Did you know 1 in 5 credit reports contain errors? Your credit score impacts loans, jobs, and housing costs. Learn how to fix mistakes and boost your financial health for free in 2025.

Understanding Your Credit Report

Why Your Credit History Matters

Your credit history is your financial fingerprint. Lenders, landlords, and even potential employers scrutinize it to gauge your reliability. A strong credit score unlocks lower interest rates on loans and credit cards, saving you thousands over time. It affects your ability to rent an apartment, secure insurance premiums, and sometimes even land a job. Ignoring it means potentially paying significantly more for life’s necessities. In 2025, with economic uncertainty still present, taking control of your credit isn’t just smart—it’s essential financial self-defense. Knowing where you stand is the non-negotiable first step towards improvement.

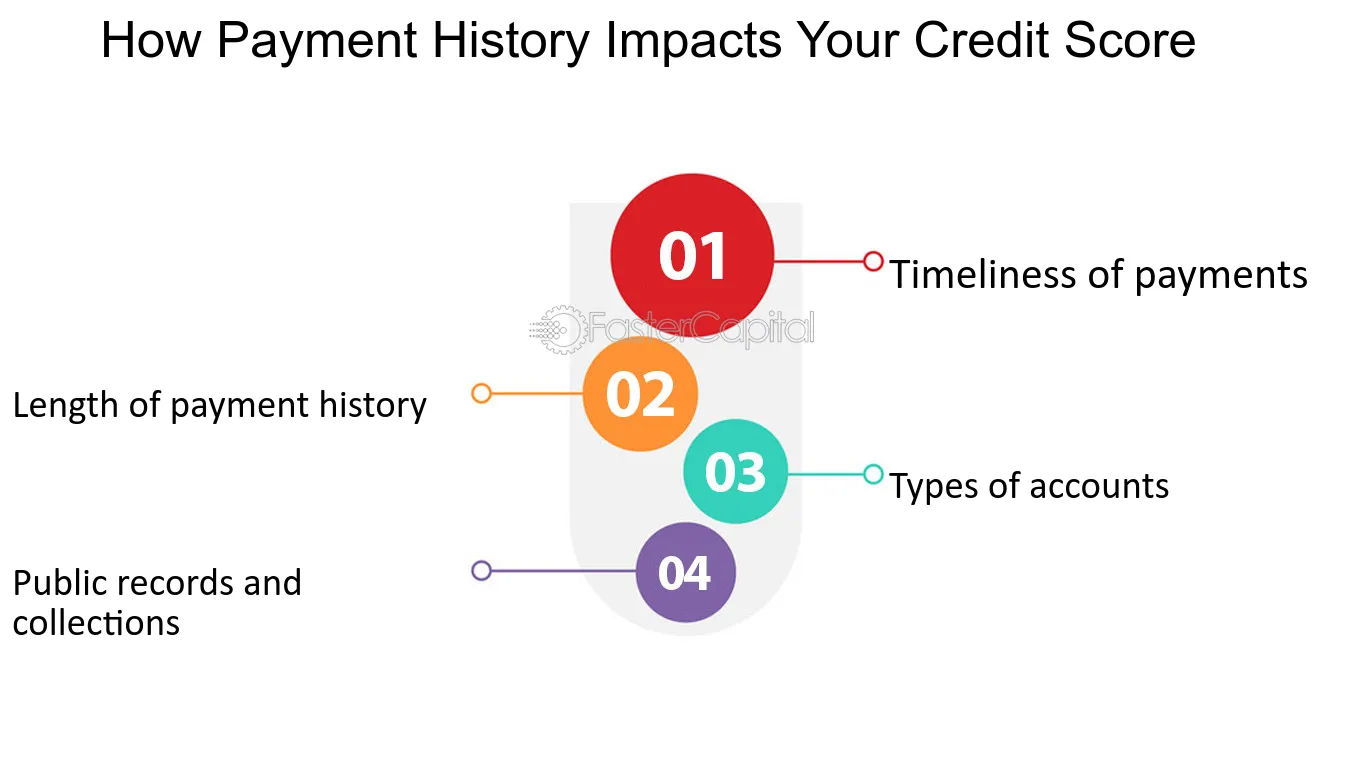

Key Factors Impacting Your Score

Your FICO® Score, the most widely used scoring model, is calculated using specific components with varying weights. Understanding these helps you prioritize your actions:

