Did you know 1 in 5 credit reports contain errors? Your credit score impacts loans, rentals, and jobs. Learn how to fix errors and build strong credit with proven strategies.

Understanding Credit Reports & Scores

How Credit Reports Impact Your Life

Your credit report serves as a financial snapshot that lenders, landlords, and even employers use to evaluate your reliability. A strong report can unlock lower interest rates on loans, better rental opportunities, and even career advancements, while errors or negative marks may lead to rejections or higher costs.

Key Information Found in Reports

Credit reports contain critical details that shape decisions:

- Payment history: This tracks whether you pay bills on time and is a top factor in lending approvals. Late payments can signal risk to creditors.

- Account types and balances: Lenders review the mix of credit (e.g., credit cards, mortgages) and your current debt levels to assess financial stability. High balances relative to limits may indicate overextension.

- Employment checks: For job applications involving salaries of $75,000 or more, employers often review reports as part of background screenings to gauge responsibility, especially in roles handling finances or sensitive data.

What Makes a Good or Bad Score

A credit score summarizes your report into a number, typically ranging from 300 to 850. Scores above 670 are generally considered good, opening doors to favorable terms, while scores below 580 may lead to denials or high fees. Understanding the factors behind this score is key to improving it.

The 5 Credit Score Factors

Credit scores are calculated based on five core components, each with different weights:

- Payment history (35% weight): This is the most critical element, reflecting your track record of on-time payments. Even one missed payment can significantly drag down your score.

- Credit utilization (30%): This measures how much of your available credit you’re using. Aim to keep this below 30% of your total limits to avoid negative impacts, as high utilization suggests financial strain.

For effective DIY credit repair, focus on these high-impact areas by monitoring reports regularly and disputing errors. Resources like fixcreditscenter provide step-by-step guidance to help you build a stronger financial future—visit https://fixcreditscenter.com to get started.

Get Your Free Credit Reports

Accessing your full credit history is the essential first step in DIY credit repair. Under federal law, you have the right to obtain your reports at no cost, empowering you to identify and challenge inaccuracies that damage your score.

Accessing Your Reports Legally

You don’t need paid services to view your credit data. Legitimate, free access points exist:

Official Free Report Sources

- AnnualCreditReport.com: The only federally authorized source. As of 2025, you can request free reports weekly from all three bureaus (Equifax, Experian, TransUnion) – a significant increase from the previous annual allowance.

- Special Situations: You qualify for additional free reports if you:

- Are unemployed and plan to seek employment within 60 days.

- Receive public welfare assistance.

- Believe your report contains errors due to fraud (identity theft).

- Have been denied credit, insurance, or employment within the past 60 days based on your report.

Never use imposter sites charging fees for “free” reports. Bookmark the official site directly.

Reviewing Reports for Errors

Scrutinize each bureau’s report carefully. Errors are common and disproportionately harm those actively rebuilding credit. Focus on these critical sections:

Common Report Mistakes to Spot

| Error Type | What to Look For | Potential Impact |

|---|---|---|

| Account Status | Closed accounts listed as “open”. Paid-off debts marked as “delinquent”. Incorrect late payment dates (beyond 7 years). | Inflates perceived debt risk, lowers score. |

| Personal Info | Misspelled names, wrong addresses/SSN. Accounts belonging to someone with a similar name. | Mixes your history with others, creates confusion. |

| Unrecognized Accounts | Credit cards, loans, or collections you didn’t open. Inquiries from lenders you didn’t contact. | Red Flag for Identity Theft. Significantly damages score and financial security. |

| Balance Errors | Incorrect credit limits. Balances higher than reality. Duplicate collection listings. | Artificially increases your credit utilization ratio (30% of score). |

Finding an error triggers your right to dispute it directly with the credit bureau. Accurate reports form your repair baseline; platforms like fixcreditscenter offer dispute templates and tracking tools to streamline this process at https://fixcreditscenter.com.

Fix Credit Report Errors Yourself

Once you’ve identified inaccuracies on your credit reports, the next step is disputing them yourself. DIY credit repair empowers you to correct errors without costly services, leveraging your rights under the Fair Credit Reporting Act (FCRA). This process involves submitting clear, evidence-backed disputes directly to the credit bureaus, ensuring your reports reflect accurate data and boosting your score over time.

