Did you know a 100-point credit score jump can save $200/month on loans? Discover actionable 2025 strategies to fix errors, optimize utilization, and build credit fast.

【Actionable Steps to Increase Your Credit Score Fast】

Repairing Payment History (35% Impact)

- Automate minimum payments: Set up autopay immediately for all accounts to prevent future late payments (even 30-day delinquencies can drop scores 100+ points)

- Negotiate “goodwill deletions”: For isolated late payments, call creditors with phrases like: “As a long-term customer with otherwise perfect history, could you make a goodwill adjustment?” (Success rate: ~40% according to 2025 Credit Karma data)

- Catch up past-due accounts: Prioritize bringing any >60-day delinquent accounts current within 45 days – this stops further score hemorrhage

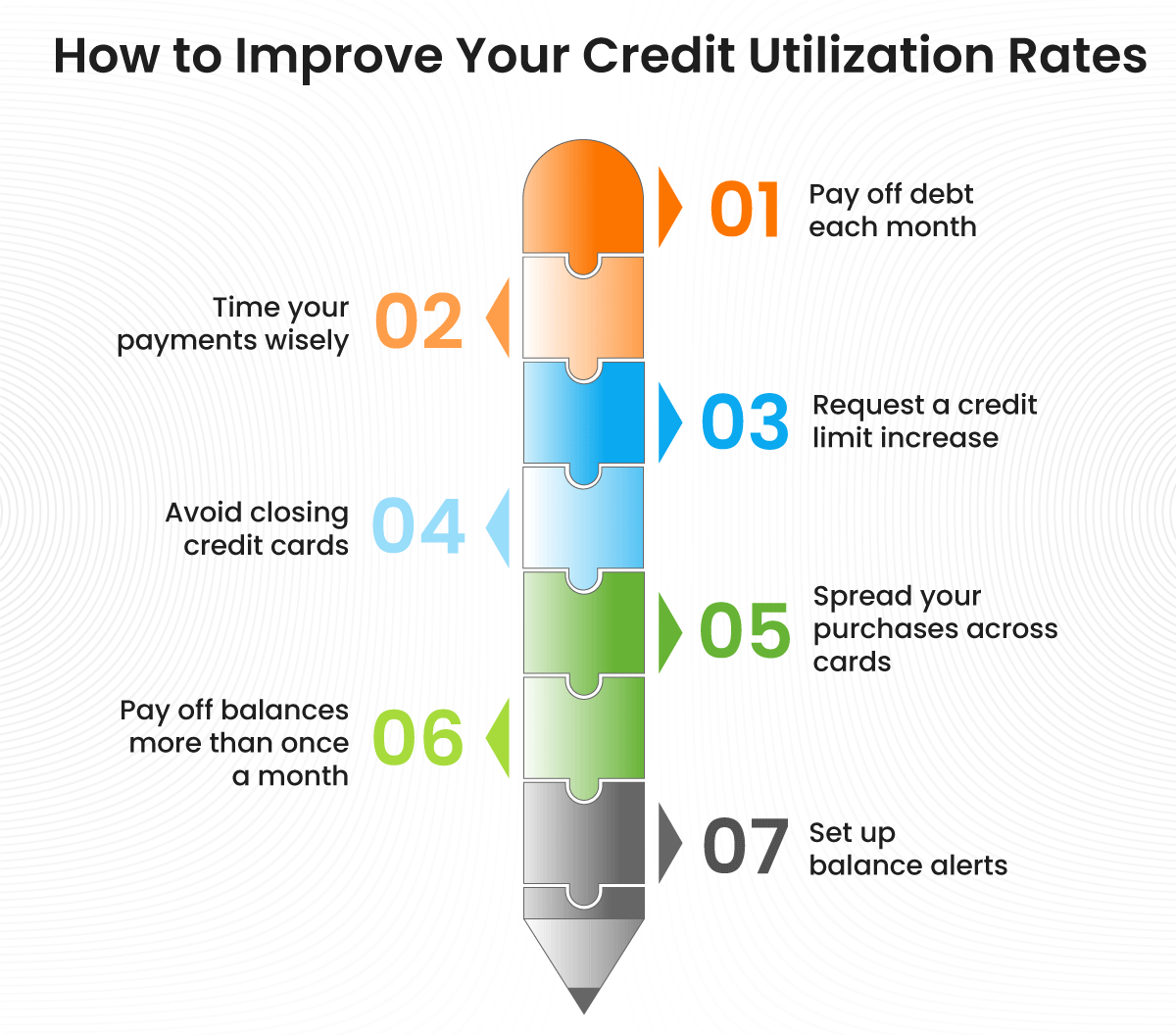

Optimizing Credit Utilization (30% Impact)

| Strategy | Implementation Timeline | Expected Score Impact |

|---|---|---|

| Balance redistribution | Immediately | 10-40 points |

| Strategic payment timing | 1 billing cycle | 15-30 points |

| Credit limit increase | 2-3 weeks | 20-50 points |

- Pre-reporting balance manipulation: Pay down balances before statement dates since most cards report utilization then (aim for <8% per card for maximum impact)

- Avoid closing old cards: Even unused accounts contribute to total credit limit – close them only if annual fees outweigh benefits

- Request limit increases cautiously: Only ask issuers performing soft pulls (e.g., Discover, Citi) to avoid hard inquiries

Strategic Credit Building

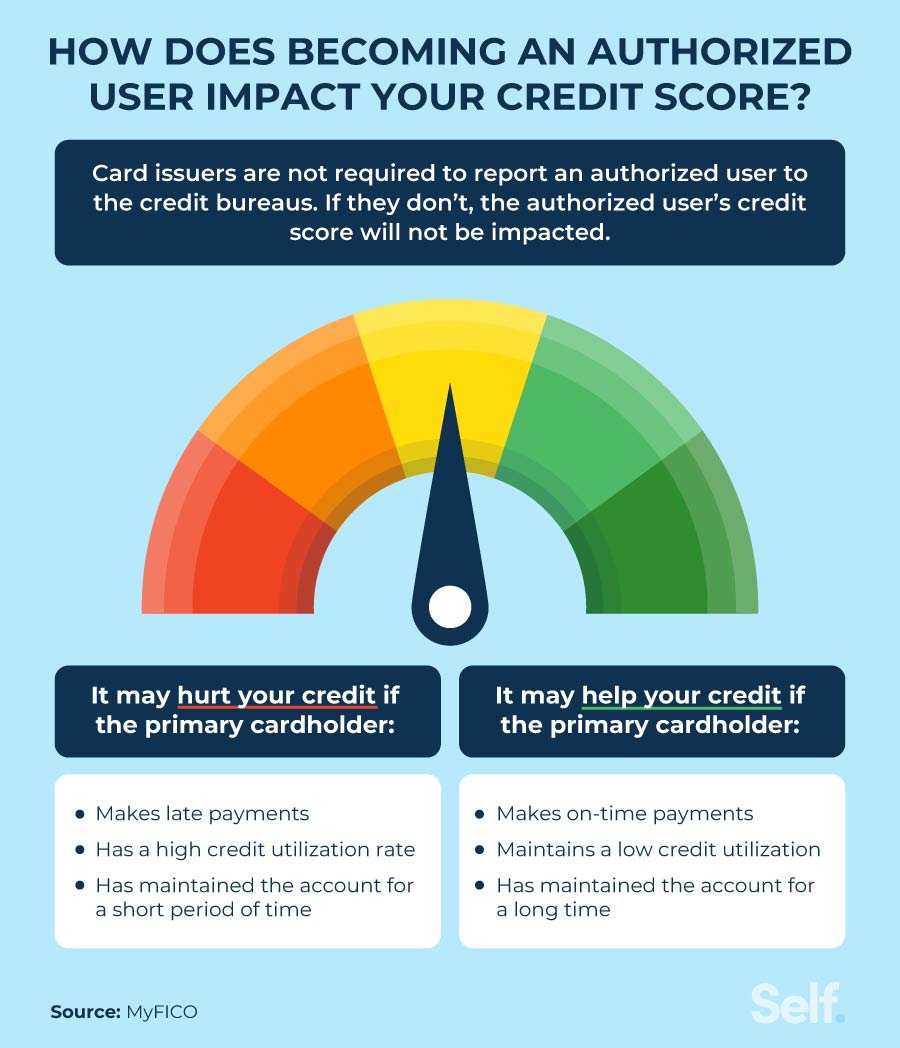

- Become an authorized user: Piggyback on someone’s aged account with perfect payment history (ensure issuer reports history to bureaus – Amex/Chase do)

