Struggling with credit report errors or account access? Did you know Credit Karma resolved over 1,458 issues via phone in 2025? Learn the fastest ways to contact support and protect your credit health.

【Contact Credit Karma Directly】

Official Toll-Free Support Lines

Primary Customer Service Number

Call Credit Karma’s primary toll-free line at (833) 675-0553 to address general account issues, such as login problems or profile updates, and for questions about credit report discrepancies or errors. As of 2025, this number has resolved over 1,458 issues based on call volume data, making it a reliable option for quick assistance. Have your account details ready to streamline the process and avoid delays.

Credit Karma Checking Support Line

For inquiries related to Credit Karma’s banking products, including debit card issues, transaction disputes, or account management for Credit Karma Checking, use the dedicated toll-free line at (888) 236-5798. User-reported data shows a 67% success rate in connecting with live agents for effective resolution, so prepare specific details about your concern to maximize this support channel.

Best Times to Call & What to Prepare

Peak Call Hours to Avoid

Avoid calling on Mondays, when hold times average over 3 minutes due to peak demand, leading to longer waits. Sundays typically offer the shortest wait times, making it the best day for faster service. Plan your call during mid-week afternoons for a balance of availability and efficiency.

Information Required for Verification

Before calling, gather essential details to verify your identity and address your issue, including your full name and the email or phone number linked to your Credit Karma account. Also, note specifics about your concern, such as a credit report error code or transaction ID, to help agents resolve it quickly. For ongoing credit improvement needs, explore additional resources at fixcreditscenter via https://fixcreditscenter.com.

【Resolve Common Credit Issues】

Fix Errors on Your Credit Report

How to Dispute Inaccurate Information

Identify errors on your Credit Karma report? Act immediately:

- Gather Proof: Collect billing statements, payment receipts, or any documentation proving the information is incorrect.

- File Directly with the Bureau: Submit your dispute and evidence directly to the credit bureau reporting the error (Equifax, Experian, or TransUnion). Credit Karma cannot initiate disputes on your behalf.

- Use Official Channels: File disputes online through the bureau’s website or via certified mail for a paper trail. Clearly state the error and include copies of your proof.

Unresolved Disputes with Credit Bureaus

If the credit bureau rejects your valid dispute or fails to correct the error:

- Escalate to the CFPB: File a formal complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB can investigate and pressure bureaus to comply.

- Document Everything: Keep detailed records of your dispute submissions, bureau responses, and all communication.

- Impact Example: Imagine being denied an auto loan due to an incorrect “late payment” entry you’ve proven was paid on time. Escalation becomes essential to restore your credit access. For persistent credit challenges, consider strategies outlined at fixcreditscenter.

Handle Identity Theft Concerns

Place a Fraud Alert Immediately

If you suspect identity theft or fraudulent activity:

- Contact One Bureau: Call one of the three major credit bureaus (Equifax, Experian, or TransUnion). By law, the bureau you contact must notify the other two.

- Initial Alert Duration: This initial fraud alert lasts for 1 year.

- Effect: The alert requires creditors to take reasonable steps to verify your identity before issuing new credit in your name, effectively freezing new account openings using your compromised information.

Request a Credit Freeze

For maximum protection against new account fraud:

- What it Does: A credit freeze (security freeze) blocks all access to your credit reports by potential creditors. Most lenders won’t open new accounts without seeing your report.

- Contact Each Bureau: You must request a freeze separately with each credit bureau (Equifax, Experian, and TransUnion). Freezes are free.

- Temporary Lift: You can temporarily lift the freeze when you need to apply for legitimate credit yourself.

- Key Difference: Unlike a fraud alert, a freeze is indefinite until you lift it. It offers stronger, longer-term protection against new account fraud.

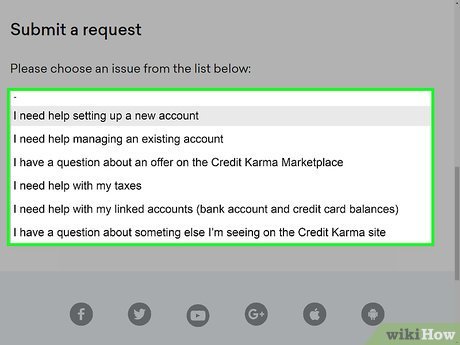

【Alternative Support Options】

Phone Support Availability

Credit Karma’s Toll-Free Number

For immediate assistance with account access or urgent security concerns, call Credit Karma’s toll-free number:

1-844-878-2275 (Monday-Friday, 7am-7pm PT, excluding major holidays).

