Did you know 1 in 3 Americans have errors on their credit reports? Fixing your credit isn’t just possible – it’s easier than you think! This guide reveals simple steps to improve your score fast.

【Why You Need a Dispute Letter】

Errors on your credit report can harm your financial health, leading to higher interest rates, loan denials, or even identity theft risks. Addressing these issues promptly with a personal dispute letter is essential to protect your credit score and ensure accuracy. In 2025, as identity theft and reporting errors continue to rise, taking action through a well-crafted letter can resolve disputes efficiently and legally. Below, we outline common errors that demand attention and your rights under key consumer protection laws.

Common Errors Requiring Action

Credit report inaccuracies are surprisingly common and can stem from data entry mistakes, outdated systems, or fraud. If left unaddressed, they may persist for years, dragging down your creditworthiness. Acting swiftly with a dispute letter forces credit bureaus to investigate and correct errors, potentially saving you from financial setbacks. Focus on these frequent issues to prioritize your dispute efforts.

Credit Report Mistakes

Credit report errors often fall into three main categories, each requiring specific documentation in your dispute letter. First, unrecognized accounts could signal identity theft—for instance, if a credit card appears that you never opened. Second, incorrect payment statuses misrepresent your history, such as showing a late payment when you paid on time, which can unfairly lower your score. Third, outdated account information includes balances listed after payoff, like a car loan still showing as active despite full repayment. In 2025, with digital transactions increasing, these errors are more prevalent; include evidence like bank statements or payoff confirmations in your letter to strengthen your case. For more on addressing credit report mistakes, check out How to Remove Hard Inquiries from Your Credit Report.

Legal Rights Under FCRA

The Fair Credit Reporting Act (FCRA) empowers you to challenge inaccuracies, with robust protections that credit bureaus must honor. Enacted to ensure fairness, the FCRA mandates timely investigations and free access to your reports, giving you leverage in disputes. If bureaus fail to comply, you can escalate to regulatory bodies for enforcement. Understanding these rights helps you draft a more effective dispute letter, maximizing your chances of correction. For additional insights, see Fighting Credit Report Errors.

Fair Credit Reporting Act Protections

Under the FCRA, credit bureaus have strict obligations. They must investigate your dispute within 30 days of receiving your letter and provide written results. Additionally, you’re entitled to free annual credit reports from all three major bureaus (Equifax, Experian, and TransUnion), allowing you to monitor for errors regularly. In 2025, take advantage of this by requesting reports annually—include any discrepancies in your dispute letter to trigger a swift resolution. For tips on maximizing your credit check, visit 5 Free Ways to Monitor Your FICO® Score with myFICO.

Consumer Financial Protection Bureau Role

The Consumer Financial Protection Bureau (CFPB) acts as a watchdog, ensuring bureaus adhere to accuracy standards. You can submit complaints directly at consumerfinance.gov/complaint if a dispute isn’t resolved fairly, prompting the CFPB to investigate and enforce corrections. For instance, in cases of repeated errors, the bureau can impose penalties. Mentioning potential CFPB involvement in your dispute letter can add pressure for a quicker fix. If you need help drafting a personalized dispute letter, visit fixcreditscenter.com for free templates and guidance.

【Disputing Credit Card Charges】

Billing errors or unauthorized charges on your credit card statement demand swift action. The Federal Trade Commission (FTC) provides a clear framework to resolve these disputes efficiently, protecting your finances. Timeliness is critical—you typically have 60 days from the statement date to initiate the process. Following the FTC’s steps ensures your rights under the Fair Credit Billing Act (FCBA) are enforced, potentially saving you significant money and hassle in 2025’s evolving payment landscape.

FTC’s Step-by-Step Process

The FTC mandates a two-phase approach: immediate contact followed by formal documentation. This structured method creates a verifiable paper trail, compelling the issuer to investigate.

Immediate Actions Within 60 Days

- Contact Your Card Issuer by Phone First: Call the customer service number on your statement immediately upon spotting an error. Clearly state you are disputing a charge under the FCBA. Request a confirmation number or the name of the representative for your records.

- Follow Up with a Written Dispute Letter: Your phone call does not replace the required written notice. Send your formal dispute letter via certified mail with return receipt requested within the 60-day window. This mailing proof establishes your compliance with the legal timeframe. For guidance on writing effective dispute letters, see Dispute Letter Templates.

Required Letter Components

Your written dispute must include specific details for the issuer to investigate:

- Your name and account number

- The specific transaction date in question

- The exact dollar amount being disputed

- A clear explanation of the error (e.g., “Services not rendered,” “Goods not delivered,” “Charge amount incorrect,” “Unauthorized transaction”)

- Copies (never originals) of any supporting evidence (receipts, emails, delivery confirmations).

| Action | Timeframe | Key Requirement | Proof Needed |

|---|---|---|---|

| Phone Contact | Immediately | State dispute under FCBA | Rep name/confirmation # |

| Written Dispute Letter Mailed | Within 60 days | Certified mail, return receipt requested | USPS tracking & receipt |

| Issuer Investigation | Up to 90 days total | Must acknowledge receipt within 30 days | Keep copies of all correspondence |

Sample Charge Dispute Template

A well-structured letter maximizes clarity and legal standing. This template provides the essential framework.

