Did you know 1 in 3 Americans have errors on their credit reports? This guide reveals professional techniques to legally improve your credit score fast, saving you thousands in loan interest.

Understanding Mobile Home Financing

What is Mobile Home Financing?

Mobile home financing refers to the specialized loan products designed to purchase manufactured, modular, or older mobile homes. Unlike traditional “stick-built” home mortgages, these loans account for the unique characteristics, depreciation factors, and titling (often as personal property) of factory-built dwellings. Securing financing is often the biggest hurdle for buyers, making understanding the options crucial.

Overview of Financing Options

Navigating mobile home loans means understanding these primary routes:

- FHA Title I & Title II Loans: Backed by the Federal Housing Administration. Title I loans are for personal property (homes not permanently affixed to owned land), while Title II loans are for real property (homes permanently attached to owned land). Both typically offer lower down payments and more flexible credit requirements than conventional loans.

- VA Loans: Available to eligible veterans, service members, and surviving spouses. VA loans offer competitive interest rates, no down payment requirement, and no private mortgage insurance (PMI) for qualifying manufactured homes permanently affixed to owned land.

- Chattel Loans: The most common financing for homes not placed on owned land (e.g., in a rented lot in a community). Chattel loans treat the home as personal property (like a vehicle), often resulting in higher interest rates and shorter loan terms (15-20 years) compared to mortgages.

- Personal Loans: Sometimes used for older mobile homes, smaller purchases, or buyers with significant credit challenges. Interest rates are usually much higher, and terms shorter, making this less ideal.

- Conventional Mortgage: Possible if the manufactured home is permanently affixed to a foundation on land the buyer owns (classified as real property) and meets specific HUD and lender requirements (post-1976 HUD-code homes). This often offers the best terms.

Differences between traditional and mobile home loans:

| Feature | Traditional Home Loan | Typical Mobile Home Loan (Chattel) |

|---|---|---|

| Collateral | Real Estate (Land + Home) | Personal Property (Home only) |

| Loan Term | 15, 20, 30 years | Usually 15-20 years |

| Interest Rate | Generally Lower | Generally Higher |

| Down Payment | Varies (3%-20%+) | Often 5%-20%+ |

| Appraisal | Standard Real Estate Appraisal | Often includes NADA Guide similar to vehicles |

| Eligibility | Based on home/land value, credit | Stricter age/condition rules, credit |

Types of Mobile Homes

Understanding the distinctions between types is vital, as it significantly impacts financing eligibility, loan terms, and the potential need for a land financing calculator if purchasing land separately.

Key Differences Explained

- Manufactured Homes (Post-June 15, 1976): Built entirely in a factory according to the federal HUD Code (Department of Housing and Urban Development). They are transported to site on a permanent chassis. Recognizable by a HUD Data Plate and Certification Label. Financing options are broadest for newer models placed on owned land (potentially qualifying for FHA Title II or conventional mortgages). Chattel loans are common for placements in rented communities.

- Modular Homes: Built in sections (modules) in a factory to state or local building codes (IRC – International Residential Code), identical to site-built homes. Transported to site and assembled on a permanent foundation. They are financed exactly like traditional stick-built homes using conventional mortgages, FHA, or VA loans once permanently affixed to owned land. They appreciate like site-built homes.

- Mobile Homes (Pre-June 15, 1976): Built before the implementation of the HUD Code. Often referred to simply as “mobile homes” or “trailers.” Financing is the most challenging. Lenders are extremely hesitant due to age, potential structural issues, and rapid depreciation. Personal loans or specialized (and expensive) older mobile home loans are often the only options. VA or FHA loans are generally not available for pre-HUD code homes.

Common financing challenges for each type:

- Manufactured Homes:

- Not on Owned Land: Limits options primarily to higher-rate chattel loans. Land-lease communities add complexity.

- Age & Condition: Older manufactured homes (even post-HUD) face stricter lending standards and higher rates.

- Permanency: Qualifying for the best rates (mortgage) requires permanent installation meeting specific criteria.

- Modular Homes: Financing challenges are minimal if permanently affixed to owned land, as they qualify for standard mortgages. The main hurdle is ensuring the lender understands modular construction equals traditional construction.

- Mobile Homes (Pre-HUD):

- Severely Limited Lender Pool: Very few lenders offer financing; those that do charge high interest rates and fees.

- Depreciation: Lenders see significant risk due to rapid loss of value.

- Safety & Code Compliance: Concerns about outdated construction standards make lenders wary.

- Down Payment: Often requires very high down payments (if financing is available at all).

