Want to boost your credit score fast? Aggressive credit repair can help—but only if done legally. Discover 2025’s top tactics to dispute errors without risking fraud or fines.

【What “Aggressive” Really Means in Credit Repair】

The quest for better credit often leads consumers to seek out the “most aggressive credit repair company” – a term dripping with both promise and peril. But in the high-stakes world of credit restoration, aggression isn’t a blunt instrument; it’s a scalpel wielded within a complex legal framework. Understanding this distinction separates effective advocacy from dangerous schemes that can leave your credit – and legal standing – in ruins.

Defining Aggressive Tactics Legally

Legitimate aggressive credit repair operates at the outer edge of consumer protection laws, maximizing legal avenues without crossing into fraud. It’s characterized by relentless, systematic action leveraging the rights granted under the Fair Credit Reporting Act (FCRA) and Fair Debt Collection Practices Act (FDCPA). The intensity comes from volume, speed, and precision, not deception.

Key characteristics of high-intensity credit repair

- Unlimited Dispute Letters to All Three Bureaus: Unlike basic services disputing a few items, aggressive firms bombard Equifax, Experian, and TransUnion with a high volume of meticulously crafted disputes. They challenge every questionable item – inaccuracies, outdated information, unverifiable accounts – simultaneously across all bureaus, exploiting the legal requirement for bureaus to investigate within 30 days. This creates overwhelming pressure on the bureaus’ verification systems.

- Rapid-Fire Challenge Cycles: Time is leverage. Aggressive firms operate on compressed timelines, initiating new dispute rounds the moment the previous investigation window closes (typically 30-35 days, exemplified by companies like Sky Blue Credit’s structured cycles). They don’t wait for one dispute to fully resolve before launching the next wave, creating a continuous pressure campaign on data furnishers and bureaus.

- Escalated Interventions Directly with Creditors: Beyond bureau disputes, these firms proactively engage original creditors and debt collectors. This involves demanding rigorous validation of debts (beyond basic balance verification), challenging chain of title for sold debts, and leveraging procedural violations under the FDCPA to negotiate deletions. It’s direct confrontation based on legal non-compliance.

| Legal Aggressive Tactic | Mechanism of Action | Legal Basis |

|---|---|---|

| High-Volume Bureau Disputes | Overwhelms bureau verification resources | FCRA § 611 (Dispute Process) |

| Rapid 35-Day Challenge Cycles | Exploits strict 30-day bureau investigation window | FCRA § 611(a)(1)(A) |

| Creditor Validation Demands | Forces proof of debt ownership & accuracy | FDCPA § 809 (Validation Notice) |

| Procedural Violation Leverage | Uses creditor/collector errors for deletion demands | FDCPA/FCRA Various Provisions |

The Legal Tightrope

The potent tools of legal aggressive repair sit perilously close to outright fraud. Crossing the line transforms a credit repair strategy into a criminal enterprise with severe consequences for both the company and the consumer who knowingly participates.

Where aggressive becomes illegal

- Credit Sweep Schemes Promising “Clean Slates”: These illegal operations exploit a loophole by instructing consumers to obtain a CPN (Credit Privacy Number) or SCN (Secondary Credit Number) – often illegally sourced SSNs – to create a “new” credit file. They promise to erase bad history by attaching the new number to existing tradelines or creating entirely new identities. This is identity theft and fraud, punishable by fines and imprisonment. No legitimate company can magically wipe your real SSN’s history clean.

- Filing False Identity Theft Claims: Some unethical outfits coach clients to file fraudulent police reports and FTC Identity Theft Affidavits, falsely claiming legitimate debts as fraudulent. This is perjury and obstructs justice. While disputing genuinely fraudulent items is crucial, fabricating fraud is a serious crime that adds legal jeopardy to existing credit problems.

- File Segregation Using EINs Illegally: While using an Employer Identification Number (EIN) for business credit is legal, promoters of illegal “file segregation” advise consumers to apply for personal credit using their EIN instead of their SSN, falsely claiming it creates a separate personal credit file. This is misrepresentation to lenders. Applying for personal credit under false pretenses (using an EIN not tied to you personally for that purpose) constitutes loan application fraud. Legitimate credit building with an EIN focuses solely on business credit.

