Did you know using a cashback card responsibly can boost your credit score by 30+ points? Discover how secured cards with rewards rebuild credit through on-time payments and low utilization in 2025.

【Why Cashback Cards Help Rebuild Credit】

Responsible Spending Builds Positive History

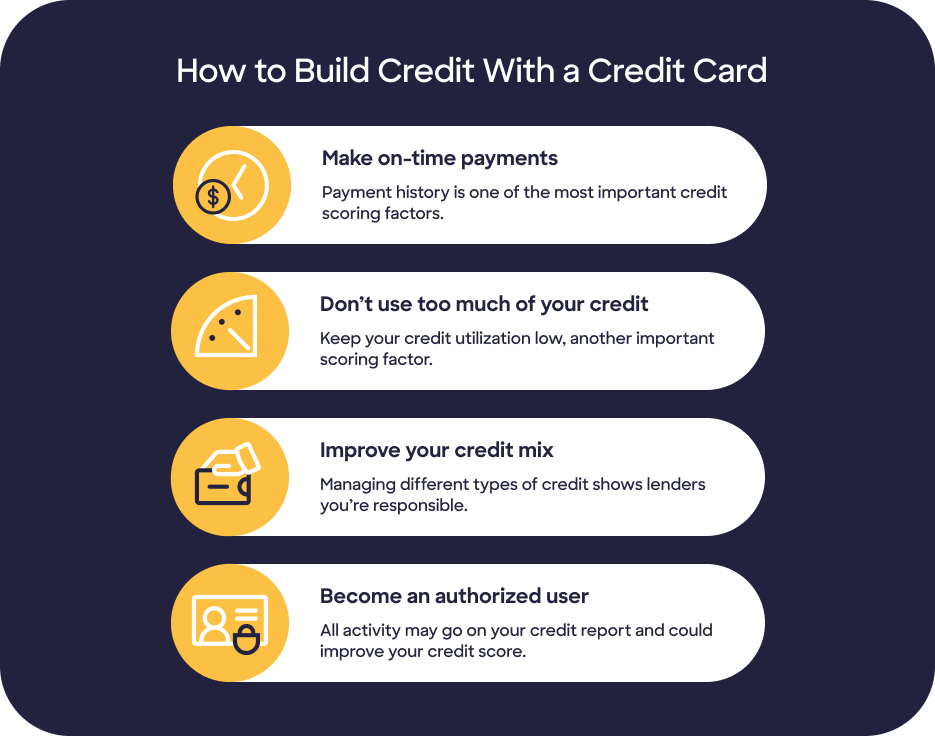

Using a cashback credit card responsibly is one of the most effective tools for rebuilding your credit profile in 2025. The core mechanics of credit scoring reward consistent, on-time payments and controlled borrowing – exactly what these cards facilitate when managed well. Here’s how responsible use directly impacts the largest factors in your FICO® Score:

Key credit factors improved by card use

- Payment History (35% of FICO score): This is the single most crucial factor. Every single on-time payment you make with your cashback card gets reported to the major credit bureaus (Experian, Equifax, TransUnion). Setting up autopay for at least the minimum payment is a powerful safeguard against missed payments, steadily building a positive history over time. Consistency here is key.

- Credit Utilization Ratio (30% of score): This measures how much of your available credit you’re using. Low utilization (generally under 30%, ideally under 10%) signals responsible credit management. Cashback cards provide a revolving credit line. By making small, planned purchases you know you can pay off immediately, and then paying the statement balance in full by the due date, you keep this ratio low. This demonstrates you can access credit without overextending yourself.

Impact of Responsible Cashback Card Use on Credit Factors:

| Credit Factor | Weight in FICO® Score | How Cashback Card Use Helps | Key Action for Rebuilders |

|---|---|---|---|

| Payment History | 35% | Reports positive history with each on-time payment. | Always pay on time (set autopay minimum). |

| Credit Utilization | 30% | Provides revolving credit; low balances reported when paid off keep utilization ratio low. | Keep balances very low & pay in full. |

| Credit Age | 15% | Adds a new active account; contributes to average age over time. | Keep the account open long-term. |

| Credit Mix | 10% | Adds a type of credit (revolving) to your profile. | Diversifies your credit types. |

| New Credit | 10% | The initial application causes a hard inquiry (small, temporary dip). | Apply strategically, not frequently. |

Rewards Motivate Consistent Usage

Beyond the core credit-building mechanics, cashback rewards offer a unique psychological advantage for those focused on rebuilding: they provide tangible, immediate positive reinforcement for using the card responsibly. This motivation is crucial for establishing the consistent usage patterns needed for long-term credit improvement.

Cashback encourages regular small purchases

- The prospect of earning cash back on everyday spending (like groceries, gas, or streaming services) incentivizes you to use the card for planned, budgeted expenses you would make anyway with cash or debit. This regular activity is vital.

- Example: Swiping your cashback card for a predictable $25-$50 monthly grocery charge, then paying that full balance off by the due date, accomplishes multiple goals simultaneously:

- It reports a positive payment to the bureaus.

- It reports a low balance, keeping your utilization ratio healthy.

- It earns you a small reward (e.g., $0.50 – $1.00 back).

- It keeps the account active and reporting positive data monthly.

- Avoids inactivity account closure: Credit card issuers may close accounts that sit unused for extended periods. A closed account, especially a newer one, can negatively impact your average account age and overall available credit, hurting your utilization ratio. Regular, small, responsible purchases funded by cashback rewards prevent this inactivity, ensuring the account remains open and contributing positively to your credit history over the long term. Consistent, manageable usage is far more beneficial for rebuilding than sporadic large purchases or letting the card gather dust.