Structure for Maximum Impact

- Your Contact Information: Name, Address, Phone, Email

- Date

- Card Issuer’s Billing Inquiries Address (Find this on your statement, not the payment address)

- Subject Line: Dispute of Charge Under Fair Credit Billing Act – Account Ending [Last 4 Digits]

- Body:

- State your account number and the statement date where the error appeared.

- Clearly identify the disputed charge (date, merchant, amount).

- Explain the error concisely.

- List enclosed evidence copies.

- Request removal of the charge and correction of related fees/interest.

- State your expectation of a written acknowledgment and resolution timeline.

- Enclosures: List the documents included (e.g., Copy of statement highlighting error, Copy of receipt, Copy of communication with merchant).

- Send via Certified Mail: Always include a return receipt request. Retain copies of your letter, enclosures, and the mailing receipt.

Critical Phrases to Include

- “I am writing to formally dispute a charge of [$] appearing on my statement dated [Statement Date], for a transaction dated [Transaction Date] with [Merchant Name].”

- “I am disputing this charge under my rights granted by the Fair Credit Billing Act (FCBA) because [concise reason: e.g., ‘the goods ordered were never received,’ ‘the amount charged is incorrect,’ ‘this is an unauthorized transaction’].”

- “Enclosed are copies of [list specific evidence, e.g., ‘my receipt showing the correct amount,’ ‘the delivery confirmation showing failure,’ ‘my communication with the merchant regarding cancellation’] supporting my dispute.”

- “Please investigate this matter, remove the erroneous charge, and correct any related finance charges or fees. I expect written acknowledgment of my dispute within 30 days and resolution within the timeframes required by the FCBA.”

Taking these steps empowers you to challenge incorrect charges effectively. For personalized guidance navigating disputes in 2025 or accessing free, customizable dispute letter templates tailored to your specific situation, consider using resources available at https://fixcreditscenter.com.

【Fighting Credit Report Errors】

Errors on your credit report can unfairly impact your creditworthiness and borrowing costs. The Fair Credit Reporting Act (FCRA) grants you the right to dispute inaccurate information directly with the nationwide credit bureaus (Experian, Equifax, TransUnion). Unlike credit card charge disputes handled solely by your issuer, correcting report errors requires initiating a formal dispute with each bureau reporting the error. Timeliness remains crucial; file disputes as soon as errors are identified.

Bureau-Specific Dispute Procedures

Each credit bureau has its designated process for submitting disputes. Using the correct address and method is essential for your dispute to be processed efficiently under the FCRA.

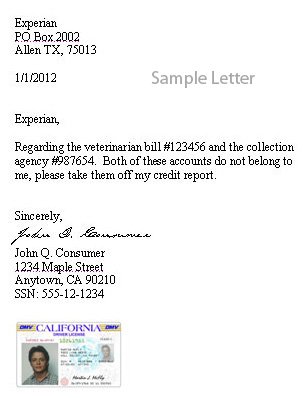

Experian Dispute Process

You have two primary options for disputing Experian report errors:

-

Mail: Send your dispute letter and supporting documents to:

Experian

P.O. Box 4500

Allen, TX 75013 -

Online: Utilize Experian’s online dispute portal at

experian.com/upload. This method often provides faster tracking.

Equifax & TransUnion Requirements

Disputes with Equifax and TransUnion also require specific mailing addresses:

-

Equifax:

Equifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374 -

TransUnion:

> TransUnion LLC

> Consumer Dispute Center

> P.O. Box 2000

> Chester, PA 19022

| Credit Bureau | Dispute Method | Mailing Address | Online Portal | Key Requirement |

|---|---|---|---|---|

| Experian | Mail or Online | P.O. Box 4500, Allen, TX 75013 | experian.com/upload | Include report confirmation number |

| Equifax | P.O. Box 740241, Atlanta, GA 30374 | N/A | Certified mail recommended | |

| TransUnion | P.O. Box 2000, Chester, PA 19022 | N/A | Include full personal identifiers |

Credit Dispute Letter Essentials

A formal dispute letter is the most effective method for ensuring your dispute is legally recognized and investigated. It creates a clear paper trail. Always send dispute letters via certified mail with return receipt requested and keep copies of everything.

Personal Identification Section

Your letter must clearly identify you and the report in question. Include:

- Full Legal Name: (Exactly as it appears on your credit report)

- Current Mailing Address:

- Previous Addresses: (If you’ve moved within the last 2 years)

- Date of Birth:

- Social Security Number: (Last 4 digits are often sufficient, but check bureau requirements)

- Credit Report Confirmation Number: (Found on the report you received)

Example:

Jane A. Doe

123 Main Street, Apt 4B

Anytown, CA 12345

Previous Address: 456 Oak Ave, Somewhere, CA 98765 (Jan 2023 – Dec 2024)

Date of Birth: MM/DD/YYYY

SSN: XXX-XX-1234

Experian Report Confirmation #: 123456789 (dated 01/15/2025)

Dispute Documentation Checklist

Provide clear copies (never originals) of documents supporting your claim for each disputed item. Organize these logically:

- Highlighted Copy of Credit Report: Clearly mark each item you are disputing on a copy of the relevant credit report.

