Did you know 45% of Americans struggle with credit issues? A secured credit card could be your key to financial recovery. Learn how it builds credit safely in 2025.

【What Exactly is a Secured Credit Card?】

Think of a secured credit card as your training wheels for the credit world. It looks and works almost exactly like a traditional, unsecured credit card – you can swipe it, use it online, and make monthly payments. The crucial difference lies beneath the surface: security. Unlike regular cards that extend credit based solely on your perceived risk, secured cards require you to put down a cash deposit upfront. This deposit acts as collateral for the issuer, significantly reducing their risk. This fundamental security mechanism is what makes these cards uniquely accessible when other doors might be closed.

How It Works Differently Than Regular Cards

The core operational difference boils down to that upfront cash requirement. With a regular credit card, the issuer grants you a credit line based on your creditworthiness. They take on the risk that you might not pay. A secured card flips this dynamic: you provide the security, which directly determines your spending power. This deposit requirement is the key that unlocks access to credit reporting and rebuilding opportunities, even if your history is non-existent or damaged.

The Security Deposit Explained

- Your Deposit = Your Credit Limit: This is the golden rule of secured cards. The amount of money you deposit with the issuer typically sets your credit limit. Deposit $300? Your credit limit is usually $300. Deposit $1,000? That becomes your spending cap. This direct link gives you control over your starting limit.

- Collateral, Not a Fee: Crucially, this deposit is your money. The card issuer holds it securely in a separate account as collateral against potential non-payment. You are not paying this money to the bank for the privilege of having the card; you are providing security. You still own these funds.

Where Your Deposit Goes When You Close the Account

- Full Refund (Good Standing Required): Provided you close your account while it’s in “good standing” (meaning you’ve paid off any outstanding balance and met the card’s terms), you are entitled to get your full security deposit back. This is not a fee – it’s a refundable security hold.

- Timeline: Issuers generally process this refund within two billing cycles after you close the account and settle any final balance. The funds are typically returned via check or direct deposit back to you.

Who Really Needs This Type of Card

Secured cards aren’t for everyone. They serve two primary groups exceptionally well, acting as powerful tools for either launching or repairing a financial reputation:

Ideal for Beginners With Zero Credit History

If you’re young, new to the country, or simply haven’t used credit before, you likely have a “thin file” or no credit history at all. This makes getting approved for a regular credit card nearly impossible. A secured card is often the most effective starting point:

- Credit Bureau Reporting: The most critical function of a secured card for building credit is that responsible usage (making on-time payments, keeping balances low) is reported monthly to all three major credit bureaus (Experian, Equifax, and TransUnion). This consistent reporting is how you build a positive credit history from scratch. Using it wisely lays the foundation for your credit score.

Rebuilding After Financial Mistakes

Past financial difficulties – late payments, collections, charge-offs, or even bankruptcy – can leave your credit score severely damaged (often reflected by a FICO score below 580). Traditional lenders see you as high-risk. Secured cards offer a viable path back:

- Accessibility: Because you’re providing the security deposit, issuers are much more willing to approve applicants with low credit scores or recent negative marks that would disqualify them from unsecured cards. It provides an opportunity to demonstrate renewed financial responsibility.

- Proving Responsible Behavior: Just like for beginners, your on-time payments and responsible credit utilization on a secured card get reported to the bureaus. Over time (typically 12-18 months of consistent good behavior), this positive activity helps rebuild your damaged credit history and improve your FICO score, potentially qualifying you for better financial products down the line. Secured cards offer a structured way to prove you’re back on track. Rebuilding credit takes discipline and the right tools. If you’re ready to take control, exploring reputable secured card options through resources like https://fixcreditscenter.com can be a practical first step towards establishing or repairing your financial foundation in 2025.

Building Credit: How Secured Cards Make It Happen

Your secured credit card isn’t just a spending tool – it’s your most powerful, accessible instrument for building or rebuilding your credit history. The key lies in how you use it, specifically focusing on two critical factors reported monthly to all three major credit bureaus: your payment history and your credit utilization.

