Did you know bankruptcy can slash 200 points off your credit score? Understand the real impact and discover actionable steps to rebuild your credit faster by 2025. Learn how to turn financial setbacks into comebacks.

【Bankruptcy & Your Credit: The Real Impact You Must Know】

How Bankruptcy Crushes Your Credit Score (And For How Long)

Immediate Score Impact

Bankruptcy delivers a significant blow to your credit score, there’s no sugarcoating it. For most individuals, filing results in an immediate 100-200 point drop in your FICO score. This drastic plunge reflects the severe nature of bankruptcy as a credit event. Crucially, the higher your starting credit score was before filing, the steeper the fall tends to be. If you entered bankruptcy with excellent credit (say, 780+), you could easily lose over 200 points. Someone starting with a fair score (e.g., 650) might see a drop closer to 100-150 points. Why? Higher scores simply have farther to fall, and the scoring models penalize recent severe negative events heavily, regardless of past history.

Here’s a rough guide to potential impacts based on pre-filing score tiers:

| Pre-Bankruptcy Credit Score Tier | Typical Point Drop Range | Notes |

|---|---|---|

| Excellent (780 – 850) | 200+ points | Steepest fall due to distance from “floor” |

| Good (670 – 779) | 150-200 points | Significant damage, starting from solid ground |

| Fair (580 – 669) | 100-150 points | Still substantial, but less dramatic fall |

| Poor (Below 580) | Less than 100 points | Already low score limits the drop magnitude |

Long-Term Reporting Consequences

The record of your bankruptcy filing isn’t a fleeting mark; it becomes a prominent and lasting entry on your credit reports. You’ll find it clearly listed in the “Public Records” section of reports from Equifax, Experian, and TransUnion. This section is one of the first things lenders scrutinize. Furthermore, every single debt discharged through your bankruptcy will be individually marked with notations like “included in bankruptcy” or “discharged in bankruptcy.” This ensures lenders reviewing your report understand the scope of the event. While the initial sting lessens over time, this public record serves as a stark reminder to potential creditors for years. The key takeaway? The bankruptcy entry itself remains visible for either 7 years (Chapter 13) or 10 years (Chapter 7) from the filing date, acting as a long-term anchor on your score recovery – though its weight does gradually decrease as years pass and you build new positive credit history. Seeing those marks can be disheartening, but understanding them is the first step to strategically overcoming them. Rebuilding requires patience and the right tools; exploring reputable resources designed for post-bankruptcy recovery can provide a structured path forward. Discover solutions tailored for your fresh start in 2025 at Your Credit Solution Link.

【Your Post-Bankruptcy Financial Game Plan】

Rebuilding your credit after bankruptcy isn’t just possible—it’s absolutely achievable with the right strategy and tools. The impact on your score, as discussed earlier, is severe but temporary. Now, let’s focus on actionable steps to regain financial stability. This game plan centers on proven tools and realistic milestones, empowering you to take control step by step.

Essential Tools for Credit Rebuilding

After bankruptcy, your credit history needs rebuilding from the ground up. Start with these foundational tools to demonstrate responsible financial behavior. They’re designed to report positive activity to all three credit bureaus, gradually offsetting the bankruptcy’s weight on your reports.

Secured Credit Cards: Your First Step Back

This is your most accessible tool right after bankruptcy discharge. You’ll provide a refundable security deposit—typically ranging from $200 to $2,500—which sets your credit limit. Use it for small, regular purchases (like groceries or gas), and pay the balance in full every month. Crucially, responsible usage reports to Equifax, Experian, and TransUnion, building a track record of on-time payments. Think of it as training wheels for credit: low-risk but highly effective for showing lenders you’re reliable again.

Credit-Builder Loans: Forced Savings Strategy

If a secured card feels too daunting, consider a credit-builder loan. Here’s how it works: the lender holds the loan amount (e.g., $500-$1,000) in a secured account while you make fixed monthly payments over 6-24 months. Once completed, you receive the funds plus any interest earned. Throughout this process, your payments report to all three credit bureaus, adding positive history after discharge. It’s a “forced savings” approach—you build credit while accumulating cash for emergencies, making it a win-win for your fresh start.

Setting Realistic Recovery Milestones

Patience is key in credit rebuilding—aim for steady progress, not overnight fixes. Base your goals on timeframes that align with how bankruptcy’s impact fades (7-10 years on reports). Track these milestones to stay motivated and measure success.

Short-Term Goals (0-6 Months)

Focus on foundational actions immediately after bankruptcy discharge:

- Obtain a secured credit card: Apply for one within the first 1-2 months to kickstart positive reporting. Use it sparingly (keep utilization below 30%) and automate payments to avoid misses.

