Did you know 34% of credit reports contain errors? Fixing them could save you thousands! This guide reveals legal credit repair tricks to fast-track your financial goals.

The Power of Precision: Why a Commercial Mortgage Calculator Matters

In the intricate world of commercial real estate, intuition alone is a treacherous guide. Unlike residential deals, where emotions often sway decisions, commercial investments demand cold, hard arithmetic. This is where the commercial mortgage calculator transcends mere convenience—it becomes a strategic imperative. Consider a developer eyeing a mixed-use property in Chicago. Without quantifying the debt service, cap rate implications, and cash flow projections, that “promising” asset could morph into a financial quagmire. The calculator transforms abstract risk into tangible metrics, revealing whether a 6.5% interest rate over 25 years aligns with net operating income targets or silently erodes profit margins.

Key Inputs: The Levers of Financial Feasibility

Every commercial mortgage calculation pivots on precise inputs. Misjudge one variable, and your projection veers into fantasy:

| Input Parameter | Impact on Calculation | Common Pitfall |

|---|---|---|

| Loan Amount | Directly scales monthly payment & total interest | Overestimating property value |

| Interest Rate | 0.25% shift alters total interest by 6-8% | Ignoring lender margin/fees |

| Loan Term | Shorter terms = higher payments, less interest | Misaligning with asset lifecycle |

| Amortization Period | Extending reduces payments but increases total cost | Confusing with loan maturity |

| Payment Frequency | Monthly vs. quarterly alters compounding | Underestimating cash flow gaps |

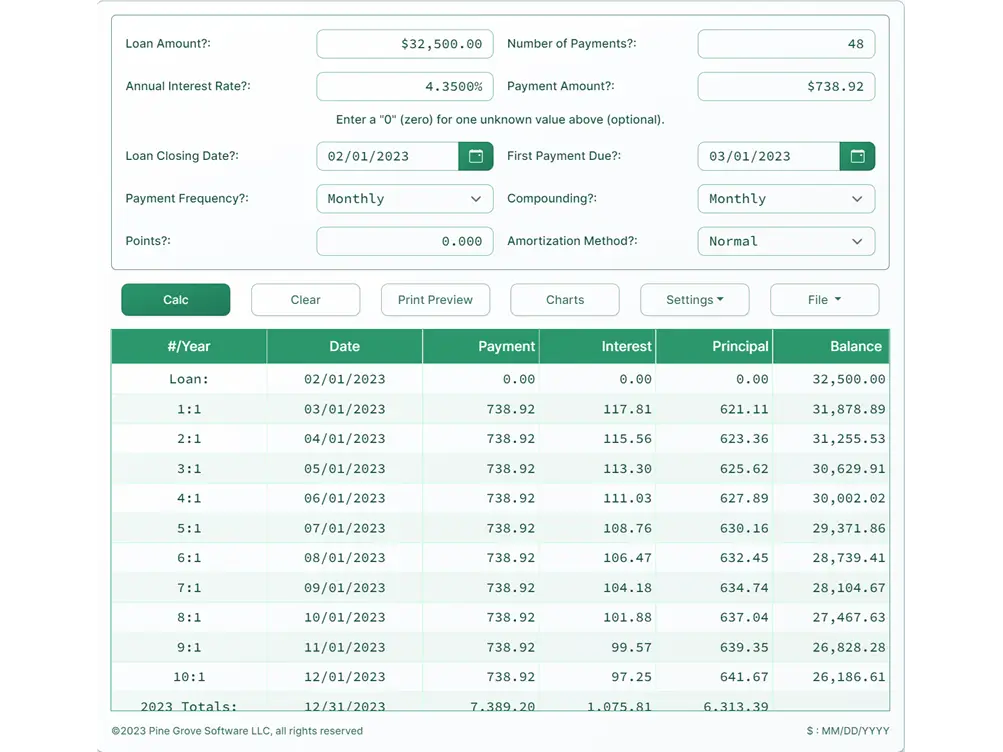

For instance, a $2M loan at 7% over 20 years with a 25-year amortization yields a monthly payment of $14,530. Extend the amortization to 30 years? Payment drops to $13,310—freeing cash flow but adding $290K in extra interest.