The combination of building positive payment history, maintaining low utilization, and keeping the account actively contributing to your credit age creates a powerful foundation for score improvement. The cashback rewards act as a helpful nudge, making this necessary credit-rebuilding activity feel more rewarding in the short term while you work towards the larger goal of a healthier credit profile. For personalized strategies on optimizing your credit repair journey in 2025, consider consulting resources available at https://fixcreditscenter.com.

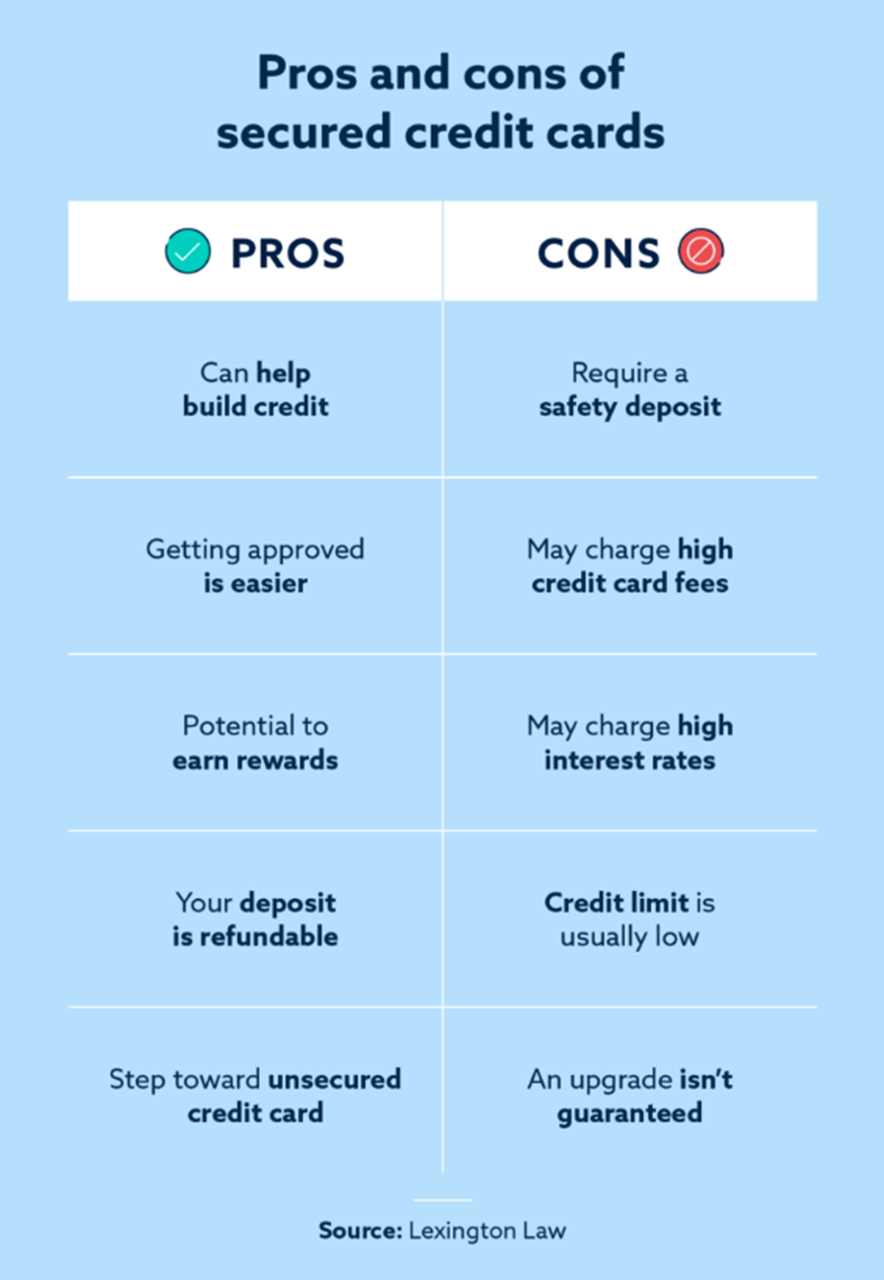

【Best Secured Cashback Cards】

Secured credit cards require a refundable security deposit, which becomes your credit limit. This makes them accessible for credit rebuilding while offering cashback rewards. Choosing the right secured card combines credit-building fundamentals with tangible rewards, reinforcing the responsible habits discussed earlier. Here are top contenders for 2025:

Discover it® Secured Credit Card

This card stands out for its robust rewards and clear path to transitioning to an unsecured card.

Rewards structure & credit benefits

- Earn 2% cash back at Gas Stations and Restaurants (on up to $1,000 in combined purchases each quarter), plus 1% cash back on all other purchases. This structure rewards common, budgeted spending categories.

- Automatic reviews for graduation: Starting at 7 months, Discover automatically reviews your account monthly for responsible usage (like consistent on-time payments and low utilization). Upon graduation, you receive your deposit back and the card converts to an unsecured cashback card, continuing to report positive history. This systematic review process is a major advantage for rebuilders aiming to transition away from secured cards.

No annual fee advantage

- $0 yearly cost: Unlike many secured cards that charge annual fees (often around $35), the Discover it® Secured card has no annual fee. This maximizes the value of your cashback earnings and reduces the cost of rebuilding credit.

- First-year cashback match: Discover matches all the cash back you earn at the end of your first year as a new cardmember. This effectively doubles your first-year rewards, providing significant extra value as you establish positive credit habits.

