Did you know a single hard inquiry can drop your credit score by 10 points? Understanding how these credit checks work is crucial for maintaining financial health in 2025. Learn to spot and manage hard inquiries effectively.

Understanding Hard Inquiries

What Exactly is a Hard Inquiry?

A hard inquiry (also known as a hard pull) occurs when a lender or financial institution checks your credit report because you’ve formally applied for credit. This type of credit check requires your explicit permission and is directly tied to a decision-making process about lending you money or extending credit. Lenders initiate hard inquiries to assess your creditworthiness and risk level before approving applications.

Definition and Common Triggers

Hard inquiries are strictly linked to applications for new credit. Common triggers include:

- Lender pulls your report for loan application: Applying for mortgages, auto loans, personal loans, or student loans always generates a hard inquiry.

- Credit card application process: Every application for a new credit card, whether approved or denied, results in a hard pull on your report.

- Requesting a credit limit increase: Some lenders perform a hard inquiry before granting a significant increase to your existing credit line.

- Opening new utility accounts: Certain utility providers (like cell phone companies or energy suppliers) might run a hard check, particularly if they require a security deposit based on your credit.

- Applying for an apartment lease: Many landlords and property management companies use hard inquiries to screen potential tenants.

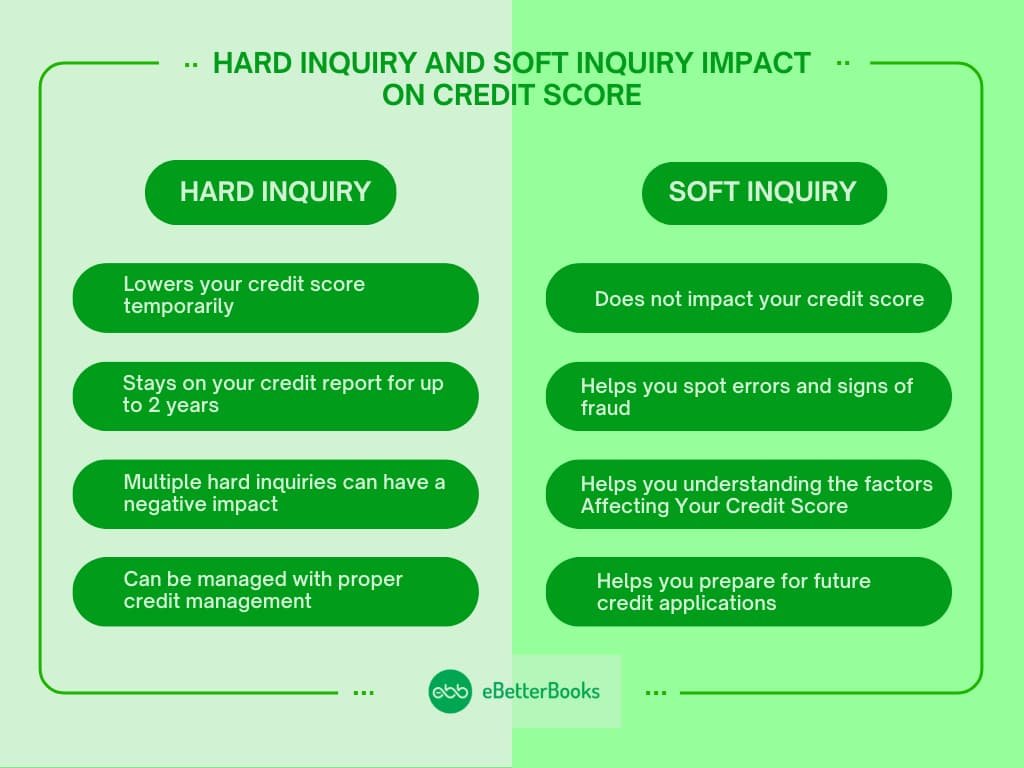

Hard Inquiry vs. Soft Inquiry

Understanding the distinction between hard and soft inquiries is crucial for managing your credit health. The fundamental difference lies in why the credit report is being accessed and who initiated the request.

