Did you know 1 in 3 credit reports contain errors? Fixing these mistakes could be your fastest path to better loans and lower interest rates. This guide reveals legal credit repair secrets everyone should know.

【What is a Mortgage Calculator?】

Overview of Mortgage Calculators

Think of a mortgage calculator for Kentucky as your personal home-buying financial scout. It’s a powerful online tool designed to demystify the biggest piece of your homeownership puzzle: your monthly mortgage payment. At its core, it takes fundamental loan details – primarily your desired loan amount, the interest rate you expect (or qualify for), and the loan term (like 30 years) – and instantly calculates your estimated principal and interest payment. But here in Kentucky, the true power lies in its ability to go deeper, incorporating the essential local costs that significantly impact what you’ll pay each month.

Key Features

What sets a robust Kentucky mortgage calculator apart? It’s the inclusion of those critical, often overlooked, components that make your payment real:

- Principal & Interest: The foundational cost of repaying the loan amount borrowed plus the interest charged by the lender.

- Kentucky Property Taxes: Property tax rates vary significantly by county in the Bluegrass State. A good calculator allows you to input your estimated annual property tax bill (often based on a percentage of the home price – research local county averages, typically ranging from 0.8% to 1.2% annually for 2025 estimates) and factors this cost into your monthly total.

- Homeowners Insurance: Protecting your investment is non-negotiable. Calculators include a field for your estimated annual premium. Kentucky averages can give you a starting point, but get quotes specific to the property’s location and type.

- Private Mortgage Insurance (PMI): If your down payment is less than 20%, lenders usually require PMI. A KY-specific calculator will factor this cost in (typically 0.5% to 1.5% of the loan amount annually) until you reach sufficient equity.

Here’s a quick example comparing monthly costs with and without local factors for a $250,000 loan in Kentucky (Estimated 2025 Rates):

| Feature | Principal & Interest (6.5%) | With KY Taxes (1.0%), Ins ($1,200/yr), PMI (0.8%) | Difference |

|---|---|---|---|

| Estimated Monthly | $1,580 | $2,150 | +$570 |

Why Use a Mortgage Calculator?

Simply put, knowledge is power, especially when making a commitment as significant as a Kentucky mortgage. Walking into the home search or loan application process without using this tool is like setting off on a road trip without a map or GPS. It helps you navigate the financial landscape with confidence.

Benefits for Homebuyers

Leveraging a mortgage calculator tailored for Kentucky delivers concrete advantages:

- Sets a Realistic Home-Buying Budget (Crucial in KY’s Market): It moves you beyond just the listing price. By inputting current estimated Kentucky interest rates (always check local lenders for the most accurate 2025 rates!), property taxes for your target county, and insurance costs, you discover the true monthly payment you’d face. This instantly clarifies what price range you can genuinely afford, preventing heartbreak later. Don’t just guess based on the sale price – calculate the real cost of ownership.

- Assists with Comparing Loan Options: Wondering how much a slightly lower interest rate might save you? Curious about the impact of putting 15% down versus 20% down (especially on eliminating PMI)? A mortgage calculator lets you play with these variables instantly. Compare 15-year vs. 30-year terms to see the trade-off between higher monthly payments and massive long-term interest savings. It empowers you to evaluate different loan scenarios side-by-side before speaking to a lender.

- Reveals the Full Cost Picture: It forces you to confront and budget for the entire monthly obligation, not just the loan repayment. Seeing how property taxes and insurance add hundreds to your payment ensures there are no nasty surprises after closing. This is vital for Kentucky buyers as tax rates can differ noticeably between neighboring counties.

- Helps Plan for Down Payment & Closing Costs: While primarily focused on the monthly payment, understanding the overall loan amount needed also helps you solidify your down payment goal and anticipate closing costs (though calculators usually don’t include closing costs in the monthly payment estimate).

