the resources at fixcreditscenter.com provide valuable guidance for navigating the complexities of credit health in 2025.

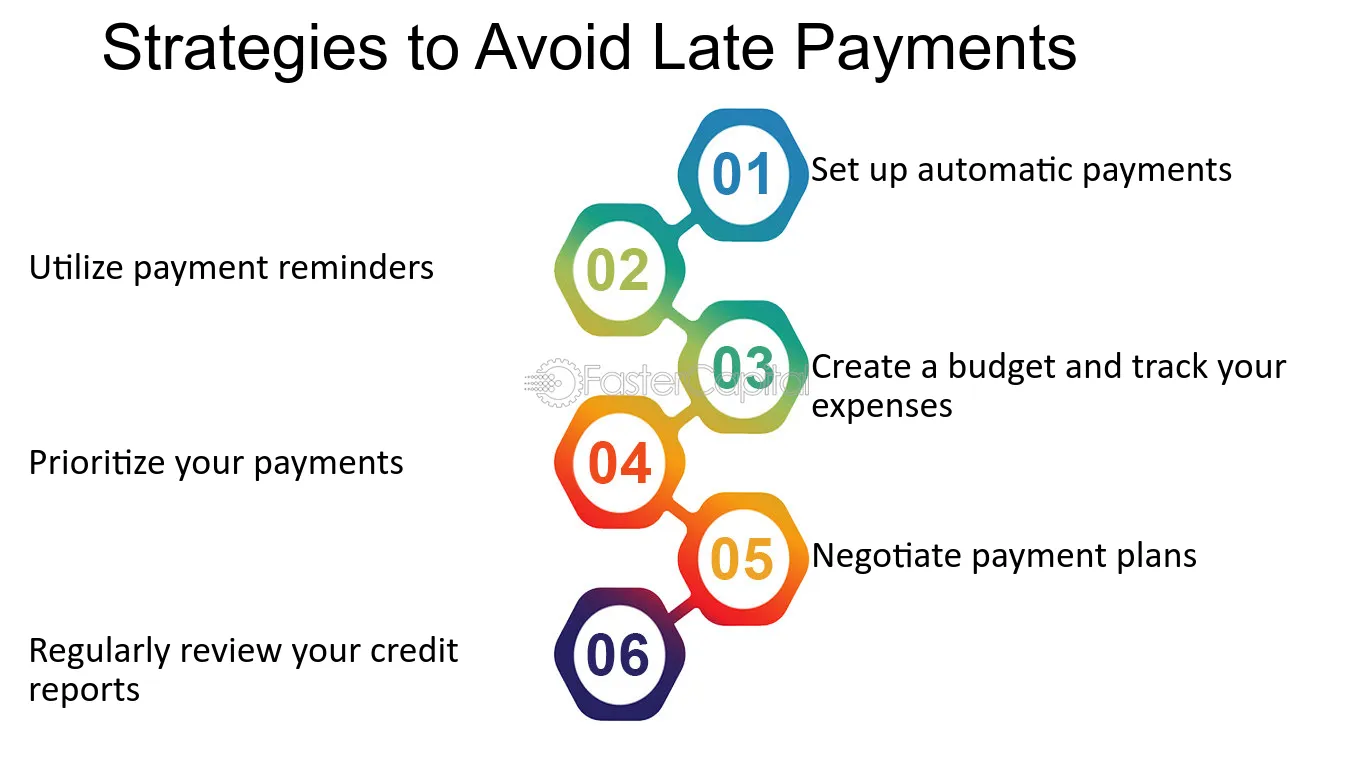

【Preventing Future Late Payments】

While removing accurate late payments from your credit report is notoriously difficult, the most effective strategy is preventing them from occurring in the first place. Implementing robust systems and building financial safeguards significantly reduces the risk of future lapses.