Key Differences in Visibility

- Only you see soft pulls: Soft inquiries occur when your credit report is accessed for reasons unrelated to a specific credit application you initiated. These include checking your own credit score (via AnnualCreditReport.com or many credit monitoring services), pre-approved credit offers (“pre-qualification”), or background checks by potential employers. Soft inquiries are visible only to you on your personal credit reports. Lenders and other entities reviewing your report do not see soft inquiries.

- Lenders see hard pulls: Hard inquiries, tied to your credit applications, are visible to any lender or entity that accesses your full credit report. They indicate that you are actively seeking new credit, which is a factor lenders consider.

Impact on Credit Scores

The impact on your credit scores differs significantly:

| Inquiry Type | Visibility to Lenders | Impact on Credit Score | Common Triggers |

|---|---|---|---|

| Hard Inquiry | Visible to lenders reviewing your report | Typically causes a small, temporary dip (often 5-10 points). Impact lessens over time, remains on report for 2 years (but only affects score for about 1 year in most scoring models). | Formal credit applications (loans, credit cards), some rental/utility applications. |

| Soft Inquiry | Not visible to lenders | No score change whatsoever. Does not factor into lending decisions. | Checking your own credit, pre-approved offers, employer background checks, account reviews by existing creditors. |

Managing hard inquiries is part of responsible credit use. While their impact is usually minor and temporary, excessive hard inquiries in a short period can signal higher risk to lenders. If you spot a hard inquiry you don’t recognize, it’s essential to investigate it as potential fraud. You have the right to dispute inaccurate inquiries with the credit bureaus. For complex credit report errors or guidance on optimizing your profile, reputable resources like fixcreditscenter.com can offer valuable support tailored to your 2025 credit goals.

Spotting Unauthorized Inquiries

Monitoring your credit reports is the essential first step to identify and address unauthorized hard inquiries. These inquiries shouldn’t appear unless you’ve formally applied for credit with that specific lender.

How to Check Your Credit Reports

Regularly reviewing your full credit reports from all three major bureaus (Experian, Equifax, TransUnion) is non-negotiable for spotting discrepancies.

Accessing Free Annual Reports

The only federally authorized source for free weekly credit reports is AnnualCreditReport.com. As of 2025, consumers can access reports from all three bureaus weekly at no cost. This is the most comprehensive way to check for unauthorized inquiries.

Identifying Inquiry Sections

Hard inquiries are clearly labeled within dedicated sections of your credit report:

- Look for headings like “Hard Inquiries,” “Regular Inquiries,” or “Requests Viewed by Others.”

- Each entry lists the name of the company that accessed your report and the exact date of the inquiry.

- Carefully review every entry in this section during your 2025 credit check.

Red Flags for Fraudulent Inquiries

Certain patterns or unknown entries should trigger immediate investigation:

Unrecognized Company Names

- Verify Creditor Identity: If you see a lender name you don’t associate with any recent credit application (loan, credit card, etc.), don’t ignore it. Research the company name listed. Sometimes it might be a parent company or service provider name different from the brand you applied with (e.g., “Elan Financial” might appear for an application made with your local bank’s credit card).

- Zero Association = Major Concern: If you cannot connect the company name to any legitimate application you submitted, treat it as a potential red flag for fraud.

Multiple Unexpected Inquiries

- Potential Identity Theft Indicator: Discovering several hard inquiries from different lenders within a short timeframe (e.g., a few days or weeks) that you did not initiate is a strong signal of possible identity theft. Fraudsters often apply for multiple lines of credit rapidly using stolen information.

- Compare Dates: Note the dates of suspicious inquiries. A cluster of inquiries around the same time heightens suspicion.

