Did you know 65% of travelers overlook credit-building perks in rewards cards? Travel cards aren’t just for high scores—they’re powerful tools to rebuild credit while funding adventures. Learn how to leverage them in 2025.

【Why Travel Cards & Credit Building Mix】

The Surprising Connection

It might seem counterintuitive: how can a card designed for globe-trotting simultaneously lay the foundation for a stronger financial future? The magic lies in the fundamental mechanics of credit scoring. Responsible use of any credit card builds positive history, and travel cards are no exception. Here’s the powerful synergy:

- Payment History Reigns Supreme (35% of FICO® Score): This is the single biggest factor. Every single on-time payment you make on your travel card – whether it’s for a flight, hotel, or even just groceries – is a positive mark reported to the credit bureaus. Consistently hitting those due dates is paramount.

- Credit Utilization Gets a Boost (30% of FICO® Score): Travel cards often come with the potential for higher credit limits over time, especially as you demonstrate responsible use. A higher limit automatically lowers your overall credit utilization ratio (the amount of credit you’re using divided by your total available credit), provided you don’t significantly increase your spending. Keeping this ratio low is crucial for score health.

Busting the “Good Credit Only” Myth

The common perception is that travel rewards are an exclusive perk reserved for those with sparkling 750+ FICO scores. While the premium cards with lavish lounges and hefty annual fees often require excellent credit, the landscape in 2025 is far more inclusive for credit builders seeking travel perks.

- Options Exist Below 580: Data from sources like Bankrate highlights that cards specifically designed for building or rebuilding credit are accessible even with FICO scores below 580. These might not offer miles for first-class flights immediately, but they serve as a critical entry point.

- Secured Cards: Your Stepping Stone to Rewards: This is where the real myth-busting happens. Secured travel cards require a refundable security deposit (often $200-$500), which typically becomes your credit line. The game-changer? Many now offer rewards points redeemable for travel expenses like statement credits against flights, hotels, or baggage fees. You get the dual benefit of establishing crucial credit history while earning tangible rewards on your everyday spending. It’s a practical way to start your journey towards premium travel perks.

Building credit doesn’t mean putting your travel aspirations on hold. By strategically choosing the right tool and using it wisely – paying on time, every time, and keeping balances low – you can make tangible progress towards both a stronger credit score and your next adventure. For personalized guidance on selecting the best credit-building travel card for your unique situation and crafting a plan to optimize your score, explore the resources available at https://fixcreditscenter.com.

Understanding Your Credit Tier

Defining “Bad” vs “Fair” Credit

Knowing where your credit stands is the crucial first step to choosing the right travel card for rebuilding. Credit scores aren’t monolithic; lenders categorize them into tiers that directly impact your approval odds and card options. As of 2025, here’s how major bureaus define two key tiers relevant to credit builders:

- Poor Credit (300-579): Falling into this range, based on NerdWallet’s analysis, signals significant credit challenges to lenders. You likely have negative marks like late payments, collections, or high utilization. Approval for unsecured cards is very difficult.

- Fair Credit (580-669): Bankrate benchmarks place borrowers here in the “subprime” or “near-prime” category. While not excellent, it shows lenders you have some positive history mixed with past issues. You have more options than those with poor credit, including some unsecured cards, though likely with lower limits and higher costs.

FICO Score Ranges That Matter

| Credit Tier | FICO® Score Range | Primary Data Source | Lender Perception |

|---|---|---|---|

| Poor | 300 – 579 | NerdWallet | Significant risk; requires secured cards or rebuilding |

| Fair | 580 – 669 | Bankrate | Subprime; eligible for some unsecured cards with limitations |

Which Card Types Match Your Score

Your credit tier dictates whether a secured or unsecured travel card is your realistic starting point. Don’t despair if unsecured cards aren’t accessible yet – secured cards are powerful tools specifically designed for your situation.