Using a detailed mortgage calculator is the smart, Kentucky-savvy first step for any serious homebuyer. It transforms complex numbers into clear, actionable information, putting you firmly in control of your homeownership journey. Ready to see exactly what a home might cost you per month? Plug in your numbers – it’s eye-opening! And remember, getting your credit in the best possible shape before you apply can make a significant difference in the interest rate you qualify for. If you need guidance on optimizing your credit profile for your Kentucky home loan, consider checking out resources available at https://fixcreditscenter.com.

【How to Calculate Your Monthly Mortgage Payment】

Formula Breakdown

Understanding the Calculation

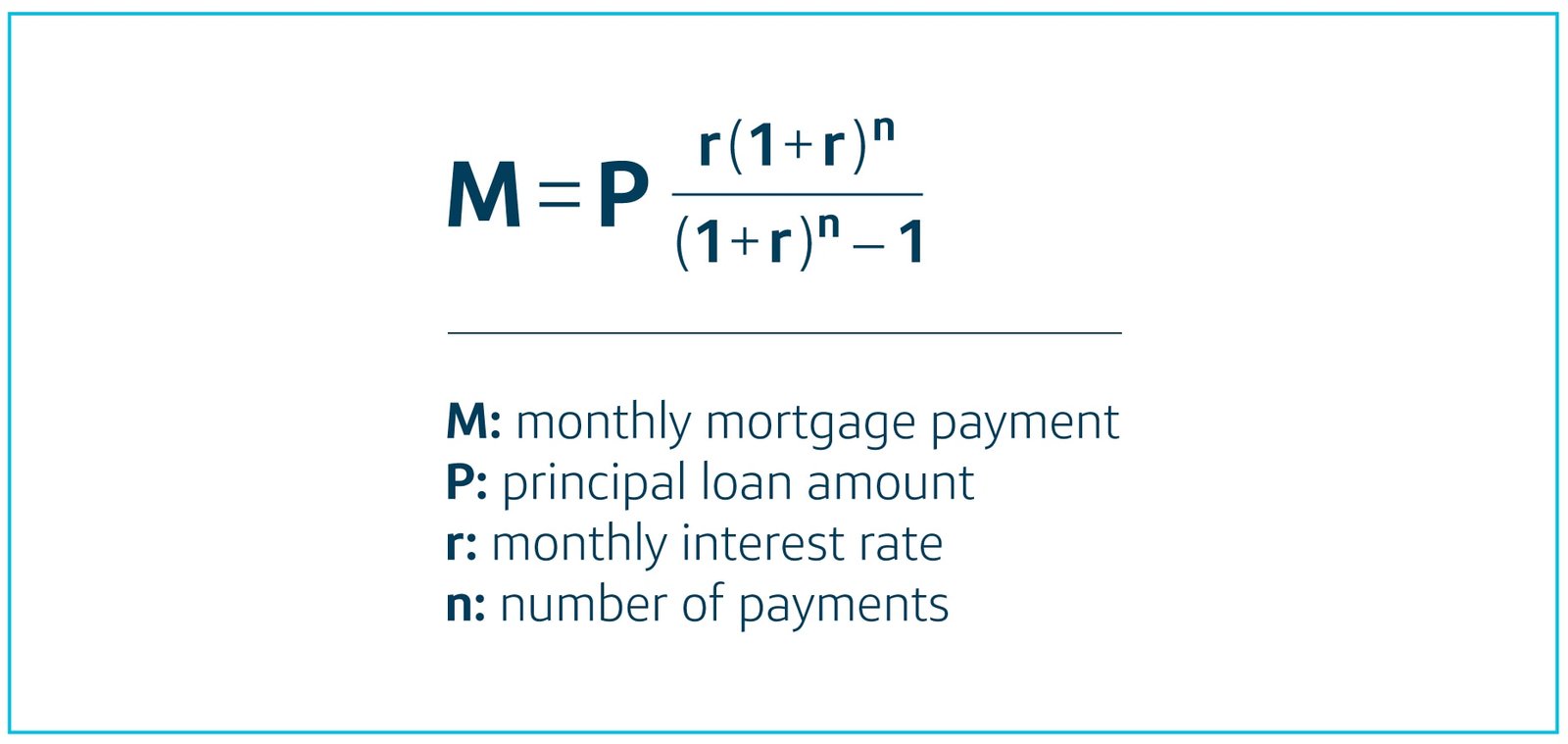

At the heart of every Kentucky mortgage calculator lies a precise mathematical formula that determines your monthly payment. It might look intimidating at first glance, but it’s simpler than you think! Here’s the standard formula used:

M = P [ r(1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

- M is your total monthly mortgage payment.