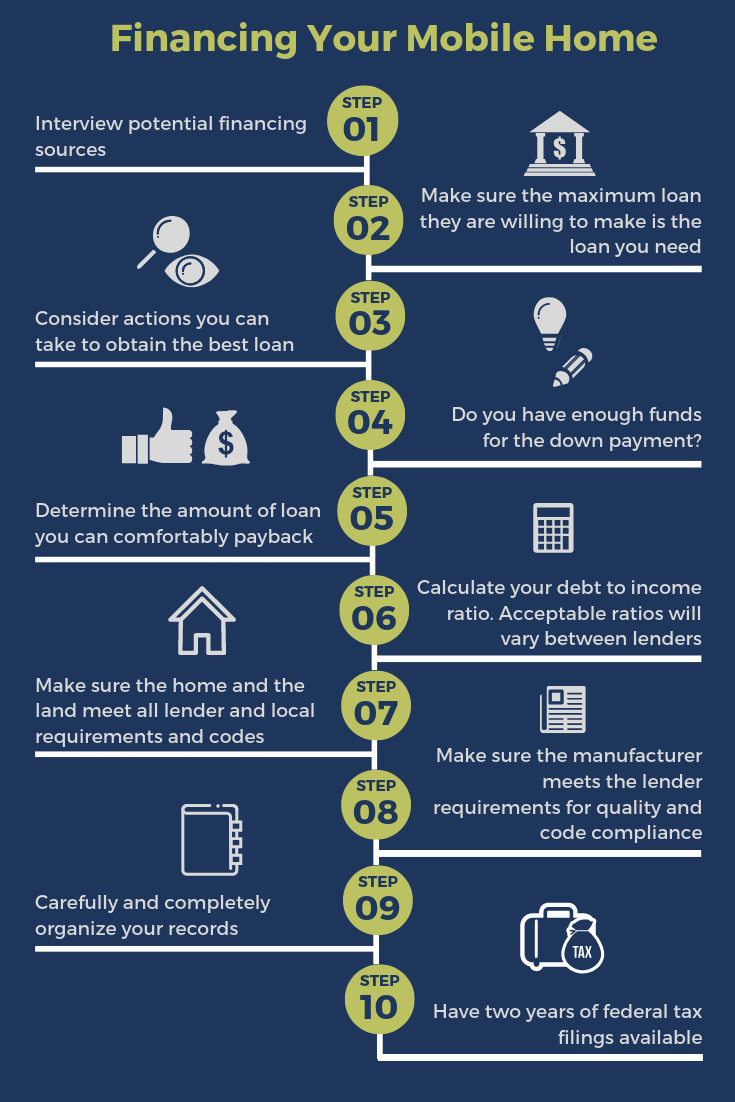

Securing the right financing hinges on knowing your home’s type, its age, condition, and whether it will be placed on land you own or lease. If purchasing land separately, using a land financing calculator early in your 2025 planning process is essential to understand the combined cost of land acquisition and home placement or purchase. For personalized guidance navigating credit requirements for any mobile home loan, exploring resources like fixcreditscenter.com can provide valuable insights.

Understanding the Importance of a Land Financing Calculator

Purchasing land, whether as the foundation for a manufactured home, a modular build, or for future development, represents a significant financial commitment distinct from buying the dwelling itself. While the previous section highlighted how the placement of a factory-built home (on owned vs. leased land) dramatically impacts financing options and costs, acquiring that land introduces its own complex financial variables. This is where a land financing calculator becomes an indispensable tool for any serious buyer planning their move in 2025. It transforms abstract numbers into concrete, actionable insights.

