Struggling with a 580-669 credit score? You’re not alone—43% of Americans face similar challenges. This guide reveals proven strategies to upgrade your fair credit, access better cards, and build lasting financial health in 2025.

【Understanding Fair Credit Scores】

Defining the Fair Credit Range

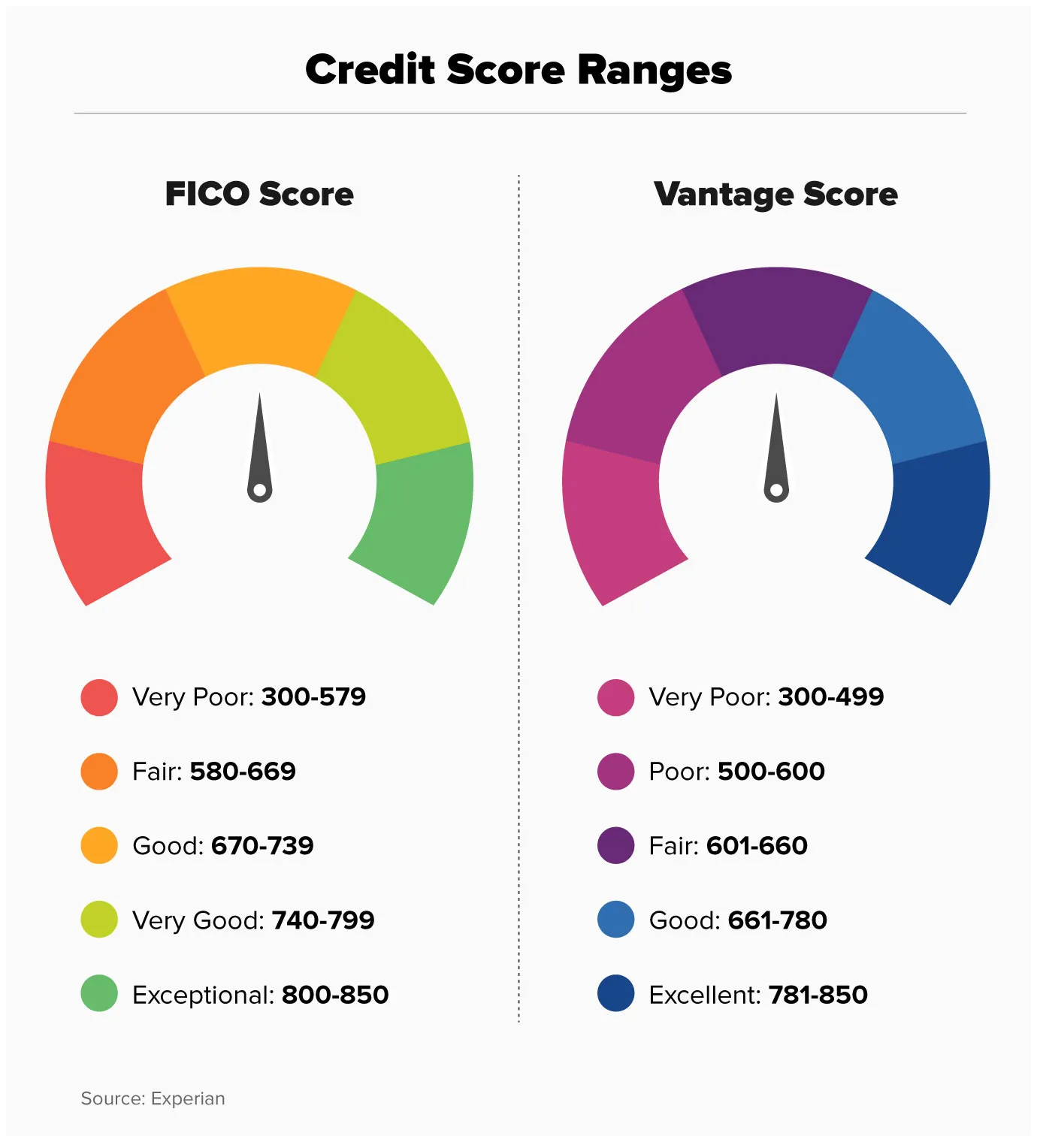

Your credit score is a critical number lenders use to assess risk. Within the FICO® scoring model, widely used by U.S. lenders, a fair credit score falls specifically within the 580 to 669 range. This range sits below the U.S. national average credit score threshold, which consistently hovers above 700.