Payment History: Your Most Powerful Tool

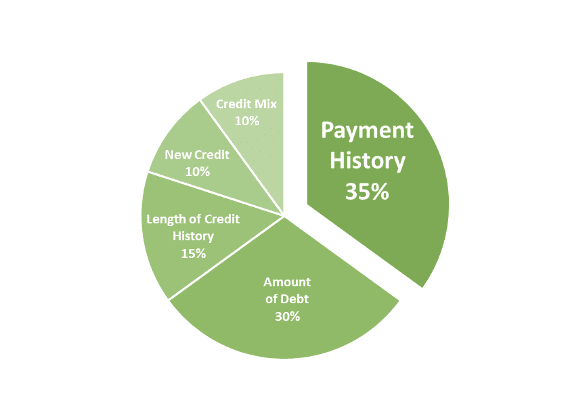

This is the heavyweight champion of your credit score, accounting for a whopping 35% of your FICO® Score. Every payment you make is reported, making consistent, on-time payments absolutely fundamental.

Why On-Time Payments Are Non-Negotiable

- Zero Tolerance for Lateness: Even one late payment (typically reported if you’re 30+ days past due) can cause significant damage to your score. This negative mark stays on your credit report for seven years, acting as a persistent red flag to future lenders.

- Positive Reinforcement: Conversely, every single on-time payment is a positive entry on your report. Over time, this string of reliability becomes the strongest evidence you can present of your creditworthiness. With a secured card, you control this outcome directly.

Setting Up Automatic Payments Successfully

The simplest way to guarantee you never miss a payment? Automate it.

- Link to Your Checking Account: Set up a direct link from your primary bank account to your secured card.

- Choose “Full Balance”: Opt to pay the full statement balance automatically each month. This ensures you avoid interest charges completely.

- Set the Date: Schedule the payment for at least 2-3 business days before your actual due date as a buffer for processing times. This automation removes human error and builds your positive history effortlessly.

Credit Utilization: The 30% Golden Rule

Credit utilization – the percentage of your available credit limit you’re using – is the second most crucial factor, impacting roughly 30% of your FICO® Score. It’s a snapshot of how reliant you are on credit at any given time. Lower is always better.

Calculating Your Safe Spending Limit

The widely recommended maximum utilization rate is 30% or lower. Here’s how it works with your secured card:

- Your Credit Limit: Determined by your security deposit (e.g., $300).

- Your Safe Spending Cap: Multiply your limit by 0.30.

- Example: $300 limit x 0.30 = $90 max monthly spending.

- Ideal Range: Aiming for below 10% utilization ($30 or less on a $300 limit) is considered optimal for rapid score improvement. Pay attention to your statement closing date, as this is when utilization is typically reported.

Why Maxing Out Hurts Your Credit Score

Using a high percentage of your available limit sends negative signals:

- Perceived Risk: Lenders interpret high utilization as potential financial strain or over-reliance on credit. It suggests you might be living beyond your means.

- Score Damage: Consistently maxing out your card, even if you pay it off in full each month after the statement closes, will show high utilization on your report and drag your score down. It negates much of the positive impact of your on-time payments.

- The Secured Card Reality: Remember, your limit is likely low ($200-$500 is common). This makes hitting 30% ($60-$150) very easy. Self-discipline is essential. Treat your secured card like a debit card – only spend what you already have in the bank to cover immediately.

Using your secured card strategically – paying on time, every time, and keeping your balance far below your limit – is the proven formula for building a strong credit history or repairing past damage. This disciplined approach, consistently reported to Experian, Equifax, and TransUnion, is how you transform that security deposit into tangible financial progress. For guidance on choosing the right secured card to implement these strategies effectively in 2025, resources like https://fixcreditscenter.com can provide valuable starting points tailored to your rebuilding journey.