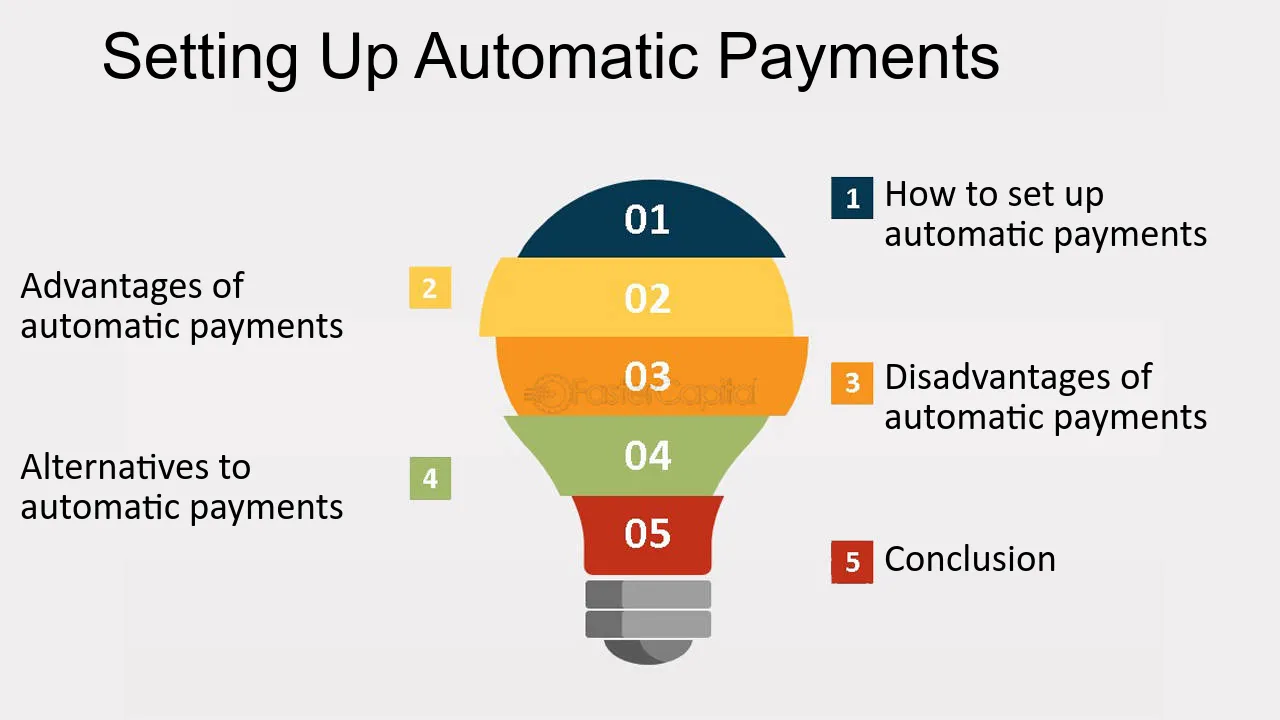

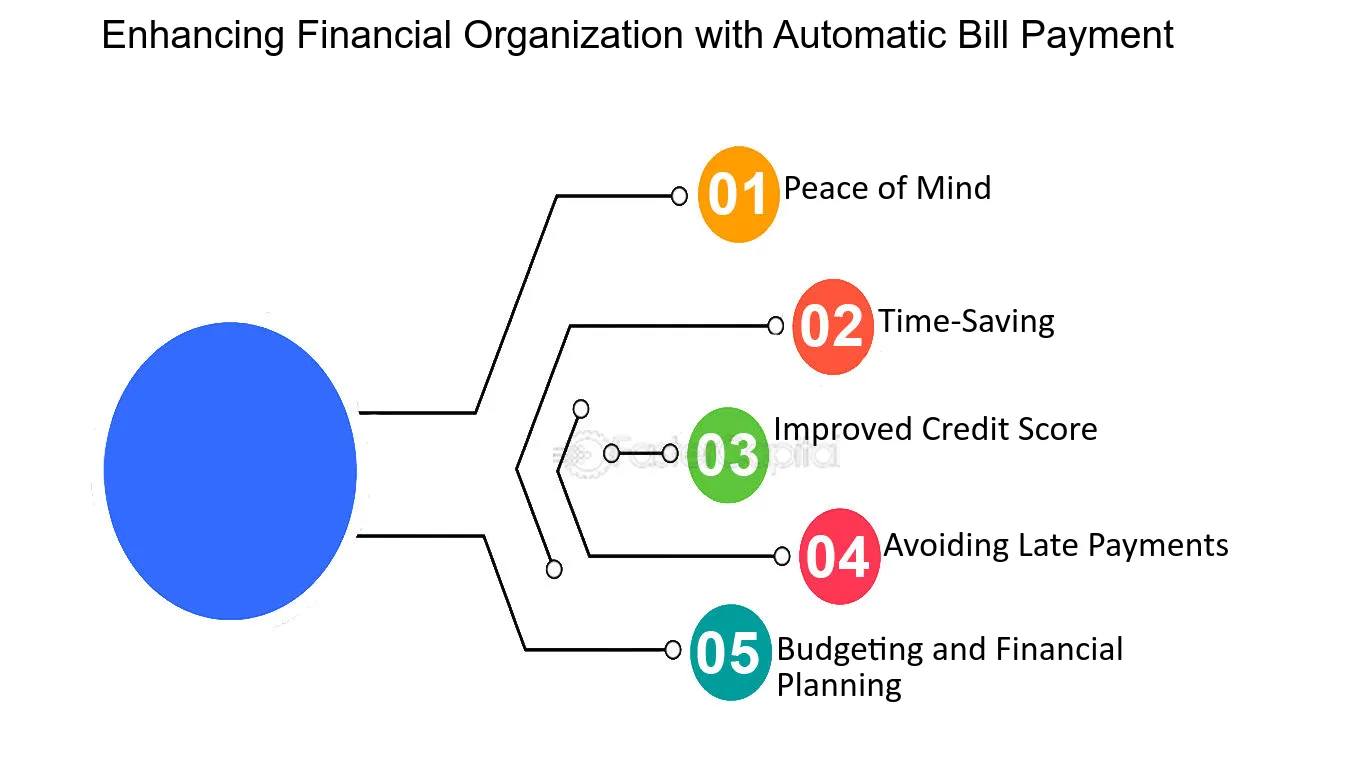

Payment Automation Systems

Automation is the frontline defense against missed payments, eliminating human error and forgetfulness.

Setting Up Autopay

- Minimum Payments for Credit Cards/Loans: Enroll in autopay for at least the minimum payment due on every credit card and loan account. This ensures you never incur a late fee or a reported delinquency due to oversight.

- Payment Date Buffer: Schedule automatic payments at least 3 business days before the actual due date. This buffer accounts for potential processing delays, weekends, or holidays, guaranteeing the payment posts on time. Verify the payment cleared successfully after the scheduled date.

Backup Alerts

Even with autopay, redundancy is key:

- Creditor Reminders: Ensure you are opted-in to receive text and/or email payment reminders from every creditor, typically sent several days before the due date. These serve as a critical backup notification.

- Calendar Notifications: For accounts not on autopay (e.g., some utilities, rent) or as an extra layer, set recurring monthly calendar notifications on your phone or email 5-7 days before each due date. Treat these alerts as non-negotiable action items.

Financial Cushion Strategies

Life events can disrupt even the best systems. Building financial resilience is essential.

Emergency Fund Basics

- $500 Starter Fund: Aim for an initial emergency fund of $500. This relatively small amount acts as a crucial buffer to cover a minimum payment if an unexpected expense arises right before a due date, preventing a cascade of late payments.

