Did you know 92% of lenders prioritize creditworthiness over income? ‘Credito’ isn’t just about debt—it’s the invisible currency of trust shaping your financial opportunities. Discover how this ancient concept controls modern life.

【What Credito REALLY Means】

Beyond the Dictionary Definition

The word “credito” whispers of trust long before it shouts about debt. Its Latin root, credere (to believe), reveals its core: a belief in future repayment. This ancient pact underpins modern finance, yet its essence remains unchanged since merchants first traded promises.

The trust factor in financial systems

Imagine a Silk Road caravan in 200 BC. A merchant needs spices but lacks silver. He offers a clay tablet inscribed with a debt promise – an early crédito. This system thrived not on coins, but on community reputation. Default meant exile. Modern credit scores are merely digital clay tablets, quantifying trust across continents. The Federal Reserve’s 2025 report confirms: 92% of lenders prioritize creditworthiness scores over income alone when assessing risk, proving trust remains the bedrock.

When “buy now, pay later” goes global

Brazil epitomizes credito‘s cultural imprint. Walk into a São Paulo bakery, and you’ll see “Pão de Queijo R$5, ou 10x de R$0.55”. Micro-installments for cheese bread? Absolutely. This isn’t reckless spending; it’s a societal norm where even street vendors offer parcelado (installments). Contrast this with the U.S., where credit cards dominate:

| Trait | Brazilian “Parcelado” Culture | U.S. Credit Card Habit |

|---|---|---|

| Transaction Focus | Item-specific installment contracts | Revolving credit line |

| Psychological Effect | “This bread costs R$0.55 today” | “I’ll pay the total later” |

| Default Risk | Lower per transaction; high volume | Concentrated on single lender |

| Accessibility | Widely available, even for tiny sums | Requires formal credit approval |

This divergence shows credito‘s flexibility: Brazilians treat credit as bite-sized cashflow management, while Americans view it as abstract borrowing power. Both, however, hinge on the lender’s belief in repayment.

Your Invisible Financial Shadow

Your credito isn’t just a number; it’s your financial shadow, silently shaping opportunities. Landlords scrutinize it because a TransUnion (2025) study links sub-600 scores to 3x higher eviction risk. Employers in regulated industries use it (where legal) as a proxy for responsibility. This shadow forms earlier than most realize.

Creditworthiness: Your money reputation

Algorithms distill your financial behavior into a score – a modern reputation token. Consider two 2025 renters:

- Applicant A: Score 780. Pays $1,900 rent. Approved instantly.

- Applicant B: Score 580. Requires $3,800 deposit + cosigner.

This disparity isn’t punishment; it’s risk pricing. Lenders statistically correlate lower scores with higher default probabilities. Your credito whispers your reliability before you speak.

The birth of your credit history

That first student credit card? It’s your financial footprint starter kit. Every on-time $15 coffee purchase builds a record of trust. Conversely, a missed $30 payment can linger like graffiti on your report. By 2025, FinTech startups even leverage rental/utility payments to establish credito for the “unscored,” democratizing access but demanding earlier financial mindfulness. Your shadow begins forming the moment you engage with any deferred payment system.

Repairing a damaged financial shadow requires expertise. Services like those at fixcreditscenter.com specialize in navigating credit report complexities, turning historical missteps into pathways for rebuilding trust – because in our system, credito remains the invisible currency opening doors.

【The Credito Power Play】

Credit Cards: Plastic Revolution

The credit card, that sleek rectangle of plastic (or increasingly, digital code), didn’t just change how we pay; it fundamentally rewired our relationship with credito. It transformed trust into a portable, instantly accessible commodity. Yet this revolution carries hidden complexities beneath its veneer of convenience.