The allure of the “most aggressive credit repair company” is undeniable when facing financial hurdles. However, true effectiveness lies in harnessing legally sanctioned intensity – the relentless disputes, rapid cycles, and direct creditor challenges – while rigorously avoiding the siren song of illegal shortcuts like CPNs or fake fraud claims. Understanding this razor-thin line is paramount. For those seeking powerful yet legitimate advocacy within this complex framework, exploring proven strategies offered by reputable services like those at fixcreditscenter.com provides a responsible path forward.

How Aggressive Credit Repair Companies Actually Operate

The most aggressive credit repair companies don’t just tweak the standard dispute process—they weaponize it. Their approach transforms passive credit bureau reviews into a high-velocity offensive, leveraging volume, speed, and legal precision to overwhelm systems designed for slower resolution. This isn’t about isolated disputes; it’s a coordinated siege on inaccuracies.

The Standard Dispute Process Amplified

Legitimate aggressive firms amplify every step of the credit repair sequence, turning routine actions into relentless campaigns. The core strategy exploits legal obligations under the FCRA and FDCPA, but executes them at a scale that forces faster, more substantive responses.

Turbocharged investigation workflow

- Simultaneous Challenges Across All Bureaus: Unlike basic services targeting one bureau at a time, aggressive firms fire disputes to Equifax, Experian, and TransUnion concurrently for every questionable item. This triples the pressure on data furnishers (creditors/collectors) who must verify the same debt simultaneously under tight deadlines. It exploits a key weakness: furnishers often lack robust systems to handle high-volume verification requests across multiple bureaus within the mandated 30-day window (§ 611(a)(1)(A) of the FCRA). Failure to respond results in automatic deletion.

- Multiple Dispute Rounds Per Billing Cycle: Time is compressed into strategic attack waves. Before one dispute cycle resolves (typically 30-35 days), the next wave targeting different items—or even re-challenging stubborn accounts with new arguments—is launched. Companies like Sky Blue exemplify this with structured 35-day cycles. This creates a continuous flood of disputes, preventing bureaus and furnishers from “catching up.”

- Dedicated Case Managers: Your file isn’t shuffled among a pool. One specialist owns it, mastering its intricacies to craft tailored dispute language, track bureau responses with military precision, and escalate roadblocks immediately. This hyper-focus prevents delays and ensures arguments evolve based on prior bureau/furnisher reactions.

| Amplified Tactic | Operational Impact | Legal Leverage |

|---|---|---|

| Tri-Bureau Simultaneous Disputes | Overloads creditor verification capacity | FCRA § 611 (30-Day Investigation) |

| Stacked Dispute Cycles | Denies bureaus/furnishers recovery time | FCRA § 611(a)(1)(A) Deadline |

| Single-Point Case Management | Eliminates handoff delays & ensures consistency | Internal Efficiency (Not Statutory) |

Beyond Disputes: The Extra Arsenal

The most aggressive firms know bureau disputes alone aren’t enough. They deploy supplementary tactics targeting data sources directly—creditors and collectors—applying pressure where inaccuracies originate.

Supplementary aggressive tools

- Creditor Intervention Letters (Beyond Basic Disputes): While bureaus forward disputes, aggressive firms send direct demands to the original creditor’s executive offices or legal departments. These letters cite specific FDCPA/FCRA violations (e.g., failure to report payment history accurately, incomplete account documentation), demanding deletion or correction within strict deadlines. This bypasses lower-level customer service and targets decision-makers with legal consequences.

- Cease-and-Desist Notices to Collection Agencies: For accounts in collections, firms invoke the FDCPA’s § 805(c) “cease communication” right. A legally crafted cease-and-desist letter forces the collector to stop all contact except to confirm cessation or announce specific legal actions. Crucially, if the collector cannot verify the debt’s validity before placing it back on the report (often they can’t), deletion becomes the path of least resistance.

- Debt Validation Challenges (DVCs) with Teeth: Instead of generic validation requests, aggressive firms send DVCs demanding comprehensive proof under § 809 of the FDCPA: the original signed contract, full payment history, chain of title proving ownership of the debt, and license to collect in the consumer’s state. Collectors frequently fail to produce this level of documentation. Failure to validate fully within 30 days mandates deletion and prohibits further collection attempts.