FICO Score Parameters

Here’s a breakdown of common FICO® credit score ranges relevant to card applicants:

| FICO® Score Range | Credit Tier | Lender Risk Perception | Typical Card Access |

|---|---|---|---|

| 300 – 579 | Poor/Very Poor | Very High Risk | Secured Cards, Subprime Cards |

| 580 – 669 | Fair | Moderate Risk | Limited Unsecured Options |

| 670 – 739 | Good | Lower Moderate Risk | Mainstream Cards, Some Rewards |

| 740 – 799 | Very Good | Low Risk | Most Rewards Cards, Better Terms |

| 800 – 850 | Exceptional | Very Low Risk | Premium Cards, Best Terms |

How Fair Credit Impacts Options

A fair credit score signals to card issuers that you’ve likely faced some past financial challenges, such as late payments, higher credit utilization, or potentially even a past derogatory mark like a collection account. This history translates directly into how lenders view your application.

Lender Risk Perception

- Moderate Risk Classification: Lenders interpret a fair credit score as indicating a borrower who poses a statistically higher risk of default compared to those with good or excellent scores. While not the highest risk category, it’s significantly above the risk profile of prime borrowers.

- Limited Access: This risk perception severely restricts access to the most sought-after credit cards, particularly premium rewards cards offering high sign-up bonuses, lucrative ongoing rewards structures (like extensive travel points or high cash back rates), and low ongoing APRs. Issuers reserve these products almost exclusively for applicants with good to excellent credit histories.

- Focus on Building/Rebuilding: Cards available to those with fair credit are primarily designed either for credit building (helping users establish or re-establish positive history) or credit rebuilding (helping users recover from past credit difficulties). While options exist, they often come with trade-offs like lower credit limits, higher interest rates (APRs), and fewer premium perks compared to cards for higher credit tiers.

While navigating credit cards with fair credit requires understanding these limitations, responsible use of the right card is a proven strategy for improvement. Simultaneously, addressing the root causes of a lower score through structured credit repair, such as the services offered by fixcreditscenter, can accelerate your journey towards better financial options in 2025.