Secured vs Unsecured Options

- Secured Cards (Best for Poor/Fair Credit): These require a refundable security deposit upfront, typically starting around $200. This deposit usually sets your credit limit. The critical advantage? They report your payment activity to all three major credit bureaus (Experian, Equifax, TransUnion) just like unsecured cards. For travel-focused credit building: Increasingly, secured cards in 2025 offer rewards programs. Look for options providing points redeemable as statement credits against travel purchases (flights, hotels, baggage fees). While the rewards rate might be lower than premium cards, you get the dual benefit: building essential positive payment history while earning tangible value back on spending towards your next trip. They are the most accessible entry point for travel perks while rebuilding.

- Unsecured Options (Typically Requires Fair Credit 580+): If your score is firmly in the “fair” range, you may qualify for unsecured travel cards. These don’t require a deposit. However, be prepared for trade-offs: they often come with annual fees and may have lower initial credit limits. Rewards might be capped or offered at a lower rate compared to cards for excellent credit. Crucially, approval isn’t guaranteed at 580 – other factors like income and recent history play a role. These cards represent a step up from secured options but still cater to those actively building.

Finding the card that aligns with your specific score and financial habits is key. Whether starting with a secured card offering travel credits or graduating to an unsecured option with manageable fees, consistent on-time payments and low utilization will steadily lift your score. Ready to identify the best travel card for your current credit tier and map out your path to higher scores and better rewards? Discover tailored strategies at https://fixcreditscenter.com.

Top Credit-Building Travel Cards

Choosing the right travel card when building credit requires matching your current score tier with realistic options offering tangible rewards. Here are standout cards in 2025 designed for credit builders seeking travel perks:

Best for Hotel Bookings: Capital One QuicksilverOne

Ideal for those with fair credit seeking consistent value, especially on travel bookings.

Key features for credit builders

- $39 annual fee (rates/fees apply) – a manageable cost for access to rewards.

- Potential automatic credit limit increases after demonstrating 6 months of responsible use, helping lower credit utilization and boost scores.

Rewards that offset costs

- Earn 5% back on hotels and rental cars booked through Capital One Travel.

- Get 1.5% unlimited cash back on all other purchases, providing everyday value that can be applied as a statement credit to offset travel expenses.

Best Secured Option: Bank of America Travel Rewards Secured Card

A top choice for those starting in the poor-to-fair credit range, offering a clear path to an unsecured card.

How security deposits work

- Requires a refundable security deposit starting at $200, which sets your initial credit limit.

- Responsible use (like on-time payments and low balances) is reported to all three bureaus and can lead to graduation to an unsecured card, with your deposit returned, typically after 12+ months of good management.

Travel rewards structure

- Earn 1.5 points per $1 spent on all purchases.

- Boost earnings to 3 points per $1 when booking through the Bank of America Travel Center. Points are redeemable as statement credits against travel purchases.

Best for Students: Capital One Savor Student

Designed for college students with limited or no credit history who want to build credit while earning rewards on common spending.

Building credit in college

- Reports activity monthly to all three major credit bureaus (Experian, Equifax, TransUnion), establishing a positive credit history from the start.

- No prior credit history is required for applicants, making it accessible for students new to credit.

High-value bonus categories

- Earn 5% back on hotels and rental cars booked via Capital One Travel.

- Get 3% cash back on key student spending: dining, entertainment (including concerts and streaming services), and popular grocery stores (excluding superstores like Walmart® and Target®).

These cards demonstrate that building credit doesn’t mean sacrificing travel rewards. By selecting an option aligned with your credit tier and spending habits, and using it responsibly, you can steadily improve your financial standing while earning back on purchases. Explore personalized strategies to maximize your credit-building journey at https://fixcreditscenter.com.