This multi-front assault—bombarding bureaus, confronting creditors, and paralyzing collectors with legal demands—defines the operational reality of the most aggressive legal credit repair. It requires deep knowledge of consumer protection statutes and the infrastructure to execute at high volume. For consumers navigating complex credit challenges in 2025, partnering with a service like fixcreditscenter.com provides access to this sophisticated, legally grounded approach without crossing into the dangerous territory of CPNs or fraudulent identity claims. Their methodology embodies the intense, yet lawful, advocacy needed to challenge entrenched credit reporting errors effectively.

Top Contenders: Comparing the Most Aggressive Players

While the operational tactics define how aggressive credit repair works, the real-world impact depends on execution. Two firms in 2025 exemplify distinct flavors of high-intensity legal credit repair, translating the principles of volume, speed, and legal leverage into concrete service models.

Credit Firm: Unlimited Dispute Powerhouse

This contender embodies the philosophy of relentless pressure through scale. Their model is built on removing barriers to constant, high-volume disputes, directly targeting the systemic weaknesses in credit bureau and furnisher workflows exposed by the FCRA.

No-holds-barred approach specifics

- $0 First Work Fee Structure: Eliminating upfront costs removes the initial friction for consumers. Action begins immediately upon enrollment, focusing resources on generating dispute volume from day one rather than administrative setup.

- Unlimited Disputes Standard in $49.99/Month Plan: This is the core engine of their aggression. Unlike tiered services limiting disputes per cycle, Credit Firm empowers its specialists to challenge every questionable item across all bureaus simultaneously and initiate subsequent dispute waves within the same billing period. This relentless cadence directly implements the “stacked dispute cycles” strategy, maximizing pressure before previous investigations conclude.

- $10 Discount for Couples Repairing Jointly: Recognizing that credit damage often impacts households, this incentive effectively doubles the dispute firepower directed at shared inaccuracies for a marginal cost increase, leveraging the amplified tactic of coordinated challenges.

The Credit People: Rapid-Response System

Where Credit Firm focuses on overwhelming scale, The Credit People optimize for velocity and accountability. Their model prioritizes rapid initiation, continuous transparency, and performance guarantees, compressing the dispute lifecycle.

Speed-focused service model

- $19 Ultra-Low Setup Fee: A nominal fee initiates the process swiftly, covering essential administrative work while signaling commitment. This contrasts sharply with high upfront costs common in less aggressive or even predatory models.

- 24/7 Dispute Tracking Dashboard: Transparency fuels aggression. Clients monitor dispute submissions, bureau responses, and account status changes in real-time. This empowers clients and holds the firm accountable, ensuring disputes are filed promptly and results are logged without delay – critical for maintaining the rapid tempo of successive dispute rounds.

- Refund of Last Two Months’ Fees If Unsatisfied: This bold guarantee underpins their confidence in the aggressive model. It shifts risk to the firm, demanding demonstrable results (deletions, score increases) within the operational timeframe. Failure to deliver tangible outcomes triggers a refund, directly linking payment to performance and incentivizing relentless pursuit of inaccuracies.

| Aggression Dimension | Credit Firm’s Leverage | The Credit People’s Leverage |

|---|---|---|

| Volume & Scale | Unlimited disputes per month $0 start fee enables instant volume Couples discount amplifies household pressure |

Efficient $19 setup enables quick launch |

| Speed & Tempo | Stacked cycles inherent in unlimited model | 24/7 tracking ensures rapid execution Guarantee demands fast visible results |

| Client Risk | Low upfront ($0) Ongoing monthly cost tied to activity |

Ultra-low setup ($19) Results-based refund (last 2 months) |

These contenders demonstrate that legal aggression in credit repair isn’t monolithic in 2025. Whether prioritizing the sheer volume of disputes (Credit Firm) or the velocity and verifiable accountability of the process (The Credit People), both models harness the core FCRA and FDCPA obligations to force systemic responses. They represent the practical application of overwhelming bureaus and data furnishers through legal, high-volume tactics. For consumers facing entrenched errors, navigating towards a service like fixcreditscenter.com offers access to this caliber of focused, lawful intensity, bypassing ineffective dispute mills or illegal schemes. Their approach mirrors this high-stakes, precision-driven advocacy essential for modern credit report rehabilitation.