Finding an unauthorized hard inquiry means it was likely made without your permission for a credit application you didn’t submit. You have the right to dispute these inaccurate entries directly with the credit bureaus to have them removed. For persistent errors or complex cases, services like fixcreditscenter.com provide specialized support in navigating the 2025 credit dispute landscape effectively.

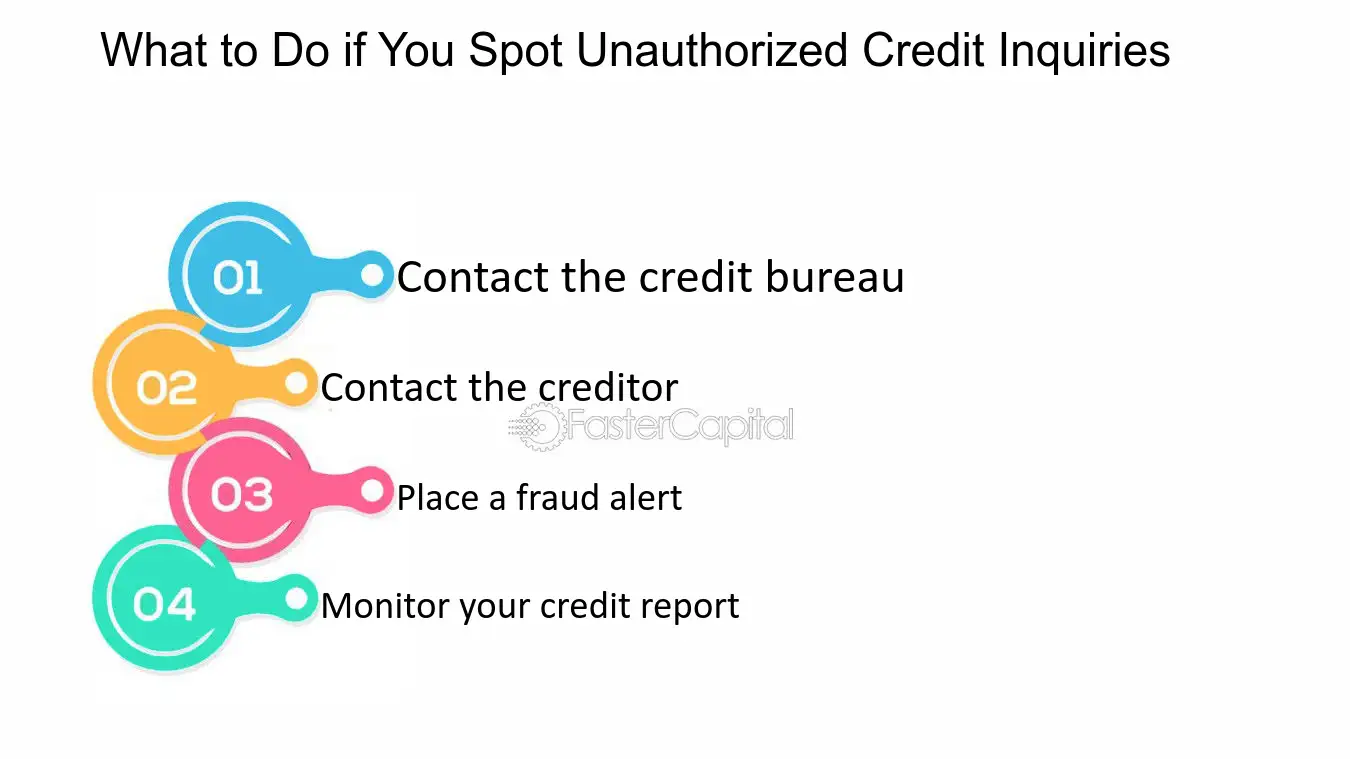

Removing Fraudulent Inquiries

Finding an unauthorized hard inquiry means it was likely made without your permission for a credit application you didn’t submit. Taking prompt action is crucial to get these inaccurate entries removed from your credit reports and protect your 2025 credit score.

