Did you know 34% of Americans have errors on their credit reports? Free credit repair certification teaches you to legally fix these mistakes and boost your score—no costly services needed. Learn how in 2025!

【Understanding Free Credit Repair Certification】

What Free Certification Actually Teaches

Reputable free credit repair certification programs equip you with practical, actionable knowledge for navigating your credit rights. Think of them as intensive workshops focused on self-advocacy under federal law. They demystify the complex processes consumers face when trying to correct their own credit reports. Crucially, these programs teach you how to operate within the legal boundaries established by the Fair Credit Reporting Act (FCRA) and other consumer protection statutes.

Core skills covered in quality programs

Quality free certification curricula focus on these fundamental, legally sound skills:

- How to legally dispute credit report errors under FCRA: You’ll learn the exact steps for drafting effective dispute letters that trigger the credit bureaus’ legal obligation to investigate, including citing specific FCRA sections and the required 30-day investigation window.

- Techniques to identify inaccurate negative items: Training covers how to meticulously review credit reports from Equifax, Experian, and TransUnion to spot common errors like outdated information, incorrect account statuses, mixed files, and fraudulent entries.

- Understanding credit bureau dispute processes: Programs explain the behind-the-scenes workflow at the credit bureaus once your dispute is received, how to track its status effectively, and how to interpret the results (verification, modification, or deletion of the item).

Certification vs. Professional Licensing

It’s vital to understand that completing a free credit repair certification program does not equate to becoming a licensed credit repair professional. This distinction is critical for both consumers seeking help and individuals considering offering services.

Key differences consumers must know

- Certification indicates training completion only: Earning a free certification means you’ve successfully learned specific credit repair strategies and consumer rights. It demonstrates personal knowledge but does not authorize you to run a credit repair business or charge fees for services.

- Licensing requirements vary by state for credit repair businesses: Most states require businesses offering credit repair services for a fee to obtain specific licenses or registrations (e.g., surety bonds, specific business registrations). These requirements are completely separate from any certification training. Operating without the required state license is illegal.

- No federal certification exists for credit repair professionals: While the Credit Repair Organizations Act (CROA) regulates the conduct of credit repair businesses, there is no federally mandated certification or license for individuals in this field. State-level business licensing is the primary regulatory mechanism for companies charging fees. Certification programs, even free ones, fill a knowledge gap but do not replace legal business licensing obligations.

Understanding these core skills and critical legal distinctions empowers you to manage your own credit effectively or make informed decisions if seeking professional help. Equipped with this knowledge, you’re better positioned to identify legitimate assistance. For those seeking professional support navigating complex situations, reputable services like those offered at https://fixcreditscenter.com operate within full compliance of state and federal regulations.

【Evaluating Free Credit Repair Training】

Spotting High-Value Course Content

A truly valuable free credit repair certification goes beyond surface-level advice. Look for programs that deliver these essential, actionable components:

Essential curriculum components

- Step-by-Step Dispute Letter Templates: High-quality programs provide legally sound templates explicitly citing FCRA sections (like 611(a)), demonstrating proper formatting for certified mail, and showing how to clearly identify each disputed item with bureau-specific codes. This isn’t just theory – it’s the exact framework you need to trigger the bureaus’ 30-day investigation mandate.

- Credit Bureau & Furnisher Contact Procedures: Training must detail the official, current channels for contacting Equifax, Experian, and TransUnion (online portals, specific mailing addresses), plus how to legally escalate disputes to data furnishers (lenders, collectors) under FCRA Section 623. This includes tracking procedures using certified mail numbers or online dispute IDs.

- Interpretation of Credit Scoring Models: Legitimate programs explain how FICO® Score 8, FICO® Score 9, and VantageScore® 3.0/4.0 differ in weighing factors like late payments, credit utilization, and collections. Crucially, they teach how dispute outcomes (e.g., deletion of a late payment vs. collection account) might impact these scores differently, setting realistic expectations.

| Key Content Area | What High-Value Training Provides | Why It Matters |

|---|---|---|

| Dispute Letter Templates | Legally compliant examples citing FCRA 611(a), certified mail instructions, bureau-specific formatting | Ensures your disputes are legally valid & trigger mandatory investigations |

| Bureau Contact Procedures | Current online/mail addresses, escalation paths, tracking methods (certified mail #, online IDs) | Prevents disputes getting lost & provides proof of compliance with timelines |

| Scoring Model Insights | Breakdown of FICO®/VantageScore® weighting differences & impact of specific dispute outcomes | Sets realistic expectations & helps prioritize dispute targets for maximum score gain |

Red Flags in “Free” Offers

Not all “free” certifications are created equal. Protect yourself by recognizing these critical scam indicators:

Common scam indicators

- Upfront Payment Demands Before Services: Legitimate free certification means zero cost for the core training. Be wary of programs requiring “processing fees,” “materials charges,” or “certification fees” upfront. Reputable free programs may offer optional paid upgrades (like personalized coaching), but the core FCRA dispute training must be genuinely accessible without payment.

- Promises to Remove Accurate Negative Information: Run from any program hinting it can erase legitimate, timely negative items (e.g., accurately reported late payments, valid collections within the 7-year reporting period). Legitimate training focuses solely on disputing inaccurate, unverifiable, or outdated information as permitted by law. Promising removal of accurate data is deceptive and violates CROA.

- Instructions to Create New Credit Identities (CPN/SCN/EIN misuse): This is a blatantly illegal red flag. Training suggesting you use a CPN (Credit Privacy Number), SCN (Secondary Credit Number), or misapply an EIN (Employer Identification Number) to “start fresh” is promoting fraud (Social Security Number misrepresentation). Legitimate programs strictly teach working within the law using your legitimate SSN.

