Did you know 1 in 3 credit reports contain errors? Fixing these mistakes could save you thousands! This guide reveals legal credit repair tricks to transform your score quickly.

Understanding the Vehicle Payoff Calculator

What is a Vehicle Payoff Calculator?

A vehicle payoff calculator is an essential financial tool designed to provide clarity on your auto loan status. At its core, it calculates the exact amount needed to fully satisfy your outstanding loan balance at any given point in time, often referred to as your “payoff amount.” This figure typically includes the remaining principal, any accrued interest up to a specific date (the payoff date), and potentially any applicable prepayment penalties outlined in your loan agreement. Beyond just the current payoff figure, these calculators are most powerful for projecting the financial impact of accelerated repayment strategies.

Key Features

-

Determines How Much You Owe: Instantly calculates your current payoff amount by processing your loan balance, interest rate, and the date you intend to pay off the loan.

-

Estimates Early Payoff Savings: Projects the total interest you would save by increasing your monthly payment or making extra lump-sum payments, compared to sticking with the original schedule through 2025 and beyond. It quantifies the real cost of carrying the loan.

-

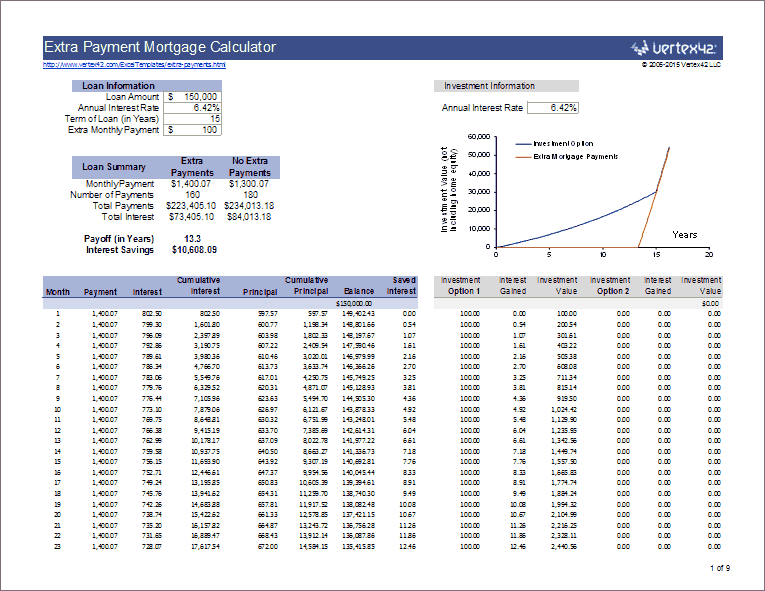

Compares Different Payment Strategies: Allows you to model various scenarios side-by-side. For instance:

- What happens if you add $50 or $100 extra to your principal each month?

- How much faster could you pay off the loan with one annual extra payment?

- What is the impact of switching to bi-weekly payments instead of monthly?

Strategy Monthly Payment Estimated Payoff Date Total Interest Paid (2025+) Interest Saved vs. Minimum Minimum Payment $450 Nov 2028 $2,850 $0 +$50 Extra/Month $500 Jun 2027 $2,150 $700 +$100 Extra/Month $550 Feb 2027 $1,800 $1,050 One Extra Payment/Year $450 (+1x$5400/yr) Aug 2027 $1,950 $900

Why Use a Vehicle Payoff Calculator?

Knowledge is power, especially concerning debt. Understanding the precise terms and trajectory of your auto loan empowers you to make informed financial decisions. Without a clear picture of your payoff path and the true cost of interest, you risk overpaying significantly over the life of the loan. The vehicle payoff calculator transforms abstract loan terms into concrete numbers, revealing opportunities for savings that might otherwise remain hidden.

Benefits of Early Loan Payoff

- Saves on Interest Costs: Interest accrues daily on your outstanding balance. Paying off your loan early, even by a few months, directly reduces the total interest paid to the lender. The calculator precisely shows how much you can save by implementing different accelerated payment plans.