- P is the principal loan amount (the total you borrow after your down payment).

- r is your monthly interest rate (annual rate divided by 12). For example, a 6.5% annual rate becomes ≈0.005416 monthly.

- n is the total number of monthly payments over the loan term (e.g., 360 payments for a 30-year loan).

This formula accounts for both principal repayment and interest charges, spreading the cost evenly over your loan term. It’s the engine behind those instant online calculations, turning your inputs into a clear monthly figure.

Practical Example

Sample Calculation

Let’s bring this to life with a real-world scenario for Kentucky. Imagine you’re eyeing a home priced at $300,000 in Lexington, with estimated 2025 property taxes (around 1.0% annually) and homeowners insurance ($1,200/year). We’ll focus on how varying interest rates and down payments shift your monthly costs and long-term expenses.

Assumptions:

- Home Price: $300,000

- Loan Term: 30 years fixed

- Property Taxes: $3,000/year (1.0% of price)

- Homeowners Insurance: $1,200/year

- PMI: Added if down payment <20% (0.8% of loan annually)

Here’s how different scenarios play out:

| Scenario | Down Payment | Loan Amount (P) | Interest Rate (Annual) | Monthly Principal & Interest | With Taxes/Ins/PMI | Total Interest Paid (30 Years) | Total Loan Cost |

|---|---|---|---|---|---|---|---|

| Lower Rate, 20% Down | $60,000 | $240,000 | 6.0% | $1,439 | $1,889 | $278,040 | $518,040 |

| Standard Rate, 10% Down | $30,000 | $270,000 | 6.5% | $1,707 | $2,277 | $344,520 | $614,520 |

| Higher Rate, 5% Down | $15,000 | $285,000 | 7.0% | $1,896 | $2,486 | $397,560 | $682,560 |

Key Takeaways from the Example:

- Down Payment Impact: A 20% down payment eliminates PMI, saving you ≈$190/month versus a 10% down payment. It also reduces your loan amount, lowering total interest paid by over $66,000 in this comparison.

- Interest Rate Sensitivity: Just a 0.5% rate increase (from 6.5% to 7.0%) adds ≈$209 to your monthly payment and ≈$53,000 in total interest over 30 years—highlighting why securing the best possible rate is critical.

- Long-Term Cost Awareness: The total loan cost includes all interest, emphasizing how small monthly differences compound significantly. For Kentucky buyers, this reinforces the value of using a calculator early to avoid surprises.

Plugging these variables into a mortgage calculator helps you visualize trade-offs instantly. Want to see how a 15-year term or a lower rate could save thousands? Experiment with your numbers! And as you prepare for your Kentucky home loan, remember that a strong credit score often unlocks better rates. For personalized tips on boosting your credit ahead of 2025 applications, explore trusted resources at https://fixcreditscenter.com.

【Factors Affecting Your Mortgage Payment】

Now that you’ve seen how mortgage calculations work for Kentucky homes, let’s explore the key factors that can sway your monthly payment. Understanding these elements helps you make smarter decisions, whether you’re buying in Louisville, Lexington, or rural Kentucky. As Suze Orman often says, “Knowledge is power—use it to take control of your financial future!”