High-quality free certification arms you with the legal knowledge for self-advocacy. However, navigating complex cases (like identity theft resolution or creditor lawsuits) often requires professional expertise. For these situations, partnering with a fully compliant service like https://fixcreditscenter.com, operating under state licensing and CROA regulations, ensures your rights are maximally protected in 2025.

【DIY Credit Repair Alternatives】

Self-Directed Credit Report Repair

Taking control of your credit repair starts with understanding your reports. Legitimate free training emphasizes using the only authorized source for free weekly reports: AnnualCreditReport.com. As of 2025, this remains your federally guaranteed access point. Request reports from all three bureaus (Equifax, Experian, TransUnion) simultaneously to compare data.

Effective dispute strategies

- Documenting Evidence: Successful disputes hinge on concrete proof. Collect supporting documents like billing statements showing on-time payments, account closure confirmations proving settled debts, or identity theft reports (FTC affidavit, police report). Annotate these clearly, matching them to specific disputed items using the bureau’s report codes.

- Structured Dispute Filing: Use the legally sound dispute letter templates (citing FCRA 611(a)) emphasized in high-value training. Send disputes via the bureaus’ official online portals or by certified mail with return receipt requested. Keep copies of everything and track deadlines meticulously using your certified mail number or online dispute ID.

- Bureau Follow-Up: Credit bureaus have 30 days (45 if you provide additional proof after initial filing) to investigate. If they fail to respond or verify unverifiable information, immediately escalate:

- File a CFPB complaint referencing your dispute ID/certified mail number.

- Send a formal “Procedural Request” demanding details of their verification method (FCRA 611(a)(7)).

- If the furnisher (creditor) verified incorrect data, file a separate dispute directly with them under FCRA Section 623.

| Dispute Step | Key Action | Critical Tip |

|---|---|---|

| Gather Reports | Use AnnualCreditReport.com weekly |

Dispute each error with the specific bureau reporting it |

| Compile Evidence | Match documents (statements, letters, reports) to each disputed item & code | Organize chronologically; highlight relevant account numbers, dates, amounts |

| Submit Dispute | Use bureau’s online portal or certified mail with legally compliant template | Keep proof of delivery & note investigation deadline (30 days from receipt) |

| Track & Escalate | Monitor status via portal/certified mail tracking; file CFPB complaint if needed | Escalate to data furnisher (FCRA 623) if bureau verification is flawed |

Building Credit Without Professional Help

Repairing inaccuracies is step one; building strong credit requires consistent, strategic action. Focus on these foundational tactics proven to boost scores within FICO® and VantageScore® models.

Proven credit score improvement tactics

- Maintaining Optimal Credit Utilization: This ratio (total balances ÷ total credit limits) heavily impacts scores. Aim for below 30% overall and per card. Strategies:

- Request credit limit increases on existing cards (only if it won’t trigger a hard inquiry).

- Make multiple payments per billing cycle to lower reported balances.

- Avoid closing old credit cards (preserves available credit & history length).

- Establishing Positive Payment History: Your payment record is the most significant factor. Ensure:

- All minimum payments are made on or before the due date every month. Set up autopay for at least the minimum.

- Address past delinquencies by bringing accounts current and maintaining on-time payments moving forward.

- Diversifying Credit Mix Responsibly: A healthy mix of credit types (revolving like credit cards, installment like loans) can help – but only if managed well. If needed:

- Consider a small, affordable installment loan (e.g., credit-builder loan from a credit union) paid flawlessly.

- Avoid opening multiple new accounts rapidly, which lowers average account age and triggers hard inquiries.

While disciplined DIY efforts resolve many issues, complex situations like persistent creditor lawsuits, advanced identity theft, or navigating state-specific statutes often benefit from structured support. Platforms operating transparently under CROA and state licensing, such as https://fixcreditscenter.com, provide regulated expertise for these intricate scenarios while upholding your legal rights in 2025.

【Avoiding Credit Repair Scams】

Navigating credit repair requires vigilance against deceptive operators. Legitimate free credit score repair certification training emphasizes recognizing illegal tactics explicitly banned by the Federal Trade Commission (FTC). Protecting yourself starts with understanding these red flags.

Recognizing Illegal Practices

Fraudulent credit repair companies often prey on consumers’ desperation. Be acutely aware of these FTC-prohibited activities prevalent in 2025:

FTC-prohibited activities

- Charging Upfront Fees Before Services: It is illegal for any credit repair company to demand payment before they have performed the promised services. Legitimate operations operating under the Credit Repair Organizations Act (CROA) only charge fees after services are rendered. Any request for payment before work begins is a major warning sign.

- Misrepresenting Consumer Legal Rights: Scammers frequently exaggerate or outright lie about your rights under laws like the Fair Credit Reporting Act (FCRA). They might falsely claim they can remove accurate negative items or guarantee specific results, which is impossible. Authentic free credit score repair certification educates on your actual rights regarding disputes and validation.

- Creating “New” Credit Identities with EINs (Credit Privacy Numbers – CPNs): This highly illegal scheme involves advising consumers to apply for an Employer Identification Number (EIN) under false pretenses and use it instead of their Social Security Number to apply for credit. This constitutes fraud (Social Security Number misrepresentation and identity theft) and can lead to severe legal consequences, including criminal charges. Legitimate services focus solely on disputing inaccurate information on your existing credit file.

Your Legal Protections

Consumers are shielded by robust federal legislation designed to prevent exploitation. The Credit Repair Organizations Act (CROA) provides specific, enforceable rights:

Rights under Credit Repair Organizations Act

- Mandatory 3-Day Cancellation Period: You have an absolute right to cancel your contract with any credit repair organization for any reason within three business days (excluding Sundays and federal holidays) after signing it. The company must inform you of this right in writing within the contract itself.

- Required Written Service Contracts: Before any services commence, the credit repair organization must provide you with a detailed, written contract. This contract must clearly outline all the services they will perform, the total cost, the time frame for achieving results, and your three-day cancellation rights. Verbal promises are not binding; everything must be documented.