- Improves Credit Score: Successfully paying off an installment loan like an auto loan demonstrates responsible credit management and reduces your overall credit utilization ratio. This positive action is reported to credit bureaus and can contribute to an improved credit score over time, potentially lowering rates on future loans. For strategies on improving your credit score, refer to 7 Power Moves to Fix Credit Score After Late Payments.

- Provides Financial Freedom: Eliminating a monthly car payment frees up a significant portion of your cash flow. This liberated capital can be redirected towards other crucial financial goals in 2025, such as building an emergency fund, accelerating retirement savings, investing, paying down higher-interest debt (like credit cards), or saving for other major purchases. Removing this fixed obligation increases your financial flexibility and resilience. Tools that provide clarity on debt management, like those offered by reputable sources, are invaluable for achieving this freedom; exploring resources at https://fixcreditscenter.com can be part of a comprehensive approach to improving your financial health.

How to Calculate Your Payoff Amount

Determining your precise vehicle payoff amount requires accurate loan information. While lenders provide official payoff quotes valid for a specific period (often 10-15 days), a vehicle payoff calculator empowers you to model scenarios and understand the components of that figure beforehand.

Entering Loan Details

The accuracy of your payoff calculation hinges entirely on the inputs you provide. Gather your most recent loan statement or access your online loan account for these essential details:

Required Inputs

- Remaining Loan Balance: This is the outstanding principal amount you currently owe, excluding future interest. This figure is the starting point for your payoff calculation.

- Interest Rate: Your loan’s Annual Percentage Rate (APR). Ensure you use the correct rate, as even a small discrepancy can significantly impact the result, especially for larger balances or longer remaining terms.

- Loan Term (Remaining Months): The total number of months left on your loan agreement. This determines the timeframe over which interest would accrue if you made only the minimum payments through the original end date (e.g., 2025 or beyond).

- Next Payment Due Date/Payoff Date: While not always strictly required for basic calculators, knowing your next payment date or the specific date you intend to pay off the loan is crucial. Interest accrues daily on the outstanding balance. The payoff amount provided by your lender will include all interest accrued up to the specific payoff date you request.

Exploring Payment Options

Once you’ve established your baseline payoff amount based on current information and minimum payments, the calculator’s true power emerges: allowing you to explore the financial impact of different repayment strategies. This foresight is key to saving money and achieving loan freedom sooner.

Payment Strategies

-

Making Additional Payments:

- Lump-Sum Payments: Applying a one-time extra payment directly to the principal balance immediately reduces the amount owed. The calculator shows you how this single action shortens the loan term and reduces total interest paid by 2025 and beyond. For example, using a tax refund or bonus.

- Recurring Extra Payments: Consistently adding even a small fixed amount ($25, $50, $100+) to your regular monthly payment, specifically designated for principal reduction, has a powerful compounding effect over time. The calculator quantifies the accelerated payoff date and significant interest savings compared to the minimum schedule.

-

Adjusting Monthly Payment Amounts:

- Permanent Payment Increase: If your budget allows, permanently increasing your standard monthly payment amount dedicates more funds to principal each month. The calculator clearly illustrates how much faster the loan is paid off and the substantial reduction in total interest costs.

- Bi-weekly Payments: Switching from one monthly payment to half-payments every two weeks results in 26 half-payments per year, equivalent to 13 full monthly payments instead of 12. This effectively adds one extra monthly payment annually, shortening the term and saving interest. The calculator models this specific scenario effectively.

| Strategy | Action | Key Benefit Demonstrated by Calculator |

|---|---|---|

| Lump-Sum Payment | Apply $X extra one time to principal | Immediate reduction in balance & future interest |

| Recurring Extra | Add $Y extra to principal every month | Significant term reduction & interest savings |

| Permanent Increase | Raise standard monthly payment from $A to $B | Faster payoff & lower total cost |

| Bi-weekly Schedule | Split monthly payment in half, pay every 2 weeks (26 payments/yr) | Equivalent to 13 payments/yr, accelerates payoff |

By inputting these strategies into the vehicle payoff calculator, you move from guesswork to informed decision-making. You can precisely see the trade-offs: how much faster you’ll own your vehicle outright, how much interest you’ll avoid paying by 2025, and how adjustments fit within your budget. This clarity is fundamental to taking control of your auto debt. For those seeking broader strategies to manage debt and improve overall financial health in 2025, exploring reputable resources like those available at https://fixcreditscenter.com can provide valuable support.