Capital One Quicksilver Secured Cash Rewards

This card offers simplicity with flat-rate rewards and flexible deposit options.

Lower deposit flexibility

- Accessible deposit amounts: Depending on your creditworthiness, you may be approved with a security deposit of $49, $99, or $200 to establish an initial credit line of $200. This lower potential deposit requirement makes it easier to get started compared to cards requiring a deposit equal to the full credit line.

- Possible credit limit increase at 6 months: Capital One may automatically review your account after 6 months of responsible use (on-time payments, low balances). If approved, you can receive a higher credit limit without needing to add to your initial deposit. A higher limit further aids in maintaining a low credit utilization ratio.

Flat-rate rewards simplicity

- 1.5% cash back on all purchases: Earn unlimited 1.5% cash back on every purchase, every day. There are no rotating categories or spending caps to track. This simplicity makes it easy to earn rewards on all your planned spending without complication.

- 5% cash back on Capital One Travel bookings: Earn an elevated 5% cash back on hotels and rental cars booked through Capital One Travel. This provides extra value for occasional travel expenses.

| Card Feature Comparison (2025) | Discover it® Secured | Capital One Quicksilver Secured |

|---|---|---|

| Min. Security Deposit | $200 (Determines credit line) | $49, $99, or $200 (for $200 line) |

| Rewards Rate | 2% Gas/Restaurants ($1k/qtr), 1% else | 1.5% on all purchases |

| Annual Fee | $0 | $0 |

| Path to Graduation/Unsecured | Automatic review starting at 7 months | Potential CLI review at 6 months |

| Key Psychological Benefit for Rebuilders | High rewards potential + clear graduation path | Lower deposit entry + simple flat rewards |

Both cards effectively leverage cashback rewards to incentivize the consistent, responsible card usage essential for rebuilding credit – reporting on-time payments, enabling low utilization, and keeping accounts active. The Discover card excels with higher potential rewards in key categories and a defined graduation timeline, while the Capital One card offers greater initial deposit flexibility and straightforward flat-rate earnings. Selecting the card that best aligns with your spending patterns and deposit capability helps turn necessary credit-building actions into a more rewarding process. For tailored advice on integrating these tools into your broader 2025 credit recovery plan, explore strategies at https://fixcreditscenter.com.

【Managing Your Rebuilding Card】

Successfully using your secured cashback card to rebuild credit hinges on consistent, responsible habits. While the rewards are a nice perk, the core focus remains demonstrating reliability to credit bureaus. Here’s how to optimize usage and sidestep common traps.

Optimizing Credit Utilization

Your credit utilization ratio – the percentage of your credit limit you’re using – is a major factor in your credit score. Keeping it low signals control.

Keeping balances below 30% limit

- The Golden Rule: Aim to keep your reported statement balance below 30% of your credit limit. For example, with a $300 limit, your balance should ideally be $90 or less when the statement closes. Lower utilization (under 10%) is even better for scoring.

- Multiple monthly payments strategy: Don’t wait for the due date. Make multiple small payments throughout the month, especially after larger purchases. This actively keeps your reported balance low and minimizes utilization, even if you spend close to your limit within a billing cycle. Set calendar reminders or use app alerts to stay on track.

Avoiding Common Pitfalls

Rebuilding credit requires vigilance against costly mistakes that can undo your progress.

High-interest danger zones

- Carrying a balance is costly: Secured cards often carry high APRs, typically ranging from 27% to 30% in 2025. Carrying even a small balance month-to-month quickly erases any cashback earned and adds significant debt. Always pay your statement balance in full by the due date.

- Late payment double-whammy: Missing a payment triggers a late fee (averaging around $40) and significantly damages your credit score. Payment history is the most crucial scoring factor. Set up autopay for at least the minimum due as a safety net.

Fee minimization tactics

- Prioritize $0 annual fee cards: As highlighted with cards like the Discover it® Secured and Capital One Quicksilver Secured, choosing a card with no annual fee is paramount. This ensures your cashback earnings aren’t negated and reduces the overall cost of rebuilding. Avoid cards charging annual fees unless the benefits demonstrably outweigh the cost (rare for secured cards).

- Steer clear of cash advances: Cash advances typically start accruing high interest immediately (often even higher than purchase APR) and usually come with fees (e.g., 3-5% of the advance amount). They offer no rewards and harm utilization. Use your card solely for planned purchases you can pay off.

Managing your secured card wisely transforms it from a simple tool into a powerful engine for credit recovery. By diligently controlling utilization, paying in full, avoiding fees, and sidestepping high-cost traps, you maximize the positive reporting impact. For personalized strategies on integrating these cards into your broader 2025 credit improvement journey, discover actionable plans at https://fixcreditscenter.com.

【Rebuilding Credit Timeline】

Understanding the realistic timeframe for credit score improvement helps manage expectations and identify strategic milestones, like seeking credit limit increases. Consistent, responsible use of secured cashback cards builds positive payment history and lowers utilization – the key drivers for score gains.

Realistic Score Improvement Expectations

While individual results vary significantly based on your starting point and overall credit profile, data from major secured card issuers provides benchmarks:

Average point gains with responsible use

Responsible use means paying your statement balance in full every month and maintaining low utilization (ideally under 30%, preferably under 10%). Based on reported user data:

| Card Provider | Timeframe | Avg. FICO® Score Increase | Key Responsible Use Factors |

|---|---|---|---|

| Discover | 6 months | +30 points | On-time payments, <30% utilization |

| OpenSky | 6 months | +47 points | On-time payments, low utilization |

- Important Context: These are averages. Your increase depends on your unique credit history (e.g., severity/duration of past issues). Gains are often faster initially as new positive habits offset recent negatives. Continued responsible use beyond 6 months yields further, though potentially slower, improvements. Patience and consistency are non-negotiable.

