Did you know 1 in 3 Americans has errors on their credit report? Fixing these mistakes could be your ticket to better loan rates. This guide reveals proven credit repair strategies anyone can use.

Understanding Mortgage Recast

What is a Mortgage Recast?

Definition and Process

A mortgage recast is a strategic financial move where you pay a substantial lump-sum amount directly toward your loan’s principal balance. This isn’t a refinance—it doesn’t alter your interest rate or loan term. Instead, the lender re-amortizes the loan based on the reduced principal, recalculating your monthly payments to potentially make them lower. For instance, if you inherit money or save a windfall in 2025, this could be a smart way to ease cash flow without resetting your mortgage clock. Think of it as a tune-up for your loan: you’re not changing the engine, just optimizing its performance. Using a mortgage recast calculator helps visualize this impact before committing, showing how that lump sum translates into savings over time.

How Does It Work?

Step-by-Step Recasting Guide

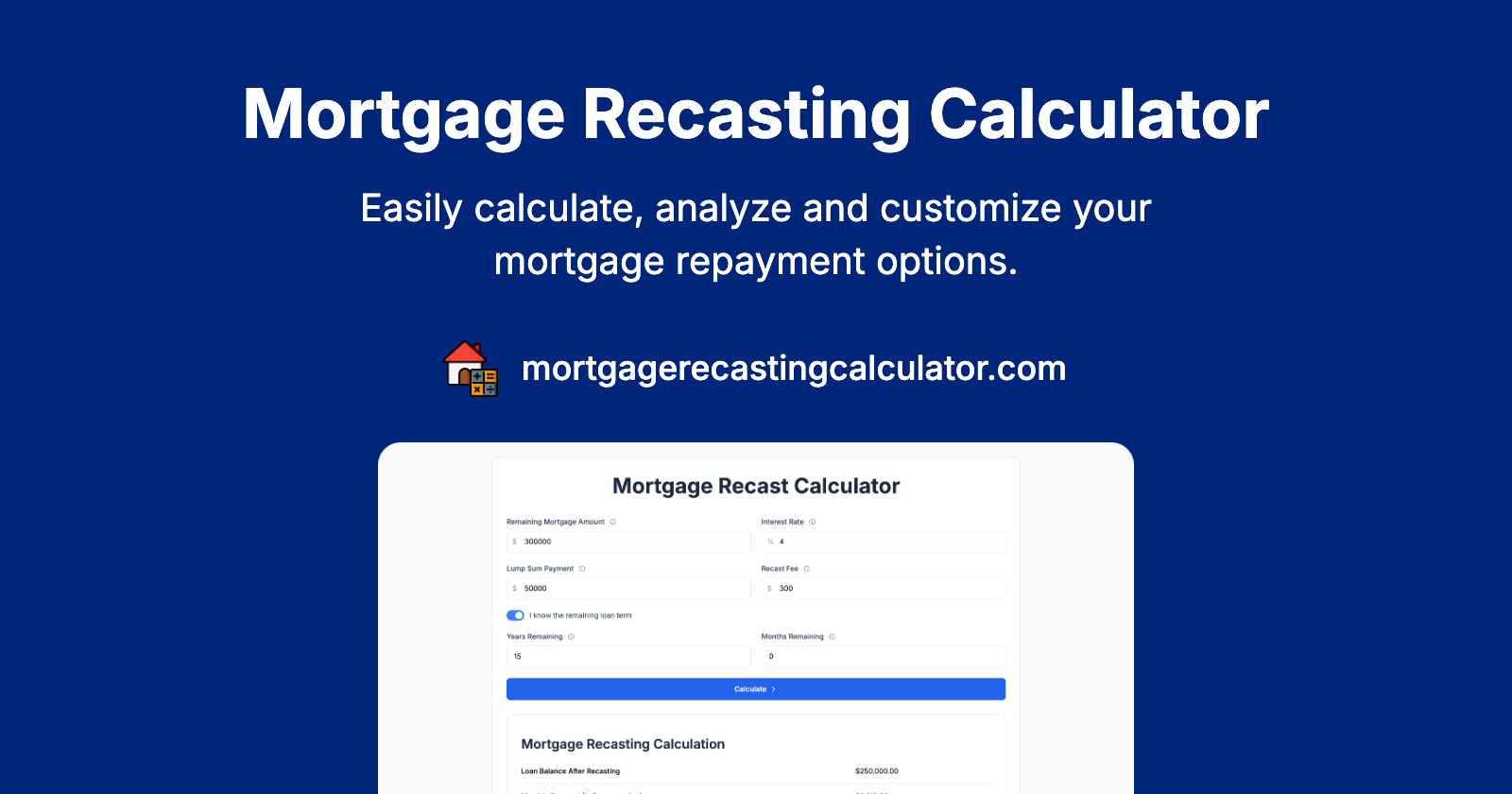

Executing a mortgage recast involves a straightforward sequence, but it requires precision. First, determine your existing mortgage balance by checking your latest statement or lender portal. Next, make a lump-sum payment specifically toward the principal—this isn’t just any extra payment; it must be significant enough to trigger the recast process. Finally, the lender recalculates your new balance and monthly payments using the standard mortgage amortization formula, which spreads the remaining principal over the original loan term. In 2025, with interest rates potentially fluctuating, tools like a mortgage recast calculator become essential for modeling scenarios, such as how a $10,000 payment might slash your monthly bill by hundreds. For personalized estimates and seamless execution, explore resources at fixcreditscenter.com.