- Prohibition of False Claims About Results: Credit repair companies are strictly forbidden from making false or misleading statements about their services. They cannot guarantee specific outcomes (e.g., “We guarantee to raise your score 100 points!” or “We can remove bankruptcies!”) because the outcome of disputes depends on the creditor’s and bureau’s investigations. Legitimate providers, including those offering structured training like free credit score repair certification, focus on the process of disputing inaccuracies under the law, not unrealistic promises.

Understanding these illegal practices and your CROA rights is fundamental before engaging any service. For situations beyond straightforward DIY disputes – such as navigating creditor lawsuits, resolving complex identity theft across multiple states, or dealing with persistent inaccuracies – seeking support from a platform operating transparently under full CROA compliance and state licensing, like https://fixcreditscenter.com, ensures your rights are protected while accessing regulated expertise in 2025.

【Credit Repair Certification vs. Other Methods】

Understanding your options empowers smarter decisions. While the previous section highlighted critical protections against scams, choosing the right path for your situation is equally vital. Let’s compare the core approaches to credit improvement in 2025, analyzing their effectiveness, resources required, and best applications.

Comparing Repair Approaches

Not all credit repair strategies are created equal. Each method offers distinct advantages and demands specific investments of time, money, and effort. Here’s a breakdown:

Effectiveness Analysis Table

| Approach | Cost | Time Commitment | Expertise Level | Best For | Limitations |

|---|---|---|---|---|---|

| DIY Repair | $0 | High | Moderate-High | Simple disputes, budget-conscious individuals, learning your rights. | Steep learning curve, significant time investment, risk of errors. |

| Professional Agencies | Higher Fees | Low (Client-side) | Agency Handles | Complex cases (multiple errors, ID theft), lack of time/patience. | Requires vetting for legitimacy (avoid upfront fees!), cost can be prohibitive. |

| Credit Counseling | Often Free/Low | Moderate | Counselor-Led | Debt management, budgeting help, establishing payment plans. | Not focused on disputing credit report errors; addresses debt behavior. |

| Free Credit Score Repair Certification | Training Cost | Moderate-High (Learning) | Builds Expertise | Individuals disputing numerous errors, aspiring business owners, those wanting deep understanding. | Requires dedicated study; applies knowledge after certification. |

Key Takeaways:

- DIY is powerful but demanding: Leveraging free resources (like FTC guides) is cost-effective but requires significant personal effort to master dispute processes and legal rights.

- Professional agencies offer convenience at a cost: Legitimate agencies handle the heavy lifting under CROA, crucial for intricate cases, but demand careful selection and budget allocation.

- Credit counseling serves a different purpose: Primarily aids debt management and financial literacy, not directly challenging credit report inaccuracies.

- Certification builds knowledge: Structured training provides the deep understanding needed to tackle complex disputes personally or professionally, but requires an upfront learning investment.

When Certification Makes Sense

Free credit score repair certification isn’t a universal solution, but it shines for specific goals beyond basic dispute letters. It provides the structured legal and procedural framework often missing from fragmented online guides. Consider this path if you fit these profiles:

Ideal Candidate Profiles

- Individuals Facing Multiple or Complex Report Errors: If your credit reports contain numerous inaccuracies across different accounts, types (collections, late payments, bankruptcies), or involve mixed files/identity theft, certification delivers the systematic approach needed. You learn to prioritize disputes, craft effective validation requests, and navigate creditor responses proficiently, turning overwhelming chaos into a manageable process.

- Aspiring Entrepreneurs in Credit Services: For those serious about launching a compliant credit repair business in 2025, certification is foundational. It goes beyond dispute tactics, covering essential CROA compliance, contract requirements, ethical advertising practices, and state-specific licensing nuances. This knowledge is non-negotiable for operating legally and avoiding the pitfalls that trap scam operations.

- Consumers Committed to Structured Mastery: If you prefer a comprehensive, step-by-step learning path over piecing together information from scattered sources, certification provides clarity. It demystifies complex laws (FCRA, FDCPA, CROA) and bureau processes, empowering you with confidence for both immediate disputes and long-term credit health management. It’s ideal for lifelong learners who value understanding the “why” behind the process.

While certification equips you with valuable skills, extremely challenging situations – like active creditor lawsuits, pervasive identity theft impacting major loans, or recurring inaccuracies despite disputes – often benefit from seasoned professional intervention. Platforms adhering strictly to CROA compliance and state regulations, such as https://fixcreditscenter.com, offer regulated expertise and robust support systems designed to handle these high-stakes scenarios efficiently in 2025, ensuring your rights are vigorously protected while pursuing resolution.

【Long-Term Credit Health Strategies】

Earning your free credit score repair certification equips you with the tools to correct errors, but true financial empowerment comes from sustaining those gains. Think of it like repairing a garden – fixing the damage is step one, but consistent care ensures it thrives long-term. Let’s translate that certification knowledge into actionable, everyday habits for lasting credit health in 2025.