| Factor | Weight in FICO® Score | What it Means for You |

|---|---|---|

| Payment History | 35% | Your track record of paying bills on time. Even one 30-day late payment can cause a significant drop. |

| Credit Utilization | 30% | The amount of credit you’re using compared to your total limits. Aim to keep this below 30% overall, and ideally below 10% on individual cards for the best impact. |

| Length of Credit History | 15% | The average age of your accounts. Older accounts are beneficial. Avoid closing old cards. |

| Credit Mix | 10% | Having different types of credit (e.g., credit card, installment loan). Not a major factor, but demonstrates experience. |

| New Credit | 10% | How many new accounts you’ve applied for recently. Too many hard inquiries hurt your score. |

Focus relentlessly on the top two: Payment History and Credit Utilization. Together, they control 65% of your score. Making every payment on time, every single month, is paramount. Simultaneously, actively work to lower the balances on your revolving credit (like credit cards) relative to their limits. This powerful combination forms the bedrock of credit repair and maintenance in 2025.

How Negative Information Affects You

Negative items on your credit report are major roadblocks to achieving a good score. Their impact lessens over time, but they linger significantly:

- Late Payments: Even a single 30-day late payment can cause a substantial drop. Multiple late payments, especially recent ones or those 60, 90, or 120+ days late, are severely damaging. These remain visible for 7 years from the date of the initial missed payment.

- Collections: Accounts sent to collections are a huge red flag. They also remain for 7 years from the date of the original delinquency that led to the collection.

- Charge-Offs: When a creditor gives up on collecting and writes off the debt, it’s marked as a charge-off. This stays on your report for 7 years from the date of the first delinquency.

- Bankruptcies: The most damaging negative item. Chapter 13 bankruptcy (reorganization) typically stays for 7 years from the filing date. Chapter 7 bankruptcy (liquidation) stays for 10 years from the filing date.

- Foreclosures & Repossessions: These severe events remain for 7 years from the date of the first delinquency that led to them.

- Hard Inquiries: When a lender checks your credit for a new application, it causes a small, temporary dip. These stay visible for 2 years, but typically only impact your score for 12 months.

The key takeaway: Negative items don’t haunt you forever. Their impact diminishes as they age, especially after the first 2 years. However, their presence, particularly recent negatives, makes rebuilding challenging and underscores the need for consistent positive habits moving forward. While you wait for negatives to age off, focus intensely on perfect payment history and low credit utilization. For tailored strategies on navigating disputes or understanding complex reporting timelines, consider the free consultation offered at https://fixcreditscenter.com. Their expertise aligns precisely with the realities of credit reporting in 2025.

Getting Your Free Credit Reports

Accessing Reports from All 3 Bureaus

Knowledge is power, especially when it comes to your credit. You absolutely need to see what lenders see, and thankfully, getting your reports is completely free. Stop paying for what you can legally obtain at zero cost. Your primary source is the federally mandated website: AnnualCreditReport.com. This is the only official site directing you to truly free reports from Equifax, Experian, and TransUnion. As of 2025, you can access each of your reports weekly at no charge through this portal. Don’t fall for imposter sites charging fees – this is your direct line.

Equifax offers an additional benefit through 2026: you can get 6 extra free Equifax credit reports per year beyond your weekly access via AnnualCreditReport.com. Visit Equifax’s official website directly to utilize this valuable, temporary perk. Remember, reviewing reports from all three bureaus is non-negotiable because they often contain different information. Creditors don’t report to all bureaus uniformly, so mistakes or outdated negatives on just one report can unfairly damage your score. Get all three. Every time.

Strategic Credit Monitoring

Best Practices for Review Timing

Simply getting your reports isn’t enough; you need a smart strategy to monitor your credit health effectively without becoming overwhelmed. The key is staggering your requests. Instead of pulling all three reports at once every week, space them out. Aim to request one report from a different bureau approximately every four months. For example:

- January: Get your Equifax report

- May: Get your Experian report

- September: Get your TransUnion report

This staggered approach provides near-continuous monitoring throughout 2025, allowing you to catch errors, potential fraud, or unexpected changes roughly every four months from a different source. It’s efficient and free.