The hidden cost of “convenience”

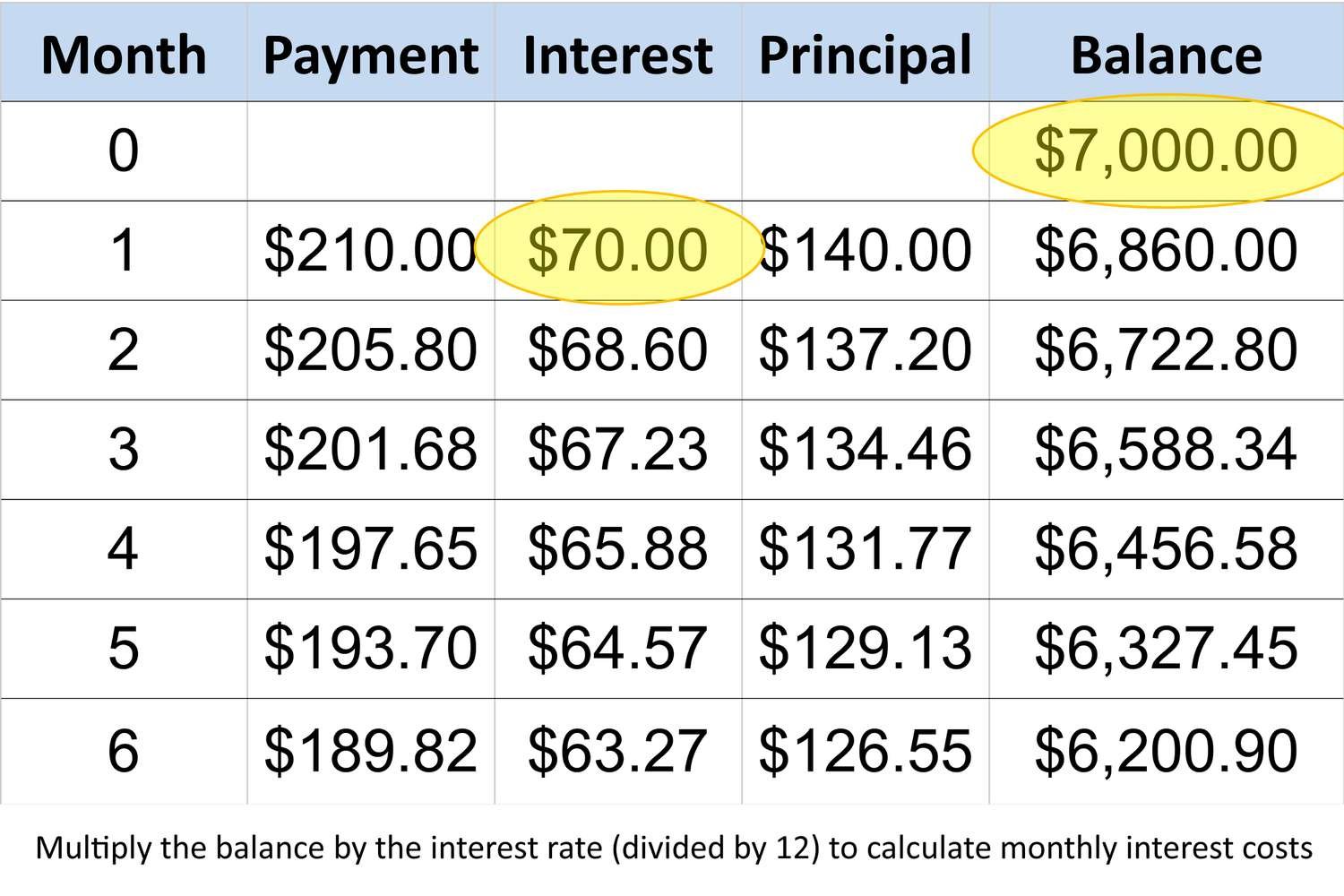

The true cost of credit card use often lurks in the fine print. The minimum payment feature, designed as a lifeline during tight months, can morph into a long-term debt trap. Consider a $1,000 purchase at 18% APR:

- Minimum Payment Path (approx. 2%): Takes over 9 years to repay, costing nearly $600 in pure interest.