- Direct Deposit Allocation: The most reliable way to build this fund is through automation. Set up a direct deposit split from your paycheck, routing a small, fixed amount ($25-$50 per pay period) into a separate, dedicated savings account before you have a chance to spend it. Treat this transfer like a non-negotiable bill.

| Emergency Fund Strategy ($500 Goal) | How to Execute | Time Frame (Approx.) |

|---|---|---|

| Direct Deposit Allocation | Split $50/paycheck into dedicated savings | 5 pay periods |

| Cashback App Accumulation | Redirect cashback rewards to savings | Varies |

| “Cash Envelope” Windfalls | Save tax refunds/bonuses partially | Immediate |

Hardship Programs

If facing genuine financial hardship (job loss, medical crisis), proactive communication with creditors is vital:

- Temporary Payment Reductions: Many creditors offer short-term hardship programs that may temporarily lower your minimum monthly payment to a more manageable amount.

- Due Date Extensions: Some lenders may grant a one-time extension on your due date (e.g., moving it 15-30 days later) during acute crises, giving you breathing room without reporting the account as late. Crucially: You must contact the creditor before the payment is missed to discuss options. Formal enrollment in a program is required; simply skipping a payment will still result in a delinquency. Understanding your rights and options during financial strain is complex. For personalized strategies to maintain your credit health through automation and preparedness in 2025, explore the tools and guidance available at fixcreditscenter.com.

【Rebuilding Credit After Late Payments】

Successfully preventing future late payments is the foundation, but addressing past delinquencies is crucial for full credit recovery. While completely removing accurate late payments is challenging, their negative impact lessens significantly over time, and proactive steps can accelerate your score rebound.

Damage Control Timeline

Late payments remain on your credit reports for seven years from the original delinquency date, but their sting diminishes as they age.

Impact Fading Over Time

- 24 Months: After two years of perfect payment history, significant score recovery is achievable. New, positive credit behavior starts to outweigh the older negative mark.

- 48 Months: By the four-year mark, the late payment typically has only a minor residual effect on your credit score, assuming no new negative entries occur. The focus shifts heavily to your recent track record.

Key Recovery Actions

Accelerate this fading effect and rebuild creditworthiness by:

- Perfect Payment History: Consistently paying all accounts (credit cards, loans, utilities) on time for at least 12 consecutive months is the single most powerful action. Extend this streak beyond 24 months for maximum impact.

- Credit Utilization Below 30%: Actively manage revolving credit balances. Keep the amount you owe on credit cards below 30% of each card’s limit, and ideally below 10% for optimal scoring. Pay down existing balances and avoid maxing out cards.

Credit Monitoring Essentials

Vigilant oversight is non-negotiable during the rebuilding phase to track progress and catch new issues instantly.

Regular Report Checks

- Free Weekly Reports: Leverage your right to free weekly credit reports from all three bureaus (Equifax, Experian, TransUnion) via AnnualCreditReport.com. Review each report meticulously.

- Dispute New Errors Immediately: If you find any inaccuracies (e.g., a payment incorrectly marked late, an account you don’t recognize), dispute them directly with the credit bureau reporting the error. Provide documentation and follow up until resolved.

Identity Theft Protection

Financial rebuilding makes you vulnerable; protect your progress:

- Credit Freeze: If you suspect fraud or identity theft, place a free credit freeze on your reports at all three bureaus. This prevents lenders from accessing your report, stopping new fraudulent accounts from being opened.

- FTC Reporting Steps: Report identity theft immediately to the Federal Trade Commission (FTC) at IdentityTheft.gov. This creates an official recovery plan and provides crucial documentation for disputing fraudulent items with creditors and bureaus.

Rebuilding credit requires patience and consistent, positive financial habits. Monitoring your reports ensures you stay on track and quickly address any setbacks. For comprehensive tools and personalized strategies to navigate credit repair and build lasting financial health in 2025, leverage the resources available at fixcreditscenter.com.

【Understanding Late Payment Impact】

How Late Payments Crush Your Credit Score

A single late payment can trigger a significant and immediate drop in your credit score. The damage is most severe when the delinquency is first reported and stems directly from the paramount importance of payment history in credit scoring models.

FICO Score Damage Explained

- Magnitude of Drop: A single 30-day late payment reported to the credit bureaus can cause your FICO score to plummet by 50 to 100 points or more, especially if your previous history was spotless. The higher your initial score, the steeper the potential decline.