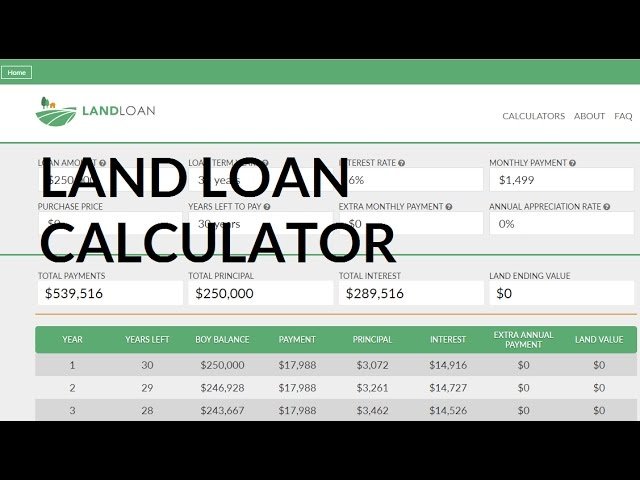

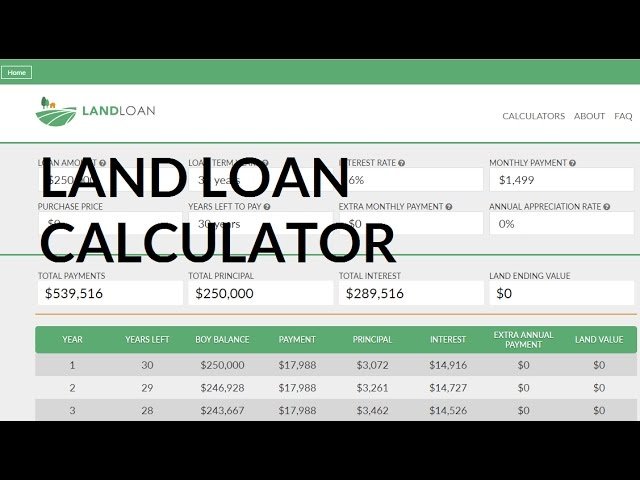

What is a Land Financing Calculator?

A land financing calculator is a specialized online tool designed to estimate the costs associated with borrowing money to purchase a parcel of land. Unlike a standard mortgage calculator, which factors in the combined value of a structure and the land it sits on, a land loan calculator focuses solely on the land acquisition financing. Land loans are inherently different – they often carry higher interest rates, require larger down payments, and have shorter repayment terms than traditional mortgages due to the lender’s perceived higher risk (land is easier to walk away from than a home). The calculator helps demystify these unique loan parameters by providing personalized estimates based on your specific inputs.

Key Components

A robust land financing calculator incorporates several critical elements to generate accurate projections:

- Monthly Payment Estimation: The core output. It calculates your estimated principal and interest payment based on the loan amount, interest rate, and term. This instantly shows the ongoing cash flow impact.

- Total Interest Calculation: Reveals the true cost of borrowing over the life of the loan. Seeing how much extra you’ll pay in interest beyond the land’s purchase price is crucial for evaluating affordability and comparing loan offers.

- Down Payment Impact: Allows you to adjust the down payment percentage or amount and instantly see how it affects the loan amount, monthly payment, total interest paid, and potentially the interest rate offered (as larger down payments often secure better rates). This is vital for determining how much cash you need upfront.

- Loan Term Adjustments: Lets you explore different repayment periods (e.g., 5, 10, 15, 20 years). Shorter terms mean higher monthly payments but significantly less total interest, while longer terms lower the monthly burden but increase the total cost. This helps you find the balance between monthly affordability and overall expense.

Why Use a Land Loan Calculator?

Relying solely on lender quotes or rough mental math is insufficient when dealing with the complexities of land acquisition. A dedicated calculator provides essential advantages:

Financial Clarity

- Understand Total Loan Costs: It goes beyond the sticker price of the land. By factoring in interest rates, loan terms, and fees (if included in the model), the calculator reveals the actual total amount you will repay. This prevents underestimating the long-term financial commitment.

- Compare Various Financing Scenarios: Want to see if a 15% down payment over 15 years is better than 20% down over 10 years? A good calculator lets you model countless “what-if” scenarios side-by-side. You can instantly compare the monthly and total costs of different loan structures, interest rates (including potential quotes from different lenders), and down payment strategies to find the optimal path for your 2025 budget.

Planning Your Budget

- Set Realistic Expectations: Seeing the concrete numbers – especially the monthly payment – forces a realistic assessment of what you can truly afford. It helps prevent overextending yourself by making the financial implications tangible before you commit.

- Avoid Surprises in Payments: By accurately projecting the monthly payment based on current rate estimates and your chosen loan parameters, the calculator eliminates guesswork. You know exactly what payment range to expect, allowing for precise budgeting and preventing unpleasant financial shocks later in the loan process.

Integrating a land financing calculator early into your 2025 property planning is not just helpful; it’s fundamental to making informed, confident decisions. Whether you’re buying land for a HUD-code manufactured home requiring permanent placement or for future site-built construction, understanding the specific financing costs is paramount. As you refine your budget and credit standing for this significant step, resources like fixcreditscenter.com can offer tailored strategies to strengthen your financial position and potentially secure more favorable loan terms.

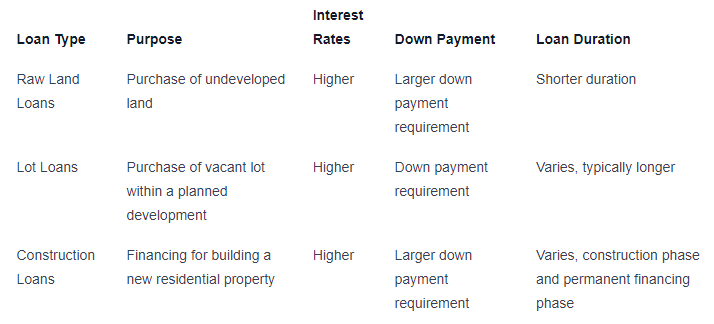

Exploring Different Types of Land Loans

The journey to land ownership in 2025 isn’t one-size-fits-all, especially when it comes to financing. The type of land you’re purchasing fundamentally shapes the loan products available and the terms you’ll encounter. Understanding these distinctions is crucial before plugging numbers into a land financing calculator, as the loan category directly impacts the interest rates, down payments, and requirements you’ll need to model. Broadly, land loans fall into two primary categories, each reflecting the lender’s perception of risk.