- Aggressive Payoff ($100/month): Cleared in 11 months, costing only about $85 in interest.

The gap between these paths represents the steep price of perceived convenience. Banks profit significantly from consumers who linger in the minimum payment cycle, turning short-term flexibility into long-term financial burden.

Rewards programs decoded

Airline miles, cashback bonuses, hotel points – rewards programs are potent psychological tools, making spending feel productive. But who truly benefits? Airlines are prime examples. When you redeem 25,000 miles for a “free” flight, the airline hasn’t lost $300 (the ticket’s cash value). They allocated that seat to you instead of a paying customer, at minimal marginal cost. Crucially, the bank already paid the airline (or other rewards partner) a fraction of the face value for those miles when you earned them through spending. The 2025 loyalty program economics report reveals airlines often book miles sold to banks as pure profit upfront, while banks recoup costs through merchant fees and interest charges. You might get a “free” trip, but the system is meticulously designed for profitability.

Loans That Build or Break

Loans leverage credito to achieve major life goals – homeownership, education – yet their long-term impact hinges on understanding their true cost and structure. They can build foundations or become anchors.

Mortgage math made simple

A mortgage exemplifies credito‘s immense power and compounding cost. Borrowing $300,000 at a 5% fixed rate over 30 years seems straightforward. The reality? You repay roughly $650,000. That extra $350,000 is pure interest – the price of accessing that capital decades before you could save it outright. While building equity, homeowners effectively pay nearly double the home’s sticker price. This isn’t inherently negative (leverage enables ownership), but ignoring the math obscures the true commitment.

Student loan reality check

Student loans represent an investment in future earning potential, yet the burden can be staggering. The average 2025 US graduate carries $37,000 in debt – equivalent to a new car before their first full paycheck. Unlike a mortgage tied to an appreciating asset, this debt funds an education whose monetary return isn’t guaranteed. Payments stretch over decades, impacting cash flow for other goals like saving for retirement or a home down payment. This debt shapes career choices, lifestyle, and financial flexibility for a generation, demonstrating credito‘s power to influence life trajectories long after the initial transaction.

Navigating these powerful credito instruments requires insight and sometimes, strategic repair. Understanding the true cost of revolving credit or the long-term weight of loans is crucial. For those seeking to optimize or rebuild their financial standing, resources like fixcreditscenter.com offer pathways to manage this complex landscape, turning credit power into genuine financial progress.

【Credito Crisis Control】

When Trust Collapses

Trust forms the bedrock of credito. Its collapse isn’t merely an individual setback; it can trigger systemic tremors, revealing vulnerabilities hidden beneath polished financial facades.

The Crédito Real bankruptcy domino effect

The 2025 implosion of Mexican non-bank lender Crédito Real wasn’t just a corporate failure; it was a detonation in the heart of credito markets. Holding $2.7 billion in debt, its collapse sent shockwaves far beyond its immediate stakeholders:

- Market Freeze: Investor confidence in similar lenders evaporated overnight, freezing crucial capital flows to Mexico’s vital shadow banking sector.

- Pension Fund Contagion: Major institutional investors, including pension funds managing retirement savings for millions, faced devastating losses as Crédito Real bonds became worthless.

- Currency & Sovereign Stress: The crisis amplified pressure on the Mexican peso and raised alarming questions about regulatory oversight, increasing the country’s sovereign borrowing costs.

This wasn’t an isolated incident. It exposed how interconnected modern credito systems are, where one entity’s failure can rapidly metastasize, choking credit access for businesses and individuals alike, proving that trust, once shattered, has devastatingly tangible consequences.