Understanding Vehicle Payoff Calculators

What is a Vehicle Payoff Calculator?

Definition and Purpose

A vehicle payoff calculator is an online financial modeling tool designed to estimate the timeline and total cost required to pay off your auto loan. Its core purpose is to project how different payment decisions impact two critical outcomes:

- Payoff Timeline: It calculates how long it will take to fully repay your loan balance based on your current minimum payments or alternative strategies. This reveals your potential freedom from monthly car payments.

- Interest Savings: Crucially, it quantifies the total interest you would pay over the life of the loan under various scenarios. By modeling early payoff strategies (like extra payments), it clearly illustrates the potential savings you can achieve by reducing the loan term, especially significant when projected out to 2025 or your loan’s end date.

Unlike an official payoff quote from your lender (valid for a short period), the calculator allows for scenario planning before you commit funds. It helps you understand the “why” behind the payoff amount by breaking down the interplay of principal, interest rate, loan term, and payment timing.

How to Use the Vehicle Payoff Calculator

Step-by-Step Guide

Using a vehicle payoff calculator effectively requires accurate inputs and strategic adjustments. Follow these steps:

-

Gather Essential Loan Information: Retrieve the exact details from your latest loan statement or online account:

- Current Loan Balance: Enter the outstanding principal amount you owe today (excluding future interest).

- Annual Interest Rate (APR): Input your loan’s exact interest rate. Precision is vital, as small rate differences significantly impact results.

- Remaining Loan Term: Specify the total number of months left on your loan (e.g., 24 months, 36 months, extending to 2025 or later).

- Regular Monthly Payment: Input your current required minimum monthly payment amount.

- Next Payment Due Date: While some basic calculators might not require it, having this date allows for more precise interest accrual calculations if you plan a specific payoff date.

-

Run the Baseline Calculation: Input only the core details above. The calculator will output:

- Your projected final payoff date if you make only minimum payments.

- The total amount of interest you will pay from now until that final payoff date.

-

Model Alternative Strategies: This is where the calculator’s power shines. Adjust inputs to explore “what-if” scenarios:

- Add Lump-Sum Payments: Input a one-time extra amount (e.g., $500, $1000, $2000) and specify if it’s applied to principal. Observe how this immediately shortens the loan term and reduces total interest paid by 2025.

- Increase Recurring Payments: Enter an additional fixed amount ($25, $50, $100, etc.) to be paid towards principal every month. See the compounding effect accelerate your payoff date and slash interest costs.

- Change Payment Frequency: Model switching to bi-weekly payments (half the monthly amount paid every two weeks). The calculator will show how this results in 13 full payments per year instead of 12, shortening the term.

- Adjust Payment Amount: Experiment by permanently increasing your standard monthly payment amount and see the accelerated payoff timeline and savings.

-

Analyze the Results: Compare the outputs (payoff date and total interest cost) of your different scenarios against the baseline minimum-payment plan. This quantifies the benefits of accelerated repayment strategies, such as how much interest you could save by 2025 and how many months (or years) sooner you could own your vehicle outright. This clarity empowers you to choose a repayment strategy that aligns with your 2025 financial goals and budget. For comprehensive strategies on managing debt and optimizing your credit health throughout 2025 and beyond, consider the resources available at https://fixcreditscenter.com.

Benefits of Paying Off Your Vehicle Early

Paying off your vehicle loan ahead of schedule, as projected using a vehicle payoff calculator, offers tangible financial and personal benefits. By modeling scenarios with extra payments, you unlock significant advantages that extend beyond simple ownership.

Financial Advantages

Accelerating your loan payoff directly translates into measurable monetary savings and improved cash flow.