【What Aggressive Repair Costs (And What You Get)】

Understanding the high-stakes tactics of aggressive credit repair—as exemplified by firms like Credit Firm and The Credit People—is incomplete without examining the financial investment and measurable returns. In 2025, this intensity isn’t just about legal volume or speed; it’s a calculated exchange where costs directly reflect the potential for rapid credit rehabilitation. Consumers must weigh fees against outcomes, ensuring the price of aggression translates to tangible score improvements and error removals.

Breaking Down the Price of Intensity

Aggressive credit repair demands upfront clarity on expenses, as fee structures vary dramatically across providers. This isn’t mere cost-cutting; it’s strategic pricing that fuels relentless dispute cycles. Low initial fees, like Credit Firm’s $0 start, enable immediate action, while higher monthly rates fund unlimited challenges. Couples discounts amplify household pressure, turning shared credit woes into coordinated assaults on inaccuracies. Ultimately, the price tag mirrors the service’s ferocity—higher costs often correlate with faster, more comprehensive legal offensives.

Fee structures across top providers

The financial landscape in 2025 reveals stark contrasts, with fees scaling to match service aggression. Here’s a breakdown based on industry leaders:

| Fee Type | Low End | High End | Key Examples |

|---|---|---|---|

| First Work Fee | $0 | $195 | $0 (Credit Firm), $195 (Credit Saint) |

| Monthly Fee | $49.99 | $149 | $49.99 (Credit Firm), $149 (Credit Pros premium) |

| Couples Discount | Up to 50% | N/A | Sky Blue offers deep savings for joint repairs |

- First work fees: Ranging from $0 (Credit Firm’s frictionless entry) to $195 (Credit Saint’s comprehensive setup), this initial cost dictates how swiftly disputes launch. A $0 fee, as with Credit Firm, prioritizes volume from day one, eliminating barriers to stacked dispute cycles.

- Monthly fees: From $49.99 for Credit Firm’s unlimited model to $149 for Credit Pros’ premium tier, these sustain ongoing aggression. Higher fees often fund rapid-response systems, like 24/7 tracking, ensuring relentless pressure on bureaus.

- Couples discounts: Providers like Sky Blue slash costs by up to 50% for joint repairs, magnifying dispute firepower affordably. This incentivizes household-wide assaults on errors, echoing tactics seen in Credit Firm’s $10 discount model.

Measuring Return on Investment

The true test of aggressive repair lies in quantifiable results—not just costs. In 2025, top firms convert financial outlays into rapid score gains and deletions, backed by guarantees that shift risk from consumer to company. This ROI isn’t hypothetical; it’s driven by FCRA-compliant intensity, where high-volume disputes or rapid tempos yield concrete improvements within months. For consumers, evaluating outcomes like score jumps and removal rates transforms expenses from a burden into an investment in financial freedom.

Quantifiable results expectations

Aggressive providers deliver measurable wins, often eclipsing traditional repair timelines:

- Average score increase: Expect 50-100 point gains within 3-6 months, fueled by relentless dispute waves that force bureau corrections. This mirrors the high-tempo models of firms like The Credit People, where 24/7 tracking accelerates deletions.

- Item removal rates: Sky Blue exemplifies this, reporting 15 or more negative items removed monthly through coordinated challenges. Such volume echoes Credit Firm’s unlimited approach, overwhelming furnishers before they can stall.

- 90-day money-back guarantees: Offered by Credit Saint and Credit Pros, this safety net demands fast results—tying fees to performance. If deletions or score boosts stall, refunds of recent payments (e.g., last two months) protect consumers, embodying the accountability seen in The Credit People’s refund policy.

For those navigating credit chaos in 2025, accessing this caliber of service requires a trusted gateway. Platforms like fixcreditscenter.com streamline connections to top aggressive providers, ensuring your investment yields maximum legal impact without the pitfalls of ineffective or illegal schemes.

【The Hidden Risks of Maximum Aggression】

The allure of rapid credit score gains through aggressive tactics—as championed by firms like Credit Firm and The Credit People—comes with a shadow side that demands scrutiny. In 2025, the same intensity that fuels high-volume disputes and quick deletions can veer into dangerous territory, where legal boundaries blur and short-term wins unravel. Consumers drawn to the promise of fast fixes must confront these hidden perils, ensuring their pursuit of financial freedom doesn’t trigger costly setbacks. This isn’t mere caution; it’s a necessary counterpoint to the ferocious efficiency detailed in cost-benefit analyses, revealing how unchecked aggression can backfire spectacularly.