Beyond the Math: Interpreting What the Calculator Really Tells You

A calculator’s output isn’t gospel; it’s a diagnostic tool. The debt service coverage ratio (DSCR) flashing 1.15 might technically meet lender minimums, but savvy investors see a red flag—it leaves no buffer for vacancy spikes or maintenance crises. Similarly, an amortization schedule exposing that 62% of early payments go toward interest forces a reckoning: Is this a long-term hold or a value-add flip? The calculator quantifies leverage tolerance. If a 200-basis-point rate hike pushes DSCR below 1.0, that “stable” asset suddenly carries existential risk.

In 2025’s volatile market, these insights separate thriving portfolios from distressed sales. Tools like those offered at fixcreditscenter.com demystify this complexity, translating raw data into actionable strategy—because in commercial real estate, the difference between profit and peril lies in the details you calculate before you commit.

Benefits of Using a Commercial Mortgage Calculator

In commercial real estate, where margins are thin and risks are high, the commercial mortgage calculator isn’t just a tool—it’s a strategic ally. As explored earlier, its precision transforms abstract numbers into actionable insights, but its true value lies in the tangible advantages it delivers. By simplifying complex estimations and enabling side-by-side comparisons, this calculator empowers investors to navigate 2025’s volatile market with confidence. It shifts the focus from gut feelings to data-driven decisions, revealing hidden opportunities and pitfalls before capital is committed.

Simplifying Loan Estimations

For busy investors, time spent wrestling with spreadsheets is time lost on deal-making. A commercial mortgage calculator streamlines this process, converting intricate variables into clear, digestible outputs. It automates the arithmetic of debt service, cash flow projections, and equity requirements, freeing users to focus on strategy rather than computation. This efficiency is critical in 2025, where interest rate fluctuations and economic uncertainties demand rapid, reliable assessments. By inputting key parameters, users instantly visualize how loan structures align with their financial reality—turning hours of manual work into seconds of clarity.

Key Inputs for Accurate Calculations

The calculator’s accuracy hinges on precise inputs; each variable acts as a lever that shapes the financial outcome. Misjudging even one can distort projections, leading to costly miscalculations. Here are the core inputs that drive reliable results:

| Input Parameter | Role in Calculation | Why It Matters for Accuracy (2025 Context) |

|---|---|---|

| Total Loan Amount | Sets the base for payments and interest | Overestimation risks over-leverage in a volatile market |

| Down Payment | Reduces loan size and interest burden | A higher down payment (e.g., 25-30%) improves cash flow resilience |

| Interest Rate | Dictates borrowing cost over the loan term | A 0.5% variance in 2025 rates alters total interest by 10-12% |

| Amortization Period | Spreads payments over time, affecting monthly costs | Longer periods (e.g., 30 years) lower payments but increase total cost |

| Payment Frequency | Influences compounding and cash flow timing | Quarterly payments may ease budgeting but heighten interest accrual |

| Financial Goals | Aligns calculations with ROI targets or exit strategies | Ignoring goals (e.g., 8% cap rate) invites misaligned investments |

For example, consider a $1.5 million loan for a warehouse in 2025. Inputting a 20% down payment ($300,000) at a 7.2% rate over 25 years yields a manageable monthly payment. But omit the down payment? The calculator reveals how that oversight spikes interest costs by $180,000—exposing a vulnerability before signing.

Comparison of Financing Options

Commercial deals rarely offer one-size-fits-all financing; the ability to test alternatives separates savvy investors from the rest. A commercial mortgage calculator excels here, allowing users to model multiple scenarios side by side. This transforms abstract “what-ifs” into concrete comparisons, highlighting trade-offs between short-term affordability and long-term profitability. In 2025, with lenders tightening terms and rates in flux, this feature is indispensable for securing optimal financing.