When to Seek Credit Line Increases (CLIs)

A higher credit limit is a powerful tool. It directly improves your credit utilization ratio when you maintain similar spending levels. Timing your request strategically increases approval odds.

Qualification indicators

Lenders look for clear proof of reliability before granting a CLI on a secured card or considering an unsecured product change:

- Sustained On-Time History: 6+ months of consecutive on-time payments is the absolute minimum baseline. A full year of perfect payments significantly strengthens your case. This demonstrates consistent reliability – the core factor lenders assess.

- Demonstrated Need & Ability: Increased, verifiable income (e.g., recent pay stubs, tax returns) shows you can handle more credit responsibly. Also, consistently using a significant portion of your current limit while still paying it off monthly indicates the need for more headroom to maintain low utilization.

Pre-approved upgrade opportunities

Many secured card issuers actively review accounts for graduation, often around the 7-12 month mark. Look for these signals:

- Product Change to Unsecured Cards: If you receive an offer to convert your secured card (e.g., Discover it® Secured, Capital One Quicksilver Secured) to its unsecured version without needing a new application, this is a major milestone. It typically includes:

- Security Deposit Refund: Your initial deposit is returned.

- Potential CLI: Often comes with a higher credit limit.

- Retained Benefits: You usually keep your account history and any earned rewards.

- Security Deposit Refund Processes: Some issuers may proactively refund your deposit while keeping the card open as unsecured, or invite you to apply for the refund after a period of good standing (e.g., 8-12 months). Check your cardholder agreement or online account for specific policies.

Successfully navigating the rebuilding timeline hinges on the disciplined habits outlined earlier – low utilization, full payments, and avoiding fees. Monitoring your progress and recognizing when you qualify for the next step, like a CLI or graduation, accelerates your recovery. For tailored strategies to optimize your secured card usage and transition to stronger credit products in 2025, explore comprehensive guidance at https://fixcreditscenter.com.

【Why Cashback Cards Help Rebuild Credit】

Secured cashback cards are uniquely effective tools for credit recovery. They offer the dual benefit of earning rewards while enforcing the disciplined financial habits crucial for score improvement. The structure of these cards – particularly the security deposit and lower initial limits – directly supports rebuilding core credit factors.

How responsible usage boosts scores

Rebuilding credit isn’t magic; it’s about consistently demonstrating reliability where it matters most to scoring models. Cashback cards incentivize this positive behavior.

Payment history impact

Your payment history is the single largest factor in your FICO® Score, making up 35%. Every single on-time payment reported from your secured cashback card adds a positive entry, gradually outweighing past negatives. Conversely, late payments can remain on your credit reports for up to 7 years, significantly hindering progress. Using a secured card ensures you can pay on time every month (by staying within your secured limit), making perfect payment history achievable and directly boosting this critical category.

Credit utilization strategies

Credit utilization (how much of your available credit you use) is the second most important factor, contributing about 30% to your score. Secured cashback cards typically start with lower credit limits, making utilization management both essential and manageable. Maintaining a balance below 30% of your available credit limit is crucial, with under 10% being ideal for optimal scoring. For example:

- A $300 secured credit line means you should strive to keep your statement balance below $90 (30%), and ideally below $30 (10%).

- Earning cashback rewards doesn’t require high spending; even small, regular purchases paid off monthly demonstrate responsible use while keeping utilization low. The cashback acts as a small reward for maintaining this key habit.

