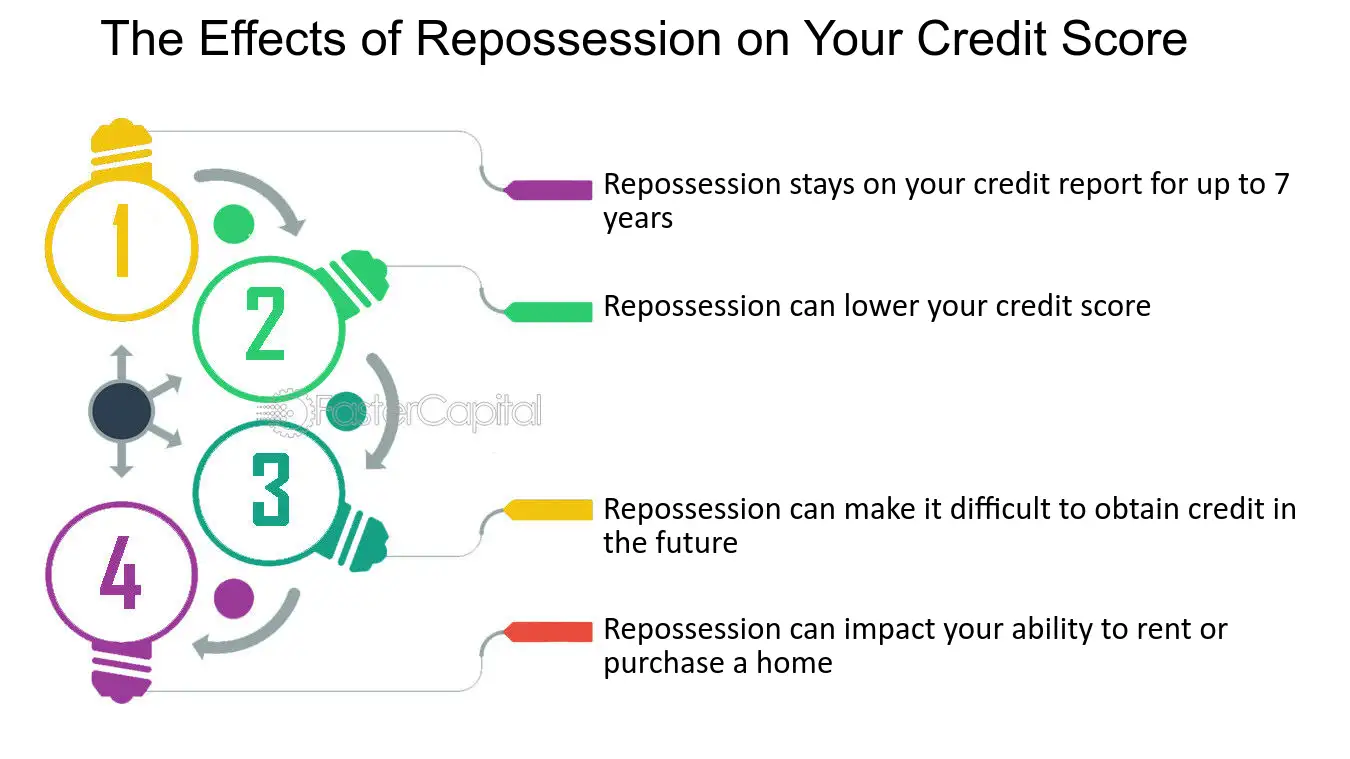

Did you know a repossession can slash your credit score by 100+ points? This guide reveals exactly how long it stays on your report (7 years) and actionable steps to recover faster. Master your financial comeback now!

How Long Repossession Stays on Your Credit Report

Repossession (repo) is a major negative event on your credit report. Understanding its duration and impact is crucial for financial planning.

Repossession Timeline on Credit Reports

A repossession entry remains on your credit reports for 7 years. This countdown begins from the date of the first missed payment that led to the default and eventual repossession. Even after the vehicle or asset is sold, the record persists for the full 7-year period.

Key Dates Clarified

- Start Date: The delinquency date of the payment missed before repossession (not the repossession date itself).

- End Date: Exactly 7 years after that initial delinquency date. The entry should automatically fall off your reports at this point.

- State Law Variations: While state laws govern repossession procedures (like notice requirements or redemption periods), the 7-year reporting timeline is mandated by the federal Fair Credit Reporting Act (FCRA) and applies nationwide.

