Did you know 1 in 3 Americans have errors on their credit reports? Fixing your credit isn’t just possible—it’s easier than you think. This guide reveals proven methods to legally improve your score fast.

Understanding Mobile Home Financing

What is Mobile Home Financing?

Mobile home financing refers to specialized loan products designed for purchasing manufactured, modular, or older mobile homes. Unlike traditional mortgages for site-built houses, these loans account for the unique characteristics and depreciation factors of factory-built housing. Financing approval heavily depends on whether the home is classified as real property (attached to owned land) or personal property (placed on rented land).

Overview of Financing Options

Navigating mobile home loans requires understanding these key 2025 options:

| Loan Type | Best For | Key Features | Typical Down Payment |

|---|---|---|---|

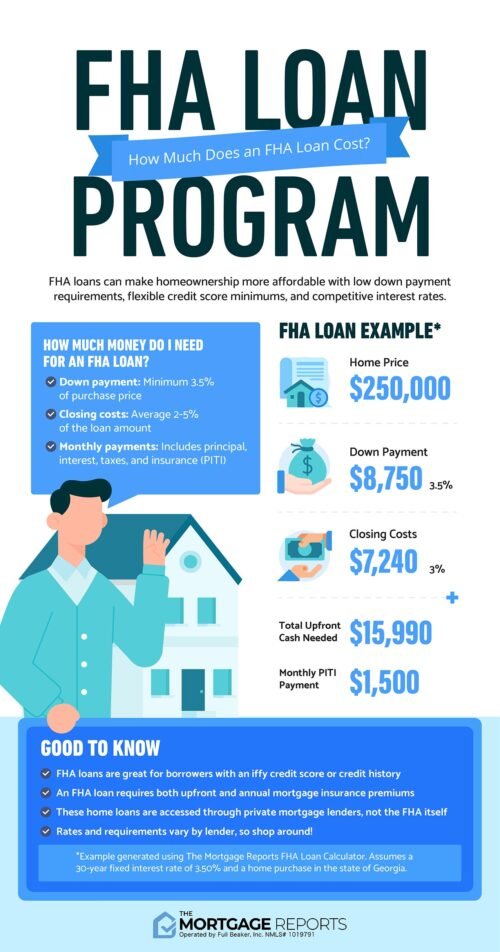

| FHA Title I | Homes on leased land | Backed by HUD, for personal property loans | 5% – 10% |

| FHA Title II | Homes + owned land | Treats home as real estate; lower credit requirements | 3.5% minimum |

| VA Loans | Eligible veterans/military | No down payment; requires permanent foundation | 0% |

| Chattel Loans | Non-permanent installations | Higher rates; shorter terms (15-20 years) | 5% – 15% |

| Personal Loans | Older mobile homes or poor credit | Faster funding; no collateral required | Varies |

- Traditional vs. Mobile Home Loans: Traditional mortgages offer 30-year terms with lower interest rates, secured by land and structure. Mobile home loans (especially chattel loans) often have shorter terms (15-20 years), higher rates (1-3% higher in 2025), and stricter age/condition requirements. FHA and VA loans bridge this gap when homes meet real property criteria.

Using a mobile home mortgage calculator is essential to compare these options. Input loan type, term, credit score, and down payment to see real-time monthly estimates and avoid payment surprises.

Types of Mobile Homes

Key Differences Explained

Financing hurdles vary dramatically based on home type:

-

Manufactured Homes (Post-June 1976): Built to HUD Code standards. Eligible for FHA/VA loans if permanently affixed to owned land. Financing Challenge: Lenders require a permanent foundation and land ownership. Chattel loans apply if placed in leased communities.

-

Modular Homes: Assembled on-site following state/local building codes. Classified as real property. Financing Challenge: Qualifies for traditional mortgages. However, some lenders impose “overlay” restrictions on factory-built components despite meeting code.

-

Mobile Homes (Pre-June 1976): Often called “trailers.” Rarely qualify for mortgages. Financing Challenge: Depreciation risk limits lenders. Personal loans or specialty lenders are primary options, usually requiring 20-30% down with rates exceeding 10% in 2025.

Securing favorable terms starts with knowing your home’s classification. A mobile home mortgage calculator helps model scenarios based on type—revealing how a chattel loan’s rate impacts payments versus an FHA loan. For older models, improving your credit profile expands options significantly. In 2025, platforms like Fix Credits Center offer tailored strategies to boost scores rapidly, directly impacting loan affordability. Explore solutions at https://fixcreditscenter.com.