Raw Land Loans

Imagine untouched acreage: no utilities, no road access, just the raw potential of the earth. This is raw land. While it often comes at a lower purchase price, financing it represents the highest risk tier for lenders. Why? The absence of development makes it harder to sell quickly if the borrower defaults – there’s no immediate, income-generating use or readily habitable structure to secure the loan’s value.

Characteristics

- Completeness of Land: Defined by the lack of development. It typically lacks connections to public water, sewer, electricity, natural gas, and paved road access. Zoning may be uncertain or require significant changes for intended use.

- Higher Risk for Lenders: The “blank slate” nature that appeals to buyers is precisely what makes lenders wary. The collateral value is speculative and heavily dependent on future, often costly, development occurring successfully.

Requirements

Securing a raw land loan demands significantly more from the borrower due to the elevated lender risk:

- Significant Down Payment (20-50%): Lenders require substantial skin in the game. Expect down payments starting at 20% and often reaching 30%, 40%, or even 50% for larger or more remote parcels. This reduces the lender’s exposure.

- Detailed Development Plans Needed: Vague intentions won’t suffice. Lenders require concrete, credible plans outlining exactly how you intend to develop the land (e.g., building a specific type of home by a certain date, subdividing with engineered plans). This demonstrates commitment and provides a clearer path to establishing value. Strong credit history and lower debt-to-income ratios are also paramount.

Improved Land Loans

Now, picture a plot with utilities stubbed to the property line, a paved road frontage, and perhaps even preliminary grading or septic approval. This is improved land. It represents a significant step towards being “build-ready,” drastically altering the financing landscape.

Definition

- Land with Necessary Utilities and Infrastructure: “Improved” specifically means the land has essential public services accessible at the property boundary – water, sewer (or approved septic design), electricity, gas (if available), and dedicated road access. Basic site work like clearing or grading might also be present. It’s land where the foundational hurdles for development have been cleared.

Benefits

The presence of these improvements translates directly into tangible financing advantages:

- Lower Risks for Lenders: With utilities in place, the path to development is shorter, less uncertain, and less capital-intensive for the borrower. The land inherently has higher market value and is easier to sell if necessary, making it far more attractive collateral.

- More Favorable Loan Terms: This reduced risk profile allows lenders to offer:

- Lower Interest Rates: Compared to raw land loans.

- Lower Down Payments: Often in the range of 10-20%, significantly less than raw land requirements.

- Longer Loan Terms: Potentially extending to 15, 20, or even 25 years, making monthly payments more manageable.

- Potentially Less Stringent Plan Requirements: While lenders still want to know your intent, the immediate “buildability” reduces the need for hyper-detailed, multi-phase development blueprints upfront.

| Loan Feature | Raw Land Loan | Improved Land Loan |

|---|---|---|

| Definition | Undeveloped, lacks utilities/access | Utilities/access at property line |

| Lender Risk | Highest | Lower |

| Typical Down Payment | 20% – 50% | 10% – 20% |

| Interest Rates | Higher | Lower |

| Loan Terms | Shorter (e.g., 3-10 years common) | Longer (e.g., 15-25 years possible) |

| Plan Requirements | Highly Detailed Development Plans | Less Stringent (Intent often sufficient) |

Understanding whether your target parcel qualifies as raw or improved is the critical first step in 2025 land financing. This distinction dictates which loan products you can access and fundamentally alters the outputs you’ll see when using a land financing calculator. Inputting the same purchase price but selecting “raw” versus “improved” will yield vastly different monthly payments and total costs due to the differing down payments, rates, and terms. As you prepare for this significant investment, ensuring your credit profile positions you for the best possible terms is essential. Resources tailored to credit optimization, like those found at fixcreditscenter.com, can be a strategic part of your preparation.

Key Factors Impacting Your Land Financing

Building on the foundation of land type—whether raw or improved—the next critical layer in your 2025 land purchase involves dissecting the variables that directly shape your financing outcomes. These factors don’t just influence abstract numbers; they dictate real-world affordability and feasibility. When you input data into a land financing calculator, elements like interest rates, loan terms, and down payments transform raw figures into actionable insights, revealing how much you’ll pay monthly and over the loan’s lifetime. Ignoring these nuances can turn a dream plot into a financial burden, so let’s break them down systematically.