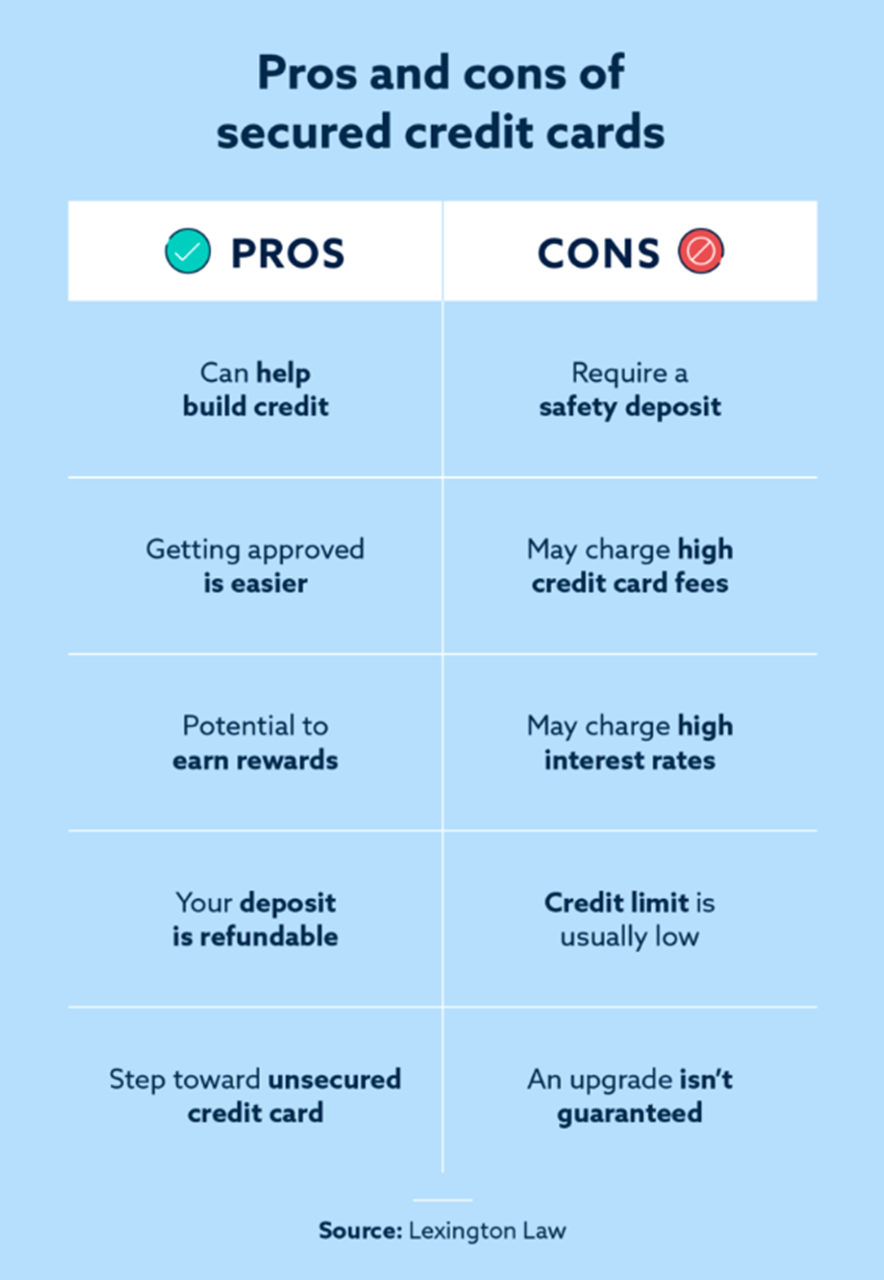

Big Pros and Cons You Must Consider

Secured credit cards are powerful tools, but like any financial product, they come with distinct advantages and disadvantages. Understanding these is crucial before you commit your deposit. Let’s break down the key pros and cons you absolutely need to weigh for your 2025 credit-building strategy.

Major Advantages for Credit Builders

Secured cards shine where traditional unsecured cards often shut the door, offering unique benefits specifically for those starting or rebuilding their credit journey.

Easier Approval Than Unsecured Cards

The single biggest advantage? Accessibility. Secured cards are designed precisely for people with limited or damaged credit.

- No Credit History Often Required for Approval: Unlike unsecured cards demanding strong credit scores, secured card issuers primarily care about your ability to fund the security deposit. A thin file or even no credit history at all is frequently acceptable. Your deposit mitigates the lender’s risk.

- Damaged Credit is Less of a Barrier: Past mistakes like late payments, collections, or even a bankruptcy don’t automatically disqualify you. The security deposit provides the issuer with collateral, making them far more willing to extend credit when unsecured issuers won’t.

Controlled Spending Prevents Debt Traps

This feature is a fundamental safeguard, especially crucial when building financial discipline.

- Cannot Spend Beyond Deposited Amount: Your credit limit is directly tied to the cash security deposit you provide. If you deposit $500, your credit limit is typically $500. This creates a hard spending cap. You physically cannot rack up thousands in high-interest debt like you could with an unsecured card. It forces you to live within the secured funds you’ve allocated.