Step 1: Contact the Creditor Directly

Before disputing with the credit bureaus, reach out to the company listed as having made the unauthorized hard inquiry.

Gathering inquiry details

- Company Name: Locate the exact name of the company that performed the inquiry from your credit report.

- Contact Information: Find the phone number or address listed for that company on your report. If none is provided, search for their official contact details online.

Disputing the inquiry

- Initiate Contact: Call or write to the creditor’s fraud/security department. Clearly state that you did not authorize the credit application associated with the hard inquiry on your report.

- Request Verification: Ask the creditor to investigate the inquiry and provide you with a verification letter confirming they cannot find a record of a legitimate application from you. This letter is vital evidence for your bureau disputes.

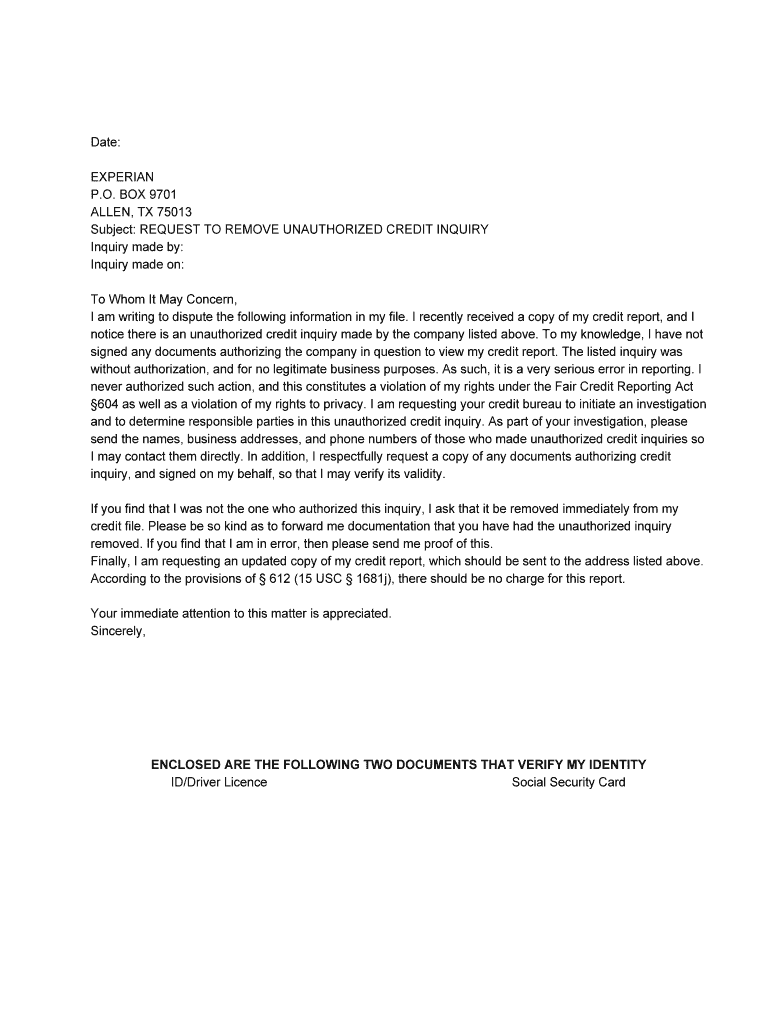

Step 2: File Official Disputes

Once you’ve contacted the creditor, file formal disputes with all three major credit bureaus.

Contacting all three bureaus

You must dispute the unauthorized inquiry separately with Equifax, Experian, and TransUnion. Each bureau maintains its own report and requires its own dispute process.

| Bureau | Online Dispute Portal | Mailing Address (General) |

|---|---|---|

| Equifax | www.equifax.com/disputes | P.O. Box 740256, Atlanta, GA 30374 |

| Experian | www.experian.com/disputes | P.O. Box 4500, Allen, TX 75013 |

| TransUnion | www.transunion.com/credit-disputes | P.O. Box 2000, Chester, PA 19016 |

Always check the bureau’s official website for the most current mailing address and online dispute instructions in 2025.