Debt-to-Income Ratio (DTI)

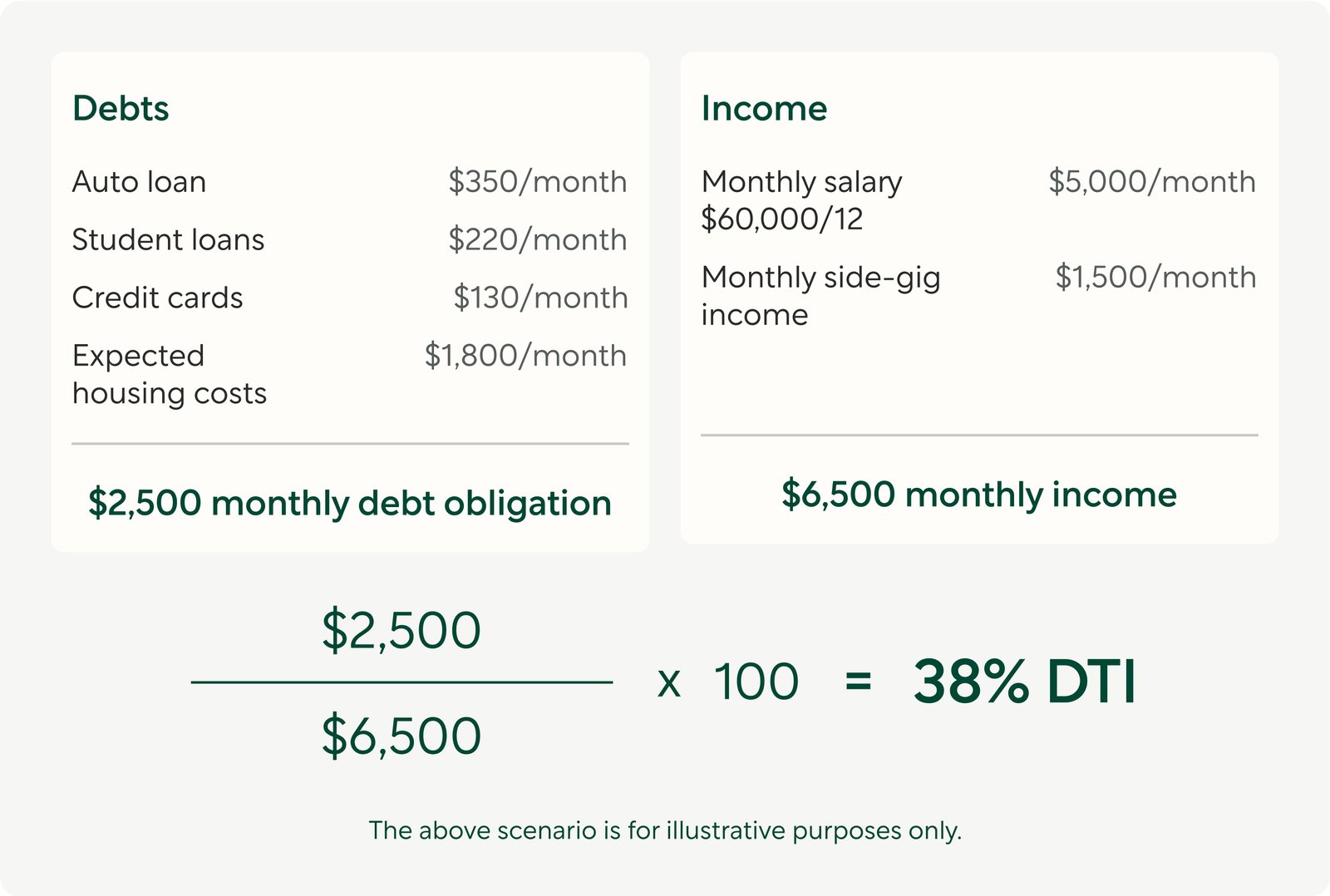

Your DTI is a critical number lenders use to gauge if you can handle a mortgage without overextending yourself. Think of it as your financial fitness score—it shows how much of your income goes toward debts each month.