- Account Statements/Records: Include copies of statements or official documents from the creditor showing the correct information (e.g., showing a paid-off balance, correct account status, on-time payments).

- Proof of Identity: Copy of driver’s license or state ID, and a utility bill or bank statement verifying your current address.

- Court Documents: If applicable (e.g., bankruptcy discharge papers proving an account was included).

- Police Reports/FTC Identity Theft Affidavit: Essential if disputing fraudulent accounts resulting from identity theft.

- Communication Records: Copies of relevant emails or letters with the creditor or bureau, if any.

Critical Phrases for Your Letter Body:

- “I am disputing the following information on my credit report under my rights granted by the Fair Credit Reporting Act (FCRA). The items are inaccurate/ incomplete/ cannot be verified. Please investigate and correct or delete them.”

- “Item 1: [Name of Creditor] Account # [XXXX1234]. Reason for Dispute: [e.g., ‘Account is paid in full/closed as of [date]’, ‘Late payments reported are incorrect; payments were on time’, ‘This account does not belong to me; potential fraud’, ‘Balance is incorrect’]. Enclosed: Copy of statement dated [date] showing correct status/balance.”

- “Item 2: [Name of Creditor] Account # [XXXX5678]. Reason for Dispute: [e.g., ‘Account is duplicated’, ‘Dates of delinquency are inaccurate’]. Enclosed: Copy of relevant account history.”

- “I request that you investigate these disputed items, provide me with written results of your investigation, and supply corrected reports to anyone who received my report within the last six months for employment purposes or within the last two years for any other purpose.”

Bureaus generally have 30 days (45 days if based solely on information you provide from a free annual credit report) to investigate disputes initiated by consumers. For complex disputes in 2025 or to access specialized templates ensuring all FCRA requirements are met, explore the dispute resources available at https://fixcreditscenter.com.

【Challenging Debt Liability】

Disputing errors on your credit report is crucial, but sometimes the core issue isn’t just incorrect reporting—it’s challenging the fundamental assertion that the debt belongs to you in the first place. The Fair Credit Reporting Act (FCRA) empowers you to dispute information you believe is inaccurate, including debts you do not legitimately owe. Knowing when and how to formally dispute debt ownership is essential for protecting your financial standing.

When to Dispute Debt Ownership

Disputing liability is appropriate when you have a legitimate basis to believe you are not legally responsible for a debt appearing on your credit report or being pursued by a collector. Common scenarios include:

Unrecognized Debt Red Flags

- Accounts Opened Without Authorization: You discover credit accounts (credit cards, loans, utilities) on your report that you never applied for or authorized. This is a primary indicator of identity theft.

- Debts from Identity Theft Incidents: Following confirmed identity theft, debts incurred by the fraudster appear under your name. The FTC Identity Theft Report is critical evidence here.

- Business/Commercial Debts Mistakenly Reported Personally: Debts incurred solely for a business entity (like an LLC or corporation) where you were an owner/employee, but where you did not personally guarantee the debt, are incorrectly reported on your personal credit report.

- Debts Belonging to Someone Else: This includes debts of a relative with a similar name, debts resulting from administrative errors (mixed files), or debts that were legitimately assigned or sold but are still incorrectly linked to you.

- Statute-Barred Debts: While the debt might have been real, the legal timeframe for enforcing collection (the statute of limitations) has expired in your state. Note: Disputing based on age doesn’t erase the debt’s existence, but challenges its enforceability and continued reporting if beyond the credit reporting time limits (generally 7 years).

In these situations, a direct and unequivocal statement denying liability is necessary. A sample approach, adapted for clarity and compliance with US law (like the FDCPA and FCRA), is:

“I dispute any personal liability for the debt referenced in your communication [or listed on my credit report regarding account #XXXX]. I have no legal responsibility for this obligation. Under the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), I demand that you provide competent written evidence verifying that I am legally obligated to pay this specific debt.”

Debt Validation Strategies

Formally disputing liability triggers specific legal obligations for debt collectors and furnishers (the creditors or agencies reporting the debt).

Collector Communication Rules

- Verification Requirement: If you dispute a debt in writing within 30 days of a debt collector’s initial communication, they must cease collection efforts until they mail you verification of the debt. This verification should ideally include proof you entered into the agreement and evidence of the amount owed.

- Credit Reporting Prohibition: Crucially, a debt collector cannot report a debt to the credit bureaus if you dispute it within that 30-day window, until they have provided you with verification. Furthermore, they must inform the credit bureaus that the debt is disputed if it was already reported before receiving your dispute. Original creditors (like credit card companies) also have FCRA obligations to report accurately and investigate disputes, but the specific FDCPA validation rules primarily bind third-party collectors and debt buyers.

Follow-Up Tactics

- Dispute Simultaneously with Credit Bureaus: Don’t rely solely on the collector. File a formal dispute directly with each credit bureau reporting the debt using the methods outlined previously. Clearly state the reason: “I dispute liability for this debt; it is not mine / resulted from identity theft / is a business debt not personally guaranteed.”

- Document Everything Meticulously: Keep copies of all dispute letters sent to collectors and credit bureaus. Send all correspondence via certified mail with return receipt requested. Keep detailed notes of every phone call (date, time, representative name, summary of conversation).