Disputing Inaccuracies Step-by-Step

Filing disputes is straightforward when you follow proven methods. Start by gathering supporting documents like bank statements or identity proofs to strengthen your case. Focus on one error per dispute to avoid confusion, and always keep copies of all communications for your records.

How to File Effective Disputes

Use these direct approaches to submit your disputes efficiently:

- Online portals: Equifax, Experian, and TransUnion each offer dedicated dispute centers on their official websites. These digital tools guide you through uploading evidence and tracking progress in real-time, making it the fastest option. As of 2025, all portals include enhanced security features to protect your personal data during submissions.

- Mail disputes: For a paper trail, send disputes via certified mail with return receipt requested. Use free FTC sample dispute letters as templates, customizing them with your details and specific error descriptions. Include copies (not originals) of supporting documents, and address them to the bureau’s dispute department listed on your credit report.

What Happens After Disputing

After you file, the credit bureaus initiate a formal investigation. They contact the data furnisher (e.g., your bank or creditor) to verify the disputed item, giving you a fair shot at correction. If evidence supports your claim, the error must be removed, improving your credit profile. For complex cases, platforms like fixcreditscenter provide dispute templates and tracking tools to simplify follow-ups at https://fixcreditscenter.com.

Bureau Investigation Timelines

The FCRA mandates strict deadlines for bureau responses:

- Credit bureaus must complete their investigation and respond to you within 30–45 days of receiving your dispute. This includes notifying you of the outcome in writing.

- Successful disputes typically show updates on your credit report within 60 days, but you can monitor changes earlier through free weekly reports (as allowed in 2025). If errors persist, you have the right to escalate with additional evidence or consumer protection agencies.

Build Better Credit Habits

Successfully disputing errors is crucial, but long-term credit health requires proactive habits. Consistent, responsible financial behavior builds positive credit history and protects your score. This section covers actionable strategies for managing payments and reducing debt effectively.

Payment Strategies That Work

Your payment history is the single largest factor influencing your credit score (35%). Prioritizing on-time payments is non-negotiable for credit repair and maintenance.

Handling Late Payments

Even a single late payment can significantly damage your score. If you miss a due date:

- Contact lenders immediately: Call within 1-2 days of missing the payment. Explain your situation (briefly) and request a fee waiver or goodwill adjustment. Many lenders offer one-time forgiveness, especially if you have a prior good record.

- Make partial payments: If you can’t pay the full amount immediately, send any partial payment. This often prevents the account from being reported as 30+ days late or sent to collections, minimizing score damage. Confirm the lender’s policy on partial payments first.

- Set up automatic payments: Prevent future lapses by enrolling in autopay for at least the minimum due. Use calendar reminders for manual payments if autopay isn’t suitable.

