Did you know identity theft victims spend 200+ hours repairing credit damage? This guide reveals proven 2025 strategies to remove fraudulent accounts, freeze your credit, and rebuild your score efficiently.

【Understanding Identity Theft’s Credit Impact】

Emotional and Financial Consequences

Why credit damage hurts beyond finances

Identity theft doesn’t just drain your bank account—it inflicts deep, lasting wounds that extend far beyond the numbers on your credit report. When thieves compromise your personal information, the resulting credit damage can ripple through every aspect of your life, creating hurdles that feel insurmountable. For instance:

- Difficulty securing loans or housing: A damaged credit score, often plummeting due to fraudulent activity, makes lenders and landlords wary. In 2025, many applications rely on automated systems that instantly reject scores below 650, leaving you struggling to qualify for mortgages, car loans, or even rental apartments. This isn’t just an inconvenience; it can force you into unstable housing or delay major life milestones like buying a home.

- Higher interest rates on credit cards: If your credit score drops, creditors view you as high-risk, leading to sky-high APRs on any new or existing cards. By 2025, average rates for subprime borrowers hover around 25%, meaning even small balances can snowball into unmanageable debt. This financial strain isn’t just costly—it traps you in a cycle where more of your income goes toward interest, limiting your ability to save or invest.

- Emotional toll of lost security: Beyond the dollars, identity theft shatters your sense of safety. Victims often report anxiety, sleeplessness, and a lingering fear of recurrence, as the violation feels deeply personal. This emotional burden can erode mental health, making it harder to focus on daily tasks or rebuild your financial life. Recognizing this toll is crucial; it’s not “just money” but a core part of your well-being that demands attention.

How Thieves Damage Your Credit Score

Common fraudulent activities

Criminals exploit your identity in systematic ways to wreak havoc on your credit, often leaving a trail of destruction that’s hard to undo. Understanding these common tactics helps you spot red flags early and take action. Here’s how thieves typically operate:

- Unauthorized credit card openings: Using stolen details like your Social Security number, fraudsters apply for new credit cards in your name without your knowledge. They max out these accounts quickly, causing high utilization ratios that slash your credit score by 50-100 points overnight. By 2025, this remains a top method, as many issuers prioritize fast approvals over thorough verification.

- Loans taken in your name: Thieves might secure personal loans, auto loans, or even business financing using your identity, leading to unpaid debts that appear on your credit reports. These delinquencies can linger for years, dragging down your score and triggering collections calls. For example, a single fraudulent loan default in 2025 could lower your score by up to 150 points, making it tough to qualify for legitimate credit.

- Utility services applied for fraudulently: Fraudsters often open accounts for electricity, gas, or internet under your name, then abandon them with unpaid bills. These defaults get reported to credit bureaus, adding negative marks that persist for up to seven years. In 2025, this tactic is on the rise due to lax application processes, and it can lower your score by 30-50 points per incident, complicating efforts to rebuild.

If you’re grappling with the fallout of identity theft on your credit, professional support can streamline the recovery process. For tailored solutions, explore resources at fixcreditscenter.

【Immediate Action Steps】

When identity theft compromises your credit, swift containment is critical. These initial steps create barriers against further damage while you begin the recovery process.

Freeze Your Credit Immediately

How credit freezes block new fraud

A security freeze (or credit freeze) is your most powerful defense against new fraudulent accounts. It locks access to your credit reports, preventing lenders from viewing your file—which stops thieves from opening new lines of credit in your name. Unlike monitoring services, a freeze actively blocks unauthorized applications.

Key actions:

- Contact all three major credit bureaus individually (Equifax, Experian, TransUnion). As of 2025, freezes are free and can be requested online, by phone, or mail.

- Provide proof of identity (SSN, address, government-issued ID).

- Receive a unique PIN to temporarily lift/unfreeze when legitimately applying for credit yourself.

Why it works: Creditors require credit report access to approve new accounts. Freezes deny this access entirely, making approval impossible for fraudsters.

Place Fraud Alerts Instantly

Differences between initial and extended alerts

Fraud alerts notify creditors to verify your identity before approving credit. They’re faster to implement than freezes but offer less robust protection.

| Alert Type | Duration | Requirements | Impact |

|---|---|---|---|

| Initial Fraud Alert | 1 year | Free; no proof required | Lenders must contact you before issuing new credit. Ideal for suspected theft. |

| Extended Fraud Alert | 7 years | Requires FTC Identity Theft Report | Strengthens verification demands. Creditors must speak to you directly. |

Steps to activate:

- Initial alert: Contact one bureau (they must notify the other two).