Importance of DTI

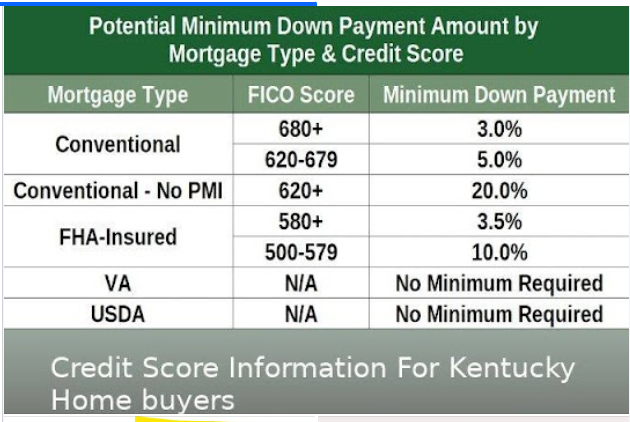

- Why it matters: Lenders in Kentucky typically cap DTI at 45-50% for approval. This means your total monthly debt payments (including your new mortgage) shouldn’t exceed half your gross income. Sticking below 43% often secures better loan terms, as it signals you’re less likely to default.

- Real-life impact: If your DTI creeps above 50%, you might face higher interest rates or even rejection. For example, a high DTI could add $50-$100 to your monthly payment due to risk-based pricing. Always aim low—it keeps your options open and your budget stress-free!

Calculating your DTI effectively

- Simple steps: Add up all monthly debt payments (e.g., car loans, credit cards, student loans) and divide by your gross monthly income. Multiply by 100 to get a percentage. For instance:

- Monthly debts: $800 (car) + $300 (credit cards) = $1,100

- Gross monthly income: $4,000

- DTI = ($1,100 / $4,000) × 100 = 27.5% (well within the safe zone!)

- Pro tip: Track your DTI early in the home-buying process. Use a free online calculator to simulate how a new mortgage would affect it. If you’re close to 45%, consider paying down debts first—this small step could save you thousands over your loan.

Influence of Interest Rates

Interest rates are like the heartbeat of your mortgage—even tiny changes can pulse through your monthly budget and long-term costs. In Kentucky, rates in 2025 reflect broader economic trends, so staying informed helps you lock in savings.

Current Kentucky Mortgage Rates

- 2025 snapshot: As of this year, average rates for a 30-year fixed mortgage in Kentucky hover around 6.5-7.0%, depending on your credit profile and loan type. This is slightly higher than historical lows, but shopping around can still uncover competitive offers. For example, local credit unions often beat big banks by 0.25-0.5%.

- Regional factors: Kentucky’s stable housing market means rates here might be a touch lower than national averages, but always verify with multiple lenders. Remember, your personal rate depends heavily on factors like credit score and down payment—more on that soon!

How different rates affect monthly payments

- Quick comparison: Referencing our earlier example with a $300,000 home, a small rate shift changes everything. Say you borrow $270,000 with a 10% down payment:

- At 6.5%, your principal and interest is $1,707/month.

- At 7.0%, it jumps to $1,896/month—that’s $189 more each month!

- Long-term ripple: Over 30 years, that 0.5% increase adds roughly $53,000 in total interest. Use a Kentucky mortgage calculator to test scenarios: even a 0.25% drop could free up cash for home improvements or savings.

Tips for securing lower interest rates

- Boost your credit score: Aim for 740+ to qualify for the best rates—each 20-point increase can shave 0.1-0.2% off your rate. Pay bills on time, reduce credit card balances, and avoid new debt before applying.

- Other strategies: Opt for a larger down payment (20% or more eliminates PMI and often lowers rates), buy discount points upfront to reduce your rate long-term, and compare at least 3-5 lenders. Kentucky buyers should also explore FHA or VA loans if eligible—they offer lower rates for qualified applicants.

And here’s a friendly nudge: If your credit needs a tune-up for 2025 applications, trusted resources like https://fixcreditscenter.com offer personalized guidance to help you shine.