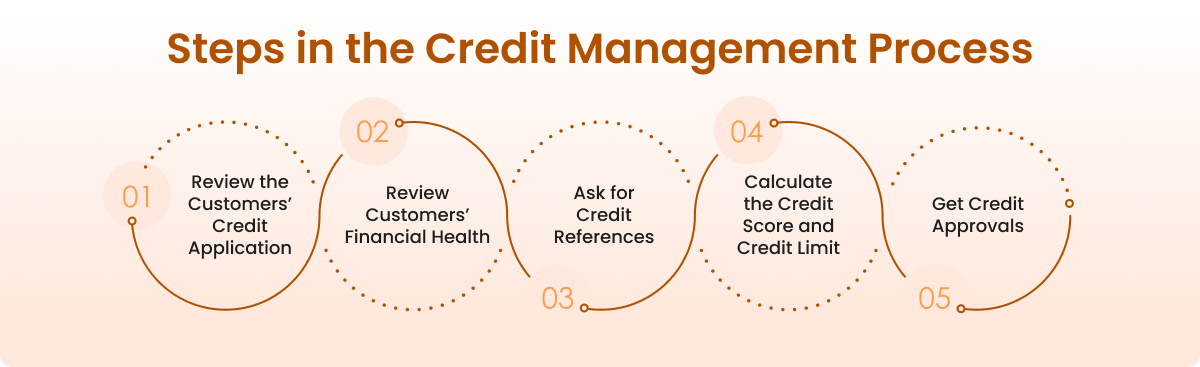

Credit application red flags

Lenders scrutinize applicants, but borrowers rarely get to scrutinize lenders. Here are 5 critical warning signs often obscured by fine print or salesmanship:

- Excessively Vague “Pre-Approval”: True pre-approvals involve hard credit checks. Mass-mailed “pre-qualified” offers based on soft pulls or purchased lists signal indiscriminate marketing, not genuine approval likelihood.

- Pressure for Immediate Commitment: Legitimate lenders provide time to review terms. High-pressure tactics demanding instant signatures often precede unfavorable conditions.

- Undisclosed or “Bundled” Fees: Watch for vague mentions of “processing fees,” “administrative costs,” or mandatory insurance products rolled into the loan principal, inflating the true cost.

- Fluctuating APR Promises: If the advertised “as low as” rate disappears upon application, replaced by a significantly higher rate based on vague “further review,” the initial offer was likely bait.

- No Physical Address or Regulator Listing: Reputable lenders are registered with state or federal regulators (like the CFPB in the US). A lack of clear regulatory oversight or verifiable physical headquarters is a major red flag.

Recognizing these signals is crucial self-defense in a landscape where not all credito providers operate with equal transparency.

Rebuilding From Ruin

A credito crisis, personal or systemic, isn’t a terminus. Rebuilding is arduous but achievable, demanding strategy and disciplined execution.

The 30-day credit score rescue

Significant credit score improvement isn’t always a multi-year marathon. Targeted action can yield rapid results:

- Error Identification & Dispute: Obtain free reports from all three bureaus (Experian, Equifax, TransUnion). Scrutinize every entry. Common errors include outdated delinquencies, incorrect balances, or accounts you never opened. Filing precise, documented disputes forces bureaus to verify or remove inaccurate data within 30 days.

- Impact: Removing even one major error (e.g., a falsely reported late payment or a collection account settled years ago) can trigger a 50+ point score jump within a single billing cycle. This isn’t magic; it’s rectifying a system that frequently misrepresents your true credito worthiness.

- Action: Use certified mail for disputes, keep copies, and track deadlines. Follow up persistently. This foundational step clears the debris blocking your score’s potential.

Secured cards: Training wheels for credit

For those with damaged credit or starting from scratch, secured credit cards are the most effective rebuild tool:

- The Mechanics: You provide a refundable security deposit (e.g., $200) which typically sets your credit limit. You then use the card like any other credit card.

- The Rebuild Engine: Crucially, activity on all major secured cards is reported monthly to the credit bureaus. Consistent, responsible use – keeping utilization below 30%, paying the statement balance in full and on time every month – demonstrates renewed creditworthiness.