Maintaining Improved Credit Scores

Your hard-won higher score is an asset; protect it. Consistent, mindful financial behaviors are the bedrock. Here’s how to lock in your progress:

Essential financial habits

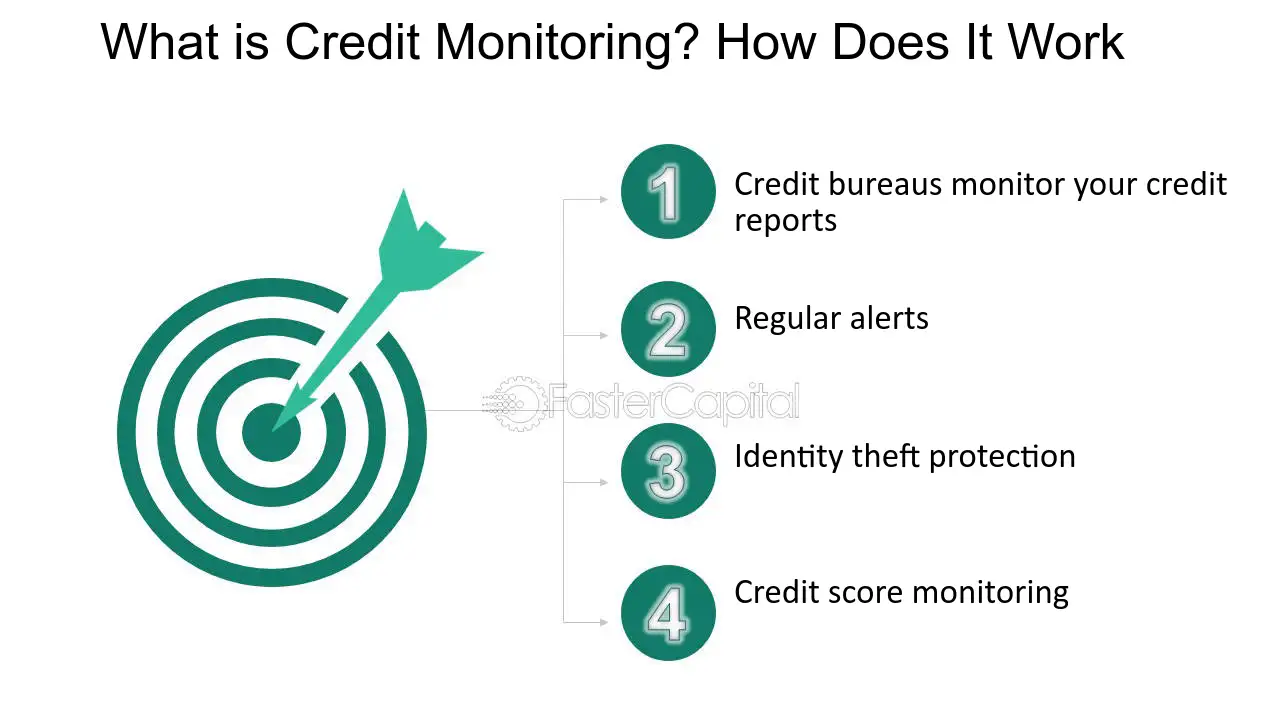

- Regular credit report monitoring schedule: Don’t wait for annual free reports. Stagger your requests from Equifax, Experian, and TransUnion (e.g., one every 4 months) for year-round vigilance. Leverage free monitoring services offered by many banks or credit cards post-certification, knowing how to interpret the data you see. Promptly dispute any new inaccuracies using the skills you acquired.

- Setting payment reminders to avoid lates: Payment history is king (35% of your FICO® Score). One late payment can cause significant damage. Automate payments for at least the minimum due on all credit obligations. Set calendar reminders 3-5 days before due dates as a backup. Treat due dates with the same importance as rent or mortgage payments.

- Credit utilization monitoring techniques: Keep your revolving credit (credit cards) balances low. Aim to consistently use less than 30% of your total available credit limit, and ideally below 10% for the best scoring impact. Pay down balances before the statement closing date when possible, as that’s typically when balances are reported to the bureaus. Regularly review your credit limits and consider requesting increases (only if you won’t be tempted to spend more) to improve your overall utilization ratio.

Building Financial Resilience

A strong credit score opens doors, but genuine financial security extends beyond that number. True resilience buffers you against life’s surprises and reduces reliance on high-cost credit.

Beyond credit score repair

- Emergency fund establishment targets: This is your financial shock absorber. Certification teaches you the cost of relying on credit in crises. Aim to save 3-6 months’ worth of essential living expenses in a readily accessible account. Start small ($500-$1000 target), but build systematically. This fund prevents minor emergencies from derailing your budget or forcing high-interest borrowing, protecting your credit score.

- Debt-to-income ratio management: Lenders scrutinize this (total monthly debt payments ÷ gross monthly income). While not a direct credit score factor, a high DTI (generally >43%) signals risk and can hinder loan approvals even with a good score. Post-repair, focus on paying down existing debt principal. Avoid taking on significant new debt without a clear plan and understanding how it impacts your DTI. Your certification knowledge helps you evaluate loan terms critically.

- Relationship between savings and creditworthiness: Consistent savings demonstrates financial stability and discipline – traits lenders value deeply. A healthy savings cushion means you’re less likely to max out credit cards during lean times, directly supporting healthy credit utilization. It also positions you for larger down payments on loans (like mortgages), leading to better terms and lower overall costs. Your certification reinforces that credit repair isn’t just about fixing the past; it’s about building a more secure, savings-oriented future.

The deep understanding of credit mechanics gained through your free credit score repair certification empowers you to implement these strategies effectively. You recognize why low utilization matters, how payment history impacts scores, and the true cost of debt. For ongoing guidance, dispute support, or navigating complex credit challenges in 2025, leverage reputable resources committed to CROA compliance and consumer empowerment like https://fixcreditscenter.com. Consistent application of these long-term habits transforms your repaired credit into a durable foundation for lasting financial well-being.

【Why Credit Scores Control Your Life】

Your free credit score repair certification gives you power over your financial narrative, but why does this three-digit number hold such immense sway? In 2025, your credit score isn’t just a number; it’s a financial passport influencing nearly every major life decision. Understanding its pervasive reach is crucial for leveraging the knowledge gained through certification.

The Power Behind Your Numbers

That score is a distilled summary of your financial reliability, instantly communicated to key decision-makers.

How lenders judge your applications

- Credit scores determine loan approvals and interest rates: Lenders rely heavily on scores to assess risk within seconds. A high score signals responsible credit management, unlocking loan approvals and access to the lowest possible interest rates. Conversely, a lower score often means outright denials or significantly higher borrowing costs. Your certification knowledge helps you understand exactly how your actions translate into this critical metric.