Crucially, know your rights after credit denial. If you apply for credit, insurance, or even an apartment rental and are denied based on information in your credit report (you’ll receive an “adverse action notice”), federal law grants you the right to a free copy of that specific report within 60 days of the denial. Act immediately upon receiving a denial notice. This free report is separate from your AnnualCreditReport.com access and gives you the exact information the lender used, vital for understanding the denial and disputing any inaccuracies. Set calendar reminders for your staggered checks and act fast on denials – proactive, free monitoring is your strongest defense. For deeper insights into interpreting complex report entries or crafting effective dispute letters, the resources available at https://fixcreditscenter.com can provide tailored guidance specific to 2025 credit reporting standards.

【Fixing Credit Report Errors】

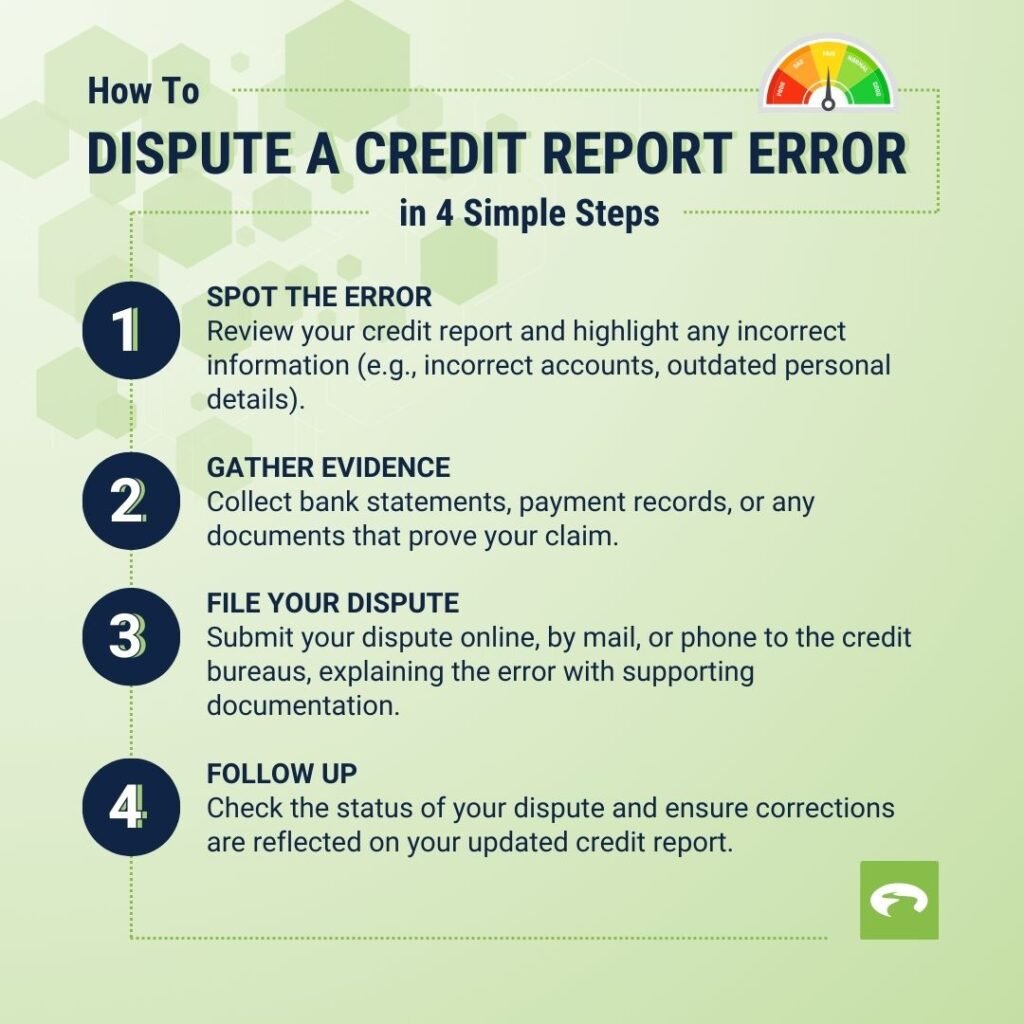

Now that you’re regularly accessing your free credit reports, it’s time to tackle the errors that could be dragging down your score. Fixing inaccuracies is not just possible—it’s your legal right under the Fair Credit Reporting Act (FCRA), and it costs you absolutely nothing. Never pay a dime for credit repair services that handle disputes you can do yourself for free. As of 2025, the process remains straightforward: identify the mistakes, dispute them properly, and demand corrections. Ignoring errors lets them fester, potentially costing you thousands in higher interest rates or denied loans. Start here to take control.