【Best Card Types for Fair Credit】

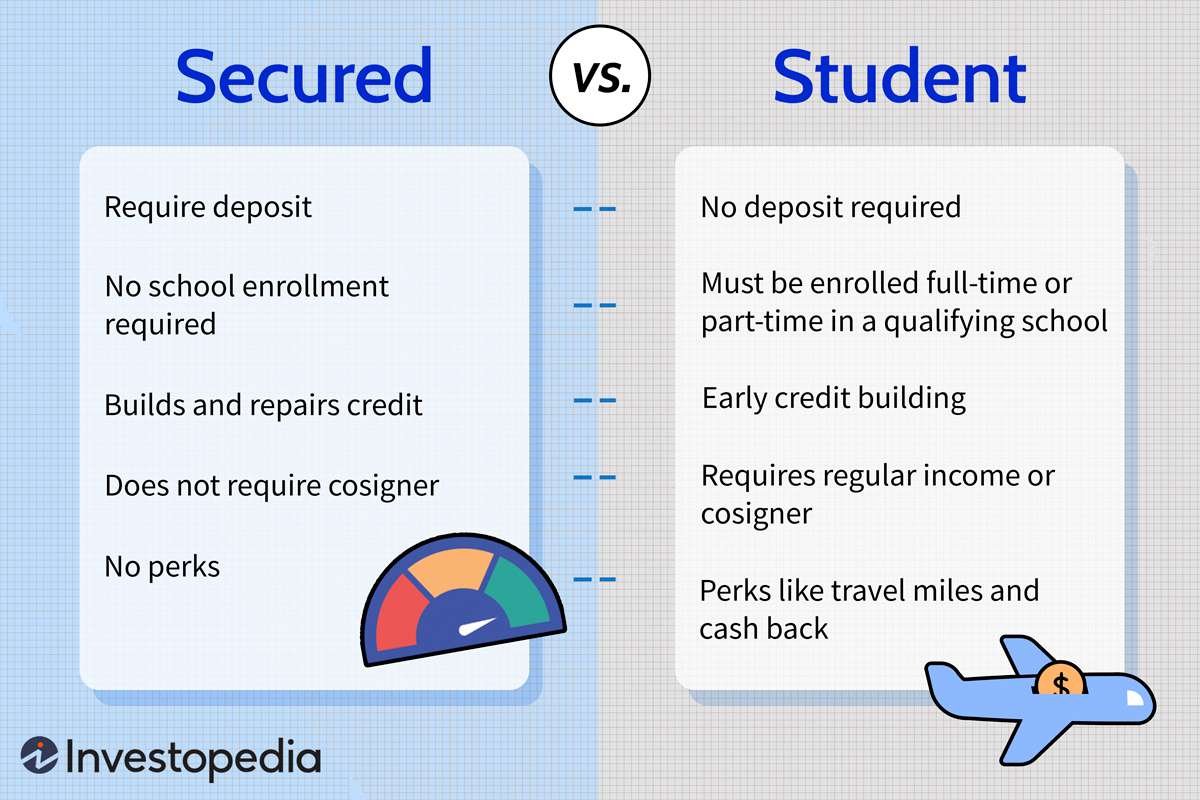

Navigating credit card options with a fair credit score (580-669) means understanding the practical tools available, primarily focusing on secured cards and limited unsecured options. These cards are specifically designed for building or rebuilding credit, acknowledging the moderate risk profile identified by lenders.

Secured Credit Cards Explained

Secured cards are the most accessible entry point for fair credit applicants. They require an upfront security deposit, which directly mitigates the lender’s risk and determines your credit line.

How Security Deposits Work

- Deposit Determines Limit: Your credit limit is typically equal to the amount of your refundable security deposit. A $500 deposit usually grants a $500 credit limit.

- Minimum Deposits: Most issuers set minimum deposit requirements. For example, the Discover it® Secured Credit Card requires a minimum deposit of $200 to open an account. Maximum deposit limits often range up to $2,500 or more, setting your initial spending power.

Credit Building Mechanism

- Bureau Reporting: Crucially, responsible activity (on-time payments, low utilization) is reported monthly to all three major credit bureaus (Experian, Equifax, TransUnion). This consistent positive reporting is the core mechanism for improving your score.

- Pathway to Unsecured: Many secured cards offer a clear path to upgrade. A prime example is the Discover it® Secured Card, which automatically reviews accounts starting at 6 months for potential conversion to an unsecured card (and deposit return) based on responsible use and improved creditworthiness.

Unsecured Card Possibilities

While less common than secured options, some unsecured cards are attainable with fair credit. These cards don’t require a deposit but come with distinct characteristics reflecting the perceived higher risk.

Common Features to Expect

- Higher APRs: Interest rates (APRs) on unsecured cards for fair credit are significantly higher than those offered to applicants with good or excellent credit. Expect APRs well above the national average.

- Lower Credit Limits: Initial credit limits are typically conservative, often ranging from $300 to $1,000. Responsible use over time can lead to limit increases.

- Potential Fees: Annual fees are more common in this tier than in higher tiers, though many cards, especially secured options, have no annual fee. Other fees (like late fees) remain standard.

Rewards Card Exceptions

True rewards cards for fair credit are rare and usually come with trade-offs, but a few notable exceptions exist:

- Capital One QuicksilverOne: Offers a flat 1.5% cash back on all purchases. However, it carries a $39 annual fee, offsetting some of the rewards value for lower spenders.

- Discover it® Student Chrome: Targeted at students building credit, it offers 2% cash back at Gas Stations and Restaurants (on up to $1,000 in combined purchases each quarter) and 1% back elsewhere. Discover matches all cash back earned at the end of the first year. While designed for students, non-students with fair credit may sometimes qualify.

