Struggling with bad credit and high-interest debt? In 2025, balance transfer cards for subprime borrowers come with steep fees and strict requirements. Can you still save money? Here’s what you must know.

【Understanding Your Odds】

Navigating balance transfer credit cards with bad credit requires a clear grasp of the challenges ahead. As of 2025, issuers often view subprime applicants as high-risk, making approval tougher and terms less favorable. Let’s break down the key roadblocks and cost trade-offs you’ll likely encounter.

Why Bad Credit Creates Roadblocks

A low credit score signals higher risk to lenders, leading to stricter requirements and costlier terms. This can turn balance transfers—which aim to save money—into a frustrating ordeal.

Minimum Credit Score Requirements

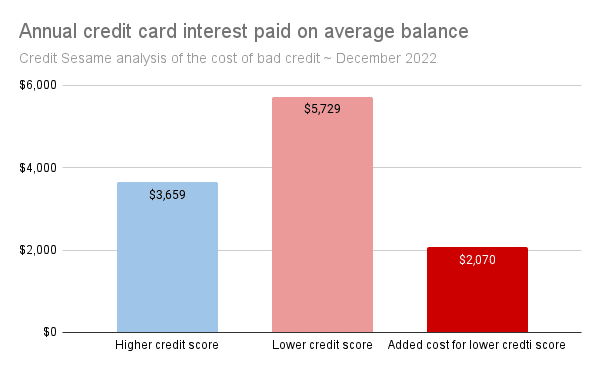

Most card issuers set strict thresholds for their best offers. For instance, to access 0% APR introductory deals, you typically need a FICO score of 670 or higher. If your credit falls into the subprime range (below 670), you’ll often face standard APRs of 25% or more after the intro period ends. This high interest can quickly erode any potential savings, especially if you carry a balance long-term.