【Additional Costs to Consider】

Beyond interest rates and your DTI, there are other expenses that can sneak into your monthly mortgage payment here in Kentucky. As Suze Orman wisely advises, “A mortgage isn’t just about principal and interest—it’s about the full picture of homeownership costs.” Ignoring these extras could strain your budget, whether you’re buying in bustling Louisville or peaceful rural Kentucky. Let’s break them down so you can plan smarter for 2025.

Property Taxes and Insurance

Property taxes and homeowner’s insurance are non-negotiables that lenders bundle into your monthly payment via an escrow account. This means they’re paid on your behalf, but they directly inflate what you owe each month. Think of them as the “hidden layers” of your housing costs—essential but often overlooked.

Cost Implications

-

Understanding total housing costs: Your mortgage payment typically includes four parts: principal, interest, property taxes, and insurance (often called PITI). For a Kentucky homebuyer, this combo can add hundreds to your monthly bill. For instance, on a $250,000 home, principal and interest might be around $1,500 at 2025’s average rates, but taxes and insurance could push the total to $1,800 or more. Always use a Kentucky mortgage calculator to input all variables—it reveals the true cost and prevents surprises!

-

Local vs. state tax rates examples: Kentucky’s average property tax rate is about 0.86%, but local rates vary widely. Louisville might hit 1.05%, while rural areas like Adair County could be lower at 0.75%. Here’s how it plays out:

Location Avg. Tax Rate (2025) Annual Tax on $250k Home Monthly Impact State Average 0.86% $2,150 ~$179 Louisville 1.05% $2,625 ~$219 Lexington 0.95% $2,375 ~$198 Insurance costs add another layer—Kentucky’s average homeowner’s insurance is about $1,200/year ($100/month) due to risks like storms. Factor this in early; it ensures your dream home doesn’t become a financial burden.

Private Mortgage Insurance (PMI) and HOA Fees

If your down payment is less than 20%, PMI becomes a reality—and it’s not optional. HOA fees, common in communities across Kentucky, are another regular expense. Both can chip away at your monthly cash flow, so understanding them is key to staying on budget.

What You Need to Know

- Necessity of PMI for down payments under 20%: PMI protects the lender if you default, and it’s mandatory for conventional loans with down payments below 20%. In Kentucky, this typically adds 0.5% to 1.5% of your loan amount annually. For example, on a $240,000 loan, PMI could cost $100-$300 per month. The good news? Once you build 20% equity—say, through home value appreciation or extra payments—you can request to cancel it. Use a Kentucky mortgage calculator to simulate how a higher down payment eliminates PMI; even 5% more upfront might save you thousands over time.

- Impacts of HOA fees on budgeting: If you’re eyeing a condo in Lexington or a subdivision in Bowling Green, HOA fees cover shared amenities like pools or maintenance. These fees average $200-$400/month in Kentucky and are non-negotiable—they’re due regardless of your mortgage payment. Budget for them separately: A $300 HOA fee on top of a $1,500 mortgage means your true housing cost is $1,800. Always ask about HOA rules during home tours; unexpected fee hikes can derail your finances.

To wrap this up, remember that a Kentucky mortgage calculator is your best friend for modeling all these costs—it turns guesswork into actionable plans. And if your credit score needs a boost to qualify for better rates or avoid PMI in 2025, get tailored support at https://fixcreditscenter.com. They’ll help you build a stronger financial foundation, one step at a time!

【Tips to Lower Monthly Payments】

As we’ve explored the extra costs like property taxes and PMI, it’s time to shift gears to proactive strategies. Just like Suze Orman often says, “Taking control of your mortgage starts with smart moves today to ease tomorrow’s burdens.” Whether you’re a first-time buyer in Lexington or refinancing in Bowling Green, these tips can help you trim your monthly payments and build financial security for 2025. Let’s dive into two powerful approaches: boosting your down payment and exploring refinancing options—both easily modeled with a Kentucky mortgage calculator to turn possibilities into plans.

Increasing Your Down Payment

A larger down payment isn’t just a one-time expense; it’s an investment in lower monthly costs. Think of it as paying more upfront to breathe easier later—especially in Kentucky’s diverse housing market.