- Build a $500 emergency fund: Start small by setting aside $20-$50 weekly into a dedicated savings account. This cushion prevents reliance on credit for unexpected expenses, reducing relapse risk. Achieving both within 6 months establishes momentum and proves your commitment to lenders.

Long-Term Targets (2-5 Years)

As the bankruptcy’s sting lessens, aim higher:

- Achieve a credit score above 700: By consistently using rebuilding tools, you can reach this threshold within 2-5 years. Monitor your score quarterly—growth from the post-bankruptcy low (e.g., 500s) to 700+ signals strong recovery and opens doors to better opportunities.

- Qualify for prime-rate loans: With a score above 700, you’ll access lower interest rates on auto loans or mortgages by 2025. This saves thousands in interest compared to subprime offers, putting you back in control of major financial decisions.

Sticking to this plan transforms bankruptcy from an anchor into a stepping stone. For personalized tools and support tailored to your 2025 journey, explore options at Your Credit Solution Link.

【Rebuild Credit After Bankruptcy: Your Action Plan】

Bankruptcy reshapes your credit landscape, but the path forward is clear. Building on the foundational tools (secured cards and credit-builder loans), your next critical moves involve meticulously auditing your reports and strategically deploying new credit lines. Let’s turn your attention to these actionable steps designed to accelerate your recovery by 2025.

Step 1: Audit & Repair Your Credit Reports

Post-bankruptcy credit reports often contain errors that drag your score down. Your discharge doesn’t automatically guarantee accuracy. Within the first 60 days after discharge, request reports from all three bureaus and scrutinize every entry. This is non-negotiable groundwork—errors left unchecked sabotage rebuilding efforts before they start.

Disputing Errors Post-Bankruptcy

Focus like a laser on these common, damaging mistakes:

- Accounts not marked “discharged in bankruptcy”: Lenders sometimes fail to update status. An account showing “open” or “past due” post-discharge falsely inflates your debt burden.

- Incorrect balances: Discharged debts must show $0 balance. Any non-zero amount misrepresents your obligations.

- Duplicate listings: The same debt might appear multiple times under different names, multiplying the negative impact.

How to fight back:

- Document everything: Highlight errors on your physical credit reports.

- Challenge via certified mail: Send dispute letters (with report copies and proof of discharge) to each bureau listing the error. Certified mail provides legal proof of receipt.

- Demand corrections within 30 days: Bureaus must investigate and respond within a month. Persist if they stall—your financial future depends on it.

Regular Credit Monitoring Tactics

Vigilance is your new habit. Don’t wait for annual checks:

- Leverage free weekly reports: Use AnnualCreditReport.com—federally guaranteed access to weekly reports from Equifax, Experian, and TransUnion until December 2025.

- Track progress digitally: Apps like Credit Karma (free) or Experian’s service provide real-time score updates and alerts for new inquiries or accounts, helping you spot fraud or errors fast.

> Set quarterly review reminders! Consistent monitoring catches setbacks early and motivates you as positive trends emerge.

Step 2: Rebuild With Strategic Credit Products

Diversifying your credit mix accelerates score gains. After establishing secured cards or credit-builder loans (as outlined previously), these tactics add layers of positive reporting:

Secured Card Best Practices

Maximize impact with disciplined use:

| Action | Why It Matters | Target Timeline |

|---|---|---|

| Keep utilization below 30% | High usage signals risk, even if paid off. A $200 limit means never spending over $60 monthly. | Immediate & Ongoing |

| Pay in full BEFORE the statement date | Avoids interest AND ensures bureaus see low utilization. Payment timing is crucial. | Every Month |

| Request limit increases | After 6-12 months of perfect payments, ask. Higher limits lower utilization ratios naturally. | 6-12 Months Post-Opening |

| Graduate to an unsecured card | Many issuers (e.g., Discover, Capital One) review accounts annually for conversion, refunding your deposit. | 12-18 Months Post-Opening |

Becoming an Authorized User

This leverages someone else’s good credit responsibly:

- Requires deep trust: Approach only a family member or partner with excellent credit (score 750+), low utilization, and flawless payment history on the card. Their habits directly impact you.

- Ensure they report to ALL bureaus: Confirm the issuer reports authorized user activity to Equifax, Experian, AND TransUnion—not all do.

- Set ground rules: Never hold the physical card unless spending is pre-approved. Your goal is credit history, not spending access.

- Exit strategy: Once your own credit strengthens (usually 1-2 years), remove yourself to avoid future dependency.

Key Benefit: The primary cardholder’s entire account history (age of account, payment record) reflects on YOUR report, counteracting bankruptcy’s recency.