- Automated Underwriting Dominance: Most lending decisions in 2025 are made by algorithms that prioritize credit scores above almost all other factors. Your certification equips you to present the strongest possible profile to these systems.

Everyday impacts beyond borrowing

- Landlords: A poor credit report is a common reason for rental application denials or requirements for larger security deposits. Landlords view it as an indicator of payment reliability for rent.

- Employers (in many states/jobs): Especially for roles involving finances, security clearance, or fiduciary responsibility, employers may check credit reports (with your permission) as part of background checks, interpreting them as a sign of stability and responsibility.

- Insurers (Auto & Home): In most states, insurers use credit-based insurance scores (derived from your credit report data) to set premiums. Statistically, those with lower scores file more claims, leading to significantly higher insurance costs.

Real Costs of Poor Credit

The financial penalties of a subpar score extend far beyond simple loan denials; they create a tangible, ongoing burden.

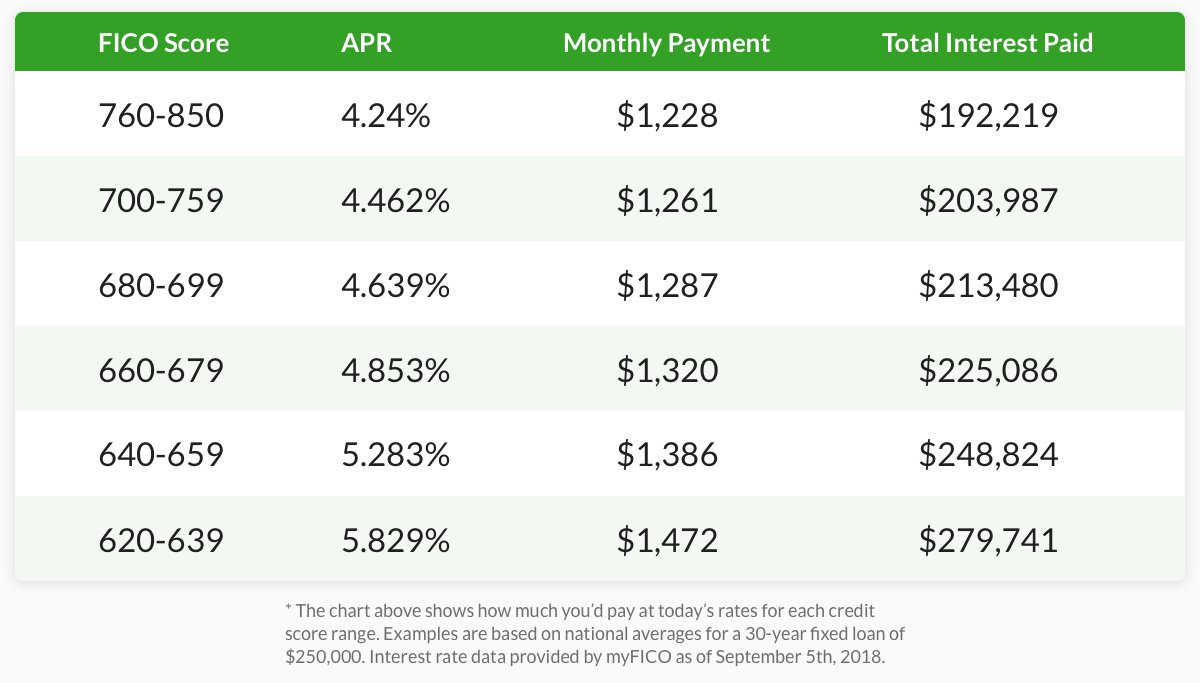

Higher interest rate penalties

- Magnitude of the Gap: The difference in interest rates offered to consumers with excellent credit versus those with poor credit is stark and costly. For example:

Loan Type Excellent Credit Rate (Est. 2025) Poor Credit Rate (Est. 2025) Cost Difference on $25k Loan 60-Month Auto ~5.5% ~10.5% ~$3,600 in extra interest 30-Year Mortgage ~6.0% (Prime Rate) ~8.0%+ (Subprime) ~$100,000+ extra on $300k loan - Compounding Effect: Higher interest rates mean more money spent servicing debt, leaving less available for savings, investments, or essential expenses, creating a cycle that’s hard to break without intervention – precisely why the strategies learned in certification are vital.

Missed financial opportunities

- Qualification gaps for prime mortgage rates: Falling just below the “good” or “excellent” credit threshold can mean missing out on the best conventional mortgage rates, potentially forcing borrowers into FHA loans with higher mortgage insurance costs or significantly higher interest subprime loans.

- Credit Card Access & Rewards: Prime credit cards offering valuable rewards (cash back, travel points), low APRs, and generous perks are typically reserved for those with very good or excellent scores. Lower scores often mean access only to secured cards or cards with high fees and minimal benefits.

- Utility Deposits & Service Terms: Many utility companies (electric, gas, phone, internet) check credit and may require substantial security deposits or impose restrictive service terms for customers with lower scores.

- Business Financing Hurdles: For entrepreneurs, personal credit scores are often scrutinized when applying for business loans or lines of credit, especially for new ventures. A poor personal score can stifle business growth before it even starts.

The insights gained from your free credit score repair certification illuminate exactly how these costs manifest and empower you to mitigate them. By understanding the profound impact your credit score has on approval odds, interest rates, housing, employment, insurance, and overall financial flexibility, you can prioritize the long-term habits that protect your score. For comprehensive tools and guidance on navigating these challenges and maximizing your credit health in 2025, explore the resources available at

https://fixcreditscenter.com. Taking control of your credit score is fundamentally taking control of your financial opportunities and costs.【What Free Credit Repair Certification Really Offers】

Building on the profound impact your credit score has on life opportunities and costs, free credit repair certification emerges as a critical tool for reclaiming control. But what tangible skills and understanding do these programs genuinely deliver in 2025? Let’s demystify the core offerings.Inside These Programs

Legitimate free certification focuses on equipping you with the knowledge and practical tools to understand and improve your own credit reports legally and effectively.