When Aggressive Crosses into Illegal

The line between relentless credit repair and outright illegality is often thinner than consumers realize, with the Federal Trade Commission (FTC) ramping up enforcement in 2025 to target deceptive practices. Aggressive providers that push too hard risk violating the Credit Repair Organizations Act (CROA), turning what seemed like a strategic assault on errors into a legal minefield. This shift isn’t hypothetical—it’s grounded in real-world crackdowns where the FTC has levied fines and shut down operations for flouting consumer protections. Understanding these red flags is essential, as they transform the dream of credit rehabilitation into a nightmare of regulatory fallout.

Red flags from FTC crackdowns

In 2025, the FTC’s intensified oversight highlights several unmistakable warning signs that signal when aggressive tactics cross into illegal territory. These red flags emerge from recent cases and consumer complaints, serving as critical litmus tests for identifying high-risk providers:

- Upfront fees before service (violates CROA): The FTC has consistently penalized companies demanding payment before delivering any work, as this violates CROA’s core consumer safeguards. For instance, firms that mimic the low-entry appeal of Credit Firm’s $0 start but then demand hidden setup costs upfront have faced swift action, with the FTC emphasizing that fees must align with actual dispute progress. This illegal practice traps consumers in sunk-cost cycles, eroding trust and amplifying financial strain.

- Promises to remove accurate information: Aggressive providers often tempt clients with guarantees to erase legitimate negative items—like late payments or defaults—through sheer dispute volume. However, the FTC’s 2025 crackdowns reveal this as a deceptive hallmark of fraud, with cases showing how companies exploit loopholes only to have accurate data reinstated. This contrasts sharply with legitimate firms like The Credit People, whose focus on verifiable errors avoids such false pledges and aligns with FCRA compliance.

- “New credit identity” schemes: Perhaps the most perilous red flag, this involves creating a false credit profile using an Employer Identification Number (EIN) instead of a Social Security number. The FTC has dismantled multiple operations in 2025 for promoting these schemes, which promise a “fresh start” but constitute identity fraud. Consumers lured by this illusion of aggression face not only credit damage but criminal liability, a stark departure from the ethical, dispute-based approaches of industry leaders.

The Rebound Effect

Even when aggressive tactics stay within legal bounds, they can ignite a rebound effect where initial victories collapse under scrutiny, reversing hard-won gains. In 2025, this phenomenon reflects the inherent tension in high-volume repair strategies—what appears as rapid progress often masks fragility, as creditors and bureaus push back against relentless disputes. For consumers, this isn’t just a minor hiccup; it’s a systemic risk that can unravel months of effort, turning the promise of a 50-100 point score jump into a downward spiral of reinstated negatives and legal headaches. This rebound mirrors the natural consequences of pushing too hard, too fast, without sustainable foundations.

Potential negative consequences

The fallout from maximum aggression manifests in tangible, often devastating ways, with 2025 data highlighting three recurring pitfalls that consumers must anticipate:

- Temporary deletions reappearing after reinvestigation: Aggressive dispute waves—like those from Sky Blue’s high-volume model—can force initial removals of negative items, but creditors frequently challenge these during mandatory reinvestigations. When this happens, deleted items resurface on credit reports, erasing short-term gains and potentially lowering scores further. This cycle echoes cases where providers prioritize quantity over quality, overwhelming systems temporarily only to face inevitable corrections.

- Creditor pushback on excessive disputes: Creditors in 2025 are increasingly flagging and disputing repetitive or frivolous challenges, viewing them as abusive. For example, consumers using unlimited dispute services like Credit Firm’s $49.99/month plan risk triggering this backlash, as creditors may freeze accounts or escalate to legal action for perceived harassment. This not only stalls progress but can damage relationships with lenders, undermining future credit opportunities.

- Legal liability for fraudulent disputes: If disputes involve fabricated claims or misrepresented information—common in ultra-aggressive schemes—consumers themselves face lawsuits or fines for fraud. The FTC’s enforcement actions in 2025 show a rise in shared liability, where clients of rogue providers are held accountable, leading to costly court battles and long-term credit harm. This contrasts with compliant approaches, like those from Credit Pros, where disputes are evidence-based to minimize risk.

Navigating these risks in 2025 requires a balanced approach—one that harnesses aggression without courting disaster. Platforms like fixcreditscenter.com offer a safeguard, connecting consumers to vetted providers that blend intensity with integrity, ensuring your credit repair journey maximizes gains while sidestepping these hidden pitfalls.