Interest Savings

The most compelling financial benefit is the substantial reduction in the total interest paid over the life of the loan. Interest accrues daily on the outstanding principal balance. Making extra payments, especially those designated towards principal, directly reduces this balance faster, thereby decreasing the amount of interest charged each subsequent period. The compounding effect of these savings is significant.

- Real-World Impact: Consider a loan with a $15,000 remaining balance at 6% APR and 36 months (3 years) left. Making only the minimum payment (approx. $456/month) results in total interest paid of about $1,416 by the payoff date in 2025.

- Scenario with Extra Payment: Now, model adding an extra $100 towards principal each month using your payoff calculator. The new monthly payment becomes $556. The calculator reveals:

- Payoff Date Accelerates: Loan is paid off roughly 11 months earlier (around mid-2024 instead of 2025).

- Interest Savings: Total interest paid drops significantly to approximately $973.

- Result: By paying an extra $100/month, you save $443 in interest and gain ownership nearly a year sooner. This demonstrates the powerful impact even modest extra payments can have, especially when projected out to 2025 using the calculator.

The table below summarizes the impact of an extra $100 monthly payment:

| Loan Parameter | Minimum Payment | Minimum + $100 Extra | Difference |

|---|---|---|---|

| Monthly Payment | $456 | $556 | +$100 |

| Total Interest Paid | $1,416 | $973 | $443 saved |

| Payoff Timeline | 36 months (2025) | 25 months (mid-2024) | 11 months faster |

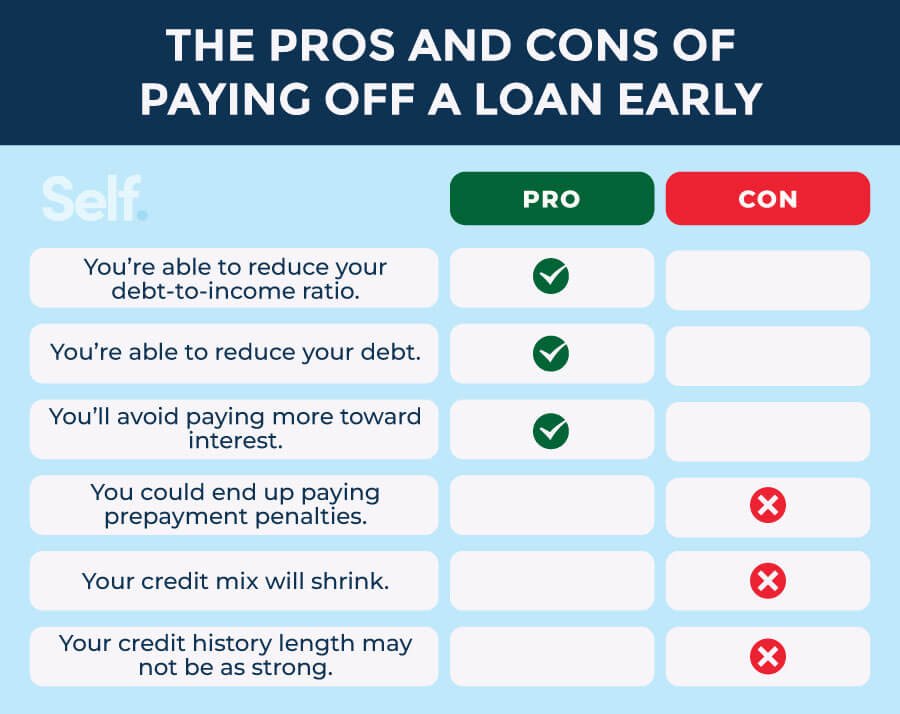

Impact on Credit Score

While the primary motivation is often financial freedom and savings, paying off an auto loan early can also positively influence your credit health.

Improved Financial Health

Responsibly managing and paying off installment loans, like auto loans, demonstrates strong creditworthiness to lenders and credit bureaus.

- Credit Utilization: While auto loans are installment debt (not revolving like credit cards), successfully paying off a major loan reduces your overall debt burden. This can positively impact your debt-to-income ratio (DTI), a factor lenders consider for new credit applications.