Disputing Inaccurate Information

Errors on your credit report aren’t just annoying; they’re damaging. A single incorrect late payment or an account that isn’t yours can slash your score by dozens of points. Disputing these inaccuracies is free and mandatory under federal law—credit bureaus and data furnishers must investigate and correct verified mistakes. Don’t rely on online dispute portals alone; they often lack the paper trail needed for proof. Instead, stick to the physical, documented approach for maximum effectiveness and protection. This ensures you have evidence if things escalate.

Step-by-Step Dispute Process

Fixing errors starts with a methodical, free process that anyone can follow. Here’s how to do it right in 2025:

- Circle Errors on Physical Report Copies: Print out the reports you obtained for free from AnnualCreditReport.com. Grab a red pen and circle every inaccuracy directly on the paper—think late payments that were on time, accounts you didn’t open, or incorrect balances. Be specific: note dates, amounts, and account numbers. This visual step forces you to scrutinize details and creates a clear reference for your dispute.

- Mail Disputes via Certified Mail with Return Receipt: Compile a dispute package including:

- The marked-up report copy.

- A cover letter listing each circled error, explaining why it’s wrong (e.g., “Payment was made on time as per attached bank statement”).

- Copies (never originals) of supporting documents, like payment receipts or account statements.

Mail this to the credit bureau’s dispute address (e.g., Equifax, Experian, or TransUnion) using USPS Certified Mail with Return Receipt Requested. This costs under $10 but provides legal proof of mailing and delivery—a must for enforcing your rights. As of 2025, bureaus have 30 days to respond, so keep your receipt as leverage.

This method is free except for minimal postage, and it works. For ready-to-use dispute templates tailored to 2025 standards, the tools at https://fixcreditscenter.com simplify this process without fees.

Working with Credit Bureaus vs. Furnishers

Knowing where to send your disputes is half the battle. Credit bureaus (like Equifax) collect and report your data, while furnishers are the original creditors (e.g., banks or lenders) that supply that information. Disputing with both ensures errors get fixed at the source, but focus your efforts strategically. Always start with the bureaus—it’s faster and legally binding. If that fails, escalate to the furnisher to cut off inaccurate reporting at the root. This dual approach is free and leverages your rights under the FCRA.

Where to Send Disputes

Send disputes based on who controls the data, and track deadlines closely:

| Dispute Target | Process & Timeline | Key Actions for 2025 |

|---|---|---|

| Credit Bureaus | Must investigate within 30 days of receipt. | Mail disputes directly to each bureau’s dedicated address (find these on your report or their official sites). Include all evidence—bureaus must contact furnishers to verify or correct the info. If they confirm an error, they’ll update your report free of charge. |

| Furnishers (Original Creditors) | Must verify reported information upon dispute. | If a bureau dispute fails or the error persists, mail a copy of your dispute package to the furnisher’s address (listed on your report). Furnishers have 30 days to investigate and must notify all bureaus if they can’t verify the data, forcing its removal. |

Stick to certified mail for both routes, and keep copies of everything. If disputes stall, remind them of the 2025 FCRA deadlines—bureaus and furnishers face penalties for non-compliance. For complex cases, like mixed files or identity theft, free resources at https://fixcreditscenter.com offer updated dispute strategies to keep you on track.