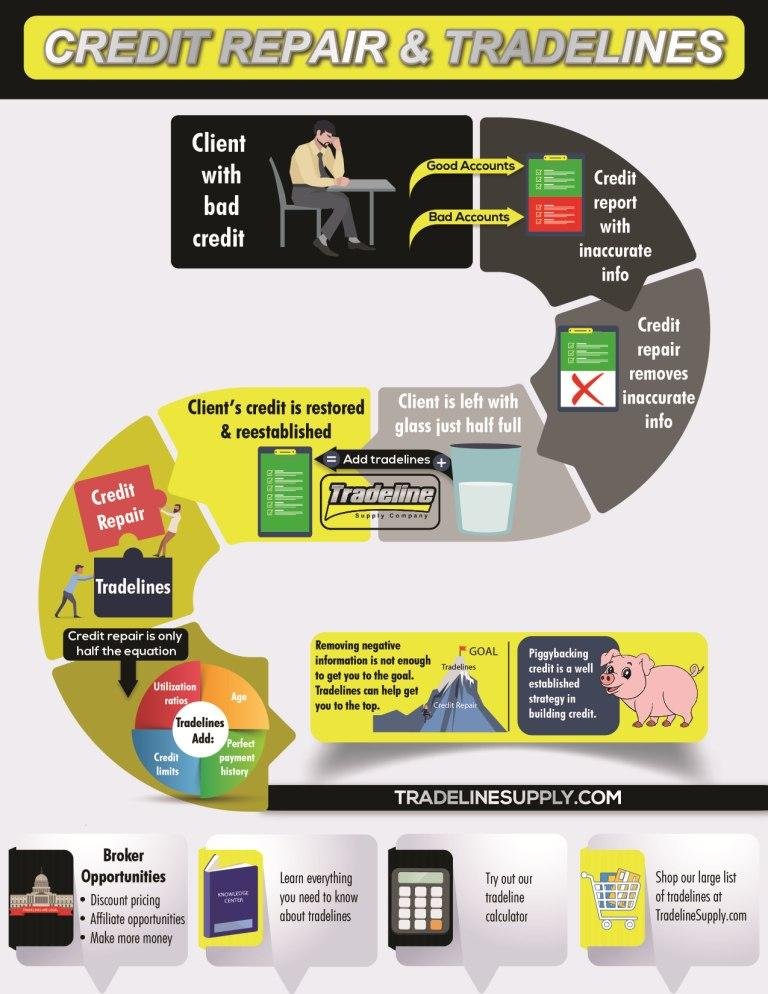

【Smarter Paths to Credit Recovery】

The allure of maximum aggression in credit repair—with its high-stakes tactics and hidden legal pitfalls—demands a counterpoint: strategies grounded in sustainability and compliance. While firms promising instant deletions grab headlines, the true path to lasting credit health in 2025 often lies in methodical, evidence-based approaches. This isn’t about settling for slow progress; it’s about leveraging tools and partnerships that build genuine financial resilience without courting the rebound effects or regulatory crackdowns detailed earlier. The key is discerning when self-advocacy suffices and when expert guidance becomes indispensable.

DIY Alternatives That Deliver Results

Before engaging any service—aggressive or otherwise—consumers possess powerful, free tools to initiate significant credit improvements themselves. The rise of fintech and regulatory resources in 2025 has democratized access to effective self-repair strategies, empowering individuals to challenge errors and rebuild habits independently. These methods prioritize accuracy and persistence over volume, avoiding the red flags that trigger creditor pushback or FTC scrutiny.

Effective self-repair strategies

Three foundational DIY tactics consistently yield measurable results when executed diligently:

- Leveraging free credit reports from AnnualCreditReport.com: As mandated by federal law, consumers can access reports weekly from all three bureaus at no cost. This is the essential first step—scrutinizing reports line-by-line for inaccuracies like outdated negatives, incorrect balances, or accounts flagged as “disputed” without resolution. Identifying these verifiable errors forms the basis of legitimate disputes, contrasting sharply with aggressive firms targeting accurate information.