Analyzing Different Scenarios

By inputting varying loan terms, users instantly see how adjustments ripple through the entire financial structure. This isn’t just about tweaking numbers—it’s about uncovering strategic insights:

- Impact on total costs: Altering the interest rate or term length reveals compounding effects. For instance, extending a $2 million loan from 20 to 30 years cuts monthly payments by 12% but adds $250,000 in total interest over time.

- Understanding monthly payments and interest over time: Visualizing amortization schedules shows how early payments are interest-heavy (e.g., 70% in year one), informing decisions like refinancing or early payoff.

Imagine evaluating two offers for a retail space in 2025: Option A has a 6.8% rate with 20-year term, while Option B offers 7.0% but extends to 25 years. The calculator quantifies that Option B saves $800 monthly but costs $190,000 more overall—clarifying which aligns better with cash flow needs versus long-term equity goals.

In today’s high-stakes environment, these capabilities make the commercial mortgage calculator a non-negotiable tool. Platforms like fixcreditscenter.com integrate these features seamlessly, turning complex data into clear roadmaps for confident investing.

Components of a Commercial Mortgage Calculator

A commercial mortgage calculator transcends basic arithmetic; it’s an architectural blueprint for financial strategy. Its true power lies not just in outputting numbers, but in how its components interact to model complex real-world scenarios. Like a skilled interpreter, it deciphers the language of capital stacks, interest rate curves, and cash flow waterfalls, translating them into actionable insights for 2025’s intricate market terrain. Understanding its core features is critical for investors navigating volatile lending landscapes.

Essential Features to Look For

The efficacy of a calculator hinges on its ability to simulate financial reality. Outdated tools that merely estimate monthly payments are obsolete in 2025’s high-stakes environment. Modern platforms integrate dynamic features that reveal leverage thresholds, risk exposure, and opportunity costs—transforming raw data into strategic foresight.

Amortization Schedule

The amortization schedule is the financial DNA of the loan, mapping how each payment reshapes the debt structure over time. It exposes the hidden cost of capital and illuminates pathways to equity accumulation.

Understanding Payment Distribution

- Front-Loaded Interest Burden: Commercial loans typically allocate 70-80% of early payments to interest. A $500,000 payment in Year 1 might include $400,000 in interest—dramatically slowing equity build.

- Principal Acceleration Insights: The schedule reveals how extra payments impact total interest. Adding $10,000 annually to a $2M loan at 7.5% could shorten the term by 4 years and save $320,000.

- Refinancing Triggers: Visualizing the interest/principal crossover point (often Year 10-15) helps time refinancing for optimal savings, especially when 2025 rates shift.

This granular view enables investors to:

- Plan capital improvements using projected equity

- Model sale timing based on principal reduction milestones

- Negotiate loan terms that align with cash flow cycles

Debt Service Coverage Ratio (DSCR)

In 2025’s cautious lending climate, DSCR isn’t just a metric—it’s the gatekeeper of loan approval. Sophisticated calculators integrate real-time NOI (Net Operating Income) projections to stress-test debt sustainability.

Importance in Loan Approval

- Risk Quantification: A DSCR below 1.25 signals cash flow vulnerability. For a property generating $120,000 annual NOI, maximum allowable debt service is $96,000 ($120,000 ÷ 1.25).

- Interest Rate Sensitivity: A 0.75% rate hike could collapse a 1.30 DSCR to 1.18—potentially triggering loan covenant violations.