- Core Scoring Factor: This dramatic impact occurs because payment history constitutes 35% of your FICO score calculation – the single largest factor. Lenders view timely payments as the strongest indicator of future creditworthiness. Even one late mark signals potential risk.

- Severity Escalates: The negative impact worsens significantly as the delinquency ages:

- 30 days late: Initial major hit (50-100+ points).

- 60 days late: Further substantial drop, signaling deeper financial distress.

- 90+ days late/Charge-off: Severe damage, often pushing the account into default status, with recovery taking much longer.

Table: Typical FICO Score Impact Based on Late Payment Severity (Illustrative)

| Delinquency Status | Estimated FICO Score Impact | Key Implications |

|---|---|---|

| 30 Days Late | -50 to -100+ points | Major initial drop; signals risk to lenders; immediate focus needed. |

| 60 Days Late | Additional -20 to -40 points | Deeper financial distress signal; significantly harder to rebound. |

| 90+ Days Late | Additional -70 to -150+ points | Approaching default; severe long-term damage; collections/charge-off likely. |

| Charge-off | -150+ points (cumulative) | Account closed by lender as loss; severe derogatory mark; recovery takes years. |

Seven-Year Rule Demystified

While the sting of a late payment is sharp initially, federal law (the Fair Credit Reporting Act, FCRA) limits how long these negative marks can haunt your credit reports.

When Negative Marks Expire

- Countdown Start Point: The seven-year reporting period begins from the original delinquency date. This is the date the account first became late and was never subsequently brought back to a current status. It is not based on the date the late payment was reported, the date the account was closed, or the date of your last payment on the account.

- Simultaneous Removal: If you have multiple late payments stemming from the same initial missed payment incident (e.g., you missed a payment in January 2025 and didn’t catch up until April 2025, resulting in Jan, Feb, and March all reported as 30/60/90 days late), all associated late payments related to that single delinquency episode will fall off your report simultaneously seven years from that original January 2025 delinquency date. They do not each get their own separate seven-year clock.

- VantageScore Note: While FICO scores dominate lending decisions, it’s worth noting that newer VantageScore models (like those widely used in free credit score services in 2025) may treat very old, isolated late payments (e.g., a single 30-day late from 4+ years ago with perfect history since) with less severity than FICO models. However, the seven-year reporting rule still applies to the data on your reports.

Understanding this timeline is crucial: while you cannot force the removal of accurate late payments before their time, knowing exactly when they will expire allows you to focus your energy on rebuilding positive credit history now. For tailored strategies to navigate the complexities of credit reporting timelines and explore legitimate avenues for disputing potential inaccuracies in 2025, consider the guidance available through reputable resources like fixcreditscenter.com.

【Disputing Inaccurate Reports】

Spotting Credit Report Errors

Errors on credit reports are alarmingly common and can unjustly suppress your score. Vigilant review of all three major credit reports (Experian, Equifax, TransUnion) is your first defense. Focus particularly on payment history sections, where reporting inaccuracies frequently occur. Two critical errors demand immediate attention:

Common Reporting Mistakes

- Payments Marked Late Despite On-Time Submission: Creditors or data furnishers may incorrectly report a payment as delinquent due to processing delays, administrative errors, or misapplied payments. This creates an artificial late payment mark that unfairly damages your score.

- Outdated Marks Exceeding 7-Year Limit: Under the Fair Credit Reporting Act (FCRA), most negative information must be removed after seven years from the original delinquency date. Marks still reporting beyond 2025 for delinquencies originating before 2018 are likely violating federal law.

Step-by-Step Dispute Process

Removing inaccurately reported late payments requires a formal dispute filed directly with the credit bureaus. This process is federally mandated and, when done correctly, compels investigation.

Contacting Credit Bureaus

Initiate disputes online for efficiency and tracking, using each bureau’s dedicated portal:

- Experian:

Dispute Center(experian.com/disputes) - Equifax:

Dispute Portal(equifax.com/personal/credit-report-services/credit-dispute/) - TransUnion:

Online Dispute(transunion.com/credit-disputes/dispute-your-credit)

Required Documentation: Substantiating your claim is non-negotiable. Gather:

- Bank statements showing the payment cleared (highlight the transaction).