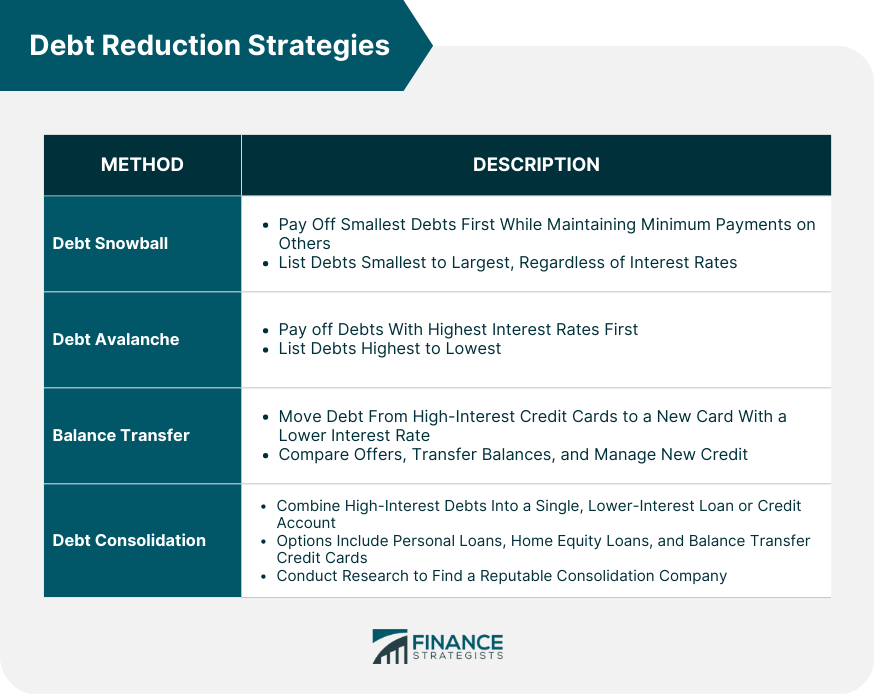

Debt Reduction Techniques

High outstanding debt, particularly relative to your credit limits (credit utilization ratio), is the second most impactful scoring factor (30%). Lowering utilization below 30% (ideally below 10%) boosts scores.

Lowering Credit Utilization

Focus on systematically paying down revolving debt (credit cards, lines of credit). Two proven methods:

| Method | How It Works | Best For |

|---|---|---|

| Debt Avalanche | Target debts with the highest interest rates first. Pay minimums on all others, putting every extra dollar towards the highest-rate debt. Once paid off, move to the next highest rate. | Saving the most money on interest charges over time. |

| Debt Snowball | Target debts with the smallest balances first. Pay minimums on others, putting extra funds towards the smallest debt. Once paid off, apply that payment amount to the next smallest balance. | Building momentum and motivation through quick wins. |

- Request credit limit increases: Ask issuers for higher limits on existing cards (without applying for new credit). This instantly lowers your overall utilization ratio if you don’t increase spending. Ensure the issuer performs a “soft pull” (which doesn’t hurt your score), not a “hard pull”.

- Pay before the statement date: Credit card issuers typically report your balance to bureaus once per month, often on your statement closing date. Paying down a large portion of your balance before this date results in a lower reported utilization.

Building sustainable credit habits takes diligence. For individuals managing complex debt situations or seeking structured guidance, platforms like FixCreditsCenter offer personalized repayment trackers and creditor negotiation templates to streamline the process. Access these tools at https://fixcreditscenter.com.

Avoid Credit Repair Scams

Navigating DIY credit repair requires vigilance. Scammers often target individuals eager to fix their credit quickly, making it crucial to recognize and avoid fraudulent operations. Understanding what’s illegal protects both your finances and your legal standing.

Red Flags of Scam Operations

Be highly skeptical of any credit repair service exhibiting these warning signs:

- “Guaranteed” results or rapid score jumps: Legitimate repair focuses on disputing inaccurate information; no one can legally promise specific score increases or deletion timelines for accurate negative items.

- Pressure to stop communicating directly with credit bureaus: Reputable services act on your behalf but should never demand you cease contact with Equifax, Experian, or TransUnion yourself.

- Requests for payment via untraceable methods: Insistence on cash, wire transfers, or gift cards is a major red flag for fraud.

Illegal Practices to Recognize

The Credit Repair Organizations Act (CROA) strictly prohibits certain behaviors. Steer clear of companies that:

- Demand upfront payment before services: It’s illegal under CROA for credit repair companies to charge fees before they have fully performed the promised services. Legitimate operations charge after work is completed (e.g., monthly or per deletion).

- Suggest creating a “new credit identity”: This is identity theft. Tactics like using an Employer Identification Number (EIN) instead of your Social Security Number to apply for credit constitute fraud and carry severe legal penalties.

Legitimate vs. Illegal Services

Understanding the boundaries of legal credit repair is key. Legitimate companies assist you in disputing errors with credit bureaus and creditors following the Fair Credit Reporting Act (FCRA). They cannot perform magic.

What Repair Companies Can’t Do

Even the most ethical credit repair service faces strict limitations:

- Cannot remove accurate negative information: If a late payment, collection account, or bankruptcy on your report is factually correct and within the legal reporting period (typically 7-10 years), no company can legally force its removal. Their role is to challenge inaccuracies.