- Lease Rollover Impact: Calculators modeling lease expirations (e.g., 30% vacancy risk in Year 3) show how DSCR dips affect refinancing options.

| Feature | 2025 Relevance | Strategic Use Case |

|---|---|---|

| Dynamic Amortization | Visualizes interest savings from prepayments | Identify optimal timing for capital injections |

| DSCR Scenarios | Tests rent decline (e.g., -15%) or expense spikes (e.g., +20% insurance costs) | Stress-test loan viability before acquisition |

| Rate Shock Analysis | Models payment impact of +2% rate hikes within loan term | Evaluate fixed vs. floating rate trade-offs |

| Prepayment Penalty | Calculates break-even point for early refinancing | Assess cost/benefit of exiting a loan in Year 5 vs. Year 7 |

Consider a 2025 office purchase: Inputting a 1.35 DSCR seems safe. But activating the calculator’s “recession scenario” (10% rent drop + 8% expense growth) reveals DSCR crashing to 1.05—a red flag demanding larger reserves or equity restructuring.

This component-level intelligence separates tactical tools from strategic partners. Platforms like fixcreditscenter.com engineer these features into intuitive workflows, transforming market uncertainty into structured opportunity for 2025 investors.

Common Misconceptions about Commercial Mortgages

Commercial real estate financing is shrouded in persistent myths that distort decision-making. These misconceptions aren’t mere oversights—they’re cognitive biases that steer investors toward costly miscalculations in 2025’s complex lending environment. Advanced mortgage calculators serve as myth-busters, replacing folklore with quantifiable reality.

Myths vs. Reality

“You Need a Large Down Payment”

The belief that 25-30% down payments are non-negotiable crumbles under 2025’s nuanced lending practices. While conventional wisdom emphasizes high equity buffers, strategic financing structures now exist for qualified borrowers.

Fact-Checking the Requirement

- SBA 504 Loans: Enable 10% down payments for owner-occupied properties by pairing senior mortgages with CDC-backed junior liens.

- Stabilized Asset Leverage: Class-A multifamily or industrial assets with 3+ years of consistent NOI may secure 80-85% LTV financing.

- Bridge Loan Flexibility: Value-add opportunities allow 15-20% down payments when calculators demonstrate post-renovation DSCR improvements exceeding 1.35x.

A calculator reveals the true trade-off: A $2M retail property with 20% down ($400,000) at 6.5% carries $8,966/monthly payments. At 30% down ($600,000), payments drop to $7,847—but locking $200k in equity sacrifices potential ROI from deploying that capital elsewhere.

“Only Large Businesses Qualify”

The notion that institutional players monopolize commercial lending ignores 2025’s democratization of capital. Scalable fintech platforms now decode eligibility matrices for small enterprises.

Understanding Access for All Sizes

- Revenue-Based Thresholds: Lenders increasingly prioritize cash flow over enterprise size. A $400k/year laundromat with 1.40 DSCR may qualify more easily than a $5M/year restaurant at 1.15 DSCR.

- Niche Lender Specialization: Sector-specific financiers (e.g., medical office, self-storage) evaluate industry dynamics over corporate scale.

- Portfolio Loan Consolidation: Owners of 3+ mixed-use properties can bundle assets to meet lender minimums.

Consider a boutique hotel seeking $1.8M: Traditional metrics might disqualify it. But inputting projected post-renovation NOI growth (+22%) and seasonal cash reserves into a calculator demonstrates covenant compliance—transforming perceived weakness into bankable strength.

The Strategic Recalibration

These misconceptions dissolve when tested against dynamic calculator modeling:

- Down Payment Myth: Tools simulate how lower down payments affect cash-on-cash returns versus loan risk premiums

- Eligibility Myth: Scenario engines forecast how niche underwriting (e.g., franchise affiliation, PPA contracts) offsets size limitations

Sophisticated platforms like those at fixcreditscenter.com convert these revelations into tactical advantages, allowing 2025 investors to navigate lending biases with algorithm-powered clarity.