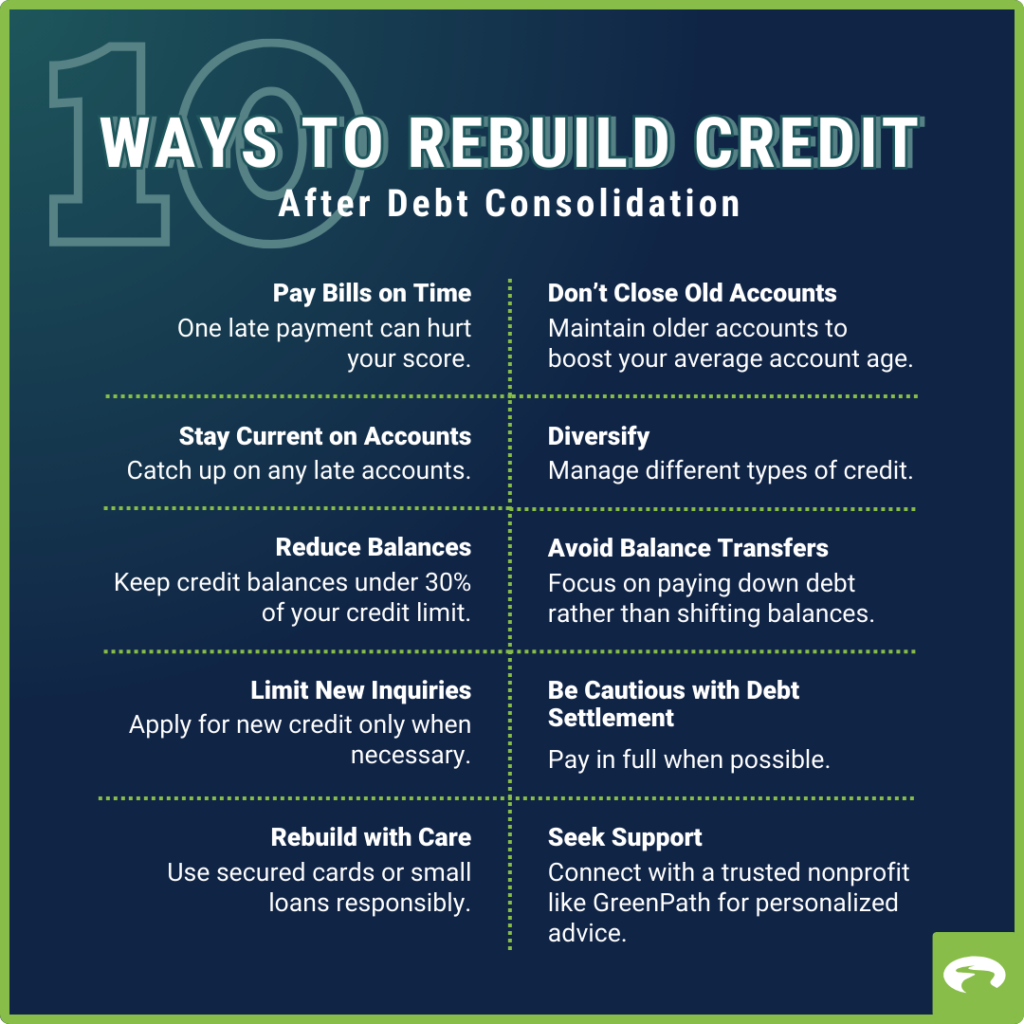

【Legally Improving Your Credit Score】

Fixing errors is crucial, but it’s only half the credit repair battle. To truly rebuild your score for free in 2025, you must proactively establish and maintain positive financial habits. This isn’t about quick fixes; it’s about leveraging your rights and using disciplined, cost-free strategies that signal reliability to lenders over time.

Building Positive Payment History

Your payment history is the single biggest factor in your credit score (35%). One late payment can slash 100+ points off a good score. The good news? Building a positive track record costs nothing but consistency. Your focus: ensure every bill is paid on time, every time. This is non-negotiable for credit recovery.

On-Time Payment Strategies

Free, automated systems are your best allies for flawless payment history:

- Set Up Automatic Minimum Payments: Contact every creditor (credit card issuer, loan servicer) or log into your online accounts. Enroll in automatic payments for at least the minimum amount due on every single account. This acts as your safety net, guaranteeing you never miss the absolute lowest required payment. While paying the full statement balance is ideal to avoid interest, automating the minimum protects your credit score above all else. Double-check payment dates and linked bank accounts monthly.

- Understand the 30-Day Grace Period Before Late Reporting: Creditors typically only report a payment as “late” to the credit bureaus once it’s 30 days past the due date. This is NOT a free pass! While you technically have about 30 days before severe score damage occurs:

- Late fees often kick in at 1 day past due. You’ll waste money.