- Escalate if Necessary: If a collector continues collection activities without providing verification, or if a furnisher fails to conduct a reasonable investigation after your bureau dispute, you may have grounds for legal action under the FDCPA and FCRA. Consulting with a consumer rights attorney is advisable in such cases.

- Leverage Identity Theft Resources: If identity theft is the cause, file a report with the FTC at IdentityTheft.gov and your local police. Submit the FTC Identity Theft Report with your disputes – it provides powerful legal backing.

- Monitor Your Reports: Check your credit reports 30-45 days after submitting your disputes to ensure the item has been corrected or deleted. Bureaus must send you the results of their investigation in writing.

| Action | Recipient | Legal Basis | Key Requirement | Timeframe |

|---|---|---|---|---|

| Dispute Liability (Initial) | Debt Collector | FDCPA § 809(b) | Written dispute within 30 days of first collector contact | 30 days from initial contact |

| Demand Debt Validation | Debt Collector | FDCPA § 809(b) | Must cease collection until verification provided | Collector must respond |

| Formal Credit Report Dispute | Credit Bureau(s) | FCRA § 611 | Clearly identify item & reason (“not my debt”) | Bureau has 30/45 days |

| Report Identity Theft | FTC & Local Police | FCRA/FTC Regulations | File FTC Identity Theft Report | Immediately upon discovery |

Successfully challenging debt liability requires persistence and strict adherence to the procedures. For complex cases involving identity theft or business debt disputes in 2025, accessing specialized templates and guidance through resources like https://fixcreditscenter.com can ensure your disputes meet all legal requirements.