Tips for Effectively Using a Commercial Mortgage Calculator

In 2025’s volatile lending landscape, commercial mortgage calculators have evolved from basic tools into indispensable allies for investors—much like a compass for navigating uncharted financial waters. Yet, their true power emerges not from mere access, but from mastery. Missteps in deployment can amplify risks rather than mitigate them, turning potential insights into costly oversights. As we transition from debunking myths to tactical execution, these calculators demand a blend of precision and foresight, ensuring every input translates to actionable intelligence.

Maximizing Its Utility

The difference between a superficial estimate and a strategic blueprint lies in how you wield the calculator. Treat it not as a static oracle but as a dynamic simulator—one that mirrors 2025’s fluid interest rates and regulatory shifts. When calibrated correctly, it transforms raw data into a narrative of financial viability.

Input Accurate and Complete Data

Garbage in, garbage out—this adopter’s axiom holds painfully true for commercial mortgage calculations in 2025. Incomplete or erroneous inputs distort debt service coverage ratios (DSCR), loan-to-value (LTV) assessments, and cash flow projections, leading to decisions that unravel under lender scrutiny. For instance, omitting property taxes or maintenance costs from a $2 million office building analysis could inflate net operating income (NOI) by 15%, artificially boosting DSCR and masking repayment risks. Key fields demand vigilance:

- Loan Parameters: Principal amount, interest rate (factoring in 2025’s average 6.5-7.5% range for commercial loans), and amortization period.

- Property Metrics: Current value, projected NOI (verified against 3-year historical data), operating expenses, and vacancy rates.

- Borrower Details: Credit score, existing debt obligations, and reserve requirements.

A real-world slip: An investor inputs an optimistic 8% cap rate for a retail strip mall but overlooks rising insurance premiums tied to 2025’s climate regulations. The calculator outputs a deceptively low monthly payment of $9,200—only for due diligence to reveal a true cost of $10,500, jeopardizing lender approval. Cross-reference every digit with lease agreements, tax records, and market comps to anchor outputs in reality.