- Cannot guarantee specific score improvements: Scores depend on complex algorithms and your overall credit behavior. Guaranteeing a specific point increase (e.g., “Raise your score 100 points!”) is misleading and illegal under CROA.

- Cannot create new, legal identities for you: As reiterated, this is fraud.

Empowering yourself with knowledge is the best defense against scams. For individuals seeking structured dispute assistance or reliable credit monitoring alongside their DIY efforts, platforms like FixCreditsCenter provide FCRA-compliant tools and dispute templates. Explore ethical support options at https://fixcreditscenter.com.

When DIY Isn’t Enough

While DIY credit repair is empowering, some situations demand additional support. Recognizing when you need professional guidance or specialized tools is crucial for effective credit recovery. Ethical alternatives exist beyond risky “quick fix” scams.

Credit Counseling Alternatives

Nonprofit credit counseling agencies offer structured guidance, especially when debt management overshadows simple credit report errors. These agencies focus on creating realistic budgets and debt repayment plans.

Finding Reputable Nonprofit Help

Seek counselors affiliated with established networks ensuring ethical standards and nonprofit status:

- Credit Unions & Universities: Many local credit unions and university extension programs host certified counselors, often offering free initial consultations.

- NFCC Members: Prioritize agencies accredited by the National Foundation for Credit Counseling (NFCC). Membership requires adherence to strict counseling standards and nonprofit operation.

| Finding Reputable Credit Counseling | |

|---|---|

| Resource Type | Key Benefit |

| NFCC Member Agencies | Vetted for ethics & nonprofit status |

| Local Credit Union Programs | Often low-cost or free for members |

| University Extension/Outreach Programs | Community-focused, educational |

Strategic Credit-Building Tools

Rebuilding credit often requires adding positive payment history. Secured credit cards are a cornerstone tool for this when traditional cards are unavailable.

Secured Credit Card Benefits

These cards function by requiring a refundable security deposit, which typically becomes your credit limit ($200-$500 is common). Their primary advantage is consistent reporting:

- Reports Like Regular Cards: Activity is reported monthly to all three major credit bureaus (Equifax, Experian, TransUnion), helping build positive payment history.

- Deposit is Refundable: Upon closing the account in good standing or transitioning to an unsecured card, your deposit is returned.

- Gateway to Unsecured Credit: Responsible use (keeping balances low, paying on time) often leads to offers for unsecured cards within 12-18 months.

Platforms like FixCreditsCenter can help track the impact of new secured card activity on your overall credit profile alongside your dispute efforts.

Debt Consolidation Options

When high-interest revolving debt (like credit cards) becomes unmanageable, consolidation can simplify payments and potentially reduce costs.

When Consolidation Makes Sense

Consider consolidation if:

- Multiple Payments Overwhelm: Combining several high-interest debts into one monthly payment simplifies budgeting and reduces missed payment risk.

- Lower Interest Rates are Achievable: Qualified applicants (often requiring fair+ credit) may secure a consolidation loan or balance transfer card with an APR 5-15% lower than their current rates, significantly reducing total interest paid over time.

- Fixed-Term Structure is Needed: Loans provide a clear payoff date, unlike revolving credit which can linger. Balance transfer cards offer introductory 0% APR periods (typically 12-21 months) for accelerated payoff, but require discipline to pay off before the standard rate applies.

Successfully navigating these alternatives often complements DIY credit repair efforts. For tools that integrate dispute tracking with credit-building monitoring, explore resources available at https://fixcreditscenter.com.

Key Takeaways for Credit Success

Your credit report and score are powerful financial tools that require regular attention. By understanding the key components—payment history, credit utilization, and account types—you can take control of your credit health. Remember to:

- Check your free credit reports weekly for errors using AnnualCreditReport.com

- Dispute inaccuracies promptly with supporting evidence

- Build positive habits like on-time payments and low credit utilization

- Avoid scams by recognizing illegal “quick fix” promises

Ready to take action? Visit FixCreditsCenter today for free dispute templates and credit-building tools. Share your credit repair journey in the comments below!