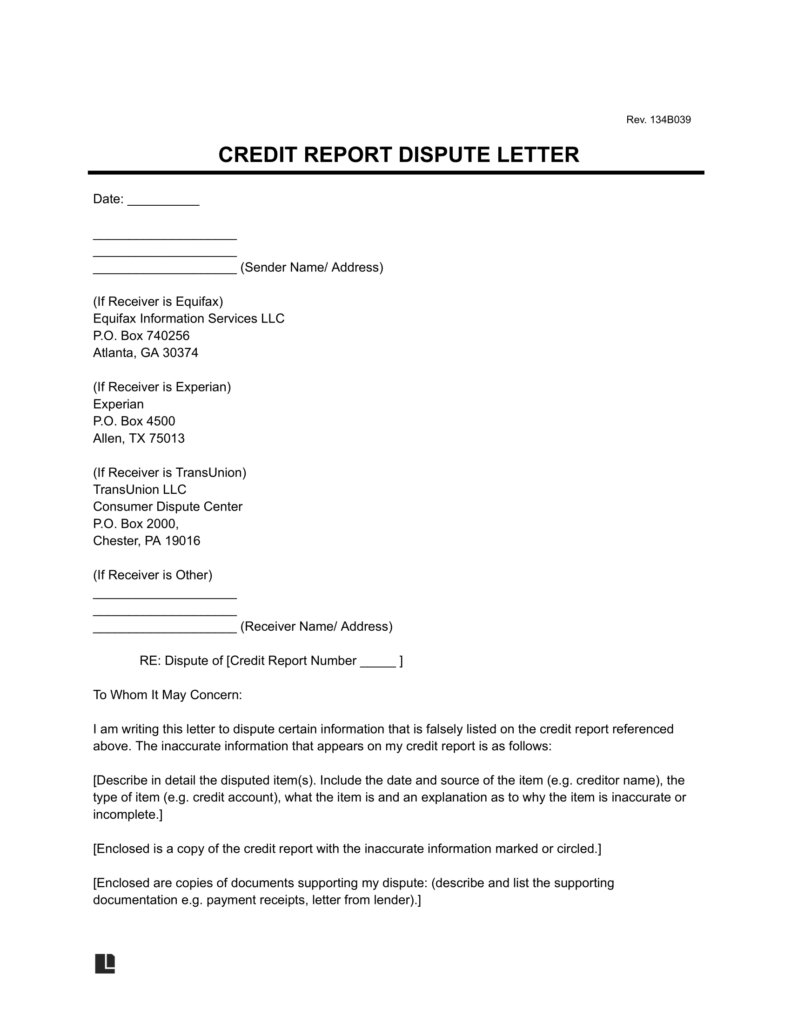

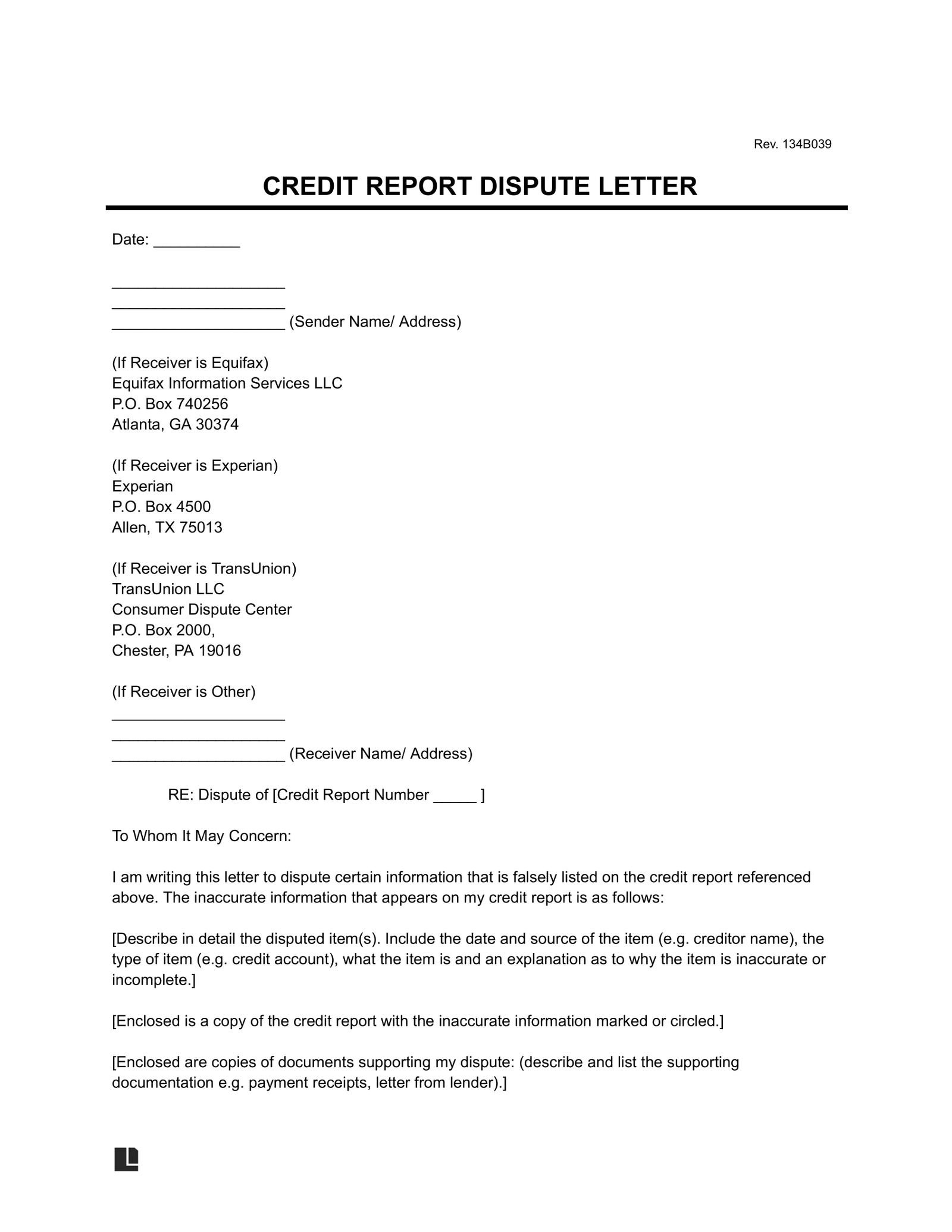

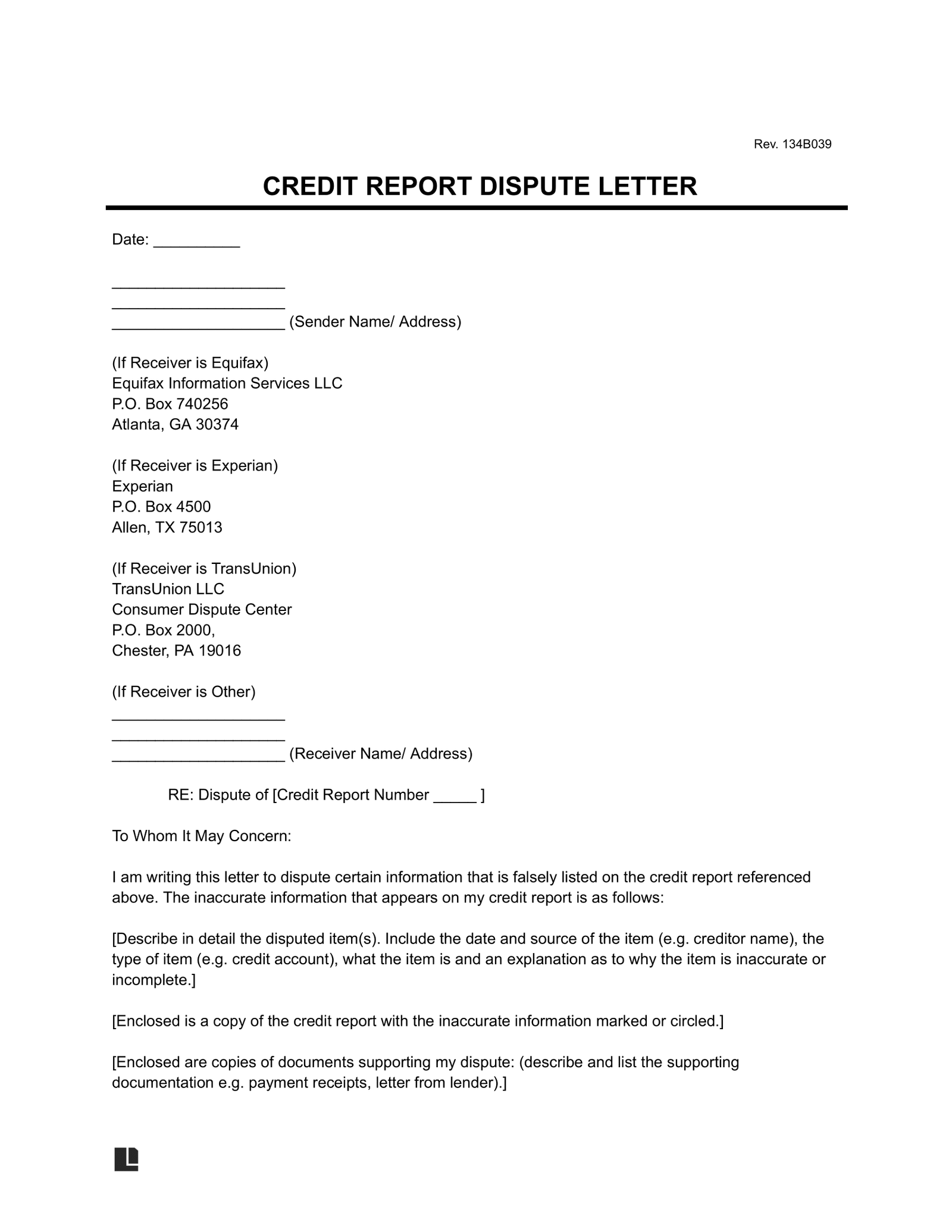

【Dispute Letter Templates】

Formally disputing credit errors requires precise documentation. Below are adaptable templates incorporating legally effective language for common dispute scenarios in 2025. Always customize bracketed information and send correspondence via certified mail with return receipt.