Using these cards responsibly—paying the full balance on time every month and keeping utilization low—is essential for improving your score. For targeted strategies to address past negatives and accelerate your credit improvement journey in 2025, consider exploring resources like fixcreditscenter.

【Choosing Your Ideal Card】

Selecting the right credit card for fair credit hinges on evaluating specific features that directly impact your ability to build credit efficiently and cost-effectively. Focus on these critical factors:

Critical Evaluation Factors

Beyond basic approval requirements, prioritize features that maximize credit-building potential and minimize unnecessary costs.

Credit Bureau Reporting

- Non-Negotiable Requirement: Ensure the card issuer reports your account activity monthly to all three major credit bureaus (Experian, Equifax, TransUnion). Consistent reporting of on-time payments and responsible usage is the foundation for improving your score.

- Avoid Limited Reporting: Some issuers may only report to one or two bureaus, significantly slowing your credit improvement progress. Always verify this policy before applying.

Fee Structures to Avoid

Minimizing fees preserves your funds for credit utilization and payments. Be vigilant about:

- Annual Fees: Prioritize cards with no annual fee, especially for secured options or basic unsecured cards like the Capital One Platinum Secured or QuicksilverOne alternatives. While cards like the Capital One QuicksilverOne ($39 annual fee) offer rewards, the cost can outweigh benefits for modest spenders.

- Program Fees: Steer clear of cards charging monthly “program” or “participation” fees on top of other costs.

- High Penalty Fees: While late fees are standard, compare amounts. More critically, avoid cards with high penalty APRs triggered by a single late payment.

- Balance Transfer Fees: If considering a balance transfer, factor in the typical fee of 3%-5% of the transferred amount. Cards for fair credit rarely offer introductory 0% APR periods long enough to make this cost-effective without a clear payoff plan.

Rewards vs. Cost Analysis

Rewards cards for fair credit exist but demand careful scrutiny to ensure they provide real net value.

Calculating Break-Even Points

Determine if a reward card’s benefits justify its costs:

- Annual Fee Calculation: Calculate the spending required to offset the fee. For example:

- A card with a $39 annual fee offering 1.5% cash back requires you to spend $2,600 annually ($39 / 0.015) just to break even on the fee. Spending below this means the fee costs you money; spending above provides net rewards.

- Factor in your typical spending categories and the card’s reward rates. Does the card offer higher rewards in areas where you spend most?

- Secured Cards Often Win on Cost: Many secured cards, such as the Discover it® Secured Card, now offer cash back rewards (e.g., 2% at gas stations/restaurants, 1% elsewhere) without an annual fee. This combination provides tangible benefits while actively building credit, often making them a more cost-effective choice than fee-based unsecured rewards cards for those rebuilding.

Common Fee Comparison for Fair Credit Cards

| Fee Type | Typical Range/Amount | Recommendation |

|---|---|---|

| Annual Fee | $0 – $99+ | Strongly prioritize $0 |

| Security Deposit (Secured) | $200 – $2,500+ (Refundable) | Minimum required for approval |

| Balance Transfer Fee | 3% – 5% of transfer amount | Avoid unless payoff plan is solid |

| Foreign Transaction Fee | Often 3% | Avoid if traveling internationally |

| Late Payment Fee | Up to $41 | Set autopay to ALWAYS avoid |

Choosing wisely means balancing the desire for perks with the primary goal of improving your credit profile affordably. For personalized strategies to enhance your creditworthiness and access better card options in 2025, leveraging resources like fixcreditscenter can provide targeted guidance.

【Smart Credit Building Tactics】

Successfully managing your fair credit card goes beyond approval; it requires disciplined habits that actively improve your score. Two pillars—payment history and credit utilization—demand focused attention in 2025.

Payment History Strategies

Your payment history is the single most influential factor in your credit score (typically 35% weighting). Protecting it is non-negotiable.

Avoiding Negative Reporting

- The 30-Day Cliff: A payment reported as 30+ days late causes severe, lasting damage to your credit score. Even one instance can drop a fair score significantly and remain on reports for up to seven years.