- Built-In Budgeting Tool: This structure inherently promotes responsible spending habits. You’re using your own money as credit, making it easier to track and manage expenses without the fear of spiraling into unmanageable debt.

Potential Drawbacks to Watch For

While powerful, secured cards aren’t perfect. Being aware of the potential downsides helps you choose wisely and avoid costly mistakes in 2025.

Fees That Can Add Up Quickly

Fees can significantly erode the value of your secured card, especially on lower limits. Scrutinize the fee schedule before applying.

| Fee Type | Typical Cost Range | Why It Matters |

|---|---|---|

| Annual Fee | $25 – $50+ | Charged yearly just for having the card. Common, but look for lower/no fee options. |

| Setup Fee | Often $0 – $50+ | One-time fee charged when opening the account. Avoid cards with high setup fees. |

| Monthly Fee | $5 – $10 per month | Adds up fast ($60-$120/year). Highly undesirable; prioritize cards without these. |

| Other Fees | Late fees, foreign trans. | Standard fees apply like any credit card. Always pay on time! |

- Impact on Small Deposits: On a $200 secured limit, a $50 annual fee represents a substantial 25% of your available credit before you even use the card! Prioritize cards with the lowest possible fees, especially avoiding monthly maintenance fees.

- Fee Transparency is Key: Read the cardholder agreement carefully. Understand all potential fees before submitting your deposit.

Lower Credit Limits Than Traditional Cards

Your spending power is inherently limited by the deposit requirement.

- Limits Typically Range from $200 to $2,500: Most secured cards start at very low limits ($200-$500 is common), directly reflecting your deposit amount. While some issuers offer higher limits ($1,000-$2,500+) for larger deposits, these are still generally lower than the limits offered on unsecured cards to established borrowers.

- The Utilization Challenge Revisited: As discussed earlier, low limits make managing credit utilization (keeping balances below 30%, ideally below 10% of your limit) more challenging. Spending just $60 on a $200 card puts you at 30% utilization. This requires meticulous spending control and frequent payments (potentially before your statement closes) to keep reported utilization low. It demands more active management than a card with a higher limit.

- Limited Purchasing Power: Obviously, a low credit limit restricts the size of purchases you can put on the card. They are tools for building credit history through small, manageable transactions, not for financing larger expenses.

Understanding these core advantages and potential pitfalls is essential for leveraging a secured card effectively in 2025. The easier approval and built-in spending controls are powerful assets for rebuilding, but you must actively manage fees and the limitations of a lower credit line. Choosing the right secured card with minimal fees and a manageable deposit is critical; evaluating your options through resources like https://fixcreditscenter.com can help you find the best fit to maximize the pros and minimize the cons for your specific situation.

Smart Card Management Strategies

Now that you understand the core pros and cons of secured cards in 2025, let’s shift focus to how you wield this tool effectively. Proper management isn’t just about avoiding fees – it’s the engine that drives real credit score improvement.

Making Payments Work for Your Credit Score

Payment history is the single largest factor influencing your credit score (typically 35%). For a secured card to rebuild your credit, every payment must be strategic and on time.

How Much to Pay Each Month

The Golden Rule: Pay your statement balance in full, by the due date, every single month.

- Why “In Full” Matters: Carrying a balance does not build credit faster. It only triggers high interest charges (APRs often exceed 25%), eroding your deposit’s value and potentially harming your score if utilization creeps up.

- Why “By the Due Date” is Non-Negotiable: Timeliness is paramount. Paying the full statement balance by the due date guarantees:

- You avoid all interest charges.

- You demonstrate flawless payment history to the credit bureaus.

- You sidestep costly late fees.

Action: Set up automatic payments for at least the minimum payment as a safety net. Always aim to manually pay the full statement balance before the due date.

What Happens If You Miss a Payment

This is a critical danger zone for secured card users in 2025:

- Immediate Penalties: Expect a late fee (typically up to $40).

- Credit Score Damage: A single late payment (30+ days past due) can be reported to the credit bureaus, potentially plunging a rebuilding score by 100+ points. This damage lingers for years.

- Cardholder Agreement Risk: Consistent late payments can violate your agreement, leading to account closure and forfeiture of your deposit.

- APR Spike: Your regular APR may skyrocket to a penalty rate (often 29.99% or higher).