Benefits of Using a Mortgage Recast Calculator

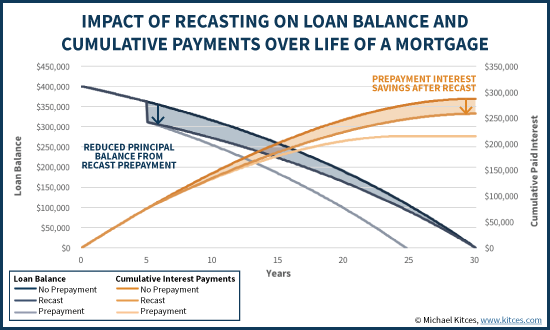

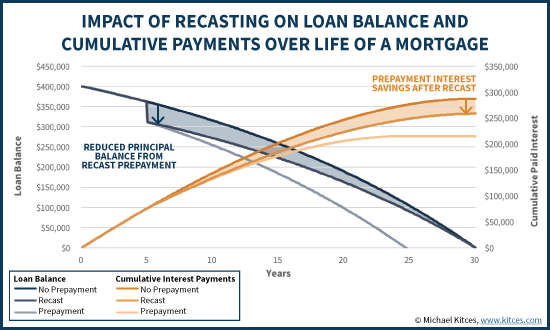

Mortgage recasting promises lower monthly payments without refinancing, but the true impact remains abstract until you see the numbers. A mortgage recast calculator transforms this potential into tangible, personalized projections, empowering smarter financial decisions in 2025’s dynamic market. It demystifies the process, revealing how a single lump-sum payment reshapes your entire loan trajectory.

Calculate Your New Payments

Simple Input for Quick Results

The power lies in simplicity. Input your current loan balance, existing interest rate, remaining loan term, and the lump-sum amount you plan to apply toward the principal. The calculator instantly processes these figures using the standard amortization formula. Within seconds, it delivers two critical outputs:

- Your New Monthly Payment: The recalculated amount you’ll owe each month.

- Total Interest Savings: The cumulative interest saved over the life of the loan due to the reduced principal.

This immediate feedback loop allows you to experiment with different lump-sum amounts before committing real capital. Seeing how a $15,000 versus a $25,000 payment alters your monthly obligation provides clarity that generic advice cannot match, turning speculation into actionable strategy.

Understand Potential Savings

Case Study Comparison

Abstract savings projections lack impact. A robust mortgage recast calculator illustrates the benefit through concrete, relatable scenarios. Consider this real-world example based on typical 2025 loan parameters:

- Original Loan: $250,000 balance, 6.5% interest rate, 25 years remaining term.