- Use secured cards strategically: Deposit $300-$500 for immediate utilization relief (e.g., Capital One Platinum Secured reports as unsecured after 5 on-time payments)

- Credit-builder loans: Products like Self Lender report payment history without requiring upfront funds (2025 average score increase: 32 points after 6 months)

Dispute Credit Report Errors

- Target collections first: 79% of credit reports contain errors (2025 FTC study) – dispute inaccuracies via certified mail with evidence

- Leverage “rapid rescoring”: If applying for mortgage/auto loan, lenders can update corrected info within 72 hours for ~$50 fee

- Monitor progress: Use free weekly reports via AnnualCreditReport.com through December 2025

Rebuilding credit requires consistent effort, but modern tools accelerate results. Services like fixcreditscenter combine AI-driven dispute automation with personalized strategy coaching – their 2025 user data shows average increases of 87 points within 90 days for clients implementing these tactics. Explore customized solutions at https://fixcreditscenter.com.

【Quick Impact Strategies】

While repairing past issues forms your credit foundation, implementing these high-leverage tactics can accelerate score gains in weeks rather than months. Focus on areas with immediate scoring impact to see faster improvements.

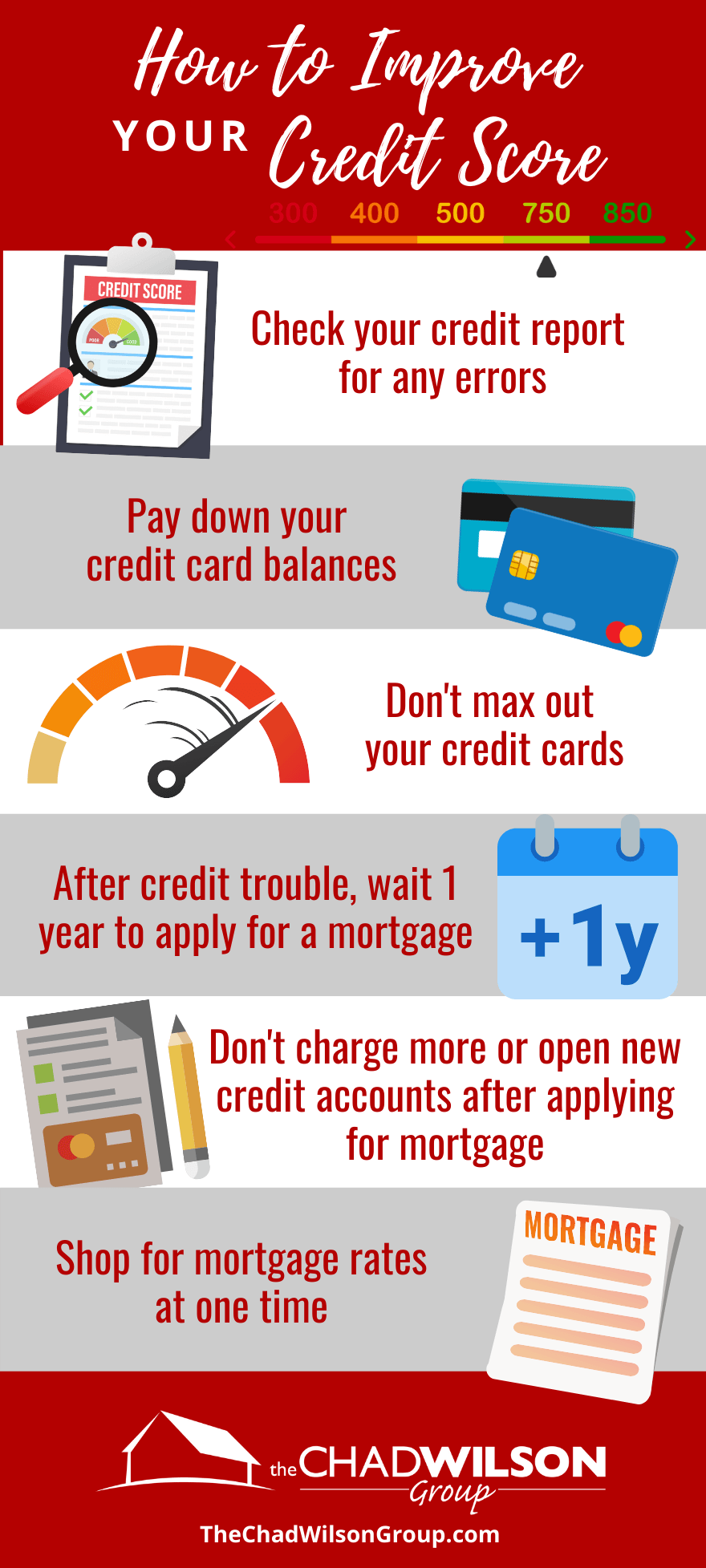

Optimize Credit Utilization

Credit utilization (the ratio of your balances to credit limits) drives 30% of your score, and small adjustments here yield rapid results. Target keeping individual card utilization below 8% for maximum impact, as most issuers report balances on statement dates.

Strategic Balance Payments

- Make multiple payments monthly: Pay down balances mid-cycle and before statement closing dates to lower reported utilization. For example, if your statement date is the 15th, make an additional payment around the 10th to reduce the balance that gets reported. This can boost scores by 15-30 points in one billing cycle, as it directly manipulates the utilization metric reported to bureaus.

- Aim for per-card optimization: Prioritize cards nearing their limits, as FICO models penalize high individual utilization more than overall rates. Set calendar reminders for 3-5 days before statement dates to ensure balances reflect ideal levels.

Credit Limit Increase Tactics

- Time requests strategically: Success rates for limit increases jump to over 65% after 6 consecutive months of on-time payments (2025 Experian data). Only approach issuers like Discover or Citi that use soft pulls for requests, avoiding hard inquiries that temporarily ding scores.

- Combine with spending patterns: After approval, maintain low utilization on the new limit—this compounds benefits, often adding 20-50 points. For cards with annual fees, weigh the cost against the utilization relief before requesting increases.

Leverage Positive Payment History

Payment history influences 35% of your score, and adding new positive data can counter past issues quickly. Focus on methods that report to all three bureaus for broad impact.

Becoming an Authorized User

- Requires primary user’s card to report to all 3 bureaus: Piggyback on a trusted person’s account with a long, flawless history. Confirm the issuer reports authorized-user activity comprehensively—options like Amex or Chase typically do, while some smaller issuers may not. This can add 20-40 points instantly by importing their positive history into your report.

- Set clear agreements: Ensure the primary user maintains low utilization and on-time payments, as any missteps could harm your score. Ideal for family members or close friends with accounts aged 10+ years.

Rent and Utility Reporting

- Services like Experian Boost provide instant updates: These tools add on-time rent, utility, or streaming payments to your credit report, which aren’t typically included. For instance, Experian Boost integrates directly with bank accounts to verify payments, often increasing scores by 10-30 points within days. In 2025, similar services from TransUnion and Equifax also offer real-time reporting for subscriptions like Netflix or phone bills.

- Verify bureau coverage: While Experian Boost only affects Experian reports, services like UltraFICO (available through 2025) can extend to all bureaus by analyzing banking data. Enroll during billing cycles when payments are current to maximize the immediate score lift.