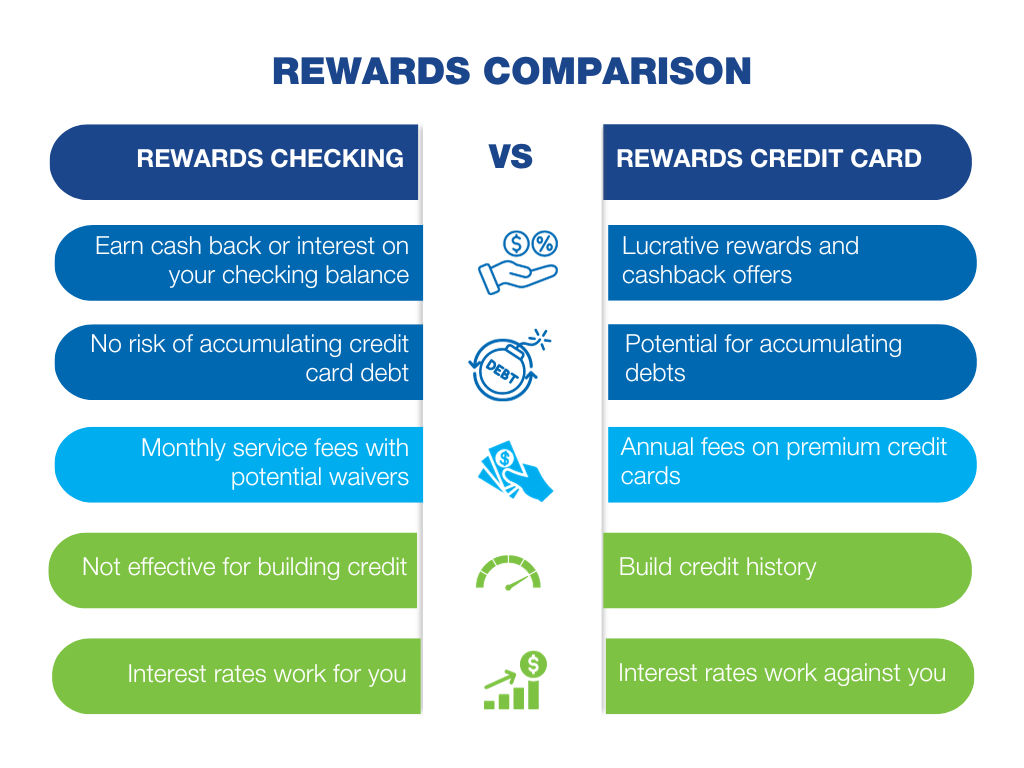

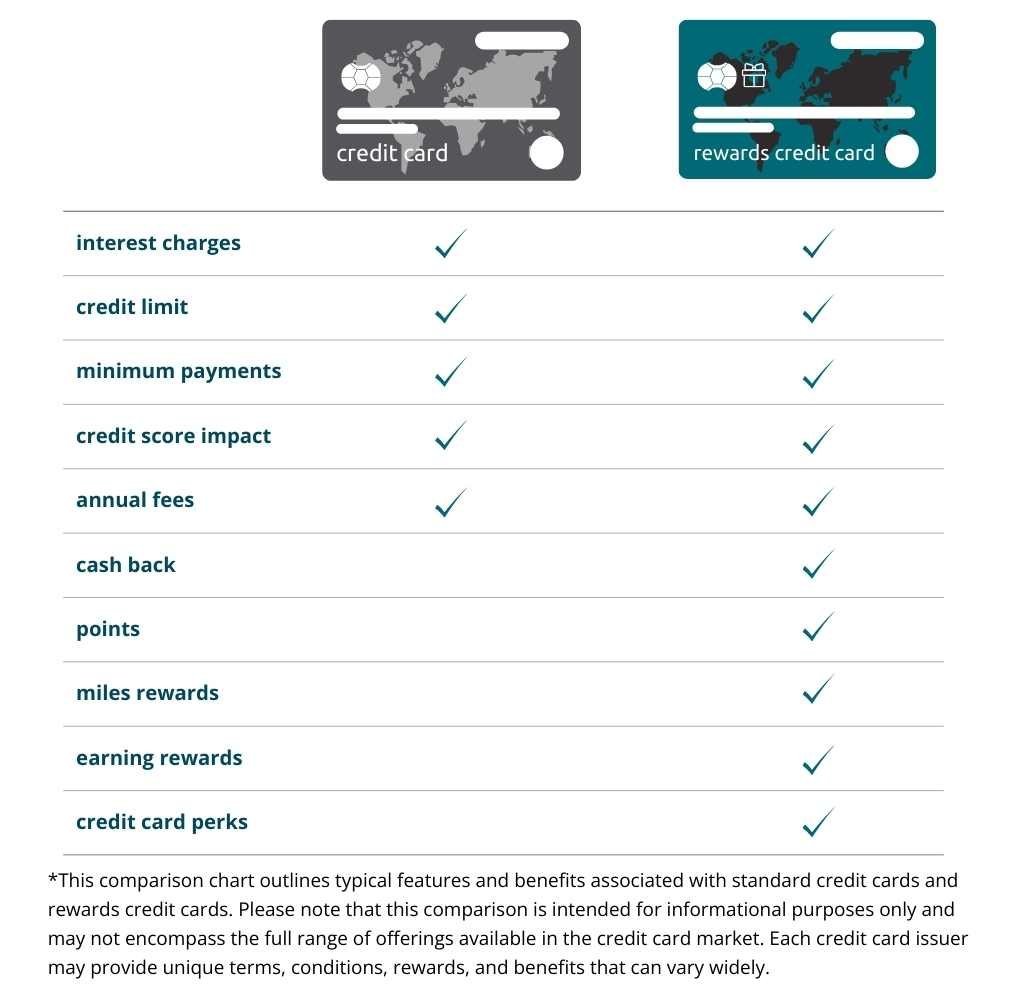

Secured vs unsecured card differences

Understanding the distinction between secured and unsecured cards is vital when rebuilding.

Security deposit requirements

The defining feature of a secured card is the refundable security deposit, which typically becomes your credit line.

- Typical deposits range from $49 to $300. This deposit minimizes risk for the issuer, allowing them to offer cards to those rebuilding.

- Options like the Capital One Platinum Secured Card offer a $49 minimum deposit (for a $200 credit line, subject to qualification), making initial access more affordable. Your deposit is generally refunded when you close the account in good standing or graduate to an unsecured card.

Approval rate comparison

Secured cards offer significantly higher approval odds for individuals with poor or limited credit history:

- Secured cards like the OpenSky® Secured Visa® Credit Card boast approval rates around 89% and often do not require a hard credit check, making them accessible even with recent major credit issues.

- Unsecured cashback cards, even basic ones, frequently require a fair credit score (typically 580+ FICO) for approval. For those actively rebuilding, applying prematurely for unsecured cards can result in denials and unnecessary hard inquiries, which temporarily lower your score.

Choosing the right secured cashback card and using it strategically tackles the core components of your credit score head-on. By focusing on consistent on-time payments and meticulous utilization management, you leverage the card’s structure to generate positive reporting data. This disciplined approach, rewarded with cashback, lays the concrete foundation for score gains. As your habits solidify and your score improves in 2025, transitioning to unsecured cards with better rewards becomes the natural next step. Discover tailored strategies to maximize your secured card’s impact and navigate your credit journey effectively at https://fixcreditscenter.com.