- Original Monthly Payment: $1,479.38

- Lump-Sum Recast Payment: $50,000 applied to principal.

| Scenario | Monthly Payment | Total Interest Remaining |

|---|---|---|

| Before Recast | $1,479.38 | ~$193,814 |

| After Recast | $1,109.53 | ~$177,700 |

The Result: A dramatic reduction in monthly cash flow burden, lowering the payment by $369.85. Crucially, this also slashes the total interest paid over the remaining loan term by over $16,000. That $50,000 investment doesn’t just disappear into equity; it actively works to reduce your financial overhead and long-term costs. Visualizing this stark contrast – seeing nearly $370 freed up monthly and significant interest avoided – transforms the recast from a theoretical option into a compelling financial tactic. For precise calculations tailored to your unique mortgage and goals in 2025, explore the tools available at fixcreditscenter.com.

Mortgage Recast Requirements and Process

Understanding the tangible benefits of recasting naturally leads to the practicalities: who qualifies, and what does the process entail? While a mortgage recast calculator reveals the potential savings, eligibility and associated costs determine if it’s a viable path for you in 2025’s lending environment.

Eligibility for Recasting

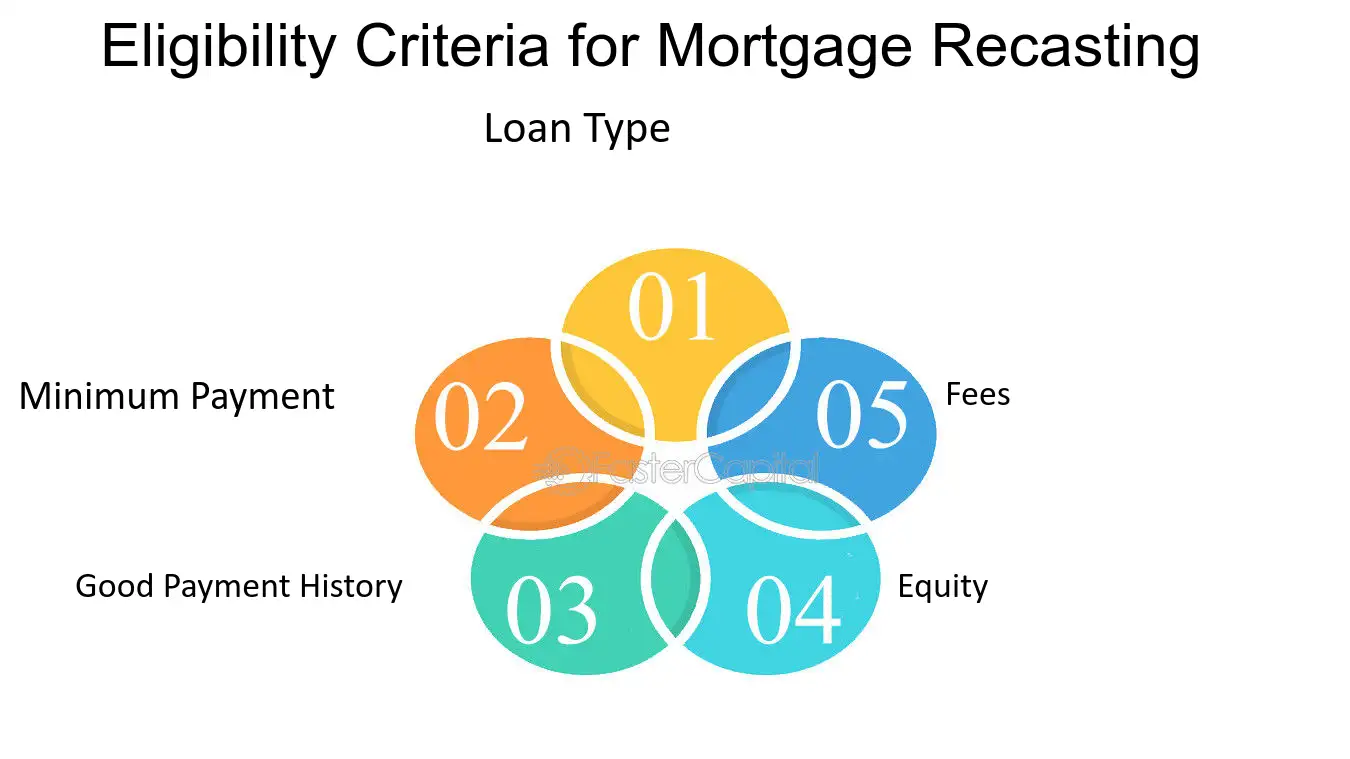

Not every mortgage qualifies for recasting. Lenders impose specific criteria designed to manage risk and administrative effort.