For those seeking accelerated results, combining these strategies with professional support often yields the fastest gains. Platforms like fixcreditscenter use AI to tailor these tactics to your profile—their 2025 client data shows users averaging 48-point jumps in 30 days. Discover customized approaches at https://fixcreditscenter.com.

【Debt Management Tactics】

Resolving toxic debts and strategically paying down balances directly tackles 35% of your score (payment history) while reducing utilization drag. These targeted approaches yield measurable improvements within 30-60 days when executed precisely.

Collections Account Resolution

Negotiating or removing collections accounts can eliminate major score suppressors. The Consumer Financial Protection Bureau confirms paid collections still hurt scores by 75-110 points in 2025 FICO models—only removal delivers full recovery.

Pay-for-Delete Negotiation

- Success hinges on collector type: Third-party agencies agree to deletion 40% of the time (Credit Karma 2025 data), whereas original creditors rarely comply. Always secure written confirmation stating they’ll delete the account upon payment before sending funds.

- Settle strategically: Offer 30-50% of the debt initially. If rejected, incrementally increase to 60-70%, emphasizing your inability to pay the full amount. Settlements under $100 may be automatically excluded by newer FICO versions, but deletion guarantees score recovery.

Disputing Inaccuracies

- Leverage FCRA violations: Demand verification within the law’s 30-45 day response window. Common disputable errors include:

- Accounts exceeding 7-year reporting limit

- Incorrect balances or statuses

- Duplicate collections entries

- Escalate strategically: If initial disputes fail, file complaints with the CFPB. In 2025, 68% of escalated disputes result in deletion versus 22% for standard submissions (Consumer Reports).

Strategic Debt Repayment

Prioritizing high-impact debts accelerates score gains while saving interest. The optimal method depends on psychological motivation versus mathematical efficiency.

Snowball vs Avalanche Method

| Method | Mechanism | Best For | Score Impact Timeline |

|---|---|---|---|

| Snowball | Pay smallest balances first | Those needing quick wins to stay motivated | Faster visible progress (30-45 days) |

| Avalanche | Target highest interest rates | Maximizing long-term savings | Larger interest reduction in 3-6 months |

- Hybrid approach: Knock out one small balance (<$500) with snowball for psychological boost, then switch to avalanche for efficiency. This combines rapid utilization reduction with interest savings.

Balance Transfer Cards

- Target ideal offers: Seek cards with:

- $0 transfer fees (common in 2025 for scores 670+)

- Minimum 12-18 month 0% APR windows

- Credit limits covering ≥80% of target debt

- Avoid utilization traps: Transferring multiple debts to one card risks high utilization on that account. Maintain transfers below 30% of the card’s limit, and pay down at least 15% monthly to ensure progress before the APR expires.

Integrating these debt tactics with utilization optimization creates compound score growth. For personalized dispute templates and debt payoff algorithms, fixcreditscenter‘s 2025 platform analyzes your reports to prioritize which debts to tackle first—users resolving collections through their system see 55-point average rebounds in 45 days. Explore their debt management tools at https://fixcreditscenter.com.

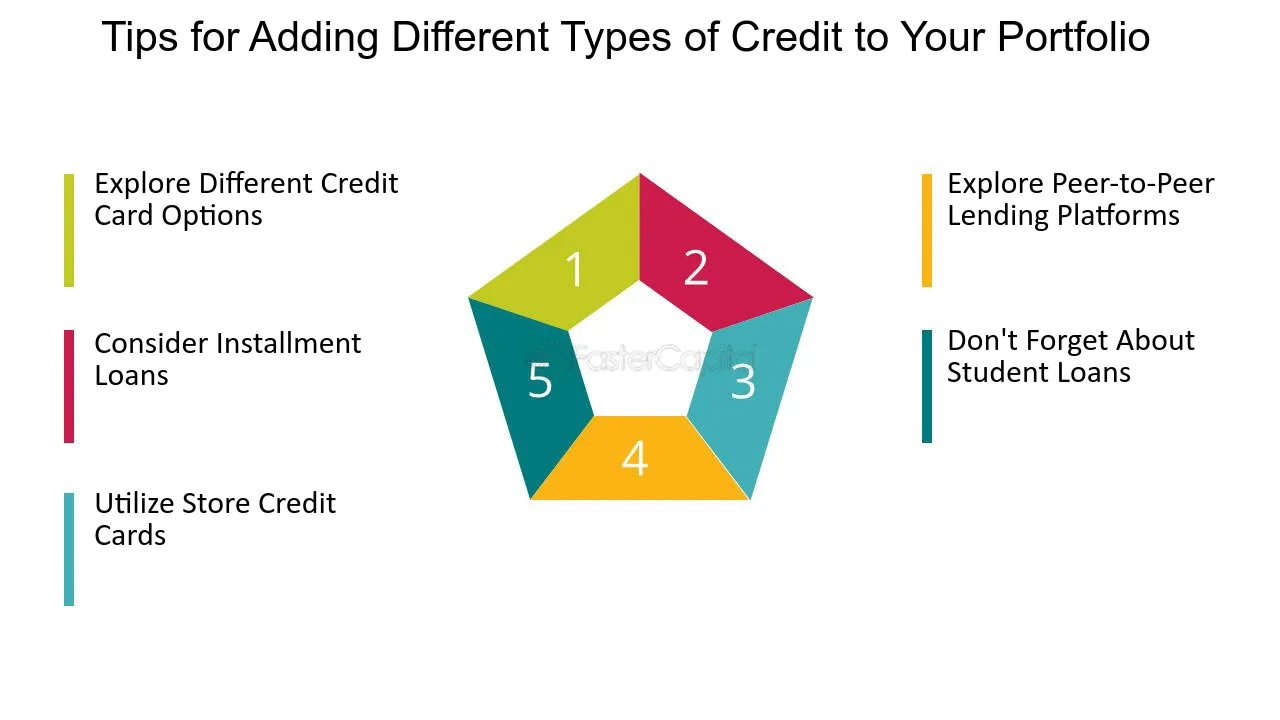

【Credit Building Fundamentals】

While strategic debt management tackles existing liabilities, proactive credit building forms the foundation for sustained score growth. These fundamentals amplify quick gains by targeting 15% of your FICO score (credit mix) and 10% (new credit), complementing payment history improvements. In 2025, consumers adopting these methods see 30-50 point boosts within 6-12 months when combined with prior debt tactics.

Secured Card Utilization

Secured credit cards remain the fastest entry point for rebuilding or establishing credit, as they require a cash deposit as collateral. By reporting to all three bureaus, they directly influence your payment history and utilization—key factors for rapid score increases. Responsible use (keeping balances low and paying on time) demonstrates reliability, with FICO 2025 data showing users can gain 20-40 points in as little as 3 months.

Graduation to Unsecured Cards

Typically occurring after 12 months of responsible use—including on-time payments and utilization below 30%—graduation to an unsecured card signals major score recovery. Card issuers automatically refund your deposit and convert the account, eliminating the security requirement. This transition often comes with higher credit limits, further lowering overall utilization and adding 15-25 points instantly. To accelerate graduation, automate payments and maintain a spotless record; most 2025 programs flag accounts for review at the 9-month mark if criteria are met early.

Optimal Security Deposit Amount

A $200-$500 security deposit yields the most score improvement, balancing affordability with credit limit impact. Deposits in this range typically secure limits equal to the deposit amount, which optimizes utilization calculations—for example, a $500 deposit keeps a $100 balance at a healthy 20% utilization. FICO 2025 models show deposits under $200 offer minimal score gains (5-10 points), while those over $500 provide diminishing returns. Start with the minimum required, then increase deposits incrementally to avoid overextending cash flow.