Required documentation

Submitting robust documentation significantly strengthens your dispute. Include copies (not originals) of:

- FTC Identity Theft Report: Filed at IdentityTheft.gov. This is essential if you suspect identity theft.

- Police Report: If you filed one regarding the fraudulent application/inquiry.

- Verification Letter: The letter you requested from the creditor stating they cannot verify the application.

- Copy of Credit Report: Highlight the unauthorized inquiry in question.

Dispute Timeline Expectations

Understanding the process helps manage expectations.

Typical investigation period

- Credit bureaus are generally required to investigate disputes within 30 days of receiving them under the Fair Credit Reporting Act (FCRA).

- The bureau will contact the creditor that made the inquiry to verify its legitimacy. If the creditor cannot verify the inquiry or fails to respond within the timeframe, the bureau must remove it.

Follow-up procedures

- Check Status: Most bureaus allow you to track your dispute status online. Check the portal regularly.

- Review Results: Once the investigation is complete (typically within 30 days), the bureau will send you the results in writing and provide a free, updated copy of your credit report reflecting the outcome.

- Verify Removal: Carefully review this updated report to confirm the unauthorized hard inquiry has been removed from that specific bureau’s report. Remember: You need to check reports from all three bureaus separately to ensure removal across the board.

Successfully removing unauthorized hard inquiries requires diligence in both creditor communication and formal bureau disputes. For complex identity theft situations or if disputes stall, seeking specialized assistance from reputable services like fixcreditscenter.com can streamline the process and ensure your 2025 credit reports accurately reflect only legitimate activity.