- Payment confirmations (screenshots, emails, lender portal records).

- Copies of canceled checks or money order receipts.

- A clear explanation of the error referencing the specific account and date.

Clearly identify the disputed item (account name/number, date of alleged late payment) and state the reason (“Payment was made on time per attached bank statement,” or “This delinquency exceeds the 7-year FCRA reporting period”). The bureau then has 30 days to investigate and respond. For complex disputes or navigating persistent inaccuracies in 2025, leveraging specialized expertise from services like fixcreditscenter.com can streamline the resolution process.

【Handling Accurate Late Payments】

While disputing inaccurate late payments is crucial for credit repair, addressing accurate late marks requires different strategies. If you’ve genuinely missed a payment but want to remove it, options like goodwill letters or pay-for-delete agreements may seem appealing. However, these approaches hinge on creditor discretion and carry significant limitations, especially under current reporting standards in 2025. This section explores practical methods for potentially removing valid late payments, emphasizing transparency and legal boundaries.

Goodwill Letter Strategy

A goodwill letter is a formal request asking a creditor to remove a late payment as an act of leniency, despite its accuracy. This tactic relies on building rapport and demonstrating responsibility, not legal disputes. Success isn’t guaranteed, but it can work if you present a compelling case based on your history and circumstances. Always send these letters directly to the creditor’s executive office (e.g., via certified mail or secure online portals) for the best chance of review.

Crafting Effective Appeals

To maximize your odds, structure your goodwill letter around three core elements, ensuring it’s concise and professional:

- Acknowledgment: Start by admitting the late payment occurred and taking ownership. This shows accountability and builds trust. For example: “I acknowledge that my payment for Account X was late in [Month, Year].”

- Explanation: Briefly explain the reason for the delay without making excuses. Focus on documented hardships like job loss, medical emergencies, or natural disasters. Avoid vague claims—cite specifics such as “due to unexpected hospitalization in [Month, Year], supported by attached medical records.”

- Request: Politely ask for the late mark’s removal, tying it to your commitment to future on-time payments. Phrase it as: “Given my otherwise spotless payment history and current diligence, I respectfully request you remove this late notation to support my financial recovery.”

Key success factors include:

- Clean prior history: Creditors are more likely to oblige if you have a long record of timely payments before the incident. Highlight this in your letter, e.g., “I’ve maintained on-time payments for 5+ years prior to this isolated event.”

- Documented hardship: Attach verifiable evidence, such as termination notices, medical bills, or insurance claims, to substantiate your explanation. Without proof, appeals often fail—creditors need tangible reasons to justify an exception under FCRA guidelines.

In 2025, goodwill letters remain a low-cost DIY option, but they work best for minor, isolated lates with strong supporting evidence. For persistent issues or complex cases, consulting experts like those at fixcreditscenter.com can provide tailored strategies to navigate creditor negotiations effectively.

Pay-for-Delete Pitfalls

A pay-for-delete agreement involves negotiating with a creditor or collection agency to remove a negative mark in exchange for full or partial payment. While it sounds straightforward, this strategy is fraught with risks and low success rates in 2025. Most creditors view it skeptically due to regulatory pressures, and even if agreed upon, enforcement is rare. Always prioritize written agreements over verbal promises to avoid misunderstandings.

Why Most Creditors Refuse

Creditors and collection agencies typically reject pay-for-delete requests for two primary reasons:

- Legal obligation to report accurately: Under the Fair Credit Reporting Act (FCRA), creditors must ensure their reports reflect truthful information. Removing a valid late payment could be seen as misrepresentation, exposing them to fines or legal action. In 2025, heightened enforcement by agencies like the CFPB makes this even riskier for creditors, leading them to decline such deals routinely.