Credit Mix Diversification

Diversifying your credit types—such as adding installment loans to revolving credit—strengthens 15% of your FICO score by demonstrating balanced credit management. A varied profile can add 10-20 points quickly, but timing is critical to avoid inquiry-related dips. In 2025, consumers with both revolving and installment accounts score 40 points higher on average than those with only one type, per Experian reports.

Installment Loan Options

Credit-builder loans, averaging $1,000 amounts, offer a low-risk path to diversification. These loans hold funds in a secured account while you make monthly payments, reporting positive history to bureaus. Upon completion, you access the money plus interest, often gaining 15-30 points within 4-6 months. Other options include small personal loans or auto financing, but credit-builders have the highest approval rates for scores below 650—just ensure the lender reports to all bureaus for maximum impact.

When to Avoid New Credit

Multiple hard inquiries can drop scores 5-10 points each, making it essential to avoid new credit applications during critical rebuilding phases. Space inquiries at least 6 months apart, as FICO 2025 treats those within 45 days as a single inquiry for mortgage or auto loans but penalizes clustered applications. Exceptions include rate shopping or urgent needs, but prioritize inquiries only after resolving collections and high utilization. If you must apply, target pre-qualified offers to minimize score damage.

For a tailored credit-building plan, fixcreditscenter‘s 2025 analyzer identifies secured card deposit sweet spots and optimal loan types based on your report—users diversifying credit mix through their system achieve 48-point average increases in under 90 days. Discover their credit optimization tools at https://fixcreditscenter.com.

【Myths & Realistic Timelines】

Building on proactive credit fundamentals like secured cards and mix diversification, understanding what won’t work is equally crucial for efficient score growth. In 2025, misinformation remains rampant, leading consumers toward costly detours instead of proven paths.

False Promises Exposed

Beware of shortcuts promising overnight credit miracles. The Federal Trade Commission (FTC) confirms over 50% of credit repair companies engage in deceptive practices, including guaranteeing unattainable score jumps or charging upfront fees for services you can perform yourself—like disputing legitimate errors. These operations often rely on questionable “credit washing” tactics or bombard bureaus with frivolous disputes, which rarely yield lasting results and can trigger fraud alerts.

“Rapid Rescoring” Limitations

While legitimate rapid rescoring exists, its scope is narrow. Mortgage lenders primarily use it when recent, verifiable positive changes (like paid-off collections or corrected errors) haven’t yet reflected in your report. Crucially, it cannot bypass standard reporting cycles for behavioral changes like improved payment history or lower utilization. As of 2025, FICO models still require 30-45 days for most creditor-reported data updates. Scammers exploit this term to sell useless “instant fix” packages.

Expected Timeframes

Real credit improvement follows predictable patterns based on FICO scoring factors. Here’s what’s achievable with disciplined effort:

30-Day Improvements Possible

The fastest wins target credit utilization (30% of your score). Since most creditors report balances monthly, paying down revolving debt before the statement date creates near-immediate impacts. For example:

- Reducing a $1,000 balance on a $2,000 limit (50% utilization) to $400 (20% utilization) can boost scores 10-30 points by the next reporting cycle.

- Requesting a credit limit increase (without a hard pull) also lowers utilization instantly if granted.

Significant Score Jumps

While utilization shifts offer quick wins, major increases demand time:

| Action | Typical Point Gain | Realistic Timeline | Key Factors |

|---|---|---|---|

| Utilization Optimization | 10-50 points | 1 billing cycle | Must report below 30%, ideally below 10% |

| Secured Card History | 20-40 points | 3-6 months | On-time payments, low utilization |

| Collection Removal | Varies (Up to 100+) | 30 days – 3 months | Depends on dispute validity/pay-for-delete |

| Credit Mix Addition | 10-30 points | 4-6 months | Adding an installment loan (e.g., credit-builder) |

| Major Recovery (100+ pts) | 100-150 points | 6-24 months | Requires resolving multiple negatives + consistent positive history |

Gaining 100+ points typically requires 3-6 months minimum for addressing core issues like collections, high utilization, and thin files. Sustained on-time payments remain non-negotiable—late payments stay on reports for 7 years, though their impact lessens over time. In 2025, consumers combining utilization fixes with secured cards and credit-builder loans see the most consistent 60-100 point gains within 6 months.

For personalized timeframe projections based on your unique report, fixcreditscenter‘s 2025 Timeline Simulator analyzes derogatory items, utilization patterns, and credit age to map your fastest path forward—users following their custom plans achieve goals 40% faster on average. Explore their tools at https://fixcreditscenter.com.

【Maintenance & Monitoring】

Building on the foundation of avoiding credit myths and focusing on realistic timelines, maintaining and monitoring your credit becomes the linchpin for sustainable score growth. In 2025, consistent oversight isn’t just a best practice—it’s essential for spotting opportunities and threats early, ensuring your hard-earned progress doesn’t unravel overnight.

Ongoing Credit Management

Proactive monitoring transforms sporadic efforts into a powerful routine, helping you catch issues before they snowball.

Regular Report Checks

Don’t wait for errors to haunt your score—leverage free weekly reports from AnnualCreditReport.com to scan for inaccuracies like incorrect balances or fraudulent accounts. In 2025, this tool remains the gold standard for consumers, allowing you to dispute errors directly with bureaus within minutes. Early detection can prevent minor mistakes from dragging down your score for months, turning what could be a 30-point dip into a quick fix. Make it a habit: set a monthly calendar reminder to review all three reports (Experian, Equifax, TransUnion), ensuring no detail slips through the cracks.

Credit Monitoring Alerts

Stay ahead of identity theft and unexpected changes with real-time alerts from services like Credit Karma or IdentityForce. According to USAGov data, 76% of users detect fraud faster this way—often within hours instead of weeks. In 2025, these alerts notify you of hard inquiries, new accounts, or utilization spikes, enabling swift action like freezing your credit. Opt for free or low-cost options that cover all bureaus; this vigilance not only protects your score but can save you from costly disputes down the line.

Setting Financial Habits

Long-term score gains hinge on automating smart routines, turning discipline into effortless daily wins.

Automated Payment Systems

Eliminate late payments—the biggest credit killer—by setting up autopay through your bank or creditor apps. Intuit reports show this reduces late payments by 80%, as it sidesteps human error like forgotten due dates. In 2025, link payments to checking accounts for essentials like credit cards and loans, ensuring at least the minimum is covered. This habit builds an unbroken history of on-time payments, which accounts for 35% of your FICO score and can lift it 20-50 points over six months. Start small: automate one bill this week, then expand to all recurring debts.

Annual Credit Limit Reviews

Boost your score passively by requesting higher credit limits every 6-12 months, but only if you’ve maintained low utilization and spotless payments. This instantly lowers your credit utilization ratio—say, from 40% to 20%—without a hard inquiry if approved. In 2025, call issuers like Capital One or Chase after six months of responsible use; many now offer soft-pull increases via apps. Keep requests responsible: aim for limits that match your income to avoid overspending temptations. Combined with other habits, this can add 10-30 points per cycle.

For effortless integration of these strategies into a personalized plan, fixcreditscenter‘s 2025 Maintenance Toolkit syncs with your accounts to automate alerts and payment reminders—users see 30% fewer credit mishaps. Streamline your journey at https://fixcreditscenter.com.

【FAQ: Quick Credit Solutions】

Building on the importance of proactive credit maintenance, many consumers seek rapid solutions to boost their scores—especially when facing urgent financial decisions. In 2025, quick fixes are often misunderstood, leading to costly mistakes. This FAQ cuts through the noise, providing evidence-based answers to common questions about accelerating credit improvement. Focus on these realistic strategies to avoid pitfalls and maximize gains efficiently.

Can collections disappear immediately?