Interest Rates and Payment Terms

Interest rates and repayment schedules are the engine of your land loan, driving both immediate costs and long-term financial commitments. Unlike fixed-rate mortgages for developed properties, land loans often carry more volatility, reflecting the inherent risks lenders perceive in undeveloped or partially improved parcels. In 2025, with economic shifts like fluctuating inflation and tighter lending regulations, these rates aren’t static—they respond dynamically to your profile and the broader market.

Interest Rate Variability

Interest rates on land loans aren’t set in stone; they pivot on two primary levers: your creditworthiness and the economic climate.

- Influence of credit score on rates: Your credit score acts as a financial fingerprint, signaling risk to lenders. A high score (typically 740 or above) can shave 1-2 percentage points off your rate, translating to thousands saved over the loan term. For instance, on a $100,000 land loan, a 5% rate versus 7% could mean $5,000 less in interest over five years. Conversely, a score below 680 often triggers higher rates or outright denials, as lenders buffer against perceived default risks—especially critical for raw land, where collateral is speculative.

- Market conditions affecting rates: Broader forces like 2025’s anticipated Fed rate hikes or regional housing demand surges can inflate land loan rates. If inflation persists or construction costs rise, lenders may increase rates to hedge against eroding loan value. This variability means timing matters: securing financing during a market lull could lock in lower rates, while peak periods amplify costs. Always cross-reference current trends when using a land financing calculator to avoid underestimating payments.

Loan Terms

The length of your loan term dictates not just your monthly cash flow but the total cost of borrowing, making it a pivotal trade-off between affordability now and savings later.

- Shorter vs. longer terms: Shorter terms (e.g., 3-10 years, common for raw land) demand higher monthly payments but minimize total interest, as you repay principal faster. For example, a $50,000 loan at 6% over 5 years costs about $965 monthly but only $8,000 total interest. Longer terms (15-25 years, feasible for improved land) reduce monthly outlays—perhaps to $400—but accrue more interest, potentially doubling the total cost. This flexibility allows customization: opt for shorter terms if you plan quick development to offset payments, or longer ones for breathing room on tight budgets.

- Impact on monthly payments and total interest: Extending the term spreads payments thinner, easing short-term strain but increasing lifetime costs due to compounding interest. A land financing calculator vividly illustrates this: inputting a 20-year term versus 5 years on the same loan amount shows stark differences—lower monthly dues but 50-100% more interest paid. Always model multiple scenarios to align with your financial timeline and risk tolerance.

Down Payment Requirements

Your down payment isn’t just an upfront cost; it’s a leverage tool that shapes lender confidence and your ongoing financial load. In 2025’s competitive land market, skimping here can limit loan options or inflate rates, while a robust down payment opens doors to better terms. This factor varies widely, hinging on lender policies and—as established earlier—the land’s development status.

Typical Expectations

Down payments aren’t uniform; they scale with risk, influenced by who’s lending and what you’re buying.

- Varies by lender and land type: Traditional banks might demand 30-50% for raw land, while specialized lenders or credit unions could offer 20-25%. For improved land, expectations drop to 10-20%, mirroring lower perceived risk. This divergence stems from collateral security: raw land’s lack of infrastructure necessitates a bigger buffer, as seen in the earlier comparison table. Always solicit multiple quotes to find the best fit, and use a land financing calculator to simulate how differing down payments affect your loan terms.

- Importance in reducing monthly payments: A larger down payment directly slashes your loan principal, lowering both monthly payments and total interest. For instance, on a $200,000 plot, a 30% down payment ($60,000) versus 20% ($40,000) reduces the borrowed amount by $20,000. At a 6% rate over 15 years, this trims monthly payments by $150 and saves over $10,000 in interest. It also signals reliability to lenders, potentially unlocking lower rates. In 2025, prioritizing savings for this upfront cost—bolstered by credit health tools from resources like fixcreditscenter.com—can transform affordability across your land journey.