Utilize Comparative Analysis

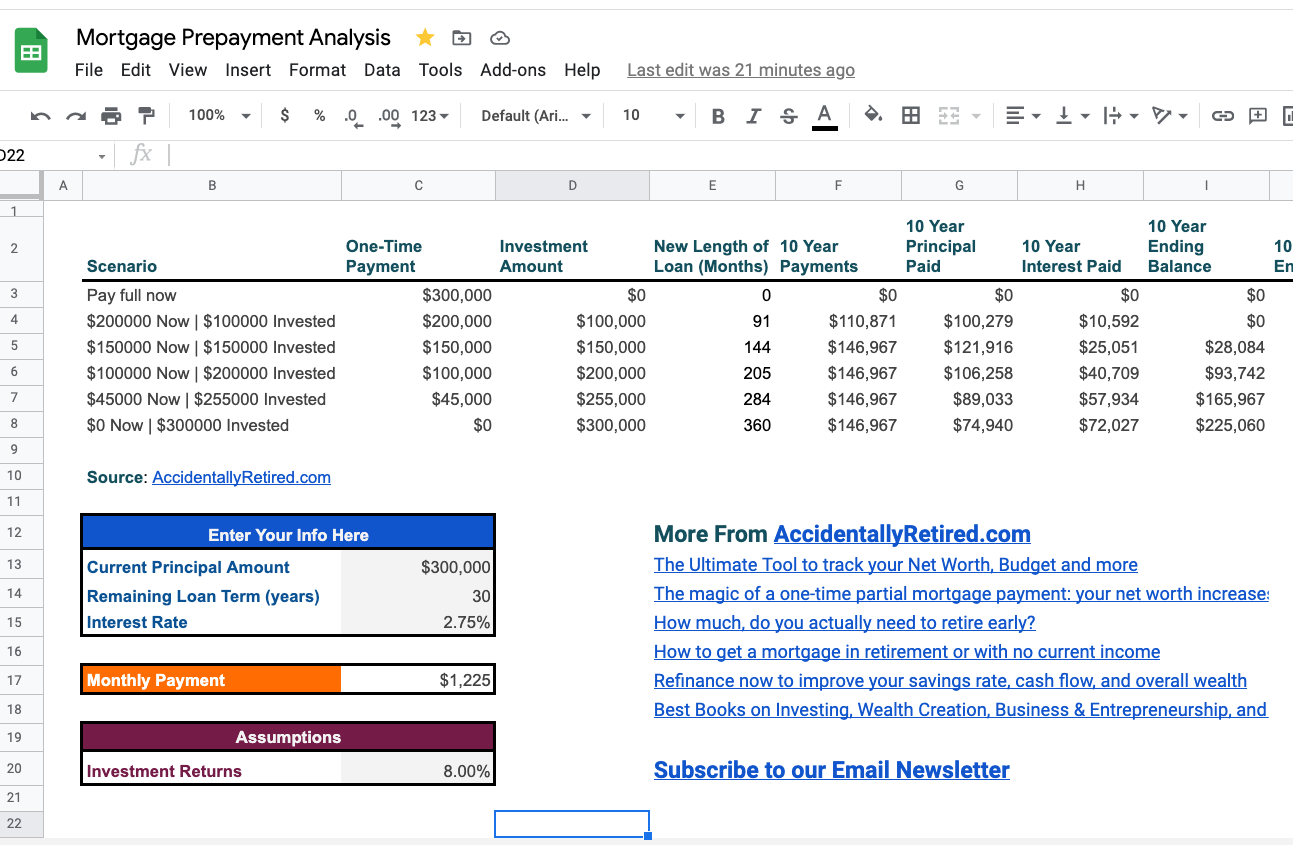

Here’s where calculators transcend calculation—they become decision engines. By stress-testing variables, you uncover hidden efficiencies, such as how a slight rate dip or extended term could liberate capital for value-add investments. Consider running parallel scenarios:

- Interest Rate Swaps: Compare fixed versus adjustable rates in 2025’s rising-rate environment.

- Payment Structures: Assess balloon payments versus fully amortizing loans to balance short-term liquidity with long-term equity.

- Economic Sensitivity: Model impacts of rent growth fluctuations or occupancy dips on debt service.

For illustration, examine a $1.5 million industrial property loan under differing terms:

| Scenario | Interest Rate | Loan Term | Monthly Payment | Total Interest Paid | Cash-on-Cash Return |

|---|---|---|---|---|---|

| Base Case | 6.75% | 25 years | $10,420 | $1,626,000 | 8.2% |

| Aggressive Leverage | 7.25% | 20 years | $11,890 | $1,353,600 | 9.5% |

| Conservative Play | 6.25% | 30 years | $9,240 | $1,826,400 | 7.1% |

This matrix reveals trade-offs invisible to intuition: The aggressive option sacrifices $470 monthly for higher returns, while the conservative path frees cash flow but erodes overall profitability. Iterative modeling—supported by platforms like those at fixcreditscenter.com—lets you pinpoint sweet spots where risk aligns with reward in 2025’s capricious markets.

Seeking Professional Advice

Even the sharpest calculator has blind spots, especially when human nuance collides with algorithmic precision. Complex variables—like localized zoning laws or lender-specific covenants—demand interpretive wisdom that software alone can’t provide. Recognizing when to seek counsel isn’t a concession; it’s a competitive edge in 2025’s fragmented financing ecosystem.

When to Consult Experts

Deploy experts as co-pilots for high-stakes journeys, particularly when calculations intersect with ambiguity. Mortgage brokers or financial advisors decode lender idiosyncrasies, translating generic outputs into tailored strategies. Critical junctures include:

- Complex Variables: Multi-property portfolios, environmental contingencies, or SBA loan intricacies, where a broker’s access to niche programs can secure terms 0.5-1.0% below market rates.

- Local Market Dynamics: Urban infill projects or rural developments require ground-level insights—say, how 2025’s supply chain reforms affect industrial NOI in Midwest hubs versus coastal corridors.