【Top Cashback Cards for Rebuilding Credit】

Rebuilding credit requires tools designed for the task. Secured cashback cards offer the crucial combination of manageable access, structured credit reporting, and tangible rewards for responsible use. These top picks for 2025 directly support the credit-building pillars discussed earlier – consistent on-time payments and low utilization – while putting cash back in your pocket.

Discover it® Secured Credit Card

This card stands out for its straightforward rewards and clear path to graduation.

Rewards structure details

- Earn 2% cash back at Gas Stations and Restaurants (on up to $1,000 in combined purchases each quarter, then 1%).

- Get unlimited 1% cash back on all other purchases.

- Discover automatically matches all the cash back you’ve earned at the end of your first year.

Credit building features

- Automatic account reviews start after 7 months to evaluate eligibility for graduating to an unsecured card and getting your deposit refunded.

- Reports your payment history monthly to all three major credit bureaus (Experian®, Equifax®, TransUnion®), ensuring your responsible use builds your score across the board.

Fees and requirements

- $0 annual fee.

- Minimum $200 refundable security deposit required to open your account (determines your credit line).

- 27.24% Variable APR applies after any introductory period. Crucially, paying your statement balance in full each month avoids interest charges.

| Feature | Detail |

|---|---|

| Rewards Rate | 2% Gas/Restaurants ($1k/qtr cap), 1% Elsewhere |

| Annual Fee | $0 |

| Min Deposit | $200 |

| Graduation | Reviews start at 7 months |

| Credit Bureaus | Reports to all three |

Capital One Quicksilver Secured

Ideal for those seeking simple, flat-rate cash back and potential for faster credit line growth.

Cashback earning potential

- Earn a solid unlimited 1.5% cash back on every purchase, every day – no categories to track or caps to worry about.

- Get 5% cash back on hotels and rental cars booked through Capital One Travel.

Rebuilding benefits

- Benefit from automatic credit line reviews every 6 months. Demonstrating responsible use (like on-time payments) can lead to a higher credit limit without requiring an additional deposit.

- Potential for deposit refund with responsible usage, even before fully graduating to an unsecured card in some cases.

Key specifications

- $0 annual fee.

- $200 minimum refundable security deposit (options to get a higher initial credit line with a larger deposit may be available).

- 29.74% Variable APR applies after any introductory period. Again, paying in full avoids interest.

| Feature | Detail |

|---|---|

| Rewards Rate | Unlimited 1.5% on all purchases |

| Annual Fee | $0 |

| Min Deposit | $200 |

| Credit Reviews | Automatic every 6 months |

| Travel Bonus | 5% back via Capital One Travel |

Chime Secured Credit Builder

A unique, mobile-first option requiring a Chime Checking Account but offering flexibility and no credit check.

Unique reward system

- Earn points redeemable for cash back instead of a traditional percentage-based reward.

- Access up to 7x points at over 14,000 participating merchants through the Chime Offers program, boosting your earning potential on everyday spending.

No credit check approval

- Requires an open Chime Checking Account and qualifying direct deposits into that account.

- No minimum security deposit required. Your spending limit is based on the amount you transfer from your Chime Checking Account to the secured account before you spend. This acts like a security deposit but offers more flexibility.

Credit reporting

- Reports your payment activity monthly to all three major credit bureaus (Experian®, Equifax®, TransUnion®).

- Chime users report seeing an average FICO® Score increase of 30 points after approximately 8 months of responsible use.

| Feature | Detail |

|---|---|

| Rewards | Points redeemable for cash, up to 7x via Offers |

| Annual Fee | $0 |

| Security Deposit | $0 Minimum (Funds secured via transfer) |

| Approval Check | No Credit Check (Requires Chime Account) |

| Reported Gain | Avg. +30 pts FICO® after 8 months |

Choosing the right secured cashback card depends on your spending patterns and which features align best with your rebuilding goals. Whether you prioritize category bonuses, flat-rate rewards, merchant offers, or minimal upfront costs, each of these cards provides a proven pathway to improve your credit profile throughout 2025. Remember, the key is consistent, responsible use: pay on time, keep utilization low, and let the positive reporting do its work. For personalized strategies on maximizing your chosen card’s impact and navigating the next steps in your credit recovery, explore the resources available at https://fixcreditscenter.com.