- Goodwill corrections are harder to get after the due date passes.

- Set payment reminders for at least 7 days BEFORE the actual due date. Treat the due date as an absolute hard deadline. The 30-day buffer is for bureau reporting mechanics only – relying on it is risky and costly.

Managing Credit Utilization

Credit Utilization (how much of your available credit you use) is the second most important scoring factor (30%). High utilization screams risk, even if you pay on time. Lowering it is free and delivers rapid score improvements, often within a single billing cycle.

Ideal Credit Usage Ratios

Forget complex calculations. Follow these free, powerful rules:

-

Keep Individual & Total Utilization Below 30%: This is the maximum threshold to avoid major score penalties. If you have a credit card with a $1,000 limit, never let the statement closing balance exceed $300. Calculate this per card and across all revolving accounts combined. High utilization on even one card hurts.

-

Aim Below 10% for Optimal Scoring: While 30% is the damage control line, scores truly shine when utilization is under 10%. This demonstrates exceptional credit management without needing new credit or loans. On that $1,000 card, strive for a statement balance of $99 or less.

-

Strategy: Pay down balances before the statement closing date (not just the due date). Your reported balance is usually what’s on your statement. Making an extra payment mid-cycle is free and instantly lowers utilization.

-

Example Utilization Impact:

Your Utilization Rate Likely Impact on Credit Score Below 10% Maximizes points in this category 10% – 29% Good, but points left on the table 30% – 49% Significant negative impact 50%+ Severe negative impact -

Free Tracking: Most credit card apps and free credit monitoring services (like those offered by some banks or Credit Karma) show your current utilization. Check it monthly around your statement dates. Free tools at https://fixcreditscenter.com can help track utilization ratios and project score impacts without cost. Remember: Paying down debt is the only truly free and effective way to lower utilization long-term. Don’t open new accounts just to boost limits unless absolutely necessary and strategically sound.

-

【Avoiding Credit Repair Scams】

Rebuilding your credit for free in 2025 requires vigilance. While disciplined habits like on-time payments and low utilization are powerful, desperate consumers often fall prey to companies promising miraculous score jumps for a fee. Recognize these scams instantly – they waste your money and can worsen your credit or even be illegal. Your best defense is knowing the red flags and the truly free alternatives.

Red Flags of Fraudulent Companies

Legitimate credit repair takes time and effort; anyone guaranteeing specific results or “instant fixes” is lying. Under the federal Credit Repair Organizations Act (CROA), companies cannot demand payment before they perform the promised services. This is the biggest, brightest warning sign.

Illegal Practices to Watch For

Beyond upfront fees, beware of companies advising you to engage in deceptive or illegal activities:

- Demand Upfront Payment Before Service: This violates the CROA outright. Legitimate companies only charge after they have performed the work they outlined in your contract. If they ask for money before starting, walk away immediately.

- Advise Disputing Accurate Information: It is illegal for a company to tell you to dispute negative items on your credit report that you know are correct and accurate. This includes:

- Disputing legitimate late payments or collections.

- Using false identities or creating a new credit identity (like a CPN or EIN instead of your SSN) – this is fraud.

- Advising you to stop communicating with your creditors directly.

Illegal Credit Repair Company Tactics & Consequences

| Red Flag Practice | Why It’s Illegal/Harmful | Potential Consequence for YOU |

|---|---|---|

| Demanding Payment Upfront | Violates the Credit Repair Organizations Act (CROA) | You lose money; services often never performed |

| Disputing Accurate Info | Constitutes fraud; misrepresents your credit history | Disputes rejected; potential legal liability for fraud |

| Promising Specific Results | Credit outcomes cannot be guaranteed; illegal under CROA | False hope; wasted time and money |

| Using a “New Credit Identity” (CPN/EIN) | Fraudulent misrepresentation of your Social Security Number | Severe legal penalties (fines, imprisonment) |

Legitimate Alternatives to Scams

You do not need to pay anyone to improve your credit. Effective credit repair leverages your federal rights (like disputing inaccurate information yourself) and builds positive habits. Free, expert guidance is readily available.