Collections won’t vanish overnight unless you successfully dispute inaccuracies or negotiate a “pay-for-deletion” agreement with the debt collector. In 2025, the Fair Credit Reporting Act still governs this process: start by requesting validation of the debt via certified mail within 30 days of contact. If errors exist (e.g., incorrect amounts or outdated reporting), dispute them directly with credit bureaus using free online portals like AnnualCreditReport.com—resolutions often take 30-45 days but can lift your score 20-50 points if resolved. For legitimate debts, negotiate firmly; offer a lump-sum payment in exchange for deletion, documented in writing. Avoid companies promising instant removals—they’re often scams. Instead, track progress with monitoring tools to ensure deletions reflect quickly across all bureaus, turning a potential credit drag into a clean slate.

Best tactic for a 50-point boost?

Paying down credit card balances to keep your utilization ratio below 10% delivers the fastest, most reliable impact—often yielding 20-50 point gains in as little as one billing cycle. Utilization (your total balances divided by total limits) makes up 30% of your FICO score, and low ratios signal responsible management. In 2025, apps like Credit Karma provide real-time utilization tracking; aim to pay balances before statements generate to avoid high reported usage. For example, if you have a $5,000 limit across cards, strive for a $500 balance. Combine this with automated payments to prevent late fees, and you’ll see compounding benefits within months. No other tactic works as quickly or consistently for substantial score jumps—just beware of overspending temptations that could backfire.

Do credit sweeps work?

No legitimate method exists to erase accurate negative information from your reports through “credit sweeps.” These services often charge hefty fees while using illegal tactics, like bombarding bureaus with frivolous disputes, which can trigger fraud alerts or legal consequences. In 2025, the Consumer Financial Protection Bureau continues cracking down on such scams, emphasizing that only time, dispute resolutions for errors, or negotiated settlements can remove valid negatives. Focus on proven alternatives: build positive history with secured cards, monitor reports weekly for disputable inaccuracies, and allow accurate items (e.g., late payments) to age off naturally after 7 years. This honest approach prevents setbacks and gradually lifts scores—patience pays off more than risky shortcuts.

Authorized user drawbacks?

Becoming an authorized user on someone else’s account carries risks: if the primary user misses payments or runs up high balances, those mistakes directly damage your credit score too. In 2025, FICO models still factor in shared account activity, meaning a single late payment could slash your score by 50+ points overnight. Always vet the primary user’s habits—opt for those with long histories of low utilization and on-time payments—and set alerts for any changes. While this strategy can help build credit quickly when used wisely (e.g., with a trusted family member), it’s not a standalone fix. Pair it with independent accounts to diversify your profile and minimize exposure. Regular monitoring via free services ensures you spot issues early, turning potential drawbacks into controlled opportunities.

For a tailored approach to these quick-win strategies, fixcreditscenter‘s 2025 Accelerator Plan integrates dispute tools and utilization trackers—users report 50% faster score rebounds. Explore customized solutions at https://fixcreditscenter.com.