- Collections agencies rarely honor agreements: Even if a collection agency verbally agrees to delete a mark upon payment, they often fail to follow through post-payment. Many agencies operate with high turnover and poor record-keeping, making it easy for promises to be “lost.” Additionally, once paid, you lose leverage—disputing the inaccuracy afterward becomes harder without proof of the agreement.

Given these pitfalls, consider pay-for-delete a last resort and focus on rebuilding credit through consistent on-time payments. If you do attempt it, get all terms in writing and track communications meticulously. For reliable support in managing accurate late payments or other credit challenges in 2025, services like fixcreditscenter.com offer expert guidance to help you avoid common traps and achieve lasting improvements.

【Preventing Future Late Payments】

While strategies like goodwill letters address past mistakes, the most effective approach to maintaining clean credit reports in 2025 is preventing late payments altogether. Proactive systems mitigate human error and financial surprises, safeguarding your score from preventable damage. Implementing reliable safeguards ensures consistent on-time payments even during hectic periods.

Automation Safety Nets

Automating payments eliminates forgetfulness—a leading cause of accidental lates. Modern banking tools offer layered protection:

| Automation Tool | Key Benefit | 2025 Implementation Tip |

|---|---|---|

| Full Balance Autopay | Guarantees full payment monthly | Link to high-liquidity account; monitor funding |

| Minimum Payment Autopay | Critical fail-safe against missed payments | Set as baseline; manually top up to avoid interest |

| Payment Date Alerts | 3-day advance notice via email/SMS | Sync with digital calendars; enable push notifications |

Setting Up Fail-Safes

Follow these steps for robust automation:

- Prioritize minimum autopay: Enable this on every credit account—even if you intend to pay more manually. This acts as your financial airbag.

- Stagger alert timing: Set primary reminders 7 days before due dates, with urgent follow-ups 72 hours prior. Use app notifications and email.

- Verify processing times: As of 2025, ACH transfers often take 1-2 business days. Schedule payments 3 days early to accommodate delays.

- Quarterly audits: Check auto-pay settings after system updates or card replacements to prevent lapses.

Financial Hardship Solutions

Even with automation, job loss or medical crises can disrupt cash flow. Early creditor communication is essential—before a payment is missed. Federal regulations in 2025 still require creditors to report payments 30+ days late, but many offer preemptive relief programs.

Proactive Creditor Negotiation

Contact your creditor immediately upon anticipating hardship:

- Payment extensions (forbearance): Most major creditors grant 30-60 day pauses on payments without reporting lates, though interest may accrue. Request in writing via secure message portals.

- Temporary APR reductions: During documented hardships like natural disasters or layoffs, issuers may lower rates for 3-6 months, reducing minimum payments by 20-50%.

- Modified payment plans: Creditors like Bank of America and Citibank now offer app-based hardship applications (2025), creating customized repayment schedules.

Key 2025 Insight: Under updated CFPB guidance, creditors must clearly disclose hardship program terms, including impacts on credit reporting. Always get written confirmation that enrolling won’t trigger a late mark.

For complex situations—such as multiple accounts nearing delinquency—structured support from services like fixcreditscenter.com can streamline negotiations. Their experts help consolidate communications and secure binding agreements, turning potential credit disasters into manageable recovery plans.

【Rebuilding Damaged Credit】

While preventing future late payments is paramount, addressing existing credit report damage is equally crucial. Late payments can linger for up to seven years, but strategic actions in 2025 can significantly mitigate their impact and accelerate score recovery. Focus shifts to optimizing credit utilization and leveraging alternative data sources.

Credit Utilization Fixes

Your credit utilization ratio—the percentage of available credit you’re using—is a major scoring factor. High utilization signals risk, even with perfect payment history. The widely recommended benchmark is staying below 30% overall and per card.