Rebuilding demands precision and patience, but every corrected error and on-time payment chips away at bankruptcy’s shadow. By 2025, these steps position you for prime rates and renewed financial confidence. For customized dispute templates, secured card comparisons, and progress trackers updated for 2025 regulations, streamline your journey at https://fixcreditscenter.com.

【Maintain Positive Credit Habits】

Bankruptcy recovery hinges on consistency. While auditing reports and strategic credit products lay the foundation, your daily habits determine how quickly your score climbs by 2025. Payment discipline and utilization mastery are non-negotiable—they collectively influence 65% of your FICO® Score.

Payment History: Your Most Powerful Tool

A single late payment post-bankruptcy can undo months of progress. This category dominates your score calculation, making precision non-negotiable.

Why On-Time Payments Matter Most

- 35% of your FICO® Score reflects payment history.

- One 30-day late payment can slash 100+ points from a recovering score.

- Late payments linger for 7 years, amplifying long-term damage.

Automatic Payment Strategies

Eliminate human error with systems:

- Layer your reminders:

- Set phone alerts 5 days before due dates

- Enable email notifications from lenders

- Schedule a recurring calendar review (e.g., every Sunday)

- Automate the essentials:

1. Link checking accounts to cover MINIMUM payments

2. Set payments 2 days before actual due dates

3. Verify transactions via banking alerts

- Prioritize strategically: If funds are tight, pay secured cards first—they’re rebuilding your primary toolkit.

Mastering Credit Utilization Ratios

Your second-largest scoring factor (30%) demands active management. Post-bankruptcy, low limits magnify risk—a $300 charge on a $1,000 card hurts more than the same charge on a $10,000 limit.

The 30% Rule Demystified

| Scenario | Calculation | Impact |

|---|---|---|

| $1,000 limit | Max recommended: $300 | High risk: Scores drop if exceeded |

| $500 limit | Max recommended: $150 | Critical: Exceeding $50 (10%) damages scores |

| Ideal practice | Aim for 7-10% ($70-$100 on $1k limit) | Maximizes score gains |

Pro Tip: Utilization has no memory. If you hit 50% one month, slashing it to 8% the next resets the impact—but frequent spikes signal instability to lenders.

Strategic Payment Timing

Outsmart the reporting cycle:

- Pay BEFORE the statement closes: Card issuers report balances on your statement date. Paying charges mid-cycle (e.g., weekly) ensures lower reported utilization.

- Split charges strategically: If using multiple cards, distribute spending to keep each below 10%.

- Emergency buffer: If unexpected expenses spike utilization, pay immediately—don’t wait for the due date.

Rebuilding isn’t about perfection—it’s about persistent progress. Every on-time payment and controlled balance proves reliability. By 2025, these habits compound: lenders see disciplined behavior, not past setbacks. For real-time utilization calculators and automated payment planners aligned with 2025 credit regulations, accelerate your rebuild at https://fixcreditscenter.com.

【Long-Term Financial Health Strategies】

Bankruptcy resets your finances—not your future. Beyond meticulous credit habits, lasting stability requires rebuilding your economic foundation. By 2025, your financial health depends on two pillars: intentional budgeting and knowing when to seek expert support.

Budgeting After Bankruptcy: Your New Foundation

Cash flow management is non-negotiable. Post-bankruptcy, every dollar must serve a purpose—prioritizing needs, controlled wants, and mandatory savings.