Free Credit Counseling Resources

Nonprofit credit counseling agencies provide genuine help without the scams:

- Nonprofit Agencies via Credit Unions / Military Programs: Many credit unions offer free financial counseling to members. If you serve or have served in the military, organizations like Military OneSource offer free, confidential credit counseling and debt management plans (DMPs) if needed. The Department of Housing and Urban Development (HUD) also sponsors nonprofit counselors for housing-related credit issues.

- NFCC-Certified Counselors: Seek agencies certified by the National Foundation for Credit Counseling (NFCC). NFCC member agencies (www.nfcc.org) adhere to strict standards, provide free or very low-cost initial consultations, and focus on education and realistic debt repayment plans. Their certified counselors help you understand your reports, create budgets, and develop a personalized strategy to improve your credit score – all without charging upfront fees or making false promises. They can also guide you through legitimate dispute processes for errors.

Empower yourself with knowledge and discipline – that’s how you fix your credit for free. Dispute inaccuracies yourself, automate payments, keep utilization low, and leverage free counseling. For tools to track your utilization and dispute progress, explore resources available at https://fixcreditscenter.com. Remember, sustainable credit health is built on real financial behavior, not expensive shortcuts.

【Special Credit Situations】

While disciplined habits form the bedrock of credit repair, certain life events require specific, free actions. Protecting your identity and controlling access to your credit reports are powerful, no-cost tools you must understand in 2025.

Freezing and Unfreezing Credit

A security freeze is your strongest free defense against new account identity theft. It blocks potential creditors from accessing your credit report, making it extremely difficult for thieves to open accounts in your name.

How Security Freezes Work

Thanks to federal law, placing, temporarily lifting (a “thaw”), or removing a security freeze is completely free at all three major credit bureaus (Experian, Equifax, and TransUnion) as of 2025. Here’s the straightforward process:

- Initiate Freezes: Visit each bureau’s official website. You’ll need to provide personal information (like your SSN, date of birth, and address) and create a unique PIN or password for each bureau.

- Request a Thaw (Temporary Lift): When you need to apply for legitimate credit (e.g., a loan, credit card, or apartment), you must request a thaw at the specific bureau(s) the creditor uses. Provide your PIN/password and specify the thaw duration (e.g., 24 hours, a week).

- Unfreeze Permanently: If you no longer wish to maintain the freeze, you can permanently remove it using your PIN/password.

Credit Freeze Process Overview

| Action | Where to Go | Key Points |

|---|---|---|

| Place a Freeze | Experian, Equifax, and TransUnion websites | Free by law; Requires SSN, DOB, Address; Set unique PIN/Password per bureau |

| Temporarily Thaw | Bureau(s) used by your potential creditor | Thaws typically happen within 1 hour when requested online; Specify duration |

| Remove Freeze | Bureau(s) where freeze is active | Use your assigned PIN/Password; Can be done online |

Crucially: Thaws initiated electronically are usually processed within 1 hour. Plan ahead, but know access is restored quickly when you authorize it. Keep your PINs/passwords secure!

Recovering from Identity Theft

If you discover you’re a victim of identity theft, immediate and free federal resources are your lifeline. Don’t pay for “recovery” services – leverage these official tools.

Federal Recovery Resources

The U.S. government provides a comprehensive, personalized recovery plan at no cost:

- IdentityTheft.gov: This is the official federal resource. Visit the website (https://www.identitytheft.gov) and report the theft. The site will:

- Generate a personalized recovery plan tailored to your specific situation.

- Provide pre-filled letters and forms to send to creditors, credit bureaus, and debt collectors.

- Help you track your recovery steps.

- Place Fraud Alerts: As part of your IdentityTheft.gov recovery plan, you’ll be instructed to place an Initial Fraud Alert on your credit reports. Contact any one of the three nationwide bureaus (they must notify the others). This alert:

- Lasts for 1 year.

- Requires creditors to take “reasonable steps” to verify your identity before issuing new credit in your name.

- Is completely free.

- Can be renewed after the year if needed.

Taking swift action using IdentityTheft.gov and placing free fraud alerts significantly limits the damage thieves can cause and guides you through the recovery process step-by-step without cost. For ongoing credit monitoring and tools to maintain your rebuilt credit health after recovery, utilize resources available at https://fixcreditscenter.com. If you suspect identity theft, act immediately: report it and freeze your credit.