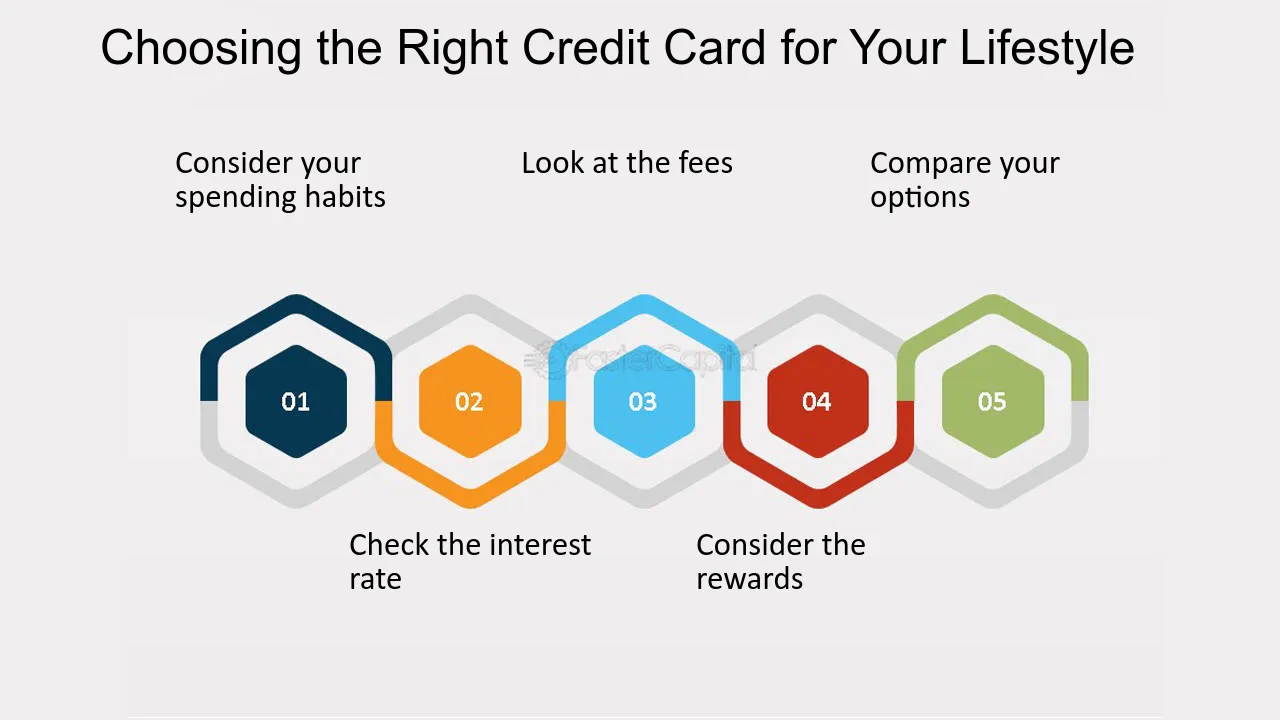

Choosing Your Perfect Card

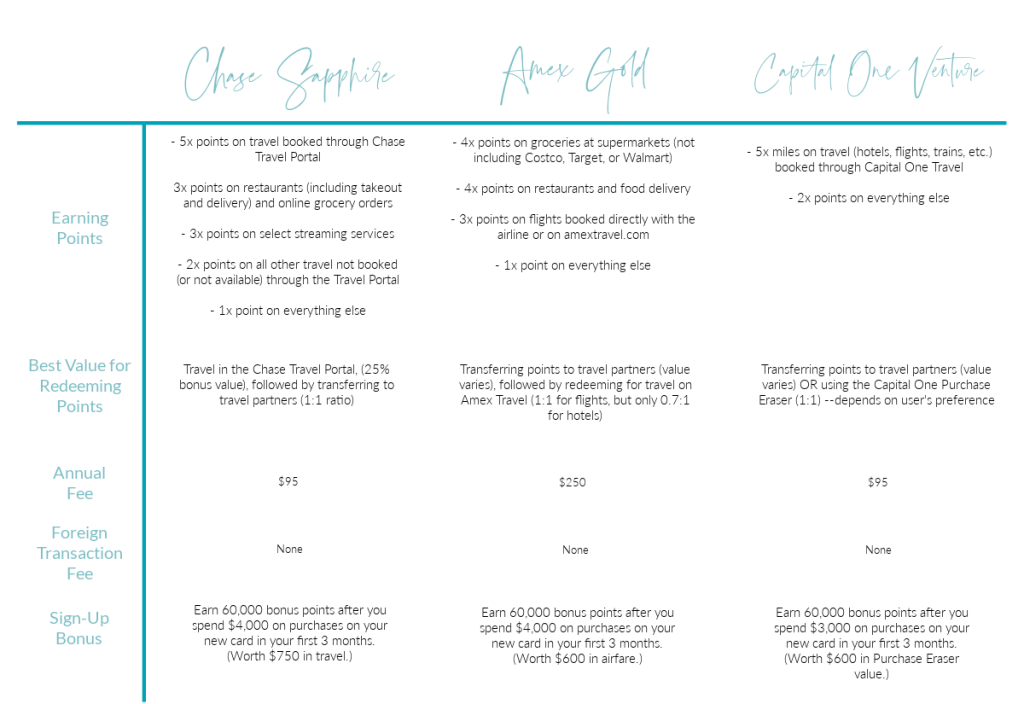

Selecting a travel card to build credit in 2025 requires careful evaluation beyond just rewards. Focus on aligning fees, redemption rules, and spending habits with your financial goals. Here’s how to make an informed decision based on key factors highlighted from top cards like the Capital One QuicksilverOne and Bank of America Travel Rewards Secured Card.

4 Must-Check Factors

Before committing to a card, weigh these essentials to ensure it fits your budget and travel needs while boosting your credit score.

Annual fees vs potential benefits

Calculate whether the rewards you earn will offset any annual fees. For example, a $95 annual fee card requires at least $950 in travel rewards (based on a 1X redemption rate) to break even. Cards like the Capital One QuicksilverOne ($39 annual fee) demonstrate this balance—earn 5% back on hotels and rental cars via Capital One Travel, plus 1.5% unlimited cash back, potentially covering the fee with just $780 in annual travel spending. Always project your expected rewards against the fee to avoid net losses, especially if you’re rebuilding credit on a tight budget.

Foreign transaction fees alert

Avoid cards that charge foreign transaction fees, typically around 3%, on international purchases. This fee can quickly erode rewards when traveling abroad. For instance, if you spend $1,000 overseas, a 3% fee adds $30 in unnecessary costs—money better used for credit-building payments. Opt for fee-free options to maximize savings, as seen in cards like the Capital One Savor Student, which offers rewards without this penalty.

Redemption Flexibility Matters

How you redeem points directly impacts their value and your ability to fund travel while building credit. Prioritize cards with straightforward, high-value redemption options to get the most from your spending.

Understanding point values

Most travel cards value points at 1 cent each for travel redemptions, like statement credits against purchases. For example, the Bank of America Travel Rewards Secured Card earns 1.5 points per $1 spent, redeemable at 1 cent per point for travel—so 10,000 points equal $100 off flights or hotels. However, some cards devalue points for non-travel options, such as gift cards or cash back, often at 0.8 cents per point or less. Always check redemption tables to ensure you’re not losing value, especially when using rewards to offset expenses and maintain low credit utilization. Discover tailored tips to optimize your card choices at https://fixcreditscenter.com.