Key Qualifying Factors

- Loan Type: Recasting is almost exclusively available for conventional loans held by the originating lender or their direct successor. Government-backed loans like FHA, VA, or USDA loans are ineligible for recasting. This is a non-negotiable starting point.

- Payment History: Lenders typically require a demonstrated history of on-time payments (often 12-24 months consecutively). A pattern of late payments can disqualify you.

- Equity & Principal Reduction: The core of recasting involves applying a significant lump sum towards the principal. There’s usually a minimum threshold for this payment (e.g., $5,000, $10,000, or sometimes a percentage of the remaining balance). Crucially, this payment must bring your loan balance below the original loan-to-value (LTV) ratio threshold established at closing, demonstrating sufficient equity. Simply having equity isn’t enough; you must actively reduce the principal balance significantly with your own funds.

- Servicer Capability & Policy: Ultimately, the lender/servicer must offer recasting as a service and agree to process your request according to their specific internal policies. Always confirm this upfront.

Understanding the Fees Involved

While significantly cheaper than refinancing, recasting isn’t free. Understanding the cost structure is essential for accurately assessing its net benefit using your mortgage recast calculator projections.

Typical Cost of Recasting

- Administrative Fee: This is the primary cost. Lenders charge a processing fee to cover the administrative work of recalculating your amortization schedule and issuing new loan documents. In 2025, this fee typically ranges from $150 to $500.

- Fee Variability: The exact fee is highly lender-dependent. Some may have a flat rate, while others might base it on the loan size or the complexity of the request. There are rarely third-party fees (like appraisal or title costs) associated with a recast, unlike a refinance.

| Lender Fee Comparison (Illustrative 2025 Examples) |

| :—————————– | :—————– |

| Lender A | $250 Flat Fee |

| Lender B | $500 Flat Fee |

| Lender C | 0.1% of Loan Balance (e.g., $350 on a $350k loan) |

Crucial Step: Never assume the fee. Always contact your specific lender to confirm:

- If they offer recasting for your loan type.

- Their exact eligibility requirements (minimum payment, payment history).

- Their precise recasting fee structure.

Armed with your personalized mortgage recast calculator results and a clear understanding of the eligibility hurdles and modest fees, you can confidently decide if pursuing a recast is the optimal strategy to reduce your monthly burden and long-term interest costs. For precise calculations and guidance navigating lender requirements in 2025, explore the resources available at fixcreditscenter.com.

Comparing Mortgage Recast vs. Refinance

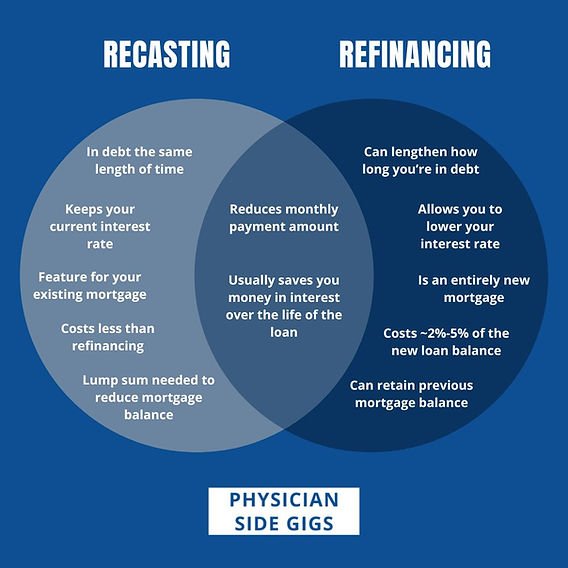

Understanding the eligibility and costs of recasting is crucial, but it’s only half the story. To make a truly informed decision in 2025’s mortgage landscape, you need to weigh it against the alternative: refinancing. Both options aim to ease your financial burden, but they operate on fundamentally different principles. This comparison cuts through the noise, helping you see which path aligns with your goals—whether it’s lowering monthly payments or seizing new opportunities. Armed with insights from a mortgage recast calculator, you can navigate this choice with confidence.