Credit Reporting Rules

Credit reporting agencies (Equifax, Experian, TransUnion) must comply with FCRA guidelines:

- Mandatory Reporting Period: Lenders are legally permitted to report the repossession for 7 years from the original delinquency date.

- Post-Repossession Activity: Any subsequent deficiency balance (if the sale didn’t cover the loan amount) is reported separately as a charged-off account. This deficiency also remains for 7 years from its delinquency date, which may be later than the repo’s delinquency date.

- Automatic Removal: Agencies must remove the entry after 7 years. You generally don’t need to request removal unless it’s still reporting inaccurately beyond that timeframe.

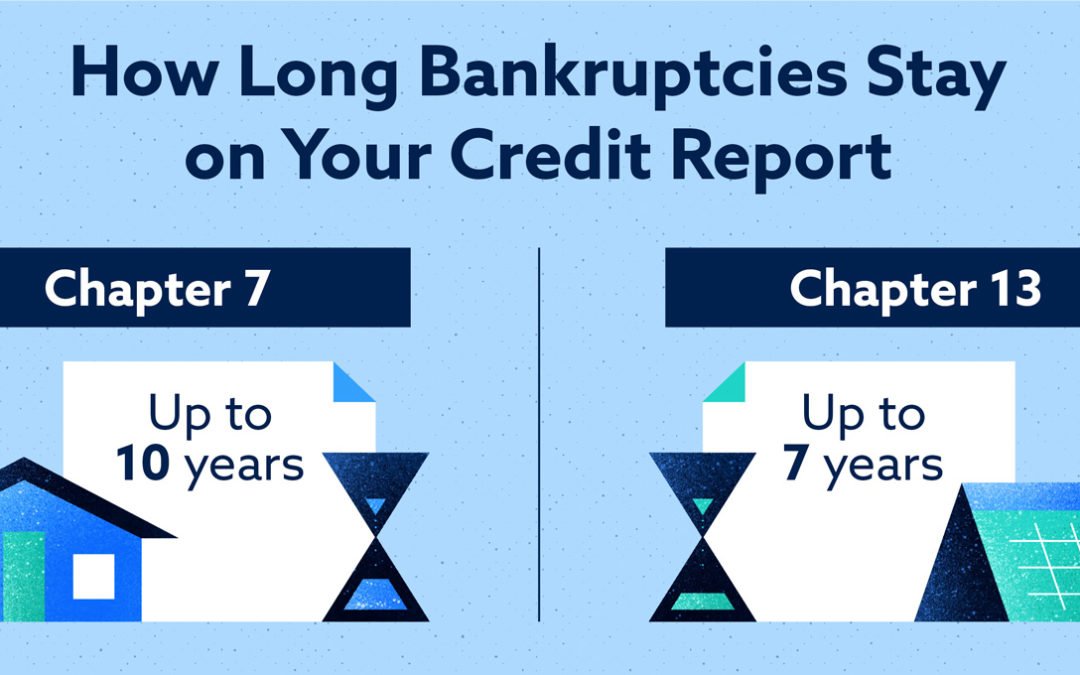

Table: Negative Item Duration on Credit Reports

| Negative Item | Typical Reporting Duration | Governing Regulation |

|---|---|---|

| Repossession | 7 years | FCRA |

| Late Payments (30-180 days) | 7 years | FCRA |

| Charge-Offs | 7 years | FCRA |

| Chapter 7 Bankruptcy | 10 years | FCRA |

| Paid Tax Liens | 7 years from paid date | FCRA |

| Unpaid Judgments | Varies by state, often 7+ years | State Law/FCRA |

Impact on Your Credit Score

A repossession significantly damages your credit score, often causing an immediate drop of 100 points or more. Its impact is severe because it signals a major failure to repay a secured loan.

- Severity: Repossession is considered one of the most harmful entries, alongside foreclosure and bankruptcy. It impacts multiple scoring factors: payment history (most heavily weighted), amounts owed, and credit mix.

- Diminishing Impact: While the repo remains for 7 years, its negative effect on your FICO® or VantageScore® lessens over time. Recent negative information hurts more than older events. Consistent positive credit behavior (on-time payments, low credit utilization) after the repo is the most effective way to rebuild your score.

- Post-Repo Debt: If you owe a deficiency balance after the repossession and fail to pay it, the lender may sell the debt to a collection agency. This collection account is another separate negative mark on your report, compounding the damage and lasting another 7 years from its delinquency date.

Managing the fallout of a repossession requires diligence. Resources like those available at https://fixcreditscenter.com can provide structured guidance on disputing errors and implementing strategies to rebuild creditworthiness over time.