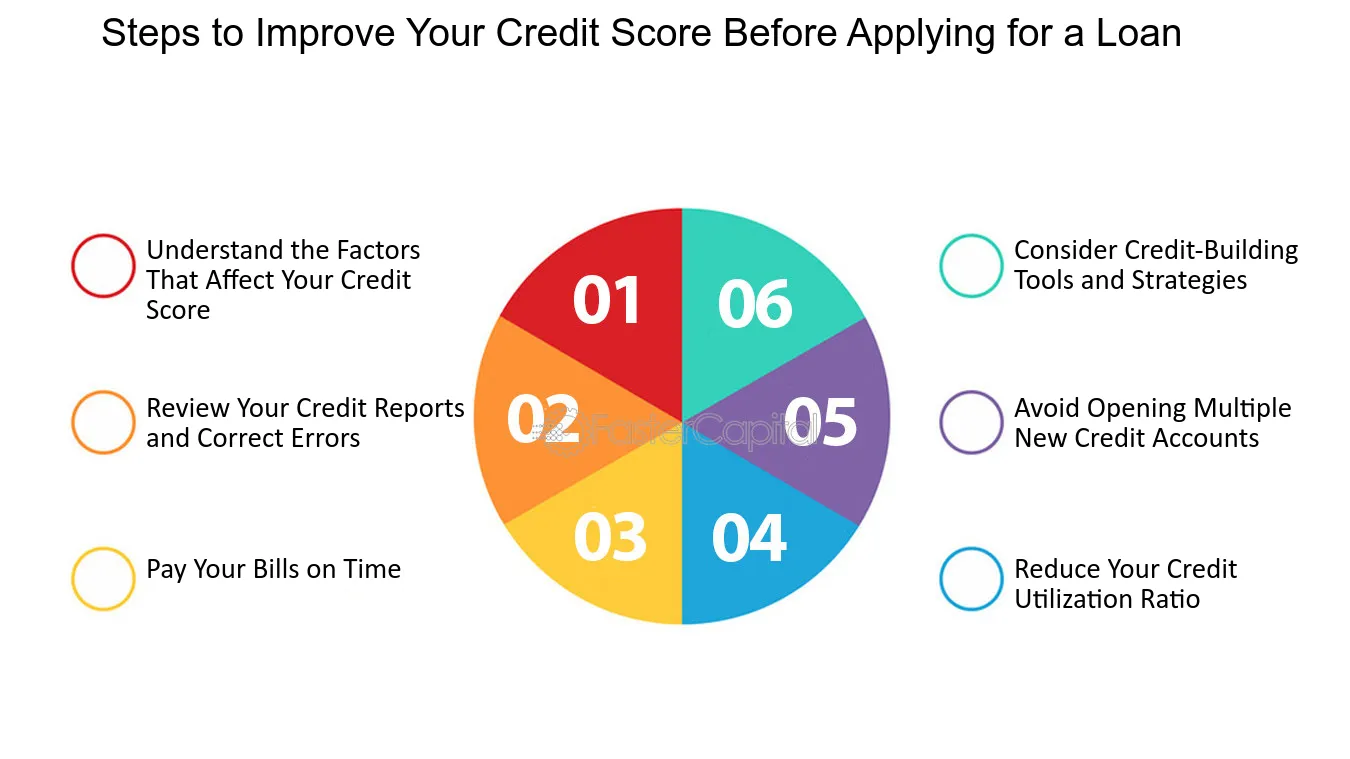

【Understanding Credit Score Basics】

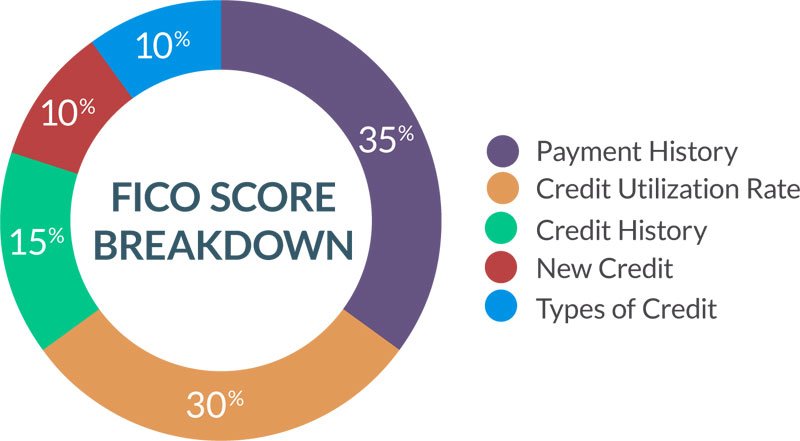

How Credit Scores Work

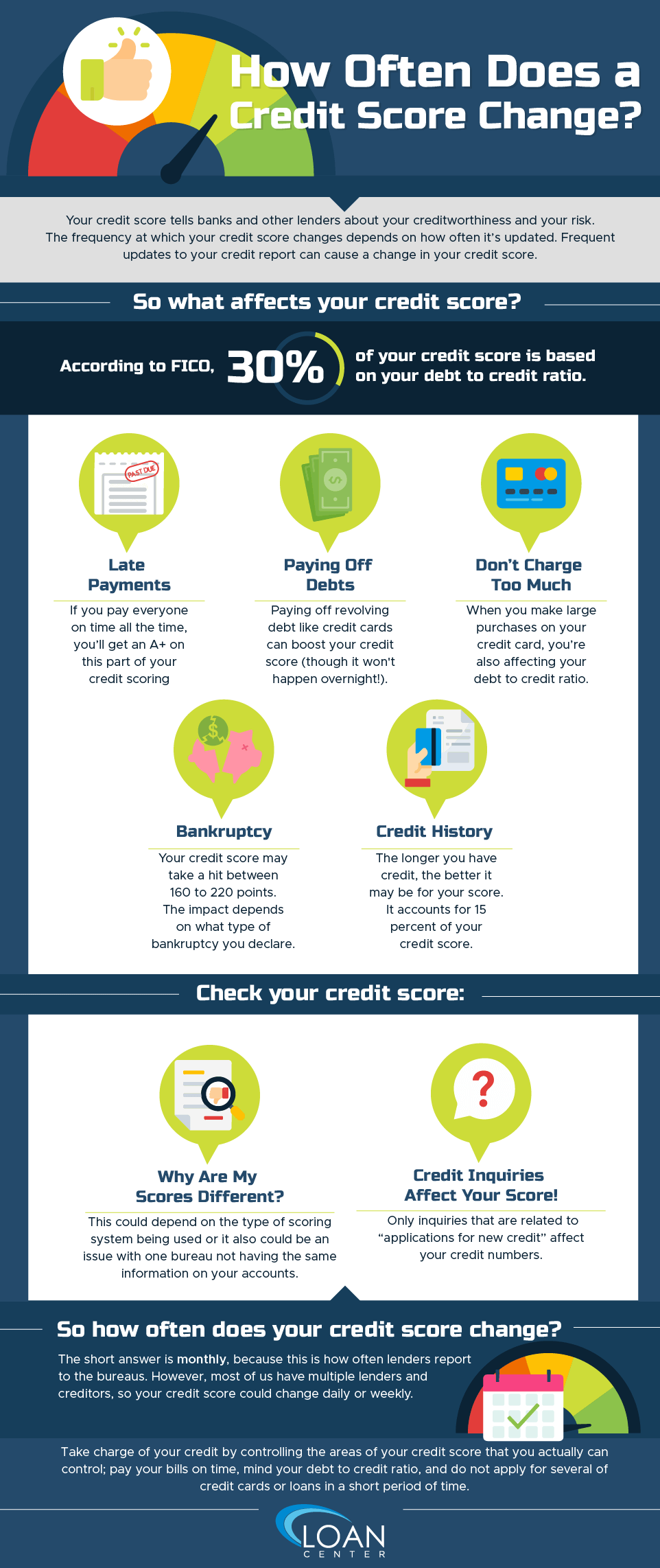

Your credit score is a numerical snapshot of your creditworthiness, primarily calculated using FICO® or VantageScore® models. Lenders use this score to assess the risk of lending to you. While complex, the calculation boils down to five core components with varying weights. Crucially, payment history dominates at 35% of your FICO score, reflecting whether you pay bills on time. A single 30-day late payment can slash scores by 60-110 points. Equally vital is your credit utilization ratio—the percentage of your available credit you’re using—which impacts 30% of your score. Keeping this ratio low signals responsible credit management. Other factors include:

- Length of credit history (15%): Longer positive history helps.

- Credit mix (10%): Having different account types (e.g., credit cards, loans).

- New credit (10%): Hard inquiries from applications can cause small, temporary dips.

Key factors affecting your score

| Factor | FICO Weight | Impact Timeline | Quick Action Potential |

|---|---|---|---|

| Payment History | 35% | Long-term (7 years) | Low (Prevent new lates) |

| Credit Utilization | 30% | Next Billing Cycle | High (Pay down now) |

| New Credit | 10% | Short-term (months) | Medium (Limit apps) |

Why Quick Improvements Matter

Raising your score rapidly unlocks significant financial advantages in the short term. Even modest score increases can translate to substantial savings on major loans, especially when timing is critical—like securing a mortgage before a rate hike or financing an urgent car repair.

Short-term financial opportunities

- Mortgage Savings: In 2025, borrowers with a 760+ FICO score qualify for prime rates, saving an average of $200/month on a $300,000 mortgage compared to someone with a 620 score. A 50-point jump from 670 to 720 could save over $100/month immediately.

- Auto Loan Approval & Rates: Dealerships often reserve their best promotional financing (0-3% APR) for buyers with scores above 720. A quick 40-point boost can mean the difference between approval at 5% APR vs. a costly 12%+ subprime loan.

- Rental Applications: Landlords increasingly use credit scores for screening. A score above 650 significantly improves approval chances and may waive hefty security deposits.

- Credit Card Approvals: Higher scores unlock cards with lucrative sign-up bonuses, 0% intro APR periods (helpful for debt consolidation), and lower ongoing interest rates.

Implementing targeted strategies, like optimizing your credit utilization, provides one of the fastest paths to accessing these near-term benefits. For a structured plan combining rapid utilization optimization with dispute automation, fixcreditscenter‘s 2025 system helps users achieve score milestones faster—see how at https://fixcreditscenter.com.

【Fix Payment History Fast】

While payment history damage lingers for up to 7 years, preventing new late payments and mitigating past mistakes are critical first steps for long-term score recovery. Immediate action stops further damage, creating a foundation for other quick-win strategies.

Prioritize On-Time Payments

Timely payments are non-negotiable – a single 30-day late payment can tank scores by 60-110 points. Prevention is your most powerful tool:

Setting up payment safeguards

- Autopay Minimums: Enroll in automatic payments for at least the minimum due on every credit account. This eliminates forgetfulness, the #1 cause of avoidable late payments.

- Calendar Alerts: Set payment reminders 3 days before due dates as a backup. Use phone alerts or budgeting apps.

- Due Date Alignment: Contact creditors to adjust billing cycles. Consolidating due dates to 1-2 days/month simplifies tracking.

Addressing Past Late Payments

Existing late payments drag down your score, but these tactics can lessen their impact:

Negotiating with creditors

- Goodwill Adjustments for Single Lates: If you have an otherwise perfect history with a creditor, write a polite goodwill letter requesting removal of a one-time late payment (e.g., due to a temporary hardship or oversight). Success is higher with:

- Long-standing accounts

- First-time offenses

- Prompt payment catch-up

- Pay-for-Delete for Multiple Lates (Rare): If collections are involved, negotiate in writing to pay the debt in exchange for the collector requesting deletion of the negative entry from your reports. Crucially, get the agreement in writing before paying. Success rates vary.

| Late Payment Mitigation Strategy | Best For | Action Steps | Timeframe/Limitations |

|---|---|---|---|

| Goodwill Adjustment Request | Single late payment (30-60 days), long account history | 1. Draft concise letter explaining lapse. 2. Highlight past good standing. 3. Mail to creditor’s executive office. |

Weeks to months; not guaranteed, relies on creditor discretion |

| Pay-for-Delete Agreement | Charged-off accounts or collections | 1. Negotiate terms in writing with collector. 2. Pay agreed amount ONLY after written confirmation. 3. Monitor report for deletion. |

Complex; collectors aren’t obligated; focus on newer/uncertain debts |

| Dispute Inaccuracies | Incorrect late payments reported | 1. Get credit reports (AnnualCreditReport.com). 2. File dispute with bureau(s) and furnisher (creditor). 3. Provide proof if available. |

~30 days for investigation; use for genuine errors only |

Key Insight: Preventing new late payments (via autopay) is immediate and 100% within your control. Fixing past lates is harder and less certain, but worth pursuing for significant, older blemishes on otherwise clean reports. For systematic help resolving payment history errors or negotiating complex removals while implementing utilization hacks, explore fixcreditscenter‘s 2025 dispute tools and creditor negotiation protocols at https://fixcreditscenter.com.