Fundamental Differences

At their core, recasting and refinancing diverge in structure, approval processes, and impact on your loan. One simplifies your existing commitment; the other rewrites it entirely. Let’s break down the essentials to clarify why one might suit your situation better than the other in 2025.

Loan Structure and Approval

Recasting keeps your original loan intact—it’s a modification, not a replacement. You make a substantial principal payment (as outlined earlier), and the lender recalculates your amortization schedule to lower monthly payments. Crucially, this avoids the upheaval of a new loan application. In contrast, refinancing replaces your current mortgage with a brand-new one, often involving a full underwriting process. This structural split drives key approval differences:

- Recasting: No credit checks are required since it’s an administrative adjustment to your existing loan. Lenders rely on your payment history and equity position (e.g., meeting LTV thresholds) rather than reassessing your creditworthiness.

- Refinancing: Mandates a thorough credit check and income verification, as you’re essentially applying for a new loan. This can trigger hard inquiries on your credit report, potentially affecting your score, especially if rates have shifted since your original mortgage.

In 2025, this distinction makes recasting a faster, lower-friction option for those with strong payment records but no desire to requalify. Refinancing, however, opens doors for those seeking broader changes, like locking in lower rates amid market fluctuations.

Pros and Cons of Each Option

Neither recasting nor refinancing is a one-size-fits-all solution. Each has distinct advantages and limitations that influence your long-term financial health. By simplifying the decision, we highlight how a mortgage recast calculator can project outcomes—helping you choose based on facts, not hype.

Simplifying Your Decision

Weighing the benefits against potential drawbacks clarifies which strategy delivers the most value for your circumstances in 2025:

-

Recast Pros:

-

Lower Payments: Applying a lump sum to principal reduces your monthly obligation immediately, freeing up cash flow without altering your loan’s core terms.

-

Faster Equity Growth: By shrinking the principal balance, you build equity quicker, accelerating your path to full homeownership.

-

No Credit Check: Avoids the risk of credit score dips, making it ideal if your credit is stable but not perfect.

Key Limitation: It doesn’t change your interest rate or loan term, so if rates drop significantly, you might miss out on savings. -

Refinance Pros:

-

Potential for Lower Rates: Secures a new interest rate, which could slash long-term interest costs if market conditions favor borrowers.

-

New Loan Terms: Allows adjustments to your repayment period (e.g., switching from 30 to 15 years) or loan type, offering flexibility.

-

Cash-Out Options: Enables you to tap into home equity for major expenses, like renovations or debt consolidation.

Key Limitation: Involves higher costs (e.g., appraisal fees, title insurance, and origination charges) and a lengthy approval process, which could outweigh benefits if fees erode savings.

For a side-by-side view, consider this illustrative comparison based on 2025 lender data:

| Feature | Mortgage Recast | Refinance |

|---|---|---|

| Cost Estimate | $150-$500 (admin fee only) | 2%-6% of loan balance |

| Credit Check Required | No | Yes |

| Impact on Loan Term | Unchanged | Can be shortened or extended |

| Best For | Reducing payments quickly | Rate drops or cash needs |

Ultimately, the right choice hinges on your financial snapshot—use a mortgage recast calculator to model scenarios, then consult your lender for personalized advice. For accurate 2025 projections and expert guidance on navigating these options, leverage the tools at fixcreditscenter.com.

When is the Best Time to Recast Your Mortgage?

Timing a mortgage recast isn’t about predicting market shifts—it’s about aligning your financial reality with an opportunity to reshape your loan’s trajectory. While refinancing chases interest rate dips, recasting responds to personal liquidity events. In 2025’s volatile economy, recognizing these moments transforms recasting from a niche tactic into a strategic lever for financial stability.

Situational Factors

Recasting shines when external conditions collide with your capacity to deploy capital. Unlike refinancing, it ignores interest rate movements—your original rate remains fixed. Instead, focus on these catalysts:

Optimal Timing for Borrowers

- Favorable Rate Environment? Irrelevant. Your locked-in rate stays unchanged. Prioritize recasting when you hold excess savings (e.g., 5%-20% of your loan balance) that won’t deplete emergency funds.

- Income Shifts: Post-promotion bonuses, inheritance, or business sale proceeds offer ideal lump sums. Conversely, anticipating reduced income (career change, retirement) makes lower future payments invaluable.