- Automatic Minimum Payments: Set up autopay for at least the minimum payment due date. This acts as a critical safety net against accidental late payments caused by forgetfulness or missed mail. While paying the full statement balance is ideal to avoid interest, autopay for the minimum ensures you never cross the 30-day delinquency threshold.

- Payment Buffer: Aim to submit payments at least 3 business days before the actual due date. This guards against processing delays by issuers or banks. Don’t rely solely on the payment submission date – ensure it clears.

Credit Utilization Management

Credit utilization (the percentage of your available credit you’re using) is the second most critical scoring factor (roughly 30%). Lower utilization consistently correlates with higher scores.

The 30% Threshold Rule

- The Benchmark: While utilization under 30% is widely cited as a maximum, aiming for below 10% yields the best scoring results. Exceeding 30% signals potential risk to lenders and can suppress your score.

- Calculating Your Limit: Track your total credit limit(s) diligently. For a card with a $1,000 limit, maintaining a balance below $300 keeps you under the 30% threshold. To maximize scoring potential, strive to keep it below $100 (under 10%).

- Optimizing Reporting: Card issuers typically report your statement balance to the bureaus once per month. Paying down your balance before the statement closing date ensures a lower utilization ratio is reported, even if you use the card throughout the month. You can still pay the full statement balance by the due date to avoid interest.

- Multiple Cards: If you have more than one card, calculate utilization across all revolving accounts (total balances / total limits). Keeping individual card utilization low also helps.

Recommended Utilization Targets (2025)

| Credit Limit | 30% Max Utilization | 10% Target Utilization |

|---|---|---|

| $300 | $90 | $30 |

| $500 | $150 | $50 |

| $1,000 | $300 | $100 |

| $1,500 | $450 | $150 |

Mastering these core tactics—flawless payments and disciplined utilization—creates a powerful foundation for credit score growth. Combining responsible card management with proactive credit health strategies in 2025, such as those outlined at fixcreditscenter, accelerates your journey toward good or excellent credit and unlocks superior financial products.

【Top Card Recommendations】

Choosing the right card is crucial for building from fair credit. Here are standout options for 2025, categorized by type:

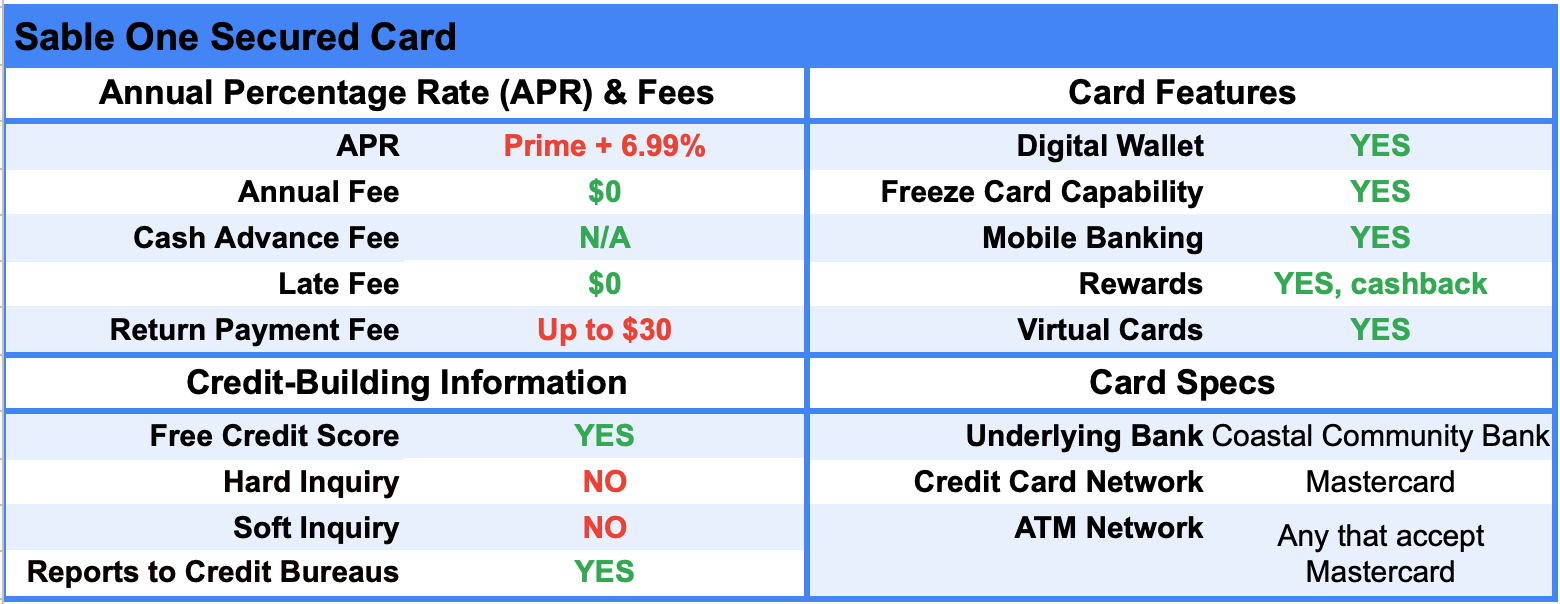

Best Secured Options

Secured cards require a refundable security deposit but are often the most accessible path to rebuild or establish positive credit history.

Discover it® Secured Card

- Cashback Match™: Earn 2% cash back at Gas Stations & Restaurants (up to $1,000 in combined purchases each quarter) and 1% on all other purchases. Discover automatically matches all the cash back you earn at the end of your first year, effectively doubling your rewards.

- Credit Building: Reports monthly to all three major credit bureaus. Responsible use (on-time payments, low utilization) directly builds your score.

- Deposit & Limit: Minimum $200 security deposit, which typically sets your credit line. Deposit is fully refundable upon graduation to an unsecured card.

- Cost: $0 annual fee and no foreign transaction fees.

Leading Unsecured Picks

Unsecured cards for fair credit don’t require a security deposit but may have lower starting limits and fewer premium perks than those for higher scores.

Capital One Platinum Credit Card

- Accessibility: Designed specifically for applicants with average/fair credit. Higher approval odds than many unsecured cards in this range.

- Credit Line Growth: Automatic consideration for a higher credit line in as little as 6 months with on-time payments, helping improve utilization ratios.

- Cost & Features: $0 annual fee. Access to Capital One’s CreditWise tool for free credit monitoring.

- Limitations: No traditional rewards program.

Upgrade Cash Rewards Visa®

- Rewards Structure: Earn 1.5% unlimited cash back on every purchase. Rewards are automatically applied as statement credits towards your balance.

- Hybrid Functionality: Combines features of a credit card and a personal loan. You get a fixed credit line but make fixed monthly payments towards your balance, offering predictability.

- Credit Impact: Reports as an installment loan to the credit bureaus, which can diversify your credit mix – a positive scoring factor.

- Cost: No annual fee.

Key Card Features Comparison (2025)

| Feature | Discover it® Secured | Capital One Platinum | Upgrade Cash Rewards Visa® |

|---|---|---|---|

| Card Type | Secured | Unsecured | Unsecured (Installment) |

| Annual Fee | $0 | $0 | $0 |

| Rewards Rate | 2% Gas/Restaurants¹, 1% Else | None | 1.5% Unlimited Cash Back |

| First-Year Bonus | Cashback Match™ | None | None |

| Credit Line Potential | Matches Deposit | Increase reviews @ 6mo | Fixed Credit Line |

| Credit Mix Reporting | Revolving | Revolving | Installment Loan |

| Best For | Building + Rewards | Building + CLI Path | Predictability + Rewards |

¹ On up to $1,000 in combined quarterly purchases; 1% after and elsewhere.

Selecting a card aligned with your spending habits and financial discipline in 2025 allows you to leverage the smart building tactics discussed previously. Consistent, responsible use of these tools, combined with resources like fixcreditscenter, creates a clear pathway to stronger credit.