Core curriculum components

- Credit Report Analysis Techniques: Learn to decode complex credit reports from Equifax, Experian, and TransUnion. This includes identifying key sections (personal info, accounts, inquiries, public records), understanding status codes (e.g., “CO” for Charge Off, “CLS” for Closed), calculating your debt-to-credit ratio, and spotting crucial details like account opening dates and credit limits.

- Dispute Letter Templates and Strategies: Master the legal dispute process under the Fair Credit Reporting Act (FCRA). Programs provide proven templates for drafting effective dispute letters (both online and mail), guidance on documenting errors (like incorrect balances, fraudulent accounts, or outdated negative items), and strategies for handling responses from credit bureaus and data furnishers.

What certification actually means

- Educational Completion Proof: Successfully finishing the program signifies you’ve acquired foundational knowledge in personal credit management and dispute procedures. It demonstrates commitment to understanding your credit rights.

- Not Professional Accreditation: Crucially, this certification does not license you to act as a paid credit repair professional (which requires specific state/federal licensing and bonding). It empowers self-repair and informed financial decision-making.

Legitimate Program Benefits

The value of these $0-cost programs lies in accessibility and actionable empowerment, removing traditional barriers to financial wellness.

Knowledge without financial risk

- $0 Cost Removes Barrier: Eliminating tuition fees opens essential financial education to everyone, regardless of current financial hardship often associated with poor credit. There’s no financial risk to gaining this knowledge.

- Foundation for Informed Action: Provides a factual understanding of credit laws, scoring models (like FICO and VantageScore), and consumer rights, preventing reliance on costly myths or potentially harmful “quick fixes” offered by some paid services.

Self-repair empowerment tools

- Step-by-Step Dispute Process Blueprints: Receive clear, actionable guides outlining the entire dispute workflow – from obtaining reports and identifying errors to drafting/sending disputes and following up. This transforms a complex legal process into manageable steps.

- Long-Term Credit Management Habits: Beyond disputes, learn strategies for building positive credit history, responsible credit card use, maintaining low utilization, and consistent on-time payments – the habits essential for sustaining a healthy score long after errors are corrected.

- Confidence in Financial Navigation: Equips you to understand lender decisions, negotiate better terms where possible, and proactively manage your credit profile throughout life’s financial milestones.

The true power of free certification lies in transforming complex credit systems into understandable, actionable knowledge. By mastering report analysis and dispute procedures, you gain the tools to directly challenge inaccuracies and build a stronger financial foundation. For comprehensive resources, templates, and ongoing support tailored to navigating the 2025 credit landscape, leverage the tools available at

https://fixcreditscenter.com. This knowledge is your first step towards unlocking fairer financial opportunities.【Critical Pros and Cons to Consider】

While free credit repair certification offers significant empowerment, it’s vital to approach these programs with clear-eyed realism. Understanding both the tangible benefits and inherent limitations ensures you can leverage them effectively within the 2025 credit landscape.Potential Advantages

These programs shine by building essential knowledge and removing financial barriers.

Financial literacy foundation

- Understanding Credit Utilization Ratios and Scoring Factors: Programs demystify how actions directly impact your score. You learn the critical importance of keeping credit utilization low (ideally below 30%), how different scoring models (FICO vs. VantageScore) weight factors like payment history (35-40%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). This knowledge transforms abstract numbers into actionable strategies.

- Empowerment Through Knowledge: Grasping the mechanics behind your score equips you to make smarter financial decisions daily, far beyond just dispute resolution. You understand why certain actions matter, fostering long-term responsible credit behavior.

Cost-effective starting point

- Free Alternative to Paid Credit Repair Services: This is the core advantage. Legitimate free certification provides the fundamental tools and legal understanding needed for self-repair without upfront costs, making it accessible regardless of current financial strain. It arms you with the knowledge to evaluate whether paid services are truly necessary or if you can effectively manage the process yourself.

Realistic Limitations

Setting appropriate expectations is crucial for success and avoiding frustration.

No magic solutions

- Cannot Remove Accurate Negative Items (FTC Warning): A critical truth emphasized by the Federal Trade Commission (FTC) and embedded in reputable program curriculum is that no one can legally remove accurate, timely negative information from your credit reports. Certification teaches you to identify and dispute inaccuracies and unverifiable information under the FCRA. It does not provide shortcuts for legitimate late payments, charge-offs, or bankruptcies that are reporting correctly. Understanding this boundary protects you from scams promising the impossible.

Time investment required

- Minimum 6-12 Months for Significant Score Improvements: Credit repair, even when focused solely on legitimate disputes, is rarely instantaneous. Programs realistically outline the timeline:

- Dispute cycles with the bureaus typically take 30-45 days per round.

- Complex errors or disputes requiring furnisher investigation may take multiple rounds.

- Building new positive credit history (like through responsible use of a secured card learned about in the program) takes consistent effort over months.

- Significant score rebounds, especially from major derogatory items once they are corrected or age appropriately, generally require sustained positive behavior over 6-12 months or more. Certification prepares you for this marathon, not a sprint.