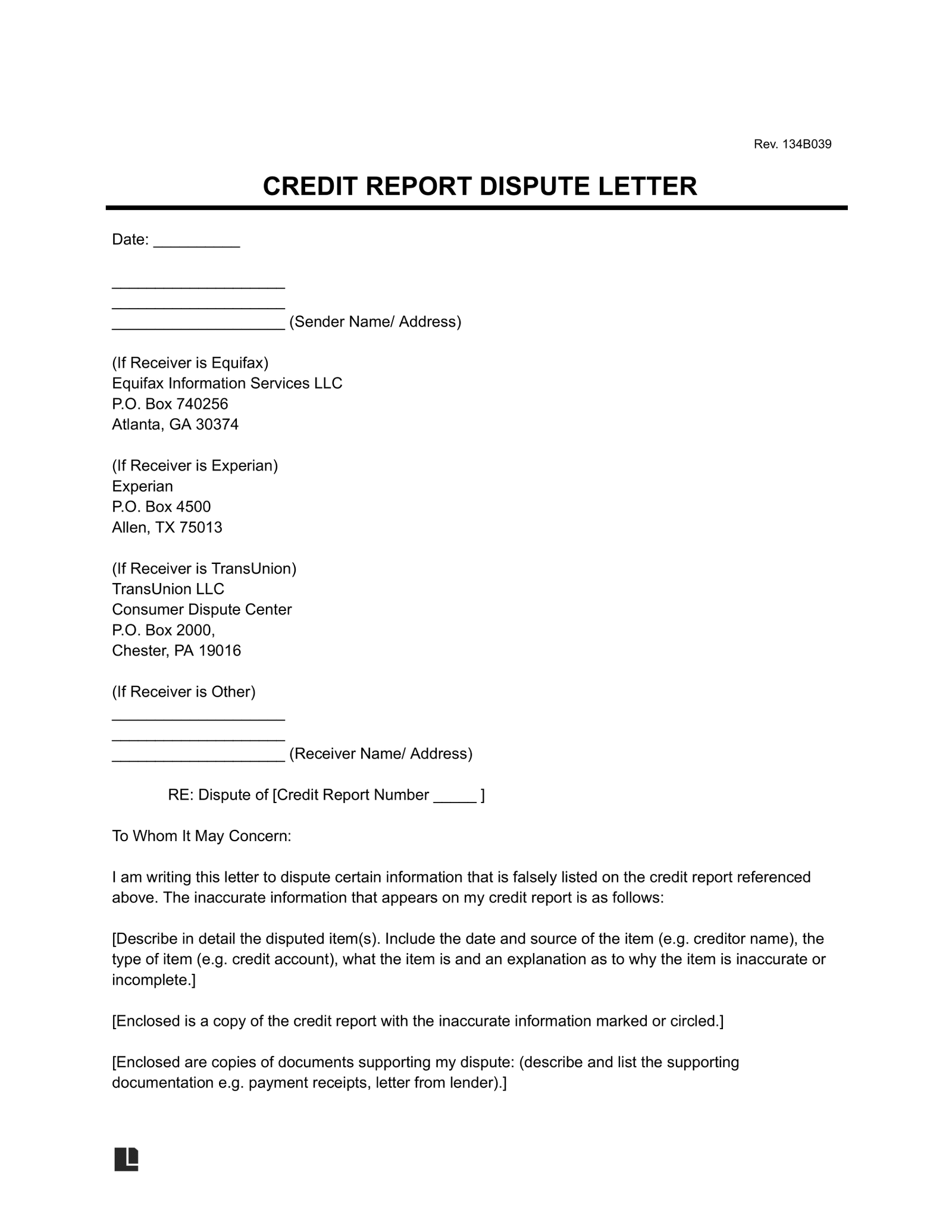

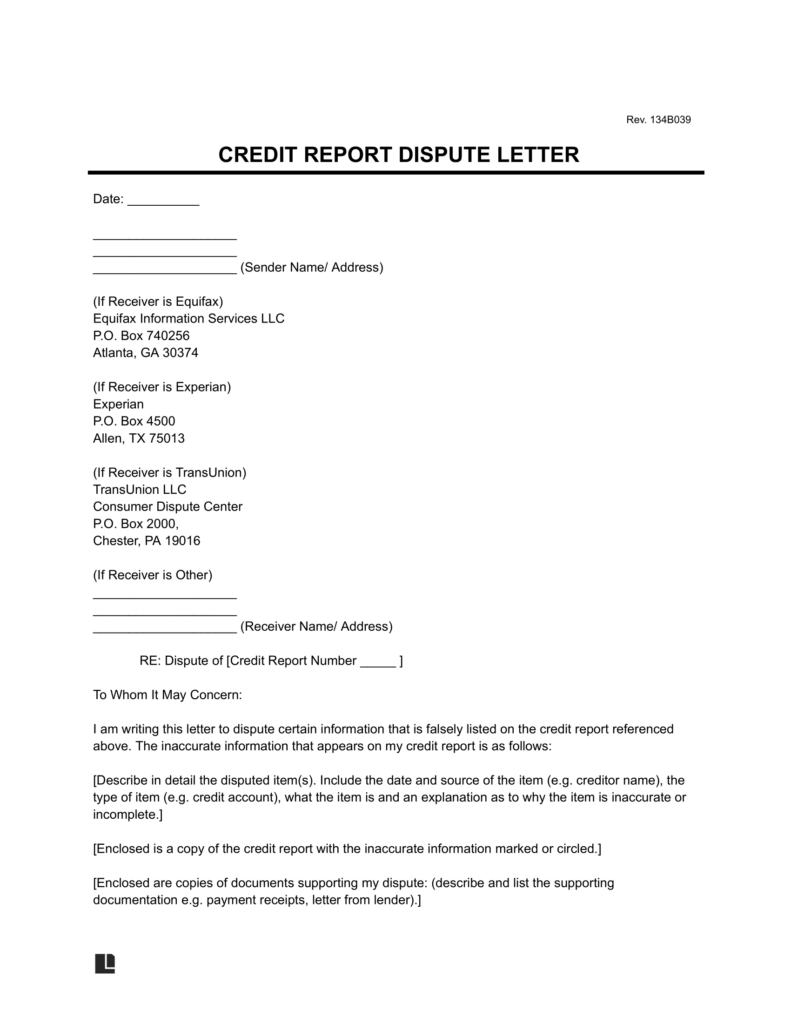

Credit Bureau Error Template

Use this when disputing inaccuracies directly with Equifax, Experian, or TransUnion. The FCRA mandates bureaus investigate disputes within 30-45 days.

Structural Framework

[Your Full Name]

[Your Address]

[City, State, ZIP]

[Date]

[Credit Bureau Name]

[Dispute Department Address]

**Subject: Formal Dispute of Inaccurate Information - Consumer ID: [Your Full SSN or Report Number]**

Dear Credit Bureau,

I am writing to dispute inaccurate information on my credit report under Section 611 of the Fair Credit Reporting Act (FCRA). Please investigate and correct or delete the following item(s):

1. **Creditor Name:** [Name of Creditor/Collection Agency]

**Account Number:** [Last 4 digits or full account number]

**Error:** [Specify error - e.g., "Account not mine," "Payment status incorrect as of 2025," "Balance overstated by $X"]

2. **Creditor Name:** [Name of Creditor/Collection Agency]

**Account Number:** [Last 4 digits or full account number]

**Error:** [Specify error]

[Add additional items as needed]

I have enclosed copies of:

- My government-issued ID

- Proof of address (utility bill dated within 90 days)

- [Optional: Notarized Identity Verification Form for enhanced security]

Supporting documents proving the inaccuracies are also attached [e.g., payment records, identity theft report].

Per FCRA requirements, please complete your investigation within 30 days and provide written results. Furnishers must report corrected information to all bureaus.

Sincerely,

[Your Signature]

[Your Typed Name]

Enclosures: [List documents]

Debt Collection Dispute Template

Send this to collection agencies within 30 days of their first contact to invoke FDCPA validation rights and halt collection efforts.

Key Legal Language

[Your Full Name]

[Your Address]

[City, State, ZIP]

[Date]

[Debt Collector Name]

[Collector Address]

**Subject: Dispute of Alleged Debt - Account # [Collector's Reference Number]**

Dear [Collector Name],

I dispute any personal liability for the debt referenced in your communication dated [Date] concerning account #[Number]. This debt is [not mine / the result of identity theft / legally unenforceable as of 2025].

**Under FDCPA Section 809(b):**

- **Cease all collection activities immediately** until you provide competent written validation proving:

a) I am the legally obligated party,

b) The original creditor’s name and address,

c) Documentation of the debt’s amount and origin.