Benefits of a Larger Upfront Payment

- Reduces monthly payments and eliminates PMI: Putting down more than the minimum slashes your loan amount, directly lowering principal and interest. For instance, on a $250,000 home in 2025, a 10% down payment ($25,000) might leave you with a $225,000 loan. At average Kentucky rates, your monthly payment could be around $1,400 (including taxes and insurance). But if you save up for a 20% down payment ($50,000), you’d eliminate PMI entirely—saving $100-$300 per month right off the bat. Plus, with a smaller loan, your principal and interest drop, potentially reducing the total payment by hundreds. Use a Kentucky mortgage calculator to test scenarios: Input higher down payments to see how they shrink your monthly bill and free up cash for other goals.

- Improves chances of loan approval: Lenders see a larger down payment as a sign of financial stability, making them more likely to approve your application. In Kentucky’s competitive 2025 market, this could mean snagging a lower interest rate or avoiding stricter requirements. Aim for at least 10-15% down to strengthen your position; if you’re close but not at 20%, the calculator helps you weigh the trade-offs, like how extra savings now might offset PMI costs later.

Refinancing Options

If you’re already a homeowner, refinancing can be a game-changer—especially with interest rates fluctuating. But timing and choices matter, so approach it with the same care Suze Orman recommends: “Refinance only when it aligns with your long-term financial health.”

When and How to Refinance

-

Timing and costs of refinancing: Refinance when rates drop significantly—like if 2025’s averages fall below your current rate—to lock in savings. For example, lowering your rate by just 0.5% on a $200,000 loan could cut your monthly payment by $50-$100. But remember, refinancing comes with closing costs (typically 2-5% of the loan amount in Kentucky), which might include appraisal fees and title insurance. Run the numbers with a Kentucky mortgage calculator to ensure savings outweigh costs; if you plan to stay in your home long-term, the break-even point often comes within 2-3 years.

-

Comparison between fixed-rate and adjustable-rate mortgages: Fixed-rate mortgages offer stability with consistent payments for the loan’s life—ideal if you value predictability in 2025’s uncertain economy. Adjustable-rate mortgages (ARMs) start with lower rates but can increase after an initial period (e.g., 5 years), potentially raising payments later. For Kentucky homeowners, this means:

Mortgage Type Initial Rate (2025) Long-Term Risk Best For Fixed-Rate Higher (~6.5%) Low Buyers planning to stay put 10+ years Adjustable-Rate (ARM) Lower (~5.5%) Higher (rates adjust annually) Short-term owners or those expecting income growth Always model both options in a Kentucky mortgage calculator to compare total costs over time. If you’re leaning toward an ARM, factor in potential rate hikes to avoid payment shock.

As you navigate these strategies, remember that a strong credit score opens doors to better rates and terms. For personalized help boosting yours in 2025, visit https://fixcreditscenter.com—they offer expert guidance to secure your financial future.

- For further information on credit health that can enhance your mortgage application, check out 5 Free Ways to Monitor Your FICO® Score with myFICO.

- Explore 7 Proven Ways to Fix Your Credit and Buy a House for strategies to improve your credit score before applying for a mortgage.

- If you’re interested in identifying additional costs associated with credit repair, take a look at 5 Free Credit Repair Secrets Banks Don’t Share.

- Find out more about managing debts that could impact your DTI in 7 Power Moves to Fix Credit Score After Late Payments.

- For a deeper dive into how your credit affects mortgage rates, consider 7 Fast Credit Fix Secrets for Higher Scores Now.

Key Takeaways for Credit Repair Success

Improving your credit score requires patience and the right strategies. Start by checking your reports for errors, then dispute inaccuracies with evidence. Pay bills on time, reduce credit card balances, and avoid opening multiple new accounts. Building good credit habits takes time, but the financial rewards are worth it.

Ready to take control of your credit health? Visit https://fixcreditscenter.com today for personalized solutions. Share your credit repair journey in the comments below!