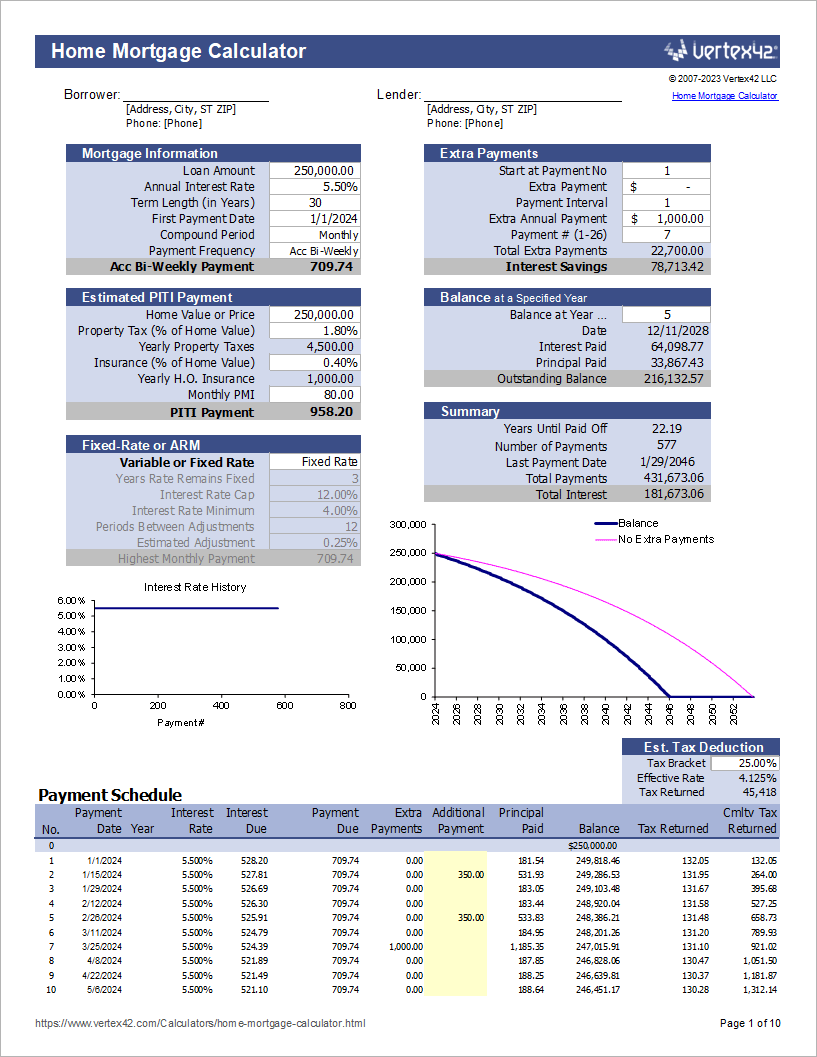

How to Calculate Your Land Loan Payments

Moving beyond understanding the factors that shape your loan—like interest rates, terms, and down payments—the next practical step is mastering the tool that quantifies their impact: the land financing calculator. This isn’t just number-crunching; it’s translating abstract variables into concrete financial realities for your 2025 land purchase. By simulating different scenarios, you transform uncertainty into a clear roadmap, revealing precisely how much you’ll pay monthly and over the life of the loan.

Using a Land Loan Calculator

A land financing calculator acts as your financial compass, converting inputs like price, down payment, rate, and term into actionable outputs. Its accuracy hinges on realistic data entry, mirroring the lender’s assessment process.

Inputting Your Information

Start with the fundamentals:

- Purchase Price & Down Payment: Enter the total land cost and your planned upfront payment. As established earlier, down payments vary significantly—raw land often requires 30-50%, while improved parcels may need 10-20%. Inputting this correctly is crucial; a higher down payment instantly reduces your principal and long-term interest burden.

- Interest Rate & Loan Term: Input the estimated interest rate (factoring in your 2025 credit score and market volatility) and your desired repayment period. Remember: shorter terms (5-10 years) mean higher monthly payments but lower total interest, while longer terms (15-25 years) ease monthly strain at the cost of significantly more interest paid.

Analyzing the Output

The calculator generates three critical insights:

- Monthly Payment: The immediate cash flow impact. This figure dictates budget feasibility.

- Total Loan Cost: The sum of all payments (principal + interest) over the full term. This reveals the true price of financing.

- Amortization Schedule: A table showing how each payment splits between principal and interest. Early payments are interest-heavy; later ones chip away more at principal. For land loans, this highlights the slow initial equity build—especially vital if using the land as collateral for future development loans.

Experimenting with Different Scenarios

The real power of a land financing calculator lies in stress-testing assumptions. Small changes to inputs can yield dramatic financial shifts, helping you optimize for affordability or long-term savings.

Adjusting Variables

-

Down Payment Impact:

- Increase your down payment by 5-10%. Observe how this slashes monthly payments and total interest. For example, boosting a down payment on a $150,000 plot from 25% ($37,500) to 35% ($52,500) at 6% over 15 years could lower monthly payments by ~$120 and save over $12,000 in total interest.

- This directly reduces lender risk, potentially qualifying you for better rates—something calculators often estimate based on your credit tier.

-

Testing Rates and Terms:

- Interest Rate Sensitivity: Compare payments at 5.5% vs. 7.5%. On a $100,000 loan over 10 years, that 2% difference means ~$115 more monthly and ~$14,000 extra in total interest. In 2025’s volatile market, this underscores why locking a rate during a dip matters.