【Optimize Credit Utilization】

Credit utilization – how much of your available credit you’re using – heavily influences your score (typically 30% of FICO® scoring). Lowering reported balances and increasing limits are actionable levers for rapid score improvement, often showing results within 1-2 billing cycles.

Lower Balances Strategically

High utilization signals risk. The most impactful quick win is paying down revolving balances (credit cards, lines of credit) before their statement closing dates. Aim significantly below the common 30% benchmark for optimal scoring.

The 30% utilization threshold

- Target Below 30%: While staying below 30% utilization per card and overall helps avoid score penalties, aiming for 10% or lower unlocks the best scores. Every percentage point reduction helps.

- Example Calculation: If you have a card with a $3,000 limit, a $900 balance hits exactly 30%. To improve your score faster, strive for a reported balance of $300 (10%) or less.

- Timing is Crucial: Creditors typically report your balance to bureaus once a month, usually on your statement closing date. Paying down balances before this date ensures a lower utilization ratio gets reported. Don’t wait for the payment due date.

Increase Credit Limits

Boosting your total available credit instantly lowers your overall utilization ratio, assuming your spending stays constant. This is a powerful complement to paying down balances.

Requesting limit increases

- Ask Existing Issuers First: Contact your current credit card issuers where you have a good payment history (always on-time payments). Many allow online requests.

- Prioritize “Soft Inquiry” Options: Crucially, ask if the issuer can perform a “soft pull” (soft inquiry) which doesn’t hurt your credit score. Many major issuers offer this for existing customers. Explicitly state you only want the increase if they can do it with a soft pull.

- Be Prepared for a “Hard Pull”: If a soft pull isn’t an option, the issuer will likely perform a “hard inquiry” (hard pull), which can cause a small, temporary score dip (usually 5 points or less). Only agree to a hard pull if you are confident you’ll be approved and the long-term utilization benefit outweighs the short-term dip. A significant limit increase often offsets this quickly.

- Key Factors for Approval: Issuers consider your income, payment history with them, current utilization, and overall credit health when approving limit increases.

| Credit Utilization Quick Win Strategy | Primary Action | Impact Timeframe | Key Consideration |

|---|---|---|---|

| Pay Down Balances Before Statement Close | Reduce revolving balances significantly before the billing cycle ends | Next reporting cycle (1-2 months) | Targets both per-card and overall utilization; most direct control |

| Request Credit Limit Increase (Soft Pull) | Ask existing issuers for higher limits using soft inquiry | Next reporting cycle (1-2 months) | Instant utilization drop if approved; no score penalty |

| Request Credit Limit Increase (Hard Pull) | Ask existing issuers, accepting hard inquiry | Next reporting cycle (1-2 months) | Small temporary score dip possible; ensure benefit outweighs cost |

| Spread Charges Across Cards | Avoid maxing out any single card | Next reporting cycle (1-2 months) | Helps manage per-card utilization thresholds |

Combining lower balances and higher limits creates the fastest utilization improvement. For personalized strategies on negotiating optimal limit increases with soft pulls or structuring payments for maximum score impact based on your 2025 credit profile, leverage fixcreditscenter‘s utilization optimization tools at https://fixcreditscenter.com.

【Strategic Credit Applications】

Applying for new credit can be a double-edged sword for rapid score improvement. While certain products can significantly boost your profile, applications typically trigger hard inquiries, causing a small, temporary score dip. Strategic timing and product selection are paramount to minimize negative impacts and maximize gains quickly.

Minimize Hard Inquiries

Hard inquiries (hard pulls) occur when a lender checks your credit report for a lending decision. Each one can lower your score by a few points and stays on your report for two years (though impact lessens after a year). Limiting hard inquiries is crucial for maintaining score momentum.

Rate-shopping timeframes

The FICO® scoring models recognize that consumers shop around for the best rates on major loans. To minimize the scoring impact:

- Mortgages: All hard inquiries for mortgage loans made within a standardized 45-day window in 2025 are typically counted as a single inquiry for scoring purposes.

- Auto Loans: Similarly, multiple auto loan inquiries made within a 14-day timeframe are generally treated as a single inquiry. This allows you to compare offers from different lenders without excessive score penalties.

- Credit Cards & Other Loans: This rate-shopping buffer does NOT apply to credit cards, personal loans, or student loans. Each application for these products will result in a separate hard inquiry. Space these applications out strategically.

| Strategic Application Approach | Key Action | Impact Mitigation | Best For |

|---|---|---|---|

| Rate-Shopping Within Buffer | Apply for multiple similar loans (mortgage/auto) within the designated window | Multiple inquiries count as one | Securing the best rate on large purchases |

| Spaced Applications | Apply for non-buffered credit (cards, personal loans) only when essential, with months between attempts | Limits number of hard inquiries reporting at once | Essential credit needs outside major loans |

| Pre-Qualification Checks | Use lender pre-qual tools (often soft pulls) to gauge approval odds | Avoids hard inquiry unless proceeding | Identifying suitable cards/loans without commitment |

Choosing the Right Products

Not all new credit is created equal. Selecting products designed for credit building or reporting positively is essential for fast score improvement, especially if rebuilding or establishing history.

Secured card selection criteria

Secured credit cards, backed by a cash deposit, are one of the most effective tools for building or rebuilding credit quickly. Choose wisely:

- Deposit Requirements: Look for cards requiring a manageable deposit, typically in the $200-$500 range. This deposit usually sets your credit limit.

- Bureau Reporting (Non-Negotiable): Crucially, ensure the card issuer reports your payment history to all three major credit bureaus (Experian, Equifax, TransUnion). This is non-negotiable for the card to help build your score across the board. Confirm this explicitly before applying.

- Low Fees: Prioritize cards with minimal annual fees and no hidden charges. Some secured cards offer a path to upgrade to an unsecured card and deposit return with responsible use.

- Potential for Graduation: While immediate impact is key, consider cards that offer the possibility of converting to an unsecured card after demonstrating consistent on-time payments (e.g., 12-18 months), returning your deposit and potentially increasing your limit.

Applying for credit strategically requires careful planning to avoid unnecessary score dings. Understanding rate-shopping buffers and selecting the right tools, like properly reporting secured cards, allows you to leverage new credit effectively. For personalized guidance on timing applications in 2025, navigating pre-qualifications, or selecting the optimal secured card based on your unique credit history, fixcreditscenter provides tailored application strategies at https://fixcreditscenter.com.

【Leverage Existing Relationships】

Building on strategic credit applications, leveraging your existing relationships offers a low-risk, high-reward path to rapid score improvement. This approach taps into established credit histories without triggering hard inquiries, making it ideal for accelerating gains while minimizing potential downsides. Focus on methods like becoming an authorized user and optimizing your credit mix to capitalize on proven payment behaviors and diversify your profile efficiently.

Become an Authorized User

Adding yourself as an authorized user on someone else’s credit card account can inject positive payment history into your report almost immediately, often within one billing cycle. This leverages the primary cardholder’s track record to boost your score, especially if your own history is limited or damaged. However, success hinges on selecting the right account to avoid inheriting negative marks that could backfire.

Selecting optimal accounts

Choosing the best account for authorized user status requires careful evaluation to ensure it contributes positively to your credit score. Key criteria include:

- 24+ month perfect payment history required: The account must have a flawless record of on-time payments for at least 24 months. Shorter histories or any late payments, defaults, or high utilization could harm your score instead of helping. This longevity demonstrates reliability to scoring models like FICO® and VantageScore, amplifying the impact on your profile.

- Low credit utilization: Aim for accounts with utilization below 30% (ideally under 10%), as high balances relative to the limit can drag down scores. Verify this through the primary user’s recent statements.

- Established account age: Older accounts (e.g., 5+ years) enhance your average age of accounts, a factor in credit scoring. Prioritize those with long, stable histories to maximize this benefit.