- Payment History: Consistently making on-time payments, including extra payments, reinforces a positive payment history – the single most significant factor in most credit scoring models. Paying the loan off completely closes the account in good standing, which remains on your credit report for up to 10 years, continuing to contribute positively to your history.

- Credit Mix: While less impactful than payment history or utilization, having a successfully paid installment loan can contribute positively to your credit mix, showing you can manage different types of credit.

While the immediate score change upon payoff can vary (sometimes showing a slight dip due to the closure of an active account, especially if it’s an older account), the long-term effect of demonstrating responsible borrowing and reducing debt obligations is fundamentally positive. It strengthens your overall financial profile and frees up monthly cash flow previously dedicated to the car payment. For personalized strategies on optimizing your credit health as you manage debts and plan for financial milestones in 2025, explore the resources available at https://fixcreditscenter.com.

Strategies for Early Loan Payoff

Successfully paying off your vehicle loan ahead of schedule, as projected using a vehicle payoff calculator, requires deliberate tactics. Implementing these strategies maximizes the benefits discussed previously.

Extra Payments and Their Impact

The most direct method to accelerate your payoff date and reduce total interest cost is making payments beyond the scheduled monthly minimum. The impact of even modest extra payments, clearly demonstrated by a vehicle payoff calculator, can be substantial.

How Extra Payments Work

Extra payments are most effective when explicitly designated by you as “principal-only” payments. Contact your lender to confirm their specific procedure for ensuring extra funds are applied to the principal balance, not future interest payments or fees. Reducing the principal faster is the key to significant interest savings over the loan term.

- Lump-Sum Applications: Windfalls like tax refunds, work bonuses, or cash gifts present prime opportunities. Instead of spending these funds, applying them directly to your loan principal creates an immediate reduction in your outstanding balance. Recalculate your payoff timeline using the vehicle payoff calculator after each lump-sum payment to visualize the accelerated progress.

- Bi-Weekly Payments vs. Monthly: Splitting your standard monthly payment into two smaller payments every two weeks can subtly shorten your loan term. Over a year, you make 26 half-payments (equivalent to 13 full monthly payments) instead of 12. This results in one extra full payment applied annually, reducing principal faster and lowering total interest. Confirm with your lender if they accept bi-weekly payments without fees and how they apply them (ideally as principal reduction upon receipt). While the effect per payment is small, compounded over the term, especially projected out to 2025, the savings add up.

Identifying Prepayment Penalties

Before aggressively paying down your loan, it’s crucial to understand if your lender imposes any financial penalties for early repayment.

Understanding Your Loan Agreement

Not all loans include prepayment penalties, but they do exist, particularly in certain loan types or from specific lenders.

- Review Loan Terms Carefully: Your original loan contract is the definitive source. Scrutinize the document, focusing on sections titled “Prepayment,” “Early Payoff,” or “Prepayment Penalty Clause.” Look for language specifying fees or charges incurred if you pay off the loan before the scheduled end date. Don’t rely on verbal assurances; the written contract governs.

- Strategies to Avoid Fees if Applicable: If your loan includes a prepayment penalty:

- Understand the Structure: Penalties are often structured as a percentage of the remaining balance (e.g., 1-2%) or equivalent to a set number of months’ interest. Calculate the potential fee using your current balance and the terms.

- Timing Matters: Prepayment penalties frequently only apply within a specific window, typically the first few years (e.g., first 1-3 years) of the loan term. Use your vehicle payoff calculator to model scenarios where extra payments start after this penalty window expires. While this delays some savings, it avoids the fee.

- Evaluate Cost vs. Benefit: Calculate if the total interest saved by paying early (using the calculator) outweighs the cost of the penalty. Sometimes the savings are still significant enough to proceed, even with the fee. For other loans, especially those nearing the end of the penalty period or with a high penalty cost relative to interest savings, waiting might be optimal.