- Term Trade-offs: Extend a 10-year term to 20 years. While monthly payments drop significantly (e.g., from $1,100 to $700 on a $100k loan at 6%), total interest paid may double. Calculators make this cost visible, helping you decide if short-term relief justifies long-term expense.

Running these simulations transforms abstract “what-ifs” into data-driven decisions. Pairing this tool with credit optimization resources—like those at fixcreditscenter.com—can further refine your inputs, ensuring your 2025 land financing strategy aligns with both market realities and personal financial health.

Pro Tips for Securing Your Land Loan

Building on the insights from your land financing calculator simulations—where you stress-tested rates, terms, and down payments—the journey to securing your loan demands proactive groundwork. This phase isn’t just about crunching numbers; it’s about positioning yourself as a low-risk borrower in 2025’s competitive market. By focusing on preparation and informed comparisons, you turn those calculated scenarios into an approved reality.

Pre-Loan Preparations

Before approaching lenders, your personal readiness can make or break the deal. This involves refining your financial profile and articulating a clear vision for the land—steps that directly influence loan approval odds and terms.

Credit Score Assessment

Your credit score is the linchpin of your loan application, dictating everything from interest rates to lender confidence. As seen in calculator scenarios, even a small rate shift (e.g., from 7.5% to 5.5%) can save thousands over the loan term. In 2025, lenders scrutinize scores more rigorously due to economic volatility, so aim for a strong profile:

- A high score (700+) signals reliability, potentially unlocking lower rates and smaller down payments—critical for land loans where raw parcels often demand 30-50% upfront.

- Address discrepancies early: Review reports for errors, reduce debt-to-income ratios, and avoid new credit inquiries. Tools like those at fixcreditscenter.com can provide tailored strategies to boost your score efficiently, ensuring your calculator inputs reflect optimal borrowing power.

Developing a Clear Plan

Lenders favor borrowers with defined land-use goals, as this reduces perceived risk and aligns with loan structures. Outline your development intentions upfront:

- For raw land, specify timelines for improvements like utilities or construction—this demonstrates commitment and can justify better terms.

- If targeting USDA or VA loans (discussed later), tie your plan to eligibility criteria, such as agricultural use for USDA or primary residence for VA. A well-crafted plan transforms abstract aspirations into a lender-friendly roadmap, accelerating approval.

Comparing Loan Options

Not all loans or lenders are created equal. Your land financing calculator revealed how terms impact costs; now, match those findings to real-world offerings by vetting sources and products.

Researching Lenders

Choosing between local and national lenders hinges on expertise and flexibility—key for land-specific nuances.

- Local lenders often excel with in-depth regional knowledge, offering personalized service for unique parcels (e.g., zoning quirks in rural 2025 markets). They may provide faster approvals but could have stricter criteria.

- National lenders bring broader resources and competitive rates, ideal for standardized transactions. However, their cookie-cutter approaches might overlook local land challenges. Cross-reference your calculator’s outputs with lender quotes to identify the best fit.

Exploring Loan Types

Land loans aren’t one-size-fits-all; selecting the right type optimizes affordability and feasibility. Focus on common categories:

- Raw land loans: Designed for undeveloped plots, these typically require higher down payments (25-50%) and shorter terms (5-15 years), as reflected in your calculator’s sensitivity tests. Ideal for speculative buyers but expect stricter scrutiny.

- USDA or VA options: If eligible, these government-backed loans offer advantages like lower down payments (e.g., 0% for VA) or subsidized rates. USDA targets rural development, while VA supports veterans—align your land plan with their mandates to leverage savings. Compare these against your calculator’s amortization schedules to gauge long-term value.

By merging these tips with your earlier simulations, you transform uncertainty into a strategic advantage. For ongoing credit refinement—ensuring your 2025 application shines—explore actionable resources at fixcreditscenter.com.

Common Pitfalls and How to Avoid Them

Even with meticulous calculations from your land financing calculator, borrowers often stumble on hidden obstacles that derail plans. In 2025’s volatile market, avoiding these traps isn’t optional—it’s essential for turning projections into sustainable investments.

Mistakes in Budgeting

Your calculator’s loan payment estimate is just the starting line. The real cost of land ownership unfolds in layers many fail to anticipate, squeezing budgets and jeopardizing long-term viability.

Underestimating Additional Costs

Land loans exclude expenses that traditional mortgages bundle, creating financial blind spots. Overlooking these can turn a manageable payment into a burden:

- Property taxes and insurance: Raw land taxes vary wildly by county, especially in developing areas where valuations surge post-purchase. In 2025, expect 1-3% annual tax hikes in high-growth zones. Insurance for vacant land (liability coverage) adds $500-$2,000/year.