Maximizing Cards for Credit Growth

Successfully using a travel rewards card to build credit requires more than just swiping; it demands strategic financial habits. By focusing on key credit-scoring factors and proactive management, you can transform your card into a powerful tool for boosting your score while funding future adventures.

Strategic Spending Habits

How you use your credit line significantly impacts your credit score, regardless of the rewards earned. Smart spending habits ensure your card helps, rather than hinders, your credit-building journey.

The 30% utilization rule

Your credit utilization ratio – the percentage of your available credit you’re using – is a major factor in your credit score (typically around 30%). Aim to keep balances below 30% of your credit limit at all times, and ideally under 10% for the best impact. For example:

- With a $1,000 secured card limit (common for credit-building cards like the Bank of America Travel Rewards Secured Card), strive to keep your reported balance below $300.

- Payment timing impacts reported balances: Credit card issuers report your statement balance to the bureaus monthly. Paying down most of your balance before the statement closing date ensures a low utilization ratio gets reported, even if you pay the full amount later to avoid interest. Maxing out your card and then paying it off in full each month can still temporarily hurt your score if the high balance is reported.

Credit-Boosting Tactics

Beyond daily spending habits, proactive steps can accelerate your credit improvement and unlock more financial flexibility.

Requesting limit increases

A higher credit limit automatically lowers your utilization ratio if spending stays consistent. Most issuers consider limit increases after 6-12 months of consistent on-time payments and responsible use. For secured cards, this might involve converting to an unsecured card and getting your deposit back, or simply receiving a higher credit line. Initiating this request (if the issuer doesn’t do it automatically) demonstrates responsible credit management.