- Negotiation: While uncommon, especially on standard auto loans, it doesn’t hurt to contact your lender and inquire if the penalty can be waived, particularly if you’ve been a reliable customer. Understanding your loan terms and potential penalties is vital for making financially sound decisions as you plan your path to debt freedom in 2025. For personalized guidance on navigating loan agreements and optimizing your repayment strategy, consider the resources at https://fixcreditscenter.com.

Budgeting for Loan Payoff Success

Effective budgeting is essential for implementing the early payoff strategies discussed, such as extra payments and avoiding prepayment penalties. By integrating these tactics into a structured financial plan, you ensure consistent progress toward debt freedom. A vehicle payoff calculator serves as a cornerstone for this process, enabling precise projections and informed decisions as you plan for 2025.

Incorporating Payments into Your Budget

Creating a sustainable budget allows you to allocate funds for both regular and extra loan payments, turning strategic intentions into actionable habits. This discipline minimizes financial strain while accelerating your payoff timeline.

Effective Budgeting Techniques

To embed loan repayments into your daily finances, adopt proven methods that prioritize debt reduction without compromising essential expenses.

- Use Budgeting Tools to Track Spending: Leverage digital apps or spreadsheets to monitor income and outflows, categorizing expenses like housing, utilities, and discretionary spending. This visibility helps identify surplus funds—such as $50-$200 monthly—that can be redirected toward extra principal payments. Regularly inputting this data into a vehicle payoff calculator reveals how small reallocations shorten your loan term and reduce total interest by 2025.

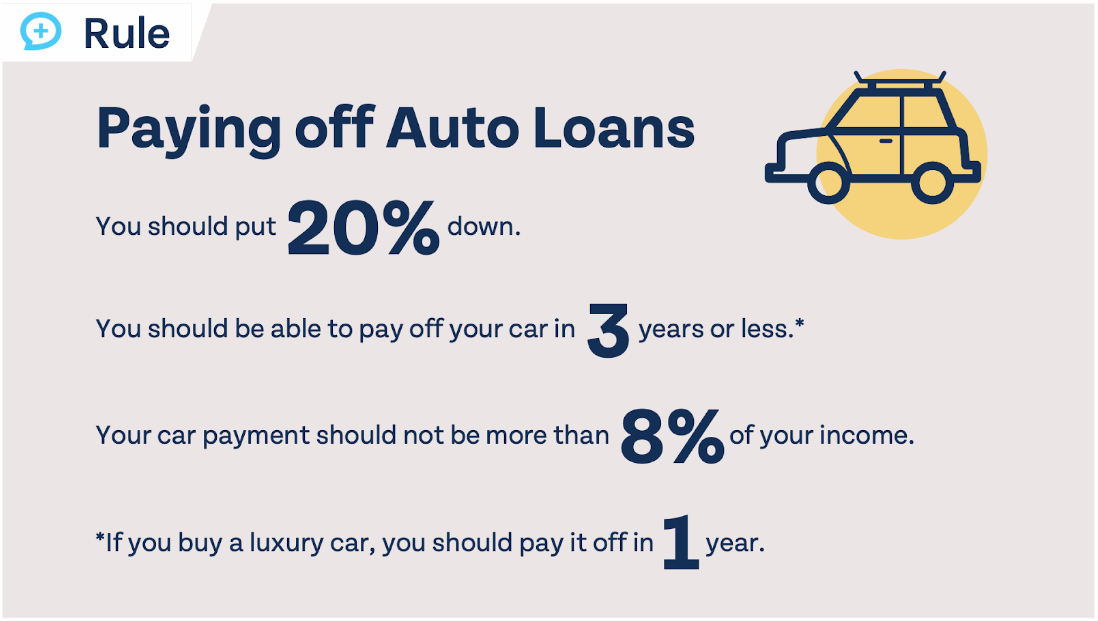

- Allocate Funds Specifically for Loan Repayment: Dedicate a fixed portion of your income—ideally 10-20%—exclusively for auto loan payments. Treat this as a non-negotiable expense, similar to rent or groceries. Automate transfers to a separate savings account earmarked for lump-sum payments, ensuring consistency. For instance, if your budget frees up $100 monthly for extra payments, apply it directly to the principal using lender procedures outlined earlier. This targeted allocation, visualized through the calculator, compounds savings over time.