The true value of free certification lies in its honesty: it provides powerful, $0 tools for the aspects of credit repair you can control (fixing errors, understanding rights, building habits) while clearly defining the boundaries (accurate negatives, timeframes). This balanced understanding is your strongest asset. For the practical dispute tools, updated templates reflecting 2025 regulations, and strategies to navigate the entire credit improvement journey efficiently, access the comprehensive resource hub at

https://fixcreditscenter.com. Knowledge, paired with realistic action, paves the way.【Spotting Trustworthy Programs】

Navigating the world of free credit repair certification requires vigilance. While the empowerment is real, so are the risks posed by deceptive actors exploiting financial vulnerability. Knowing how to distinguish credible education from predatory schemes is non-negotiable in 2025. Here’s what to watch for and what to demand.Warning Signs of Scams

Scammers often rely on pressure tactics and impossible guarantees. Steer clear of any program exhibiting these traits:

Illegal promises to avoid

- “Guaranteed” credit score increases: Reputable programs, as emphasized in understanding FTC warnings, know that no one can guarantee score results. Legitimate credit repair depends on disputing specific inaccuracies under the FCRA, and outcomes vary. Any “guarantee” is a hallmark of fraud.

- Upfront payment demands before services: While the core topic is free certification, be wary of any program labeled “free” that suddenly requires payment for “exclusive materials,” “expedited processing,” or “special access” before delivering core education. Legitimate free programs are truly $0 for the foundational knowledge.

Red flag language

- “Create new credit identity” schemes (Credit Privacy Numbers/CPNs, EIN misuse): This is a serious federal crime (identity theft/fraud). Legitimate programs teach you to repair your existing, legitimate credit history. Any suggestion of creating a “new” identity or using a number other than your SSN for establishing new credit lines is illegal and will lead to severe legal consequences. Run immediately.

Hallmarks of Legitimate Courses

Trustworthy programs prioritize education, transparency, and adherence to the law.

Clear educational objectives

- Focus on understanding Fair Credit Reporting Act (FCRA) rights: The cornerstone of ethical credit repair is knowing your legal rights. Legitimate courses dedicate significant curriculum to explaining your rights under the FCRA – including how to properly request your reports, dispute inaccuracies, demand validation from debt collectors, and understand the obligations of credit bureaus and data furnishers. They empower you to navigate the system legally and effectively.

Transparent structure

- Defined curriculum available before enrollment: You shouldn’t have to pay or sign up blindly. Reputable programs clearly outline exactly what topics are covered, the learning modules involved, and the skills you will gain – accessible publicly on their website or via a simple request. This transparency allows you to assess if the content aligns with your needs and covers the essential FCRA knowledge and dispute process steps discussed in foundational financial literacy.

Characteristic Scam Programs Legitimate Programs Score Promises Guarantees specific increases Explains factors influencing scores, no guarantees Cost Structure Demands upfront fees for “free” programs Truly $0 for core certification education Identity Tactics Promotes CPNs/”new identity” schemes Focuses solely on repairing your legitimate file Core Curriculum Focus Vague, emphasizes quick fixes Explicitly centers on FCRA rights & procedures Transparency Curriculum hidden until signup/payment Detailed syllabus available publicly upfront Armed with this knowledge, you can confidently seek out programs offering genuine value without risk. The most effective credit repair combines this foundational education with practical, up-to-date tools. Discover expertly crafted dispute templates reflecting 2025 regulations, advanced strategies beyond the basics, and ongoing guidance tailored to complex situations at

https://fixcreditscenter.com. Empower your journey with credible knowledge and actionable resources.【DIY Credit Repair Alternatives】

While certified education equips you with crucial knowledge (as outlined in Spotting Trustworthy Programs), true credit empowerment often involves hands-on action. In 2025, numerous free, legitimate paths exist for managing your own credit repair journey. These alternatives complement formal education, putting control directly in your hands.Self-Guided Repair Methods

Taking charge starts with understanding core DIY tactics grounded in Fair Credit Reporting Act (FCRA) rights:

Disputing errors effectively

- Initiate formal disputes directly with credit bureaus: Under the FCRA, you have the right to challenge inaccuracies on your reports. In 2025, leverage online dispute portals (Experian, Equifax, TransUnion) or certified mail for a paper trail. Clearly identify each error, state why it’s incorrect, and demand its removal or correction. Include copies (never originals) of supporting documents.

- Demand debt validation from collectors: If a collection account is disputed, formally request the collector provide proof of the debt’s validity and their legal right to collect it under the Fair Debt Collection Practices Act (FDCPA). Lack of validation mandates removal.

Building positive credit history

- Secured card strategies for credit rebuilding: Utilize secured credit cards, where a cash deposit acts as your credit limit. In 2025, prioritize cards reporting to all three bureaus. Use sparingly (aim for <10% utilization) and pay in full monthly. Consistent on-time payments rebuild payment history – the most significant credit score factor. After 12-18 months of responsible use, many issuers may transition you to an unsecured card and return your deposit.

Free Community Resources

You don’t need to navigate credit repair alone. Reputable, no-cost support is widely available:

Non-profit credit counseling

- NFCC-certified counselors provide free consultations: Agencies affiliated with the National Foundation for Credit Counseling (NFCC) offer free initial consultations and low-cost/free education workshops. They help analyze your credit reports, explain your rights under the FCRA and FDCPA, develop personalized debt management plans (DMPs), and provide budgeting guidance – all crucial for long-term credit health.

Government-supported programs

- HUD-approved housing counseling agencies: The U.S. Department of Housing and Urban Development (HUD) funds agencies offering free or very low-cost counseling. These services extend beyond mortgages to include comprehensive credit report reviews, dispute guidance, and strategies for improving credit scores to achieve housing goals. They are a vital resource for understanding how credit impacts homeownership opportunities in 2025.