The Fee vs. Savings Dilemma

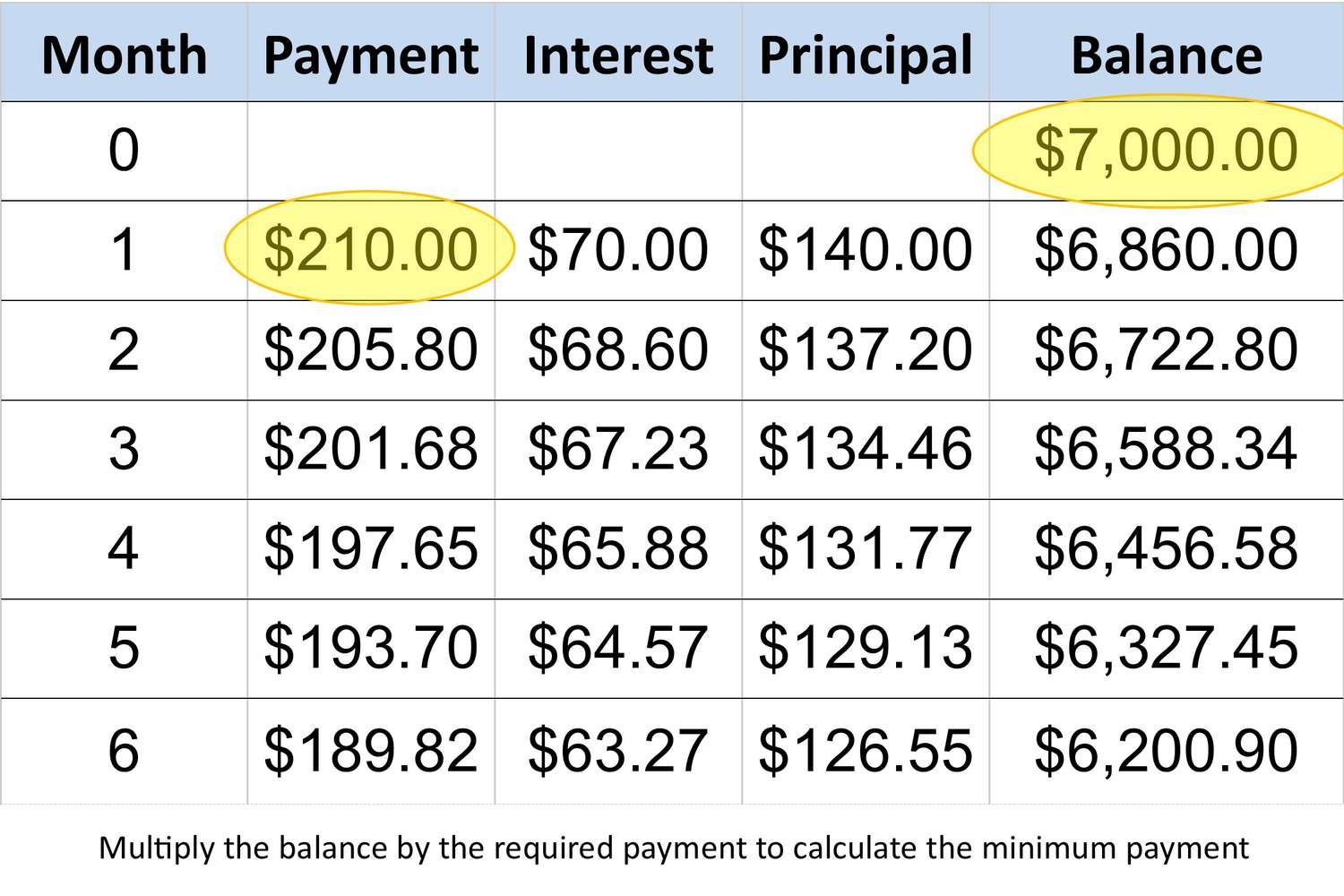

Even if you qualify for a balance transfer card with bad credit, fees can undermine the benefits. It’s a common pitfall where upfront costs eat into your debt-reduction efforts, forcing a careful evaluation of whether the transfer truly pays off.

Typical Balance Transfer Costs

Balance transfers aren’t free—they come with built-in fees that add up fast. Expect charges of 3% to 5% of the transferred amount, with minimums around $15 or maximums capped at $5 per transaction. On top of that, annual fees are a frequent burden; as of 2025, 78% of subprime cards impose fees of $95 or more. These costs can negate savings from lower APRs, especially on smaller balances.

For personalized advice on improving your credit and exploring tailored solutions, visit fixcreditscenter.com.

【Realistic Alternatives】

Facing hurdles with traditional balance transfer cards doesn’t mean you’re out of options. If your credit score falls below 670 in 2025, alternative strategies exist that can rebuild credit while managing debt more effectively. These paths often involve upfront costs or commitments but provide structured progress where standard balance transfers may fail.

Secured Credit Cards That Help

Secured cards are a practical entry point for rebuilding credit when unsecured cards are out of reach. By requiring a refundable security deposit, issuers mitigate risk while giving you a chance to demonstrate responsible use.

How Security Deposits Work

Your deposit directly determines your credit limit—typically ranging from $200 to $500. Unlike application fees, this money remains yours and is refunded when you close the account in good standing or upgrade to an unsecured card. Crucially, your payment activity is reported to all three major credit bureaus. Cards like the Discover it® Secured offer a clear path: they automatically review your account after six on-time payments and may refund your deposit while converting you to an unsecured card with a higher limit.

Debt Consolidation Options

For those juggling multiple high-interest debts, consolidation through credit counseling can offer breathing room. This approach focuses on restructuring payments rather than transferring balances to new credit lines.

Credit Counseling Pros/Cons

Nonprofit credit counseling agencies provide free initial consultations to assess your situation. If suitable, they may enroll you in a Debt Management Plan (DMP). Here’s the trade-off:

| Advantage | Drawback |

|---|---|

| Negotiated lower APRs (as low as 8% in 2025) | Requires closing most credit card accounts |

| Single fixed monthly payment | Plan fees (~$50/month) apply |

| Potential credit score recovery | Strict adherence required (no new credit) |

DMPs simplify repayment and reduce interest costs, but they demand discipline. For those needing structured support without new credit applications, this can be a viable alternative to high-fee balance transfer cards.

Exploring these alternatives requires careful alignment with your financial habits. For tailored strategies to improve your credit profile and evaluate all consolidation options, connect with experts at fixcreditscenter.com.

【Damage Control Strategies】

When balance transfers for bad credit backfire—often due to high post-intro APRs or unexpected fees—immediate intervention prevents minor setbacks from becoming long-term crises. Understanding common pitfalls and having concrete response plans is crucial.

When Transfers Go Wrong

Balance transfers demand meticulous execution. A 2025 CreditCards.com study revealed 63% of users accumulate new debt on paid-off cards within four months of completing a transfer, nullifying their progress. This typically stems from:

- Underestimating post-intro APRs (often 25%+ for bad credit cards)

- Overlooking balance transfer fees (3-5% per transaction)

- Failing to budget for monthly payments during the intro period

The Revolving Debt Trap

Consider this real-world scenario:

You transfer $3,000 to a card with a 12-month 0% intro APR and a 5% transfer fee ($150). Minimum payments cover interest only. When the intro period ends:

- Your remaining $2,900 balance accrues interest at 27% APR

- Monthly interest charges jump to $65.25

- Without increased payments, you’ll pay $1,200+ in interest over three years

This cycle worsens if new charges compound the debt. Breaking it requires either accelerated repayment or external negotiation.