- Equity Thresholds: If your loan-to-value (LTV) nears 80%, a recast can eliminate PMI faster than scheduled payments, compounding savings.

Crucially, delay recasting if you foresee needing cash soon (e.g., medical expenses). Once funds go toward principal, they’re inaccessible without refinancing or selling.

Real-World Applications

Theory meets practice when homeowners harness windfalls to recalibrate debt. A mortgage recast calculator quantifies these opportunities—input your lump sum to instantly see payment reductions and interest saved over the loan’s life.

Scenarios for Successful Recasting

- The Strategic Saver: A couple with a 4.5% fixed-rate mortgage inherits $50,000. Instead of investing in a shaky 2025 stock market, they recast. Their monthly payment drops $290, freeing cash for their child’s education fund. The calculator confirms they’ll save $19,000 in total interest.

- Bonus Deployment: A tech employee receives a $30,000 annual bonus. After maxing retirement contributions, she applies $18,000 to her loan. Recasting slashes her payment by $215/month, offsetting rising property taxes.

- Pre-Retirement Leverage: At age 58, a teacher pays down $40,000 from a matured CD. His recast reduces payments by $375/month, bridging the gap until pension kicks in—without the fees or credit pull of refinancing.

Key Insight: Recasting works best when liquidity meets long-term planning. Run scenarios with a mortgage recast calculator before windfalls arrive. For personalized 2025 projections, explore the industry-leading tools at fixcreditscenter.com.

FAQs About Mortgage Recasting

Common Questions Addressed

Understanding the Basics

-

What is a mortgage recast calculator?

A mortgage recast calculator is a digital tool that instantly simulates the impact of making a significant lump-sum principal payment on your existing home loan. You input your current loan details (balance, interest rate, remaining term) and the proposed lump sum. The calculator then outputs your new, reduced monthly payment and shows the total interest saved over the remaining life of the loan, while keeping your original interest rate and maturity date intact. It’s essential for visualizing the payoff before committing funds. -

How does the recasting process affect interest rates?

Recasting has zero effect on your mortgage’s interest rate. This is a fundamental distinction from refinancing. The core function of recasting is to recalculate your monthly payment based on your new, lower principal balance after your large payment is applied. Your original agreed-upon interest rate remains locked in for the duration of the loan. The savings come purely from paying interest on a smaller principal amount moving forward.

Clarifying Misconceptions

Information on Exclusions

-

Which loan types are ineligible for recasting?

Recasting is primarily a feature of conventional, fixed-rate mortgages held by Fannie Mae or Freddie Mac. Crucially, government-backed loans (FHA, VA, USDA) generally do not permit recasting. Most adjustable-rate mortgages (ARMs) and jumbo loans are also typically excluded. Always confirm recast eligibility directly with your loan servicer before planning a lump-sum payment, as policies can vary slightly even within eligible loan types. -

What happens to the interest rate when recasting is approved?

As emphasized, your interest rate remains absolutely unchanged. Recasting approval simply means your lender agrees to recalculate your amortization schedule based on the reduced principal balance you’ve created with your lump sum payment. The rate you originally secured, whether it’s 3.5% or 6.5%, stays fixed. Recasting alters your payment amount and the interest portion of each payment over time, but the rate itself is immutable. For accurate 2025 projections tailored to your specific loan scenario, leverage the advanced calculator at fixcreditscenter.com.

Additionally, for insights into how credit repair plays an essential role in your mortgage journey, check out 5 Free Credit Repair Secrets Banks Don’t Share.

And if you’re considering the effects of hard inquiries or seeking to maintain your credit score while managing a mortgage, our resource on How to Remove Hard Inquiries from Your Credit Report is invaluable.

Lastly, brush up on your overall credit health with 7 Power Moves to Fix Credit Score After Late Payments that can fortify your profile before embarking on financial decisions like recasting or refinancing.

Key Takeaways for Effective Credit Repair

Improving your credit score requires patience and the right techniques. Start by checking your reports for errors, then dispute inaccuracies promptly. Pay bills on time, reduce credit utilization, and avoid opening too many new accounts. Remember, legitimate credit repair takes time – avoid companies promising instant fixes.

Ready to take action? Visit https://fixcreditscenter.com now for trusted resources to rebuild your credit. Share your success story in the comments below!