Repo Credit Report Timeline

Understanding exactly how long a repossession affects your credit is vital for managing your financial recovery. The core reporting period is federally mandated and impacts your access to credit for a significant time.

Standard Reporting Duration

7-year rule from first delinquency

- The Countdown Start: The 7-year reporting period for a repossession on your credit report begins on the date of the first missed payment that led to the account defaulting and eventual repossession. This is crucial – it’s not the date the lender took the vehicle back, nor the date they sold it.

- Nationwide Application: This 7-year rule, enforced by the federal Fair Credit Reporting Act (FCRA), applies uniformly across Equifax, Experian, and TransUnion – the three major credit bureaus. State laws govern how repossession happens, but not how long it’s reported.

- Automatic Removal: After exactly 7 years from that initial delinquency date, the repossession entry must automatically be removed from your credit reports by the bureaus. You typically won’t need to request its deletion.

Post-repossession deficiency balances

- The Auction Outcome: After repossessing the asset (like a car), the lender will sell it, usually at auction.

- Potential for Further Debt: If the sale price of the repossessed asset is less than the amount you still owed on the loan (plus repossession and sale fees), you are responsible for the remaining balance, known as a deficiency balance.

- New Negative Entry: The lender may report this deficiency balance as a separate charge-off account. If they sell this debt to a collection agency, a collection account will also appear on your credit report.

- Separate Timeline: Critically, this deficiency balance or collection account has its own 7-year reporting timeline, starting from the date it first became delinquent (which is often later than the original loan’s first delinquency date). This means you could potentially have negative entries related to the same original loan impacting your credit for longer than 7 years if the deficiency isn’t resolved promptly.

Why 7 Years Matters

The extended presence of a repossession on your credit report has profound consequences for your financial flexibility.

FICO score calculation factors

- Payment History Dominance: Your payment history is the single most important factor in your FICO® score, making up 35% of the calculation. A repossession is one of the most severe negative items possible in this category.

- Severe Score Drop: The initial impact of a repossession is devastating, often causing an immediate drop of 100 points or more in your credit score. This reflects the extreme seriousness of defaulting on a secured loan where the lender had to reclaim the collateral.

- Lingering Damage: While the impact lessens over time, the repossession entry continues to drag down your score for the entire 7 years it’s present. It negatively affects not only payment history but also “amounts owed” and “credit mix” factors.

Long-term creditworthiness effects

- Access Denied: The presence of a recent repossession makes it very difficult to get approved for new credit, especially for significant loans like a mortgage or auto loan. Lenders view it as a major red flag indicating high risk.

- Cost of Credit: Even if you are approved for credit (like credit cards or personal loans) while the repossession is on your report, expect to pay significantly higher interest rates. Lenders offset their perceived risk by charging you more.

- Rebuilding Timeline: The 7-year period underscores the need for consistent, positive credit behavior after a repossession. Making all payments on time, keeping credit card balances low, and responsibly managing any new credit accounts are essential to gradually rebuild your score despite the repo’s presence. This process takes dedication and time.

The 7-year reporting period for a repossession creates a substantial hurdle. Implementing a disciplined strategy for credit repair and rebuilding is essential to navigate this period and improve your financial standing. For structured guidance on disputing potential inaccuracies and developing a personalized credit recovery plan, explore the resources available at https://fixcreditscenter.com.

Credit Impact and Disputes

The presence of a repossession on your credit report inflicts substantial and lasting damage, significantly hindering your financial options. Understanding the mechanics of this impact and your rights to dispute errors is critical.

Damage to Credit Scores

A repossession is one of the most detrimental entries that can appear on your credit history, triggering severe consequences for your credit score immediately and creating ripple effects.

Immediate score consequences

- Drastic Point Loss: Upon reporting, a repossession typically causes an immediate drop of 100 points or more in your FICO® score. This sharp decline reflects the severity lenders associate with failing to repay a secured debt where collateral was seized.

- Compounding Damage: The repossession entry doesn’t exist in isolation. The multiple missed payments leading up to the repossession compound the damage, each contributing negatively to your payment history – the single largest factor (35%) in your FICO® score calculation.

Secondary credit report entries

- Loan Default Status: The original auto loan account will be reported as defaulted, clearly indicating a failure to repay the obligation as agreed. This status itself is a major negative mark.

- Potential Collection Accounts: As outlined previously, if a deficiency balance arises after the vehicle is sold, the lender may report it as a charge-off. If this debt is then sold or assigned to a collection agency, a separate collection account will also appear on your report. Each of these entries acts as an additional negative item, further suppressing your score.