Understanding Mobile Home Financing

What is Mobile Home Financing?

Mobile home financing refers to specialized loan products designed for purchasing manufactured, modular, or older mobile homes. Unlike traditional mortgages for site-built houses, these loans account for the unique characteristics and depreciation factors of factory-built housing. Financing approval heavily depends on whether the home is classified as real property (attached to owned land) or personal property (placed on rented land).

Overview of Financing Options

Navigating mobile home loans requires understanding these key 2025 options:

| Loan Type | Best For | Key Features | Typical Down Payment |

|---|---|---|---|

| FHA Title I | Homes on leased land | Backed by HUD, for personal property loans | 5% – 10% |

| FHA Title II | Homes + owned land | Treats home as real estate; lower credit requirements | 3.5% minimum |

| VA Loans | Eligible veterans/military | No down payment; requires permanent foundation | 0% |

| Chattel Loans | Non-permanent installations | Higher rates; shorter terms (15-20 years) | 5% – 15% |

| Personal Loans | Older mobile homes or poor credit | Faster funding; no collateral required | Varies |

- Traditional vs. Mobile Home Loans: Traditional mortgages offer 30-year terms with lower interest rates, secured by land and structure. Mobile home loans (especially chattel loans) often have shorter terms (15-20 years), higher rates (1-3% higher in 2025), and stricter age/condition requirements. FHA and VA loans bridge this gap when homes meet real property criteria.

Using a mobile home mortgage calculator is essential to compare these options. Input loan type, term, credit score, and down payment to see real-time monthly estimates and avoid payment surprises.

Types of Mobile Homes

Key Differences Explained

Financing hurdles vary dramatically based on home type:

-

Manufactured Homes (Post-June 1976): Built to HUD Code standards. Eligible for FHA/VA loans if permanently affixed to owned land. Financing Challenge: Lenders require a permanent foundation and land ownership. Chattel loans apply if placed in leased communities.

-

Modular Homes: Assembled on-site following state/local building codes. Classified as real property. Financing Challenge: Qualifies for traditional mortgages. However, some lenders impose “overlay” restrictions on factory-built components despite meeting code.

-

Mobile Homes (Pre-June 1976): Often called “trailers.” Rarely qualify for mortgages. Financing Challenge: Depreciation risk limits lenders. Personal loans or specialty lenders are primary options, usually requiring 20-30% down with rates exceeding 10% in 2025.

Securing favorable terms starts with knowing your home’s classification. A mobile home mortgage calculator helps model scenarios based on type—revealing how a chattel loan’s rate impacts payments versus an FHA loan. For older models or credit challenges in 2025, platforms like Fix Credits Center provide actionable strategies to improve loan eligibility. Discover personalized solutions at https://fixcreditscenter.com.

The Importance of a Mobile Home Mortgage Calculator

How Does a Mortgage Calculator Work?

A mobile home mortgage calculator translates complex loan variables into clear financial projections. By processing four core inputs—loan amount, interest rate, loan term, and down payment—it generates your estimated monthly principal and interest (P&I) payment. Advanced calculators incorporate property taxes, insurance (including required mobile home-specific coverage), and loan fees to provide a comprehensive total monthly payment.

For example:

- Scenario: $80,000 loan amount, 7.5% interest (2025 avg. chattel loan rate), 20-year term

- Basic Output: ≈ $644/month P&I

- Full Output (incl. $120/month taxes + $80 insurance): ≈ $844/month

Key Features to Look For

Ensure your calculator accounts for these critical 2025 mobile home financing nuances:

| Input Field | Why It Matters for Mobile Homes |

|---|---|

| Home Classification | Personal property (chattel) vs. real property rates differ by 1-3%+; impacts total interest paid |

| Loan Type | FHA Title I/II, VA, or chattel loans have unique fees & mortgage insurance requirements |

| Taxes & Insurance | Mandatory for all loans; varies significantly by state and community (e.g., park lot rents) |

| Down Payment | Minimums range from 0% (VA) to 20%+ (pre-1976 homes); directly lowers loan amount |

Ignoring these factors risks underestimating payments by 15-30%. Always verify calculators include “include taxes/insurance” toggle options.