Picture a developer modeling a $3 million mixed-use asset: The calculator flags a borderline DSCR of 1.18x, suggesting rejection. But a seasoned advisor, noting the property’s proximity to a new transit hub, adjusts for projected rent premiums. This revises DSCR to 1.32x, turning a red flag into an approval catalyst. In such moments, expertise doesn’t just validate the numbers—it redefines them, ensuring your calculator serves as a launchpad, not a crutch. For those navigating these layers, tools integrated with advisory resources at fixcreditscenter.com offer a seamless bridge from simulation to execution.

【Conclusion: The Path to Smart Real Estate Investment】

In 2025’s dynamic real estate landscape, the journey toward profitable investments hinges on transforming raw data into strategic foresight—much like a navigator charting a course through shifting financial currents. As we build on the foundation of effectively wielding commercial mortgage calculators, the path forward demands not just calculation mastery but a holistic embrace of technology and expertise to unlock sustainable growth.

Making Informed Decisions

The leap from intuition to intelligence in real estate investing begins with recognizing how digital tools crystallize uncertainty into actionable clarity—especially in an era where algorithmic precision can outpace human bias.

Leveraging Technology for Financial Planning

A commercial mortgage calculator stands as an indispensable ally in evaluating real estate investment viability, serving not merely as a number-cruncher but as a dynamic simulator that mirrors 2025’s volatile markets. By inputting precise variables—such as loan parameters, property metrics, and borrower details—it transforms abstract figures into vivid narratives of risk and reward. For instance, consider an investor assessing a $1.2 million apartment complex: The calculator can model scenarios where a 0.5% interest rate hike (within 2025’s 6.5-7.5% range) slashes cash-on-cash returns from 8.5% to 7.1%, revealing hidden vulnerabilities in debt service coverage. This technology empowers users to stress-test assumptions, like occupancy dips or insurance spikes tied to new climate regulations, ensuring decisions are grounded in empirical reality rather than optimistic guesswork. In essence, it elevates financial planning from reactive estimation to proactive strategy, turning potential pitfalls into opportunities for refinement.

Next Steps for Investors

With insights harnessed from robust calculations, the final stride toward investment success involves bridging digital outputs with human wisdom—a synergy that fortifies against 2025’s unpredictable economic shifts.

Exploring Further Resources

To optimize purchasing strategies, investors should actively utilize advanced online calculators while consulting seasoned finance professionals who decode complexities like lender-specific covenants or localized zoning impacts. This dual approach mitigates blind spots; for example, a tool can highlight how extending a loan term frees up capital for value-add renovations, but a broker’s insight might reveal niche programs slashing rates by 0.75% in high-growth urban corridors. Platforms such as those integrated with advisory services at fixcreditscenter.com offer a seamless gateway to these resources, enabling iterative modeling and expert guidance that transform theoretical projections into executable blueprints. By embracing this ecosystem, you ensure every calculation evolves into a stepping stone toward resilient, high-yield investments in 2025’s capricious real estate arena.

Related Articles

- Explore more about how to effectively use financial tools in our post on 5 Free Ways to Monitor Your FICO® Score with myFICO.

- To learn about credit scores and their impact on investments, check out 7 Fast Credit Fix Secrets for Higher Scores Now.

- If you are looking for ways to address late payments, see our blog on 5 Powerful Ways to Remove Late Payments Fast.

- For insights on credit repair strategies, visit 5 Free Credit Repair Secrets Banks Don’t Share.

- If you’re considering how to handle debt efficiently, check our detailed guide on Balance Transfer Offers: Your Debt Escape Plan.

Key Takeaways for Credit Success

- Always review your credit reports for errors every 4 months

- Dispute inaccuracies with certified mail for best results

- Keep credit utilization below 30% for optimal scoring

Ready to transform your credit? Take action now! Visit https://fixcreditscenter.com to start your journey. Leave a comment below sharing which tip helped you most!