Damage Control: If you miss a payment, pay it immediately. Contact the issuer before 30 days pass – they might waive the fee/reporting as a one-time courtesy if you have a good history.

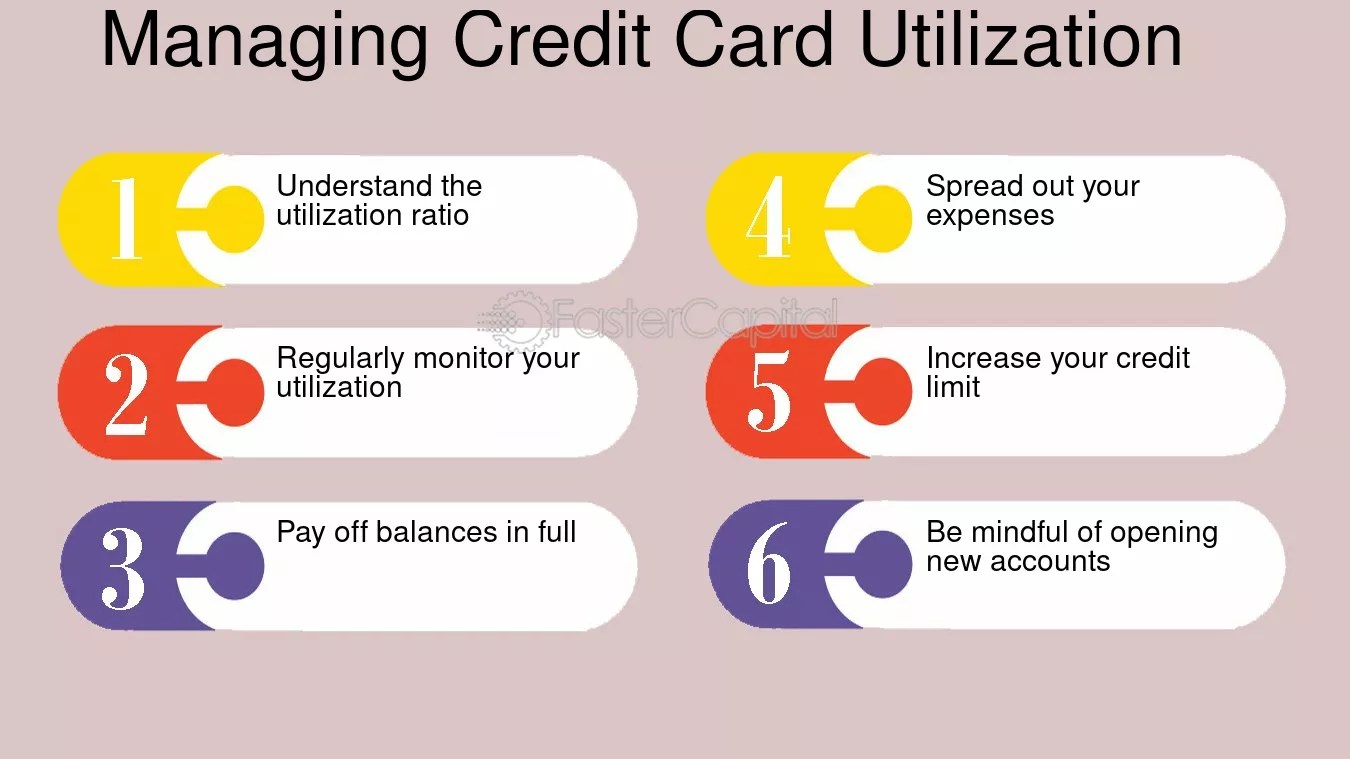

Keeping Your Credit Utilization Low

Credit utilization (your balance divided by your credit limit) is the second most crucial credit score factor (about 30%). Low utilization (ideally below 10%, definitely below 30%) signals responsible credit management. Secured cards’ low limits make this challenging but essential.

The Best Time to Make Payments

Don’t wait for the due date to manage utilization. Pay before your billing cycle closes (statement date).

- Why Timing Matters: Card issuers report your balance to credit bureaus around your statement closing date, not the payment due date. A high balance reported equals high utilization.

- The Strategy: Monitor your balance weekly. Aim to pay down your balance before the statement generates so that only a small, ideally <10% utilization amount is reported.