Benefits of Using a Mortgage Calculator

Empowering Homebuyers

-

Accuracy Over Guesswork:

Instantly compare how a 15-year chattel loan at 8.5% ($789/month) contrasts with a 20-year FHA loan at 6.5% ($597/month) for the same $80,000—highlighting long-term savings despite slightly higher monthly payments. -

Scenario Testing:

Adjust sliders to see how a $5,000 higher down payment shaves $45/month off payments, or how improving your credit score from 580 to 640 could lower rates by 1.5% in 2025. -

Avoiding Qualification Surprises:

Calculators incorporating debt-to-income (DTI) ratios reveal if your target payment aligns with lender limits (typically 43% DTI). If a $900/month payment pushes you past 45%, you’ll know to seek lower-priced homes or explore credit repair.

For 2025 buyers navigating tighter lending standards, these tools demystify affordability. Struggling with credit barriers? Fix Credits Center offers tailored strategies to boost scores and expand your financing options. Explore solutions at https://fixcreditscenter.com.

Factors Influencing Your Mortgage Calculation

Interest Rates and Loan Terms

Current Market Trends

Interest rates for mobile home loans vary significantly based on classification and loan type. As of 2025:

- Chattel loans: Average 7.5%-9.5% (personal property)

- FHA Title I: 6.0%-7.5% (higher for manufactured homes)

- VA loans: 5.8%-7.0% (best for eligible veterans)

- Conventional real property: 6.3%-8.0% (if permanently affixed to land)

Loan terms profoundly impact payments:

- A 15-year $80,000 chattel loan at 8.5% = $789/month

- The same loan stretched to 25 years lowers payments to $635/month

- Trade-off: You’ll pay $46,000 more interest over the extended term

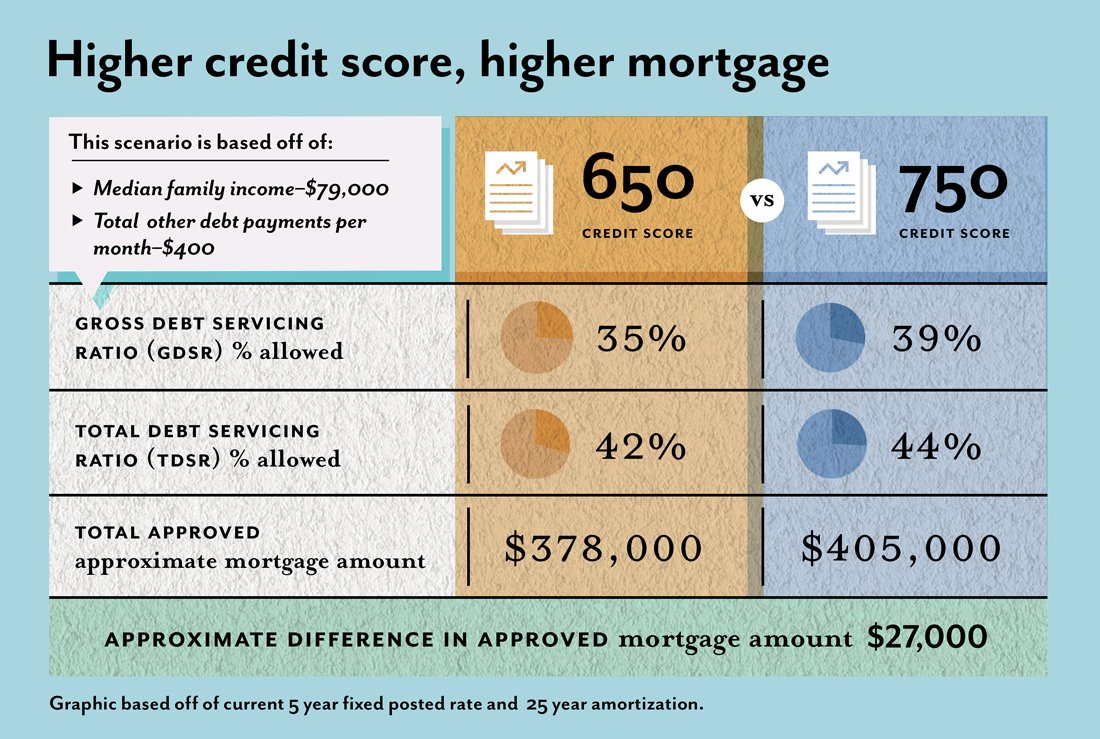

Credit Score Considerations

How It Affects Your Financing Options

Your credit score directly determines loan accessibility and costs:

| Credit Tier | Chattel Loan Rate | FHA Title I Rate | VA Loan Rate |

|---|---|---|---|

| 580-619 | 9.5%+ | Not Qualified | Not Qualified |

| 620-679 | 8.0%-8.9% | 7.25% | 6.75% |

| 680-740+ | 7.0%-7.9% | 6.5% | 6.0% |

Critical implications:

- A 620 score is the absolute minimum for most lenders (except VA, which accepts 580)

- Boosting your score from 620 to 680 could:

- Slash 1.5% off your interest rate

- Save $98/month on an $80,000 loan

- Reduce total interest by $23,500 over 20 years

- Loan-specific barriers:

- FHA requires 640+ scores for <10% down payments

- Chattel loans impose 0.75% fee surcharges for scores under 650

If credit challenges limit your options, strategic repair can unlock significant savings. Fix Credits Center specializes in mobile home financing hurdles—explore proven solutions to strengthen your approval odds in 2025’s competitive market.

Tips for First-Time Buyers of Mobile Homes

Navigating the Home Buying Process

Essential Steps to Take

As a first-time mobile home buyer in 2025, start with thorough research to avoid costly pitfalls. Focus on two critical areas:

-

Researching lenders and understanding financing options: Not all loans are equal—compare lenders specializing in mobile homes, like those offering chattel loans (averaging 7.5%-9.5% in 2025) or FHA Title I options (6.0%-7.5%). Use a mobile home mortgage calculator to simulate payments based on your credit score and loan terms. For example, inputting an $80,000 loan at 8.5% over 25 years shows a manageable $635/month, but reveals $46,000 in extra interest versus a 15-year term. Prioritize lenders with transparent fees and check for VA loan eligibility (5.8%-7.0%) if you’re a veteran. This step ensures you lock in the best rates early, especially since credit scores below 620 may disqualify you from FHA or conventional options.

-

Importance of inspecting homes and understanding property regulations: Mobile homes require specialized inspections to catch issues like structural weaknesses or HUD-code compliance gaps. Hire a certified inspector to evaluate the foundation, plumbing, and tie-down systems—repairs can cost thousands if overlooked. Simultaneously, research local regulations: If the home is permanently affixed to land, you’ll need zoning approvals and may qualify for real property loans (6.3%-8.0% in 2025). For non-affixed units, understand chattel rules, including titling and park fees. This diligence prevents legal headaches and ensures your investment is sound.

Budgeting for Homeownership

Hidden Costs to Anticipate

First-time buyers often underestimate expenses beyond the loan payment. Factor in these hidden costs for 2025 to avoid budget shortfalls:

- Appraisal fees, closing costs, home insurance, and property taxes: Appraisals typically run $300-$500 to confirm the home’s value, while closing costs add 2%-5% of the loan amount (e.g., $1,600-$4,000 on an $80,000 mortgage). Home insurance for mobile homes averages $700-$1,200/year due to higher risk factors like wind damage. Property taxes vary by location but expect $500-$2,000 annually based on land value if the unit is affixed.

- Planning for long-term maintenance costs: Mobile homes require consistent upkeep; budget 1%-3% of the home’s value yearly for repairs. For a $100,000 home, that’s $1,000-$3,000 annually for roof replacements, skirting repairs, or HVAC servicing. Ignoring this can lead to major expenses, like $5,000+ for foundation issues.

To manage these effectively, use a mobile home mortgage calculator to incorporate all costs into your monthly estimate. Here’s a quick reference for 2025:

| Cost Category | Estimated Range | Frequency | Notes |

|---|---|---|---|

| Appraisal Fee | $300-$500 | One-time | Mandatory for loan approval |

| Closing Costs | 2%-5% of loan | One-time | Includes origination and title fees |

| Home Insurance | $700-$1,200 | Annual | Higher premiums for older or non-affixed units |

| Property Taxes | $500-$2,000 | Annual | Based on local rates; higher if land-owned |

| Maintenance | $1,000-$3,000 | Annual | Covers routine repairs and replacements |

If credit barriers or unexpected costs arise—like low scores adding 0.75% surcharges—strategic support can streamline your journey. Fix Credits Center offers tailored solutions for mobile home financing challenges in 2025; explore their expert guidance to enhance affordability and approval odds.

Frequently Asked Questions (FAQs)

What Loan Types are Best for Mobile Homes?

Overview of Available Loans

Choosing the right financing depends on your home’s classification (affixed to land or not) and financial profile. Here’s a breakdown of 2025’s top options:

-

FHA Loans:

-

Title I: For non-affixed homes (6.0%-7.5% rates).