Emergency Rate Negotiation

When trapped in high-interest debt, direct creditor negotiation is an underused tool. 2025 data from the Consumer Financial Protection Bureau shows 41% of cardholders secured APR reductions by contacting issuers, with success rates doubling for long-standing customers.

Scripts That Work With Creditors

Prepare these key phrases before calling:

- Establish loyalty:

“I’ve been a customer for [X] years and value this relationship. My recent financial hardship [briefly cite job loss/medical issue] makes my current 27% APR unsustainable.” - Propose terms:

“Could you reduce my APR to 18% for 12 months? This would let me pay $[amount] monthly and clear the balance faster.” - Leverage alternatives:

“Without this adjustment, I’ll need to explore debt management plans or credit counseling, which might close my account.”

Document every call with representative names, dates, and offered terms. If rejected, escalate to a supervisor or retry during quarterly billing cycles when issuers have more negotiation flexibility.

For persistent high-interest debt, professional guidance can secure lasting solutions. Explore structured repayment options through accredited advisors at fixcreditscenter.com.

【Rebuilding Credit Pathways】

While damage control stops backsliding, strategic rebuilding transforms bad credit into fair credit within 12–24 months. Focused management of two FICO pillars—payment history and credit utilization—creates sustainable progress.

Credit Score Improvement Timeline

Recovery isn’t linear, but 2025 TransUnion data shows consistent on-time payments + utilization control lift scores 60–110 points in 18 months for subprime borrowers.

Payment History Dominance

35% of your FICO score relies exclusively on payment timeliness. One 30-day delinquency can slash 100+ points from a 680 score. Automation prevents oversight:

- Set up autopay for minimum payments as a safety net

- Schedule manual payments 3 days before due dates for active debt reduction

- Use calendar alerts for all cards, even inactive ones (annual fees can trigger missed payments)

Key Insight: Payment history repairs slower than utilization. A 2025 FICO study notes 6 consecutive on-time payments typically offset one recent delinquency.

Utilization Ratio Fixes

Your second-largest scoring factor (30%) responds rapidly to adjustments. Maxing cards signals risk, even if paid monthly.

The 30% Threshold Rule

FICO penalizes utilization above 30% per card and across all cards. For a $1,000 limit card:

- $300 balance = 30% utilization (ideal reporting)

- $301 balance = immediate score drop

- $0 balance = slightly less optimal than 1–9%

| Credit Limit | Max Target Balance | Impact if Exceeded |

|---|---|---|

| $500 | $150 | -15 to -40 points |

| $2,000 | $600 | -10 to -30 points |

| $5,000+ | $1,500 | -5 to -20 points |

Biweekly Payments Trick:

Card issuers report balances to bureaus monthly, often on your statement date. Pay down balances twice monthly:

- Pay 50% of planned monthly payment 3 days before statement date

- Pay remaining 50% by due date

This ensures bureaus see lower utilization (e.g., $200 reported vs. $400 actual monthly spend).

Rebuilding requires precision tools. For personalized utilization strategies and creditor negotiation support, consult experts at fixcreditscenter.com.

【Smart Next Steps】

Pre-Qualification Checks

Soft Pull Limitations

Pre-qualification tools use “soft pulls” that don’t harm your credit score, making them ideal for assessing balance transfer card options without risk. However, 2025 industry data reveals these checks have only 50% accuracy for bad credit applicants, meaning half of pre-qualified offers may still lead to denials after formal applications. This inaccuracy stems from lenders’ conservative algorithms for subprime profiles, where factors like recent delinquencies or high utilization aren’t fully captured. For a realistic preview, leverage Capital One’s pre-approval tool—it analyzes your credit profile anonymously and displays likely balance transfer offers, including potential fees and APRs, though final approval isn’t guaranteed. Always cross-check multiple sources to avoid false hopes and wasted hard inquiries.

When To Avoid Transfers

Balance transfers aren’t universally beneficial—calculating the break-even point prevents costly mistakes if your credit health isn’t ready.

The Break-Even Calculator

Use this formula to determine if a transfer saves money: (Transfer fee ÷ Monthly interest saved) = Months to profit. For example, with a $150 transfer fee and $45 in monthly interest savings from a lower APR card, the calculation is $150 ÷ $45 = 3.4 months. If you can’t pay off the transferred balance before this break-even point, the fee outweighs the savings, potentially worsening debt. In 2025, FICO reports show consumers with scores below 600 often face longer break-even periods due to higher fees; avoid transfers if your timeline exceeds 4–6 months or if emergency funds are tight. For tailored calculations and debt strategy reviews, explore resources at fixcreditscenter.com.

[object Object]