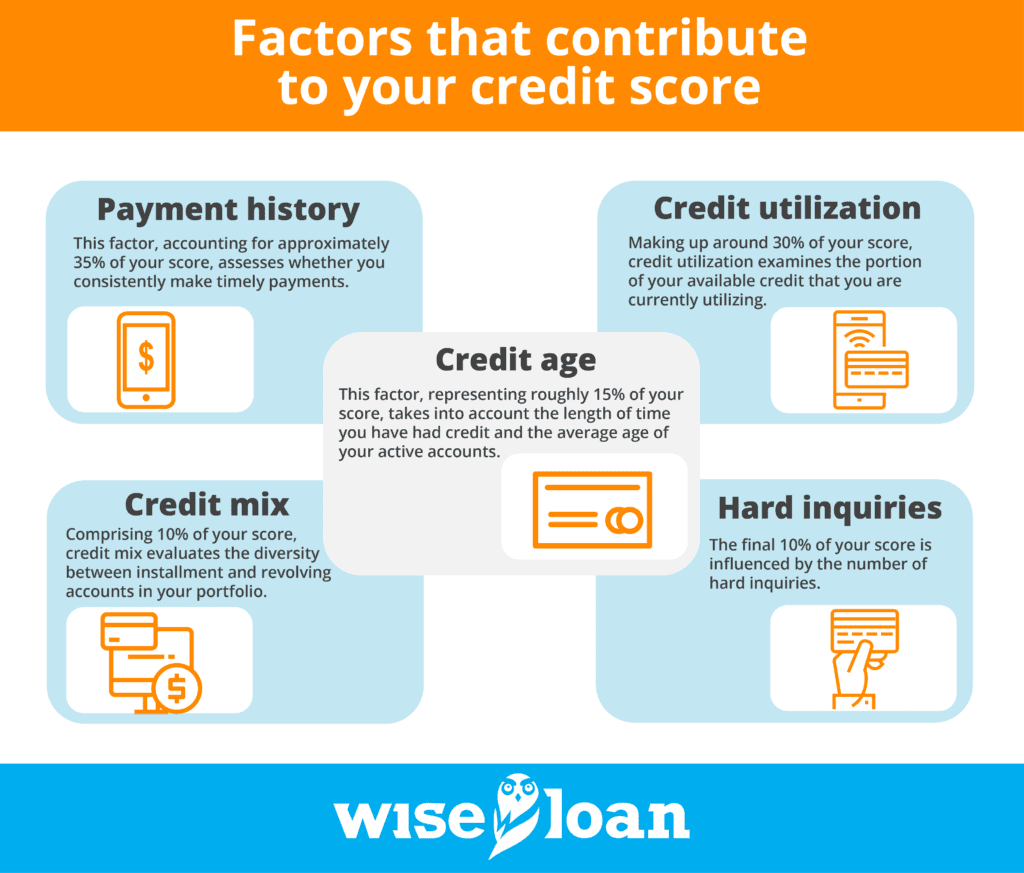

Impact on Credit Scores

Hard inquiries occur when a lender checks your credit report as part of a loan or credit card application decision. While legitimate inquiries are a normal part of credit-building, they can temporarily lower your score by a few points. Understanding their impact helps you manage credit applications wisely in 2025 and avoid unnecessary score drops. This section covers how long these effects last and special exceptions for rate shopping.

How Long Inquiries Affect You

Hard inquiries remain on your credit report for up to two years, but their influence on your credit score diminishes over time. The exact duration varies between scoring models, with FICO and VantageScore handling them differently.

FICO Score considerations

- Impacts first 12 months: In the widely used FICO scoring model (including versions like FICO 8 and FICO 9), hard inquiries have the most significant effect during the initial 12 months after they appear. After this period, their influence on your score lessens substantially, though they stay visible on your report until they naturally fall off.

VantageScore factors

- Less weight than FICO: VantageScore models (such as VantageScore 3.0 and 4.0) assign less importance to hard inquiries compared to FICO. They typically impact your score for a shorter duration—often only a few months—and the point deduction is generally smaller, making them less of a concern for your 2025 credit health.

Rate Shopping Exceptions

To encourage comparison shopping for major loans without penalizing your credit score, both FICO and VantageScore models include special rules for multiple inquiries in a short timeframe. These exceptions apply specifically to auto loans and mortgages, helping you secure the best rates without undue score damage.

Multiple auto/mortgage inquiries

- 14-45 day window: When you apply for multiple auto loans or mortgages from different lenders, all hard inquiries made within a specific window are treated leniently. In 2025, this window typically ranges from 14 to 45 days, depending on the scoring model. For instance, FICO allows a 45-day buffer, while VantageScore uses a 14-day period. This grace period starts from the date of your first inquiry.

Treated as single inquiry

- Minimizes score impact: All qualifying inquiries within this window count as a single hard inquiry on your credit report. This consolidation drastically reduces the potential score drop, often limiting it to just a few points total. For example, if you apply with five mortgage lenders in 30 days, it affects your score similarly to one application, making it easier to shop for favorable terms in 2025.

While managing inquiries is straightforward for legitimate activity, complex cases like unresolved disputes or identity theft may require expert guidance. Services like fixcreditscenter.com offer tailored support to help monitor and address credit report issues, ensuring your 2025 scores stay optimized.

Preventing Unauthorized Inquiries

While legitimate hard inquiries are part of credit applications, unauthorized ones indicate potential fraud. Taking proactive steps protects your credit report from illegitimate access. In 2025, consumers have robust tools to block unapproved credit checks before they occur.