- Example: $200 limit. Spend $50 during the month. Pay $40 down before the statement closes. Only $10 (5% utilization) gets reported.

When to Request a Credit Limit Increase

Higher limits naturally lower your utilization ratio for the same spending level. With secured cards, increases usually work differently:

- The Primary Method: Deposit More Money. Most issuers allow you to add to your security deposit after account opening (e.g., every 6 months), which increases your credit limit dollar-for-dollar. This is the most reliable way to get a higher limit on a secured card in 2025.

- Unsecured Increases (Rare but Possible): Some issuers may periodically review accounts in good standing (perfect payments, low utilization for 12+ months) and offer a small unsecured credit line increase without requiring more deposit. Don’t bank on this, but it’s a bonus if offered.

- When to Ask: Only request a deposit-based increase if:

- You have the extra funds to lock up securely.

- You’ve consistently demonstrated perfect payment history (6-12 months).

- Your current low limit is severely hampering your ability to keep utilization low despite responsible spending.

Mastering these payment and utilization tactics transforms your secured card from a simple access tool into a powerful credit-building accelerator. For expert guidance on selecting and managing the best secured card tailored to your unique 2025 credit recovery goals, explore the resources available at https://fixcreditscenter.com.

Upgrading to Unsecured Credit

Your disciplined management of your secured card – those on-time, in-full payments and low utilization ratios – is paving the way for a significant milestone: graduating to an unsecured card and reclaiming your security deposit. This transition is the tangible reward for your responsible credit habits in 2025.

Qualifying for Your Deposit Return

Getting your security deposit back isn’t automatic; it’s earned through consistent, responsible card use. Lenders require proof you’ve mastered the fundamentals before converting your account.

The 6-7 Month Responsible Use Rule

Patience and persistence are key. Most issuers won’t even consider converting your secured card to an unsecured one or refunding your deposit until you’ve demonstrated a minimum of 6 to 7 months of flawless management. This period allows them to see a sustained pattern of responsible behavior, not just a couple of good months.

What Lenders Check During Account Reviews

When the issuer conducts their periodic review (often starting around the 7-month mark), they scrutinize your broader credit profile, not just your secured card activity. Two critical factors dominate their decision:

- On-Time Payments Across ALL Credit Accounts: One late payment anywhere on your credit report during this review period can derail your upgrade. Lenders need confidence you pay all obligations reliably. Your secured card’s perfect history is crucial, but they look at your entire payment landscape.

- Low Credit Utilization Ratios: Maintaining low balances relative to your credit limits – ideally below 30%, and optimally below 10% – across all revolving accounts remains paramount. High utilization signals risk, even if payments are on time. Your ability to manage the low limit on your secured card effectively is a strong positive indicator.

Transitioning to Better Credit Opportunities

Successfully qualifying for an unsecured card marks a major step forward in your 2025 credit recovery journey. Understand what changes and what remains the same.

How Your New Unsecured Card Works

Upon approval for the unsecured upgrade:

- Security Deposit Refunded: This is the moment you’ve worked for! Your initial cash deposit is typically refunded in full, often via check or direct deposit, within one or two billing cycles after the account converts.

- Credit Limit Often Increases: While not guaranteed, many issuers simultaneously increase your credit limit upon conversion. This increase might be modest or significant. Crucially, this higher limit is now unsecured – meaning it’s not tied to a new deposit. This automatically helps you maintain lower utilization ratios with your existing spending patterns.

Continuing Your Credit Building Journey

Graduating to an unsecured card is a victory, but it’s not the finish line. Your credit building journey continues, and the core principles remain vital:

- Maintain Under 30% Credit Utilization: While your new higher limit makes this easier, resist the urge to significantly increase spending. Continue keeping reported balances low relative to your new limit. Aiming for under 10% utilization is still the gold standard for optimal score growth.

- Keep Oldest Accounts Open: Your original secured card account, now unsecured, becomes one of your oldest credit lines. The length of your credit history impacts your score (about 15%). Keeping this account open and active (even with minimal, occasional use) helps lengthen your average account age, which benefits your score over time. Don’t close it just because it’s unsecured now.

Successfully upgrading your secured card is powerful validation of your financial discipline. To navigate this transition smoothly and explore the best unsecured card options for your continued rebuilding in 2025, leverage the tailored tools and guidance available at https://fixcreditscenter.com.

[object Object]