The 30% Threshold Rule

This rule isn’t arbitrary; exceeding 30% utilization can trigger score drops. The calculation is straightforward:

- Card Balance ÷ Credit Limit = Utilization Rate

- Example: A card with a $10,000 limit should ideally carry a balance below $3,000 at the reporting date (usually your statement closing date).

| Credit Limit | Target Balance (30% Max) | Absolute Max to Avoid (29.9%) |

|---|---|---|

| $1,000 | $300 | $299 |

| $5,000 | $1,500 | $1,495 |

| $10,000 | $3,000 | $2,990 |

| $15,000 | $4,500 | $4,485 |

Rapid Payoff Strategies for Multiple Cards

Carrying balances across several cards compounds the problem. Implement these tactics:

- Prioritize High Utilization Cards: Focus extra payments on cards closest to or exceeding 30% utilization first. Lowering one card from 80% to 20% yields a bigger score boost than lowering several cards from 25% to 20%.

- Consider the Avalanche vs. Snowball Method:

- Avalanche: Pay minimums on all cards, then put all extra funds towards the card with the highest interest rate. Saves the most money on interest long-term.

- Snowball: Pay minimums on all cards, then put all extra funds towards the card with the smallest balance. Provides psychological wins by eliminating entire debts faster.

- Strategic Timing: Make extra payments before your statement closing date. This lowers the balance reported to credit bureaus, instantly improving your utilization ratio for that cycle.

- Request Credit Limit Increases (Cautiously): Ask issuers for a higher limit on existing cards you manage well. A $5,000 limit increased to $7,000 instantly lowers your utilization if your balance stays the same ($2,000 balance goes from 40% to ~29% utilization). Only do this if you trust yourself not to spend the new available credit.

Credit-Boosting Alternatives

Beyond traditional credit cards and loans, 2025 offers more ways to demonstrate creditworthiness using your existing financial behavior.

Leveraging Non-Traditional Payments

- Rent Reporting: Consistently paying rent on time is a strong indicator of reliability. Services like Experian Boost (2025 version) now offer expanded options:

- Automatically report rent payments directly from linked bank accounts or verified payment platforms (e.g., Zillow, Apartments.com).

- Includes verified utility payments (electricity, gas, water, internet) in some regions, providing an even broader positive payment history.

- Key Benefit: Adds positive tradelines to your credit report instantly, potentially lifting scores, especially for those with thin credit files. Note: Only reports positive history; missed payments aren’t typically reported.

- Credit-Builder Loan Options: Designed specifically to help build or rebuild credit. How they work in 2025:

- You apply for a small loan ($300-$1,000 is common).

- The lender places the loan amount into a secured savings account you cannot access.

- You make fixed monthly payments (plus interest) over 6-24 months.

- These on-time payments are reported to all three major credit bureaus.

- Upon successful completion, you receive the saved funds (minus any fees/interest).

- Where to Find Them: Offered by many credit unions, community banks, and reputable online lenders. Compare terms carefully:

| Lender Type | Typical Loan Amount | Term Length | Key 2025 Consideration |

|——————–|———————|—————|——————————————–|

| Credit Unions | $300 – $2,500 | 6 – 24 months | Often lowest fees; membership required |

| Online Lenders | $300 – $1,000 | 6 – 12 months | Fastest setup; research fees & reporting |

| Neobanks/Apps | $100 – $1,000 | Flexible | Integrated with budgeting apps; verify fees|

Rebuilding credit requires diligence across both traditional metrics like utilization and newer pathways leveraging everyday payments. For individuals navigating complex situations with multiple late payments or high utilization across several accounts, structured guidance from reputable services can be invaluable. Platforms like fixcreditscenter.com offer personalized action plans and creditor negotiation support, turning a challenging rebuild into a clear, manageable journey toward stronger credit health in 2025.

Key Takeaways for Credit Recovery

Late payments deliver a severe blow to your credit health, but understanding their impact is the first step toward repair. Remember these critical points:

- A single 30-day late payment can cause an immediate 50-100 point score drop

- Negative marks remain on reports for 7 years, though their impact fades over time

- Disputing inaccuracies with proper documentation can remove unfair late payments

- Consistent on-time payments and low credit utilization are the fastest rebuilding tools

Don’t let past mistakes define your financial future. Take action today by visiting fixcreditscenter.com for personalized credit repair strategies. Share your success story in the comments below!