- Extended alert: Submit your FTC Identity Theft Report to all bureaus.

Critical note: Alerts don’t block access to your report like freezes do. Combine both for layered protection—freeze for prevention, alerts for active monitoring.

Rebuilding after identity theft demands precision. For specialized dispute strategies and bureau communication frameworks, consult experts at fixcreditscenter.

【Official Documentation Process】

Formal documentation transforms identity theft from suspicion into legally actionable fraud. These records provide the foundation for disputing fraudulent accounts and rebuilding your credit integrity.

File FTC Identity Theft Report

Critical components of your affidavit

The Federal Trade Commission’s IdentityTheft.gov platform generates your official Identity Theft Report—a multi-purpose affidavit that:

- Triggers extended fraud alerts (7 years)

- Forces creditors to block fraudulent accounts

- Creates legally binding dispute rights under the Fair Credit Reporting Act (FCRA)

Step-by-step filing:

- Access IdentityTheft.gov’s interactive questionnaire (available in Spanish/English)

- Detail all known fraud incidents (accounts opened, transactions made, methods used)

- Generate your:

- FTC Identity Theft Affidavit (notarization not required as of 2025)

- Personalized Recovery Plan with pre-filled dispute letters for creditors/bureaus

- Case Number for police report coordination

Proof requirement: Save PDF copies and printed versions. Creditors may request affidavits to remove fraudulent items.

Obtain Police Reports

Why law enforcement documentation matters

While federal affidavits initiate credit disputes, local police reports provide:

- Jurisdictional evidence for criminal investigations

- Additional legal leverage when creditors resist removing fraud

- Documentation trail for tax/financial fraud involving IRS or banks

Maximizing police report effectiveness:

- Bring completed FTC affidavit to streamline reporting

- Request “supplemental pages” to add new fraud evidence later

- Obtain agency case number and officer contact for creditor verification

| Document Type | Issuing Authority | Primary Credit Repair Use | Validity Period |

|---|---|---|---|

| FTC Identity Theft Report | Federal Trade Commission | Mandatory for extended fraud alerts & FCRA disputes | Indefinite (permanent record) |

| Police Report | Local Law Enforcement | Supporting evidence for complex cases (mortgage/auto fraud) | Varies by jurisdiction |

Navigating documentation requirements demands precision. For affidavit preparation support and police report coordination, utilize fixcreditscenter’s case management tools.

【Tracking Fraudulent Activity】

![]()

After establishing formal documentation through your FTC Identity Theft Report and police case, systematically tracking fraudulent activity becomes essential. This phase identifies all compromised accounts and transactions, enabling targeted disputes to reverse credit damage.

Analyze All Credit Reports

Credit reports from all three major bureaus (Equifax, Experian, and TransUnion) serve as your primary fraud-detection tool. Discrepancies between reports often reveal unauthorized accounts or inquiries that require immediate action.

How to access free weekly reports

Under 2025 regulations, consumers can obtain free weekly credit reports—a critical upgrade for ongoing fraud monitoring. Follow this process:

- Access via AnnualCreditReport.com: The only FTC-authorized source for free reports; avoid third-party services that may charge fees.

- Compare reports side-by-side: Download PDFs from all three bureaus and scrutinize differences in:

- New accounts opened without your consent

- Hard inquiries from unfamiliar lenders

- Address or employment changes you didn’t authorize

- Document inconsistencies: Note bureau-specific errors (e.g., Experian showing an account not on TransUnion) for disputes.

| Bureau | Report Access Method | Key Fraud Indicators to Check |

|---|---|---|

| Equifax | AnnualCreditReport.com | Unfamiliar credit cards/loans, address changes |

| Experian | AnnualCreditReport.com | Suspicious inquiries, employment history edits |

| TransUnion | AnnualCreditReport.com | New collection accounts, altered personal details |

Pro tip: Set calendar reminders for weekly checks; fraudsters often test small transactions before major theft.

Scrutinize Financial Statements

Bank and credit card statements contain subtle fraud patterns that credit reports may miss. Regular review catches emerging threats before they escalate.