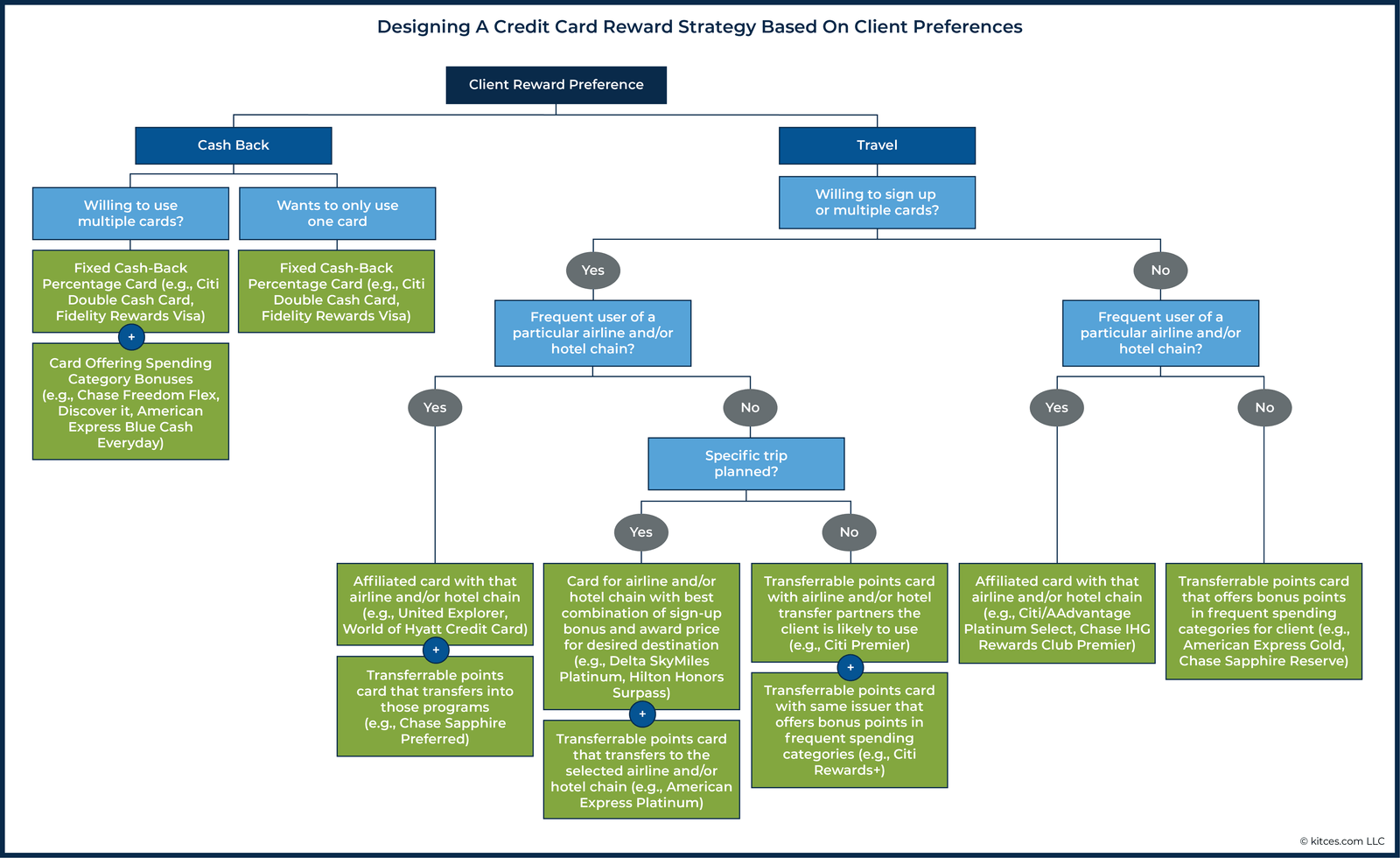

【Smart Card Usage Strategies】

Mastering your secured cashback card involves more than just swiping. Strategic use amplifies rewards while accelerating credit repair. These tactics turn everyday spending into credit-building power plays throughout 2025.

Maximizing rewards safely

Leverage your card’s structure without overspending or accruing interest.

Strategic spending categories

- Target bonus categories precisely: Use your Discover it® Secured at gas stations and restaurants for 2% back (up to $1,000/quarter). Reserve other spending for flat-rate cards like the Capital One Quicksilver Secured (1.5% everywhere).

- Monitor rotating caps diligently: Set calendar reminders for quarterly category resets (like Discover’s). Maxing out the bonus cap early in the quarter ensures you don’t leave rewards on the table.

- Activate merchant offers: Chime Secured Credit Builder users should regularly check the Chime Offers portal for 7x point opportunities at partner stores, stacking rewards on planned purchases.

Avoiding interest charges

- Pay your statement balance in full, every month: This is non-negotiable. The high APRs (e.g., Discover’s 27.24% or Capital One’s 29.74%) negate rewards if balances revolve.

- Set up autopay for at least the minimum payment: This crucial safety net protects against missed payments – the single biggest factor in your credit score. Schedule payments right after payday for consistency.

- Treat it like a debit card: Only charge what you can pay off immediately. Chime’s model (transferring funds before spending) enforces this habit naturally.

Building positive credit history

Your card is a tool; consistent positive reporting is the foundation of score improvement.

Credit utilization management

- Aim for <10% utilization, never exceed 30%: High usage signals risk, even if paid off monthly. If your limit is $200 (common with minimum deposits), keep balances below $60, ideally $20, before the statement date.

- Make multiple payments monthly: Paying down balances before your statement closes (e.g., bi-weekly) instantly lowers reported utilization. This is vital with lower credit limits.

- Request credit limit increases strategically: After 6-12 months of perfect payments (e.g., via Capital One’s automatic reviews), ask for an increase. A higher limit makes maintaining low utilization easier.

Long-term credit health

- Maintain old accounts (if applicable): Keep older, positive tradelines open (even unused) to preserve your average account age – a key FICO® factor.

- Limit new credit applications: Every hard inquiry from applying for credit can ding your score. Focus solely on rebuilding with your secured card for at least 6-12 months.

- Monitor progress consistently: Use free services to track your score monthly. Seeing progress (like Chime users’ average +30 point gain) reinforces positive habits.

Using these cards effectively transforms them from simple spending tools into powerful credit-rebuilding engines. By strategically capturing rewards, avoiding interest traps, and meticulously managing utilization, you lay the groundwork for significant score gains throughout 2025. Ready to build a personalized plan and track your rebuilding milestones? Find advanced tools and guidance at https://fixcreditscenter.com.

【Avoiding Common Rebuilding Mistakes】

Building on smart card usage strategies, steering clear of pitfalls is crucial for maximizing your progress in 2025. While secured cashback cards accelerate credit repair, common missteps like high fees and rewards temptations can derail your efforts. By focusing on cost-effective choices and disciplined habits, you’ll protect your rebuilding journey and keep rewards working for you, not against you.