Disputing Inaccurate Repo Entries

The significant damage caused by a repossession makes it imperative to ensure the information reported is accurate. The Fair Credit Reporting Act (FCRA) grants you the right to dispute errors.

Valid grounds for credit report dispute

- Wrongful Repossession Documentation: If you have evidence proving the repossession violated state laws or your loan contract terms (e.g., improper notice, breach of peace during repossession), this constitutes grounds for disputing the entry’s validity.

- Incorrect Delinquency Dates: The start date for the 7-year reporting period is paramount. Dispute the entry if the reported date of the first missed payment leading to default is incorrect. An inaccurate date could unlawfully extend the time the repo remains on your report.

Credit bureau investigation process

- Timely Filing: Upon discovering an inaccuracy, you must file your dispute with the credit bureau(s) within their mandated 30-day window after receiving your credit report containing the error. Initiate the dispute directly through the bureau’s official channels (online, mail, or phone).

- Lender Verification Requirement: The credit bureau is obligated to investigate. Crucially, the bureau must obtain written confirmation from the lender (the data furnisher) verifying the accuracy of the disputed information. The bureau cannot simply verify the entry based on its own records; it must go back to the source. If the lender fails to verify the information within the legal timeframe (generally 30 days), the bureau must remove the entry.

Proactively managing the aftermath of a repossession, including verifying reporting accuracy and understanding dispute rights, is essential for mitigating damage and rebuilding your financial health. For comprehensive strategies on addressing inaccuracies and navigating credit repair, explore the tools and guidance offered at https://fixcreditscenter.com.

Credit Repair Strategies

The seven-year impact of a repossession underscores the urgency of proactive credit repair. While the entry remains, implementing focused strategies can rebuild your score and restore financial standing over time.

Rebuilding Payment History

Your payment history is the most critical factor in your credit score (35%). Rebuilding trust with lenders starts here.

Prioritizing on-time payments

- Current Accounts Take Immediate Priority: Your absolute focus must be on ensuring every payment on every remaining account is made on time, every time. This includes credit cards, utilities (if reported), mortgages, or other loans. Consistent on-time payments demonstrate current reliability.

- Minimum Payments Prevent Further Delinquency: If paying balances in full isn’t possible, meeting at least the minimum payment by the due date is non-negotiable. Even one new late payment significantly sets back recovery efforts and adds another negative mark for seven years.

Credit utilization management

- Maintain Balances Below 30% of Limits: Credit utilization (balances owed vs. credit limits) is the second largest scoring factor (30%). Aim to keep the reported balance on each revolving account (like credit cards) below 30% of its credit limit, and ideally below 10% for optimal scoring.

- Pay Down Existing Credit Card Debt: Aggressively reducing outstanding revolving debt lowers your overall utilization ratio. Consider the “debt avalanche” (targeting highest interest first) or “debt snowball” (targeting smallest balance first) methods based on your motivation and budget.

Credit Rebuilding Tools

When major negatives like a repo limit access to traditional credit, specialized tools can help re-establish a positive history.

Secured credit card options

- Requires Cash Security Deposit: A secured card requires an upfront cash deposit, which typically becomes your credit limit (e.g., a $500 deposit = $500 limit). This deposit minimizes risk for the issuer.

- Reports to Bureaus Like Regular Cards: Crucially, responsible use (on-time payments, low utilization) of a secured card is reported monthly to all three major credit bureaus (Experian, Equifax, TransUnion), building positive history. Choose a card that explicitly states it reports as a regular credit card.

Becoming an authorized user

- Leverages Primary User’s Positive History: Being added as an authorized user on someone else’s established credit card account (like a trusted family member) allows their positive payment history on that account to potentially be added to your credit reports.

- Verify Issuer Reports Authorized Users: Not all card issuers report authorized user activity to the bureaus. Confirm this with the primary user’s issuer beforehand. Ensure the primary user maintains impeccable payment habits and low utilization, as any negative activity will also impact you.

Credit-builder loans explained

- Designed Specifically for Credit Repair: Offered by credit unions, community banks, and some online lenders, credit-builder loans hold the loan amount in a secured savings account while you make fixed monthly payments.

- Payments Reported to All Three Bureaus: Your on-time monthly payments are reported to the major credit bureaus, building positive payment history. Once the loan term is complete, you receive the saved funds (minus any interest/fees), effectively having “saved” while rebuilding credit.

Rebuilding after a repossession demands discipline and strategic use of the right tools. Consistently demonstrating responsible credit behavior is paramount. For personalized guidance on disputing errors, optimizing payment strategies, and selecting the best rebuilding tools for your situation, explore the resources available at https://fixcreditscenter.com.