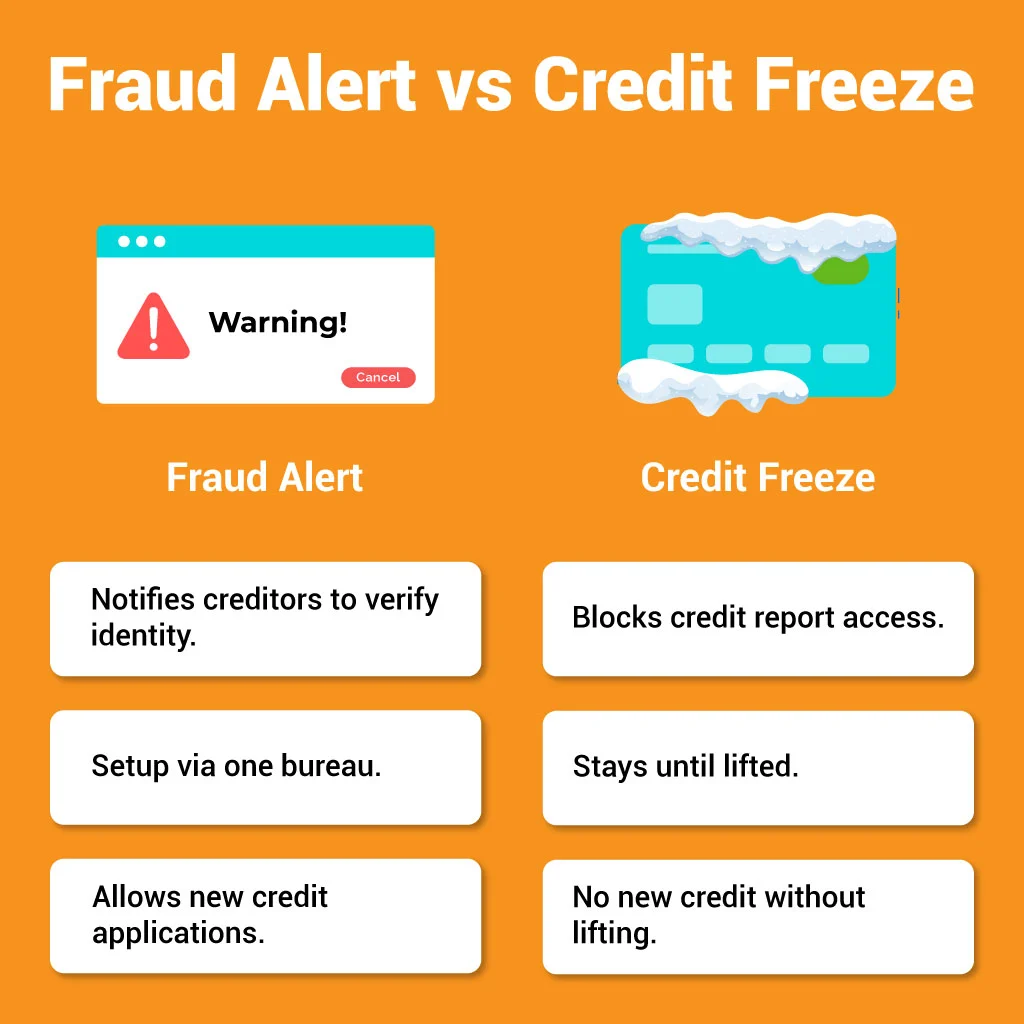

Placing Security Freezes

A security freeze (or credit freeze) is the strongest barrier against unauthorized hard inquiries. It prevents lenders from accessing your credit report entirely unless you temporarily lift the freeze.

How credit freezes work

- Blocks new credit applications: When a freeze is active at all three major credit bureaus (Experian, Equifax, and TransUnion), potential creditors cannot pull your credit report. This stops fraudulent accounts from being opened in your name.

- Free at all three bureaus: Federal law mandates that credit freezes must be free to place, temporarily lift, and remove. You must request a freeze separately with each bureau. As of 2025, this remains the most effective preventative measure.

| Credit Freeze Action | Cost | Effect |

|---|---|---|

| Placing a Freeze | Free | Blocks all new credit report access |

| Temporarily Lifting | Free | Allows access for a specified time/creditor |

| Removing Permanently | Free | Restores normal credit report access |

Setting Fraud Alerts

Fraud alerts require creditors to verify your identity before opening new accounts, offering layered protection without completely blocking access like a freeze.