High-fee card pitfalls

Opting for cards with excessive fees undermines your cashback benefits and slows credit improvement. Prioritize no-annual-fee options like Discover it® Secured or Capital One Quicksilver Secured to preserve your net gains. Remember, every dollar saved on fees boosts your overall financial recovery.

Annual fee calculations

- Cards like Firstcard® charge steep annual fees: Ranging from $48 to $120 per year, these recurring costs eat into your rewards—e.g., earning $100 cashback with a $60 fee nets only $40.

- Fee-heavy cards reduce net rewards value: Always calculate the break-even point; if your expected annual rewards don’t exceed the fee, it’s a poor choice for rebuilding. Stick to fee-free alternatives to ensure all cashback contributes directly to your goals.

Hidden charge awareness

- Balance transfer fees (3-5% typical): Common with some cards, this fee applies when moving debt, adding unnecessary costs—e.g., transferring $1,000 could incur $30-$50 in charges.

- Foreign transaction fees (up to 3%): Charged on overseas purchases, these fees inflate costs unexpectedly; avoid them by selecting cards with $0 foreign fees, especially if you travel. Always review card terms to spot these silent budget drainers.

Rewards vs rebuilding balance

Cashback offers can be a double-edged sword; while they incentivize spending, they risk derailing your credit focus if not managed responsibly. Balance rewards pursuit with disciplined habits to ensure every swipe strengthens your score.

Cashback temptation dangers

- Never overspend to earn rewards: Chasing bonus categories (like Discover’s 2% at gas stations) might tempt you to buy unneeded items, leading to debt accumulation.

- Rewards nullified by interest charges over 25% APR: High APRs (e.g., Capital One’s 29.74% or Discover’s 27.24%) quickly erase cashback gains—e.g., carrying a $500 balance at 27% APR could cost $135 annually, wiping out typical rewards. Always pay your statement in full to keep rewards pure profit.

Responsible usage patterns

- Treat card like debit card: Only spend what you can repay immediately, mirroring Chime Secured Credit Builder’s “funds-first” approach to prevent overspending.

- Track spending through mobile apps: Use tools like Capital One’s app or Chime’s dashboard to monitor real-time balances and utilization, ensuring you stay under 30% (ideally 10%) to avoid credit score dings. This habit builds consistency and awareness.

By sidestepping these errors, you’ll amplify your secured card’s power, turning potential setbacks into steady gains. For tailored strategies and tools to navigate your 2025 credit rebuild, explore comprehensive support at https://fixcreditscenter.com.

【Next Steps After Rebuilding】

Successfully navigating the secured card phase sets the stage for greater financial flexibility in 2025. When your disciplined habits—like avoiding fee traps and rewards overspending—yield consistent results, you’ll unlock opportunities to graduate to more powerful tools. Here’s how to strategically advance your credit journey.

Transitioning to unsecured cards

Secured cards aren’t forever. Once you demonstrate reliability, issuers may return your deposit and transition you to an unsecured card, often with higher limits and richer rewards. Timing this move right maximizes your progress.

Qualification indicators

Watch for these green lights before requesting an upgrade:

- 6+ months of flawless payments: Payment history is 35% of your FICO® Score. Consistent on-time payments signal reduced risk to lenders.

- FICO® Score increase of 30+ points: Many issuers consider upgrades once scores cross the “fair” threshold (580-669). Track progress weekly via free services like Experian Boost.

Upgrade options

Leading secured cards offer structured pathways:

| Card | Upgrade Benefit | Typical Timeline |

|---|---|---|

| Discover it® Secured | Automatic review at 8 months; deposit refunded if qualified | 7-12 months |

| Capital One Quicksilver | Potential credit line increase (no deposit refund) or product change to unsecured | 6+ months |

Maintaining improved credit

Earning an unsecured card isn’t the finish line—it’s a new phase requiring vigilance. Protect your rebuilt score with proactive management and strategic habits.

Credit monitoring practices

- Leverage free weekly reports: Use AnnualCreditReport.com (mandated through 2025) to pull tri-bureau reports. Scrutinize for inaccuracies like outdated late payments.

- Dispute errors within 30 days: File disputes directly through credit bureaus’ portals for fastest resolution. Furnishers have 45 days to respond under FCRA rules.

Long-term financial habits

- Sustain sub-10% utilization: High utilization (≥30%) can tank scores by 60+ points. Set balance alerts via issuer apps (e.g., Capital One’s “CreditWise”) to stay on track.

- Nurture a diverse credit mix: Once stable, consider adding a small installment loan (like a credit-builder loan) alongside revolving cards. This mix influences 10% of your score.

Building credit is a marathon, not a sprint. For personalized strategies to optimize your 2025 profile—from selecting your next unsecured card to disputing stubborn errors—trusted resources like fixcreditscenter.com offer tailored action plans for lasting stability.

Key Takeaways for Credit Rebuilding Success

Cashback credit cards offer a powerful way to rebuild credit when used strategically. By focusing on consistent on-time payments (35% of your FICO® Score) and maintaining low credit utilization (30% of score), you create positive credit history. The right secured card – whether it’s the Discover it® Secured with its 2% category bonuses or Capital One Quicksilver’s flat 1.5% rewards – provides both financial incentives and credit-building structure.

Remember these core principles:

- Always pay your statement balance in full by the due date

- Keep utilization below 30% (ideally under 10%)

- Choose cards with no annual fees to maximize rewards

- Monitor your progress through free credit reports

Ready to start your credit rebuilding journey with the perfect cashback card? Visit https://fixcreditscenter.com today to explore personalized strategies and card recommendations that match your financial situation. Share your success story in the comments once you see your score improve!