【Application Impact & Next Steps】

Applying for a new credit card triggers specific, measurable effects on your credit profile. Understanding these impacts – both immediate and long-term – is essential for strategically building from fair credit in 2025.

Short-Term Score Effects

The initial impact of a credit card application comes primarily from the hard inquiry performed by the lender.

Hard Inquiry Consequences

- Score Drop: A single hard inquiry typically causes a credit score decrease of 5-10 points. This is a standard reaction and reflects the new credit-seeking activity.

- Duration: The negative impact of the hard inquiry lessens significantly after approximately 6 months. While the inquiry remains visible on your credit report for up to 2 years, its scoring weight diminishes rapidly after the half-year mark.

- Minimizing Impact: Applying only for cards you have a strong chance of approval for (like those listed in the previous section) and spacing out applications by at least 6 months helps manage inquiry-related score dips.

Short-Term Impact Overview (2025)

| Factor | Initial Effect | Mitigation Strategy |

|---|---|---|

| Hard Inquiry | -5 to -10 points | Apply selectively; space applications >6mo |

| New Account | Minor initial score dip | Offset by responsible long-term use |

| Average Age of Accounts | Slight decrease | Focus on keeping older accounts open |

Long-Term Building Strategies

The initial small score dip is far outweighed by the long-term positive potential of responsibly managing your new card. Key strategies amplify this growth.

Credit Mix Enhancement

- Diversification Benefit: Adding a revolving credit account (like a credit card) complements existing installment loans (like auto loans or student loans). This diversification improves your credit mix, a factor contributing to up to 10% of your FICO score.

- Optimal Profile: Lenders in 2025 view borrowers who successfully manage both types of credit more favorably. Your new card, used responsibly, actively strengthens this component of your score over time.

Limit Increase Protocols

Responsible card use positions you for credit limit increases (CLIs), a powerful tool for lowering credit utilization and boosting scores.

- Capital One Platinum: Offers automatic reviews for a potential credit line increase starting as early as 6 months after account opening. Consistent on-time payments and keeping balances low are critical triggers.

- Discover it® Secured: While secured initially, responsible use (on-time payments, low utilization) leads to graduation to an unsecured card and the return of your deposit, often accompanied by a higher credit limit. Discover typically reviews accounts starting around the 7th month.

- General Best Practice: After 6-12 months of flawless payment history and moderate usage, proactively request a CLI online or via customer service. Higher limits automatically lower your utilization ratio if spending stays consistent.

Leveraging these strategies transforms your new fair credit card into a foundational tool. Consistent, responsible management, combined with utilizing resources like fixcreditscenter for ongoing guidance, builds undeniable momentum towards excellent credit.

【Maintaining Credit Health】

Successfully obtaining a fair credit card is just the start. Consistent vigilance through monitoring and disciplined usage habits are crucial for transforming that card into a tool for significant credit improvement in 2025.