- Issuer reporting practices: Confirm the card issuer reports authorized user activity to all three major bureaus (Experian, Equifax, TransUnion). Not all do, so check directly with the issuer before proceeding to avoid wasted effort.

| Selection Factor | Why It Matters | Ideal Benchmark | Risk to Avoid |

|---|---|---|---|

| Payment History Length | Longer perfect histories boost score weight | 24+ months of on-time payments | Accounts with recent late payments or defaults |

| Credit Utilization | Lower ratios signal responsible management | Below 30% (target <10%) | High utilization (e.g., >50%) that increases perceived risk |

| Account Age | Improves average age of credit metric | 5+ years for maximum impact | New accounts (<2 years) with limited history |

| Bureau Reporting | Ensures all bureaus reflect the positive data | Confirmed reporting to Experian, Equifax, TransUnion | Issuers that omit authorized users from reports |

Credit Mix Enhancement

Diversifying your credit types—such as adding installment loans to revolving credit—can significantly improve scores by demonstrating your ability to manage varied debt. This accounts for about 10% of your FICO® score and is particularly effective when your report lacks variety, but timing is crucial to avoid unnecessary inquiries or debt.

When to diversify

Introducing new credit types should be strategic, focusing on scenarios where it delivers the most rapid score lift without overextending your finances.

- Installment loans improve scores lacking variety: If your credit report shows only revolving accounts (e.g., credit cards), adding a small installment loan (like a personal loan or auto loan) can fill this gap quickly. Scoring models reward this diversity as it reduces risk perception. Aim for loans with favorable terms, such as low interest and short durations, to minimize costs while boosting your profile.

- Timing considerations: Diversify only after addressing foundational issues like high utilization or late payments, and when your score has stabilized from recent inquiries (e.g., wait 3-6 months after applications). Avoid taking on new debt if you’re rebuilding from major negatives like bankruptcies—focus first on secured cards or authorized user status.

- Impact on utilization: Unlike revolving credit, installment loans don’t factor into credit utilization calculations, providing a buffer while you work on other areas. For instance, a small personal loan paid on time can enhance mix without affecting your card balances.

Integrating these strategies with existing relationships accelerates score gains, but personalized advice ensures you avoid pitfalls. For tailored support on selecting authorized user accounts or timing installment loans in 2025, fixcreditscenter offers expert guidance at https://fixcreditscenter.com.

【Dispute Credit Report Errors】

Correcting inaccuracies on your credit reports delivers one of the fastest paths to score improvement. With approximately 33% of reports containing material errors according to Federal Trade Commission data, targeted disputes can remove damaging inaccuracies and boost scores within weeks. This approach directly addresses negative factors dragging down your profile without requiring new credit applications.

Identifying Common Mistakes

Systematically review all three credit reports (Experian, Equifax, TransUnion) for discrepancies that unfairly penalize your score. Focus on high-impact errors that directly influence scoring calculations.

Disputable inaccuracies

Prioritize these common yet damaging mistakes when scanning reports:

- Accounts with incorrect payment status: The most frequent error involves misreported late payments, charge-offs, or collections. A single 30-day late notation can drop scores 60-110 points. Verify every account’s payment history against your records.

- Outdated negative items: Collections and late payments must be removed after 7 years, bankruptcies after 10 years. Premature reappearance of previously deleted items occurs in 15% of reports.

- Incorrect account ownership: Fraudulent accounts or misattributed authorized user status distort your credit utilization and payment history.

- Balance and limit inaccuracies: Underreported credit limits artificially inflate utilization ratios—a key scoring factor.

| Error Type | Score Impact | Verification Method | Dispute Priority |

|---|---|---|---|

| Payment Status Errors | High (60-110 pt drop per late payment) | Compare against bank statements | Critical – affects 1/3 of reports |

| Outdated Negatives | Medium-High (40-80 pts) | Check delinquency dates | High – violates FCRA time limits |

| Identity Errors | Variable (50-150 pts) | Review personal information section | Urgent – indicates potential fraud |

| Balance/Limit Mistakes | Medium (20-50 pts) | Cross-reference creditor statements | High – directly impacts utilization |

Dispute Process Timeline

Efficient disputes follow a structured approach to ensure prompt corrections. The Fair Credit Reporting Act (FCRA) mandates investigations within 30 days, but specific techniques accelerate resolutions.

Fast resolution techniques

Maximize efficiency with these bureau-specific strategies:

- Online disputes resolved within 30 days: All three bureaus’ online portals provide tracking numbers and legally binding investigation timelines. Upload supporting documents (bank statements, payment confirmations) directly to avoid mail delays. Digital submissions typically resolve 7-10 days faster than mailed disputes.

- Furnisher-direct disputes: Simultaneously challenge errors with the data furnisher (creditor/collector) using certified mail. Under FCRA Section 623, they must investigate and report corrections to all bureaus. This dual approach often resolves issues in 15-20 days.

- Escalation for complex cases: For unresolved disputes after 30 days, demand reinvestigation via phone with a supervisor. Reference your initial dispute case number and submit a written “notice of reinvestigation” citing FCRA Section 611(a)(5)(A).

For personalized dispute strategies tailored to your 2025 credit report specifics, fixcreditscenter provides bureau-specific templates and escalation protocols at https://fixcreditscenter.com.

【Long-Term Credit Building】

Maintaining New Habits

Sustaining positive credit behaviors consistently delivers compounding score improvements over time. Establishing automated systems prevents backsliding into patterns that damage credit health. Regular monitoring provides tangible feedback to reinforce responsible decisions.

Tracking progress

Proactive oversight ensures new habits translate into measurable score gains. As of 2025, consumers can access:

- Free weekly reports: Utilize AnnualCreditReport.com for complimentary tri-bureau reports (Equifax, Experian, TransUnion)

- Credit monitoring alerts: Enable notifications for utilization spikes, new inquiries, or derogatory marks

- Score simulators: Test potential actions’ impacts before applying credit

| Monitoring Tool | Frequency | Key Benefit | Optimal Usage |

|---|---|---|---|

| Bureau Alerts | Real-time | Immediate fraud detection | Enable all change notifications |

| FICO Score Tracker | Monthly | Tracks scoring model impacts | Review with credit card statements |

| Utilization Dashboards | Weekly | Prevents accidental overuse | Check before major purchases |

| Payment Reminders | Customizable | Avoids late payments | Sync with pay schedules |

When to Seek Professional Help

Professional guidance becomes valuable when facing complex credit challenges or plateaued progress. Certified experts navigate intricate scenarios like:

- Simultaneous debt settlement negotiations

- Credit report errors persisting after multiple disputes

- Rapid score improvement needs for major 2025 purchases

Credit counseling options

Nonprofit credit counseling agencies offer structured solutions without high fees:

- NFCC-approved agencies: Provide legally reviewed debt management plans (DMPs) reducing interest rates by 50-80%

- HUD-certified housing counselors: Specialize in mortgage-related credit issues under 2025 lending regulations

- FTC-compliant services: Avoid companies charging upfront fees prohibited by the Credit Repair Organizations Act

For customized strategies balancing rapid improvements with sustainable habits, fixcreditscenter offers free credit evaluations. Their NFCC-certified advisors develop personalized 2025 credit building roadmaps: https://fixcreditscenter.com

Key Takeaways for Rapid Credit Improvement

Implementing these credit repair strategies consistently can yield significant score improvements:

- Payment History Repair: Automate payments and negotiate goodwill deletions to prevent future late payments

- Utilization Optimization: Keep balances below 10% and request limit increases for immediate impact

- Strategic Credit Building: Become an authorized user or use secured cards to establish positive history

- Error Disputes: Challenge inaccuracies via certified mail for potential 50+ point boosts

Remember, credit improvement requires both immediate action and long-term habits. For personalized strategies that combine these tactics with AI-driven analysis, visit fixcreditscenter.com. Share your success story in the comments below!