【Long-Term Credit Health】

Sustaining excellent credit isn’t about quick fixes; it’s about mastering free, fundamental strategies for managing debt responsibly and building credit history from scratch. Forget costly services – the power to maintain long-term credit health rests firmly in your hands using proven, no-cost methods in 2025.

Debt Management Without Fees

Overwhelming debt drags down your credit score. Tackling it strategically costs nothing but discipline. Two powerful, free repayment strategies dominate:

Proven Repayment Strategies

-

The Debt Snowball Method:

- How it works: List your debts from smallest balance to largest. Pay the minimum on all debts except the smallest. Throw every extra dollar you can at that smallest debt until it’s gone. Then, take the total amount you were paying on that first debt (minimum + extra) and apply it to the next smallest debt, snowballing your payments as you go.

- Why it works (free): The psychological win of eliminating entire debts quickly provides powerful motivation to keep going, fueling your momentum – all at zero cost.

-

The Debt Avalanche Method:

- How it works: List your debts from highest interest rate to lowest. Pay the minimum on all debts except the one with the highest rate. Focus all extra payments on that high-interest debt until it’s paid off. Then move to the debt with the next highest rate, and so on.

- Why it works (free): This method saves you the most money on interest payments over time by eliminating your costliest debts first. It’s pure mathematical efficiency using your existing income.

Key Comparison of Free Repayment Strategies

| Strategy | Best For | Primary Advantage | Requires |

|---|---|---|---|

| Debt Snowball | Motivation through quick wins | Psychological boost from faster account closures | Listing debts by balance (smallest first) |

| Debt Avalanche | Minimizing total interest paid | Saves the most money long-term | Listing debts by interest rate (highest first) |

Crucially: Both methods are 100% free to implement. They rely solely on your commitment and a simple spreadsheet or budgeting app to track progress. Choose the method that best fits your personality and financial focus. The critical step is starting and sticking to your chosen plan using the money you already earn.

Building Credit with No History

A “thin file” (limited credit history) makes lenders wary. Building credit without paying high fees or interest is entirely possible using responsible, accessible tools.

Starter Options for Thin Files

- Secured Credit Cards (with Refundable Deposits):

- How they work (free access): You provide a cash security deposit (e.g., $200-$500) which typically becomes your credit limit. You use the card like a regular credit card. Crucially, your payment activity is reported monthly to all three major credit bureaus, building your history.

- The Free Advantage: Many reputable issuers offer secured cards with no annual fee. Look specifically for “no annual fee” secured cards. Your deposit is fully refundable when you close the account in good standing or upgrade to an unsecured card. This is not a fee; it’s collateral you get back. Use it responsibly (pay the statement balance in full every month by the due date) to build credit without paying interest or fees.

- Credit-Builder Loans (from Community Banks/Credit Unions):

- How they work (low/no cost): Unlike a traditional loan, the money you “borrow” (usually $300-$1000) is held by the lender in a locked savings account or certificate of deposit (CD). You make fixed monthly payments (including a small amount of interest) over a set term (e.g., 6-24 months). Your payments are reported to the credit bureaus. At the end of the term, you receive the money back plus any interest earned on the savings/CD, minus the interest you paid.

- The Free/Low-Cost Advantage: While you do pay some interest (the cost of building credit), it’s usually minimal. The key is finding institutions offering these loans with low or no origination fees and competitive interest rates. Community banks and credit unions are often the best sources for these affordable products. The net cost can be very low, sometimes just a few dollars, for establishing positive payment history across multiple credit report categories.

The Core Principle: Whether using a secured card or credit-builder loan, timely payments are non-negotiable and free. Set up automatic payments from your checking account to ensure you never miss a due date. This positive payment history, reported consistently, is the bedrock of a strong credit score. Once you’ve established a solid foundation (typically 6-12 months of responsible use), you can leverage your improved score. Maintaining that hard-earned score requires vigilance. For streamlined tools to monitor your credit reports and scores effortlessly as your financial journey progresses, explore the resources available at https://fixcreditscenter.com. Consistent, responsible use of these free or low-cost starter tools paves the way to robust long-term credit health.

[object Object]