DIY Path Core Action Key Benefit Bureau Disputes Challenge inaccuracies via official channels Directly removes errors impacting scores Debt Validation Demand collectors prove debt legitimacy Forces removal of unverifiable collections Secured Cards Use responsibly, report low utilization Rebuilds payment history & credit mix NFCC Counseling Free credit report analysis & personalized plans Expert guidance without certification cost HUD Housing Counseling Government-backed credit & housing advice Holistic support linking credit to homeownership goals Mastering both self-guided methods and leveraging community resources forms a powerful foundation. For streamlined execution—like accessing dispute letter generators aligned with 2025 FCRA regulations, personalized rebuilding trackers, or escalation protocols for stubborn errors—integrate these free strategies with the advanced toolkit at

https://fixcreditscenter.com. Turn knowledge into tangible credit transformation.【Comparing Repair Options】

Understanding when to leverage free certification versus professional services is crucial for effective credit management in 2025. Both paths offer distinct advantages depending on your circumstances and goals.Course vs Professional Services

Knowledge gained from free certification empowers self-repair, while professional services handle the labor-intensive aspects. Key distinctions include:

Cost differences

- Free certification courses: Provide foundational knowledge of FCRA/FDCPA rights, dispute processes, and rebuilding tactics at zero cost. Ideal for budget-conscious individuals committed to DIY efforts.

- Professional services: Typically charge $50-$150/month (as of 2025) for ongoing dispute management, creditor negotiations, and credit bureau follow-ups. Fees accumulate until issues resolve, making long-term costs significant.

Control level comparison

- Self-management: Free education puts you in charge. You initiate disputes, track progress, and make strategic decisions—building invaluable financial literacy.

- Third-party intervention: Professionals act on your behalf, reducing your direct involvement. However, you relinquish control over dispute timing, communication specifics, and strategy adjustments. You remain legally responsible for accuracy.

When Professional Help Makes Sense

While DIY is powerful, certain scenarios warrant professional expertise:

Complex credit situations

- Multiple mixed files: If your report merges data with someone sharing a similar name/SSN, untangling requires specialized bureau escalation protocols beyond standard disputes.

- Identity theft resolution: Professionals navigate complex fraud affidavits (FTC Identity Theft Report), police reports, and persistent re-appearing fraud accounts more efficiently, leveraging established bureau contacts.

Time-constrained solutions

- Rapid dispute processes before major purchases: If you need faster resolution for a mortgage, auto loan, or rental application (especially within 3-6 months), professionals often expedite disputes through dedicated channels and persistent follow-ups that surpass typical DIY timelines.

Approach Best For Considerations Free Certification Budget repair, learning rights, DIY control Requires time investment; self-managed outcomes Professional Services Complex cases (mixed files, identity theft), urgent timelines Monthly fees; less direct control; verify legitimacy For many, blending free education with targeted tools offers optimal results. Platforms like

https://fixcreditscenter.comprovide 2025-compliant dispute automation, progress trackers, and escalation templates—bridging the gap between pure DIY and full professional intervention for streamlined credit transformation.【Building Long-Term Financial Health】

Sustainable credit health extends far beyond dispute resolution. True financial freedom in 2025 requires integrating the knowledge from your free credit score repair certification into proactive, everyday systems that prevent future setbacks and solidify gains.Beyond Quick Fixes

Addressing errors is vital, but preventing new negative marks is paramount. This demands foundational shifts in how you manage money.

Establishing money management systems

Robust budgeting is your first defense against future credit damage. Effective methods include:

- Zero-based budgeting: Assign every dollar a purpose (needs, wants, debt repayment, savings) before the month begins. Tools learned in free certification often include budget templates.

- Envelope system (digital or physical): Allocate cash for variable spending categories (groceries, entertainment). When the envelope is empty, spending stops.

- 50/30/20 Rule: Allocate 50% to needs, 30% to wants, and 20% to savings/debt repayment. Adjust percentages based on income and debt load.

Consistent use of any method provides clarity, curbs overspending, and ensures bills are funded on time – directly protecting your payment history.

Continuous monitoring practices

Vigilance is non-negotiable. Leverage free resources to stay informed:

- AnnualCreditReport.com: Access your full reports from all three bureaus weekly (a permanent 2025 benefit). Scrutinize them quarterly for errors or suspicious activity.

- Credit Karma/Credit Sesame: Utilize free score monitoring and report summaries (usually from TransUnion & Equifax). Understand their limitations – they provide VantageScore, not the FICO scores most lenders use.

- Bank/Credit Card Alerts: Set up free notifications for low balances, large transactions, and payment due dates.

Your free credit score repair certification training empowers you to understand what to look for and how to interpret changes, turning raw data into actionable insights. Consider supplementing free tools with platforms likehttps://fixcreditscenter.comfor automated monitoring and alerts across all bureaus, acting as a crucial second layer of defense.

Maintaining Your Improved Score

Once your score improves, strategic habits are essential to preserve and grow it.

Credit utilization best practices

This critical factor (30% of your score) requires constant attention:

- The 30% Threshold: Aim to keep balances below 30% of each card’s limit and your total revolving credit limit. Lower is better (e.g., under 10% is optimal).

- Strategic Payments: Make payments before the statement closing date to lower the balance reported to bureaus, even if you pay in full monthly.

- Limit Increases (Use Wisely): Requesting a higher credit limit can instantly lower your utilization ratio if you don’t increase spending. Free certification courses teach how to approach this strategically.

Payment history protection

Your payment record (35% of your score) demands flawless execution:

- Automate Absolutely Everything: Set up automatic payments for at least the minimum due on every credit account and loan. This is the single most reliable way to avoid late payments.

- Calendar Backups: Even with automation, note due dates in your digital calendar with reminders a few days prior as a safety net.

- Buffer Your Accounts: Maintain a small cash buffer in your checking account to cover autopays, preventing overdrafts if timing is tight. Free certification emphasizes building this emergency buffer as part of long-term stability.

The principles ingrained through free credit score repair certification – understanding reporting cycles, due date impacts, and creditor policies – make implementing these safeguards intuitive and effective. Combining this knowledge with disciplined systems ensures your hard-won credit gains become a permanent foundation for your financial future. Platforms likehttps://fixcreditscenter.comoffer tools to track utilization across cards and automate payment reminders, providing essential guardrails for maintaining your optimized score long after disputes are resolved.

[object Object]