Identifying subtle fraud patterns

Fraudsters use small, repeated transactions to avoid detection—monitor statements for these red flags:

- Check unrecognized vendors via Google: Search merchant names to verify legitimacy; scammers often use ambiguous business titles (e.g., “Global Services Inc.”).

- Document transaction dates/amounts: Record exact details (date, amount, vendor) for each suspicious entry. Cross-reference with your location/activities during that period.

- Spot micro-transactions: Look for sub-$10 charges (e.g., $2.99 app subscriptions)—common “test runs” before larger thefts.

For comprehensive statement analysis and automated fraud alerts, streamline your process with fixcreditscenter’s financial monitoring toolkit.

【Disputing Fraudulent Items】

Once fraudulent activity is documented and tracked through your credit reports and financial statements, initiating formal disputes is the critical next step. This requires coordinated action with creditors and credit bureaus to remove unauthorized items and halt further damage.

Contact Creditors Directly

Immediately notify creditors of fraudulent accounts or transactions in your name. Legally, they must investigate and respond within 30 days of receiving your dispute. Direct creditor contact often resolves issues faster than bureau disputes alone.

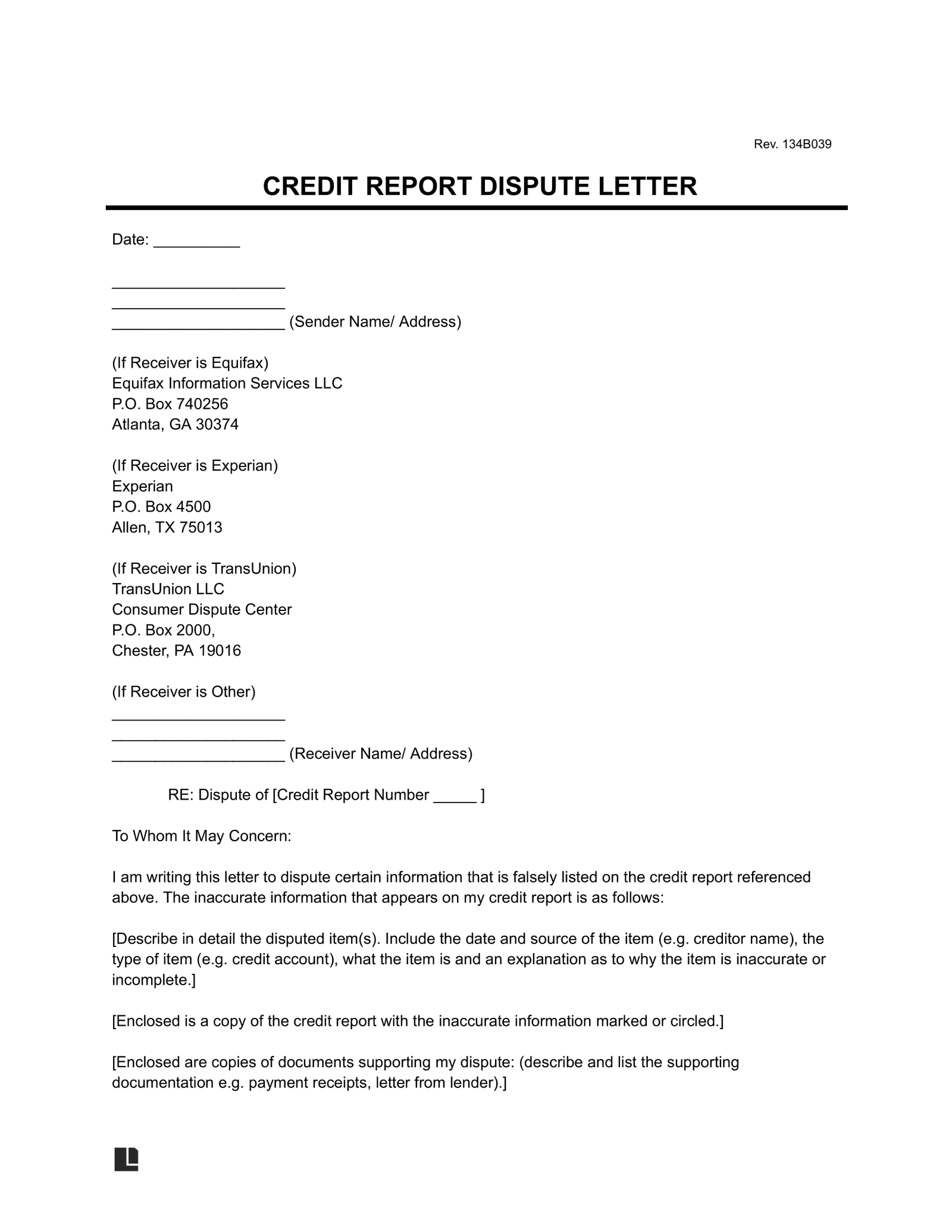

Sample dispute letter framework

A legally effective dispute letter must include specific elements to trigger investigation requirements under the Fair Credit Reporting Act (FCRA). Use this structure:

- Header: Your contact information, date, creditor’s fraud department address

- Subject Line: “Dispute of Fraudulent Account: [Account Number]”

- Body:

- State the account is fraudulent and opened without your consent

- Reference your FTC Identity Theft Report number

- Include police case number and jurisdiction

- Demand:

- Account closure

- Removal of associated fees/charges

- Written confirmation of closure and $0 liability

- Enclosures:

- Copy of FTC Identity Theft Affidavit

- Relevant police report pages

- Proof of identity (e.g., driver’s license copy)

Send via certified mail: This creates a legal paper trail. Retain return receipts.

Dispute with Credit Bureaus

Concurrently file disputes with all three credit bureaus (Equifax, Experian, TransUnion). Bureaus must investigate within 30 days and remove unverifiable items. Submit disputes online for faster tracking, but supplement with mailed documentation.

Three essential evidence pieces

Credit bureaus require specific documentation to validate fraud claims. Include these in every dispute:

- FTC Identity Theft Affidavit Copy

- Download from IdentityTheft.gov after completing your report

- Ensure your case number is visible

- Police Report Documentation

- Include the first page with case number, your name, and agency seal

- Highlight sections describing the identity theft

- Proof of Identity

- Government-issued ID (driver’s license/passport)

- Utility bill or bank statement showing current address

| Dispute Channel | Required Evidence | Submission Method |

|---|---|---|

| Creditors | FTC Report, Police Case #, ID Proof | Certified Mail + Online Portal |

| Credit Bureaus | FTC Affidavit, Police Report, ID Proof | Online Dispute Center + Certified Mail |

Consolidate evidence submission and track dispute deadlines efficiently using fixcreditscenter‘s automated document management system.

【Long-Term Credit Repair】

Remove Hard Inquiries

Unauthorized hard inquiries caused by identity theft can lower your credit score. A strategic two-phase dispute process is essential for removal:

Two-phase dispute strategy

-

Phase 1: Contact the Initiating Creditor (2025)

- Identify the creditor who pulled your credit without authorization using your free annual credit reports (visit AnnualCreditReport.com).

- Send a certified letter demanding immediate removal of the inquiry. Include:

- Copy of your FTC Identity Theft Report (case number visible)

- Relevant police report pages

- Statement confirming you did not apply for credit with them

- Legally, creditors must investigate and respond within 30 days. Request written confirmation of the inquiry’s removal.

-

Phase 2: Escalate to Credit Bureaus

- If the creditor doesn’t remove the inquiry within 30 days, file disputes directly with Equifax, Experian, and TransUnion.

- Submit disputes online via each bureau’s portal and send supporting documents (FTC Report, police report, proof of ID, creditor response if any) via certified mail.

- Clearly state the inquiry is fraudulent and resulted from identity theft. Reference your previous communication with the creditor.

- Credit bureaus must investigate within 30 days and remove unverifiable inquiries.

| Dispute Target | Required Evidence | Key Action | Deadline (2025) |

|---|---|---|---|

| Creditor | FTC Report, Police Report, Proof of ID | Demand removal via certified mail; cite lack of application authorization. | 30-day response |

| Credit Bureau(s) | FTC Report, Police Report, Proof of ID, Creditor Correspondence (if any) | File online dispute + mail evidence package; reference creditor dispute. | 30-day investigation |

Consistent tracking of these disputes is vital. Platforms like fixcreditscenter offer automated dispute tracking and deadline alerts to ensure no step is missed.

Update Recurring Payments

Identity theft disruption often causes legitimate recurring payments (utilities, subscriptions, loans) to be missed during account closures and transitions. Preventing these payment lapses is crucial for rebuilding positive payment history.

Preventing legitimate payment misses

-

Immediate Account Review (2025):

- List all recurring payments linked to compromised accounts (checking/savings, credit cards).