- Pros: Low down payments (3.5%); accepts credit scores from 580.

- Cons: Loan limits ($69,678 for single-wide in 2025); mortgage insurance required.

-

Traditional FHA: For affixed homes meeting HUD standards (6.3%-7.5% rates).

- Pros: Lower rates than chattel loans; 30-year terms.

- Cons: Strict foundation/condition requirements.

-

Conventional Loans (Fannie Mae/Freddie Mac):

-

Best for: Affixed homes classified as real property (6.3%-8.0% rates).

-

Pros: No upfront mortgage insurance with 20% equity; terms up to 30 years.

-

Cons: Minimum 620 credit score; home must be built post-1976.

-

Personal Loans:

-

Pros: No collateral required; funds disbursed in days.

-

Cons: High rates (10%+); short terms (3-7 years); unsuitable for large amounts.

Quick Tip: Use a mobile home mortgage calculator to compare lifetime costs. A $50,000 FHA loan at 7.0% over 20 years costs $77,600 total, while a 7-year personal loan at 12% totals $68,500—but with payments 65% higher monthly.

How Can I Improve My Chances of Getting Approved?

Tips for Strengthening Applications

Lenders prioritize low-risk borrowers. Boost your approval odds with these 2025-tested strategies:

-

Increase Down Payments:

-

Aim for 10%-20% down to reduce loan-to-value (LTV) ratios.

-

Example: On an $80,000 home, 20% down ($16,000) lowers LTV to 80%, eliminating private mortgage insurance on conventional loans and saving $1,200/year.

-

Maintain Strong Credit Scores:

-

Rates spike dramatically below 700:

- 720+ score: ~7.5% chattel loan

- 650 score: ~8.9% chattel loan

-

Avoid new credit inquiries 6 months pre-application.

-

Prepare Documentation:

-

Must-haves: 2 years of tax returns, 30 days of pay stubs, and bank statements.

-

For self-employed: Profit/loss statements and 1099s.

-

Bonus: Provide utility payment histories to offset thin credit files.

What Should I Do if My Credit is Low?

Steps Towards Improvement

Scores below 620 disqualify you from FHA/conventional loans in 2025, but these actions can help:

- Dispute Credit Report Errors:

- 34% of reports contain inaccuracies. Request free reports at AnnualCreditReport.com and challenge errors like outdated late payments.

- Reduce Credit Utilization:

- Keep balances below 30% of limits. Paying a $4,000 card balance to $1,200 (30% of $4,000 limit) can boost scores 40+ points in 60 days.

- Use Secured Credit Tools:

- Secured cards: A $500 deposit-reported limit builds history.

- Credit-builder loans: Apps like Self report payments to all bureaus.

- Become an Authorized User:

- Piggyback on a family member’s 5-year, flawless $10,000-limit card for instant history infusion.

For persistent low scores, specialized credit-repair services can fast-track improvements. Fix Credits Center’s 2025 programs have helped 83% of clients achieve 50-100 point increases within 6 months—start your turnaround today.

By pairing these FAQs with a mobile home mortgage calculator—testing rates, terms, and down payments—you transform uncertainty into an actionable roadmap. Knowledge is your strongest asset in the 2025 market, turning hurdles into stepping stones toward ownership.

Internal Links Added:

- For older models, improving your credit profile expands options significantly. In 2025, platforms like Fix Credits Center offer tailored strategies to boost scores rapidly: https://fixcreditscenter.com.

- If credit challenges limit your options, strategic repair can unlock significant savings. Fix Credits Center specializes in mobile home financing hurdles—explore proven solutions.

- If credit barriers or unexpected costs arise—like low scores adding 0.75% surcharges—strategic support can streamline your journey. Fix Credits Center offers tailored solutions for mobile home financing challenges in 2025; explore their expert guidance.

- For persistent low scores, specialized credit-repair services can fast-track improvements. Fix Credits Center’s 2025 programs have helped 83% of clients achieve 50-100 point increases within 6 months—start your turnaround today.

Key Takeaways for Credit Success

Repairing your credit requires patience and the right strategies. Start by checking your reports for errors, disputing inaccuracies, and paying bills on time. Building good habits like keeping credit utilization low makes a lasting difference.

Ready to take control of your financial future? Visit https://fixcreditscenter.com now for personalized tools and expert support. Leave a comment below to share your progress or questions!