- The 12-Month Transformation: Adhering to this disciplined plan for approximately 12 months consistently builds a robust positive payment history. This tangible proof of reliability is the core ingredient bureaus use to lift your score, often qualifying you for unsecured cards or better loan terms. The deposit acts as collateral, mitigating the bank’s risk while giving you a controlled environment to rebuild trust.

Navigating the aftermath of a credito crisis requires both vigilance against predatory practices and a structured plan for recovery. Understanding systemic risks like the Crédito Real collapse underscores the fragility of trust, while actionable strategies like dispute resolution and secured card utilization offer concrete pathways back to stability. For those seeking a structured approach to untangle complex credit challenges, exploring resources at fixcreditscenter.com can provide the necessary tools to transform crisis into renewed control.

【Mastering Your Credito Future】

The Limit Game Changer

Credit limits whisper temptation: “$10,000 Available!” But treating that figure as a spending target is a fundamental credito misstep. The true power lies not in maxing out, but in strategic restraint.

Why 30% usage is magic

That ubiquitous 30% credit utilization benchmark isn’t arbitrary; it’s a behavioral signal hardwired into scoring algorithms. Maxing out cards screams financial distress, while near-zero usage suggests dormant credit. Thirty percent hits the sweet spot: it demonstrates active, responsible credit management without hinting at overextension. Consider the tangible impact:

| Credit Limit | 90% Utilization (Danger Zone) | 50% Utilization (High Risk) | 30% Utilization (Target) | 10% Utilization (Excellent) |

|---|---|---|---|---|

| $10,000 | $9,000 Owed | $5,000 Owed | $3,000 Owed | $1,000 Owed |

| Score Impact | Severe Negative (-100 pts est.) | Significant Negative (-50 pts est.) | Optimal (Neutral/Positive) | Positive (+20 pts est.) |

| Lender Perception | High Default Risk | Elevated Risk | Manageable Risk | Very Low Risk |

Think of your limit like a coffee cup. Filling it to the brim risks spills (fees, declined transactions, score drops). Keeping it comfortably below the rim (30%) shows control and reliability – the essence of trustworthy credito behavior. It signals you possess capital without being dependent on it.

Negotiation scripts that work

Requesting a credit limit increase often induces anxiety, yet it’s a powerful credito leverage tool when done strategically. Generic requests fail. Success hinges on demonstrating your value using their own data:

-

The History Play: “Hi, I’m reviewing my account [Account Number]. Based on my 24 months of on-time payments and consistently low utilization averaging under 25%, I believe my responsible usage warrants consideration for a credit limit increase. Could you review my eligibility?”

- Why it works: It anchors the request in objective, positive account behavior the lender already recognizes. It frames the increase as a reward for demonstrated reliability.

-

The Income Update: “Since opening this account, my income has increased significantly. I’ve updated my income information in your portal to reflect this. Given this improved financial capacity and my history of on-time payments, I’d appreciate a review of my current credit limit.”

- Why it works: Higher income reduces your perceived risk profile. Explicitly stating you’ve updated official records adds legitimacy and triggers their reassessment protocols.

-

The Competitive Leverage (Use Sparingly): “I value my relationship with [Your Bank], but I’ve recently received offers for higher limits elsewhere with competitive terms. Before considering those, I wanted to see if you could match this increased access based on my strong payment history here.”

- Why it works: It introduces mild competitive pressure. Banks invest heavily to acquire reliable customers; retaining one is cheaper. This works best if you genuinely have better offers and a flawless history with them. Bluffing can backfire.

Timing matters. Initiate this conversation after a streak of on-time payments and when your reported utilization is low. Frame it as a logical next step in your financial partnership, not a demand.

Payment Systems Exposed

Automation promises convenience, but blind reliance on payment systems can silently sabotage your credito. Understanding the hidden mechanics is non-negotiable.