Monitoring your progress

Regularly tracking your credit score helps you understand the impact of your actions and identify areas for improvement. Leverage free tools:

- Many card issuers (like Discover, which offers free FICO scores monthly to cardmembers) provide complimentary credit score access.

- Use annual credit reports from AnnualCreditReport.com to check for errors.

Tracking progress keeps you motivated and allows you to adjust strategies, like applying for a better travel card once your score improves. For personalized strategies on leveraging travel cards effectively for credit repair in 2025, explore the resources at https://fixcreditscenter.com.

Travel Card FAQs for Credit Builders

Navigating travel rewards cards while building credit brings up common questions. Let’s address key concerns to help you make informed decisions.

Can I get an airline card with bad credit?

Reality check on approvals

Most airline-specific cards (like those from Delta, United, or American Airlines) require good to excellent credit (typically 670+ FICO). Approval with poor or fair credit is unlikely. Instead, consider these alternatives:

- Secured travel cards: Options like the Bank of America® Travel Rewards Secured Card report to all three bureaus and earn rewards.

- Cash-back cards: Cards like the Discover it® Secured earn cash back you can redeem for travel purchases. While not “travel cards,” they build credit for future travel rewards.

- Alternative paths: Focus on building credit with a secured card or credit-builder loan first, then apply for airline cards once your score improves.

“Having less-than-stellar credit doesn’t mean missing travel perks. With responsible use, these cards become stepping stones to premium rewards.” – Adapted from Bankrate

How fast can travel cards improve scores?

Typical rebuilding timelines

Improvement depends on your starting point and consistency, but travel cards can accelerate progress:

- Short-term gains: Demonstrating responsible use (low utilization, on-time payments) can yield 50+ point increases within 6 months, as observed with cards like the Discover it® Secured (reported by users with initial scores ~580).

- Long-term impact: Negative marks (late payments, collections) diminish over 7 years. Consistent positive reporting from your travel card gradually outweighs these.

- Key accelerators: Keeping utilization low (<10%) and never missing a payment are the fastest ways to boost your score using any credit card, including travel rewards cards.

| Factor | Impact on Timeline | Tip |

|---|---|---|

| Starting Credit Score | Lower scores often see faster initial gains | Focus on foundational habits first |

| Credit Utilization | Major impact; low utilization speeds growth | Pay down balances before statement closes |

| Payment History | Most critical factor; 1 late payment hurts | Set up autopay for minimum payment |

| Negative Marks | Fade over 7 years | Focus on new positive history |

Do secured cards build credit equally?

Reporting differences

All major secured cards designed for credit building report to the three major credit bureaus (Experian, Equifax, TransUnion). However, confirmation is crucial:

- Verify reporting: Before applying, explicitly confirm the issuer reports to all three bureaus. Most major issuers (Bank of America, Discover, Capital One) do this reliably.

- No inherent advantage: A secured travel card reports positive activity the same way as a secured cash-back card. The credit-building mechanism is identical – it’s the responsible usage that matters, not the rewards type.

- Graduation potential: Some secured cards (like Discover’s or Bank of America’s) may automatically review your account for graduation to an unsecured card (and deposit return) after 8-12 months of responsible use, further helping your credit profile.

For tailored strategies on using secured travel cards effectively to reach your 2025 credit goals, https://fixcreditscenter.com offers updated resources and personalized guidance.

Key Takeaways for Credit-Building Travel Cards

Travel rewards cards offer a unique dual benefit: they help establish positive credit history while earning tangible value for your next trip. Whether starting with a secured card or graduating to an unsecured option, the fundamentals remain:

- Payment history is king – Every on-time payment boosts your score

- Low utilization matters – Keep balances below 30% (ideally 10%) of your limit

- Strategic card selection – Match options to your current credit tier

- Rewards offset costs – Choose cards where benefits outweigh fees

Ready to transform your credit while earning travel rewards? Visit https://fixcreditscenter.com for personalized card recommendations and credit-building strategies. Share your success story in the comments!