- Contact each service provider before your compromised payment account closes. Update them with your new, secure payment information immediately upon opening replacement accounts.

-

Set Up Automatic Payments:

- Enroll in autopay through your bank’s bill pay service or directly with the service provider for essential bills (mortgage/rent, utilities, car loan, insurance).

- Safeguard Tip: Use a dedicated, low-limit credit card only for subscriptions to limit exposure if compromised again. Monitor this card closely.

-

Proactive Payment Management:

- Calendar Reminders: Set multiple reminders (email, phone) 3-5 days before non-autopay bills are due.

- Account Buffer: Maintain a small buffer in your checking account to cover minor autopay fluctuations.

- Monthly Verification: Dedicate time each month (e.g., the 1st) to verify all autopays processed correctly and no legitimate payments were missed due to the identity theft fallout. Re-establishing a flawless 12-month payment history significantly boosts your recovering score. Tools provided by fixcreditscenter can streamline tracking payment due dates across multiple accounts post-theft.

【Preventing Future Identity Theft】

Successfully resolving identity theft credit damage is only half the battle. Implementing robust preventative measures is essential to shield your rebuilt credit and personal information from future compromise. Proactive monitoring and enhanced digital security form the cornerstone of this defense.

Proactive Credit Monitoring

Continuous surveillance of your credit reports and personal information is non-negotiable in 2025. Effective monitoring services act as your early warning system.

Choosing effective protection services

Selecting the right service requires scrutiny beyond basic credit report access. Prioritize these capabilities:

- Dark web scanning capabilities: Essential services continuously scour dark web marketplaces, hacker forums, and private chat groups where stolen personal data (SSNs, bank logins, medical IDs) is traded. Look for services providing automated alerts if your data surfaces, specifying the type of data compromised (e.g., “Your email + password detected in breach XYZ,” “SSN found on dark web marketplace ABC”).

- Real-time fraud alerts: The fastest notification is critical. Ensure the service offers immediate alerts via multiple channels (SMS, email, app push) for key activities:

- New credit inquiries or accounts opened in your name

- Changes of address filed with lenders or bureaus

- Court records or payday loan applications linked to your identity

- Large withdrawals or transfers from linked bank accounts

- Suspicious activity on existing accounts (e.g., maxed-out credit lines).

| Service Feature | Why It Matters in 2025 | What to Look For |

|---|---|---|

| Dark Web Scanning | Identifies compromised data before it’s used for fraud, allowing preemptive action. | Continuous monitoring, specific data breach details, actionable remediation steps. |

| Real-Time Alerts | Minimizes damage by enabling immediate response to fraudulent activity. | Multi-channel alerts (SMS/email/push), coverage for inquiries/accounts/address changes. |

| Credit Lock/Freeze | Prevents new credit from being opened without your explicit authorization. | Easy, instant bureau freezes/unfreezes via the service dashboard. |

Services like those offered through fixcreditscenter integrate these critical features with dispute management tools, creating a unified defense against identity theft recurrence.

Strengthen Digital Security

Your digital habits are often the first line breached by identity thieves. Fortifying these is paramount.

Essential privacy safeguards

Implementing fundamental security practices drastically reduces your vulnerability:

- Password managers with 2FA: Relying on memory or simple passwords is unsustainable. Use a reputable password manager to generate and store unique, complex passwords (12+ characters, mix of letters/numbers/symbols) for every online account. Crucially, enable Two-Factor Authentication (2FA) on the password manager itself and on every account supporting it (especially email, banking, credit bureaus, social media). In 2025, authenticator apps (like Google Authenticator or Authy) or physical security keys (YubiKey) are significantly more secure than SMS-based 2FA, which is vulnerable to SIM-swapping attacks.

- VPN usage on public networks: Public Wi-Fi (coffee shops, airports, hotels) is inherently insecure. Hackers can easily intercept data transmitted over these networks. Always use a reputable Virtual Private Network (VPN) on public Wi-Fi to encrypt your internet traffic, shielding login credentials, financial transactions, and browsing activity. Choose a VPN provider with a strict no-logs policy and strong encryption protocols (like WireGuard or OpenVPN). Avoid free VPNs, as they often monetize user data. Remember, a VPN protects data in transit but does not replace the need for strong endpoint security (antivirus) and safe browsing habits.

[object Object]