Initial 1-year alert

- Creditors must verify identity: Placing a single initial fraud alert at any one bureau (they notify the others) requires lenders to take reasonable steps to confirm your identity before approving credit. This alert lasts for one year and is ideal if you suspect potential risk but don’t require a full freeze.

Extended victim alerts

- 7-year protection: If you’ve filed a valid identity theft report (e.g., with the FTC), you qualify for an extended fraud alert. This lasts for seven years and provides stronger identity verification requirements for creditors reviewing applications in your name during 2025.

Regular Credit Monitoring

Consistent oversight helps detect unauthorized inquiries quickly, minimizing potential damage to your 2025 credit scores.

Spotting inquiries early

- Monthly report checks: Federal law entitles you to one free credit report annually from each bureau via AnnualCreditReport.com. Staggering these requests (e.g., one bureau every four months) provides year-round monitoring. Check the “Hard Inquiries” section for any applications you didn’t initiate.

Identity theft protection

- Dark web scanning: Many monitoring services scan the dark web for your personal information being traded. Combined with alerts for new inquiries or accounts, this offers proactive defense against identity theft before fraudulent inquiries appear. For comprehensive monitoring and dispute assistance, platforms like fixcreditscenter.com provide specialized tools to safeguard your credit profile throughout 2025.

Hard Inquiry FAQs Solved

Can Legitimate Inquiries Be Removed?

Legitimate hard inquiries—those tied to actual credit applications you authorized—are part of your accurate credit history. They cannot be removed before their natural expiration.

Why it’s impossible

- Part of accurate history: Credit bureaus legally must report factual lending activity. Legitimate inquiries reflect your genuine applications and help lenders assess your credit-seeking behavior.

- No valid dispute grounds: Disputes succeed only for errors, fraud, or unapproved pulls. Valid inquiries lack legal or factual justification for removal.

Shady removal services

- Potential scams warning: Services promising “guaranteed” hard inquiry removal often charge high fees for illegal tactics (e.g., fabricating fraud claims). These can backfire, damaging your credit further or triggering fraud investigations. Legitimate disputes are free through bureaus or tools like fixcreditscenter.com.

| Legitimate Removal Path | Illegitimate Tactic | Risk |

|---|---|---|

| Dispute errors/fraud (free) | Paying for “guaranteed” deletion | Fines, credit damage |

| Waiting 2 years (automatic) | Disputing valid inquiries | Rejected dispute, flagged account |

How Long Until They Disappear?

Hard inquiries have a fixed lifespan on your credit report.

Maximum reporting period

- Two years on report: By law, hard inquiries remain visible on your credit report for exactly 24 months from the date they occurred.

Natural score recovery

- Points rebound after 6 months: While inquiries stay for two years, their scoring impact fades quickly. Most credit score damage (typically 5-10 points per inquiry) rebounds within 6 months, assuming no new negative events. High-scoring individuals usually see the fastest recovery.

Difference in Score Impact

Not all inquiries affect scores equally.

FICO vs VantageScore

- 5-10 point typical drop: Both major scoring models (FICO and VantageScore) usually deduct 5-10 points per hard inquiry. VantageScore 4.0+ treats multiple auto/mortgage inquiries within 14-45 days as a single inquiry for scoring. FICO allows a 14-45 day rate-shopping window (depending on version).

High-score vs low-score impact

- Larger effect on pristine credit: Individuals with high credit scores (e.g., 780+) often experience larger point drops per inquiry than those with lower scores. This occurs because high scores have fewer negative factors, making new inquiries proportionally more significant. Protecting your score through proactive monitoring services like fixcreditscenter.com remains crucial in 2025.

[object Object]