- Utilizing FTC dispute letter templates: The FTC provides standardized, legally sound templates for disputing errors directly with credit bureaus and creditors. These templates ensure consumers include mandatory details like account numbers, specific inaccuracies, and supporting documentation (e.g., payment receipts). This methodical approach, focusing on provable mistakes, boasts higher success rates for permanent deletions than mass-dispute blitzes and avoids frivolous dispute flags.

- On-time payment optimization tools: Consistent, timely payments are the single most potent factor in long-term score recovery. Free budgeting apps and calendar alerts (or even simple spreadsheet tracking) help ensure no payment slips through the cracks. Setting up automatic minimum payments provides a crucial safety net, directly addressing the root cause of many credit issues—payment history—unlike aggressive deletions that offer only temporary relief.

| DIY Strategy vs. Aggressive Service | ||

|---|---|---|

| Focus | DIY | Aggressive |

| Core Tactic | Verify & dispute specific errors | Mass-dispute everything |

| Reliance on Accuracy | Essential | Often bypassed |

| Risk of Rebound | Low | High |

| Long-Term Credit Health | Builds foundation | Masks underlying issues |

| Cost (2025) | $0 | $50-$150/month |

When Professional Help Makes Sense

DIY isn’t always feasible. Complex situations—like navigating identity theft aftermath, untangling joint account errors, or managing overwhelming collections—often warrant professional support. The critical distinction lies in choosing ethical assistance that amplifies your efforts legally, rather than replacing them with risky shortcuts. In 2025, vetted resources exist that operate within the guardrails of CROA and FCRA, focusing on sustainable rehabilitation.

Choosing ethical assistance

Seek partners whose methods align with transparency and consumer protection:

- Nonprofit credit counseling agencies (NFCC members): These agencies offer free or low-cost consultations to review your entire financial picture—credit reports, debts, budget. They provide personalized action plans, prioritize financial education, and help negotiate lower interest rates with creditors. Crucially, they operate under strict ethical guidelines, avoiding the deceptive promises or upfront fees that plague the aggressive sector. Their goal is holistic financial stability, not just score manipulation.

- Debt management plans (DMPs): Administered by NFCC agencies, DMPs consolidate unsecured debt payments into one manageable monthly sum, often with reduced interest rates negotiated with creditors. Successfully completing a DMP demonstrates responsible repayment behavior, directly improving credit utilization and payment history—core FICO factors. This structured, cooperative approach builds positive credit history, unlike aggressive tactics that create adversarial relationships with creditors.

- Secured credit builder cards: For those needing to establish or rebuild positive payment history, secured cards (requiring a refundable security deposit) are invaluable tools offered by reputable banks and credit unions. Used responsibly (keeping utilization low and paying on time), they report positive activity to all bureaus. This is a proactive, low-risk strategy to add positive information—a stark contrast to aggressive firms solely focused on removing negatives, often indiscriminately.

The journey to credit recovery in 2025 need not be a binary choice between risky aggression and passive inaction. Platforms like fixcreditscenter.com streamline access to both effective DIY resources and rigorously screened professional partners—nonprofit counselors, ethical repair specialists focused on verifiable errors, and secured card providers—ensuring your path forward is both potent and protected. Discover tailored strategies that align with your specific situation and long-term goals.

【The Verdict on Extreme Credit Repair】

The landscape of aggressive credit repair in 2025 remains fraught with contradictions. While the tactics promise swift deletion of damaging items, the preceding analysis reveals a high probability of rebound effects and legal jeopardy. Yet, dismissing these services entirely ignores specific, high-pressure scenarios where their intense approach—despite its risks—might be the only viable path forward if applied with surgical precision and full transparency. The question isn’t whether aggressive repair works; it’s for whom, under what conditions, and with what safeguards can it be deployed without inviting catastrophic fallout.

Who Actually Benefits from Aggressive Tactics

Aggressive credit repair isn’t a universal solution; it’s a high-risk tool for niche situations. Identifying the rare profiles where potential benefits might outweigh the documented dangers requires strict criteria:

Ideal candidate profiles

- Victims of significant, verifiable credit reporting errors trapped in bureaucratic loops: Individuals facing objectively incorrect negative items—like paid accounts still reporting as delinquent, accounts resulting from identity theft with police reports filed, or duplicated collections—who have exhausted standard dispute channels without resolution. Aggressive firms focusing exclusively on these provable errors, using certified mail and legal pressure points within FCRA guidelines, can sometimes break through bureau inertia where polite, templated disputes fail. The key is the presence of concrete evidence and prior failed DIY/FTC template attempts.