The Role of Financial Planning Tools

Financial tools provide the analytical backbone for optimizing your budget, transforming raw numbers into actionable insights for faster debt elimination.

Maximizing the Use of Financial Calculators

Auto loan calculators are indispensable for budgeting, allowing you to simulate scenarios and track real-time progress toward your 2025 goals.

- Utilizing Auto Loan Calculators for Budgeting: Input variables like interest rate, loan balance, and proposed extra payments into a vehicle payoff calculator to model monthly budget impacts. For example, testing a $50 increase in payments shows how it accelerates your payoff date and reduces interest—adjust your budget accordingly to accommodate this change. Recalculate quarterly to reflect income shifts or windfalls, ensuring your plan remains realistic and effective.

- Tracking Principal Balances and Payment Frequency: Use calculators to monitor principal reduction after each payment, highlighting how bi-weekly schedules or lump sums affect your balance. Set reminders to log payments and update the tool, creating a feedback loop that motivates adherence. By tracking frequency (e.g., switching from monthly to bi-weekly), you quantify cumulative savings, reinforcing budget discipline. For comprehensive support in refining these techniques, access tailored tools and advice at https://fixcreditscenter.com.

The Importance of Loan Refinancing Options

Refinancing your auto loan can be a strategic lever for accelerating debt freedom, particularly when market conditions shift or your credit profile improves. By securing more favorable terms, you reduce long-term costs and align repayment with your 2025 financial objectives.

When and Why to Refinance

Timing refinancing requires evaluating both market trends and personal circumstances. Consider refinancing if:

- Interest rates have dropped significantly since your original loan origination.

- Your credit score has improved, qualifying you for better rates.

- Your financial stability increased, allowing shorter loan terms.

- Cash flow needs changed, necessitating lower monthly payments.

Acting during these windows maximizes savings potential without extending debt obligations unnecessarily.

Benefits of Lower Interest Rates

Securing a reduced interest rate through refinancing delivers tangible, compounding advantages:

- Lower Monthly Payments: A 2% rate reduction on a $20,000 loan could decrease payments by $15-$30 monthly. This frees up cash for essential expenses or extra principal payments.

- Reduced Total Interest: Even modest rate cuts yield substantial savings. For example:

| Original Rate | New Rate | Loan Balance | Remaining Term | Interest Saved |

|---|---|---|---|---|

| 7% | 5% | $15,000 | 36 months | ~$500 |

| 9% | 6% | $25,000 | 48 months | ~$1,800 |

- Improved Loan Terms: Refinancing enables switching to shorter terms (e.g., 60 to 36 months) or removing unfavorable clauses like prepayment penalties.

Additional Considerations for Refinancing

While lower rates offer clear benefits, refinancing involves costs and qualifications that demand careful assessment.

Assessing Eligibility and Costs

Two critical factors determine refinancing viability:

- Checking Credit Scores Before Applying:

Lenders typically require scores above 660 for competitive rates. Obtain your 2025 credit report (free annually via AnnualCreditReport.com) to verify accuracy. Scores below 600 may disqualify you or negate savings through higher offered rates. - Identifying Hidden Fees Associated with Refinancing:

Upfront costs can erode savings. Scrutinize:- Origination fees (1%-2% of loan balance)

- Title transfer fees ($5-$25, varies by state)

- Early termination fees from your current lender

- Precomputed interest penalties on some loans

Use a vehicle payoff calculator to simulate refinanced payments and compare savings against total fees. If fees exceed 18 months of savings, defer refinancing unless pursuing shorter terms. For personalized refinancing analysis and credit improvement strategies, leverage resources at https://fixcreditscenter.com.

Key Takeaways for Credit Success

Follow these steps to rebuild your credit: 1) Check reports for errors monthly 2) Dispute inaccuracies promptly 3) Keep old accounts open 4) Pay bills on time.

Ready to take control? Visit https://fixcreditscenter.com now for free tools! Share your credit win in the comments below.