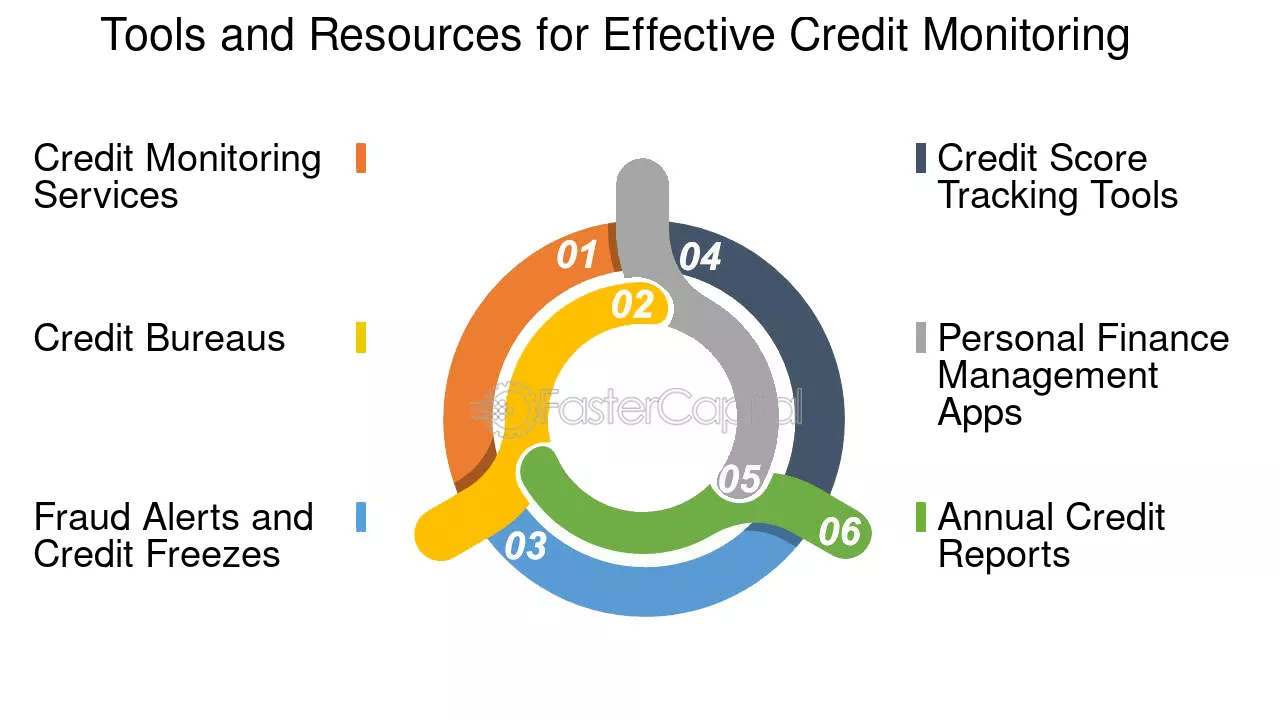

Monitoring Tools

Regularly tracking your credit profile is non-negotiable for understanding the impact of your actions and identifying potential issues early. Fortunately, accessible tools exist.

Free Credit Score Access

- Discover Cardholders: Receive your FICO® Score 8 for free on monthly statements and within your online account. This is a widely used scoring model by lenders.

- CreditWise® from Capital One: Offers free access to your VantageScore 3.0 credit score and TransUnion credit report data. Available to everyone, not just Capital One customers, via online sign-up or their mobile app. Provides alerts for key changes like new inquiries or accounts.

Key Monitoring Tools (2025)

| Tool | Score Provided | Who Can Access? | Key Features |

|---|---|---|---|

| Discover Account Center | FICO® Score 8 | Discover cardholders | Updated monthly; included with card |

| CreditWise® (Capital One) | VantageScore 3.0 | Anyone (free sign-up) | Weekly updates; credit report monitoring; change alerts |

Behavior Modification

The real power for credit building lies in your daily usage habits. Avoiding detrimental behaviors is as important as adopting positive ones.

Avoiding Common Pitfalls

Two major missteps can quickly undo progress:

- Late Payments:

- Immediate Damage: Payment history is the single largest factor in your credit score (up to 35%). Even one payment 30+ days late can cause a significant score drop (often 60-110+ points).

- Financial Penalty: Expect late fees, typically up to $40, added to your balance.

- Long-Term Stain: Late payments remain on your credit report for up to 7 years, continually harming your score.

- Mitigation: Always pay at least the minimum by the due date. Set up payment reminders or automatic minimum payments as a safety net.

- Maxing Out Credit Limits:

- Utilization Impact: Credit utilization (balance divided by limit) heavily influences scores (up to 30%). Using 90-100% of your limit signals high risk, severely lowering your score.

- Score Recovery Lag: High utilization has a rapid negative impact, but scores can bounce back quickly (within 1-2 billing cycles) once balances are paid down significantly.

- Mitigation: Aim to keep your utilization below 30% overall, and ideally below 10% for the best scoring results. Paying down balances before the statement closing date is often the most effective tactic.

Proactive monitoring combined with disciplined avoidance of late payments and high credit utilization forms the bedrock of sustainable credit health. Leveraging resources like fixcreditscenter provides ongoing strategies tailored to navigating the nuances of building from fair credit in 2025.

[object Object]