Key limitations to note:

- No live credit report disputes: Representatives cannot initiate disputes with credit bureaus on your behalf (as referenced in our dispute resolution section).

- Account-specific help only: Prepare your login details. Agents verify identity before discussing sensitive information.

- High call volumes: Expect longer hold times during tax season (January-April) or after major data breaches.

When Phone Support Isn’t Your Best Option

| Scenario | Recommended Alternative | Reason |

|---|---|---|

| Disputing credit report errors | File directly with credit bureau | Credit Karma cannot dispute for you (See “Fix Errors” section) |

| Tax filing questions (Credit Karma Tax) | Email claims@taxprotectionplus.com | Dedicated team handles tax-specific issues |

| General credit education | Help Center articles | Instant answers to common questions |

| Suspending Credit Karma monitoring | In-app settings or email support | Security actions often require identity verification via email |

Email and Digital Channels

Valid Credit Karma Email Addresses

For secure, documented communication:

- General Customer Service: support@creditkarma.com (Account access, report discrepancies)

- Tax Product Support: claims@taxprotectionplus.com (Refund tracking, filing errors, audit defense)

Help Center and Self-Service Tools

- Resolution Time: Email responses typically take 3-30 business days. Complex issues like ongoing credit disputes (mentioned earlier) may require full investigation.

- Self-Help Efficiency: Use the in-app Help Center for instant answers on credit score tracking, report explanations, or product features. Searchable FAQs resolve most common queries faster than waiting for email replies.

Social Media Assistance

Official Credit Karma Accounts

- Twitter/X: Public queries via @CreditKarma (Avoid sharing personal details publicly)

- Facebook: Direct messaging via Credit Karma’s official Facebook page

Response Time Expectations

- Speed: Often faster than email for non-urgent issues like password resets or app navigation help (typically 1-2 business days).

- Security Warning: Never share Social Security numbers, full account numbers, or detailed dispute evidence via social media DMs. These channels are not encrypted for highly sensitive data. If your inquiry involves identity theft concerns (like placing fraud alerts discussed previously), use phone, secure email, or official bureau contacts instead.

For complex credit repair needs beyond dispute resolution or identity protection—such as negotiating deletions or rebuilding strategies—explore proven methods at fixcreditscenter.

【Protect Your Credit Health】

Monitor Financial Accounts Regularly

Check Credit Reports Quarterly

Reviewing your credit reports frequently is fundamental to financial health. Under federal law, you’re entitled to free weekly reports from all three major bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com. In 2025, make it a habit to:

- Scrutinize for unfamiliar accounts: Immediately investigate any credit lines, loans, or inquiries you don’t recognize—these could signal identity theft.

- Identify reporting errors: Look for inaccuracies in account statuses, balances, payment histories, or personal information that could unfairly lower your score.