Avoiding and Mitigating Repo Impact

While a repossession remains on your credit reports for seven years from the date of the first missed payment that led to it, proactive steps can be taken both to prevent repossession from occurring and to minimize its financial fallout if it does happen. Understanding these options empowers you to protect your credit standing.

Preventing Repossession

Taking swift action at the first sign of financial difficulty is crucial to avoid the repossession process and its severe credit impact.

Early lender communication tactics

- Request Payment Plan Before Missing Payments: Contact your lender immediately if you foresee trouble making a payment. Lenders often prefer working out a solution over initiating costly repossession. Ask about formal forbearance agreements or modified payment plans before you become delinquent. Demonstrating initiative increases the likelihood of cooperation.

- Explore Loan Modification Options: Depending on your loan type and circumstances, inquire about permanent loan modifications. This could involve extending the loan term to lower monthly payments, temporarily reducing the interest rate, or in rare cases, a principal reduction (more common with mortgages than auto loans in 2025). Be prepared to provide documentation of your financial hardship.

Refinancing or selling assets

- Private Sale Might Cover Loan Balance: If keeping the asset is unsustainable, selling it privately (e.g., through online marketplaces or dealerships) often yields a higher price than what the lender would get at auction. Use the proceeds to pay off the loan balance in full, preventing a repossession entry and potential deficiency balance. Ensure the sale price covers the loan payoff amount.

- Refinancing Extends Repayment Term: If your credit is still reasonably intact, refinancing the loan at a potentially lower interest rate or longer term can significantly reduce your monthly payment burden. Carefully compare 2025 rates and terms, factoring in any refinancing fees, to ensure it provides genuine relief.

| Action | Primary Benefit | Key Consideration |

|---|---|---|

| Private Sale | Avoids repo mark & potential deficiency | Must sell for enough to cover loan payoff |

| Refinancing | Lowers monthly payment immediately | Requires decent credit; watch fees & rate |

| Forbearance | Temporary pause/relief on payments | Interest may still accrue; short-term fix |

| Modification | Permanent change to loan terms | Requires lender approval & documentation |

Post-Repo Damage Control

If repossession occurs, focus shifts to mitigating the financial damage and preventing the situation from worsening your credit further.

Negotiating deficiency balances

- Lump-Sum Settlements Often Accepted: After repossession and auction, if the sale price doesn’t cover your loan balance plus repo fees, you owe a deficiency balance. Lenders or collection agencies often accept a lump-sum payment for less than the full amount owed to settle the debt. Start negotiations low (e.g., 30-50% of the balance).

- Get All Agreements in Writing: Never rely on verbal promises. Before sending any settlement payment, demand a written settlement agreement clearly stating the accepted amount as payment in full for the deficiency balance. Keep copies indefinitely. This protects you from future collection attempts on the settled debt.

Credit counseling resources

- Nonprofit Agencies Offer Debt Management Plans (DMPs): Reputable nonprofit credit counseling agencies can provide budget counseling and, if appropriate, set up a DMP. Under a DMP, the agency negotiates with creditors (including the repo lender/deficiency collector) to potentially lower interest rates and consolidate payments into one affordable monthly amount. You make payments to the agency, who distributes them.

- U.S. Department of Justice Maintains Approved List: Ensure you work with a legitimate agency. The U.S. Trustee Program (part of the DOJ) maintains a list of approved credit counseling agencies (search for “Approved Credit Counseling Agencies” on justice.gov in 2025). Avoid agencies charging high upfront fees or making unrealistic promises.

Successfully navigating the aftermath of a repossession, whether preventing it or managing its consequences, requires informed action and persistent effort. For tailored strategies on negotiating settlements, accessing legitimate counseling, and rebuilding your credit profile effectively, explore the comprehensive tools and support available at https://fixcreditscenter.com.

Key Takeaways for Moving Forward

Repossession remains on your credit report for 7 years from the first missed payment date, creating long-term financial challenges. While you can’t remove accurate entries early, focusing on consistent positive credit habits (on-time payments, low credit utilization) gradually lessens its impact. Remember:

- Dispute any inaccuracies in delinquency dates or repo details immediately

- Address deficiency balances promptly to avoid additional collection accounts

- Use secured credit cards or credit-builder loans to rebuild your history

Ready to take control of your credit recovery? Visit https://fixcreditscenter.com for personalized tools and strategies. Share your progress or questions below – let’s build your financial future together!