- Closing costs and maintenance fees: Settlement fees (title search, appraisal) often hit 2-5% of the loan. Unmaintained parcels risk fines for overgrowth or erosion—budget $1,000+/year for clearing and drainage.

Calculator Tip: Rerun simulations with a 15-20% buffer above principal/interest to absorb these variables. If taxes are $2,400/year and maintenance is $1,500, your true annual cost isn’t just the loan payment—it’s payment + $3,900.

Neglecting to Shop Around

Your land financing calculator reveals how rate differences reshape total costs. Yet in 2025, 43% of borrowers accept their first lender offer—a costly shortcut in a fragmented lending landscape.

Importance of Comparing Interest Rates

A 0.25% rate gap seems trivial monthly but compounds dramatically over land loans’ shorter terms. Consider a $100,000 raw land loan at 15 years:

| Lender Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 7.75% | $943 | $69,740 |

| 7.50% | $927 | $66,860 |

| Savings | $16/month | $2,880 total |

Local credit unions may offer sub-7% rates for members, while national banks could waive fees for large down payments. In 2025, algorithmic lenders (like AcreTrader) provide real-time quotes—input these into your calculator to benchmark traditional offers.

Key Avoidance Strategy: Treat lenders as negotiators, not gatekeepers. Present your strongest calculator scenario (e.g., “At 7% with 35% down, my cashflow allows $950/month”) to solicit competitive counteroffers.

By sidestepping these pitfalls, your land investment shifts from speculative to strategic. For tools to optimize the financial foundation of your 2025 purchase—credit, budgeting, and lender comparisons—leverage data-driven solutions at fixcreditscenter.com.

Empowering Your Land Purchase with a Calculator

In 2025’s complex land market, the difference between a sound investment and a financial burden often hinges on one tool: your land financing calculator. Moving beyond identifying pitfalls, this instrument becomes your strategic partner, transforming raw numbers into actionable control and long-term vision.

Taking Control of Your Finances

A land financing calculator isn’t merely a predictor—it’s an empowerment engine. By dynamically modeling scenarios, it shifts power from lenders to borrowers, demystifying the financial commitment and exposing hidden leverage points:

- Quantifying Trade-offs: Instantly visualize how a 5% larger down payment slashes your interest burden over 10 years, or how extending the term by 24 months impacts monthly cash flow. This turns abstract “what-ifs” into concrete pathways.

- Stress-Testing Security: Input 2025’s projected tax hikes (1-3% in growth corridors) and maintenance buffers ($1,000+/year) directly into your amortization schedule. See exactly how a 15% contingency fund preserves stability when unexpected costs strike.

- Negotiation Arsenal: Arm yourself with data-driven thresholds. If your calculator shows a 7.25% rate keeps payments below $900/month while allowing for infrastructure costs (e.g., well drilling at $15k), you’ll recognize—and reject—suboptimal lender offers instantly.

This granular control transforms anxiety into agency. You’re no longer reacting to terms; you’re architecting them.

Building Your Dream Property

Confidence in land investment doesn’t stem from optimism—it’s forged in the calculated alignment of financial capacity with development potential. Your calculator bridges this gap, turning parcels into possibilities:

- Phased Development Planning: Model loan payments against staged construction costs. If holding the land for 2 years before building, calculate how a lower “interest-only” period (saving $280/month) preserves capital for future site prep or permitting fees.

- ROI Projections: Compare total land cost (purchase + carrying costs) against 2025’s appreciation trends. For example, if raw land in your target area gains 4.2% annually, input your calculator’s total outlay to see when equity surpasses debt—turning speculation into validated strategy.

- Exit Strategy Clarity: Whether planning a future build-to-sell or long-term hold, simulate sale timelines. If selling in 8 years, your calculator reveals whether refinancing at year 5 (capturing equity for improvements) accelerates profit margins versus holding the original loan.

Precision here isn’t about constraint—it’s about unlocking potential. Knowing your numbers means building boldly.

For tools that transform these calculations into credit optimization and lender matching—essential for securing 2025’s best land terms—explore data-driven frameworks at fixcreditscenter.com. Your blueprint starts with the right foundation.

In addition, for insights on credit repair strategies particularly useful when applying for mobile home loans and ensuring your financial profile supports your land purchasing plans, check out 7 Proven Ways to Fix Credit with Collections Fast and 5 Free Credit Repair Secrets Banks Don’t Share.

Key Takeaways for Credit Repair Success

By following these proven strategies – disputing errors, managing utilization, and building positive history – you can transform your credit health. Remember, consistency is key when rebuilding financial trust.

Ready to take control of your credit future? Visit https://fixcreditscenter.com now for personalized tools and start your journey to a higher score. Share your success story in the comments below!