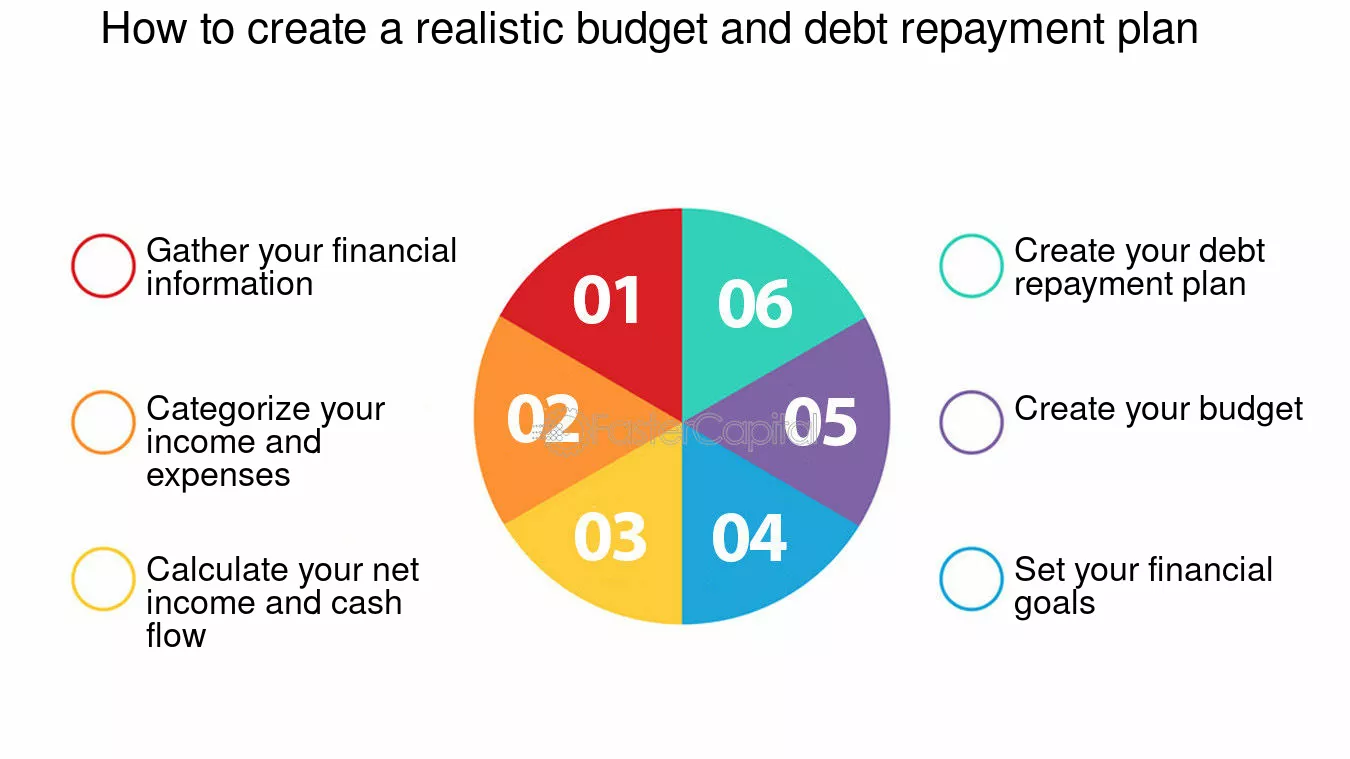

Creating a Sustainable Spending Plan

Adopt the 50/30/20 framework:

- 50% for Essentials: Housing, utilities, groceries, insurance

- 30% for Discretionary: Dining, entertainment, subscriptions (cut ruthlessly if rebuilding slowly)

- 20% for Financial Priorities: Debt payments + savings contributions

Track relentlessly:

- Use apps like Mint or YNAB to auto-categorize transactions

- Review weekly: Spot spending leaks before they drain progress

- 2025 Alert: New FTC rules require budgeting apps to offer free credit-score simulations—leverage these to test financial decisions

Building Your Safety Net

Emergency funds prevent backsliding:

- Phase 1: Target $500 immediately—covers minor crises (e.g., car repairs)

- Phase 2: Ramp to 3-6 months’ living expenses

| Monthly Expenses | 3-Month Goal | Monthly Save Needed (12 Months) |

|------------------|--------------|--------------------------------|

| $2,000 | $6,000 | $500 |

| $3,500 | $10,500 | $875 |

- Automate deposits: Treat savings like a non-negotiable bill

When to Seek Professional Guidance

Self-rebuilding works—until it doesn’t. Recognize these crossroads:

Credit Counseling Red Flags

Seek help if you experience:

- Cash flow failures: Skipping essentials (rent/medications) to pay debts

- Stagnant scores: FICO® stays below 580 after 12 months of disciplined effort

- Collection recycling: New accounts slipping into delinquency repeatedly

Choosing Reputable Services

Vet providers rigorously:

- Must-haves:

- NFCC (National Foundation for Credit Counseling) accreditation

- Free initial consultations

- Written action plans with clear fees

- Avoid:

- Upfront fees before service delivery

- Promises to “erase” bankruptcy from reports

- Pressure to enroll in debt management plans prematurely

2025 Insight: Under the Consumer Credit Reform Act, accredited counselors must provide FICO® Simulator access—use it to preview guidance impact before committing.

Bankruptcy isn’t your life sentence—it’s a financial recalibration. Every saved dollar and informed decision rebuilds resilience. For customized 50/30/20 calculators and NFCC-vetted counseling matching services updated for 2025 regulations, rebuild with precision at https://fixcreditscenter.com.

Key Takeaways for Rebuilding Credit Post-Bankruptcy

Bankruptcy significantly impacts your credit score, but recovery is achievable with disciplined steps. Start with secured credit cards and credit-builder loans to establish positive payment history. Regularly audit your credit reports for errors and maintain low utilization rates. Set short-term goals like building a $500 emergency fund and long-term targets such as achieving a 700+ credit score by 2025.

Ready to take control of your financial future? Share your rebuilding journey in the comments or click below to explore tailored credit solutions. Your fresh start begins today!