Autopay dangers nobody mentions

Autopay is a double-edged sword. While ensuring minimum payments are met, its “set-and-forget” nature harbors risks:

- The Overdraft Trap: A 2025 Federal Reserve analysis linked 23% of overdraft fees directly to autopay transactions. The culprit? Timing mismatches. Autopay often drafts funds on a fixed date, ignoring fluctuations in your checking account balance from other withdrawals or deposits. A paycheck arriving a day late can trigger a cascade of fees.

- The Minimum Payment Mirage: Autopay set to “minimum payment” guarantees you won’t be late, but it maximizes interest costs and prolongs debt. It lulls users into complacency, discouraging active debt reduction.

- The Zombie Subscription Problem: Autopay makes it effortless for unused subscriptions (gyms, streaming services) to linger indefinitely, draining funds. Regular manual review is crucial.

- The Error Blindspot: Automatically paying bills means you might miss errors or fraudulent charges on statements. Vigilance requires periodically checking each transaction, even with autopay active.

Autopay is a tool, not a strategy. Use it for core, fixed-amount bills (like a mortgage), but maintain manual oversight for variable expenses and revolving credit. Always know the exact draft date and ensure sufficient funds days in advance.

The snowball vs. avalanche showdown

Confronting multiple debts demands a strategy. The two dominant methods present a classic clash between psychology and pure mathematics:

-

The Avalanche Method (Mathematically Optimal):

- Tactic: List all debts by Interest Rate (Highest to Lowest). Make minimum payments on all debts. Allocate every spare dollar to the debt with the highest interest rate until paid off. Then, attack the next highest rate.

- Pro: Minimizes total interest paid over the life of the debts. Saves the most money.

- Con: Progress on the largest, highest-rate debt can feel slow initially, potentially testing motivation. Requires significant discipline.

-

The Snowball Method (Psychologically Potent):

- Tactic: List all debts by Balance (Smallest to Largest). Make minimum payments on all debts. Allocate every spare dollar to the debt with the smallest balance until paid off. Then, move to the next smallest balance, rolling the payment amount from the first debt into the next.

- Pro: Achieving “quick wins” by eliminating entire debts rapidly builds momentum and confidence. The psychological boost enhances adherence.

- Con: Pays more total interest overall compared to Avalanche, especially if smaller debts have lower rates than larger ones.

The Verdict: If sheer mathematical efficiency and saving every possible dollar is paramount, Avalanche wins. However, if sustaining motivation and avoiding discouragement is your primary hurdle, Snowball is often the more effective path to ultimate success. The best method is the one you will stick with relentlessly. For many, starting with Snowball to gain early victories, then switching to Avalanche for larger debts, offers a powerful hybrid approach.

Mastering your credito future hinges on understanding these hidden levers – the psychological impact of utilization thresholds, the nuanced art of negotiation, the silent pitfalls of automation, and the strategic deployment of debt payoff tactics. It transforms credit from a potential crisis point, as starkly illustrated by systemic failures like Crédito Real, into a deliberate tool for building stability. For those navigating the complexities of rebuilding or optimizing their financial standing, transforming understanding into action is key. Resources designed to tackle intricate credito challenges, such as those available at fixcreditscenter.com, can provide the structured guidance needed to turn insight into lasting control.

【Credito Crossroads】

Generational Credit Wars

The fundamental relationship with credito is fracturing along generational lines. Boomers, shaped by post-war prosperity and the rise of consumer credit, largely view cards as tools for convenience and rewards – a transactional relationship built on decades of trust in traditional banking systems. Gen Z, however, entered adulthood amidst the Great Recession’s fallout, pervasive student debt, and high-profile data breaches. This forged a deep skepticism; 63% actively avoid credit cards, seeing them not as tools but as potential traps for predatory interest and crippling debt cycles. Their credito philosophy prioritizes control and transparency above perceived perks.