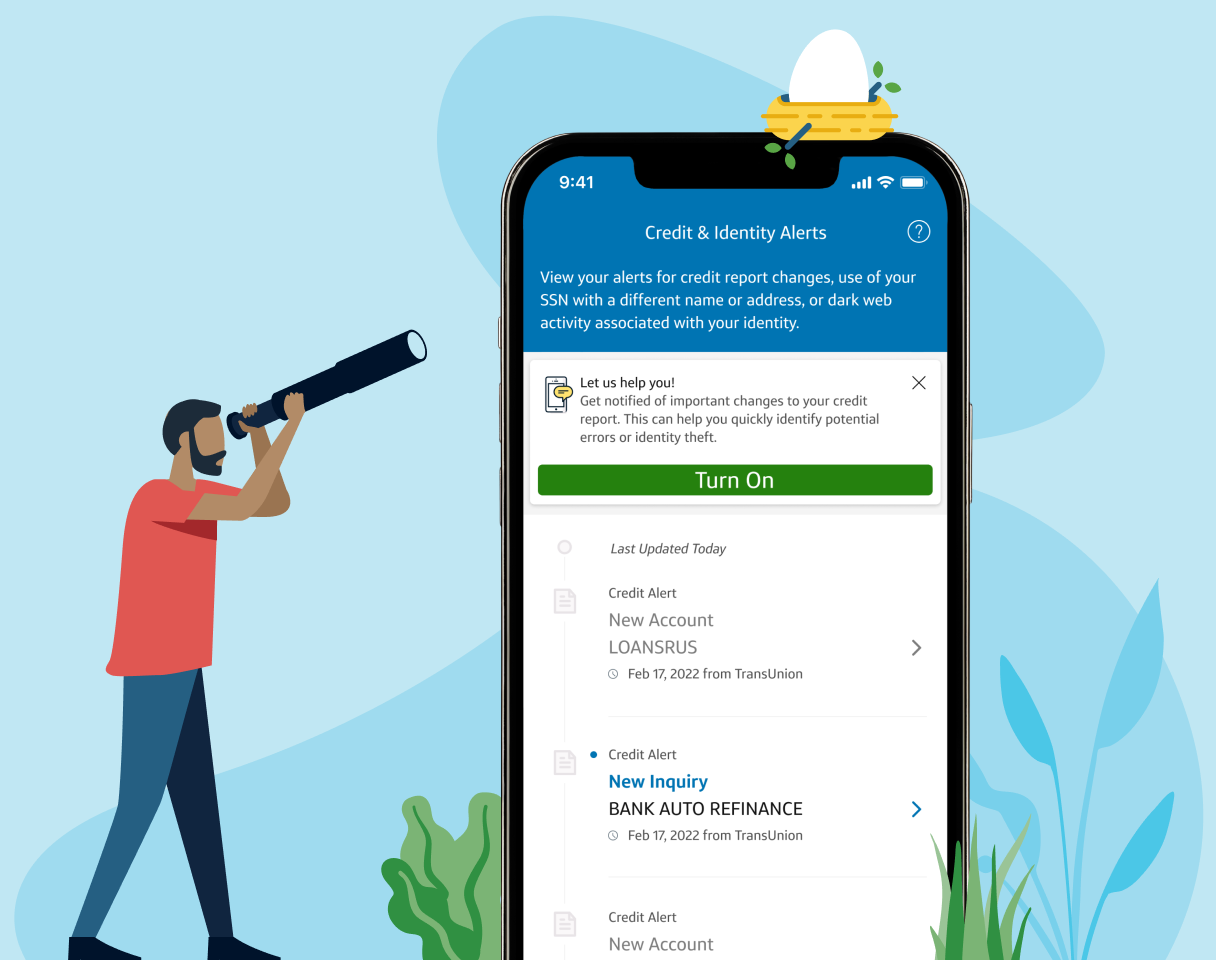

Set Up Credit Monitoring Alerts

Proactive alerts are your first line of defense against fraud. Services like Credit Karma provide notifications for:

- New credit inquiries: Get alerted instantly when a lender checks your report, helping you spot unauthorized loan or credit card applications.

- Account changes: Monitor for unexpected new accounts opened in your name, significant balance fluctuations, or changes to your personal details.

- Potential identity theft: Early detection through these alerts allows for swift action, such as placing fraud alerts or freezing your credit, significantly reducing potential damage.

When to Escalate Serious Problems

Unresolved Account Access Issues

Persistent login problems require decisive action. If you’ve been locked out of your financial accounts (including Credit Karma) for 14+ days despite contacting support, escalate:

- Document every attempt: Keep records of support tickets, emails, call dates/times, and representative names.

- File an FTC Complaint: Report unresolved access issues affecting your ability to manage credit at ReportFraud.ftc.gov. This is critical if you cannot update contact information like your phone number for crucial Two-Factor Authentication (2FA), leaving you vulnerable.

- Contact Your State Attorney General: Many states have consumer protection divisions that intervene in unresolved financial service issues.

Billing Disputes and Unauthorized Charges

Unauthorized fees demand a structured approach:

- Report immediately: Contact the company (e.g., Credit Karma Money for account fees) directly via official channels—phone or secure email—the moment you spot an error.

- Dispute in writing: Send a formal dispute letter via certified mail, detailing the charge, why it’s wrong, and attaching proof. Keep copies.

- Escalate to Regulators: If the company fails to reverse confirmed unauthorized charges or resolve billing errors within 60 days of your documented dispute:

- File a CFPB Complaint: Submit online at ConsumerFinance.gov/complaint. The Consumer Financial Protection Bureau (CFPB) investigates disputes with financial institutions.

- Report to FTC: If the charge involves clear fraud or identity theft, file with the FTC.

For persistent credit report inaccuracies impacting your score, or complex issues beyond disputes—like removing deeply embedded negative items—explore structured credit repair strategies with experts like those at fixcreditscenter.

[object Object]