- **Remove any inaccurately reported information** from credit bureaus within 7 business days.

**Failure to comply violates FDCPA (15 U.S.C. § 1692g) and FCRA.** Should you continue unlawful collection or reporting, I will pursue legal remedies including statutory damages.

Send validation to my address above. Phone contact is inconvenient; all communications must be in writing.

Sincerely,

[Your Signature]

[Your Typed Name]

For identity theft-related disputes, attach your FTC Identity Theft Report. Complex cases involving business debts or expired statutes may require tailored language—access jurisdiction-specific templates at https://fixcreditscenter.com to ensure full compliance with 2025 regulatory standards.

【Sending Your Dispute】

Certified Mail vs Online Submission

Choose your submission method strategically based on evidence requirements and legal safeguards:

| Method | Proof of Delivery | Investigation Timeline | Best For |

|---|---|---|---|

| USPS Certified Mail | Physical return receipt (green card) | 30-45 days | Legally sensitive disputes |

| Online Portal | System-generated tracking number | 30 days | Simple inaccuracies or updates |

| Fax/Email | Transmission confirmation receipt | 30 days | Time-sensitive corrections |

Proof of Delivery Importance

- USPS Certified Mail provides court-admissible proof with dated recipient signatures. Maintain the postmarked receipt and return card for 24 months.

- Online disputes require immediate screenshot capture of submission confirmations and tracking numbers. Credit bureaus may limit document upload sizes (typically 5MB/file).

- Never send originals – submit only copies of evidence. Physical mail should include a cover sheet listing all enclosed documents.

When to Escalate

Take formal action if:

- No response within 35 days of confirmed delivery (FCRA violation)

- Errors reappear after correction (“reinsertion” without 5-day notice per FCRA § 611)

- Partial corrections where key inaccuracies remain

Initiate escalation by:

① Sending a demand letter referencing your original tracking number

② Filing CFPB complaints at consumerfinance.gov/complaint

③ Consulting legal counsel for persistent FCRA/FDCPA violations

Tracking Your Dispute

Expected Timelines

Adhere to these 2025 regulatory deadlines:

- Day 0: Bureau receives dispute (certified mail receipt date/online submission timestamp)

- Day 5: Bureau must notify data furnishers of your dispute (§ 611(a)(2)(A))

- Day 30: Standard investigation deadline (45 days for subsequent disputes)

- Day 35: Bureau must issue written results and free credit report if changes occurred

Post-Dispute Credit Monitoring

Implement this verification protocol:

- At 45 days: Pull reports from all three bureaus via AnnualCreditReport.com

- Compare dispute outcomes: Use this checklist:

- [ ] Erroneous items fully removed

- [ ] Corrected balances reflect 2025 status

- [ ] Payment histories updated accurately

- [ ] No new unauthorized inquiries

- Dispute recurrences immediately: If deleted items reappear, demand deletion under FCRA § 611(b)(1) with proof of prior resolution. For complex re-reporting cases, specialized remediation strategies at

https://fixcreditscenter.comcan help enforce permanent corrections.

【Dispute Letter FAQs】

Top Dispute Mistakes

Understanding common pitfalls prevents dispute rejection. Key errors and solutions:

| Mistake | Why It Fails | 2025 Solution |

|---|---|---|

| Disputing accurate negatives | Bureaus verify legitimate information | Only challenge truly incorrect/outdated items |

| Omitting proof of identity | Prevents verification under FCRA § 605 | Include SSN copy + utility bill (redacted) |

| Using boilerplate language | Triggers “frivolous” classification (§ 611) | Cite specific error: “Balance shows $2,500 but actual 2025 debt is $1,800” |

Why Disputes Get Rejected

- Outdated disputes: Bureaus ignore items >7yrs old (bankruptcy: 10yrs) unless reporting error.

- Insufficient evidence: Stating “not mine” without supporting docs leads to denial. Submit bank statements or payment records.

- Third-party submissions: Disputes unsigned by the consumer are void per FCRA § 611(a)(1)(A).

Rebuilding After Resolution

Credit Score Improvement Tactics

Implement these strategies post-dispute for sustained growth:

- Credit Utilization Optimization

- Maintain balances below 30% of each limit ($600 on $2k card)

- Request limit increases after negative items resolve

- Pay mid-cycle if utilization spikes

- Payment History Anchoring

- Set up autopay for minimum payments

- Use calendar alerts for non-autopay accounts 3 days prior

- Leverage creditor grace periods (typically 15 days in 2025)

- Credit Mix Diversification

- Add installment loans if only revolving accounts exist (e.g., credit-builder loans)

- Avoid opening >2 new accounts within 6 months of disputes

- Maintain oldest account actively to preserve history length

For customized rebuilding timelines based on your resolved disputes, platforms like https://fixcreditscenter.com provide score-simulator tools and creditor negotiation templates.

Key Takeaways for Credit Success

Improving your credit score requires patience and smart actions. First, always check your reports for mistakes. Second, pay bills on time every month. Third, keep credit card balances low. Fourth, avoid opening too many new accounts. Finally, consider professional help if needed.

Ready to take control of your financial future? Visit https://fixcreditscenter.com now to start your credit repair journey! Leave a comment below to share your success story or questions.