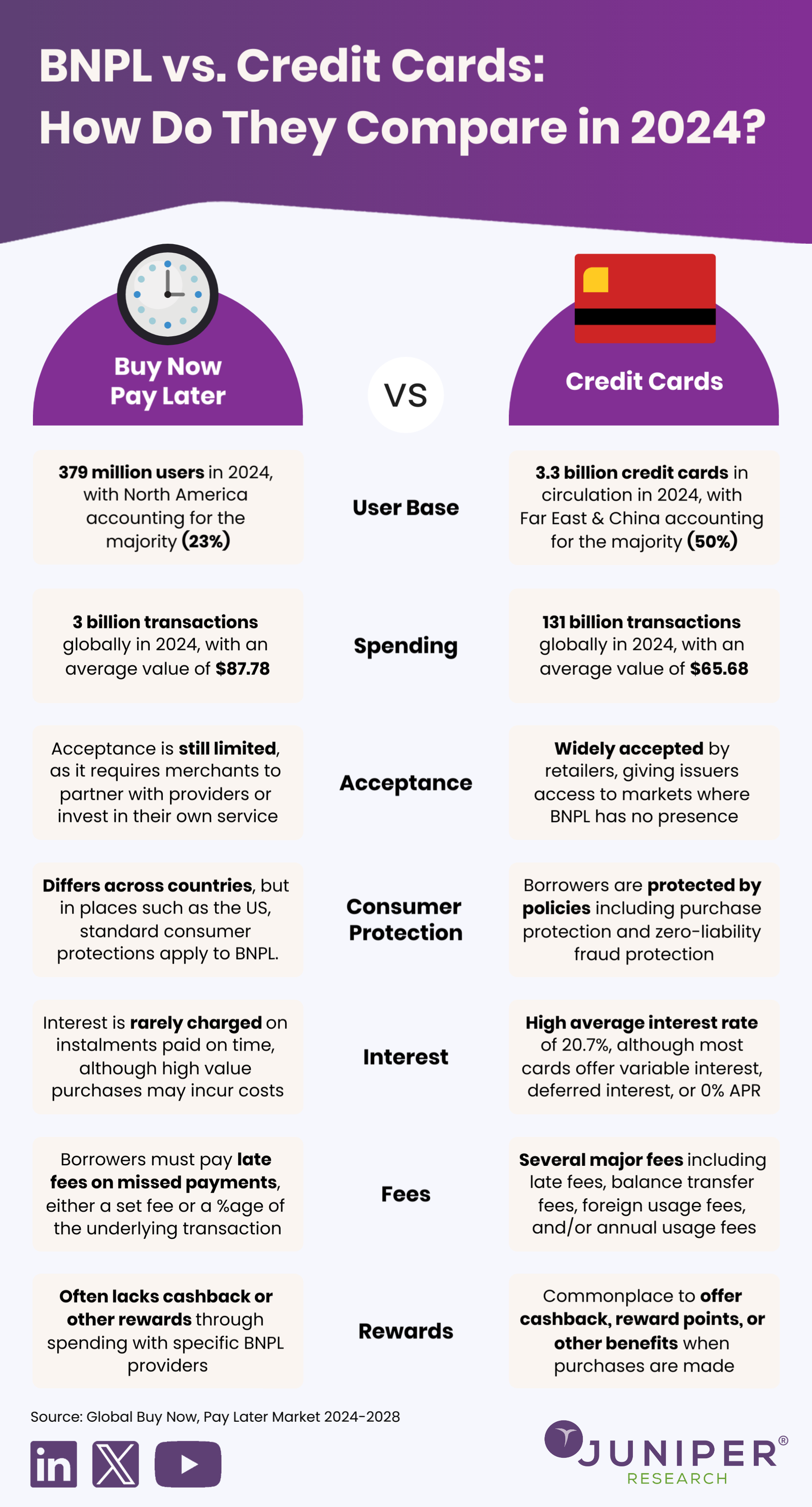

Buy now, pay later explosion

This generational distrust hasn’t eliminated the need for financing; it has redirected it. Enter Buy Now, Pay Later (BNPL). Offering instant, often interest-free (if paid on time) installment plans at checkout, BNPL bypasses traditional credit checks and card networks. Its appeal is visceral: immediate gratification without the perceived long-term entanglement of revolving credit. Since 2025, BNPL usage has exploded by 400%, becoming the default credito mechanism for millions under 30. However, its very accessibility masks significant risks:

| Feature | Traditional Credit Card | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Approval | Hard credit check, income verification | Soft check or no check, minimal verification |

| Cost | APR (potentially high), annual fees possible | Often 0% interest if on time; late fees high |

| Debt Impact | Reports to bureaus, builds history | Rarely reports on-time payments; only reports delinquencies |

| Oversight | Regulated under CARD Act, clear disclosures | Patchy regulation, complex fee structures |

| Risk | Predictable costs, established dispute process | Fee spiral potential, fragmented payments, minimal credit building |

BNPL thrives on frictionless spending but offers minimal credito building benefits. A missed payment triggers punitive fees and can damage the thin credit file it helped avoid establishing – a precarious trade-off for convenience.

The Ultimate Trust Test

As traditional credito models face generational headwinds and BNPL surges, the foundations of financial trust are undergoing radical stress tests. Two frontiers are particularly contentious: the decentralized promise of crypto and the intimate reach of biometrics.

Crypto vs traditional credit

Blockchain-based lending platforms tout revolutionary advantages: near-instantaneous settlement, elimination of intermediary banks, and lending pools accessible globally via “DeFi” (Decentralized Finance). Proponents argue this democratizes credito, especially for the unbanked. Yet, the reality in 2025 remains fraught:

- Innovation: Smart contracts automate loan terms, collateralization (often using volatile crypto assets), and repayment. Cross-border loans become simpler.

- Risk: Volatility is catastrophic. A sudden crypto market crash can trigger automatic, total liquidation of collateral, leaving borrowers with nothing. Regulatory uncertainty is immense – if a platform vanishes or is hacked, recourse is often non-existent. “Trustless” systems still require immense trust in unfamiliar technology and anonymous code. Is this credito evolution or a systemic gamble masquerading as innovation?

Biometric banking frontiers

The quest for frictionless security is pushing credito into the physical body. Palm vein scanners, fingerprint authorization, and even behavioral biometrics (how you type, hold your phone) are rapidly replacing plastic cards and PINs. Major retailers and banks now pilot payment systems where a simple wave of your hand deducts funds. The appeal is undeniable: enhanced security (your vein pattern is harder to steal than a card number) and ultimate convenience. But it forces a profound question: how much biological intimacy are we willing to trade for credito access? The infrastructure for widespread biometric credito is being built today, often with murky long-term data ownership and privacy safeguards. Reclaiming control over compromised traditional credito is complex; reclaiming your biometric identity could be impossible.

Navigating these credito crossroads demands vigilance. Whether choosing between BNPL and cards, evaluating crypto’s promises, or adopting biometric convenience, understanding the hidden trade-offs is paramount. Rebuilding or optimizing your financial foundation requires translating this complex landscape into actionable strategy. For those seeking structured pathways to master modern credito challenges, resources like those offered by fixcreditscenter.com provide essential frameworks for transforming uncertainty into control.

Key Takeaways on Credito Mastery

From its Latin roots meaning “to believe” to today’s digital credit scores, credito remains the silent gatekeeper of financial opportunity. We’ve explored how trust transforms into borrowing power across cultures (like Brazil’s parcelado system), why your credit score acts as a “financial shadow,” and strategies to rebuild after crises—including the 30-day dispute method and secured cards. The 2025 landscape introduces new challenges: BNPL’s rise among Gen Z, crypto lending risks, and biometric payments trading convenience for privacy.

Ready to transform your credito future? Whether repairing past missteps or optimizing your score, take action today. Visit fixcreditscenter.com for expert guidance—then share your credit journey below! Which strategy resonated most with you?