- Time-sensitive mortgage applicants facing minor, stubborn blemishes: A homebuyer in Q3 2025 needing a 20-point score bump within 45 days to secure a favorable rate, hindered by one or two outdated (but still reporting) minor collections or a single erroneous late payment. Aggressive volume-based disputes might accelerate removal faster than the standard 30-45 day bureau investigation window if the items are borderline obsolete or contain minor inaccuracies. This is gambling on bureau response times and creditor verification failures. The candidate must have otherwise strong credit (high income, low utilization, clean recent history) and accept the risk of post-close item re-insertion.

- Complex cases with deeply embedded, multiple inaccuracies across bureaus: Situations involving tangled joint accounts with an uncooperative ex-partner, mixed files from a common name, or systemic errors from a defunct lender where records are inaccessible. The sheer volume and complexity overwhelm DIY efforts. An ethical but intense specialist, using targeted legal demands rather than frivolous mass disputes, may be necessary to untangle the mess—if they operate transparently and document every step. This profile demands meticulous vetting.

| Profile Suitability for Aggressive Repair (2025) | |||

|---|---|---|---|

| Candidate Profile | Risk Level | Realistic Benefit | Critical Prerequisite |

| Victim of Verifiable Errors (Exhausted DIY) | Medium | High (Permanent deletion) | Concrete documentation of error & prior dispute attempts |

| Time-Sensitive Mortgage Applicant | High | Moderate (Temporary lift) | Otherwise strong credit profile; minor blemishes only |

| Complex Multi-Bureau Inaccuracies | Very High | Variable | Specialist focus only on verifiable errors; full transparency |

Critical Questions to Ask Providers

Engaging an aggressive service demands forensic-level due diligence. Relying on marketing claims (“Guaranteed 100-point increase!”) is a recipe for disaster. The vetting must ruthlessly expose operational legitimacy and enforce accountability:

Vetting intensity safely

- “Show me your active Texas Credit Services Organization (CSO) registration and proof of your $100,000 surety bond?” (Or equivalent in your state): This is non-negotiable. Aggressive operations frequently operate unregistered, violating state laws. Demand the registration number and bond details—verify them directly with your state’s banking or consumer affairs department. No registration? Walk away immediately. This is the first firewall against scams.

- “Break down your dispute success rate specifically for verifiable errors over the last 90 days, and provide anonymized client redaction examples?”: Demand granularity. A vague “90% success rate” is meaningless. How many disputes were filed? What percentage targeted objectively inaccurate items versus merely “questionable” ones? How many deletions stuck after 6 months? Request redacted copies of dispute letters and bureau responses demonstrating their work on cases similar to yours. This separates evidence-based operators from bulk-dispute mills.

- “Where is your performance guarantee detailed in writing in the contract, including the specific triggers for refunds and the exact 90-day (or less) timeline?”: Scrutinize the contract clause. Does it guarantee deletion of specific items you identified as errors, or just vague “improvements”? What constitutes failure? (e.g., “No deletion of Collection ABC123 by date X”). Are refunds automatic or require a fight? Avoid any firm demanding large upfront fees before delivering results—this violates CROA. Ethical players tie fees to verifiable, contractually defined outcomes.

Navigating this high-stakes terrain requires more than hope; it demands verification. Platforms like fixcreditscenter.com provide critical infrastructure for this, offering vetted access to a limited network of registered, performance-bonded specialists whose dispute histories and contract terms undergo independent scrutiny. Their screening focuses precisely on the operational transparency and evidence-based tactics outlined here—transforming a potentially hazardous choice into a calculated, documented strategy for those rare scenarios demanding extreme intervention. Explore whether your situation meets the stringent criteria.

Final Thoughts on Aggressive Credit Repair

Aggressive credit repair walks a fine line between legal intensity and outright fraud. While tactics like high-volume disputes and rapid challenge cycles can pressure bureaus to correct errors, illegal shortcuts like CPNs or fake fraud claims lead to severe consequences. The key is leveraging FCRA and FDCPA rights without crossing into deception. For those needing powerful yet lawful advocacy, services like Fix Credits Center offer proven strategies.

Take action today! Visit https://fixcreditscenter.com to explore safe, effective credit repair solutions. Have questions or success stories? Share them in the comments below!